Offshore "feast is over": from U.S. stock market tax补缴 to on-chain pricing power, the battle for direction among Crypto exchanges

TechFlow Selected TechFlow Selected

Offshore "feast is over": from U.S. stock market tax补缴 to on-chain pricing power, the battle for direction among Crypto exchanges

The future exchange is not a war of fleeting moments, but a divergence among those rewriting global market rules.

By: Web3 Farmer Frank

Have you ever thought about whether crypto trading will be taxed in the future?

Starting this spring, many mainland Chinese users who trade U.S. stocks via brokers like Tiger Brokers and Futu Securities have gradually received back-tax notices. This is no coincidence. With the implementation of CRS (Common Reporting Standard) for global financial information exchange, overseas accounts and investments—from high-net-worth individuals to ordinary middle-class—are now under comprehensive surveillance.

The logic is clear: the "sovereign vacuum" in finance rarely lasts long. Today’s U.S. stock brokers may well foreshadow tomorrow’s crypto trading landscape—once the wild west era ends, even the Liangshan outlaws must eventually join the official army:

From the invisible freedom of offshore U.S. stock accounts to global CRS data sharing, from the unchecked growth of third-party payments to strict central bank licensing, financial innovations operating outside mainstream regulation inevitably transition from gray zones to formal compliance—a one-way, irreversible path.

Especially this year, as Web3 gains legitimacy and institutional involvement intensifies, crypto exchanges stand at a crossroads: those pursuing local compliance sit firmly in place, offshore gray-zone operations are rapidly shrinking, while on-chain DEXs are gaining strong momentum.

There is no middle ground—only clear directional divergence.

Offshore CEX: The Party Is Over

Centralized exchanges (CEX) remain the top predators in today’s crypto ecosystem.

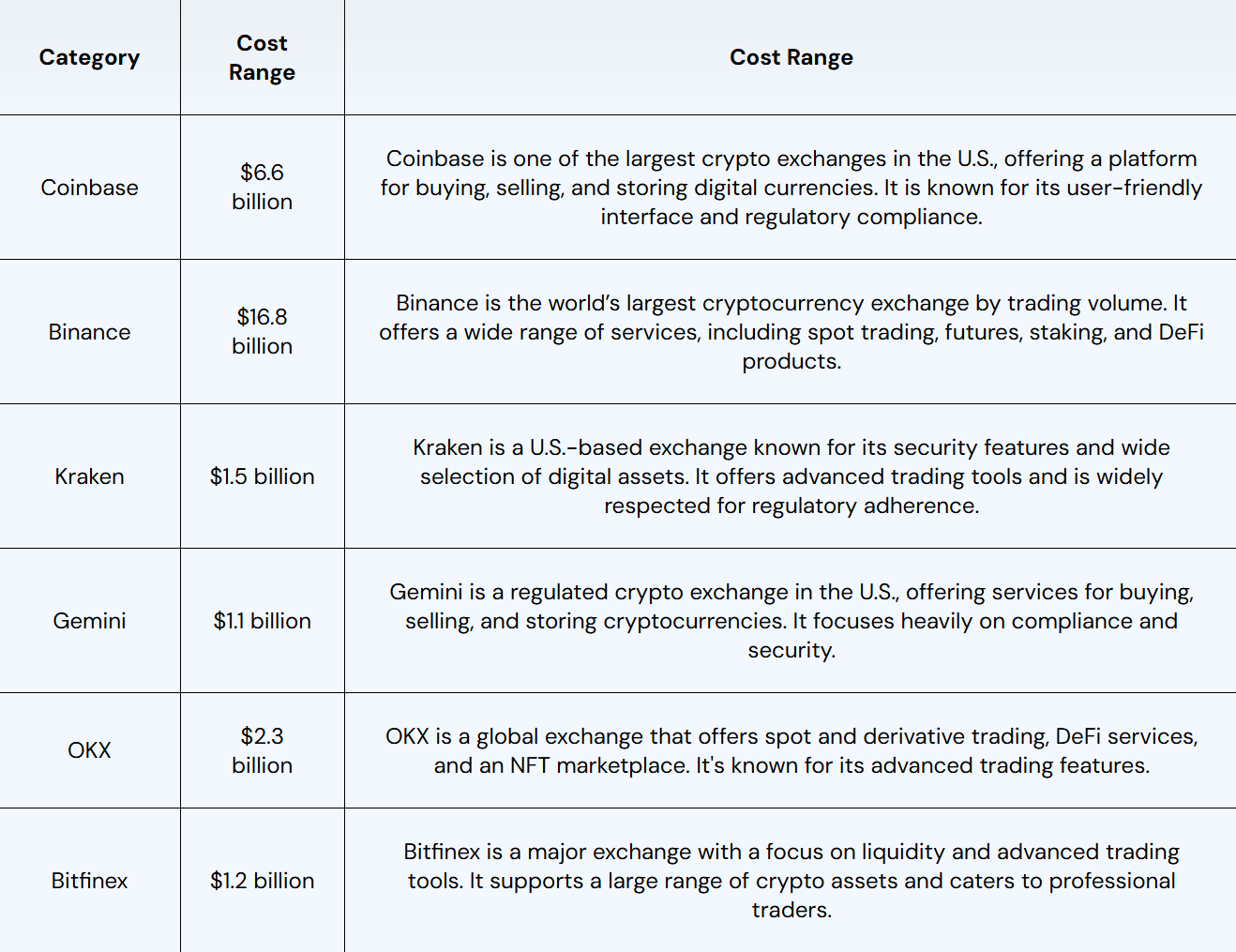

Indeed, CEXs whose core revenue comes from trading fees have captured the biggest windfall from the explosive growth of crypto. Public estimates suggest that leading offshore CEXs such as Binance and OKX generate annual revenues and profits in the tens or even hundreds of billions of dollars. For example, Binance reported $16.8 billion in revenue in 2023, with annual crypto trading volume exceeding $3.4 trillion.

This means that even during periods of global macroeconomic turbulence, offshore CEXs remain among the most profitable businesses.

Source: Fourchain

However, the golden age of the offshore model has clearly come to an end.

Compliance pressure and tax crackdowns are spreading from traditional finance into crypto. Just like the recent wave of back-tax enforcement on U.S. stock trading, attentive users should have noticed that over the past year, offshore CEXs like Binance and OKX have also faced growing public scrutiny:

including but not limited to restricting user accounts that rely solely on crypto assets as income, and requiring users to submit annual income and tax payment proofs.

Objectively speaking, the cost for offshore giants like Binance and OKX to “come ashore” has been enormous—not only do founders face legal liabilities, but significant financial investment is required too. Binance publicly disclosed that in 2024 alone, it spent hundreds of millions of dollars on compliance and security, expanding its internal compliance team to 650 experts.

Since 2025, all major players have been racing to achieve compliance and pursue potential listings during this “window of political opportunity.”

For instance, after the U.S. SEC dropped securities violation charges against Kraken and the FBI concluded its investigation into the founder, Kraken hinted at a potential IPO. Recently, it was rumored to raise $500 million at a $15 billion valuation, marking a full turn toward compliance.

OKX followed a similar path—reaching a settlement with the U.S. Department of Justice in February this year, paying over $500 million in fines, and actively advancing plans for a U.S. IPO. Reports indicate that OKX elevated its U.S.-based compliance unit to the highest priority across all departments.

These moves send a clear signal: the operational space for offshore models has shrunk to a historic low, and CEXs are rushing to seize the final compliance window.

In fact, this crypto political honeymoon period—driven by Trump reshaping policy narratives, BTC being added to corporate balance sheets, and the stablecoin boom—is likely the last chance for offshore CEXs to transform.

Miss this “coming ashore” opportunity, and they may fall from apex predators to targets of obsolescence.

A Predictable Tripartite Landscape

If today’s crypto market resembles the Hong Kong and U.S. stock markets from a decade ago in terms of Chinese investor participation, then regulatory and market evolution is merely a few years behind schedule.

When global tax compliance, capital controls, and institutional financial players converge, the future exchange landscape is almost certain to split into “three kingdoms”:

-

Locally licensed, compliant CEXs: Represented by Coinbase, Kraken, HashKey, OSL, etc., these platforms feature banking integration and compliant clearing capabilities, primarily serving local users and institutions/high-net-worth clients, building long-term brand value through regulatory moats;

-

Offshore gray-zone CEXs: Represented by Binance, Bitget, Bybit, etc., serving global retail and higher-risk users, these will inevitably be squeezed, eroded, and marginalized under current global compliance trends and increasingly competitive on-chain experiences;

-

Pure on-chain decentralized exchanges (DEX / DeFi-native): No KYC, permissionless access, natively supporting on-chain asset settlement and multi-chain composite trading, potentially becoming new global liquidity hubs in the future;

Among them, compliant exchanges are clearly the “ascending curve players” benefiting from policy tailwinds. In markets like the U.S. and Hong Kong, compliant platforms can partner with institutions and banks, and integrate into local tax systems. Their strategic goal is clear—to become the next-generation digital asset securities and clearing houses.

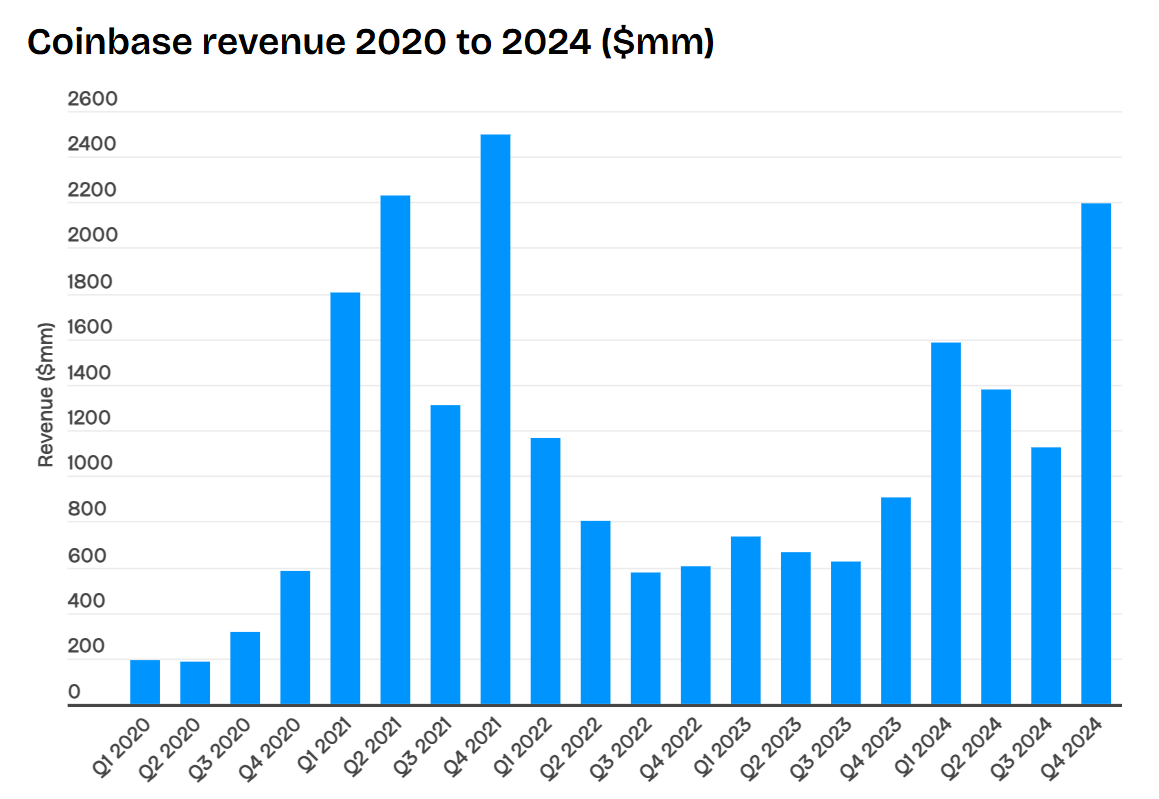

One often overlooked signal is that compliant exchanges like Coinbase are entering their golden era—Coinbase generated $6.564 billion in revenue in 2024, more than doubling YoY, with net profit reaching $2.6 billion, nearly 50% of offshore leader Binance (based on market estimates).

More importantly, Coinbase faces virtually no risk of enforcement actions or bank freezes in major jurisdictions, making it the natural “safe harbor” of choice for institutions and high-net-worth users.

On-chain DEXs represent the “global market players” with the greatest potential and highest ceiling. They don’t rely on national licenses, operate as 7×24 global liquidity hubs, especially with native support for on-chain settlements and cross-asset strategies, offering high programmability.

While their current market size remains under 10% of CEX volumes, their growth elasticity is enormous. Once the on-chain derivatives market matures, DEXs’ depth and strategic flexibility could attract large inflows of high-frequency traders, arbitrageurs, and institutional liquidity.

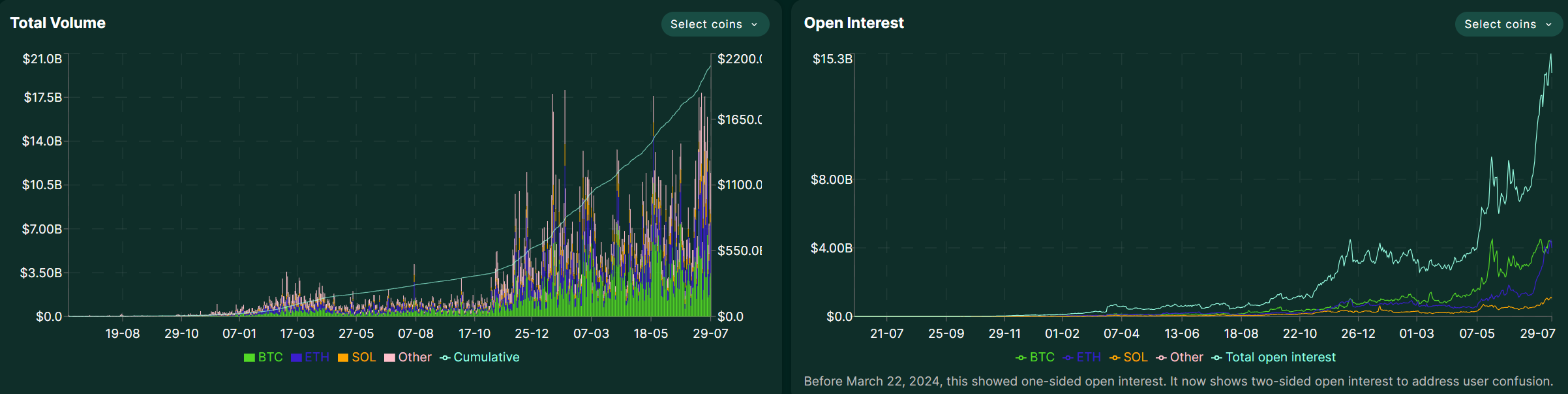

For example, Hyperliquid saw soaring asset deposits in July, rising from just under $4 billion at the beginning of the month to $5.5 billion, briefly approaching $6 billion in mid-to-late July.

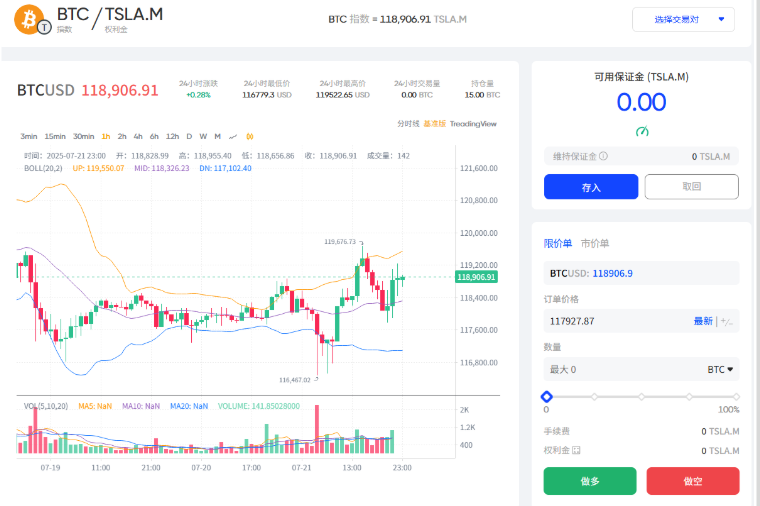

Beyond being vehicles for DeFi innovation, DEXs may also become the decentralized pricing foundation for global commodities and crypto assets. Take Fufuture’s newly launched TSLA.M/BTC index pairs based on “coin-denominated perpetual options”:

Users can use TSLA.M as margin to participate in perpetual option trading on BTC/ETH, not only opening new liquidity pathways for tokenized U.S. stocks, but also paving the way for pricing pools for tokenized gold, crude oil, or other small-cap meme assets.

Overall, the strategic significance of DEX derivatives like Fufuture—which merge options and perpetual contracts—lies in transforming long-tail assets previously idle in wallets (e.g., SHIB, TSLA.M) into usable margin, activating cross-asset liquidity, creating a natural positive feedback loop where “holding equals contributing to liquidity,” making on-chain markets closer to traditional derivatives in capital efficiency and depth.

In contrast, offshore CEXs have already peaked, with their survival space rapidly shrinking. Caught between compliance demands and on-chain competition, they lack long-term viability. Meanwhile, tightening global regulations, CRS tax data sharing, and bank KYC systems make gray-market traffic unsustainable.

The offshore model’s feast is ending. Once a “gray buffer zone” exploiting regulatory arbitrage, it may soon linger permanently on policy margins, being eaten away from both sides by compliant exchanges and on-chain markets: either integrate into tax and compliance frameworks as locally licensed entities, or go fully on-chain as borderless global markets.

The middle ground is destined to be eliminated.

New DEX Frontier: Decentralized Global Asset Pricing

From a longer-term perspective, the battle for exchanges is no longer just about traffic and fee competition—it’s about divergent paths in rewriting global market rules.

If the first phase of DEXs was largely a DeFi innovation sandbox, then with licensed local exchanges in the U.S., Hong Kong, and elsewhere absorbing compliance demand, integrating into tax systems, and aligning with banking infrastructure, the mission of DEXs may be completely redefined:

They may assume the role of “price discovery and pricing authority” for global permissionless markets.

Why does global asset pricing belong to on-chain DEXs?

-

Unlike equities and bonds, which carry strong regional attributes (except U.S. stocks and Treasuries), commodities like gold, crude oil, copper, and cryptos like BTC and ETH are inherently global trading instruments;

-

Traditional commodity futures are concentrated in Chicago, London, and Shanghai, constrained by time zones and trading hours, whereas on-chain markets operate 7×24 without interruption, offering time-zone-free, permissionless liquidity;

-

Better yet, stablecoins serve as universal settlement tools—users open positions with stablecoin margin, and all P&L is settled in stablecoins, meaning price discovery is no longer bound by geography or banking systems;

With these three advantages, DEXs are naturally positioned to become the decentralized pricing foundation for crypto and commodities.

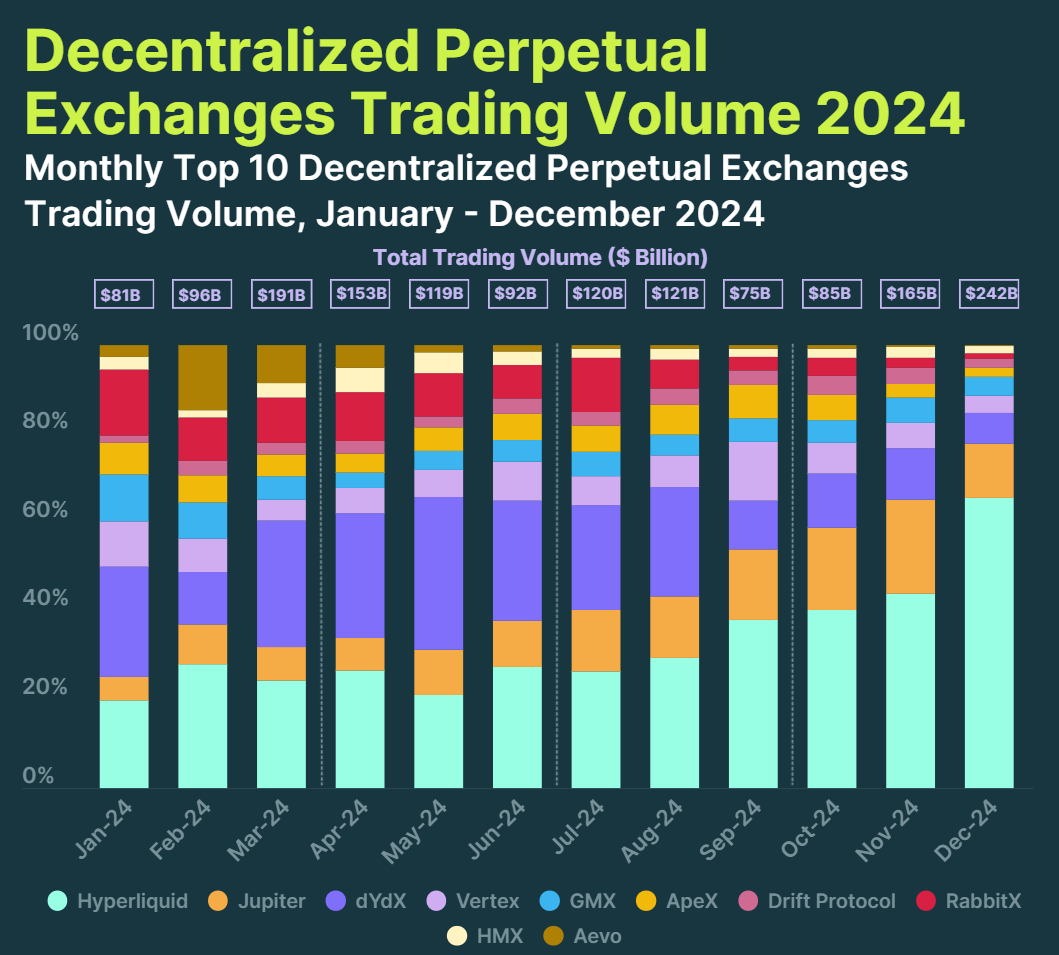

Source: CoinGecko

Of course, what truly supports price discovery on DEXs has never been spot trading alone, but rather the trading depth and price discovery mechanisms built by derivatives like futures and options.

This explains why derivative DEXs saw explosive growth in 2024, with total trading volume across Perp DEXs reaching $1.5 trillion—more than double the $647.6 billion in 2023.

Futures were led by Hyperliquid, whose annual trading volume surged from $2.1 billion in 2023 to $57 billion in 2024—an increase of 25.3x. Recently, Hyperliquid has ranked among the top five daily-volume derivatives platforms, peaking at over $10 billion in daily volume, comparable to mid-tier CEXs.

Source: Hyperliquid

At more complex levels of cross-asset strategies and on-chain derivative pricing logic, Fufuture offers a concrete case study. Its “coin-denominated perpetual options” have no fixed expiry, charge dynamic premiums based on holding duration, and combine the nonlinear payoffs of options with the trading rhythm of perpetual contracts.

Anyone who has actually used Fufuture’s perpetual options can clearly see how innovative they are compared to traditional on-chain options. Take SHIB holders as an example: meme assets like this are almost never accepted as collateral on traditional on-chain derivatives protocols, but on Fufuture, simply depositing SHIB allows it to be used as margin.

In practice, once SHIB is deposited as “available margin,” the entire trading process is nearly identical to contract trading—no need for stablecoin margin, no need to weigh expiry dates, strike prices, or profit curves. Just select the underlying asset, direction (long/short), and position size to start trading.

Theoretically, this mechanism can activate any on-chain asset—including the latest tokenized U.S. stocks—as usable margin: users can use TSLA.M or NVDA.M as margin to execute perpetual option strategies on BTC or ETH (see further reading: Liquidity Considerations for Tokenized U.S. Stocks: How Should On-Chain Trading Logic Be Rebuilt?), forming a true cross-market speculation and hedging network—something traditional CEXs struggle to offer in terms of combinatorial freedom.

From an industry standpoint, on-chain derivatives DEXs like Hyperliquid and Fufuture are significant not just because they avoid compliance constraints, but because they provide a 7×24, borderless trading and settlement network for global commodities.

Particularly, DEXs like Fufuture, with new trading mechanisms that eliminate the need to pre-convert to stablecoins and allow direct position entry, maximize the liquidity and strategic potential of on-chain assets, delivering a CEX-like experience. Only on-chain derivative DEXs can objectively achieve this—and they’re best positioned to become the “gateway to pricing power” for global assets on-chain.

Final Thoughts

The future of exchanges isn’t a short-term race, but a divergence among architects of global market rules.

One path leads to local compliance, one to offshore gray zones, and one to becoming the next decentralized pricing foundation for global commodities and crypto assets.

There is no middle ground.

At the future crossroads, directions are set—the rest is just a matter of time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News