Hotcoin Research | Bitcoin Institutional Holdings Panorama: How the Institutional Era is Reshaping Bitcoin's Pricing Logic

TechFlow Selected TechFlow Selected

Hotcoin Research | Bitcoin Institutional Holdings Panorama: How the Institutional Era is Reshaping Bitcoin's Pricing Logic

This article will analyze the impact of macro variables—such as interest rates, inflation, regulation, and the U.S. "strategic Bitcoin reserve"—on the divergence of crypto assets.

Author: Hotcoin Research

1. Introduction

Global financial markets are undergoing a qualitative shift in their perception of Bitcoin. From its initial portrayal as "digital gold" to its gradual recognition as a potential portfolio asset, major economies and large institutions worldwide are repositioning Bitcoin from a "high-volatility risk asset" to a "strategic reserve asset." Spot Bitcoin ETFs have launched in the U.S. and Hong Kong, with assets under management steadily growing. Donald Trump’s return to the White House has elevated blockchain and digital assets to a national strategic level, advocating for a Strategic Bitcoin Reserve and rolling out a series of favorable policies. Countries such as El Salvador and Bhutan have already included Bitcoin on their national balance sheets. Meanwhile, publicly traded companies like MicroStrategy and Metaplanet continue to accumulate Bitcoin, leveraging convertible or corporate bonds to purchase BTC with leverage, aiming to gain an early advantage in the evolving monetary system. This is not merely a shift in financial asset allocation logic—it may mark the beginning of a broader realignment of national strategies and capital power.

This report analyzes how macroeconomic factors—interest rates, inflation, regulation, and the U.S. “Strategic Bitcoin Reserve”—impact the divergence within the crypto market. It examines the holdings and motivations of six key actors: ETFs, governments, public and private companies, miners, and DeFi protocols. By projecting institutional Bitcoin holdings from 2025 to 2026 and analyzing market evolution against Bitcoin’s fixed supply, we aim to outline Bitcoin’s competitive attributes in a multipolar world and offer guidance for investor portfolio construction—ultimately providing a comprehensive picture of who is accumulating Bitcoin, why they are doing so, and where this accumulation may lead.

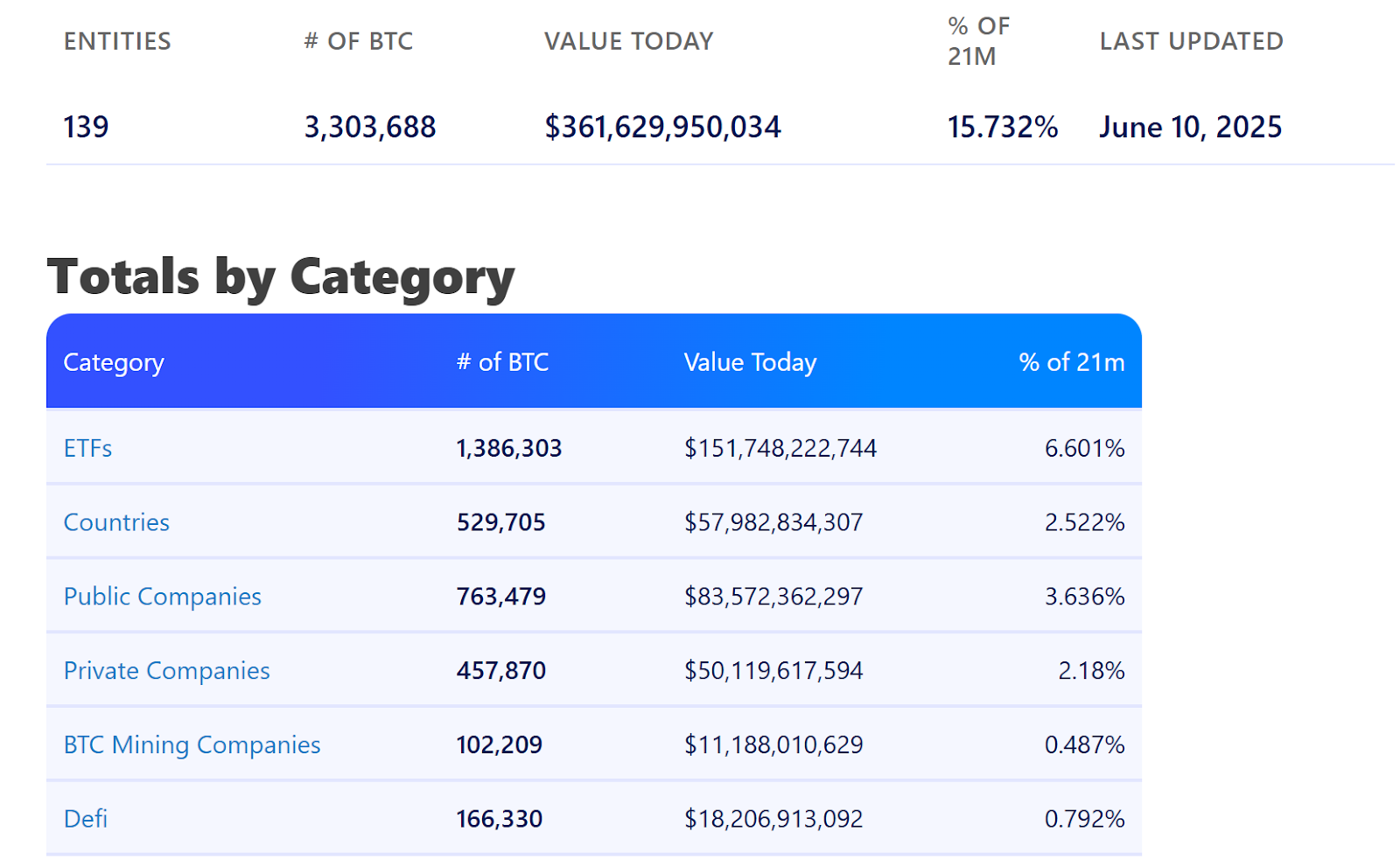

2. Institutional Holdings Structure Analysis

According to Bitbo Treasuries data, as of June 10, 2025, 139 institutional entities hold approximately 3,303,688 BTC—about 15.73% of the total 21 million supply—with a total market value of roughly $361.6 billion. ETFs account for 6.60% of total supply, making them the largest conduit for Bitcoin liquidity, followed by public companies and national-level institutions. The participation of private enterprises and DeFi projects further diversifies the ownership structure and funding sources.

Source: https://bitbo.io/treasuries/

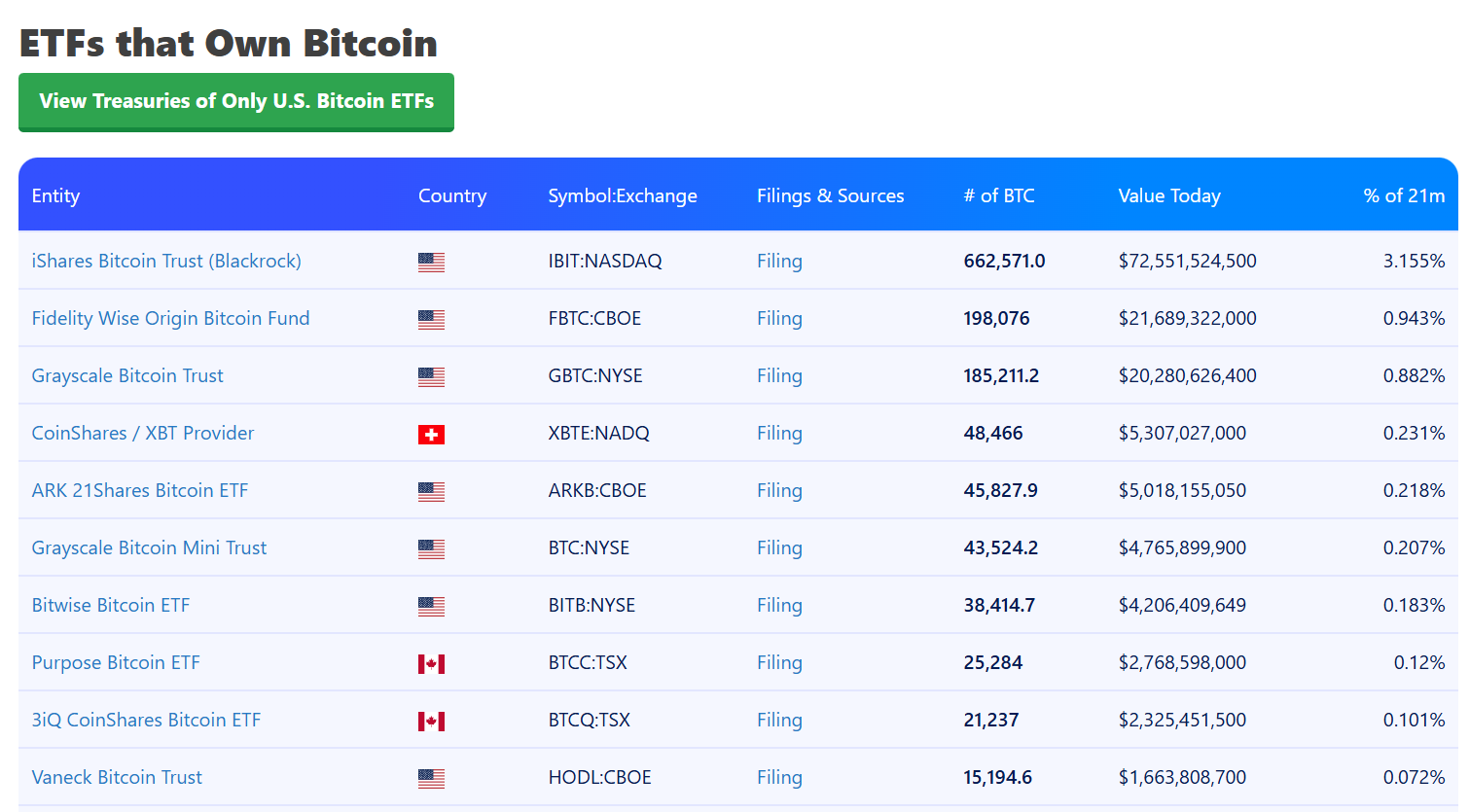

1. ETF Holdings Analysis

Since 2024, spot Bitcoin ETFs in the United States have gained regulatory approval, offering institutional investors a compliant channel and a “wallet-free” investment vehicle. As of June 10, 2025, 12 U.S.-listed spot Bitcoin ETFs collectively hold about 1.38 million BTC (6.6% of circulating supply), valued at approximately $151.7 billion. BlackRock’s IBIT alone holds 3.16% of global supply, representing 55% of all ETF holdings. Fidelity’s FBTC and Grayscale’s GBTC follow closely, together locking up nearly 1.8% of Bitcoin supply. After a brief pullback in late May, ETF inflows resumed: on June 9, net purchases reached $392 million, with IBIT and FBTC contributing over 76% of the increase.

Source: https://bitbo.io/treasuries/#etfs

With wealth platforms such as Morgan Stanley and JPMorgan Chase expected to open Bitcoin ETF access in the second half of the year, the market widely anticipates that total ETF holdings could surpass 1.5 million BTC by year-end, reinforcing the appeal of “wallet-free” institutional accumulation.

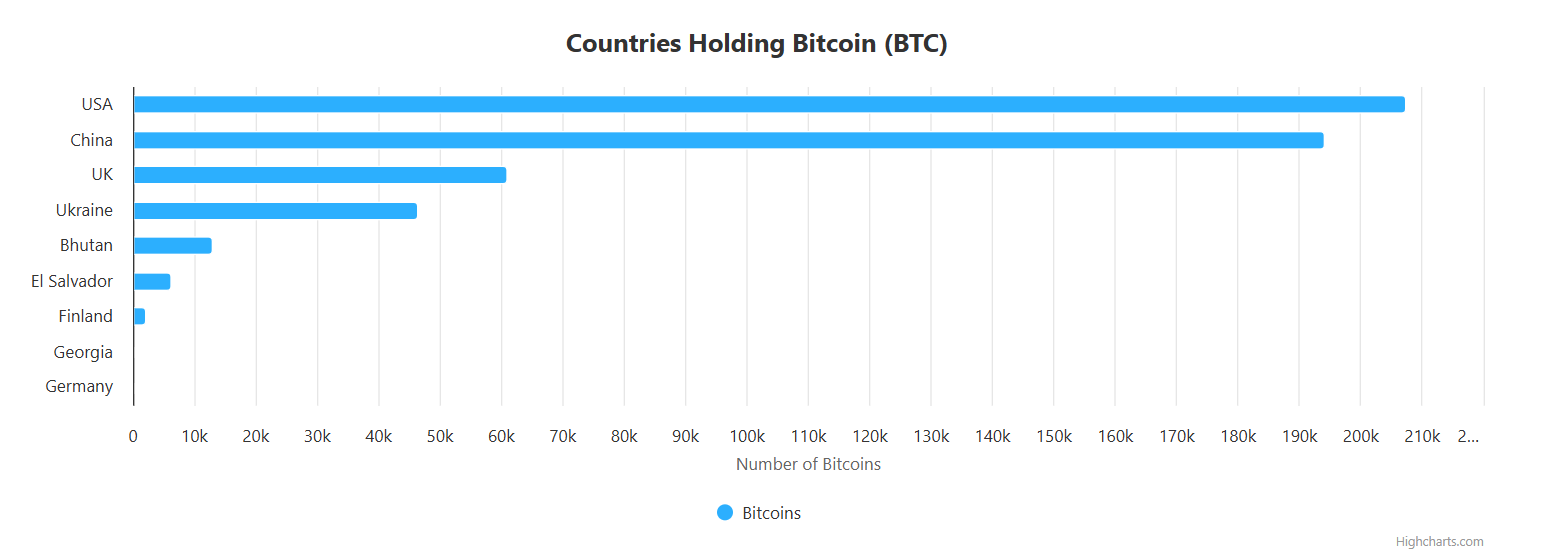

2. National Institution Holdings Analysis

In March 2025, the U.S. issued an executive order directing the Treasury Department to establish a “Strategic Bitcoin Reserve” using seized Bitcoin and implement a budget-neutral strategy to accumulate BTC. The government explicitly stated that these holdings “shall not be sold” and will be retained as long-term treasury assets. On April 29, Arizona’s legislature passed a bill allowing up to 10% of public funds to be invested in Bitcoin. Oklahoma has proposed a similar strategic reserve initiative. Texas, Alabama, and other states are following suit, seeking legislative avenues to diversify assets and capture opportunities in the digital economy.

El Salvador continues aggressive accumulation, holding around 6,190 BTC (worth ~$675 million) as of end-May 2025, branded as its “Strategic Bitcoin Reserve,” aimed at countering inflation and strengthening financial sovereignty. Additionally, Switzerland, Poland, Japan, and others are exploring the feasibility of digital asset reserves.

Source: https://bitbo.io/treasuries/countries/

3. Public Company Holdings Analysis

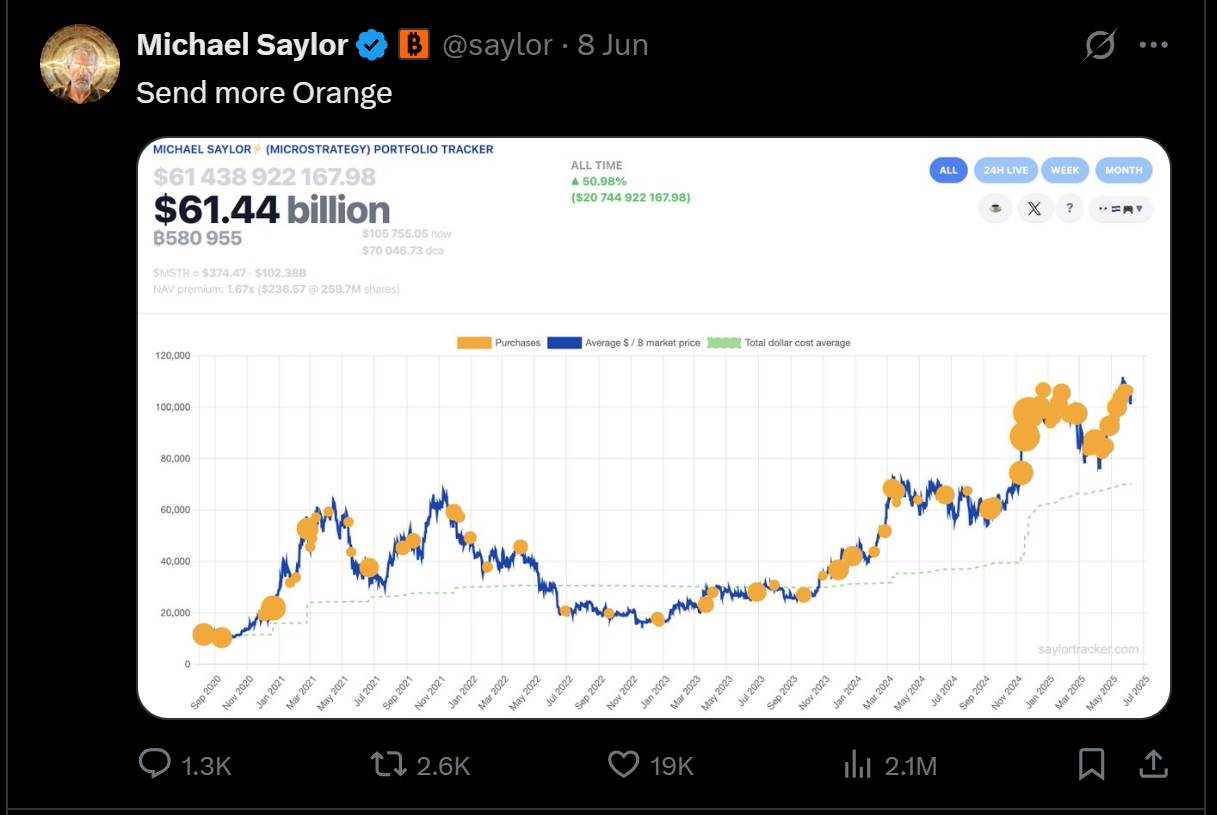

At the corporate level, MicroStrategy (now renamed Strategy) leads by a wide margin. As of May 2025, Strategy had accumulated over 582,000 BTC, becoming the world’s largest corporate holder. The company has built a unique business model around issuing Bitcoin-backed bonds and preferred shares, completing three such offerings in the past five months. In a June 11 interview with Bitcoin Magazine, Strategy Executive Chairman Michael Saylor stated that Bitcoin has passed its most dangerous phase and predicted there would be no future bear markets, forecasting a price of $1 million. He emphasized high-level U.S. government support for Bitcoin and noted that international capital is accelerating into the space, calling the next decade the final window to acquire Bitcoin. Saylor frequently posts Bitcoin Tracker updates on X, typically followed the next day by official disclosures of Strategy’s new BTC acquisitions.

Source: https://x.com/saylor

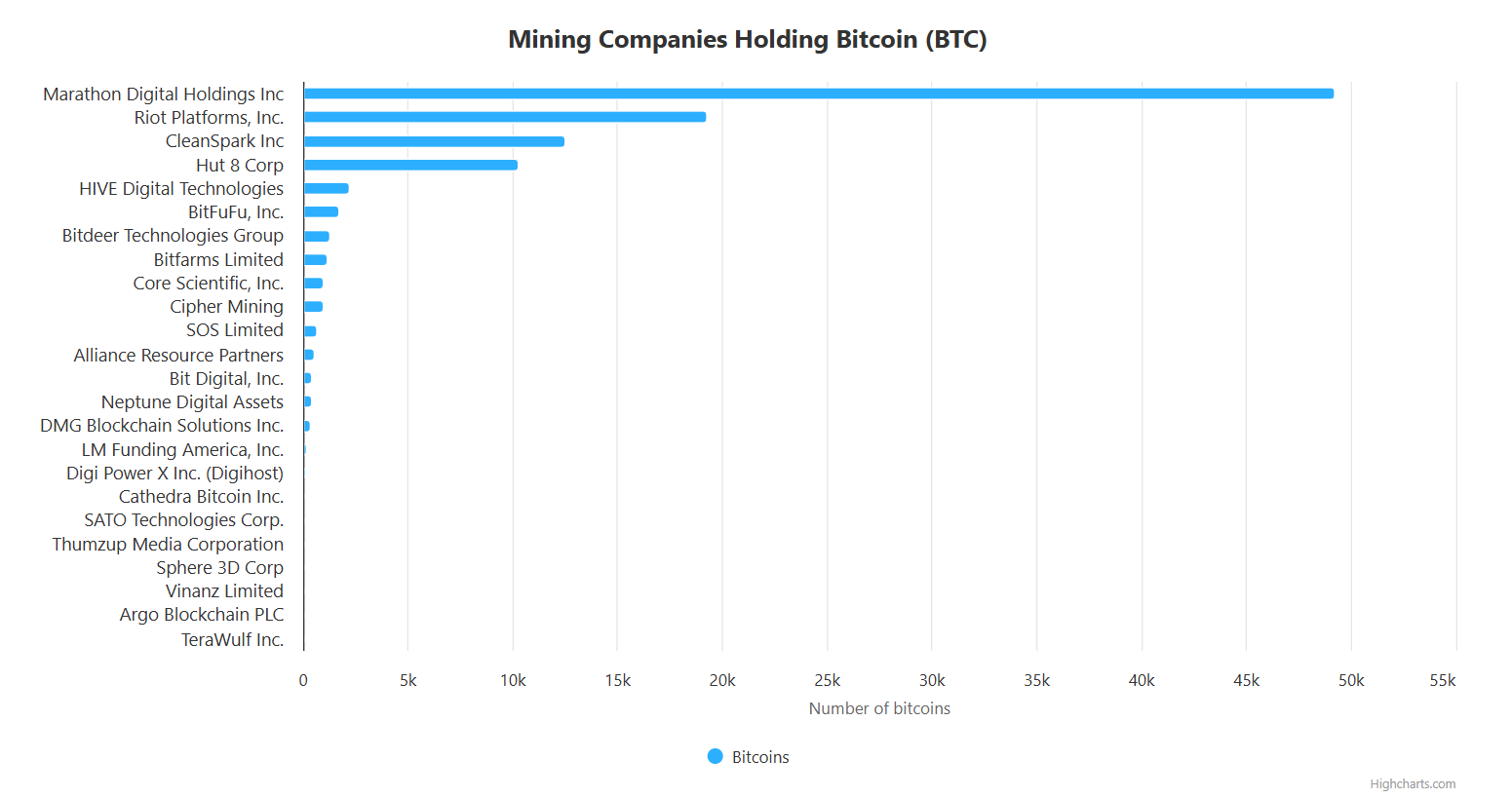

Other “high-conviction” firms are also accumulating. Marathon Digital holds ~49,200 BTC, Riot Blockchain ~19,200 BTC, CleanSpark ~12,500 BTC, Tesla maintains ~11,500 BTC (with no additions since 2022), Hut8 ~10,300 BTC, and Coinbase disclosed 9,267 BTC primarily for operations and hedging. Japanese-listed Metaplanet has seen its market cap surge due to continuous Bitcoin purchases.

Source: https://bitbo.io/treasuries/#public

4. Private Company Holdings Analysis

Many unlisted fintech firms, family offices, and funds are also building Bitcoin positions. Globally, tech companies and wealthy families are adding Bitcoin to their balance sheets. U.S. private equity and hedge funds are increasingly acquiring BTC via OTC channels, some establishing dedicated Bitcoin trusts. Private mining firms (e.g., Genesis Mining) retain mining revenue in Bitcoin form. Wealth management divisions at institutions like Morgan Stanley and Goldman Sachs are estimated to deploy tens of billions into Bitcoin between 2025 and 2026. Overall, private sector interest is surging, driven by inflation hedging, portfolio diversification, and early positioning in the digital economy.

Source: https://bitbo.io/treasuries/#private

5. Bitcoin Miner Holdings Analysis

Leading miners are increasingly choosing to self-custody Bitcoin. Many mining firms announced post-2024 halving that “HODLing” would become a core strategy. They are improving efficiency through proprietary pools (e.g., Marathon’s MARA Pool) while reducing immediate sales. For example, Marathon held nearly 49,200 BTC by May 2025 and sold none of its newly mined output in May. Riot has retained most of its recent production, reaching ~19,200 BTC. Hut8 made a one-time purchase of 974 BTC in late 2024, bringing its reserve value above $1 billion. These firms anticipate tighter supply and rising prices post-halving, converting mining rewards into long-term reserves. They are developing fixed-income streams (e.g., staking pools or loans) to cover operational costs, reducing reliance on BTC sales. Miners widely believe Bitcoin’s fixed supply ensures it becomes more valuable over time—a powerful incentive to hold.

Source: https://bitbo.io/treasuries/miners/

6. DeFi Platform BTC TVL Analysis

Wrapped Bitcoin tokens like wBTC and cbBTC allow users to hold Bitcoin across different blockchains. According to CoinGecko, wBTC has a market cap of ~$13.6 billion, while Coinbase’s cbBTC stands at ~$4.7 billion. The Bitcoin DeFi ecosystem is rapidly expanding. Emerging Bitcoin Layer 2 projects include Babylon, which has secured 47,600 BTC (~$5.1 billion) in staking. LBTC, a liquid staking token based on Babylon, enables users to earn yield while preserving principal value; it now has a market cap of $1.9 billion. These protocols introduce new liquidity tools and yield opportunities, accelerating the conversion of idle Bitcoin into income-generating assets for institutions.

Source: https://bitbo.io/treasuries/#defi

3. Drivers Behind Institutional Accumulation

A confluence of dollar depreciation, inflation pressures, global asset reallocation needs, and supportive regulatory developments forms the fundamental rationale behind the 2025 institutional “HODL wave,” driving diverse entities to increase Bitcoin exposure.

1. Macro-Level Drivers

The unprecedented scale of institutional Bitcoin accumulation in 2025 stems from deep macroeconomic forces and a maturing regulatory environment. As global economic conditions evolve, this trend is expected to persist, further cementing Bitcoin’s role as a strategic global reserve asset.

-

Dollar Depreciation and Persistent Inflation: The U.S. dollar has faced sustained pressure, with federal debt exceeding $36 trillion—123% of GDP, a historic high—raising concerns about the long-term stability of the dollar and U.S. Treasuries. Concurrently, persistent global inflation has eroded real returns on traditional financial assets. In this environment, institutions seek assets capable of resisting inflationary erosion. Bitcoin’s scarcity, decentralization, and global liquidity have led to its increasing adoption as a gold-like safe-haven reserve.

-

Evolving Regulatory Clarity: The U.S. policy stance has shifted dramatically. A new executive order from the White House explicitly supports blockchain technology and recognizes “lawful stablecoins” as tools to preserve dollar dominance. Bipartisan bills in Congress propose regulatory frameworks for stablecoins and digital assets, authorizing financial institutions to create compliant digital products. Over 20 of the 50 U.S. states have introduced or are considering legislation related to Bitcoin reserves, covering public fund allocation, tax incentives, and regulatory structures. Regulators including the SEC and CFTC accelerated crypto rulemaking by late 2024. Overall, the U.S. is shifting from strict enforcement toward a more permissive and supportive stance, enhancing certainty for institutional investment.

-

Global Asset Rebalancing and Industry Demonstration Effects: With traditional asset returns stagnating, equities and bonds face mounting challenges, compelling investors to rebalance portfolios. Since early 2025, U.S. Bitcoin ETFs have rapidly scaled, offering convenient and compliant access that accelerates institutional allocation. MicroStrategy’s high-profile accumulation has created a powerful demonstration effect. Over recent years, an increasing number of corporations, funds, and even governments have followed suit, forming a consensus around institutional Bitcoin ownership. This network effect reinforces itself, accelerating capital inflows.

2. Micro-Level Drivers

-

Government / Sovereign Fund Demand: Reflects strategic efforts by nations to diversify sovereign assets, hedge against currency depreciation, and mitigate geopolitical risks. For instance, the U.S. is advancing legislation to establish a Bitcoin “Strategic Reserve,” permanently holding confiscated BTC. Currently, governments collectively hold about 2.3% of Bitcoin supply—modest in size but potentially impactful if coordinated.

-

Public Companies and Large Enterprises: At the corporate treasury level, MicroStrategy’s example is highly influential. Founder Michael Saylor has repeatedly affirmed indefinite Bitcoin accumulation, prompting numerous global firms to add BTC to their balance sheets. Key motivations include hedging against corporate cash depreciation, enhancing asset yields, and attracting investor attention.

-

Private and Small-Medium Enterprises: Beyond large public firms, many private and smaller-cap companies are actively entering the space. Some raise equity capital and redirect proceeds into crypto assets. Whether tech giants or traditional businesses, firms are incorporating Bitcoin to optimize financial health and navigate macro uncertainty.

-

ETF Issuers and Institutional Asset Managers: Following the 2024 approval of spot Bitcoin ETFs in the U.S., traditional asset managers swiftly entered. BlackRock’s iShares Bitcoin ETF (IBIT) surpassed $70 billion AUM within a year—one of the fastest-growing funds in history—holding about 3.15% of global Bitcoin supply, making it a major market participant. ETFs provide a gateway for institutions unwilling to self-custody, drawing massive inflows. Traditional asset managers are also boosting Bitcoin allocations to enhance performance, fueling significant capital inflows and upward price momentum.

-

Mining Companies: Miners receive BTC as block rewards, with production costs far below current prices. Mining cost estimates for 2025 range from $26,000 to $28,000 per BTC, while market prices hover around $100,000. In bull markets, miners delay selling in favor of accumulation. Marathon, for example, has continuously bought BTC from January to May 2025, reaching 49,200 BTC—the second-largest among listed miners. This HODL strategy partly offsets the post-halving output drop (block rewards cut to 3.125 BTC in May 2024, annual inflation <0.5%) and reflects strong price optimism.

-

DeFi Platforms and Protocols: Decentralized finance is increasingly absorbing Bitcoin. Certain protocols use BTC as collateral to issue stablecoins or synthetic assets, generating yield. Institutional capital flowing into DeFi accelerates this trend. Some institutions are exploring ways to integrate traditional assets like bonds or real estate with Bitcoin via DeFi. As regulations clarify, DeFi platforms face growing demand for compliance, and integrating Bitcoin enhances their stability and attractiveness.

4. How Institutional Accumulation Is Reshaping Bitcoin’s Price Mechanism

1. Traditional Price Dynamics: Historically, Bitcoin’s price was driven by retail sentiment and supply-demand fundamentals, characterized by a dual engine of “bull market expectations + halving cycles.” Retail enthusiasm often triggered rapid rallies, while panic or large sell-offs caused sharp declines. Every four years, the halving event reduced miner issuance, frequently triggering new bull runs amid tighter supply.

2. New Institutional-Driven Logic: With massive institutional entry, Bitcoin’s pricing mechanism has fundamentally changed. Higher holding rates and lower流通 supply lead to greater price stability and upward pressure. Market cap growth then attracts more institutions, creating a self-reinforcing cycle: “More institutional holding → tighter supply → higher prices → larger market cap → more holding.”

-

Structural Supply Contraction: Post-halving, Bitcoin’s annual inflation has dropped to ultra-low levels. On-chain data shows 74% of circulating coins haven’t moved in two years, and about 75% have been dormant for the past six months. This means only a small fraction of new and active coins are available for trading, greatly reducing sell-side pressure. Even minor buying shocks can now trigger significant price spikes.

-

Rising Share of Long-Term Holders: As prices rise, short-term holders take profits and exit, while long-term holders accumulate further at higher levels. High-cost positions are effectively locked, enhancing market resilience. Overall, institutional and whale transaction share is rising, pushing up long-term holding ratios and tightening supply.

-

Institutional Withdrawal from Exchanges: Large institutions and funds are moving Bitcoin off exchanges into cold wallets or trust accounts for long-term holding. Simultaneously, ETFs and asset managers maintain steady buying, further reducing tradable supply. More institutional holding → less流通 supply → higher prices creates a positive feedback loop between price, market cap, and institutional participation.

Bitcoin’s market drivers have shifted from early-stage speculation and exchange flows to institutional accumulation and structural supply constraints. In this new paradigm, price is no longer solely dependent on retail sentiment or miner output, but is being redefined through the interplay of institutional holdings and evolving perceptions of intrinsic value. As analysis suggests, confidence from institutions and long-term holders provides robust price support, ushering Bitcoin into a new era of institutionalization and deeper supply-demand imbalance.

5. Conclusion and Outlook

The multi-pronged “HODL wave” from ETFs, governments, and enterprises has profoundly altered Bitcoin’s supply-demand dynamics and pricing logic: fixed issuance combined with long-term lockups is steadily shrinking the floating supply, while institutional demand for inflation hedging and reserve diversification creates sustained buying pressure. As the U.S. “Strategic Bitcoin Reserve” becomes institutionalized, state-level legislation rolls out, and sovereign funds, public companies, and miners expand participation, Bitcoin is accelerating its transformation from a “high-volatility risk asset” to a “strategic reserve asset,” entering a new era dominated by institutional behavior.

-

Higher Price Floor: With annual new supply under 0.5% and ETF inflows persisting, market expectations are shifting from “cyclical bull-bear” to “stepwise appreciation.” In a base case, Bitcoin could stabilize in the $150,000–$180,000 range by late 2025 to mid-2026. If U.S. and European rate cuts coincide with broader sovereign inflows, the bull market peak could extend to $250,000.

-

Declining Volatility: Rising institutional ownership is moderating extreme swings of “deep drawdowns followed by rapid rebounds.” On-chain data showing 74% of流通 BTC unmoved for two years indicates each institutional buy order lifts the floor and strengthens market resilience.

-

Deepening Financialization: Spot ETFs are just the beginning. Futures term structures, Bitcoin yield curves, and “BTC-denominated bonds” will mature quickly, offering traditional capital richer hedging and yield strategies, further enhancing market depth and efficiency.

-

On-Chain Ecosystem Growth: Second-layer solutions like Babylon, RGB, and BitVM, along with liquid staking protocols, are embedding DeFi and RWA capabilities into Bitcoin, improving capital efficiency and recycling idle BTC. In the long run, this will drive even higher lockup rates.

-

Risks and Uncertainties: Macro risks include sudden global liquidity tightening, geopolitical black swans, and unexpected U.S. fiscal deficit expansion. Sector-specific concerns involve regulatory fragmentation, protocol security incidents, and miner cash flow stress. In extreme cases, prices could see temporary corrections exceeding 30%, though the long-term bullish thesis remains intact.

Overall, Bitcoin stands at the intersection of institutionalization, globalization, and financialization. The next phase of value re-rating has already begun, and 2025–2026 may represent the critical window for “repricing Bitcoin on a higher foundation.”

About Us

Hotcoin Research, the core investment research hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global crypto investors. We operate a “triple-pillar” service framework combining trend analysis, value discovery, and real-time tracking. Through deep dives into industry trends, multidimensional project evaluations, and round-the-clock market monitoring, complemented by our weekly “Top Coin Selection” strategy livestreams and daily “Blockchain Headlines” briefings, we deliver precise market insights and actionable strategies for investors at all levels. Leveraging advanced data analytics models and an extensive industry network, we empower novice investors to build cognitive frameworks and help institutional clients capture alpha, jointly seizing value growth opportunities in the Web3 era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News