Decoding HKMA Documents: The "Strictness" and "Flexibility" Behind Stablecoin Regulation

TechFlow Selected TechFlow Selected

Decoding HKMA Documents: The "Strictness" and "Flexibility" Behind Stablecoin Regulation

Hong Kong welcomes responsible innovators, but be prepared for stringent regulation.

By David, TechFlow

Hong Kong is accelerating its stablecoin regulatory development.

On July 29, the Hong Kong Monetary Authority released the consultation conclusions and the full text of the "Guideline on Regulated Stablecoin Issuers," as well as the consultation conclusions and the full text of the "Anti-Money Laundering and Counter-Terrorist Financing Guideline (for Licensed Stablecoin Issuers)," along with two additional explanatory documents. These provide detailed implementation rules for the upcoming stablecoin regulatory regime effective August 1.

Previously, Hong Kong's Legislative Council formally passed the Stablecoin Ordinance on May 21, establishing a licensing regime for fiat-backed stablecoin issuers.

From ordinance passage to supporting guidelines and full implementation, Hong Kong completed the "last mile" of its stablecoin regulatory framework in under three months.

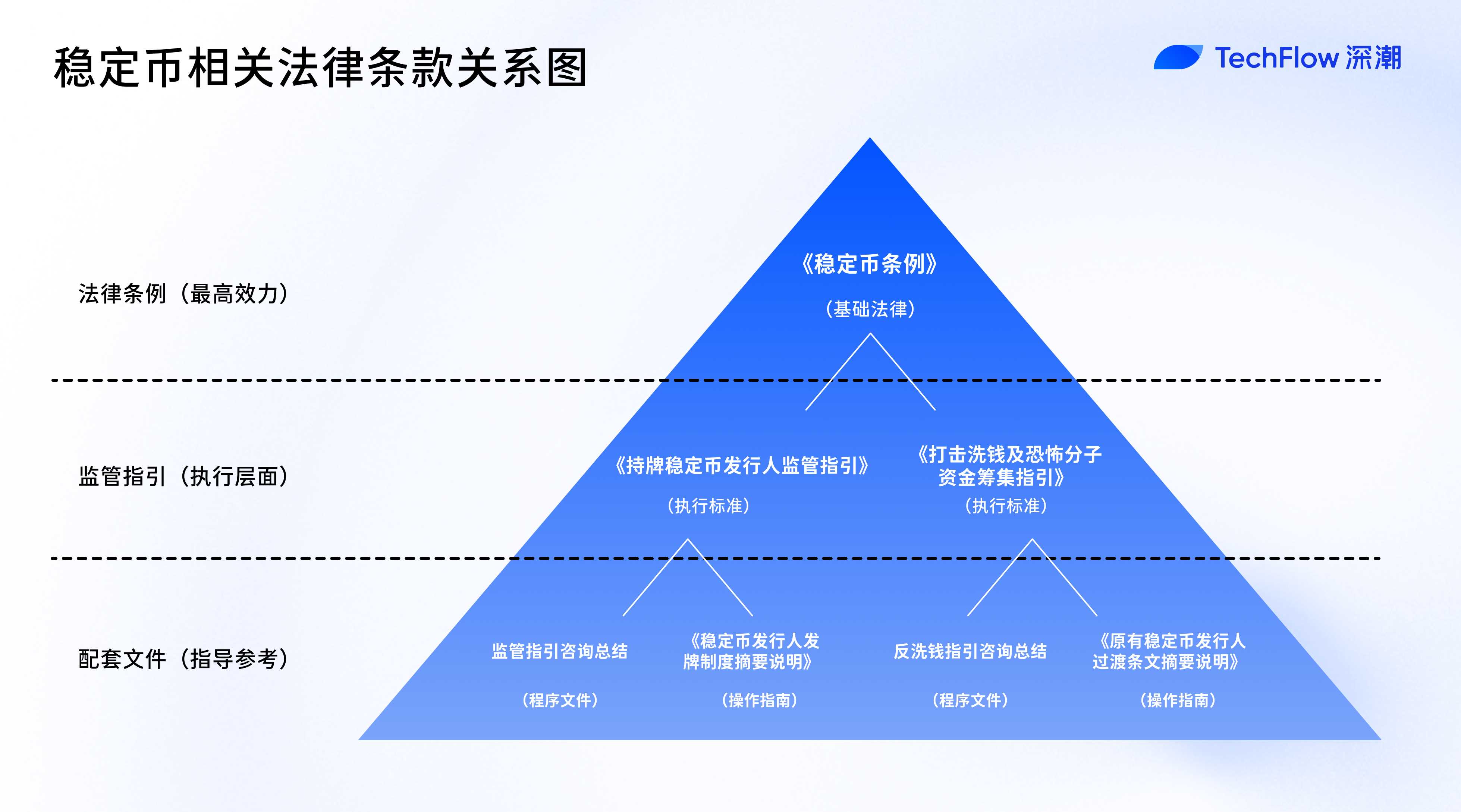

What is the relationship among all these documents?

As seen above, this comprehensive regulatory system consists of one ordinance (the Stablecoin Ordinance), two sets of guidelines (and their consultation conclusions), and two explanatory documents, forming a complete chain from legal foundation to execution details and operational guidance.

Specifically, the entire document framework includes:

-

1 foundational law: The Stablecoin Ordinance (issued in May)

-

2 regulatory guidelines: "Guideline on Regulated Stablecoin Issuers," "Anti-Money Laundering and Counter-Terrorist Financing Guideline"

-

2 consultation summaries: Records of public consultations on the two guidelines and HKMA’s responses

-

2 explanatory documents: "Summary Explanation of the Licensing Regime for Stablecoin Issuers," "Summary Explanation of Transitional Provisions for Existing Stablecoin Issuers"

Among these, the Stablecoin Ordinance sits at the top of the pyramid, serving as the foundational law that establishes the legal standing and basic framework of the licensing regime. The two regulatory guidelines operate at the implementation level, translating the ordinance’s principles into specific operational standards and compliance requirements. These guidelines carry quasi-legal force, and licensed institutions must strictly comply.

The consultation summaries, while not directly legally binding, serve as procedural records capturing the regulator’s responses to market feedback, helping market participants understand regulatory intent and the rationale behind the guidelines.

The two explanatory documents function at the interpretive and guidance level, offering market participants clarity on the system and application procedures, assisting potential applicants in understanding regulatory requirements and the application process.

In simple terms:

The Ordinance "sets the rules"—defining what constitutes a stablecoin, who can issue it, and fundamental regulatory principles;

The regulatory guidelines "set the standards"—specifying technical requirements such as capital adequacy ratios, risk management, and disclosure standards;

The explanatory documents "show the path"—clarifying how to apply for a license, how transition periods are structured, and how enforcement will be conducted.

Guideline on Regulated Stablecoin Issuers: The "Strictness" and "Flexibility" Behind the HK$25 Million Threshold

The HKMA released six documents at once. For readability, we’ll focus on the most critical one: the "Guideline on Regulated Stablecoin Issuers." This document details specific compliance obligations for issuers and directly impacts market participants’ operations and interests.

If the Stablecoin Ordinance is the foundation of Hong Kong’s stablecoin issuance framework, then this 89-page guideline is akin to the bricks and mortar filling out the structure.

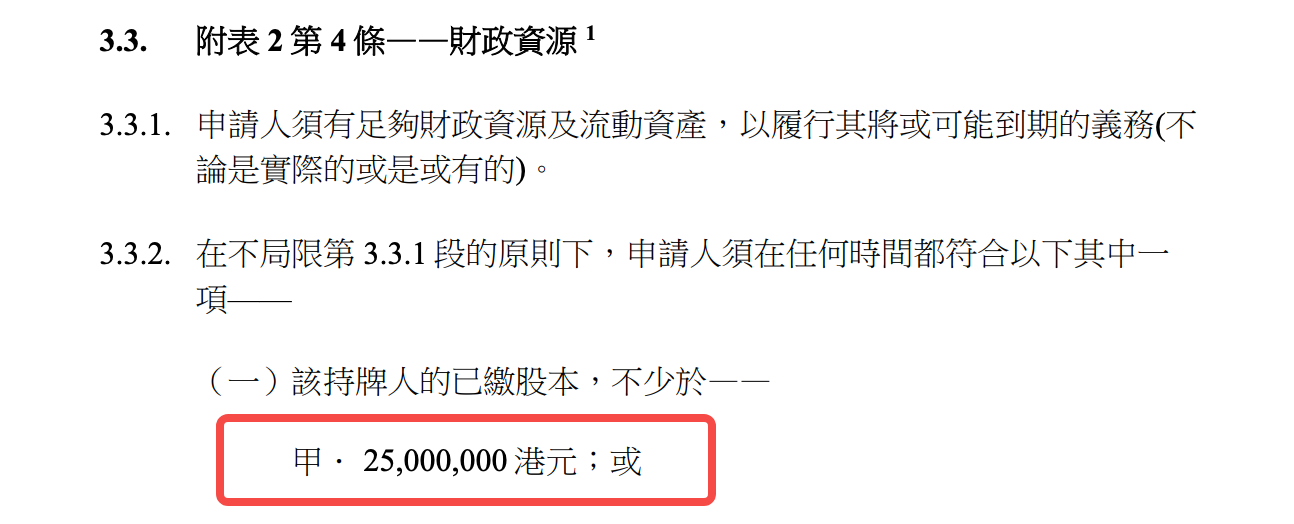

From the HK$25 million capital requirement to 12 specific private key management rules, the HKMA has laid out an exceptionally detailed, yet pragmatic, regulatory framework.

Entry Barriers: Not a Game for Everyone

A minimum capital requirement of HK$25 million (approximately USD 3.2 million) places Hong Kong in the mid-to-upper range globally for stablecoin regulation. By comparison, the EU’s MiCA regulation requires only EUR 350,000 for e-money token issuers, while Japan mandates JPY 10 million (about USD 75,000). Hong Kong’s threshold appears carefully calibrated—to ensure financial robustness without completely shutting out innovators.

But capital is just the first hurdle. More significant is the "fit and proper" test.

The guideline devotes an entire chapter to seven evaluation criteria: criminal records, business experience, financial health, time commitment, and even directors’ external appointments. In particular, the requirement that independent non-executive directors constitute at least one-third of the board aligns directly with corporate governance standards for listed companies.

This means that issuing stablecoins in Hong Kong demands not just capital, but the right people. A Web3 startup composed solely of tech enthusiasts may need to significantly restructure its governance by bringing in professionals with traditional finance backgrounds to meet these standards.

Even stricter is the restriction on business activities. Licensees must obtain prior written approval from the HKMA before engaging in any “other business activities.” This effectively positions stablecoin issuers as specialized entities, similar to traditional payment or electronic money issuers. For projects aiming to build an integrated “DeFi + stablecoin” ecosystem, this signals a need to reconsider their business models.

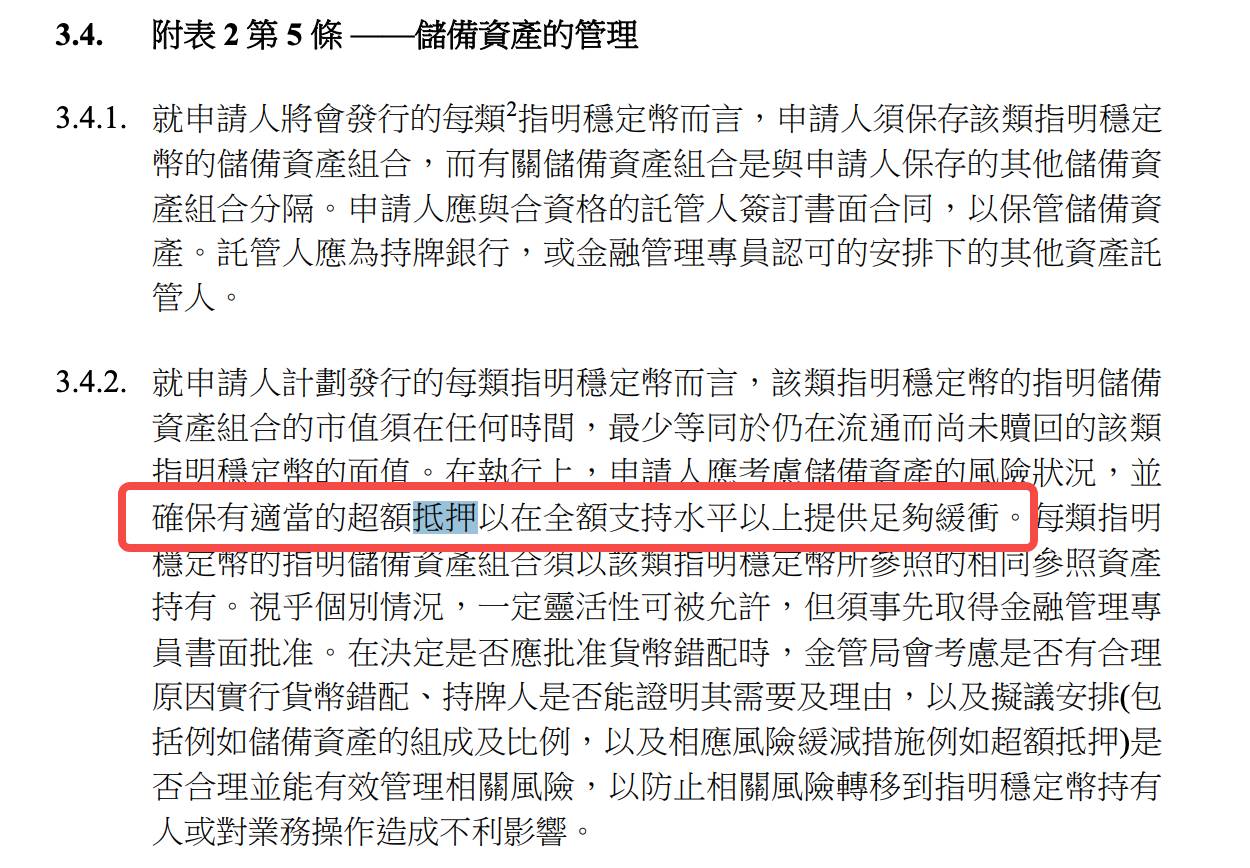

Reserve Management: 100% Is Just the Starting Point

Hong Kong adopts a dual-safeguard model of “100% plus over-collateralization” for reserve asset management.

The guideline explicitly requires that the market value of reserve assets must “at all times” be at least equal to the face value of outstanding stablecoins, while also “considering the risk profile of the reserves to ensure appropriate over-collateralization.”

How much is “appropriate”?

No specific figure is given, but requirements such as setting internal limits for market risk indicators and conducting regular stress tests suggest regulators expect issuers to dynamically adjust over-collateralization based on their own risk profiles.

This principle-based approach offers flexibility but also increases compliance costs—you must establish a full risk assessment system to justify your “appropriateness.”

On eligible reserve assets, Hong Kong shows prudence without being conservative.

Beyond cash and short-term bank deposits, the guideline explicitly accepts “tokenized forms of qualified assets,” leaving room for future innovation—potentially including tokenized U.S. Treasuries or tokenized bank deposits.

Most notably, however, is the trust segregation arrangement.

Licensees must establish “effective trust arrangements” to legally separate reserve assets from their own, and must obtain independent legal opinions confirming the validity of such arrangements. This goes beyond accounting separation—it ensures that even in the event of issuer bankruptcy, stablecoin holders’ rights remain protected.

On transparency, Hong Kong employs a "high-frequency disclosure + regular audit" approach. Issuers must publish weekly reports on the market value and composition of reserves, and undergo quarterly verification by independent auditors. Compared to even highly compliant stablecoins like USDC, which currently report monthly, Hong Kong’s requirements significantly raise the bar for transparency.

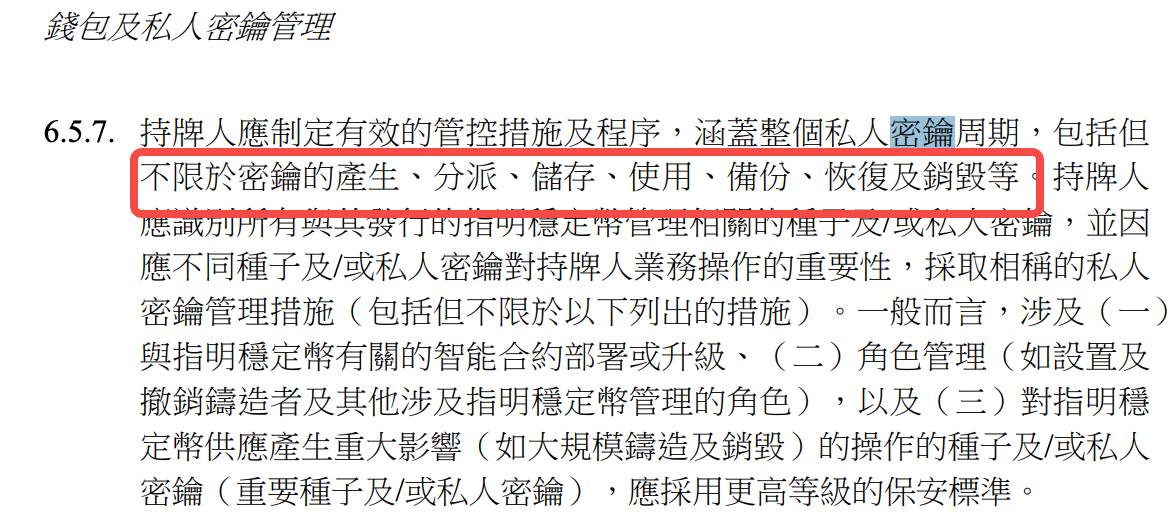

Technical Requirements: Professional-Grade Private Key Management

On private key management—a unique Web3 risk point—the guideline demonstrates surprising technical sophistication:

Twelve specific requirements cover nearly every stage of the private key lifecycle, from generation to destruction, physical security to breach response.

For example, “critical private keys must be used in isolated environments”—meaning keys for minting and redeeming stablecoins cannot connect to the internet and must operate offline;

“Key usage requires multi-party authorization”—no single individual can independently control critical keys;

“Key storage media must be located in Hong Kong or other HKMA-approved locations”—effectively ruling out overseas key custody.

These requirements show the HKMA isn’t simply applying traditional financial regulations, but truly understands blockchain technology’s characteristics and risks. In many ways, this guideline serves as a regulated version of “enterprise-grade private key management best practices.”

Smart contract audits are equally rigorous. Issuers must engage “qualified third-party entities” to audit smart contracts upon deployment, redeployment, or upgrades, ensuring they “execute correctly,” “align with intended functionality,” and “are highly unlikely to contain vulnerabilities or security flaws.” Given that the smart contract audit industry is still nascent, defining “qualified” may pose practical challenges.

Customer identification reflects a blend of Web3 and traditional KYC.

On one hand, issuers must complete “relevant customer due diligence” before providing services; on the other, they must “only transfer stablecoins to pre-registered wallet addresses.” This design attempts to balance anonymity with compliance.

Operational Standards: The “Banking” Path for Stablecoins

“T+1 redemption,” “pre-registered accounts,” “three lines of defense”—these requirements indicate Hong Kong expects stablecoin issuers to align their operations with traditional financial institutions, maximizing risk control.

Consider redemption timelines.

“Valid redemption requests should be processed within one business day of receipt”—this T+1 rule is stricter than many existing stablecoins. Tether’s terms of service reserve the right to delay or refuse redemptions, whereas Hong Kong elevates timely redemption to a legal obligation.

Yet this “banking” model isn’t mere replication. The guideline allows flexibility for “exceptional circumstances”—delays require prior written approval from the HKMA. This mechanism resembles banking “suspension of withdrawals” clauses, offering a buffer for system stability during extreme market conditions.

The three-lines-of-defense risk management framework is directly borrowed from banking best practices:

The first line comprises business units, the second independent risk management and compliance functions, and the third internal audit. For many native Web3 teams, this implies a fundamental organizational shift—you can no longer operate as a flat tech team, but must build a hierarchical, clearly defined structure.

Particularly notable is third-party risk management.

All third-party arrangements—reserve custody, outsourced tech services, or distribution—must undergo strict due diligence and ongoing monitoring. The guideline even stipulates that if a third-party provider operates outside Hong Kong, the issuer must assess local regulators’ data access rights and promptly notify the HKMA when required.

KYC Myth: Must Holders Be Identified?

Currently, the biggest concern on social media revolves around KYC.

Some analyses have suggested the regulations require identity verification for all stablecoin holders, implying full identification.

Let’s look at the actual wording in the document:

Although the guideline distinguishes between “customers” and “holders,” closer analysis reveals this distinction may be more of a “trap”—you may freely acquire and hold stablecoins, but to realize their core value (redeeming fiat currency anytime), KYC is almost unavoidable.

The guideline contains several seemingly lenient statements:

-

“A licensee should only issue specified stablecoins to its customers”

-

“The terms and conditions shall apply to all specified stablecoin holders (regardless of whether they are customers of the licensee)”

This suggests two groups: “customers” requiring KYC and “holders” who do not. But when examining actual service delivery, this distinction appears largely theoretical.

The key lies in redemption rules: “Issuance or redemption services must not be provided to specified stablecoin holders and/or potential holders unless relevant customer due diligence has been completed.”

This means anyone wishing to exercise redemption rights must first complete KYC, upgrading from “holder” to “customer.”

The guideline repeatedly emphasizes holders’ right to “redeem at par value,” considered central to a stablecoin’s “stability.” In practice, however, exercising this right is conditional—you must be willing and able to complete KYC.

For holders unable or unwilling to complete KYC due to privacy concerns, geographic restrictions, or other reasons, this “right” is effectively unenforceable.

Beyond identity verification, geographic restrictions may pose an even higher barrier.

The guideline requires issuers to “ensure specified stablecoins are not issued or offered in jurisdictions where such transactions are prohibited” and to “take reasonable measures to identify and block the use of virtual private networks (VPNs).”

For global cryptocurrency users, such geo-fencing may be more restrictive than KYC itself.

For Hong Kong, this may be an acceptable trade-off—moderate restrictions in exchange for regulatory certainty and financial stability. Whether this model becomes mainstream across the global crypto ecosystem remains to be seen.

Exit Mechanism: A Proactive “Safety Valve”

Among all regulatory requirements, the “business exit plan” may be the most overlooked yet crucial element.

The guideline requires every issuer to prepare a detailed exit plan, covering how reserve assets will be sold, redemption requests handled, and third-party services transferred.

This reflects regulators’ deep concern about systemic risk.

Unlike other crypto assets, stablecoins’ promise of “stability” enables broad adoption—but also means problems could have wider impact. By mandating advance exit planning, regulators aim to ensure orderly market digestion even in worst-case scenarios.

The exit plan must address asset sale strategies under both “normal and stressed conditions.” This forces issuers to consider:

If market liquidity dries up, how can reserves be liquidated without triggering a fire sale? If banking partners terminate services, how can redemption channels remain open?

The answers to these questions will directly determine a stablecoin project’s resilience during crises.

The Underlying Logic of Hong Kong’s Regulatory Approach

Overall, this regulatory guideline reveals Hong Kong’s unique path in stablecoin regulation: neither the U.S.-style “enforcement-first” (using enforcement actions to drive compliance) nor the European “rule-heavy” approach (exhaustive codified rules), but rather a hybrid “principles + rules” model.

On critical risks like reserve management and private key security, detailed rules are set; on implementation aspects like over-collateralization ratios and risk metrics, principle-based flexibility is preserved.

This design reflects Hong Kong regulators’ pragmatism, recognizing that the stablecoin industry is rapidly evolving and overly rigid rules could quickly become obsolete.

The HK$25 million licensing threshold is substantial, but remains reasonable compared to the HK$50 million (USD 6.4 million) capital requirement for virtual asset trading platforms. Technical requirements are thorough, yet explicitly allow innovative solutions like “tokenized assets.” Operational standards are strict, yet include emergency mechanisms for market volatility.

More importantly, this framework reflects Hong Kong’s understanding of stablecoins’ essence: they are not merely “cryptocurrencies,” but critical infrastructure linking traditional finance and the digital economy. Therefore, regulatory standards must be high enough to safeguard financial stability, yet flexible enough to accommodate technological innovation.

For market participants, the message is clear:

Hong Kong welcomes responsible innovators—but be prepared for stringent oversight.

Institutions seeking to issue stablecoins in Hong Kong must carefully assess whether they possess the necessary financial strength, technical capability, and compliance resources.

For the broader industry, Hong Kong’s approach offers a vital reference: stablecoin regulation is not about stifling innovation, but about creating sustainable conditions for it to thrive.

When regulatory rules are clear and enforcement standards transparent, compliance costs become predictable, and the boundaries of innovation become explorable.

This may well be how Hong Kong, as an international financial center, maintains its competitiveness in the era of digital assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News