Coinbase: Saying Goodbye to Being Flat—How Should Traditional Institutions Allocate to Crypto Assets?

TechFlow Selected TechFlow Selected

Coinbase: Saying Goodbye to Being Flat—How Should Traditional Institutions Allocate to Crypto Assets?

The first step to摆脱 zero configuration is often the most difficult.

Written by: Coinbase

Translated by: Luffy, Foresight News

Web1.0 and Web2.0 transformed global data communication and social media, but the financial sector has not kept pace. Today, "Web3.0" is revolutionizing money and finance using blockchain protocols. These protocols are evolving rapidly, and companies are adopting them to stay competitive.

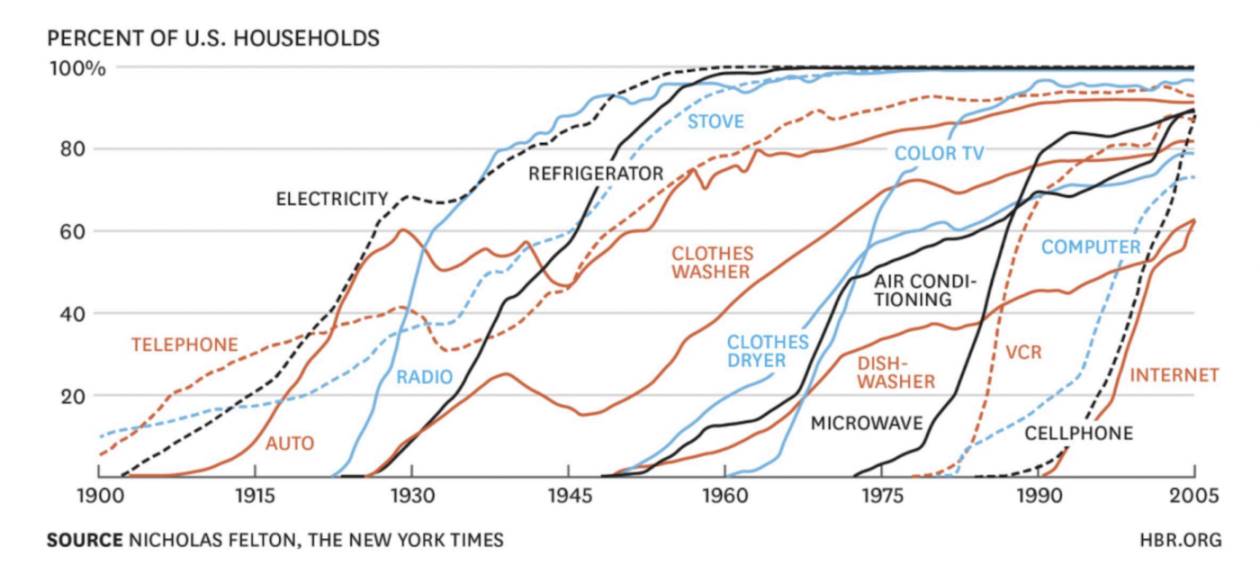

The development of disruptive technologies follows a predictable trajectory, but their adoption timelines are shortening rapidly. It took 75 years for the telephone to reach 100 million users, 30 years for the internet, 16 years for mobile phones, while today's mobile apps achieve mass adoption in just months. For example, ChatGPT reached 100 million users in less than two months! Web2.0 platforms reduced transaction friction but centralized control, capturing most of the economic value and user data. Blockchain protocols address these shortcomings, enabling money to move freely on the internet, giving users ownership, and operating without intermediaries.

Currently, institutional adoption of blockchain is accelerating, laying the foundation for disrupting traditional Web2.0 platforms at the consumer level, and policymakers are taking notice. The GENIUS Act has now become law, regulating stablecoin issuance with strategic significance for the U.S. dollar’s global dominance. The CLARITY Act has passed the House, aiming to clarify how the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) regulate cryptocurrencies. Importantly, both bills have received bipartisan support. Finally, the SEC has just announced Project Crypto, a full commission initiative to modernize securities rules and regulations, fully integrating blockchain technology into U.S. financial markets. Cryptotechnology is rewriting history.

Three Major Trends: Platforms Facing Disruption

Web2.0 platforms rely on centralization, limiting interoperability across different ecosystems. Blockchain protocols will break this model, creating open, permissionless, interoperable markets. Three major trends are driving this transformation:

Bitcoin Protocol

With a fixed supply of 21 million coins, Bitcoin is a decentralized network secured by cryptography, with a market capitalization exceeding $2 trillion and hundreds of millions of users. Initially conceived as peer-to-peer cash, Bitcoin has evolved into a store of value favored by institutions such as Coinbase (with 105 million users), BlackRock (whose Bitcoin ETF reached $80 billion fastest), and multiple governments. Daily trading volume in spot and derivatives markets reaches $70–100 billion, ensuring ample global liquidity. Interoperability initiatives like wrapped Bitcoin on Ethereum enhance network effects, enabling Bitcoin to be used across thousands of third-party applications and networks. As a result, the Bitcoin economy is growing rapidly, fueling demand for this scarce asset.

Stablecoin Adoption

Stablecoins are fiat currencies tokenized on-chain, holding over $270 billion in assets across more than 175 million wallets. Although small compared to traditional fiat, stablecoin annual transfer volume is expected to approach $50 trillion by 2025, making it the true killer application in crypto.

Stablecoins are among the top 20 holders of U.S. Treasury securities. So efficient are stablecoins—faster and cheaper than traditional wire transfers—that the U.S. government has prioritized clarifying regulatory oversight of stablecoin usage. Consequently, incumbent platforms like PayPal and Visa must adapt and actively embrace these technologies; they can no longer rely on oligopolistic relationships with banking systems.

The U.S. Treasury Secretary expects stablecoin assets could surpass $2 trillion by 2028 and handle 30% of global remittances. It is reasonable to expect that the stablecoin economy will generate billions in fee revenue for on-chain platforms like Coinbase.

Decentralized Finance (DeFi) Protocols

DeFi offers programmable asset management services, with hundreds of protocols locking up approximately $140 billion in funds, providing 24/7 trading, lending, and tokenization services. DeFi applications like AAVE and Morpho enable permissionless lending, while perpetual contracts on decentralized exchanges (DEXs) offer sophisticated strategies such as funding rate arbitrage.

BlackRock’s BUIDL (BlackRock USD Institutional Digital Liquidity Fund) will disrupt and transform asset management, shifting power to on-chain distributors. A new wave of asset managers is emerging in this space, while existing traditional platforms face existential challenges—adapt or be left behind.

Bitcoin and stablecoins are approaching full regulatory clarity and mass adoption. In the coming years, DeFi is expected to achieve clearer regulation and improved scalability. Companies engaging in on-chain activities today will lead the next wave of innovation. These three trends will bring significant shifts in corporate growth and portfolio returns. Investors with zero current exposure to crypto assets should take note.

Moving Beyond Zero Allocation: A Portfolio Approach

Cryptocurrencies are still young—Bitcoin is only 16 years old, Ethereum 10, and only recently did Ethereum upgrade to a proof-of-stake consensus mechanism, becoming an extremely robust network. Stablecoins have existed for just over seven years, and their regulation has been clarified with the passage of the GENIUS Act.

But these technologies are entering their golden age, maturing rapidly as stablecoins integrate into banking, payments, automation, AI agents, and other industries.

Just as governments are bringing crypto into the mainstream through careful policy adjustments, institutional investors are evaluating frameworks for incorporating cryptotechnology into portfolios. This process is only beginning, and the first step is always the same: moving beyond zero crypto allocation.

Five Strategies to Move Beyond Zero Allocation

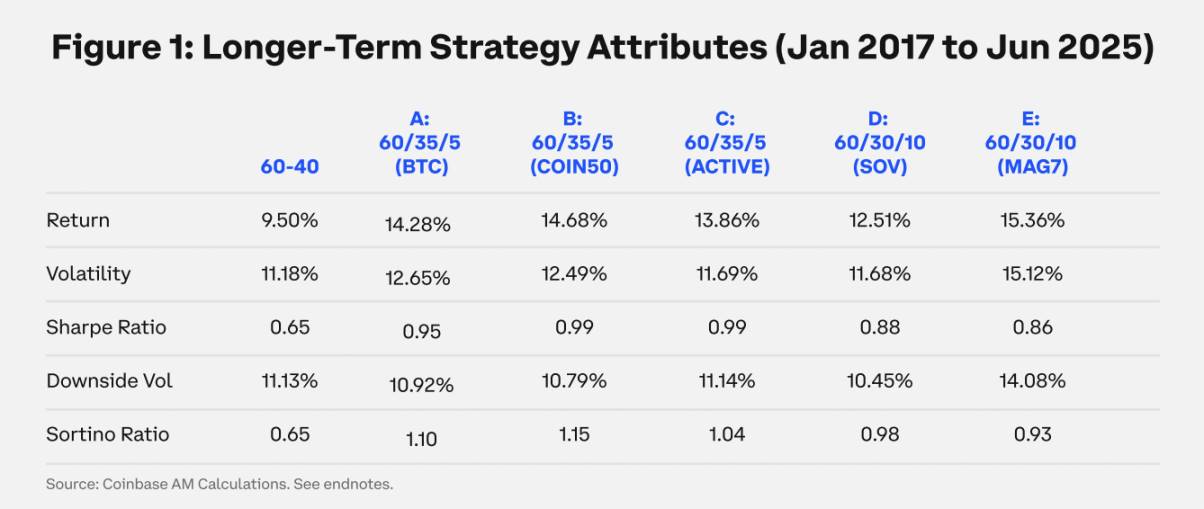

To promote cryptocurrency adoption in institutional portfolios, we evaluated five strategies leveraging portfolio analysis, capital market assumptions, and index methodologies. The following three charts outline these strategies: Portfolio A) Bitcoin (BTC), B) Coinbase 50 Index (COIN50), C) Active Asset Management (ACTIVE), D) Store of Value Index (SOV), and E) Publicly Traded Crypto Stocks (MAG7), designed to address diversification and risk-adjusted return issues within traditional 60/40 stock-bond portfolios.

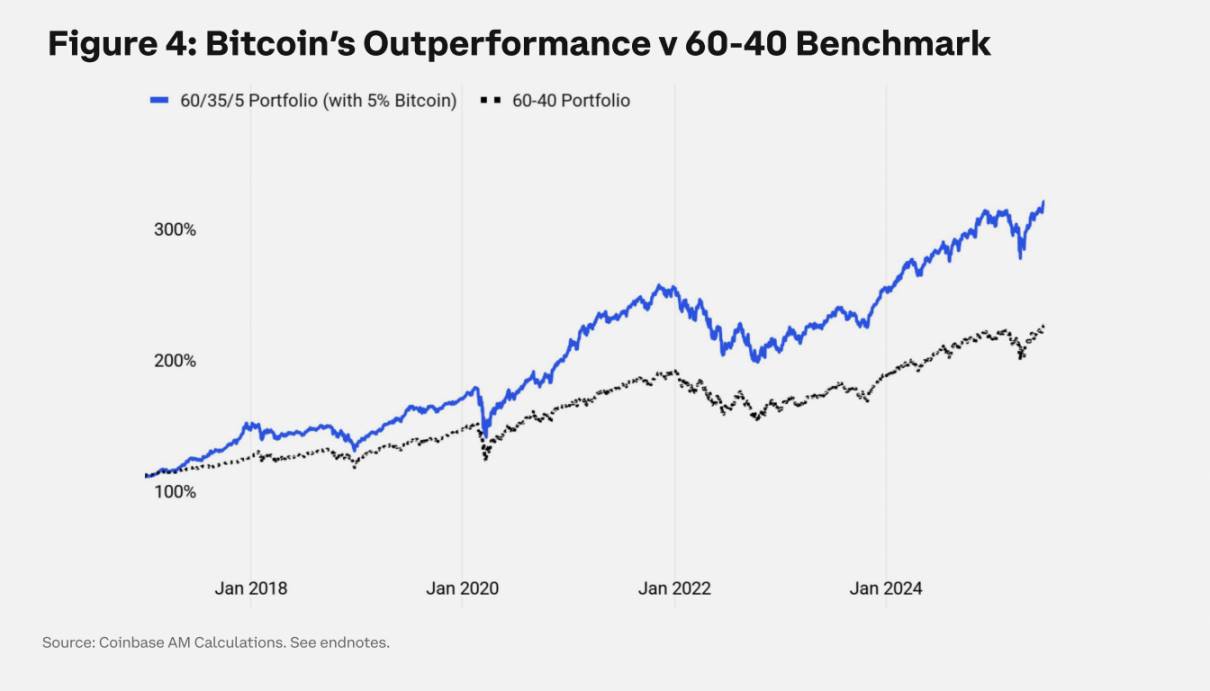

Portfolio A: Bitcoin (5% Allocation)

The simplest way to move beyond zero allocation is adding Bitcoin to a portfolio. To simplify exposure, we consider a 5% allocation to Bitcoin. From January 2017 to June 2025, a 5% Bitcoin allocation significantly enhanced portfolio returns. During this period, Bitcoin achieved a compound annual growth rate (CAGR) of 73%, with annualized volatility currently at 72% and trending downward. (Performance data shown in Figure 1).

Even a modest 5% Bitcoin allocation (replacing bond allocation) substantially improves portfolio performance compared to the 60/40 stock-bond benchmark, adding nearly 500 basis points to annual portfolio returns while improving risk-adjusted returns and reducing downside volatility.

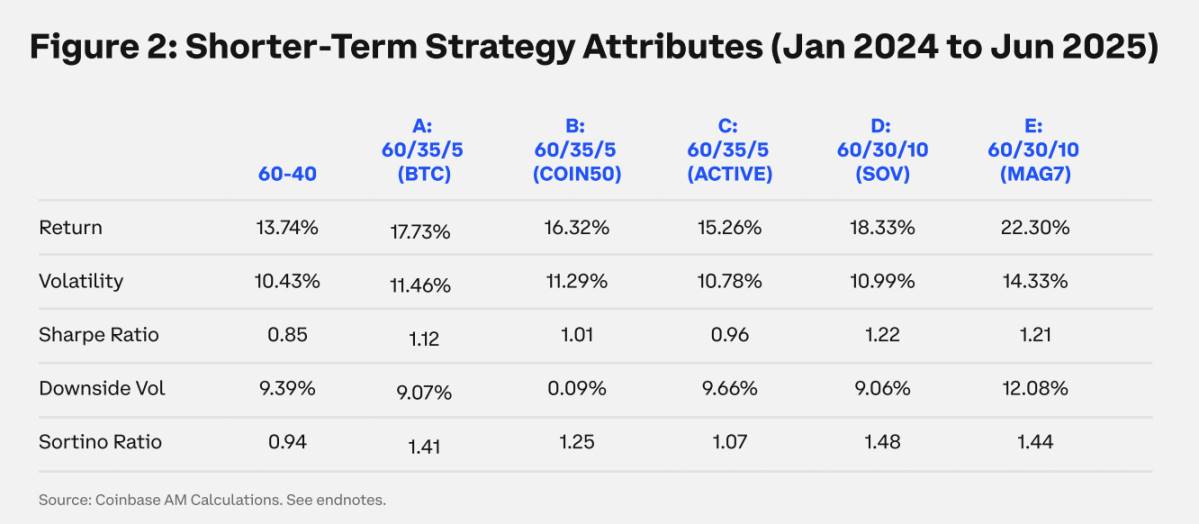

Given rising institutional adoption since the launch of Bitcoin exchange-traded products (ETPs) in 2024, a shorter sample period warrants separate analysis. Not only do overall results hold, but risk-adjusted returns are even stronger. The Sortino ratio (measuring excess return relative to downside volatility) increased by 34% as institutional adoption rose. (Performance data shown in Figure 2).

Portfolio B: Passive Coinbase 50 Index (5% Allocation)

Many crypto-focused investors seek broader exposure aligned with the evolution of the crypto market. Rule-based indices with systematic rebalancing allow institutions to capture broader market trends without focusing on micro-level asset selection—all governed by predefined rules. The Coinbase 50 Index (COIN50) serves as our benchmark index.

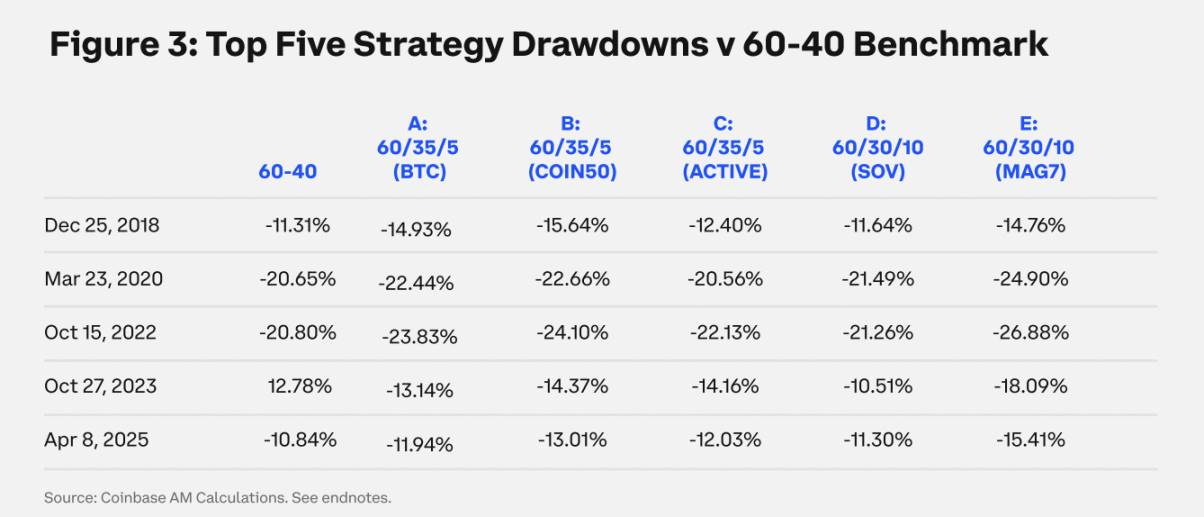

A 5% Bitcoin allocation performs similarly to a 5% COIN50 index allocation. Over longer periods, the index captured early DeFi growth and other market events such as NFTs, artificial intelligence, and meme coin rallies. For investors seeking broader crypto market exposure, this index is the preferred strategy. During shorter sample periods when Bitcoin’s market share increased, it slightly outperformed in return contribution and risk-adjusted metrics, though with slightly higher downside risk. (Performance data shown in Figures 1–3).

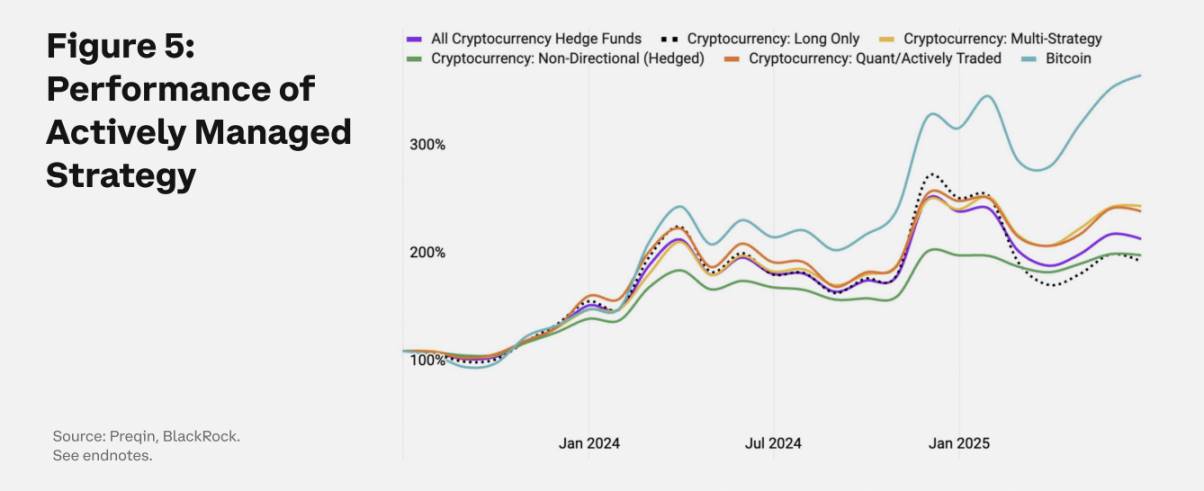

Portfolio C: Active Asset Management (5% Allocation)

Can active crypto strategies add investment value? The answer is nuanced—both yes and no. Preqin data from BlackRock provides a benchmark for actively managed crypto funds since 2020, covering five strategies: long Bitcoin, pure long crypto, multi-strategy, market-neutral hedge, and quantitative funds. Over longer time horizons, risk-adjusted returns slightly outperform benchmarks, but underperform significantly during the institutionalization phase (e.g., 2022 to present).

The primary motivation for shifting to hedge fund strategies is better downside risk management. However, the hedge fund industry has not succeeded here—the drawdowns resemble those of Bitcoin and the COIN50 index, reflecting similar levels of downside volatility as passive strategies. This may reflect scaling challenges, as active strategies take on more directional risk to meet asset demand.

The crypto industry remains in its early stages, and the current underperformance of active strategies may be characteristic of this phase.

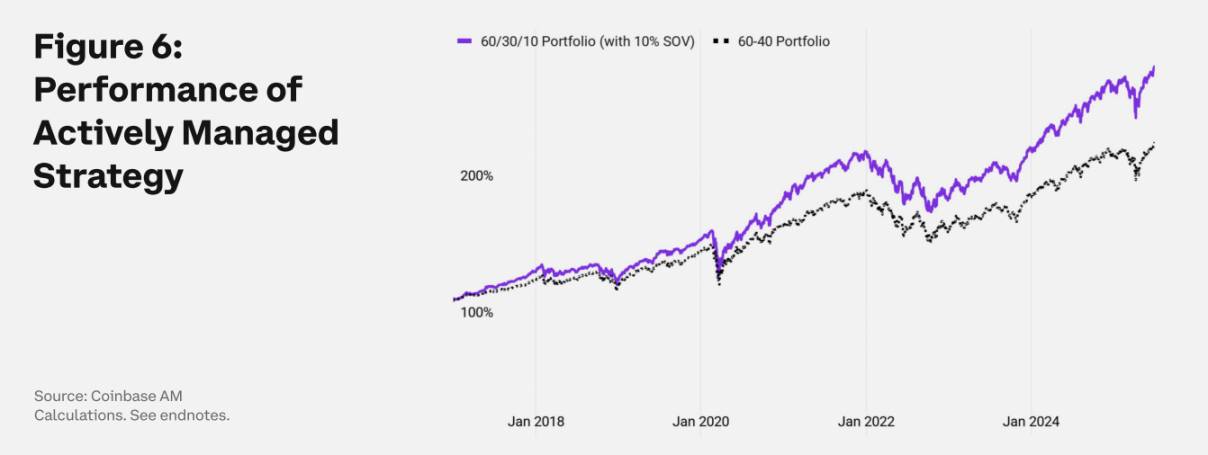

Portfolio D: Store of Value Index = Bitcoin + Gold (10% Allocation)

Is Bitcoin a threat to gold or a complement? Bitcoin has already assumed a role as a store of value. Nearly 300 entities—including state and federal governments and corporations—have established Bitcoin reserve strategies, more than double the number a year ago. Yet Bitcoin is not the only store of value; it competes with other assets like gold for this status.

Gold has a market cap of $20 trillion, Bitcoin $2 trillion. We believe gold and Bitcoin can be complementary. We created an index based on Bitcoin and gold, where Bitcoin’s weight is inversely proportional to its volatility. In today’s low-volatility environment, Bitcoin’s weight in the index increases.

We view the “Store of Value” index as part of the institutionalization process—a new asset class creation where allocators hold both gold and Bitcoin to hedge against currency devaluation caused by rising sovereign debt in wealthy nations. This differs from the current view of Bitcoin as merely another commodity.

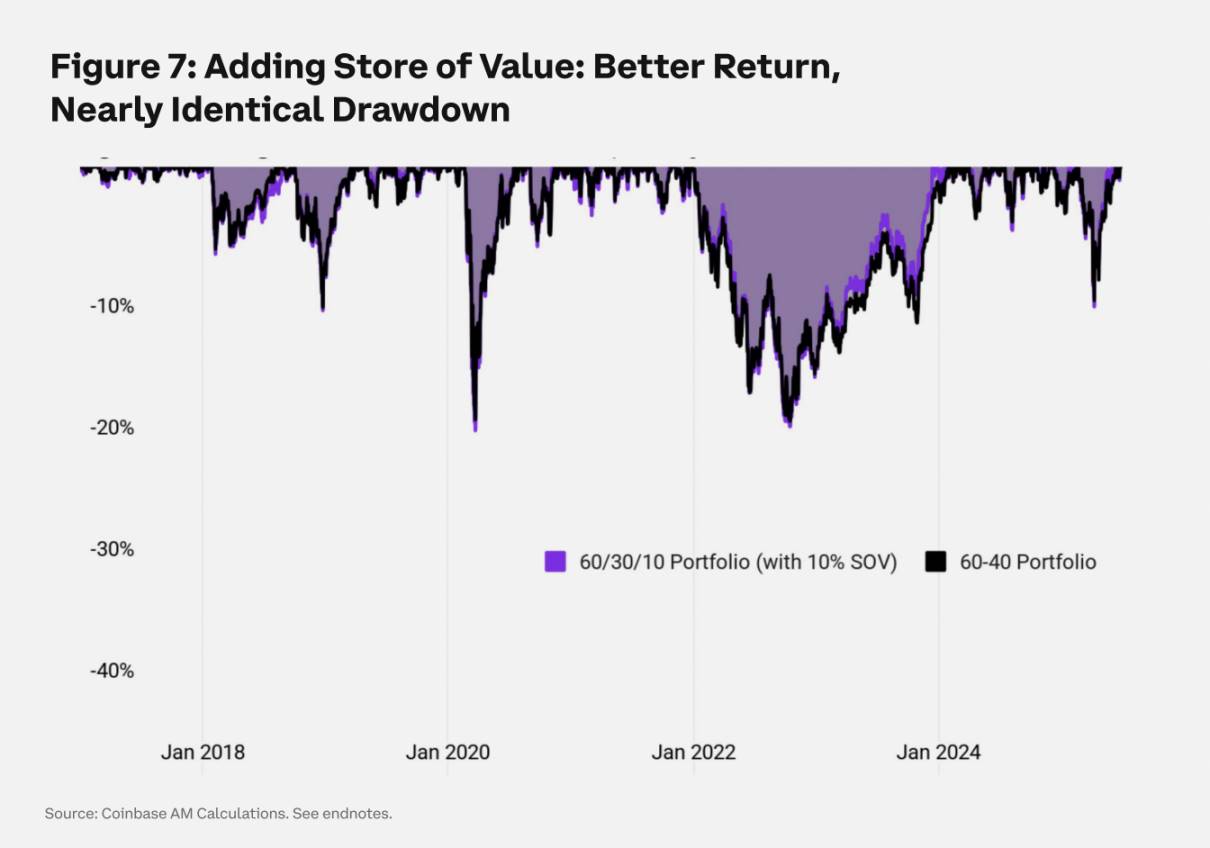

Portfolio returns (shown below) support this view. A 10% allocation to the Store of Value index reflects lower volatility, normalizing portfolio volatility over the sample period. In the short term, as the store-of-value concept gains traction institutionally, adding Bitcoin to the portfolio proves highly beneficial in return contribution and significantly outperforms pure crypto strategies on a risk-adjusted basis.

However, this advantage diminishes over the long term, underscoring the need for dynamic allocation approaches to store-of-value assets. A disciplined combination of gold and Bitcoin represents the right allocation at the right time.

Portfolio E: Crypto-Related Equities (10% Allocation)

In our final assessment of moving beyond zero allocation, we explore equity investments in crypto-native companies and established platforms rapidly integrating crypto technology. We created the “MAG7 Crypto Basket,” including publicly traded stocks of BlackRock, Block Inc., Coinbase, Circle, Marathon, Strategy, and PayPal.

During periods when growth stocks outperform the broader market, we find that allocating 10% to the MAG7 Crypto Basket boosts performance but also increases volatility. Given the higher volatility of growth stocks, replacing bonds with crypto equities unsurprisingly increases overall portfolio volatility. Risk-adjusted outcomes underperform the Store of Value Index but slightly outperform holding Bitcoin alone. The trade-off is greater investment complexity and the deepest drawdowns. (Performance data shown in Figures 1–3).

Investors seeking to meet specific criteria may consider crypto-related equities, but this is the most complex and indirect method of gaining crypto exposure discussed in this article.

Where Are We Headed?

How does crypto fit into institutional investment frameworks? Addressing this question is crucial to unlocking institutional adoption of crypto assets. This process requires a solid asset allocation framework grounded in capital market assumptions—assumptions that shape long-term price expectations and guide portfolio construction.

Elevated equity valuations and persistent government borrowing have lowered long-term return expectations. According to rigorous capital market assumptions and forward-looking models, U.S. equities are projected to return 7% annually, U.S. bonds 4%, roughly in line with cash returns. In this low-return environment, investors must explore innovative capital preservation strategies, and Bitcoin stands out.

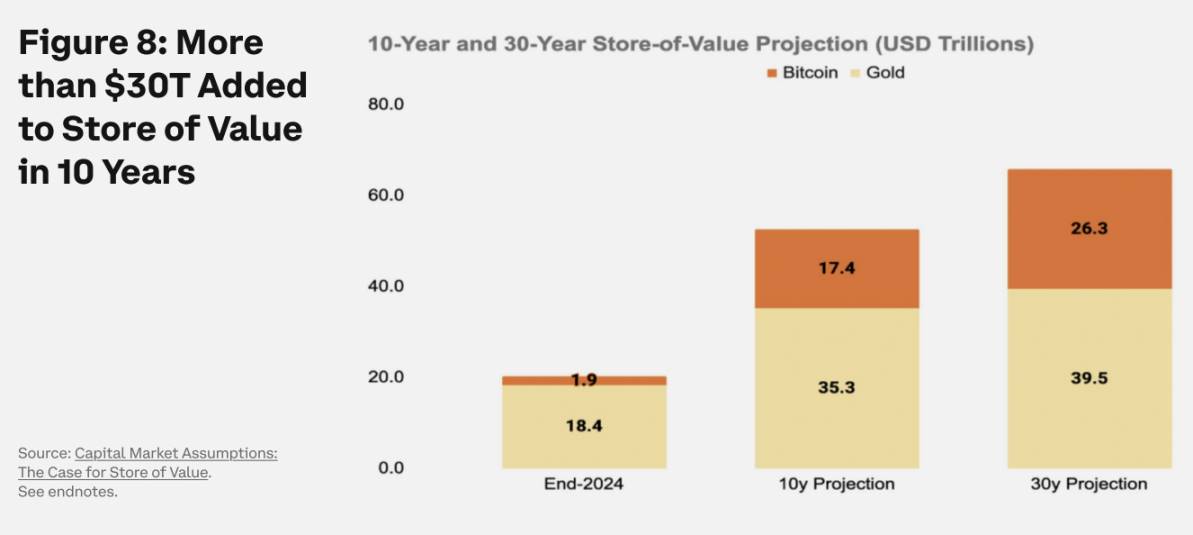

We believe store-of-value assets led by Bitcoin deserve a distinct capital market category, driven by macro factors such as monetary policy shifts and inflation hedging. We project annualized returns of 10%, with extremely low correlation to bond markets, which have delivered negligible real returns over the past decade (Figure 8).

Bitcoin’s fixed supply and decentralized nature make it a hedge against high inflation, enhancing portfolio resilience. But its appeal as a store of value goes beyond hedging—allocating to Bitcoin maximizes future capital flexibility.

Conclusion

Crypto is reshaping finance. Institutional investors seeking crypto exposure can consider multiple liquid market strategies—from direct passive allocations to Bitcoin or the Coinbase 50 Index, to actively managed funds, and strategies blending traditional and crypto finance. Moving beyond zero allocation is often the hardest step.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News