From $HYPE to the Evolution of Altcoin Investment

TechFlow Selected TechFlow Selected

From $HYPE to the Evolution of Altcoin Investment

In an era of manipulatable metrics, how to cut through the narrative fog of token economics?

Author: Ponyo

Translation: Saoirse, Foresight News

Key Takeaways

-

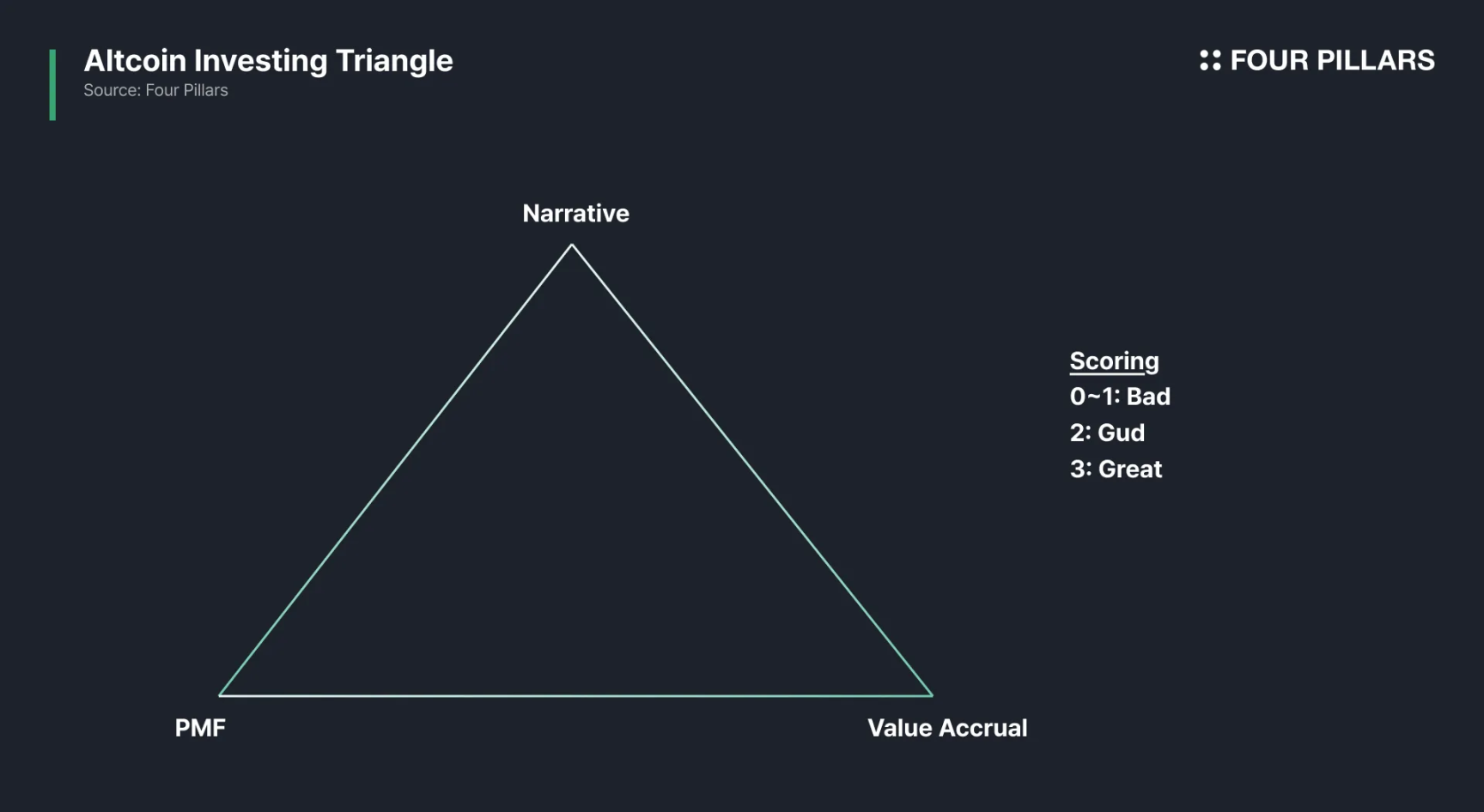

A token's success hinges on three key factors: narrative, product-market fit (PMF), and value capture.

-

Most tokens stall at the "two out of three" stage: narratives are easy to build; PMF is highly challenging but binary in outcome—either achieved or not; value capture, however, is far more complex—balancing stakeholder interests, legal compliance, and listing considerations makes designing and timing value capture mechanisms particularly difficult.

-

Only a few tokens (e.g., HYPE) satisfy all three criteria. Many otherwise strong protocols still hit bottlenecks in value capture, limiting upside even with solid fundamentals; in some cases, tokens may perform well despite weak fundamentals.

-

The investment triangle is simple in theory but hard in practice. Metrics can be manipulated, protocol documents often conceal critical details, and tokenomics may change mid-development. Market narratives evolve quickly—tokens that currently score zero or perfect across the three dimensions could see completely different futures.

In the early days of crypto, strong narratives alone could send token prices soaring—but those days are long gone. Today, token success depends on three dimensions: 1) a compelling narrative; 2) product-market fit; and 3) a robust token value capture mechanism.

Projects excelling in all three dimensions are “excellent”; meeting two qualifies as “good”; meeting one or none is “poor.”

This is my core framework for evaluating tokens.

Breaking Down the Three Dimensions

1. Narrative

The story embraced by market participants. Without a narrative, a project struggles to gain attention.

2. Product-Market Fit (PMF)

The core lies in real users, real fee revenue, and real demand. While metrics vary across products, the key is “users who consistently pay.” Revenue and user retention are paramount. Note that most metrics—such as total value locked (TVL), wallet count, transaction count, and raw trading volume—are easily manipulated, so cross-verification across multiple data points is essential. For example, with perpetual decentralized exchanges, both trading volume and open interest must be considered: high volume with low open interest typically indicates fake trading.

3. Token Value Accumulation

If a token cannot meaningfully capture protocol value, it holds no intrinsic worth. Common value accumulation mechanisms include fee sharing, token buybacks, buyback-and-burns, and mandatory usage. Personally, I favor buybacks (see Revenue Sharing Is Dead, Long Live Buyback & Burns). However, value accumulation is inseparable from protocol revenue: even with a well-designed mechanism, if the protocol generates little income, the token fails the value test.

These principles seem obvious, and most believe they already understand them—yet many still fall into the trap of assuming “narrative + user adoption = token price rise.”

Lifecycle Dynamics

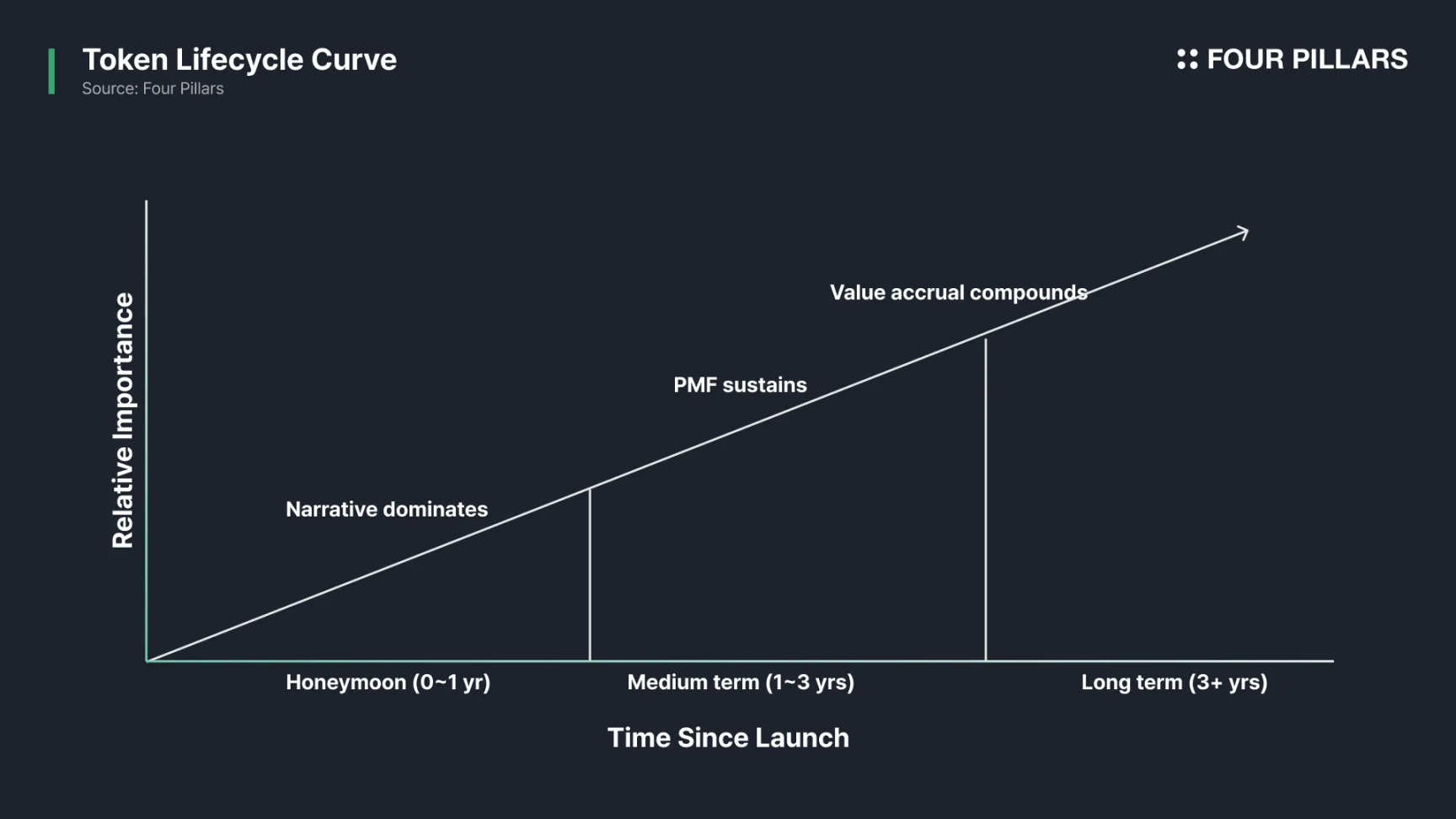

The investment triangle is not static—each dimension carries different weight at various stages of a token’s lifecycle:

-

Narrative (short-term): In early stages, teams rely on narrative to attract liquidity, attention, and initial users.

-

Product-Market Fit (medium to long-term): Narrative buys time and capital, but cannot ensure user retention—only a product that truly fits market needs enables sustainable growth.

-

Value Capture (medium to long-term): If a token is disconnected from protocol cash flows, even growing user numbers won’t prevent insiders from dumping, leaving holders at a loss.

Why Is 'All Three' So Hard?

Most tokens meet at most two of the three criteria. Narrative-building is relatively straightforward; PMF, while challenging, has clear benchmarks—either the product solves a real pain point or it doesn’t. Value capture, however, is the most underestimated dimension because it quickly becomes a “game of博弈” among stakeholders:

-

Founders: Seek funding reserves and liquidity;

-

Users: Want lower fees and higher incentives;

-

Token holders: Care only about price appreciation;

-

Market makers: Require greater market-making capital support;

-

Exchanges: Prioritize low risk and regulatory compliance;

-

Lawyers: Aim to minimize legal exposure.

These demands are often conflicting. When teams try to balance them, the result is often an “average” token—not due to lack of skill, but as an inevitable outcome of misaligned incentives.

Case Studies

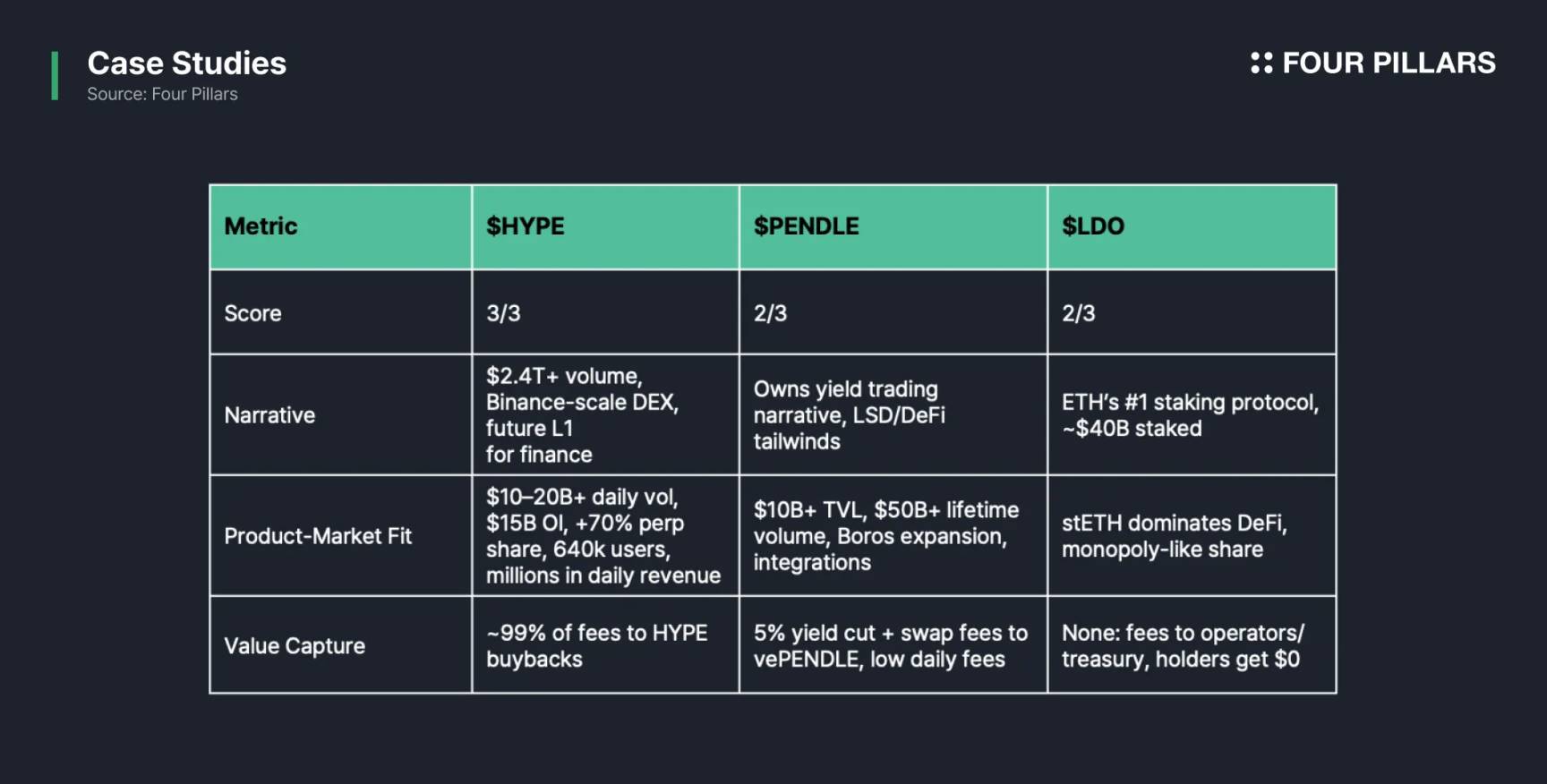

HYPE: All Three Met

-

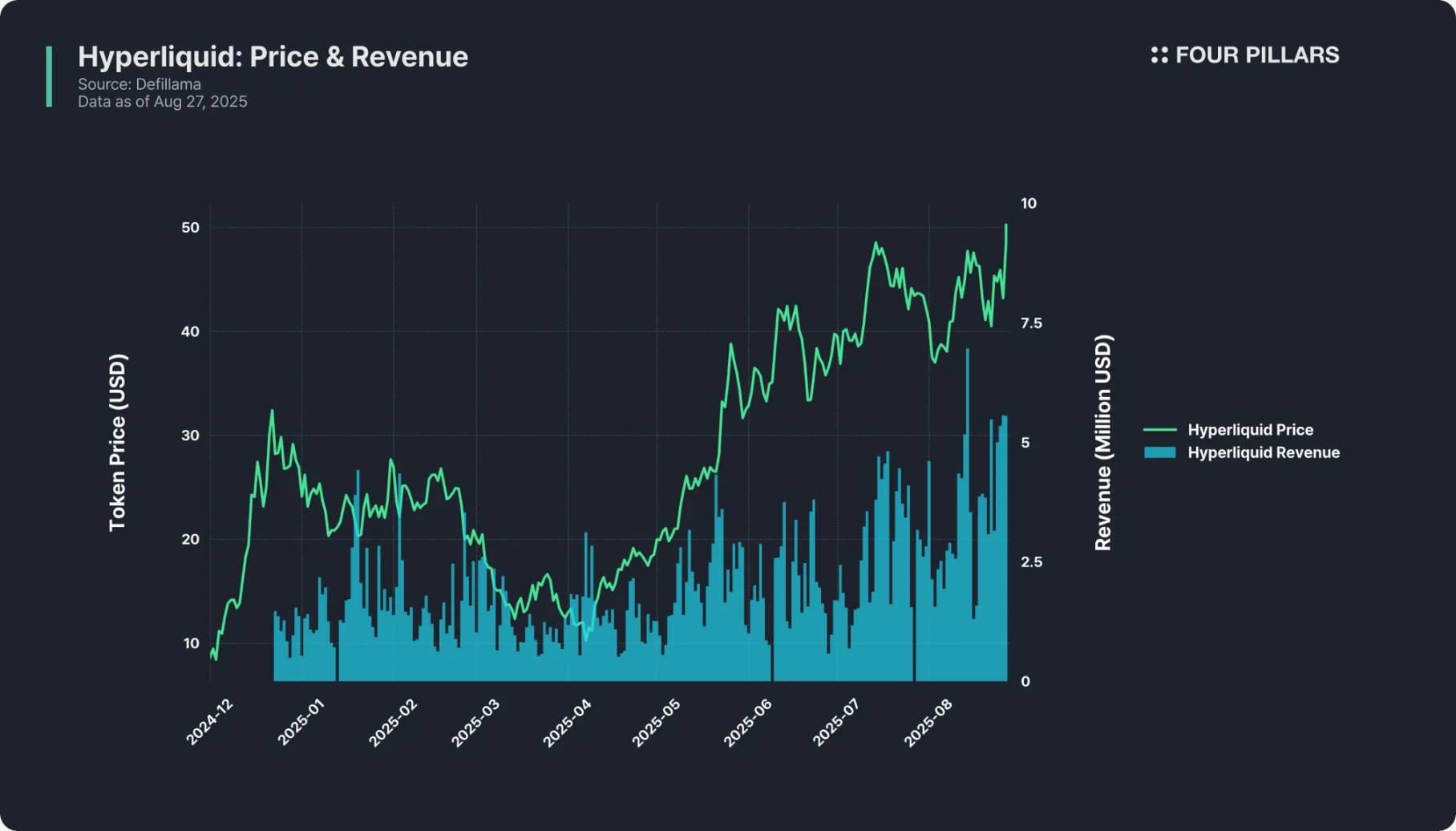

Narrative: The only “Binance-tier” decentralized exchange, with cumulative trading volume exceeding $2.4 trillion, positioned as a Layer 1 blockchain capable of hosting all financial services in the future.

-

Product-Market Fit: Daily clearing volume of $10–20 billion, ~$15 billion in open interest, over 60% market share in decentralized perpetuals, more than 640,000 users, and daily revenue in the millions of dollars.

-

Value Capture: 99% of fees (1% to HLP fund) are used to repurchase HYPE, ensuring every transaction directly feeds value back into the token.

Hyperliquid (HYPE) exemplifies the “trifecta,” perfectly satisfying all three dimensions.

LDO: Two Criteria Met

-

Narrative: As Ethereum’s largest staking protocol, managing around $40 billion in staked assets, Lido is synonymous with “liquid staking.” Ethereum staking is one of crypto’s strongest narratives today, and Lido sits at its core.

-

Product-Market Fit: Clear advantage—stETH (Lido’s liquid staking token) is deeply integrated across DeFi, Lido holds near-monopoly market share, and offers a mature product with high user trust.

-

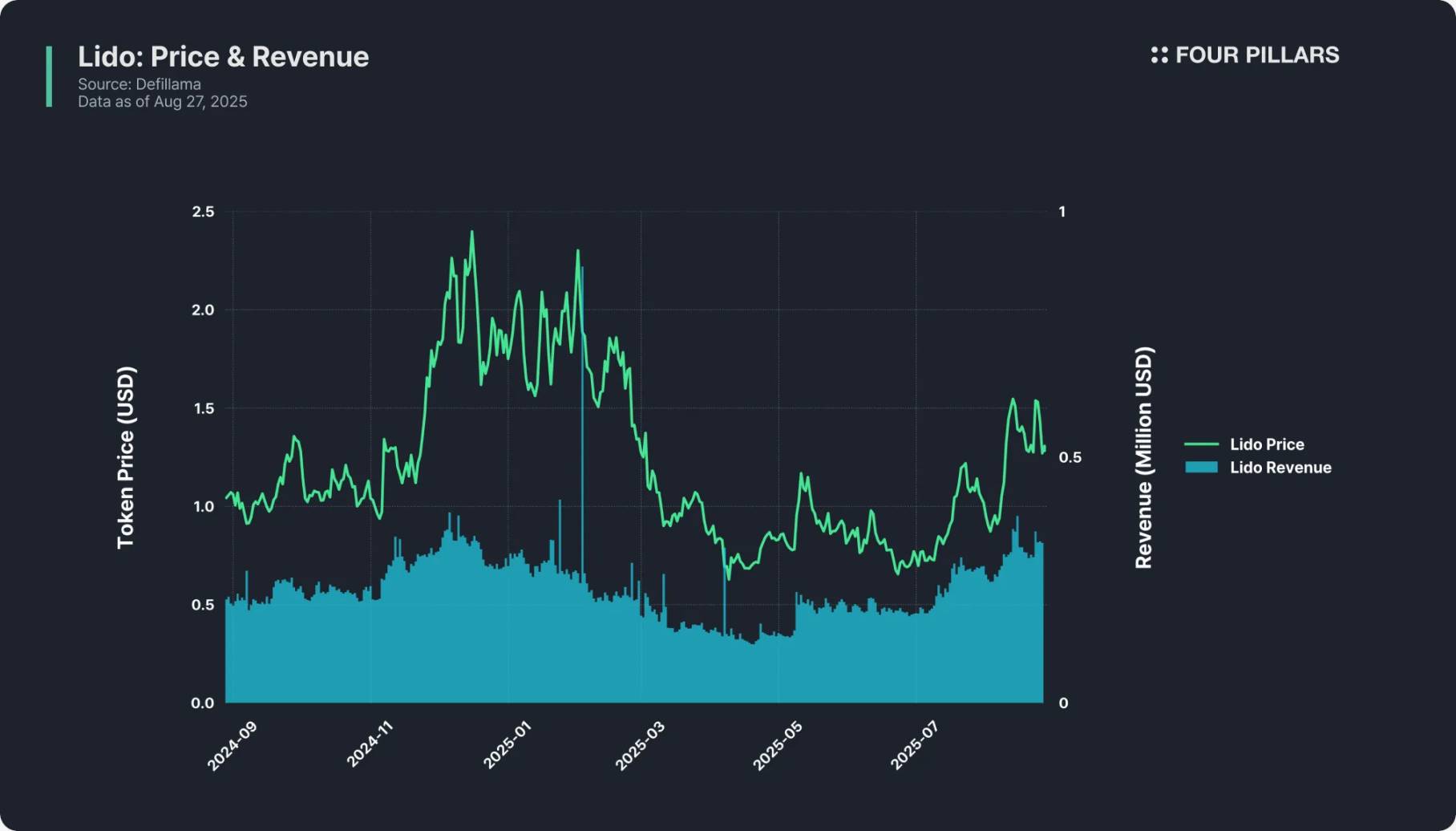

Value Capture: Entirely missing. Although Lido charges a 10% fee on staking rewards, all proceeds go to node operators and the protocol treasury—LDO holders receive nothing. The token serves only governance purposes. For example, despite generating over $100 million in revenue last year, LDO holders received zero returns.

Lido is a top-tier protocol, yet its token remains a mere “observer”—a classic case of “two out of three.”

PENDLE: Two Criteria Met

-

Narrative: Central to the “yield trading” niche—users can split yield-bearing assets into PT (principal tokens) and YT (yield tokens) and trade yield rights on Pendle. As the pioneer and leader in this space, Pendle benefits significantly from the “DeFi + liquid staking” market wave.

-

Product-Market Fit: Over $10 billion in TVL, cumulative trading volume exceeding $50 billion, multi-chain deployment, and innovative products like Boros that open new markets—widely recognized by yield traders and liquidity providers.

-

Value Capture: A weak link. Pendle takes a 5% cut on yield and allocates part of trading fees to vePENDLE stakers, but the nature of yield trading leads to low user activity—most users “set and forget,” resulting in only tens of thousands of dollars in daily fees, mismatched against its massive TVL and market cap.

Pendle relies on narrative and PMF, but limited revenue caps its value capture potential. Additionally, the product has a high barrier for average users—yield trading logic is complex and hard for non-experts to grasp, constraining short-term growth.

Zero to One Criteria Met: 99% of Tokens

The vast majority of tokens fall into this category: either they have only a narrative without real users, or they launched a product without value capture, or they’re obscure governance tokens. Aside from rare exceptions like XRP and Cardano that defy market logic through “community faith,” nearly all altcoins follow the “greater fool theory”—price rises depend solely on finding “greater fools,” not real value.

Outlook

The investment triangle is easy to grasp but hard to apply. Metrics can be gamed, protocol docs often hide crucial details, and tokenomics may shift unexpectedly. Market narratives evolve rapidly—tokens scoring zero or perfect today could see completely reversed trajectories tomorrow.

Moreover, altcoin investing is difficult due to extreme case-by-case variation: most tokens underperform BTC, ETH, or SOL. Yet, discovering a truly “three-out-of-three” rare gem could yield life-changing returns—one successful investment might erase years of losses or even transform one’s financial future. This is the allure of crypto investing—the reason people keep participating despite the odds. Good luck.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News