Crypto Trading a Crime? Hungarian Law Proposes Up to 8-Year Jail Term, Leaving 500,000 Investors in Legal Limbo

TechFlow Selected TechFlow Selected

Crypto Trading a Crime? Hungarian Law Proposes Up to 8-Year Jail Term, Leaving 500,000 Investors in Legal Limbo

Under the latest regulations, engaging in cryptocurrency transactions on an unlicensed trading platform can result in up to 8 years of imprisonment.

Original: Hassan Shittu, cryptonews

Translation: Yuliya, PANews

Hungary has abruptly shifted toward criminalizing unauthorized cryptocurrency activities, becoming one of the most aggressive countries within the EU and turning everyday crypto transactions into potential legal minefields. Under new legislation, using unlicensed platforms for crypto trading could lead to up to eight years in prison. The regulation has already forced several major fintech companies to suspend services, affecting millions of users.

The new rules took effect on July 1, sending shockwaves through the fintech industry. Industry insiders warn they could trigger a mass exodus of capital and leave investors facing a landscape of legal uncertainty.

Hungary Criminalizes Unauthorized Crypto Trading with Penalties Up to 8 Years Imprisonment

Under Hungary’s recently amended Penal Code, two new offenses have been introduced: “abuse of crypto assets” and “providing unauthorized crypto asset exchange services.”

According to the law, individuals conducting cryptocurrency transactions on unlicensed platforms face up to two years in prison. If the transaction amount exceeds 50 million Hungarian forints (approximately $140,000), the sentence can increase to three years; if it surpasses 500 million forints, the penalty rises to five years.

Moreover, service providers operating without government-issued licenses face the harshest penalties—up to eight years in prison. This sweeping regulatory overhaul has caught businesses and investors off guard.

Local media outlet Telex reported that around 500,000 Hungarians invest in crypto assets using legally declared income. However, due to the vague framework of the new law, many of these users may now face criminal charges over past or ongoing crypto activities.

“Ordinary users are effectively at risk of prosecution simply for managing their investments as they always have,” said a Telex source.

“The law is being enforced without any compliance guidelines yet published—nobody knows how to follow it.”

Notably, the Hungarian Financial Supervisory Authority (SZTFH) has 60 days to establish enforcement and compliance mechanisms, but the current regulatory environment remains unclear.

The law also mandates that all crypto transactions—whether converting tokens to fiat or swapping between tokens—must be reviewed by an authorized "validator" and accompanied by a compliance certificate. Transactions lacking such certification are deemed legally invalid, and participation may result in criminal liability.

Although exemptions exist for transactions below certain thresholds, no clear exemption criteria have been officially defined yet.

Revolut Suspends Crypto Services in Hungary as Regulatory Path Remains Unclear

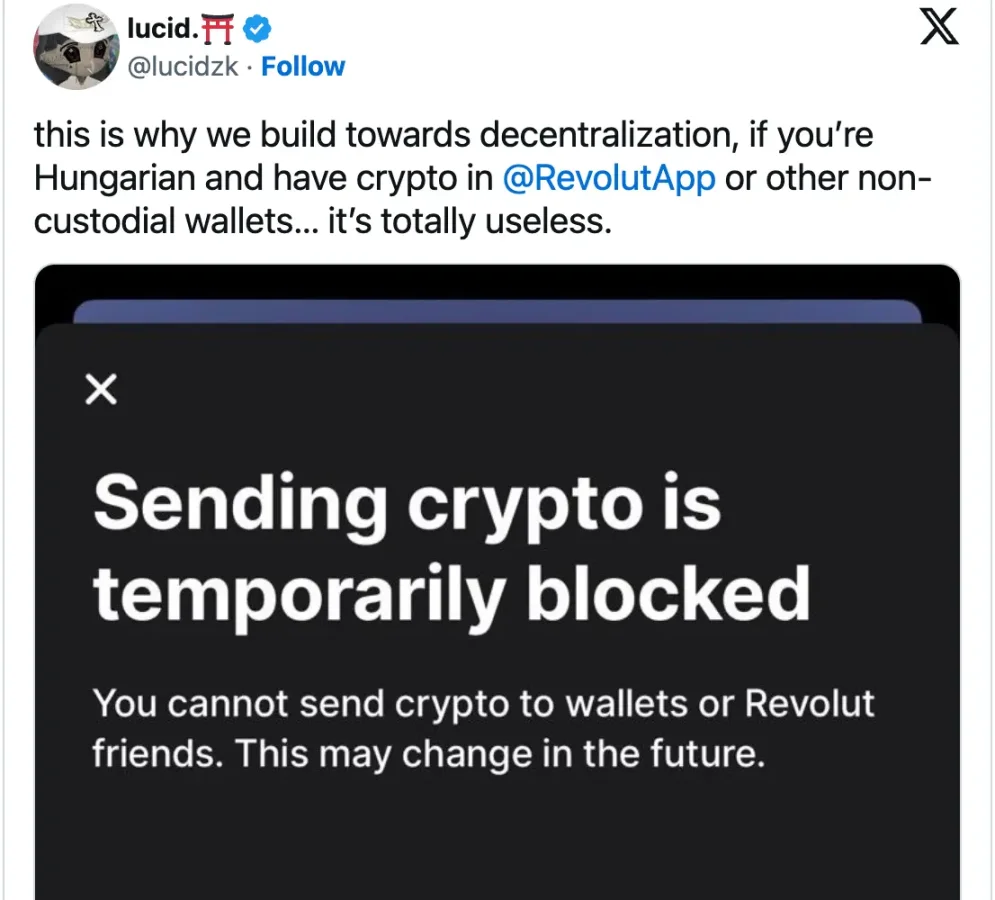

Regulatory uncertainty has already driven key market players out of Hungary. On July 9, London-based neobank Revolut announced the suspension of all cryptocurrency services “until further notice.” Revolut serves over 2 million users in Hungary.

Users can still transfer existing crypto assets to external wallets, but purchasing, depositing, and staking functions have been fully frozen. Revolut stated the suspension aims to ensure full compliance with both domestic Hungarian laws and the EU’s newly implemented MiCA crypto regulatory framework.

While Revolut is currently applying for MiCA authorization through its EU entity, additional local licensing requirements imposed by the Hungarian central bank have complicated the process. As of July 7, Revolut had completely frozen crypto balances and even disabled token selling features.

Revolut emphasized the move is temporary and added it is “working to restore services as soon as the regulatory path becomes clearer.”

Hungary Diverges from EU-Wide Crypto Regulatory Alignment

The timing of Hungary’s crackdown is particularly notable, as the EU's MiCA regulatory framework also came into force on July 1. Designed to create a unified legal framework for crypto markets across the EU, many member states chose to delay implementation to ensure a smooth transition. Yet Hungary has moved contrary to this harmonized approach.

“It’s hard to understand why Hungary would impose such strict rules just as the EU establishes common standards,” an analyst told Forbes. “This creates massive legal uncertainty and undermines financial innovation.”

However, cracking down on crypto appears part of a broader policy trend in Hungary. The government has also introduced restrictions on foreign ownership of businesses and passed laws allowing portions of citizen donations to be redirected to state funds.

Critics argue these policies primarily impact urban, well-educated voters—who typically do not support the ruling Fidesz party.

While enforcement actions against global platforms like Coinbase or Binance seem unlikely, Hungarian-registered firms and local users now face real legal risks. This creates a paradox: foreign platforms may continue serving Hungarian customers with little consequence, while domestic companies risk prosecution.

Adding to the restrictive climate, on July 3 the Hungarian central bank announced it would exclude cryptocurrencies from official reserves, citing high volatility and regulatory ambiguity.

“Stability and reliability of reserve assets must be prioritized,” the central bank stated, reaffirming its preference for traditional assets such as gold and fiat currencies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News