On-Chain Yield Report: DeFi Enters the "Invisible" Era, Institutional Adoption Accelerates

TechFlow Selected TechFlow Selected

On-Chain Yield Report: DeFi Enters the "Invisible" Era, Institutional Adoption Accelerates

Analyzing the key trends shaping on-chain stablecoin yields.

Written by: Artemis & Vaults.fyi

Translated: Felix, PANews (excerpt)

The DeFi stablecoin yield landscape is undergoing a profound transformation. A more mature, resilient, and institutionally aligned ecosystem is emerging—marking a clear shift in the nature of on-chain yields. This report, combining insights from vaults.fyi and Artemis.xyz, analyzes key trends shaping stablecoin yields on-chain, including institutional adoption, infrastructure development, evolving user behavior, and the rise of yield-stacking strategies.

Institutional Adoption of DeFi: Quiet Momentum Builds

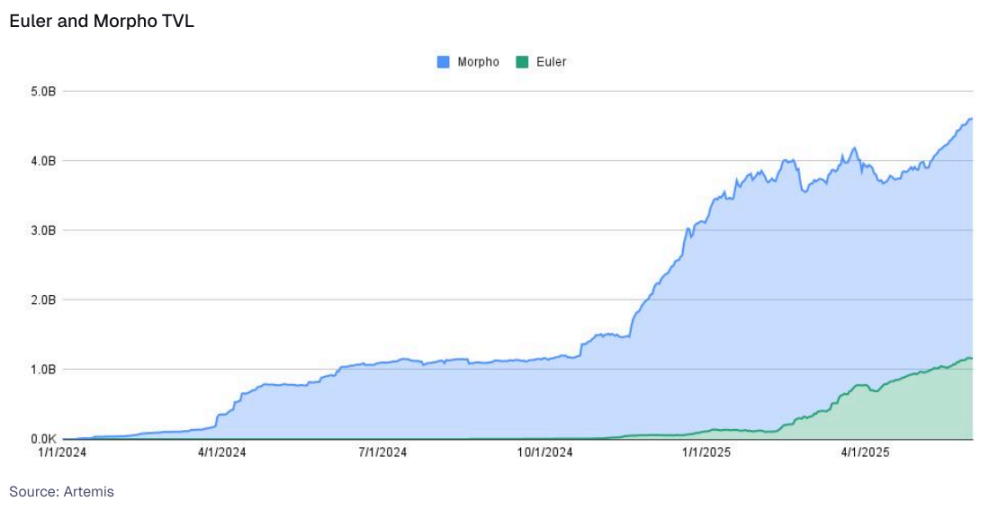

Even as nominal DeFi yields on assets like stablecoins adjust relative to traditional markets, institutional interest in on-chain infrastructure continues to grow steadily. Protocols such as Aave, Morpho, and Euler are attracting increasing attention and usage. This participation is driven less by the pursuit of absolute peak annualized returns and more by the unique advantages of composable, transparent financial infrastructure—advantages now reinforced by improved risk management tools. These platforms are no longer just yield generators; they are evolving into modular financial networks rapidly embracing institutionalization.

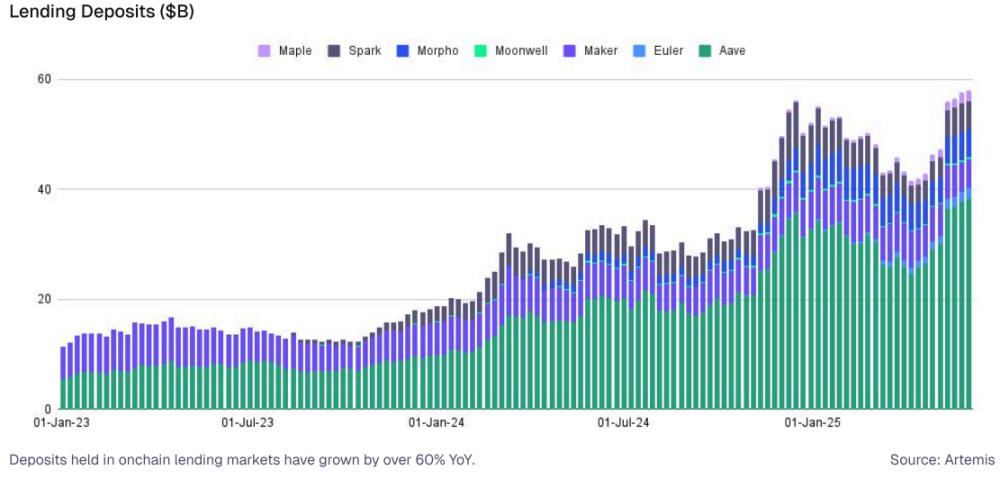

As of June 2025, collateralized lending platforms like Aave, Spark, and Morpho have collectively surpassed $50 billion in total value locked (TVL). On these platforms, 30-day borrowing yields for USDC range between 4% and 9%, generally at or above the ~4.3% yield of 3-month U.S. Treasury bills over the same period. Institutional capital continues to explore and integrate these DeFi protocols. Their enduring appeal lies in distinct advantages: 24/7 global markets, composable smart contracts enabling automated strategies, and higher capital efficiency.

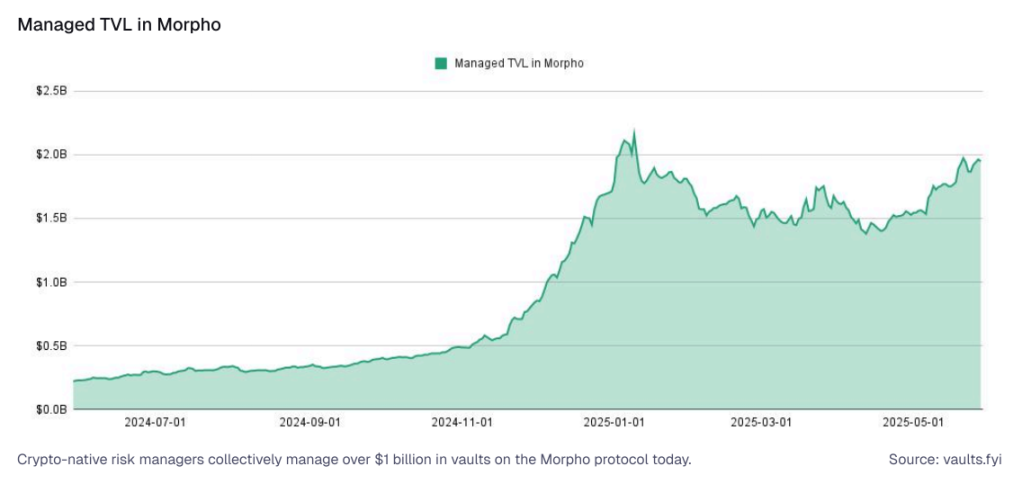

Rise of crypto-native asset managers: A new class of "crypto-native" asset management firms is emerging, with companies like Re7, Gauntlet, and Steakhouse Financial leading the charge. Since January 2025, the on-chain capital base in this sector has grown from approximately $1 billion to over $4 billion. These managers operate deeply within the on-chain ecosystem, quietly deploying funds across various investment opportunities—including advanced stablecoin strategies. In the Morpho protocol alone, major asset managers oversee nearly $2 billion in custodied TVL. By introducing professional capital allocation frameworks and actively tuning DeFi protocol risk parameters, they aim to become next-generation leaders in asset management.

A competitive landscape among native crypto managers is already taking shape, with Gauntlet and Steakhouse Financial controlling approximately 31% and 27% of custodied TVL market share, respectively, Re7 holding nearly 23%, and MEV Capital capturing 15.4%.

Shifting regulatory stance: As DeFi infrastructure matures, institutional attitudes are gradually shifting toward viewing DeFi not as a disruptive, unregulated frontier, but as a configurable complementary financial layer. Permissioned markets built on Euler, Morpho, and Aave reflect active efforts to meet institutional needs. These developments enable institutions to participate in on-chain markets while satisfying internal and external compliance requirements—particularly around KYC, AML, and counterparty risk.

DeFi Infrastructure: The Foundation of Stablecoin Yields

The most significant advances in DeFi today center on infrastructure. From tokenized real-world assets (RWA) markets to modular lending protocols, an entirely new DeFi stack is emerging—one capable of serving fintech firms, custodians, and DAOs alike.

1. Collateralized Lending: One of the primary sources of yield, where users lend stablecoins (e.g., USDC, USDT, DAI) to borrowers who provide other crypto assets (such as ETH or BTC) as collateral, typically over-collateralized. Lenders earn interest paid by borrowers, forming the bedrock of stablecoin yield.

-

Aave, Compound, and MakerDAO (now renamed Sky Protocol) introduced pooled lending and dynamic interest rate models. Maker launched DAI, while Aave and Compound built scalable money markets.

-

More recently, Morpho and Euler have transitioned toward modular and isolated lending markets. Morpho launched fully modular lending primitives, segmenting markets into configurable vaults that allow protocols or asset managers to define their own parameters. Euler v2 supports isolated lending pairs with advanced risk tools and has gained notable traction since the protocol's relaunch in 2024.

2. Tokenized RWA: Involves bringing yield from traditional off-chain assets—especially U.S. Treasuries—onto blockchains via tokenized instruments. These tokenized Treasuries can be held directly or used as collateral integrated into other DeFi protocols.

-

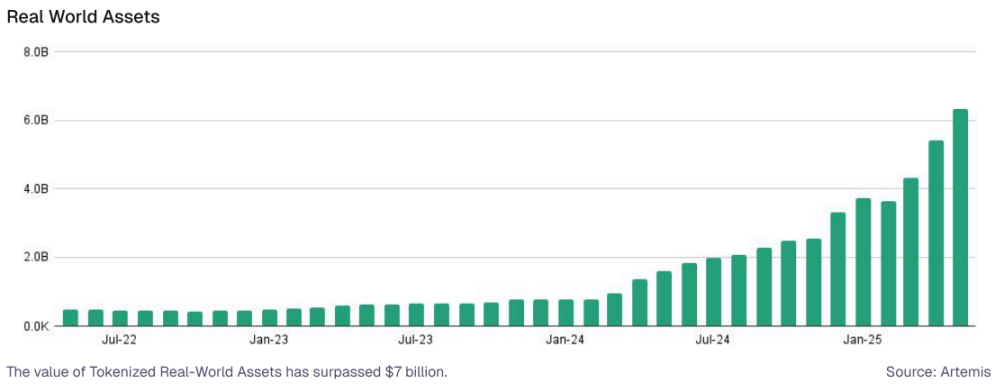

Platforms like Securitize, Ondo Finance, and Franklin Templeton are tokenizing U.S. Treasuries, transforming traditional fixed income into programmable on-chain components. On-chain U.S. Treasury exposure surged from $4 billion at the start of 2025 to over $7 billion by June 2025. As these tokenized treasury products gain adoption and embed deeper into the ecosystem, they bring new audiences to DeFi.

3. Tokenized Strategies (including Delta-neutral and Yield-bearing Stablecoins): Encompasses more sophisticated on-chain strategies, often delivering returns in stablecoin form. These may include arbitrage opportunities, market-making activities, or structured products designed to generate returns on stablecoin capital while remaining market neutral.

-

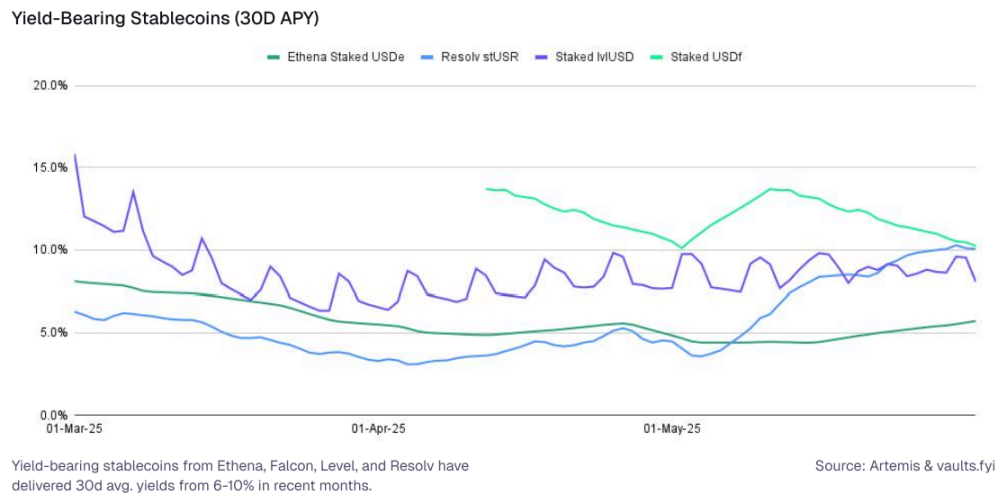

Yield-bearing stablecoins: Protocols such as Ethena (sUSDe), Level (slvlUSD), Falcon Finance (sUSDf), and Resolv (stUSR) are innovating stablecoins with native yield mechanisms. For example, Ethena’s sUSDe generates yield through “cash-and-carry” trades—shorting ETH perpetuals while holding spot ETH—with funding rates and staking rewards providing returns to holders. In recent months, some yield-bearing stablecoins have delivered yields exceeding 8%.

4. Yield Trading Markets: Yield trading introduces a novel primitive that separates future yield streams from principal, allowing floating-rate instruments to be split into tradable fixed and floating components. This development adds depth to DeFi’s financial toolkit, aligning on-chain markets more closely with traditional fixed-income structures. By making yield itself a tradable asset, these systems offer users greater flexibility in managing interest rate risk and yield allocation.

-

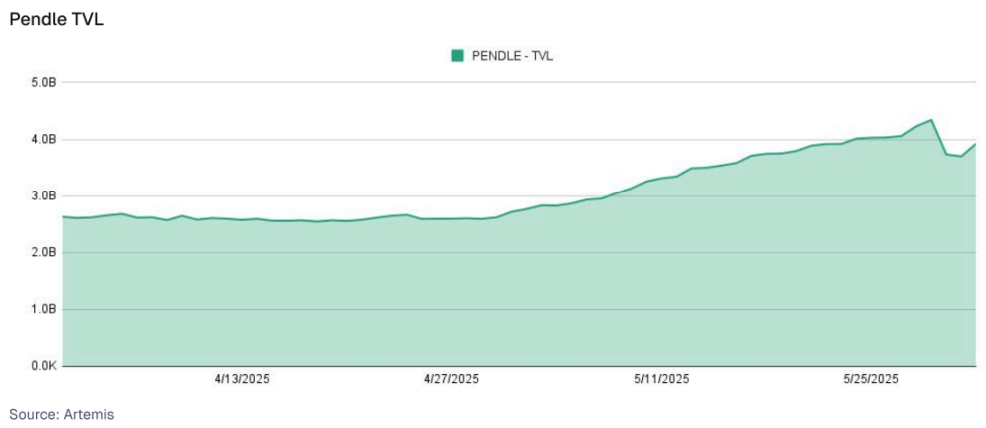

Pendle leads in this space, enabling users to tokenize yield-bearing assets into Principal Tokens (PT) and Yield Tokens (YT). PT holders gain fixed returns by purchasing discounted principal, while YT holders speculate on variable yields. As of June 2025, Pendle’s TVL exceeds $4 billion, primarily composed of yield-bearing stablecoins like Ethena’s sUSDe.

Collectively, these primitives form the foundational layer of today’s DeFi infrastructure, serving diverse use cases for both crypto-native users and traditional finance applications.

Composability: Stacking and Amplifying Stablecoin Yields

DeFi’s “money lego” nature is realized through composability, where the primitives described above serve as building blocks for more complex strategies and products. This enables enhanced yields, risk diversification (or concentration), and customized financial solutions—all centered around stablecoin capital.

Lending markets for yield-generating assets: Tokenized RWAs or strategy tokens (like sUSDe or stUSR) can serve as collateral in new lending markets, enabling:

-

Holders of these yield assets to borrow stablecoins against them, unlocking liquidity.

-

The creation of dedicated lending markets where stablecoin lenders can earn additional yield by lending to those wishing to borrow against their yield positions.

Integrating diversified yield sources into stablecoin strategies: While the ultimate goal is often stablecoin-denominated yield, the strategies achieving it can incorporate elements from across DeFi, carefully managed to produce stablecoin returns. Delta-neutral strategies involving non-USD tokens—such as liquid staking tokens (LST) or liquid restaking tokens (LRT)—can be structured to generate returns priced in stablecoins.

Leveraged yield strategies: Similar to carry trades in traditional finance, users can deposit stablecoins into lending protocols, borrow additional stablecoins against that collateral, swap the borrowed stablecoins back into the original asset (or another stablecoin in the strategy), and re-deposit. Each “loop” increases exposure to underlying stablecoin yield—but also amplifies risks, including liquidation risk if collateral value drops or borrowing rates spike unexpectedly.

Stablecoin Liquidity Pools (LP):

-

Stablecoins can be deposited into automated market makers (AMMs) like Curve, often paired with other stablecoins (e.g., USDC-USDT pools), earning fees from trades and generating yield on stablecoins.

-

The LP tokens received for providing liquidity can themselves be staked in other protocols (e.g., staking Curve LP tokens in Convex) or used as collateral in other vaults, further compounding returns and ultimately boosting overall yield on the initial stablecoin capital.

Yield aggregators and auto-compounders: Vaults exemplify the composability of stablecoin yields. They deploy user-deposited stablecoins into underlying yield sources—such as collateralized lending markets or RWA protocols—and then:

-

Automate the process of harvesting rewards (which may come in other tokens).

-

Swap those rewards back into the originally deposited stablecoin (or another desired stablecoin).

-

Re-deposit the rewards to automatically compound yield, significantly increasing annual percentage yield (APY) compared to manual claiming and reinvestment.

The overarching trend is to deliver enhanced and diversified stablecoin returns to users—managed within defined risk parameters and simplified through smart accounts and goal-oriented interfaces.

User Behavior: Yield Is Not Everything

While yield remains an important driver in DeFi, data shows that user decisions in capital allocation go beyond chasing the highest APY. Increasingly, users weigh factors such as reliability, predictability, and overall user experience (UX). Platforms that simplify interactions, reduce friction (e.g., feeless transactions), and build trust through transparency tend to retain users more effectively over time. In short, better UX is becoming a critical factor not only in driving initial adoption but also in enhancing long-term capital “stickiness” within DeFi protocols.

1. Capital Prioritizes Stability and Trust: During periods of market volatility or downturns, capital tends to flow toward established “blue-chip” lending protocols and RWA vaults—even when their nominal yields are lower than newer, riskier alternatives. This reflects a flight-to-safety mentality rooted in user preference for stability and trust.

Data consistently shows that during market stress, mature stablecoin vaults on well-known platforms retain a larger share of TVL compared to newly launched high-yield vaults. This “stickiness” underscores trust as a key factor in user retention.

Annualized yield (7-day average) and holder count:

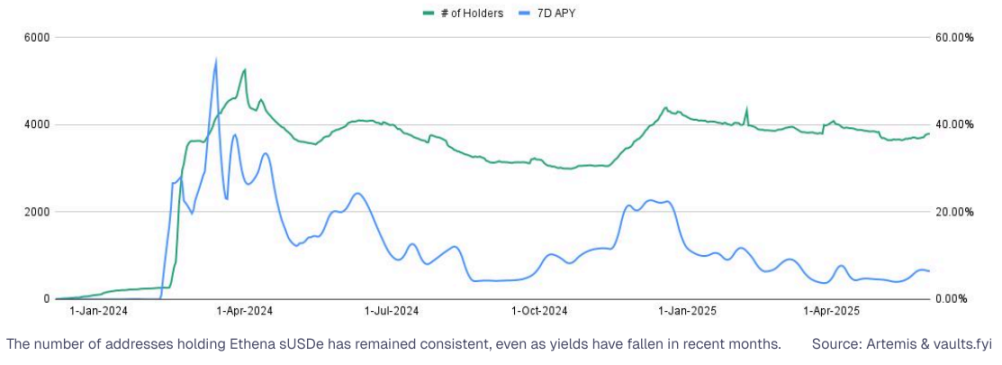

Protocol loyalty also plays a role. Users on mainstream platforms like Aave often prefer native ecosystem vaults even when competing platforms offer slightly higher rates—mirroring traditional finance, where convenience, familiarity, and trust outweigh minor yield differences. This is especially evident with Ethena, where holder counts remained relatively stable despite yields falling to historical lows, indicating that yield alone is not the primary driver of user retention.

Despite their “no-yield” risk profile, demand for certain stablecoins remains strong. Platforms enabling permissionless reward accrual harbor immense potential in crypto—value that may exceed that of current volatile stores of value or stablecoins.

2. Better UX Improves Retention: Gasless, seamless, and automated: As DeFi matures, simplifying complex operations is becoming a key driver of user retention. Products and platforms that abstract away underlying technical complexity are increasingly favored by both new and experienced users.

Account abstraction (ERC-4337)-based features—such as gasless transactions and one-click deposits—are becoming more widespread, making user interactions smoother and more intuitive. These innovations reduce cognitive load and transaction costs, ultimately driving higher capital retention and growth.

Cross-Chain Yield Gaps: How Capital Flows

Yields on similar assets—especially stablecoins—can vary significantly across different blockchain networks. Data shows capital opportunistically flows between ecosystems based on these APY gaps, and the infrastructure enabling such migration is rapidly improving.

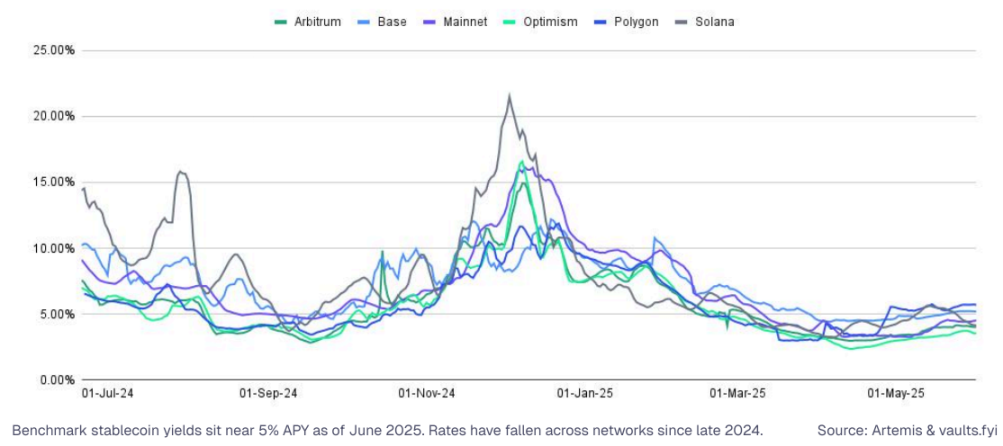

As of June 2025, Ethereum’s average lending yield hovers around 4.8%, while Polygon offers yields as high as 5.6%.

Automated Routing: Applications and aggregator protocols are increasingly capable of routing funds across chains to capture higher APYs with minimal user intervention. However, this yield optimization comes with risks—bridging assets exposes users to bridge infrastructure risk and slippage during periods of low liquidity.

Intent-centric UX: Wallets and dApps are evolving to offer users simple options like “highest yield” or “best execution.” The underlying application then automatically fulfills these intents, abstracting away complexities like cross-chain routing, asset swaps, and vault selection.

Capital allocators can leverage deep cross-chain yield analytics to optimize backend stablecoin strategies. By tracking cross-chain APY disparities, capital stickiness, and liquidity depth, these participants can:

-

Improve fund management and optimize stablecoin allocation

-

Offer competitive yields to users without manual adjustments

-

Identify sustainable arbitrage opportunities driven by structural yield gaps

-

Monetize DeFi yields: Pathways for fintech firms and neobanks

DeFi is increasingly being adopted not just by crypto-native users, but also by fintech companies, wallets, and exchanges—as “invisible” backend infrastructure. By simplifying DeFi’s complexity, these platforms embed yield directly into the user experience, boosting retention, opening new monetization paths, and increasing capital efficiency.

Three primary monetization pathways for fintech companies:

1. Stablecoin Yield Integration: Unlocking new revenue streams: Fintech companies and centralized platforms are increasingly offering stablecoin yields directly within their apps. This proven strategy can:

-

Drive net deposit growth

-

Increase assets under management (AUM)

-

Enhance platform stickiness and cross-selling potential

Examples:

-

Coinbase offers yield on USDC deposits, boosting engagement and trading volume within its ecosystem.

-

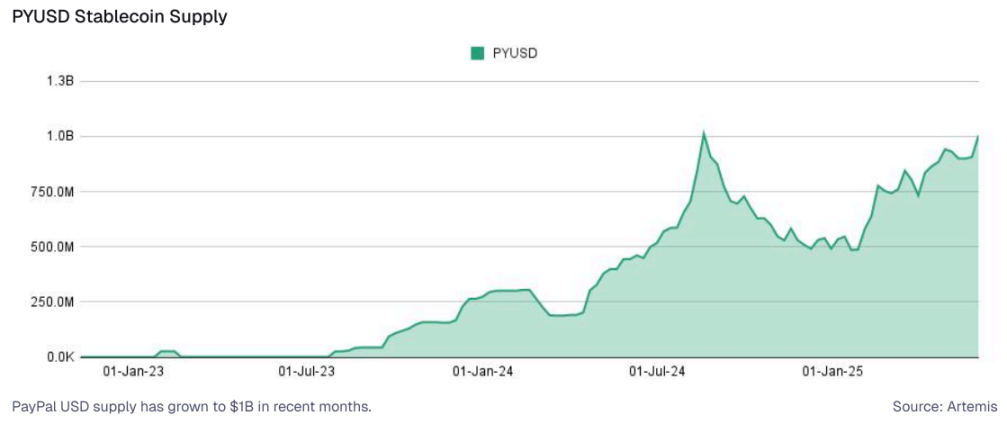

PayPal’s PYUSD yield product (~3.7% APY) attracts funds into Venmo and PayPal wallets, monetizing through reserve asset yields and increased payment activity.

-

Bitget Wallet’s integration with Aave allows users to earn ~5% APY on USDC and USDT across multiple chains, driving wallet deposits and enabling potential monetization via referrals and trading.

These integrations eliminate DeFi complexity, enabling seamless access to yield products for users, while platforms profit from net interest margin, partner incentives, and increased transaction volume. As demand for PYUSD grows through yield-centric integrations and broader institutional adoption beyond traditional DeFi, its supply has reached record highs—solidifying its role as a core passive income instrument.

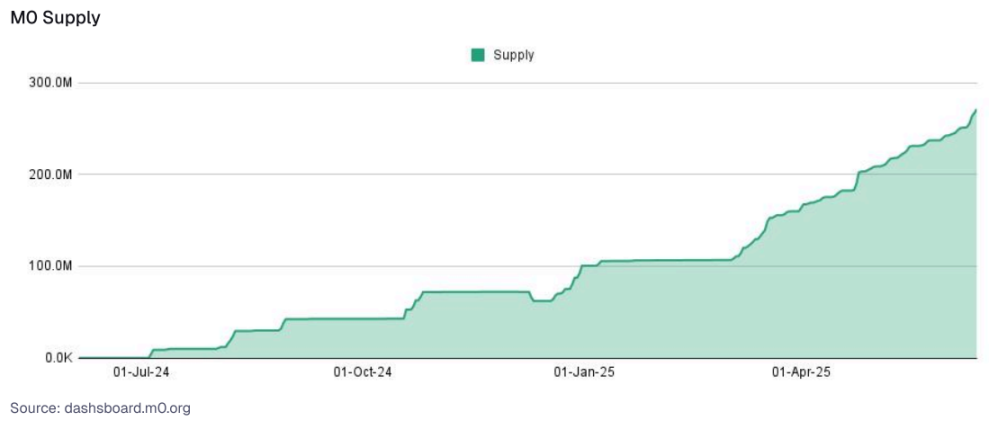

Fintech opportunity: Integrating yield-generating products or backend DeFi strategies can transform idle user balances into revenue streams and deeper engagement. Monetization avenues include net interest margin sharing, premium service fees, and building a more sticky, lower-service-cost, and cross-sell-ready user base. M0, a stablecoin infrastructure provider, enables platforms to launch custom stablecoins with built-in yield strategies—without fragmenting liquidity or ecosystems. Stablecoins supported by M0 have seen steady supply growth, now nearing $300 million.

2. Borrowing Against Crypto Assets: Seamless, DeFi-powered credit. Fintech firms and exchanges now offer non-custodial lending services using crypto assets (like Bitcoin and Ether) as collateral—powered by embedded DeFi protocols.

Example:

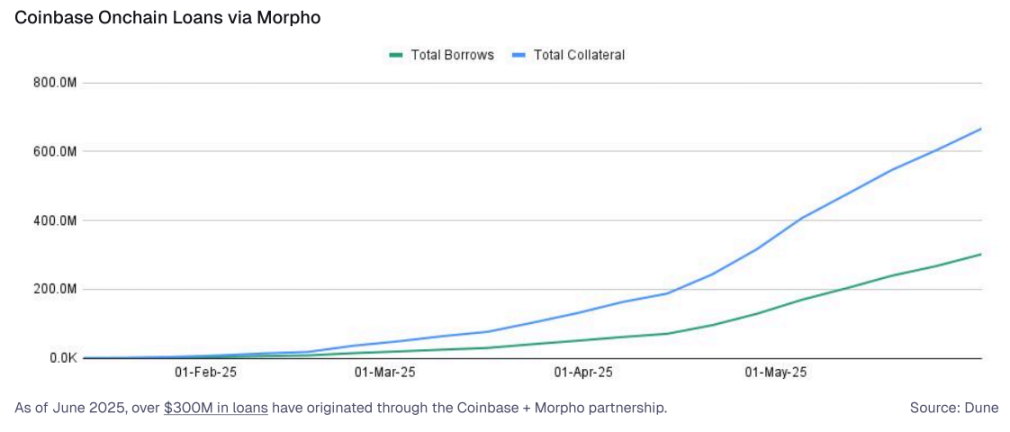

Coinbase’s on-chain lending integration with Morpho (over $300 million disbursed as of June 2025) allows Coinbase users to seamlessly borrow against their BTC holdings, powered by Morpho’s backend infrastructure. This model, often called the “DeFi mullet,” enables:

-

Origination fees

-

Interest spread income

-

Additional lending activity without the platform assuming direct custody risk

Fintech opportunity: Fintech firms with crypto users (e.g., Robinhood, Revolut) can adopt similar models—offering stablecoin credit lines or asset-backed loans via permissioned on-chain markets—to create new fee-based revenue streams.

3. Consumer Yield Products: Embedded, passive yield: DeFi yield is entering consumer-facing financial products in novel, sticky ways:

-

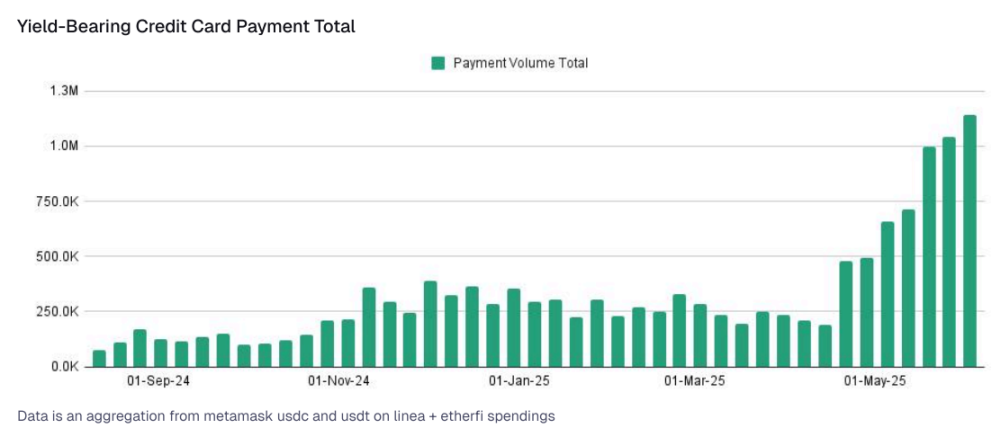

Reward-funded debit cards: The concept of “cashback” may evolve into “yield-funded,” where stablecoin yield automatically finances rewards or spending balances. Yield-funded stablecoin spending via debit cards has steadily grown to over $1 million per week.

-

Auto-yield wallets: Leveraging account abstraction (ERC-4337) for gasless deposits, automatic rebalancing, and programmable savings accounts that generate yield without user intervention.

-

Mainstream examples: Robinhood’s idle cash yield, Kraken’s USDG rewards, and PayPal’s PYUSD savings product all signal a broader shift toward frictionless, yield-bearing consumer experiences.

Among these pathways, platforms that simplify complexity, reduce friction, and leverage the flexibility of DeFi backends will lead the next wave of stablecoin monetization and user engagement.

Conclusion

The next evolution of DeFi yield is gradually moving beyond the speculative frenzy of earlier cycles. In today’s environment, DeFi is becoming:

-

Simplified: Users will increasingly neither need nor care about which specific protocol or complex strategy generates their asset yields—they’ll simply interact with streamlined frontends.

-

Integrated: DeFi yield will appear more frequently as a default or easily accessible option within existing wallets, exchanges, and mainstream fintech apps.

-

Risk-aware: Institutional partners and sophisticated users will demand robust risk scoring, comprehensive audits, insurance options, and greater transparency into underlying mechanisms.

-

Regulated and interoperable: Protocols will continue navigating regulatory landscapes, with some opting for permissioned environments or direct collaboration with regulators to meet institutional and traditional finance needs. Cross-chain interoperability will become smoother.

-

Programmable and modular: As DeFi matures, its core components—lending pools, staking derivatives, AMMs, and RWA bridges—will increasingly become modular “money legos,” embedded within familiar interfaces while powering robust financial solutions behind the scenes.

Platforms thriving in this new era will do so not by offering the highest short-term yields alone. As the space evolves and matures, the focus is shifting from chasing fleeting excess returns toward building sustainable, value-adding financial infrastructure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News