Currently, the crypto primary market seems to be陷入 a "dead-end" multifaceted crisis.

TechFlow Selected TechFlow Selected

Currently, the crypto primary market seems to be陷入 a "dead-end" multifaceted crisis.

What's truly terrifying isn't that technological narratives fail to deliver, but that everyone simply abandons narrative packaging and fully embraces a meme-driven casino culture.

By Haotian

While traveling in Lijiang and Dali, I chatted with several top-tier builders—each independently shared the same sentiment: the crypto primary market seems to be陷入 a multi-layered crisis of "no way forward":

1) Narratives rendered meaningless—has casino culture taken full control?

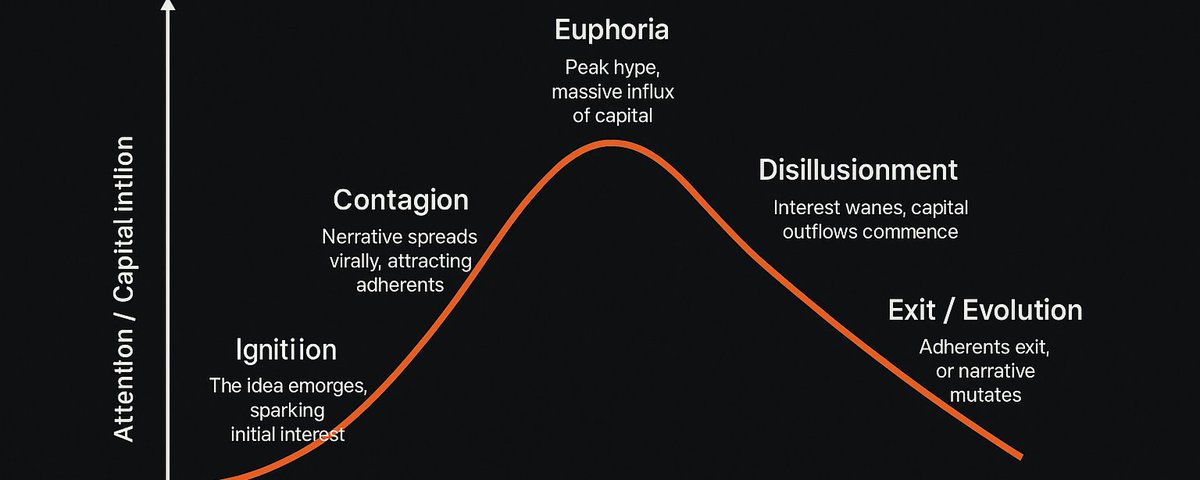

The real problem isn’t that technical narratives fail to deliver. It’s that everyone has simply given up on narrative packaging altogether, fully embracing meme-driven casino culture.

At least when tech narratives were slow to materialize, they still represented long-term visions—covered by early VC funding, supported by project teams building, testing, launching mainnets, and executing roadmaps. The transparency during this process helped ordinary users assess a project’s capabilities and make informed value judgments.

But now? Everything has become a pure game of community management and capital maneuvering. Trading opportunities are exaggerated to the point of being measured in days—or even minutes. When the market no longer focuses on long-term development around technology, purely meme-based trading risks multiply, making this space far more dangerous for the vast majority.

2) Developers fleeing, innovation stagnating?

Data doesn’t lie. According to available figures, the number of active crypto developers on GitHub has dropped nearly 30% from last year’s peak, while AI and traditional tech companies are aggressively raising engineering compensation packages.

The logic is simple: when OpenAI, Google, and Meta are all racing in the AI arms race, competing to build silicon-based civilizations, how many developers can crypto’s nostalgic vision of “disrupting the internet” really retain?

Critically, after two or three cycles of building, crypto developers have entered a phase of rapidly diminishing innovation and internal burnout. Genuine 0-to-1 technical breakthroughs are extremely rare. Concepts like restaking, intent-centric architectures, and AI agents flare up one after another—but where are the actual applications? Where’s the product-market fit (PMF)? For some reason, everyone keeps reinventing the wheel, yet no one has the energy—or perhaps the will—to care how far those wheels can actually roll.

Before, despite market noise and dead time, most people held onto a belief: just hold on, things will eventually get better. But now—where are the holders?

3) Lack of external momentum—Is crypto becoming marginalized?

Crypto’s appeal to outside capital and talent is clearly weakening. Look at the current landscape: the real alt-season is happening in U.S. equity AI markets; the true frontier of innovation lies in web2+AI. Crypto’s attractiveness to traditional VCs and top-tier talent continues to erode—and increasingly, it carries the stigma of “speculation,” losing its dignity.

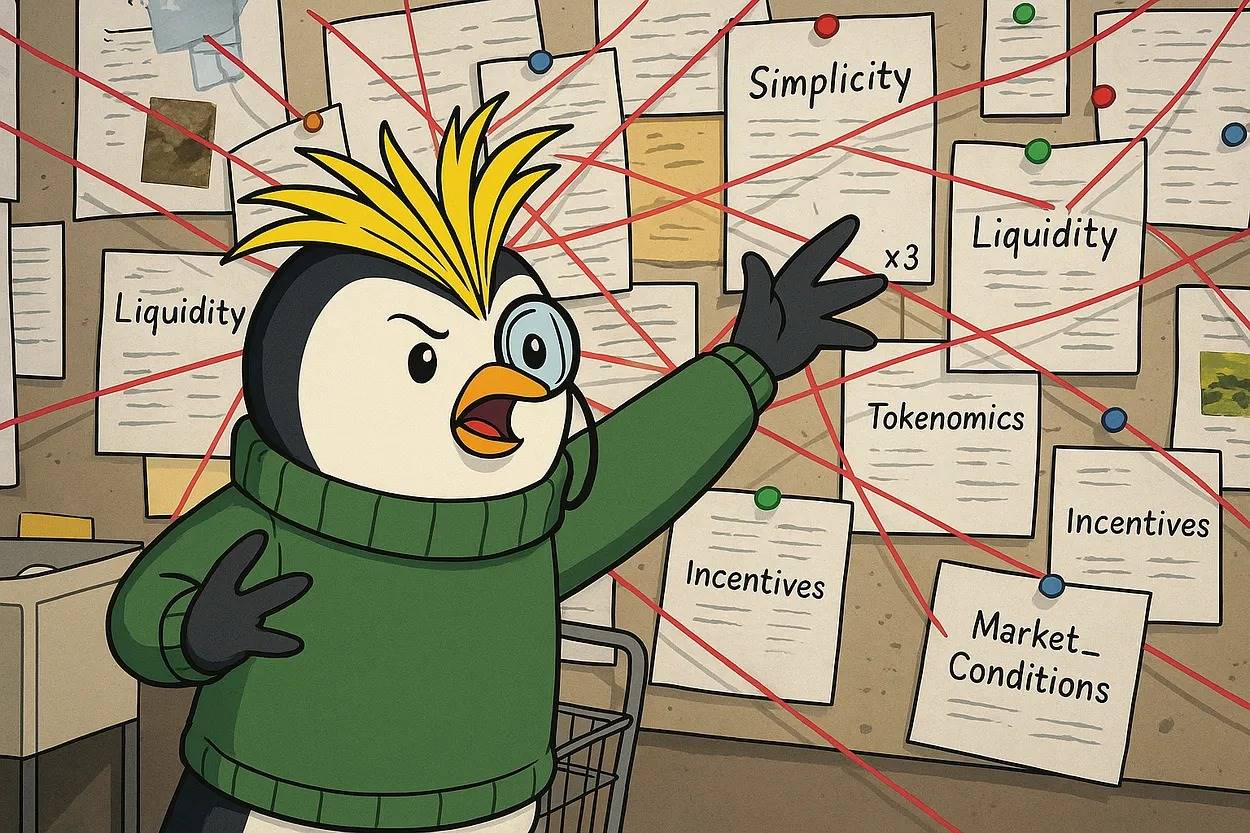

The root cause? Beyond the golden ticket of “launching tokens,” crypto has little else to offer. ETFs brought institutional money, yes—but that reflects recognition at the financial instrument level. Wall Street inflows are merely asset allocations, loosely connected at best to the altcoin market.

In what scenario is crypto truly indispensable? In the past, crypto offered relatively free space for financial experimentation. But now that traditional institutions are entering via stablecoins, ETFs, and other means, beyond the technical feature of “decentralization,” what irreplaceable value does crypto deliver to users?

Note: Raising these questions is meant to spark discussion. Even amid confusion, I still choose to believe—the real path forward may not be far off. Staying optimistic is the best help there is. What else can we do?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News