The next chapter of Web3: Moving beyond the speed race, returning to building foundations

TechFlow Selected TechFlow Selected

The next chapter of Web3: Moving beyond the speed race, returning to building foundations

To build a credible ecosystem, project teams must focus on sustainable value creation rather than obsessing over speed races or speculative games.

Author: Alec Goh, Head of HTX Ventures

The narrative around Web3 has long revolved around "freedom"—breaking monopolies of intermediaries, optimizing inefficient systems, and overturning outdated rules. By 2025, this social experiment is entering a new phase: mainstream institutions and regulators are beginning to recognize its potential and paving the way for upgrading paradigms in digital identity and asset management.

From governments signaling interest in treating Bitcoin as a strategic reserve asset, to traditional institutions accelerating their entry, today’s Web3 ecosystem already boasts ample liquidity, mature infrastructure, and global consensus. Yet as a deep-industry trading platform and venture capital firm, we must ask further: how can this transformation generate genuine long-term value?

The crypto world has always been known for speed—fast development cycles, rapid capital flows, and even faster shifts in narratives. Under multiple pressures, founders easily fall into the habit of chasing short-term velocity. But to build truly sustainable Web3 projects, teams must learn to “step back”—temporarily rising above code and market noise to return to fundamental questions: Who are we serving, and what real needs are we addressing?

History in traditional finance has already proven that all systems surviving across cycles rest on three foundations: risk management, transparency, and user trust. Web3 cannot bypass these same three tests. To build trustworthy ecosystems, project teams must focus on sustainable value creation rather than obsess over speed races or speculative games. Security and trust must be embedded in the DNA—not added as afterthoughts.

In HTX Ventures’ observation, promising explorations have begun emerging:

● Bitcoin utility breakthroughs: such as Babylon activating Bitcoin’s on-chain security through staking protocols;

● Tokenization of real-world assets: breaking down barriers to traditional finance and unlocking liquidity for long-tail assets;

● Stablecoin payment networks: significantly reducing friction in cross-border trade and reshaping global commercial infrastructure;

● DePIN (Decentralized Physical Infrastructure Networks): reconstructing traditionally monopolized sectors via shared models, enabling Web3 services to reach real-world applications.

These cases share one thing in common: using blockchain thinking to deconstruct real pain points and delivering user value through products. To turn this trend into industry norm, however, systematic efforts remain essential:

Step One: Anchor to real demand, avoid self-referential innovation

Project teams must keep asking: Are users willing to pay continuously for this solution? Does it address a fatal flaw in traditional systems? Whether cutting cross-border remittance costs by 60%, or giving a billion people access to high-yield financial tools for the first time, Web3’s killer applications will inevitably emerge at the “real-world interface.”

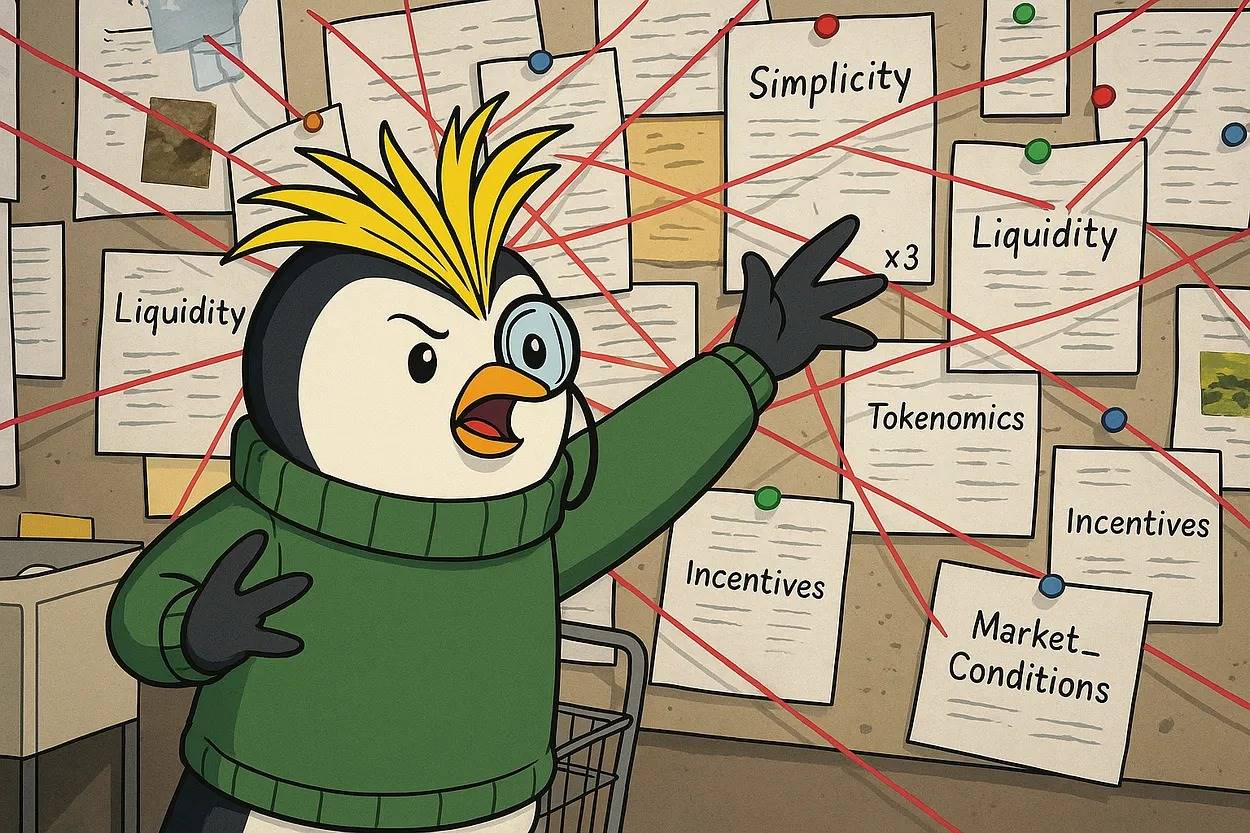

Step Two: Design decay-resistant economic and governance models

Token release curves, treasury management mechanisms, and DAO governance frameworks—these designs must serve long-term ecosystem health, not early vested interests. For example:

● Avoid token unlock schedules that peak at launch;

● Implement dynamically adjusted contributor incentives (e.g., Babylon’s Bitcoin staking model);

● Reserve gradual decentralization paths for DAOs (rather than hardcoding control);

● Introduce black swan resilience mechanisms (e.g., Shell Finance enabling fair liquidations via DLC technology).

Only when capital flows and value creation form a closed loop can projects truly accumulate network effects.

Step Three: Embed risk management into protocol DNA

Smart contract audits are just the baseline; truly robust systems require:

● Permissionless emergency exit mechanisms;

● Redundant data verification across multiple oracles;

● Crisis response protocols designed with stress-testing as priority.

As institutional capital enters, stress resistance will become the key metric distinguishing “speculative toys” from “infrastructure.”

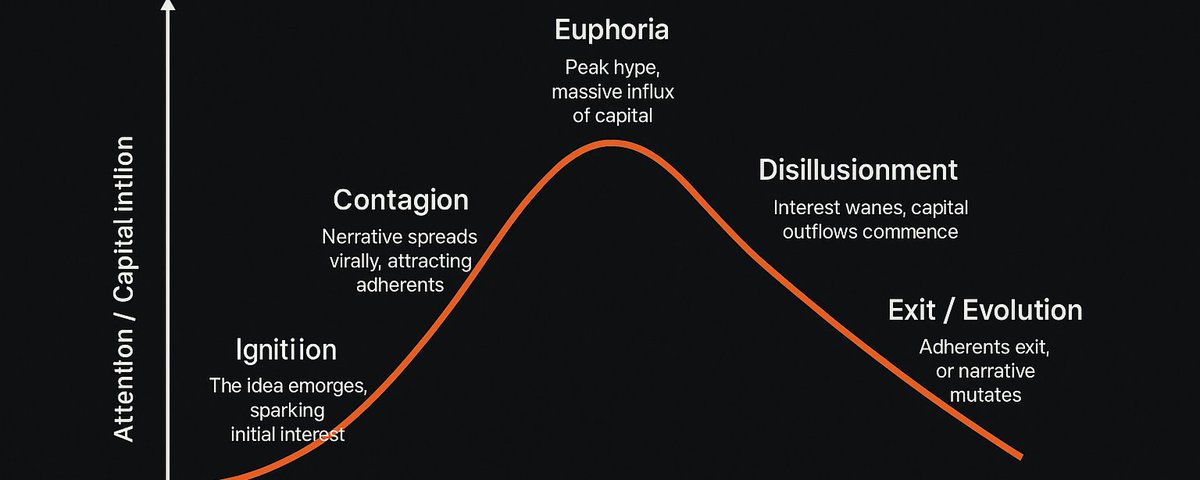

Conclusion: Speed creates bubbles, value builds trust

When sovereign funds add Bitcoin to their balance sheets, and workers receive cross-border salaries via stablecoins, Web3’s legitimacy no longer depends on slogans. Every token distribution design, every governance vote, every line of smart contract code contributes to the foundation of industry-wide trust.

Web3 in 2025 will ultimately belong to the “slow companies”—those proving that beyond technological sprinting, there are more important stories to tell, built on verifiable transparency, accumulative user value, and resilience under extreme conditions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News