The narrative economics of the crypto market: vision over metrics, sentiment before applications

TechFlow Selected TechFlow Selected

The narrative economics of the crypto market: vision over metrics, sentiment before applications

If cryptocurrency is just one big narrative, perhaps the best traders are those who read a few chapters ahead.

Author: jawor, Crypto KOL

Translation: Felix, PANews

"The human brain is naturally good at storytelling. And the economy is built upon human decisions."

——Robert J. Shiller (American economist, Nobel laureate in economics)

1. Narrative as Market Engine

In December 2017, something strange happened. Friends who had never cared about crypto markets started asking how to buy Bitcoin. Not because they read a whitepaper, or even understood what blockchain was. They simply heard a story: someone they knew made life-changing money.

That was enough.

In what Nobel laureate Robert J. Shiller calls narrative economics, cryptocurrencies are the most fertile ground—contagious narratives that influence market behavior, equaling or even surpassing traditional macro factors like interest rates or GDP.

Retail investors changed the game. In traditional finance, capital typically flows through structured channels: fund managers, analysts, investor reports. Now, capital flows through memes, viral posts, and premium Telegram groups. Narratives have become the new fundamentals—and nowhere is this more evident than in crypto.

When markets heat up, narratives become key drivers of capital allocation. Not whitepapers, not balance sheets—but belief.

The core argument is: volatility in crypto markets does not depend on technology, user growth, or revenue (at least initially). It depends on belief, and belief is built on compelling stories.

2. How Narratives Work: Viruses with Capital

Robert Shiller argues that economic narratives spread like viruses. The strongest narratives aren't necessarily true—they're just contagious. They appeal to emotion, identity, and FOMO. In crypto, this spread is instant, global, and algorithmically amplified.

A typical narrative usually starts with a seed idea: Bitcoin is digital gold. Ethereum is the world computer. DeFi is the new banking system. These ideas are simple, intuitive, and emotionally appealing. Once such a narrative takes hold, it begins reshaping people's values.

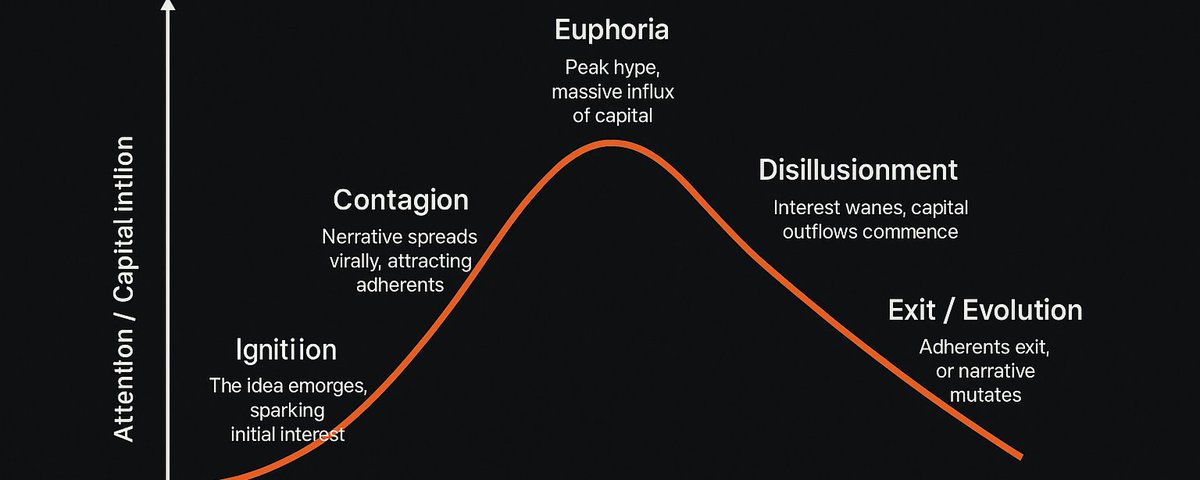

A strong crypto narrative typically follows this lifecycle:

-

A narrative emerges: someone writes a blog post, a key influencer hints at a trend, or a charismatic founder articulates a vision.

-

The narrative spreads across social platforms, YouTube channels, and Discord servers.

-

As influence grows, it changes how people think. Even if nothing changes on-chain, the associated assets feel more valuable.

-

Capital floods in, chasing the narrative.

People often talk about network effects in technological contexts. But narratives themselves have network effects. The more people believe a story, the truer it becomes—socially, economically, and eventually financially.

Two key elements make a narrative more contagious:

-

A familiar face: a person who embodies the narrative. Think of Satoshi’s mystery, Vitalik’s intellect, or Anatoly’s product prowess. People are drawn to faces.

-

A familiar plot: great narratives often echo well-known story arcs—underdogs, rebels, revolutions. Crypto fits these themes perfectly. It’s anti-bank, anti-system, pro-freedom.

In the end, in crypto, narrative isn’t an extra layer on top of the product. The narrative is the product.

3. Case Studies: Narratives That Created Markets

Bitcoin: Digital Gold

In 2020, Bitcoin itself didn’t change. What changed was how people saw it. The mainstream narrative shifted from "peer-to-peer cash" to "digital gold." Suddenly, Bitcoin was positioned as inflation protection—a safe haven in an era of money printing. What attracted MicroStrategy or Tesla wasn’t Bitcoin’s tech, but this idea.

Satoshi’s mysterious legend helped too. The vanished founder made the story more compelling. This wasn’t just code—it was a movement.

Ethereum: The World Computer

When Ethereum launched, there were almost no usable dApps. But its idea—a decentralized platform where anyone could build unstoppable applications—was powerfully attractive. "Code is law" resonated deeply. The market wasn’t buying usage; it was buying potential.

Ethereum became valuable not for what it was, but for what it promised.

DeFi Summer 2020

During DeFi summer, yields were absurdly high. But the core driver wasn’t APR—it was the narrative: permissionless finance, being your own bank, financial primitives free from banks or borders. This idea spread fast. Most protocols had little revenue, few users, and flawed tokenomics—but none of that mattered. The narrative alone was strong enough to override reality.

NFTs as Cultural Ownership

Why would someone pay millions for a JPEG? Because NFTs aren’t about the image—they’re about identity. The narrative is simple and seductive: digital ownership will redefine art, music, and status. Owning a Bored Ape isn’t about aesthetics—it’s about signaling identity.

The narrative matters more than the product. That’s why it worked.

AI Tokens in 2023–2024

Projects with minimal functionality and zero revenue skyrocketed simply because of the phrase "AI + crypto = future." An AI hype already hot in traditional finance (TradFi) spilled into crypto, bringing massive speculative capital. Utility didn’t matter—the narrative did.

Meme tokens with "agent" in the name surged tenfold. Founders hastily added "AI" to their roadmaps. Investors bought into the potential—even if it was just talk for now.

4. Why Crypto Markets Are Especially Susceptible to Narrative

Crypto lacks traditional valuation benchmarks: no balance sheets, no P/E ratios, no regulatory filings. This makes the space especially vulnerable to narratives over fundamentals.

Additionally:

-

It's a retail-driven, hype-fueled market.

-

A meme culture that spreads rapidly via social media.

-

Token liquidity and permissionless listing.

These factors create the perfect breeding ground for narrative-driven price action. In other markets, narratives are side effects. In crypto, they are the engine.

Crypto prices aren’t based on present reality, but on possible futures.

5. Edge: Trading Narratives

In a narrative-driven market, edge comes from early identification.

Smart traders and funds don’t just analyze charts or read code. They watch the social layer: who’s tweeting, meme density, emotional engagement, and whether a narrative is moving from niche to mainstream?

Here are some current popular narratives:

-

Modular blockchains: "the new design space"

-

Solana as the new Ethereum: "fast, cheap, and clean"

-

RWA: "yield meets compliance"

-

Agent-based DeFi: "AI protocols that think for you"

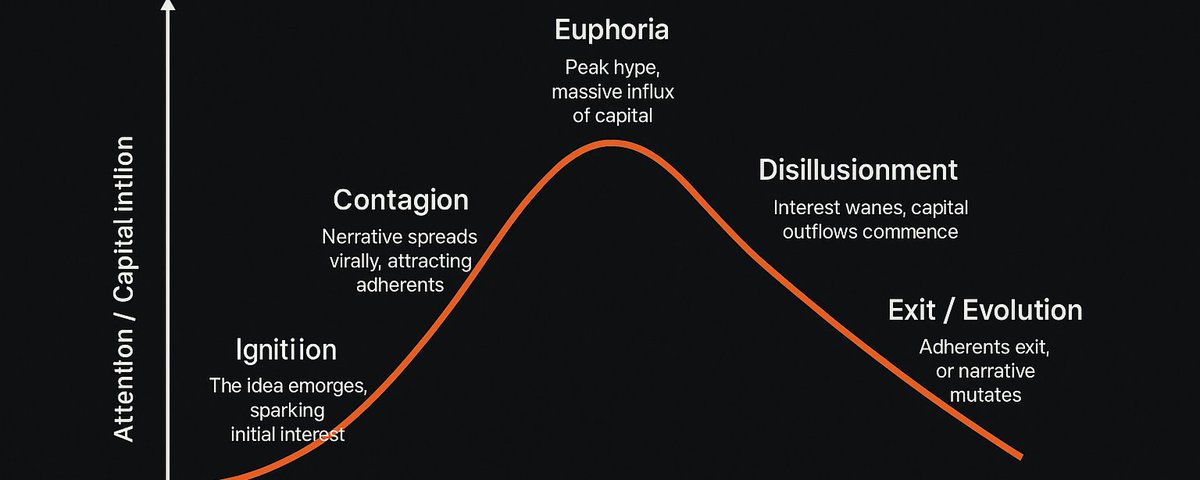

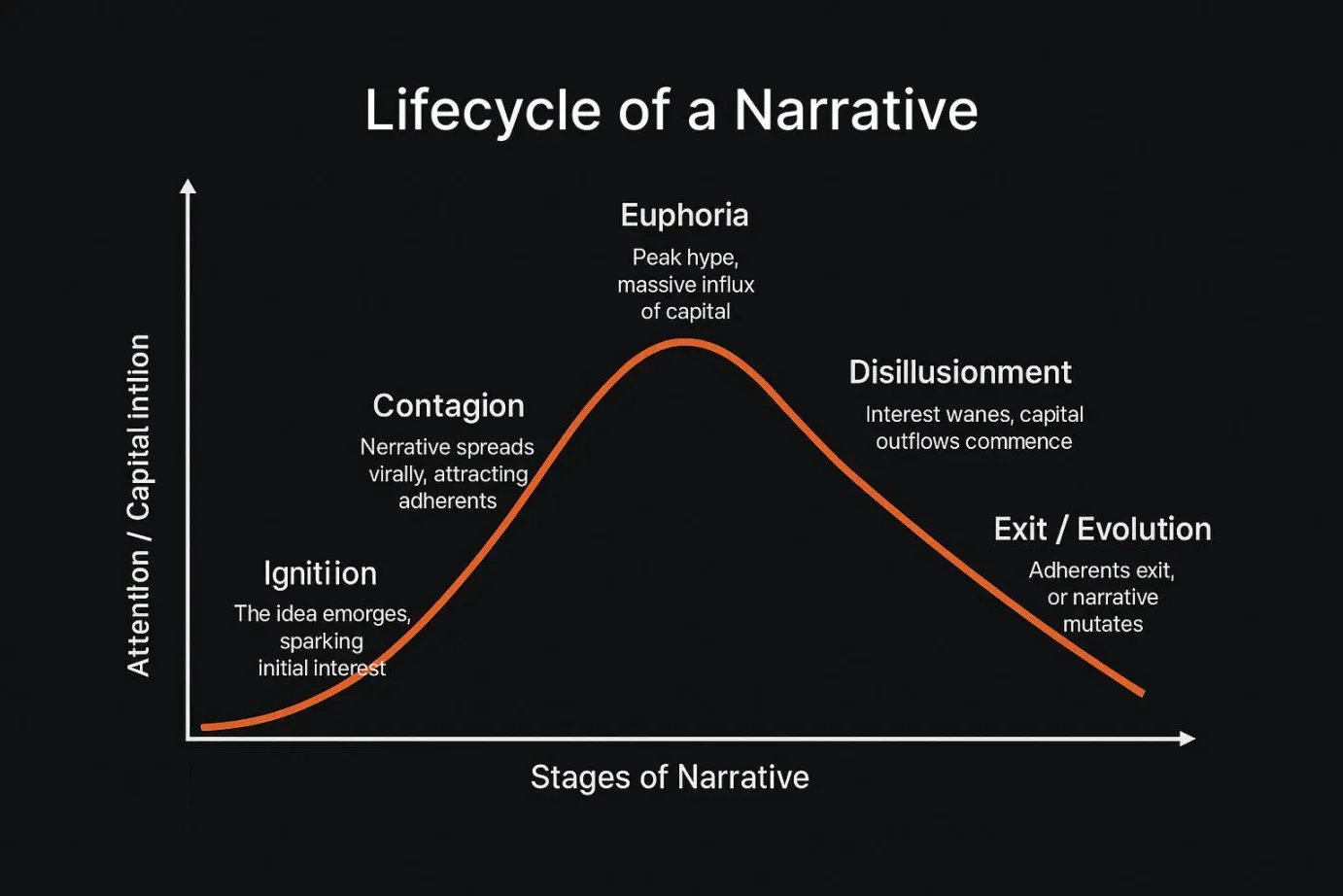

Each narrative follows the same lifecycle:

-

Spark: the idea appears in alpha chats and early discussions.

-

Spread: influencers amplify it.

-

Frenzy: everyone jumps in, tokens pump.

-

Disillusionment: products fail to deliver, interest fades.

-

Exit or evolution: the narrative either dies or transforms.

Timing is crucial. Enter in phase two, exit before phase four, and you ride the wave. Miss the cycle, and you’re left holding the narrative bag.

6. Can You Invest in Narratives?

Absolutely. In fact, in early-stage crypto investing, narrative is one of the few coherent frameworks available.

Robert Shiller makes a compelling point: ignoring narratives means ignoring macro forces. In crypto, this effect is amplified. Narratives don’t just reflect markets—they create them.

As crypto moves closer to traditional finance, some noise may fade. But the space will always attract speculators, dreamers, and builders who value vision over metrics.

In crypto, the most successful aren’t always the best engineers—but the best readers of market sentiment.

So keep an eye on narratives, monitor CT (Crypto Twitter), track emerging trends. Narratives may not be coded—but they are written.

If crypto itself is one big narrative, perhaps the best traders are those who read a few chapters ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News