In an era where storytelling reigns supreme, how can we use scoring models to identify the next hundredfold narrative?

TechFlow Selected TechFlow Selected

In an era where storytelling reigns supreme, how can we use scoring models to identify the next hundredfold narrative?

This is not just a formula, but a mental model guiding the next wave of cryptocurrency.

Author: Ignas

Translation: Luffy, Foresight News

You may have spent countless hours trying to catch the next big narrative in crypto. Get it right, and you’ll make a fortune; enter too late, and you become the bagholder.

In the crypto market, the highest investment returns come from:

-

Identifying narratives early

-

Mapping capital rotation before others do

-

Exiting when the bubble is expected to peak

-

Locking in profits

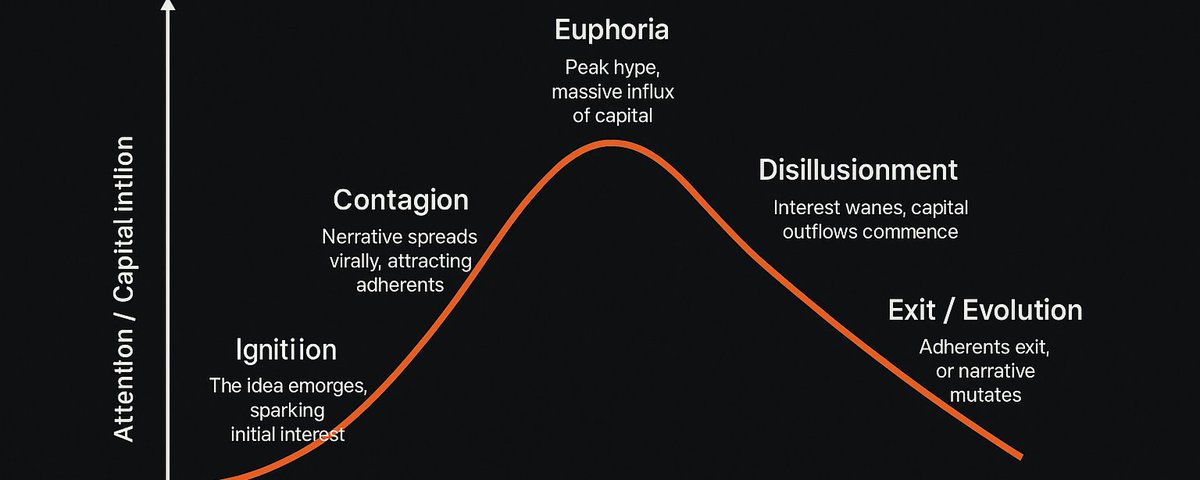

Then ask yourself: Will the next wave of narrative resurgence arrive? Narratives cycle, and speculative waves return under these conditions:

-

The narrative is backed by real technological innovation, allowing it to rebound even after the first hype wave fades

-

A new catalyst emerges

-

After the hype dies down, a committed community continues building

I elaborate on my thoughts in the article below:

https://x.com/DefiIgnas/status/1757029397075230846

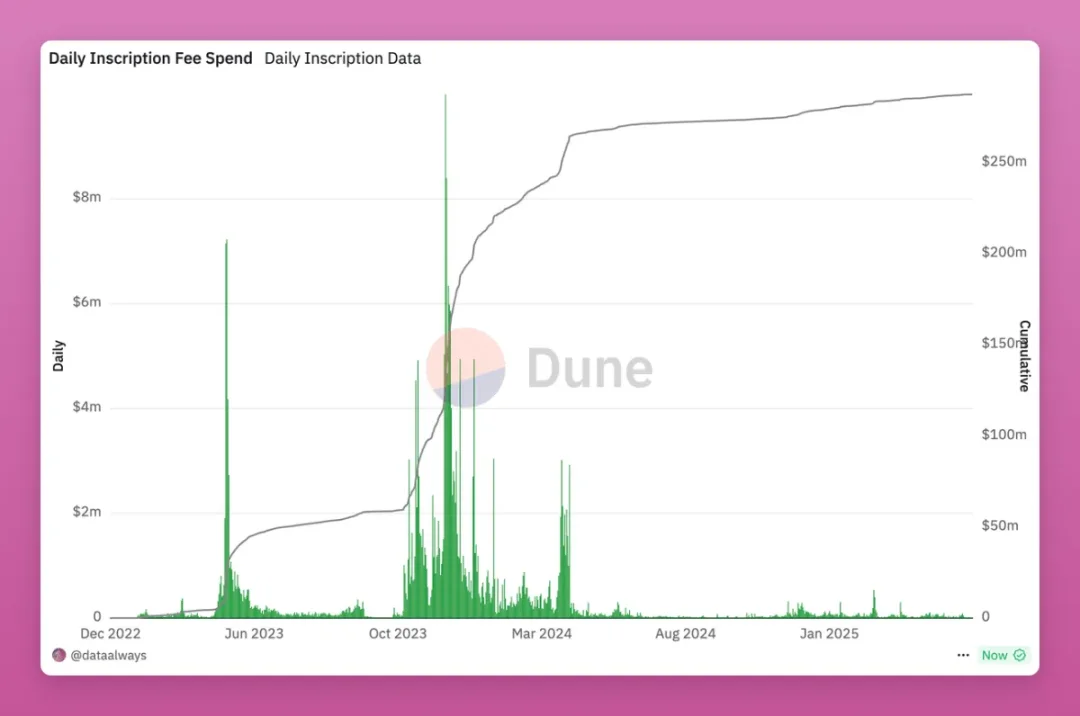

Take Bitcoin’s Ordinals as an example. We can clearly see four waves of speculation from the chart below.

-

December 2022: The Ordinals theory launched, with minimal on-chain activity.

-

March 2023: The BRC-20 standard triggered the first wave; activity cooled for six months.

-

Late 2023 – Early 2024: Ongoing development sparked second and third waves.

-

April 2024: Runes launched, prices surged, then faded within weeks.

Ordinals offered months of positioning time and multiple exit opportunities. Runes provided only a brief, single exit window. The space is now silent.

Will Ordinals (including Runes), NFTs, or other new forms make a comeback? Maybe. It depends on my narrative score.

Analysis Framework

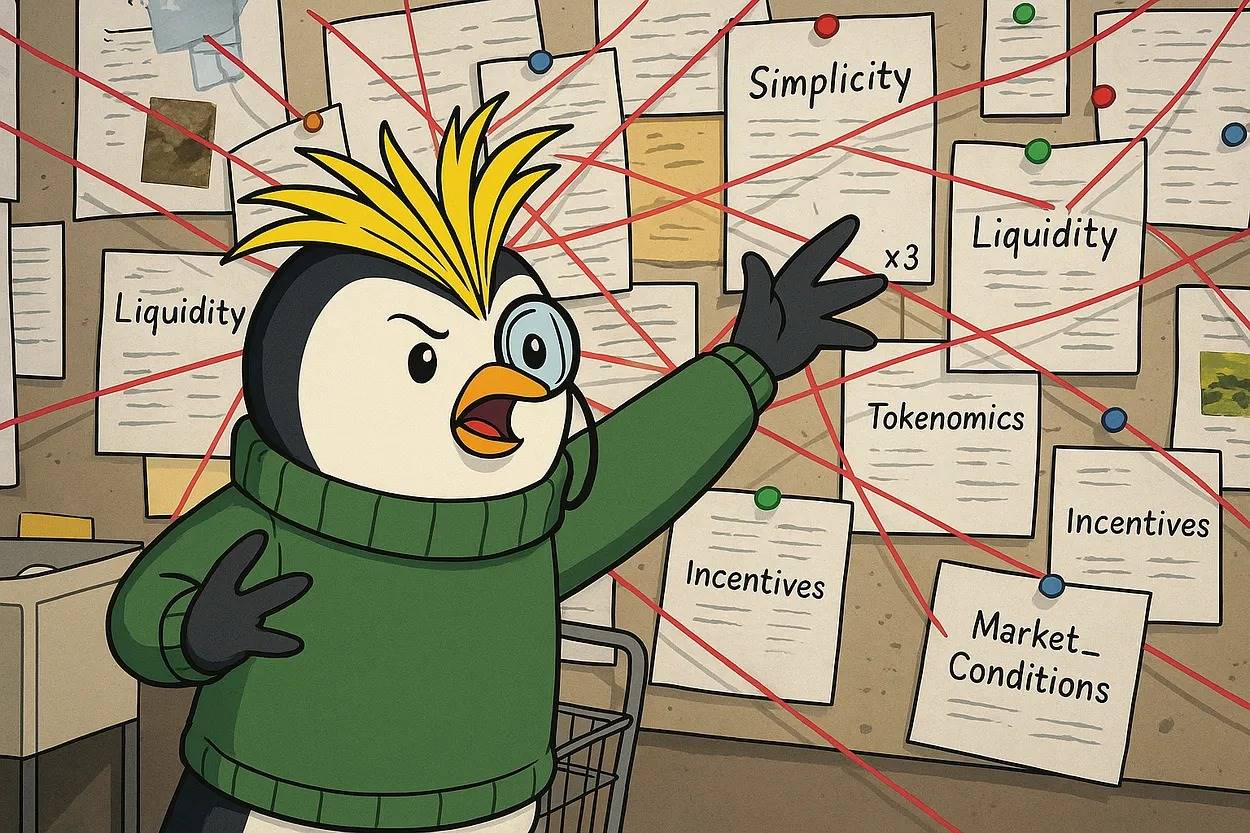

This is a framework for identifying hot new narratives and judging whether subsequent speculative waves will last. This version is still evolving—here’s my 1.0 formula:

Narrative Score = [(1.5× Innovation × Simplicity) + (1.5× Community × Simplicity) + (Liquidity × Tokenomics) + Incentives] × Market Environment

The formula isn’t perfect, but it shows which factors matter and how they’re weighted. Let’s break it down one by one!

Innovation

Here, innovation refers to crypto-native technical breakthroughs I focus on.

The strongest catalysts are 0-to-1 innovations. These can appear in new domains (DeFi, NFTs, RWA, etc.), new tokenomic models (like veTokens), or even new token distribution methods (fair launches, Pump.fun).

I’ve written before: 0-to-1 innovations uniquely shift industry trajectories, and their originality spawns new crypto subsectors.

Due to cognitive bias, recognizing such innovations is difficult. When something new appears, it might get little attention (like Ordinals) or be dismissed as noise. Thus, staying open-minded and trying every new trend—especially controversial ones—is key to getting ahead.

Without genuine technological innovation, a narrative is just a fleeting speculative bubble.

This cycle is unique because its innovation (AI) comes from outside. Thanks to AI, we’ve seen innovations like Kaito InfoFi and AI agents.

Examples from this cycle:

-

Ordinals

-

Restaking

-

AI Agents

-

InfoFi

-

SocialFi

-

ERC404

My goal isn’t to list all cases, but to build a mental model for spotting them. Innovation can be scored from 0 to 10.

Simplicity & Meme Potential

Not all innovations spread equally. Some are easy to grasp, others aren’t.

Complex narratives (like zero-knowledge proofs, restaking) spread slowly, while simple or meme-driven ones (like WIF) go viral fast. Can you explain the concept in five seconds? Is there a meme?

Examples:

-

High simplicity (10/10): AI, Memecoins, XRP as a blockchain bank

-

Medium simplicity (5/10): SocialFi, DeFi, NFTs, Ordinals

-

Low simplicity (3/10): Zero-knowledge proofs, modular chains, restaking

Complex narratives take longer to mature and rise more slowly. Also, simplicity drives community growth.

Community

Bitcoin is the greatest 0-to-1 innovation, but without a community, it would just be code. Bitcoin’s value comes from the story we assign to it.

People still don’t understand why Cardano or XRP perform well despite limited innovation—the answer is a loyal community.

Or, more radically: Memecoins.

They lack technological innovation, yet memecoins are now a $66 billion sector—entirely due to groups rallying around tokens.

The tricky part is measuring community size: Should we count X followers, topic热度 on X, Reddit subscribers, or post volume?

Some communities are hard to spot—they use different languages or platforms. For example, Korean users discuss XRP on local forums.

Kaito’s “Mindshare” is a great metric, but Loudio’s experiment showed that high mindshare doesn’t necessarily mean a real community.

https://x.com/DefiIgnas/status/1929511567768363174

To identify a real community—especially early—the best way is to immerse yourself: buy the token or NFT, join Discord or Telegram, observe who talks about it on X (not paid promotions). If you feel genuine belonging and connection, that’s a strong bullish signal.

In my view, Hyperliquid has the fastest-growing community. Attacks from Binance and OKX only strengthened its cohesion, giving the community a mission to support the team and protocol. Hyperliquid has become a movement.

https://x.com/DefiIgnas/status/1904923406325473286

I believe innovation and community are the most important factors, so both get a 1.5x weight.

Like innovation, I include the same simplicity variable in community: simpler narratives spread easier.

Memecoins (like PEPE) are easy to grasp; Hyperliquid isn’t that simple, yet still built a strong community.

Both Runes and Ordinals brought technological innovation (enabling fungible tokens on Bitcoin, once thought impossible) and had strong communities. So why did prices fall?

Because there’s a third factor to consider.

Liquidity

Innovation ignites the narrative, community builds the story and belief, but liquidity is the fuel that lets you ride the wave and exit safely at the top. It’s what separates “sustainable momentum” from “being left holding the bag when the music stops.”

Casey Rodarmor, creator of Runes, excelled at building the fungible token model, but perhaps he should have also created Uniswap-like AMM pools on Bitcoin to sustain Runes’ momentum.

Runes memecoins struggle to compete with Solana or L2 memecoins due to lack of passive liquidity pools. In fact, Runes trade more like NFTs on Magic Eden: decent buy-side liquidity, but insufficient sell-side depth for large exits. Low trading volume fails to incentivize top-tier CEX listings.

NFTs face similar liquidity issues. That’s why I once had high hopes for ERC404’s NFT fractionalization model—it could have provided passive sell liquidity and yield via trading volume. Unfortunately, it failed.

I believe liquidity is the main reason DeFi options have struggled to take off over the years.

https://x.com/kristinlow/status/1929851536965873977

During recent market volatility, I wanted to hedge my portfolio with options, but on-chain liquidity was abysmal. I had high hopes for Derive, a crypto options platform, but its future is now uncertain.

Liquidity isn’t just deep order books, continuous fresh inflows, CEX listings, or high TVL in liquidity pools—though those matter. The liquidity factor also includes protocols that grow exponentially with more liquidity, or projects with built-in liquidity bootstrapping models, such as:

-

Hyperliquid: More liquidity improves trading experience, attracting more users, leading to even more liquidity

-

Velodrome’s ve3.3 DEX: Builds liquidity through bribe mechanisms

-

Olympus OHM: Protocol-owned liquidity

-

Virtuals DEX: Pairs new AI agent launches with VIRTUAL token

Tokenomics

Tokenomics is as crucial as liquidity. Poor tokenomics lead to sell-offs. Even with deep liquidity, sustained selling pressure from unlocks poses major risks.

Good examples: High float, no large VC/team allocations, clear unlock schedules, burn mechanisms (e.g., HYPE, well-designed fair launches).

Bad examples: Hyperinflation, massive cliff unlocks, no revenue (e.g., some L2 projects).

A narrative scoring 10/10 on innovation but 2/10 on tokenomics is a ticking time bomb.

Incentives

Incentives can make or break a protocol—or an entire narrative.

The restaking narrative relied on Eigenlayer’s performance, but the token launch failed (possibly due to complexity or weak community), stalling the narrative.

Assessing liquidity early is challenging, but innovative incentive models help bootstrap it.

I’m especially interested in new token distribution models. If you’ve read my past articles, you know what I mean: markets shift when tokens are distributed in novel ways.

-

BTC hard forks → Bitcoin Cash, Bitcoin Gold

-

ETH → Ethereum Classic

-

Initial Coin Offerings (ICOs)

-

Liquidity mining, fair launches, low float with high FDV (good for airdrops, bad for secondary markets)

-

Points narratives

-

Pump.fun

-

Private-public sales on Echo/Legion

As markets evolve, so do token distributions and incentives. When an incentive model becomes overused and widely understood, it signals market saturation and peak hype.

The latest trend is corporate crypto treasuries. Public companies buying crypto (BTC, ETH, SOL), whose stock valuations exceed the value of their crypto holdings.

What’s the incentive here? Understanding this is crucial to avoid becoming the bagholder.

Market Environment

Even the best narratives launched during brutal bear markets or macro risk events (like early tariff wars) can be drowned out. Conversely, in a liquidity-fueled bull run, even mediocre narratives soar.

Market environment determines the multiplier:

-

0.1 = Brutal bear market

-

0.5 = Sideways market

-

1.0 = Bull market

-

2.0+ = Parabolic frenzy

Example: Runes (April 2024) had innovation, community, initial liquidity, and some incentives, but launched right after Bitcoin halving hype faded and markets began sharp corrections (market environment multiplier ~0.3). Result: Underwhelming. It might have performed better if launched three months earlier.

How to Use the Formula

Score each factor from 1 to 10:

-

Innovation: Is it a 0-to-1 breakthrough? (Ordinals: 9, Memecoin: 1–3)

-

Community: True believers or speculators? (Hyperliquid: 8, VC-led projects: 3)

-

Liquidity: How deep is the market? (Quick listing on top CEX: 9, Runes trading like NFTs: 2)

-

Incentives: Are they attractive and sustainable? (Hyperliquid airdrop: 8, no incentives: 1)

-

Simplicity: Can it become a meme? ($WIF: 10, zkEVM: 3)

-

Tokenomics: Sustainable? (BTC: 10, 90% pre-mine: 2)

-

Market Environment: Bull (2.0), Bear (0.1), Neutral (0.5–1)

Scoring is subjective. I give Runes an innovation score of 9, but you might give it 5. This formula simply suggests what factors to consider.

Let’s calculate Runes as an example:

Innovation = 9, Community = 7, Liquidity = 3, Incentives = 3, Simplicity = 5, Tokenomics = 5, Current Market Environment = 0.5

Plugging into the formula:

-

1.5× Innovation × Simplicity = 1.5×9×5 = 67.5

-

1.5× Community × Simplicity = 1.5×7×5 = 52.5

-

Liquidity × Tokenomics = 3×5 = 15

-

Incentives = 3

Subtotal = 67.5 + 52.5 + 15 + 3 = 138

Multiply by Market Environment (0.5):

Runes Narrative Score = 138×0.5 = 69

In contrast, memecoins score higher in my subjective assessment (116 points):

-

Innovation = 3 (due to Pump.fun’s innovative distribution model—not a complete zero)

-

Community = 9

-

Liquidity = 9 (integrated with AMMs, high volume = high LP yields, listed on CEXs)

-

Incentives = 7

-

Simplicity = 10

-

Tokenomics = 5 (100% circulating at launch, no VCs, but risks of cartels/snipers, no revenue sharing)

-

Market Environment = 0.5

Summary

-

Scan for narratives early: Use tools like Kaito, Dexuai; watch for innovation and catalysts

-

Score rigorously: Be honest. Poor tokenomics? Bear market? Weak incentives? Market environment changes constantly—native innovations (like an AMM DEX for Runes) could revive a narrative

-

Exit before incentives decay: Sell during peak token releases or after airdrops land

-

Respect trends: Don’t fight the macro trend. Accumulate cash in bear markets, deploy capital in bull markets

-

Stay open-minded: Try protocols, buy trending tokens, join community discussions… learn by doing

This is just my 1.0 formula—I’ll keep refining it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News