Who got rich from Pump.fun's token launches?

TechFlow Selected TechFlow Selected

Who got rich from Pump.fun's token launches?

Circle seeks listing, followed by Pump.fun launching tokens on-chain.

Author: Tuoluo Finance

In the past week, no TGE has drawn more market attention than Pump.fun. This token launch event, which began building momentum in June amid both anticipation and skepticism, finally took place on July 12. Despite ongoing质疑 over its $4 billion valuation, investors clearly voted with their capital—the public sale was fully subscribed within 12 minutes, prompting frustrated investors to vent profanities on social media after failing to secure allocations.

So far, Pump.fun has delivered a relatively solid performance. The price has stabilized and trended upward post-launch, and today, Pump.fun executed its first token buyback using platform fees. But can this price level be sustained? For many, that question remains unanswered.

If naming the killer application of this bull run, Pump.fun may not lead the pack but certainly ranks near the top. Without exaggeration, Pump.fun elevated MEME tokens to new heights. Its fair launch philosophy and user-friendly interface completely dismantled the high barriers of traditional token issuance—offering the irresistible ability to create a token for just $3. Even as the MEME sector cools, this model retains strong appeal.

From a mechanistic standpoint, the absence of private or pre-sales, fully algorithmic pricing via smart contracts, and a "graduation mechanism" that automatically creates a liquidity pool on DEX once market cap hits $69,000 have made Pump.fun’s fully automated listing process wildly popular. It has effectively become the most powerful money printer in this market cycle.

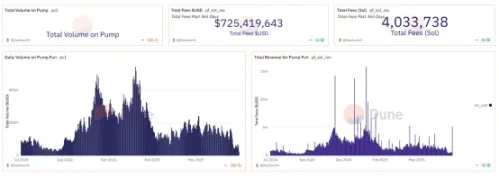

Since launching in January 2024, Pump.fun has facilitated the creation of 11.44 million tokens, served over 22 million unique addresses, and generated nearly $720 million in cumulative revenue. At its peak, single-day transaction fees hit $5.43 million, with total daily revenue reaching an astonishing $15.88 million. It's safe to say Pump.fun has captured the lion’s share of this cycle’s MEME-driven market红利, further fueling Solana’s ecosystem growth.

It is precisely this MEME-born project that suddenly announced a native token launch, sparking widespread debate. Rumors of Pump.fun issuing a token first emerged in February when Wu Shuo reported the team planned to launch on centralized exchanges with full documentation ready—but shelved due to Trump-related MEMEs draining liquidity. In June, the rumors resurfaced: Blockworks cited multiple sources claiming Pump.fun aimed to raise $1 billion through a token sale at a $4 billion valuation, with tokens offered to both public and private investors.

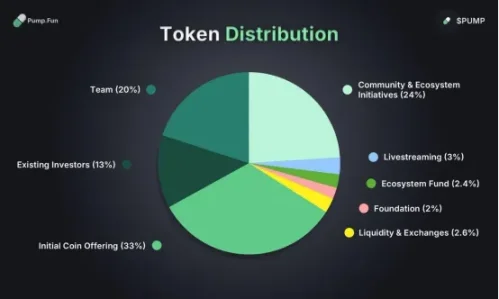

On July 10, Pump.fun confirmed the news: the native PUMP token public sale would officially begin on July 12, 2025, at 22:00, accompanied by an upcoming airdrop. A total of 150 billion tokens will be sold at $0.004 USDT each, representing 15% of the total supply (1 trillion). At a $4 billion valuation, this raises $600 million. Due to compliance restrictions, participants from the UK and US are excluded. Regarding PUMP tokenomics: 33% allocated to public sale, 24% to community and ecosystem incentives, 20% to the team, 2.4% to the ecosystem fund, 2% to the foundation, 13% to existing investors, 3% for live-streaming related use, and 2.6% for liquidity and exchange listings.

Yet compared to earlier excitement, the actual announcement faced widespread market skepticism. The primary controversy centers on the $4 billion valuation. Consider that Circle, the first stablecoin company to ring the NYSE bell, was valued at only $7 billion. If even such a legitimate player commands just that, how can a decentralized casino justify a $4 billion valuation—surpassing most current DeFi blue-chip protocols—and risk draining overall market liquidity?

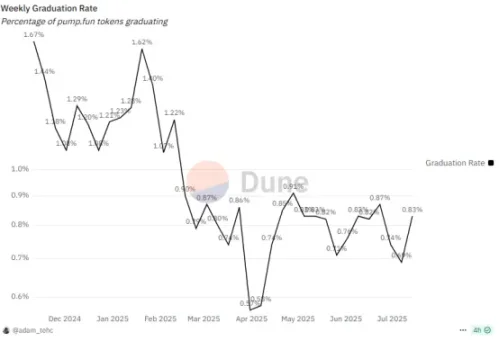

More importantly, the market context has changed dramatically. Today’s crypto landscape, aside from a brief rally recently, sees most altcoins and MEME tokens languishing in bearish trends. Trading volume tells the story: according to Dune, after peaking at $5.44 million on January 23, 2025, Pump.fun’s volume entered a cliff-like decline, now consistently below $700,000—a drop of 87.2% from highs. Daily token creations have halved from a peak of 70,000 to around 30,000. Graduation rates are shockingly low: once at 1.6% in 2024, now below 1%. Clearly, the wealth-generation effect is fading, the MEME market is cooling, and user enthusiasm is rapidly waning. No matter how powerful Pump.fun is, it remains merely a tool dependent on MEME market热度—fueling doubts about its valuation.

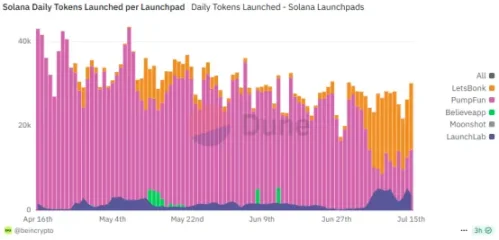

Meanwhile, while the market shrinks, competitors are rising. Once unchallenged, Pump.fun now faces pressure. Recently, letsbonk.fun—built around BONK—has grown rapidly, repeatedly surpassing Pump.fun in daily token launches and capturing the top market share. Though Pump.fun fought back quickly, competition remains fierce, forcing acknowledgment that Pump.fun’s dominance is under threat.

Against this backdrop, Pump.fun’s $4 billion valuation faces intense scrutiny. Following June’s token sale rumors, risk-averse sentiment spread across the market, triggering broad corrections among Solana-based MEME tokens and rapid capital outflows. Jocy, partner at IOSG Ventures, bluntly called this ICO more of a liquidity exit than a long-term development plan. Crypto researcher @rezxbt went further, labeling it a full-scale "harvesting operation."

Ironically, in March 2024, Pump.fun co-founder alon claimed on social media that every presale is a scam. Now, Pump.fun itself conducts a presale, delivering a textbook case of self-own. The token sale allocates 33% of total supply, with 18% to private institutional rounds and 15% to public sale—all tokens fully unlocked on day one.

In outcome, while industry critics remain skeptical, supporters and institutions clearly disagreed. The public sale raised $500 million in just 12 minutes. Six major exchanges—including Kraken, Bitget, and Bybit—participated. According to Dune dashboard data, 23,959 wallet addresses participated in the official website presale and completed KYC, with 10,145 successfully purchasing. Average subscription amount was $44,209. A staggering 89.7% of the presale occurred via the official site, while CEXs accounted for only 10.3%. Among these, small investors dominated: 5,758 users bought $1,000 or less worth of PUMP, while 202 addresses purchased over $1 million, revealing strong institutional appetite.

The entire process perfectly illustrates crypto’s classic “say one thing, do another” behavior. Technical issues during exchange sales left many unable to complete purchases, triggering complaints across social platforms. Community debate surged over Pump’s future trajectory—one camp argued overvaluation would lead to collapse once spotlight faded; the other believed Pump, as the most iconic MEME product with proven revenue logic and strong recognition, wouldn’t easily implode.

Judging solely by current results, the latter appears temporarily victorious. After listing on GMGN on July 15, Pump briefly dipped from $0.0065 to $0.0042 but then rebounded, now trading at $0.0066—an increase of 55% from the $0.004 fundraising price. FDV has risen from $4 billion to $6.6 billion, generating real wealth effects for early buyers.

Naturally, some of this rise involves orchestrated support. According to chain analysis by @EmberCN, since launch, Pump.fun has begun using fee revenue to repurchase PUMP. Over the past seven hours, 187,770 SOL in fees were transferred to address 3vkp...3WTi, converted into PUMP, then moved to storage address G8Cc...kqjm. To date, 111,953 SOL (approx. $1.83 million) has been used to acquire 3.04 billion PUMP at an average price of $0.006. While buybacks help stabilize prices, they still carry the whiff of self-dealing. Still, for holders, any price support—regardless of motive—is welcome.

Whether a liquidity exit or genuine value-building effort, the valuation debate around Pump.fun reflects the current market reality: once-fluid MEME ecosystems are now collectively struggling, and the hot attention economy increasingly appears illusory. That even the most representative application must now resort to token issuance subtly signals narrative exhaustion. Where MEME ultimately goes, PUMP token will serve as a barometer—an effective test of market judgment on attention economics. Price increases suggest market acceptance of valuation; declines force deeper reflection on MEME’s true substance, potentially triggering broader sell-offs. This may also partly explain Pump’s buyback strategy.

Returning to the headline question: who actually profited from Pump.fun’s token launch? Undoubtedly, the project team profited. Public and private sale participants appear to have gained. Short-term bulls also won. But how long can profits last? How long can the team sustain the price? These remain open questions. Some whales have already taken profits: according to Lookonchain, a whale identified as 8a5nSU used five wallets to spend 5 million USDC in the public sale, acquiring 1.25 billion PUMP. Today, they sold all holdings at an average price of $0.0067, realizing a profit of $3.416 million.

On another front, improving macro conditions may indirectly benefit MEME tokens. Ethereum narratives remain strong, driving steady gains in ETH and major altcoins. This directly fueled rallies in Ethereum blue-chip alts—take ENS, which rose over 18% today, hitting its highest level since February. Looking ahead, despite lingering uncertainty, anticipated rate cuts are on the horizon, potentially ushering in a modest altcoin upswing. MEME tokens will likely show polarization: high-quality ones benefit from sector rotation, while others face liquidity drain and obscurity.

If this path unfolds, MEME tokens—akin to lipstick or lottery economies—will persist indefinitely, but unlikely ever again stir the tidal waves of capital seen in 2024.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News