Uncovering Pump.fun and Its Mysterious Founder: A History of Rug Pulls?

TechFlow Selected TechFlow Selected

Uncovering Pump.fun and Its Mysterious Founder: A History of Rug Pulls?

The founder was allegedly involved in manipulating an ICO project when he was just 16 years old, and the "anti-malicious vision" claimed by Pump.Fun is precisely what he once represented.

Text: Joel Khalili, Wired

Translation: BlockBeats

Image source: WIRED editorial team / Getty Images

Editor's note: The much-anticipated Pump.fun platform token PUMP surged to around $0.007 shortly after its launch on July 15, then entered a one-way downward trend. The public sale price of $0.004 failed to halt the decline, and PUMP has since fallen below $0.003 today, severely undermining investor confidence. Although U.S. users were explicitly barred from participating in the PUMP public sale, American meme traders still suffered losses from meme coin trading and became equally frustrated. Burwick Law, a well-known law firm that has previously filed multiple lawsuits over meme coin investments, announced yesterday it is expanding its litigation against the Pump platform to include Solana Foundation, Solana Labs, and Jito as defendants. Additionally, the "average age" of the Pump.fun team has become a hot topic within the crypto community. According to a previous report by The New York Times, Pump.fun is headquartered in London, UK, and led by three founders in their early twenties: Noah Tweedale, Alon Cohen, and Dylan Kerler. They have registered a legal entity—Baton Corporation—with Noah Tweedale serving as CEO and all three acting as company directors. The trio met at Oxford University in the UK and have years of experience trading Dogecoin and other meme coins. This is an article from WIRED published in April this year, which may help readers better understand the Pump.fun platform and the people behind it.

Pump.fun, the world’s largest memecoin factory, allows anyone to create their own cryptocurrency. However, several years before the platform’s launch, an individual sharing the same name as co-founder Dylan Kerler had already made a small fortune by issuing and dumping self-created tokens.

According to WIRED’s investigation, an individual named Dylan Kerler issued eight tokens in 2017. At that time, Pump.fun’s co-founder Dylan Kerler was only 16 years old. Two of these tokens—eBitcoinCash and EthereumCash—gained attention on cryptocurrency forums before crashing in price, leading investors to accuse the developer of conducting a rug pull.

Analysis by blockchain security firm CertiK indicates that the developer using the name Dylan Kerler earned up to $75,000 worth of cryptocurrency in 2017 alone through sales of eBitcoinCash and EthereumCash—worth an estimated $400,000 today based on current prices.

"They waited for market share and price to rise before quickly cashing out," said CertiK Chief Security Officer Wang Tieli. "We strongly suspect EthereumCash was designed by the developer specifically for a rug pull."

The stated purpose of Pump.fun, according to its co-founders, is to protect investors from unethical actors by standardizing token issuance. Yet evidence suggests that Dylan Kerler was earlier involved in precisely the type of behavior the platform claims to guard against.

As of publication, neither Pump.fun nor Dylan Kerler responded to multiple requests for comment.

The Rise of Pump.fun and Its Mysterious Founders

Pump.fun was founded in January 2024 by three entrepreneurs in their early twenties—Noah Tweedale, Alon Cohen, and Dylan Kerler. The platform rapidly became the go-to hub for launching and trading memecoins.

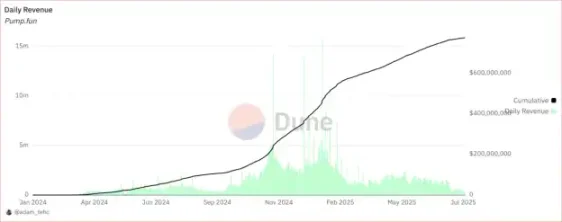

These highly volatile cryptocurrencies are primarily speculative in nature. According to third-party estimates, within just 15 months, Pump.fun has generated over $600 million in revenue via its 1% transaction fee.

The three co-founders rarely disclose their identities, locations, or corporate structure. Tweedale told WIRED last year that this anonymity was due to "personal safety" concerns, aimed at preventing ransom or attacks related to the vast amount of crypto assets managed by Pump.fun.

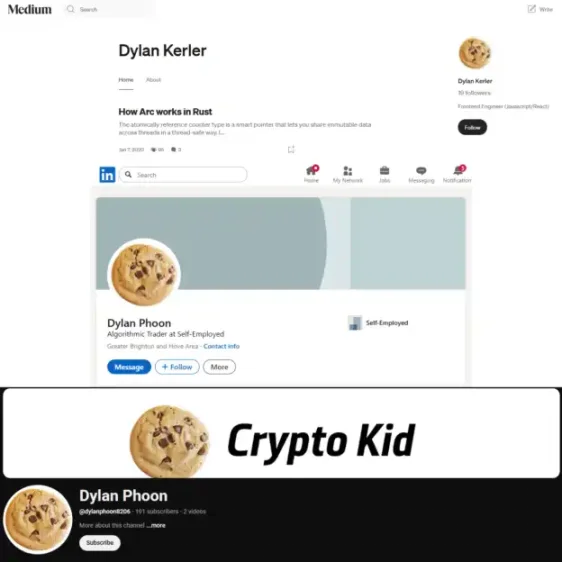

Among the trio, Kerler has the least public footprint. Aside from being listed as a director in filings with the UK Companies House registry, he has almost no visible connection to Pump.fun. Tweedale told WIRED that Kerler leads the development team responsible for writing the platform’s code and rolling out updates. Beyond an X (formerly Twitter) account named @outdoteth, Kerler’s online presence is virtually nonexistent.

Yet a trail of "digital clues" scattered across GitHub, YouTube, LinkedIn, and Medium links this name to the suspected rug pulls involving eBitcoinCash and EthereumCash.

Digital Footprints: Tracing Early Token Promotion

In 2017, the tokens eBitcoinCash and EthereumCash were first promoted by two accounts on the BitcoinTalk cryptocurrency forum: DOMAINBROKER and ninjagod, both belonging to the same user. According to one forum post, after the DOMAINBROKER account was "reportedly hacked," the user began communicating with investors under the ninjagod identity.

In a forum thread promoting eBitcoinCash, the DOMAINBROKER account provided an email address bearing the name Dylan Kerler, labeling it a "personal email." In another thread initiated by ninjagod about EthereumCash, multiple forum users directly referred to Dylan Kerler as the project’s developer.

Meanwhile, multiple clues suggest that Pump.fun co-founder Dylan Kerler and the developer behind eBitcoinCash and EthereumCash were located in the same region—the latter once stating in an old Telegram group that they were based in Brighton, UK.

Voter registration records reviewed by WIRED show that Kerler was registered at an address in Brighton and Hove, UK, as recently as 2024. When reporters visited the location on April 15, a resident who responded via intercom declined to identify themselves but confirmed that Kerler "no longer lives here," indirectly verifying the accuracy of the voter records.

Corporate filings indicate that one of Pump.fun’s legal entities was once registered at the same property in Brighton and Hove. That address is also shared by two other companies listing Kee Fatt Phoon, aged 62, as director. Phoon is also registered at that address as a voter.

Pseudonyms and Connections: Dylan Kerler or Dylan Phoon?

Dylan Kerler appears to have used the alias "Dylan Phoon"—a surname matching that of Kee Fatt Phoon, suggesting a possible familial relationship.

Until recently, a GitHub account using the nickname "outdoteth" retained an old code repository containing a Gmail address under the name Dylan Phoon. The profile picture associated with this email also appears on a Medium account named DylanKerler1, as well as on LinkedIn and YouTube accounts registered under Dylan Phoon.

The aforementioned YouTube account uploaded a video about the cryptocurrency Skycoin. Although the project was created by someone else, its logo also appeared on the BitcoinTalk profile of ninjagod—an indirect clue linking both accounts to the same person.

Another YouTube account named @dylankerler4130 posted videos about a project called "Equis," advertised as set to "revolutionize the gambling industry." Equis was similarly promoted by ninjagod on BitcoinTalk, and its code is identical to that of eBitcoinCash and EthereumCash. (The project failed to generate interest among forum investors.)

In summary, both names used by the Pump.fun co-founder—Dylan Kerler and Dylan Phoon—can be traced back to accounts on BitcoinTalk that promoted EthereumCash and eBitcoinCash.

ICO Boom and Early Rug Pull Patterns

eBitcoinCash and EthereumCash were launched during the peak of the ICO frenzy by a developer using the name Dylan Kerler. During that period, hundreds of token projects raised billions of dollars from investors through ICOs, which were popular among crypto startups because they didn’t require equity dilution.

An ICO typically involves three steps: deploying a smart contract on Ethereum to mint tokens, outlining the project vision on a website, and soliciting investments. "Many projects were just a whitepaper and a countdown timer on a website—very low barrier to entry," said Wang.

Analysts note that while some ICO-funded projects (like Ethereum) remain active, most were manipulated, exaggerated, or outright fraudulent, eventually prompting tighter regulation. Many developers overstated project utility, manipulated prices to create hype, or fabricated return rates.

"Developers aggressively sold the fantasy of high returns," said Nicolai Søndergaard, research analyst at blockchain analytics firm Nansen. "That’s exactly where FOMO psychology originates."

The noise of the ICO boom led many trusting investors to chase profits without conducting proper due diligence—a phenomenon strikingly similar to today’s investment in dubious memecoins. "Meme mania and ICOs have a lot in common," Søndergaard noted. "It’s easy to sell a story to the masses, then quickly cash out."

The Rise and Collapse of EthereumCash

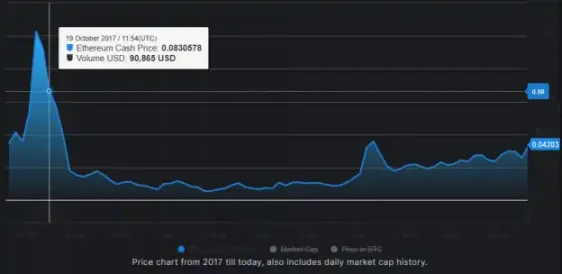

A developer using the pseudonym Dylan Kerler began promoting his most successful token—EthereumCash—in early October 2017.

The developer followed the standard playbook: minting the token on Ethereum, building a website, and launching promotional campaigns on BitcoinTalk, Twitter, and Telegram. To generate buzz, they distributed free tokens via an "airdrop" and promised to release a whitepaper—a document seen at the time as a symbol of legitimacy that could drive up prices.

"Releasing a whitepaper can greatly boost appeal," said Søndergaard. "Even just promising one is enough to stir market sentiment."

Screenshots of the project’s now-deleted website, circulated in Telegram groups, reveal how potential investors were marketed to. The page claimed: "We aim to make the transition from fiat to cryptocurrency as seamless as possible, while still maintaining integrity and a premium atmosphere (original grammatical error preserved)." Below, it displayed an image of an EthereumCash debit card allegedly usable for real-world purchases.

A form obtained by WIRED shows that within days, hundreds of people had signed up for the EthereumCash airdrop. Meanwhile, discussions on BitcoinTalk grew heated. One user wrote: "Let’s spread the word and get more people to notice this excellent token." By October 19, EthereumCash’s market cap had risen to approximately $1.3 million.

But just as early investors grew optimistic, the developer known as Dylan Kerler began quietly selling off holdings.

CertiK analysis shows that within days of creating the token, Dylan Kerler distributed millions of EthereumCash tokens to wallets under his control. One wallet starting with 0x7f3E2 was subsequently used to dump large volumes of the token onto the market.

Between October 19 and 21, 0x7f3E2 sold hundreds of batches of EthereumCash on the peer-to-peer exchange EtherDelta. These sales coincided with a catastrophic price crash—down 87.9%.

Panic spread across Telegram and BitcoinTalk. One user, perhaps trying to find humor in the situation, started calling the token "ECRASH." Others blamed the developer outright. A Telegram user who participated in the EthereumCash airdrop told WIRED: "Everyone was furious." "I think this was my first rug pull."

The much-promised whitepaper never materialized. Eventually, the developer named Dylan Kerler disappeared from the BitcoinTalk thread and Telegram group. Just days earlier, he had written: "I can assure everyone that the project is making significant progress."

In three transactions on October 20 and 21, the developer’s wallet withdrew a total of 240 ETH in proceeds from EtherDelta—worth about $75,000 at the time. After each withdrawal, these ETH were immediately transferred to another wallet address (0xc8ae1), then split into three further wallets: 0x7EAbb, 0x31728, and 0x952F3. Ultimately, these funds were sent to centralized exchanges including Binance, Bity, and the now-defunct Cryptopia—platforms commonly used to convert cryptocurrency into fiat currency.

WIRED identified at least 20 wallets used by the self-identified Dylan Kerler to issue, distribute via airdrop, or sell eBitcoinCash and EthereumCash, or to transfer proceeds to centralized exchanges.

"This layered approach serves to obscure the money trail," said Søndergaard. "If you have nothing to hide, there’s really no need to do this. It’s suspicious in itself."

Despite lingering hopes of a comeback—one user joked on October 24, "I smell a whitepaper coming"—all signs pointed to the inevitable end.

In an early October BitcoinTalk post, a developer wrote: "This will be like a pump and dump, a quick rise and fall. Early investors can get their costs back." "Sorry to be so blunt, but that’s just how it is."

Faster Than Getting Rich Is Being Forgotten

To this day, Pump.fun’s meteoric rise continues unabated. Third-party data shows the platform earns up to $1 million per day. The founders’ wealth has skyrocketed, far surpassing the earnings from eBitcoinCash and EthereumCash years ago. Yet even as this "wealth machine" keeps running, rug pulls that contradict its original mission continue to occur—almost unnoticed.

Last November, a teenager live-streamed himself on Pump.fun, creating and dumping a token within minutes and pocketing $30,000. Shouting "Holy fuck! Holy fuck!" he flipped double middle fingers at the camera—perhaps the true defining moment of this era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News