Pantera Analyzes Two Major Trends: Cryptocurrency Treasury Reserves and Stablecoins

TechFlow Selected TechFlow Selected

Pantera Analyzes Two Major Trends: Cryptocurrency Treasury Reserves and Stablecoins

At a time when confidence challenges are facing the health of the U.S. fiscal position, stablecoins have helped boost demand for Treasury securities.

Compiled & Translated: TechFlow

Investment Case in Crypto-Reserve Companies

Author: Cosmo Jiang, General Partner

A new frontier in public market crypto investing is emerging—Digital Asset Treasury Companies (DATs). These firms offer investors exposure to digital assets through permanent capital vehicles listed on public stock exchanges, adopting investment strategies similar to MSTR (Strategy, formerly MicroStrategy). After a deep dive into the mechanics of this strategy, we are confident in its merits and have made significant allocations.

As investors, we constantly challenge our own biases. Given the persistent premium in MSTR’s stock price and participation from fundamental-oriented funds like Capital Group and Norges, we see an asymmetric opportunity in leveraging the DAT trend. While this premium may not last forever, there remains strong fundamental justification for investing in digital asset treasury companies—and a rationale for why their valuations might trade above their underlying net asset value (NAV).

In the long run, investing in MSTR could allow shareholders to accumulate more bitcoin per share (BTC-per-share, BPS) than holding bitcoin directly. Here's a simple illustration:

If you buy MSTR at two times NAV, you’re effectively paying for 0.5 BTC instead of buying 1.0 BTC outright in the spot market. However, if MSTR can grow its BPS by 50% annually through fundraising (it grew 74% last year), by the end of year two, you’d own 1.1 BTC—more than a direct spot purchase.

To believe that MSTR can sustainably increase BPS, three conditions must hold:

-

Markets aren't always rational, and stocks can trade at premiums to NAV—something frequently observed in long-term markets.

-

The high volatility of MSTR’s stock enables it to raise capital via convertible bonds or call options at rich premiums.

-

The management team has sufficient financial acumen to capitalize on these market dynamics effectively.

From a macro perspective, the success of DATs lies in combining traditional investor behavior with digital asset exposure—essentially turning crypto into equities. Strong demand for MSTR, ETFs, and next-generation DAT products indicates that much capital had previously been locked out due to the complexity of crypto products such as wallet setup or exchange accounts. Now, even through traditional financial channels, this capital is entering the crypto space—an unequivocally positive signal.

From a supply structure standpoint, DATs differ significantly from ETFs: capital invested in DATs is effectively "locked in," as they function as one-way closed-end funds with low likelihood of selling pressure. In contrast, the crypto holdings within ETFs can be easily bought or sold. This structural feature could positively impact the price of the underlying asset—either because DATs continuously acquire more crypto for their treasuries or because they exert less downward pressure during market downturns.

Pantera has invested across multiple Digital Asset Treasury Companies (DATs), most notably Twenty One Capital (Nasdaq: CEP).

Founded and led by long-time Bitcoin advocate Jack Mallers, the company aims to replicate MSTR’s playbook and is backed by three major industry players: Tether, SoftBank, and Cantor Fitzgerald. Twenty One is mid-sized—large enough to leverage various capital market tools, yet small enough in market cap to maintain agility. This positioning may enable faster growth in BTC-per-share (BPS) compared to MSTR, justifying a higher valuation premium. Pantera was the largest investor in its PIPE (Private Investment in Public Equity), a financing mechanism where public companies raise capital by selling shares privately to institutional investors.

We also led the investment in DeFi Development Corp (Nasdaq: DFDV, formerly Janover), a pioneer in the U.S. DAT space. Led by CEO Joseph Onorati and CIO Parker White, DFDV follows a strategy inspired by MSTR but shifts the target asset from Bitcoin to Solana. As a potential alternative to Bitcoin, Solana offers several unique advantages: (a) It is earlier in its development lifecycle, suggesting greater upside potential; (b) It exhibits higher volatility than Bitcoin, creating more opportunities to profit from market swings; (c) It supports staking—earning yield by participating in network validation—which accelerates growth in SOL per share; (d) Current demand for Solana remains underpenetrated, as there are few alternative investment vehicles available (e.g., publicly traded miners or spot ETFs).

Our latest investment in this category is Sharplink Gaming (SBET), the first Ethereum-based digital asset treasury company in the U.S. SBET is backed by Consensys, a leading Ethereum software firm, with whom Pantera has collaborated for over a decade.

Through investments in DFDV, CEP, and SBET—and their subsequent market success—Pantera has helped catalyze a wave of similar ventures. We continue to actively evaluate additional opportunities in this space.

The Core Value of Cryptocurrency: The Dollar

Author: Erik Lowe, Head of Content

In our January blockchain letter this year, we explored how cryptocurrency could become the “accidental answer” to dedollarization. With the bipartisan GENIUS Act now passing the Senate and the new administration maintaining focus on dollar-backed stablecoins, blockchain is increasingly seen as a strategic tool for extending the global dominance of the U.S. dollar.

"As President Trump directed, we will ensure the dollar remains the world’s dominant reserve currency—and we will do so through stablecoins." — Scott Bessent, U.S. Treasury Secretary, White House Crypto Summit, March 7, 2025

The passage of the GENIUS Act establishes a clear and comprehensive regulatory framework for stablecoins, providing market participants with the confidence and clarity previously missing during the experimental phase. This further solidifies stablecoins’ status as the “killer application” within the crypto ecosystem.

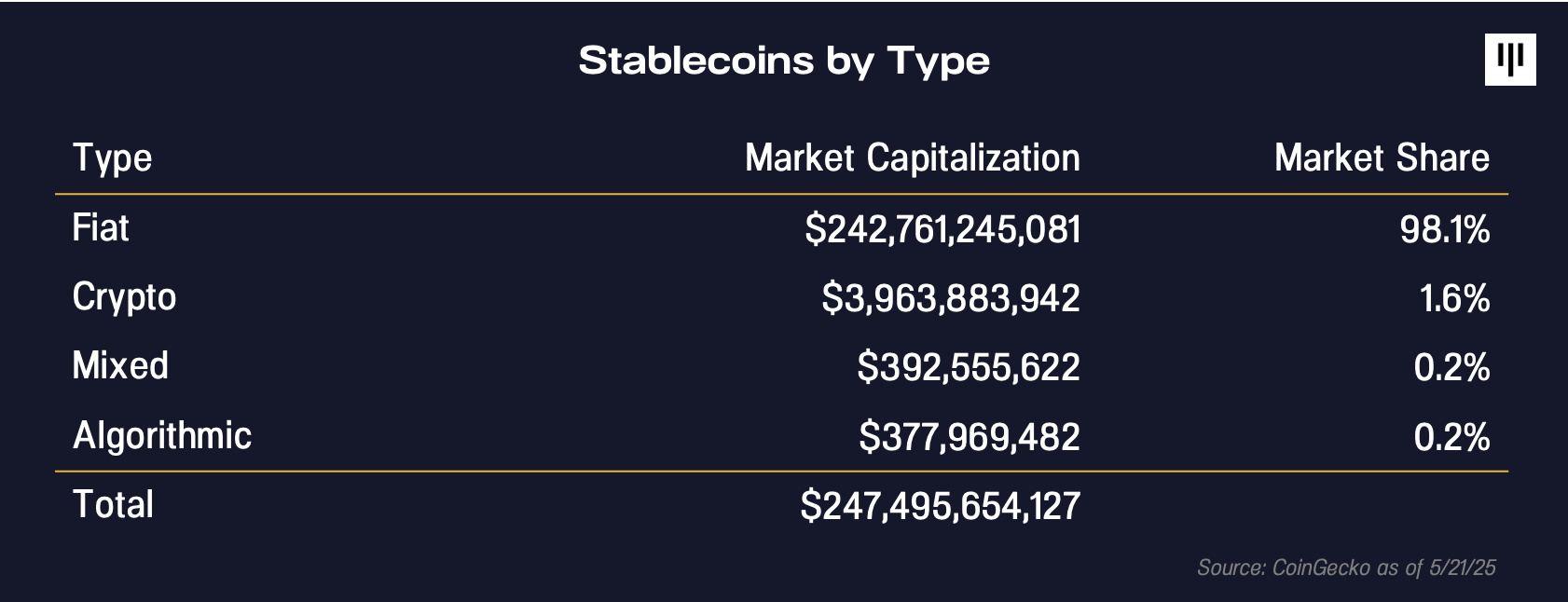

Driving Demand for the Dollar

One of the most practical use cases for cryptocurrency today is bringing the U.S. dollar onto blockchains. In the $250 billion stablecoin market, 98% of the market cap is backed by fiat currencies—not crypto or algorithmic mechanisms. This underscores stablecoins’ role as a key driver of dollar demand and highlights the real-world utility of blockchain technology.

It’s no surprise that the U.S. dollar dominates 98% of fiat-backed stablecoins, given its status as the world’s primary reserve currency.

Blockchain technology is empowering the dollar to reach all 5 billion smartphone users globally, enabling fast, low-cost, programmable value transfer. In emerging markets, individuals can hold dollar-backed stablecoins to hedge against local currency depreciation. Additionally, stablecoins offer migrants a far cheaper remittance option—compared to traditional remittance services that can charge fees equivalent to an entire month’s wages.

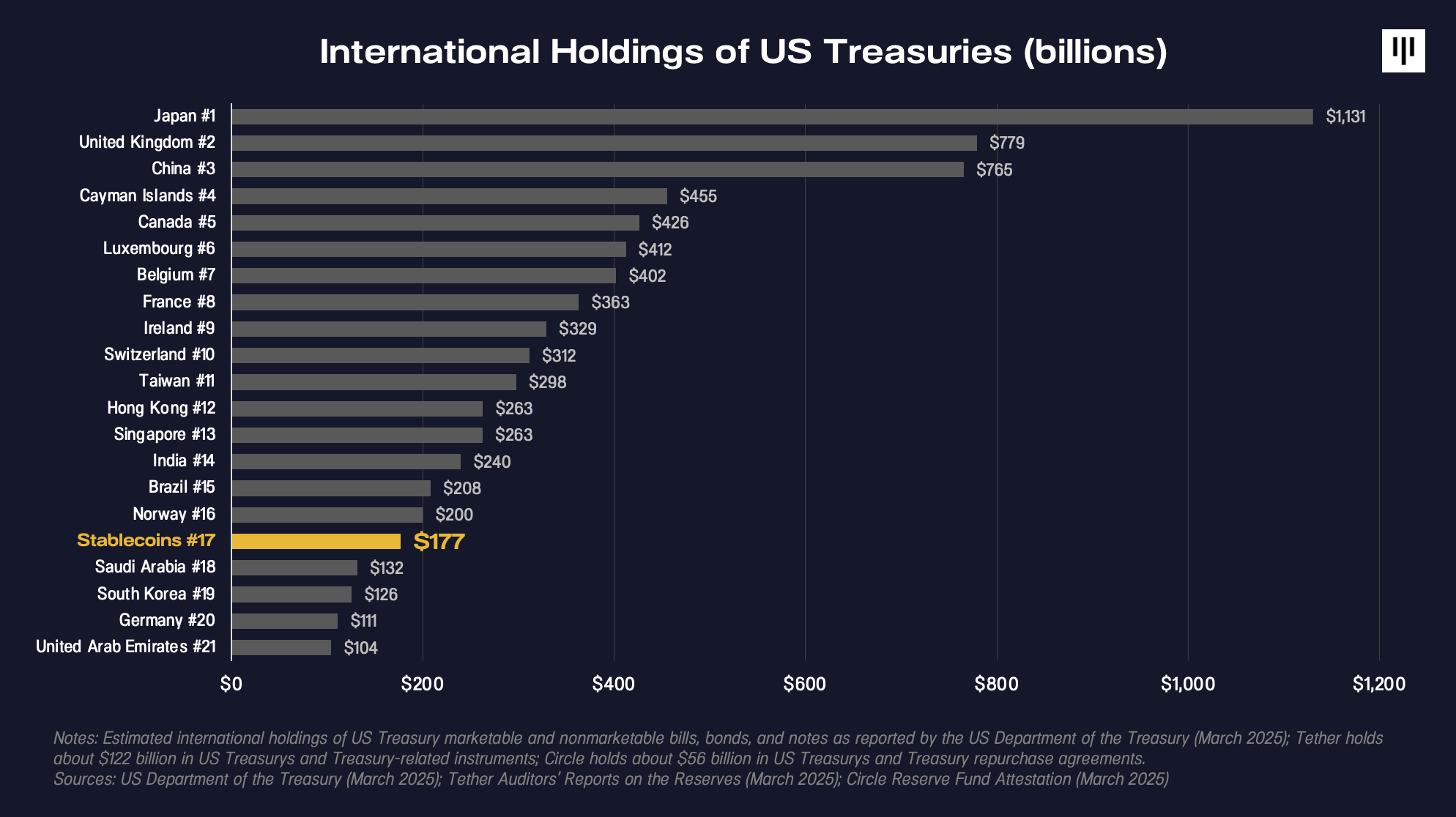

At the same time, stablecoins are becoming a global distribution channel for U.S. Treasuries.

At a time when confidence in U.S. fiscal health faces challenges, stablecoins are helping boost demand for Treasuries. Geopolitical tensions and macroeconomic uncertainty are intensifying, while traditional buyers of U.S. debt are pulling back. Last week’s 20-year Treasury auction saw rising yields and falling prices due to weak demand.

While the impact of stablecoins remains modest relative to total Treasury holdings, stablecoins like Tether’s USDT and Circle’s USDC—backed by $177 billion in Treasury-related assets—are becoming a new source of demand. Combined, they would rank as the 17th-largest holder of U.S. Treasuries globally.

We believe stablecoins will continue climbing the ranks among Treasury holders.

"This is a long-term prediction, but banks are like landlines—we don’t need them anymore. Stablecoins will eventually replace the bank deposits we’re used to." — Dan Morehead, TOKEN2049 Dubai, Keynote Speech, May 1, 2025

Strategic Alignment

The advancement of the GENIUS Act reinforces a growing consensus: stablecoins are not only one of the most powerful applications in crypto but also a strategic asset for advancing U.S. interests—from preserving the dollar’s global dominance to supporting the Treasury market.

By encouraging responsible issuance and mandating that stablecoins be backed by U.S. Treasuries, the Act strengthens the strategic alignment between crypto and the U.S. dollar.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News