Balancing Compliance and Innovation: A Study on France's Cryptocurrency Taxation and Regulatory Framework

TechFlow Selected TechFlow Selected

Balancing Compliance and Innovation: A Study on France's Cryptocurrency Taxation and Regulatory Framework

This article reviews France's existing regulatory framework, tax policies, and its alignment pathway with international standards.

Author: FinTax

1 Introduction

Against the backdrop of rapid evolution in global digital asset markets, France, as a core EU member state, has preliminarily established a regulatory and taxation framework for crypto assets that aligns with the broader European Union (EU) framework while preserving distinct national characteristics. From the enactment of the 2019 Action Plan for Business Growth and Transformation Law (PACTE Law), to the full implementation of the EU’s Markets in Crypto-Assets Regulation (MiCAR) in December 2024, France's institutional architecture has evolved from early national experimentation toward harmonized EU-wide standards. Meanwhile, the advancement of the EU’s Eighth Directive on Administrative Cooperation (DAC8) and the OECD’s Crypto-Asset Reporting Framework (CARF) marks the dawn of an era of tax transparency for crypto assets. This article provides an overview of France’s existing regulatory structure, tax policies, and its alignment with international standards.

2 Overview of France’s Crypto Asset Regulatory and Tax Landscape

France’s governance of crypto assets is characterized by regulatory leadership and a classification-based taxation system. On the regulatory front, France pioneered compliance management for crypto service providers within the EU by establishing a registration regime for Digital Asset Service Providers (DASPs). Starting December 30, 2024, the DASP framework will formally transition into the CASP (Crypto-Asset Service Provider) framework to comply with MiCAR requirements. This shift signifies France’s move from a voluntary registration model to a mandatory licensing regime, imposing stricter capital, governance, and risk management obligations on exchanges, custodians, and other service providers.

On the tax side, the French Public Finance Directorate (DGFiP) classifies market participants based on the nature and frequency of their activities, applying different tax principles and rates accordingly. Casual investors are subject to a flat 30% tax rate, while professional traders face progressive rates ranging from 0% to 45%. Additionally, diverse actors such as mining companies, DeFi participants, NFT traders, exchanges, and fund managers are taxed under different regimes—such as non-commercial profits (BNC) or corporate income tax—based on their underlying economic substance. This granular, classification-driven tax system reflects France’s recognition of the diversity of crypto activities and offers relatively clear tax expectations for various participants.

Key legislative milestones have shaped the development of France’s crypto tax regime: the 2019 PACTE Act established the legal status of crypto assets; in 2023, the tax treatment of professional investors shifted from industrial and commercial profits (BIC) to the BNC framework; and with DAC8/CARF implementation, 2026 will mark the first year of cross-border automatic exchange of crypto transaction data, signaling the end of using crypto anonymity to evade taxes. These developments illustrate France’s ongoing efforts to balance innovation support with tax compliance. The table below summarizes key milestones in France’s crypto regulatory and tax timeline:

Table 1: Timeline of France’s Crypto Asset Regulation and Taxation

3 Current Regulatory System: Transitioning from DASP to CASP

3.1 Core Regulatory Bodies and Responsibilities

France’s crypto regulation is jointly managed by two key institutions: the Autorité des Marchés Financiers (AMF) and the Autorité de Contrôle Prudentiel et de Résolution (ACPR). The AMF serves as the primary regulator, overseeing the registration and authorization of digital asset service providers and approving initial coin offerings (ICOs), with a focus on market access, disclosure, and investor protection. The ACPR focuses on anti-money laundering (AML) and counter-terrorism financing (CFT) compliance, ensuring crypto transactions are not exploited for illicit purposes.

3.2 Legal Framework and Alignment with MiCAR

Prior to MiCAR’s enforcement, France’s crypto market was primarily governed by the PACTE Law. This law defined crypto assets as digital assets and required entities offering custody or fiat-to-crypto exchange services in France to register with the AMF. With MiCAR taking effect on December 30, 2024, France is now in a critical transition phase from the national DASP framework to the EU-wide CASP regime.

Under France’s DDADUE Act, DASPs registered with the AMF before December 30, 2024, may operate under a transitional regime until July 1, 2026. During this period, they can continue operating domestically. However, to obtain the EU “passport” allowing them to offer services across the bloc, they must apply for and receive MiCA authorization earlier. CASPs under MiCAR must meet stricter requirements regarding capital adequacy, governance, risk management, and client safeguards.

3.3 International Cooperation Framework: DAC8/CARF and Tax Transparency

To further enhance market transparency, France is implementing both the EU’s DAC8 and the OECD’s CARF. According to current plans, CASPs must begin collecting user transaction data starting in 2026 and submit their first annual report to French tax authorities by June 15, 2027.

This means that beginning in 2027, France will participate in an automated cross-border information exchange mechanism with other EU member states, enabling systematic sharing of individuals’ cross-border crypto transaction data with respective tax authorities. This shift marks the end of anonymity for crypto transactions conducted via centralized platforms, transitioning tax compliance from taxpayer self-reporting to systematic reporting by CASPs and international data sharing.

4 Crypto Asset Tax Regime: Classification-Based Taxation and Reporting Logic

4.1 Tax Principles and Triggering Events

For individuals, France applies a realization-based taxation principle: taxable events occur only when crypto assets are converted into fiat currency or used to purchase goods and services. Under current rules, direct crypto-to-crypto swaps do not trigger immediate tax liabilities, a policy that significantly promotes activity within the on-chain ecosystem.

For institutional investors and corporations, taxation follows enterprise accounting principles. Crypto-to-crypto transactions typically require recognition of gains or losses at fair value—even without conversion to fiat—which may result in immediate tax obligations. This approach aligns with traditional financial asset accounting standards, requiring businesses to revalue their crypto holdings at each fiscal year-end and include unrealized capital gains or losses in taxable income. Additionally, capital losses incurred by institutional investors can be carried forward to offset future corporate profits, offering greater flexibility for tax planning.

4.2 Participant Classification and Tax Rate Structure

French tax law categorizes participants based on their nature and activity patterns, assigning different tax treatments accordingly. Below we discuss casual investors, professional and active traders, mining enterprises and pool operators, DeFi participants and liquidity providers, NFT traders, crypto exchanges and custodians, and institutional investors and fund managers.

4.2.1 Casual Investors

Casual investors are individuals who engage in low-frequency, small-scale, non-professional trading. French tax authorities use qualitative rather than quantitative criteria, considering factors such as transaction complexity, tools used, frequency, volume, and the proportion of crypto income relative to total personal income.

Casual investors are subject to a flat tax rate known as the Prélèvement Forfaitaire Unique (PFU) at 30%, comprising 12.8% income tax and 17.2% social security contributions. Gains from annual sales totaling less than €305 are exempt. Losses realized during the year can offset gains in the same year. Capital gains are calculated using the portfolio method, which considers the overall cost basis of the entire investment portfolio rather than individual transactions. The formula is:

Net capital gain = Sale price – (Total acquisition cost × Sale price) / (Total market value of assets on date of sale)

This method greatly simplifies tax reporting in practice. Additionally, casual investors may opt out of the flat tax and instead choose progressive income tax rates (0%-45%) plus 17.2% social contributions, providing potential tax optimization opportunities for low- and middle-income taxpayers.

4.2.2 Professional Investors and Active Traders

Professional investors are individuals or entities engaging in high-frequency, large-volume trading, where crypto income constitutes a significant portion of total income and activities exhibit commercial characteristics. As of January 1, 2023, the tax treatment for professional investors shifted from industrial and commercial profits (BIC) to the non-commercial profits (BNC) framework.

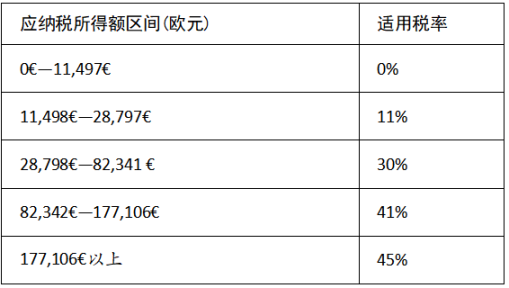

Professional investors are taxed at progressive income tax rates (0%-45%) plus 17.2% social contributions, meaning effective tax rates increase with income, reaching up to 45% on top brackets. Their taxable income is net capital gain—total gains minus total losses. Unlike casual investors, professionals can offset losses against gains within the same tax year, but losses cannot be carried forward to future years.

Table 2: Comparison Between Casual and Professional Investors

The distinction between professional and casual investors relies on qualitative assessments, including transaction complexity, tools used, frequency, volume, and the share of crypto income in total income.

4.2.3 Mining Companies and Pool Operators

Mining income is treated under the non-commercial profits (BNC) regime and must be included in annual income at its market value upon receipt. According to DGFiP guidance issued in August 2019, mining income does not incur VAT liability.

Income from mining is recognized at the market price on the day the miner receives the crypto asset. For example, if a miner receives 1 BTC on a given day, the market value of BTC on that day is recorded as taxable income. Miners may deduct costs directly related to mining operations, including electricity, hardware depreciation, maintenance, and cooling systems, following standard business expense deduction principles.

Per DGFiP guidance, mining is not considered a VAT-taxable activity when no personalized services are provided to specific beneficiaries. Therefore, miners do not pay VAT on received digital asset rewards and are not entitled to input VAT deductions. Participants in mining pools are taxed under the same BNC rules as solo miners. Pool operators, acting as intermediaries, must provide detailed records of revenue distribution to enable accurate tax reporting by participants.

Table 3: 2026 Progressive Tax Rates for BNC Net Income in France

4.2.4 Crypto Exchanges and Custodians

Crypto exchanges and custodians are subject to strict regulation in France. Starting December 30, 2024, these entities must transition from the DASP to the CASP framework to comply with MiCAR.

As commercial entities, their revenues—including trading fees, custody fees, and interest—are subject to French corporate income tax rules. The standard corporate tax rate is 25% (since 2022). Under EU and French VAT rules, crypto asset exchanges are generally treated as financial services and may qualify for VAT exemption. However, certain ancillary services—such as advisory or custody—may be subject to VAT.

CASP entities must meet enhanced requirements for capital, governance, risk management, and client protection. Compliance-related expenses are expected to be deductible as ordinary business costs.

4.2.5 Institutional Investors and Fund Managers

Gains from crypto asset transactions by institutional investors are taxed under French corporate income tax rules. Companies or funds registered in France must include any appreciation from crypto trading in their annual profits. Such gains are treated as ordinary business income, taxed at the standard 25% rate. Tax treatment may vary depending on the fund structure (e.g., UCITS, AIF), with certain funds qualifying for preferential tax treatment. For institutions under specific accounting frameworks, a “mark-to-market” regime may apply, requiring valuation and taxation of unrealized gains at each fiscal year-end.

Unlike individual investors subject to the 30% flat tax (PFU), eligible small and medium-sized enterprises (SMEs) with turnover below a threshold (typically €7,630,000) benefit from a reduced 15% tax rate on the first €42,500 of profit, with profits above this level taxed at 25%.

Table 4: Comparison Between Individual and Institutional Investors

Additionally, institutional investors engaged in cross-border crypto transactions must consider relevant tax treaties and their reporting obligations under the CARF/DAC8 framework (see Section 3.3).

4.2.6 DeFi and NFTs: Unclear Tax Categories Under French Law

DeFi participants—including stakers, yield farmers, and users of lending protocols—who earn returns by locking crypto assets in smart contracts, currently lack clear tax classification under French law. No dedicated legislation or official tax guidance exists. Based on current interpretations, since staking and yield farming contribute to blockchain network maintenance, their income may fall under the BNC regime and be recognized at market value upon receipt. However, this interpretation remains provisional and subject to clarification.

Until legal clarity emerges, DeFi participants should maintain detailed records—including staking dates, reward amounts, and market prices at receipt—and consult qualified tax advisors when filing returns.

France’s tax treatment of NFTs remains highly uncertain, with no specific legal or tax provisions. Depending on their classification, tax rates could vary widely: if deemed digital assets (like cryptocurrencies), they would be subject to either the 30% flat rate or progressive rates (0%-45%) based on the holder’s status; if classified as artworks, they would benefit from a simplified, favorable fixed tax rate of 6.5% applied to the total sale price—a special regime designed to encourage art transactions.

Given this uncertainty, NFT traders should keep comprehensive records—including purchase price, sale price, transaction date, and NFT attributes—and seek advice from tax professionals to determine the most appropriate classification for reporting purposes.

5 Conclusion and Outlook

France’s institutional development in the crypto space reflects a balanced approach combining regulation with incentives. Through the implementation of MiCAR and the adoption of DAC8/CARF, France is transforming its early-mover regulatory advantage into a competitive edge across the EU. However, this transition also signals the end of anonymity in crypto transactions, as the market moves steadily toward openness and transparency. To adapt to these regulatory shifts, individuals and institutions must take different strategic paths:

Individual investors should establish robust transaction ledgers and use specialized tax software to record every trade. Beyond the €305 tax-free allowance, accurate reporting is essential to avoid compliance risks arising from undeclared foreign accounts. They should also monitor the progress of DAC8/CARF and prepare for the impact of automatic information exchange starting in 2027.

Crypto service providers must accelerate their transition from DASP to CASP, strengthening internal AML/CFT audit processes to meet MiCAR’s heightened capital and operational requirements. They must also build comprehensive data collection and reporting systems to prepare for DAC8/CARF data obligations starting in 2026. Both institutions and individuals should remain vigilant regarding future clarifications on the legal treatment of DeFi and NFTs, as well as coordination among EU member states and the consistency and effectiveness of DAC8/CARF implementation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News