BTC price hits new high: Evaluating core metrics of top blockchains

TechFlow Selected TechFlow Selected

BTC price hits new high: Evaluating core metrics of top blockchains

As Bitcoin hits new all-time highs, triggering capital inflows into the crypto space, actual performance metrics of technical infrastructure serve as a key filtering benchmark.

Author: Bitfox Research

Bitcoin has just hit a new all-time high of $123,000. With over $10 billion invested in cryptocurrency ventures during Q2—the strongest quarterly performance since early 2022—new capital is flowing back into the sector. However, with over a dozen major blockchains competing for market attention, builders and investors must conduct due diligence. A blockchain rating initiative led by the state of Wyoming offers data-driven evaluation dimensions, assessing various blockchain networks based on core metrics such as transaction speed, system security, and adoption rates.

We analyze blockchain projects under an adjusted optimization model designed to evaluate their core indicators under equal conditions, providing a fair benchmarking framework; we also explain why well-known blockchains like XRP and Tron were excluded from the assessment scope.

Analyzing Core Evaluation Metrics

To ensure transparency in scoring, below are plain-language definitions of each metric used in the blockchain rating system:

● Network Stability Duration: Measures the length of time a public chain has operated without major reorganizations or technical failures. Operational longevity reflects reliability and forms the foundation for institutional trust.

● Daily Active Users: Dynamically monitored based on the average number of daily active wallet addresses within a quarter, reflecting actual user scale and ecosystem engagement.

● Total Value Locked (TVL): The total dollar value of assets locked in DeFi applications on-chain. High TVL indicates capital confidence and depth of the economic ecosystem.

● Stablecoin Market Cap: Total on-chain stablecoin value. This metric reflects the practical utility scale of a blockchain as a financial settlement layer.

● Transaction Throughput (TPS): Measured network throughput. High-TPS public chains can support real-world use cases such as payments and gaming.

● Transaction Fee per Transaction: The dollar cost required to complete a basic transaction. Low fees enhance accessibility for retail users and micro-payments.

● Block Generation Time: Time taken to produce a new block. Shorter times mean faster transaction confirmations and better user experience.

● Transaction Finality: The time required for a transaction to become irreversible. Fast finality is crucial for settlements, preventing double-spending and delay risks.

● Privacy Protection Mechanisms: Evaluates whether optional enhanced privacy modules are available, balancing sensitive use case needs with regulatory compliance.

● Cross-chain Interoperability: Multi-chain connectivity via native bridges or protocols like CCIP, enabling cross-chain asset movement.

● Smart Contract Functionality: Degree of support for complex on-chain logic and programmability. This is foundational for DeFi, automation, and customized application layers.

● Use Case Scale: Number and volume of stablecoin-related real-world deployments, validating technological implementation capability.

● Institutional Partnerships: Active collaborations with payment companies or governments, reflecting recognition in the real economy.

● Regulatory Compliance Record: Assessment of past legal/regulatory violations by the operating entity. A clean record enhances credibility.

● Team Background: Legal background checks on core team members. A clean history reduces governance and reputational risks.

● Resistance to Technical Threats: Evaluation of historical records regarding vulnerability exploits, outages, or major hacking incidents. Secure chains earn greater trust.

● Network Availability: Tracking of uptime and performance stability. This is a critical safeguard for stablecoin operations.

● Bug Bounty Mechanism: Whether a white-hat hacker reward program is established. Incentivizes proactive security hardening and demonstrates forward-looking protection.

● Code Maintenance Intensity: Assesses technical iteration vitality through code repository update frequency and developer activity levels.

Updated Rankings: Leading Blockchain Projects and Analysis of Core Advantages

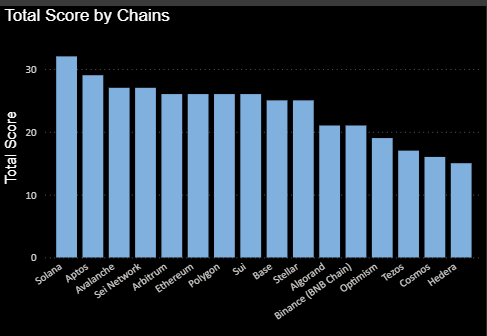

Figure 1: Updated comprehensive scores for mainstream blockchains (higher scores indicate better overall performance) data source: Bitfox.ai

Using the revised evaluation model and excluding two inapplicable metrics, Solana ranks first with a total score of 32, followed by Aptos with 29. The current ranking is: Solana (32), Aptos (29), Sei and Avalanche (27), Arbitrum and Ethereum (26). These scores comprehensively reflect a public chain’s speed, cost, security, and usage. It should be noted that some data sources may show Aptos scoring 32 points, but this includes two additional metrics not applied in earlier evaluations of chains like Solana. To ensure fair comparison, we have uniformly adjusted Aptos’ score by removing the impact of these two metrics.

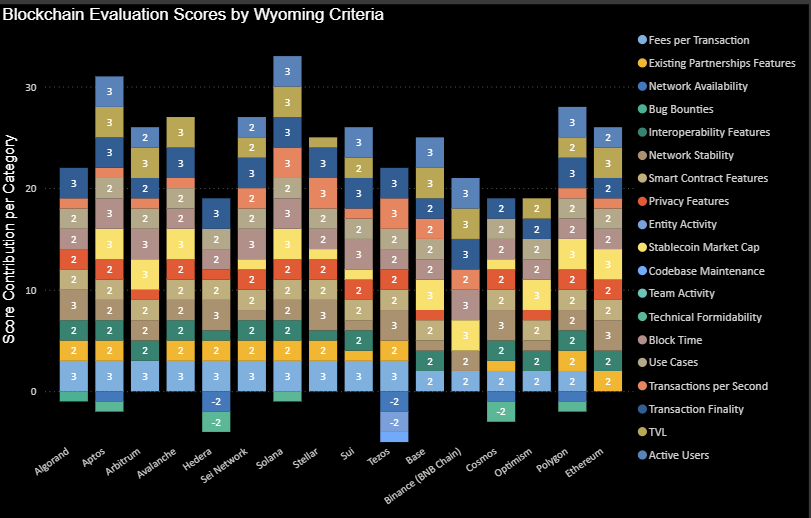

The primary reason Solana and Aptos lead the rankings is their exceptional balance across transaction speed, cost efficiency, and ecosystem scalability. Solana’s high score stems from its outstanding throughput (thousands of TPS) and ultra-low fees, combined with a large user base (peak TVL exceeding $10 billion) and a robust DeFi ecosystem. Although the relatively newer Aptos has only been operating for about two years (slightly lower stability score than Solana), its technical architecture based on the Move secure programming language, sub-second transaction finality (~1 second), and rapidly expanding developer ecosystem propelled it to second place with 29 points. Avalanche and Sei excel in specific areas: Avalanche achieves scalability through fast finality and a unique subnet architecture, while Sei is purpose-built for high-speed transactions with instant finality—both earning high performance ratings of 27 points. However, their overall scores slightly trail the leaders due to Avalanche’s lower current activity and TVL compared to Solana, and Sei’s ecosystem still being under development.

Ethereum, despite nine years of stable operation, superior security, and a vast ecosystem (leading in this dimension), faces limitations due to current technical bottlenecks—low throughput (~15 TPS) and high per-transaction costs (average >$2)—which constrain its performance evaluation, resulting in a final composite score of 26. This outcome highlights the assessment system's emphasis on technical efficiency and cost metrics, which are considered key factors for developer ecosystem growth. Among L2 solutions, Arbitrum earns 26 points thanks to low fees and substantial user numbers, though its transaction finality is constrained by Ethereum’s ~10-minute settlement mechanism and it has only two years of operational history. Other public chains such as Polygon, Sui, Base, and Stellar cluster in the 20–25 point range, each showing differentiated strengths and weaknesses across evaluation metrics.

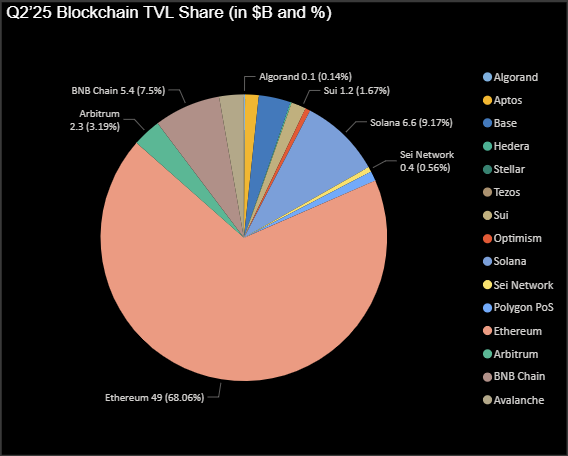

Figure 2: Ethereum dominates the DeFi market, yet still lags due to low technical efficiency data source: Bitfox.ai

In summary, under the current evaluation framework, public chains combining high performance (processing speed and throughput), low transaction costs, and sustained user growth generally outscore mature but performance-constrained or expensive alternatives. Solana and Aptos exemplify this balance. While Ethereum remains the most battle-tested and decentralized public chain, it loses significant points on "performance" metrics. Notably, the scoring model includes certain "bonus" factors beyond core speed and usage indicators—such as support for compliance features and development tool completeness—which previously gave extra points to Stellar and Solana (and early Aptos). It should be emphasized that the latest revised model has removed two initially included but inapplicable bonus metrics (e.g., compliance support tools, developer ecosystem maturity), reducing Aptos’ score by 3 points and securing Solana’s top position. The results underscore a key conclusion: in the current market environment following Bitcoin’s all-time high, builders selecting public chains should prioritize fundamental metrics such as throughput, transaction finality, and user growth.

Figure 3: Breakdown of comprehensive scores across multiple dimensions for major blockchain projects

Deep Comparison of Five Major Blockchains: Multidimensional Analysis

This section provides an in-depth analysis of the top five public chains—Solana, Aptos, Avalanche, Sei, and Ethereum—based on Wyoming’s Q4 2024 to Q1 2025 scoring data, covering broader dimensions such as compliance, privacy features, development tools, and ecosystem maturity.

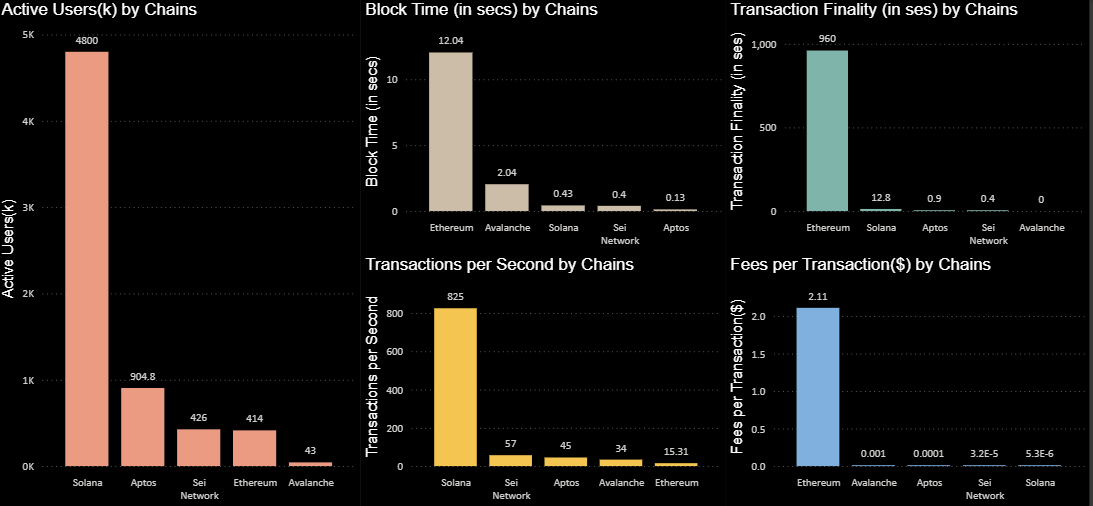

Figure 4: Key metrics for five major blockchains (Solana, Aptos, Avalanche, SEI, Ethereum). data source: Bitfox.ai

1. Solana: High Performance, Low Cost, Broad Ecosystem

● Technical Advantages: Leads the industry with over 1,000 TPS throughput and ultra-low transaction fees of approximately $0.003, along with ~13-second transaction finality and sub-second block production speed.

● Users and Adoption: Over 480 million quarterly active addresses—the highest user engagement among assessed public chains—and $6.6 billion in TVL (second highest), demonstrating strong user trust.

● Compliance and Expansion: Meets core regulatory-friendly requirements (support for analytics tools, traceable on-chain data), though lacks built-in asset freeze functionality. Earned bonus points for comprehensive developer tools, integration with analytics systems, and ecosystem maturity.

● Privacy and Risks: Does not emphasize privacy features; historically experienced network outages, but recent upgrades have significantly improved network stability.

2. Aptos: Instant Finality, Rising New Ecosystem

● Technical Highlights: Sets industry benchmarks with sub-second finality (~0.9 seconds) and block production every 0.13 seconds, with transaction fees as low as $0.0001, achieving perfect scores in fee structure, finality, and smart contract capabilities.

● Adoption and Ecosystem: Active users exceed 904,000, decentralized finance ecosystem continues to expand, backed by top-tier venture capital, with over 1,000 active developers.

● Compliance and Rewards: Aptos continues to grow its decentralized finance ecosystem.

● Privacy and Risks: No built-in privacy functions; shorter operational history (since late 2022) affects stability scoring.

To date, maintains a zero record of major security incidents.

3. Avalanche: Fast Settlement and Customizable Architecture

● Core Technical Advantages: Uses the Snowman consensus mechanism to achieve ~2-second block times and ~1-second transaction finality, with actual TPS consistently between 5–10, though throughput can be elastically scaled via subnet architecture.

● Ecosystem Status: Approximately 43,000 active users, TVL maintained at $1.2 billion level; user base and stablecoin metrics limited by current adoption rates.

● Compliance Features: Offers asset freeze functionality and a robust suite of governance tools. Gains bonus points for cross-chain interoperability and customizable subnet architecture, with good support for development tools and data analysis compatibility.

● Privacy and Risks: No native privacy mechanisms; 1,500 validator nodes represent moderate decentralization, with proven technical robustness.

4. SEINetwork: Financial-Grade Public Chain

● Technical Advantages: SEI delivers near-instant finality (~400ms) and negligible fees (<$0.0005). It is tailored for high-frequency trading applications.

● Ecosystem Maturity: Around 426,000 quarterly users and $400 million TVL, with ecosystem still growing.

● Compliance and Features: Scores highly on stability, analytical compatibility, and absence of chain reorganizations. Its institution-focused design aligns with regulatory standards.

● Privacy and Risks: Lacks privacy functions but maintains 100% uptime. Limited validator count and short launch timeline (2023) reduce decentralization and stability scores.

5. Ethereum: Security Giant, Performance-Limited

● Technical Advantages: Scores low on performance (15–30 TPS, 12-second block interval, fees above $1), but unmatched in decentralization and security.

● Ecosystem Scale: Still leads in DeFi with ~$49 billion in TVL and a broad application ecosystem, serving tens of millions of users across mainnet and Layer 2 networks.

● Compliance and Developer Ecosystem: Lacks freezing functionality at the base layer but excels in auditability, openness, and development tools, with strong support from major hosting and analytics platforms.

● Privacy and Risks: Does not natively support private transactions but earns the highest reliability rating as the most stable and transparent platform.

Analysis of Why Certain Mainstream Blockchains Were Excluded

Not all popular blockchains pass Wyoming’s eligibility screening. The state employs a strict binary filter—blockchains must fully meet all core requirements to enter the scoring phase; otherwise, they are automatically disqualified. These entry requirements aim to ensure regulatory compliance, operational transparency, and baseline decentralization, with key criteria including:

● Permissionless Network: Any user can transact or deploy applications without approval.

● Open Validator Access: Validator nodes must allow open participation rather than selective appointment.

● On-chain Analytics Support: The public chain must support transaction tracing and integrate with analytics tools.

● Transparent Supply: Token total supply and issuance mechanisms must be publicly verifiable.

● Asset Freeze/Seizure Capability: The protocol layer must include asset control mechanisms for legal scenarios.

● Custody and Compliance Support: Must receive technical support from mainstream custodians or compliant analytics platforms.

According to Wyoming’s standards:

● Tron was excluded due to validator centralization (27 fixed representatives) and lack of compliance analytics and custody support; its protocol lacks asset freeze tools, failing to meet requirements.

● XRP Ledger was disqualified because its validator access mechanism (Unique Node List - UNL) violates openness principles, despite supporting token freezing and transparent supply.

● Cardano was filtered out primarily due to the absence of asset freeze/seizure functionality at the protocol layer, prioritizing decentralization over compliance.

● Monero’s fully private model makes transactions un-auditable, failing to meet on-chain analysis requirements.

● Other blockchains such as Cronos and EOS failed screening due to restricted validator access or lack of transparency tools.

This filtering mechanism does not assess technical parameters or user scale, but focuses on whether a public chain can support public-sector and compliant stablecoin applications. Wyoming’s framework signals the core conditions future institutional-grade blockchains must satisfy.

Conclusion: Moving Beyond Irrational Market Hype, Reaffirming the Core Value of Infrastructure

As Bitcoin’s all-time high (ATH) triggers capital inflows into the crypto space, actual performance metrics of technical infrastructure become critical selection criteria. As demonstrated in this assessment, core parameters such as throughput, scalability, cost-efficiency, transaction finality, and reliable operational history decisively impact a public chain’s technological utility. The leading positions of Solana and Aptos indicate that next-generation architectures significantly outperform traditional networks on these key dimensions—offering superior user experiences and expansion potential for decentralized applications (DApps). Meanwhile, Ethereum’s universal ecosystem and security value are fully recognized, but builders must acknowledge its existing performance bottlenecks (the fundamental reason for Layer 2 solutions); however, as shown by Arbitrum and Optimism’s scores, these solutions come with technical trade-offs.

More critically, institutional factors—governance structures, compliance capabilities, and supporting ecosystems—carry significant evaluative weight. Several high-profile blockchain projects were entirely excluded from the assessment due to lacking key characteristics expected by enterprises and regulators. This provides a crucial insight for builders and investors: public chain selection should not be limited to quantitative metrics like TPS or TVL, but must also consider openness, operational transparency, and system scalability. Blockchain architectures lacking integration with compliance analytics tools or auditability carry systemic risks in long-term operations.

In the post-ATH cycle, the blockchain industry’s focus is shifting from irrational arbitrage toward building application layers capable of supporting millions of users. Wyoming’s evaluation framework mirrors this evolution—emphasizing technical efficiency metrics (transaction speed, security mechanisms, cost structure, community ecosystem) over market-hype-driven assessment paradigms. For decision-makers deploying smart contracts and planning ecosystem strategies, top-performing public chains (Solana, Aptos, etc.) demonstrate excellence across four core dimensions. Employing a standardized data analysis framework, combined with analysis of critical shortcomings in excluded projects (e.g., Tron’s centralized validation, Monero’s lack of auditability), enables project teams and investors to precisely select blockchain infrastructures with proven capacity to succeed in the new market cycle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News