Do you need to pay taxes when trading cryptocurrencies?

TechFlow Selected TechFlow Selected

Do you need to pay taxes when trading cryptocurrencies?

The complexity of tax obligations arises not only from policy uncertainty but is also closely tied to investors' awareness of compliance.

By Wenying Huang

In the wave of digital economy, virtual currency trading has swept the globe, becoming a new frontier for investors seeking wealth. Amid this digital gold rush, China's ambiguous legal status and strict regulation of virtual currencies have made tax issues even more complex. Understanding related obligations is not only crucial for legal compliance but may also directly impact investment decisions and returns. This article focuses on individual virtual currency transactions, exploring the possibilities and pathways for compliant taxation under Web3 within China’s existing regulatory framework, offering insights for building a healthy and sustainable Web3 ecosystem.

What Is Virtual Currency?

To clarify whether virtual currency transactions are taxable, we must first understand what virtual currency is and whether buying and selling it is permitted.

Cryptocurrency is a form of digital or virtual money that uses encryption techniques to secure transactions. It has no central issuing or regulating authority; instead, it relies on decentralized systems to record transactions and issue new units.

Currently, according to the "Notice on Preventing Bitcoin Risks" (Yinfa [2013] No. 289) issued by the People's Bank of China and five other ministries (hereinafter referred to as the “No. 289 Notice”), the "Announcement on Preventing Risks of Token Issuance Financing" released on September 4, 2017 by the PBOC and six other agencies (hereinafter referred to as the “Sept. 4 Announcement”), and the "Notice on Further Preventing and Addressing the Risk of Virtual Currency Trading Speculation" issued on September 24, 2021 by ten government departments including the PBOC (hereinafter referred to as the “Sept. 24 Notice”), virtual currencies are defined as lacking legal tender status and compulsory attributes, do not hold equivalent legal standing to fiat money, and cannot nor should not circulate as currency in the market. However, none of these notices deny the property or commodity characteristics attributed to virtual currencies.

Moreover, the No. 289 Notice states that “Bitcoin trading constitutes an online commodity transaction behavior, and ordinary citizens have the freedom to participate at their own risk,” while the Sept. 24 Notice mentions that “engaging in virtual currency investment and trading activities involves legal risks. Civil legal acts involving investments in virtual currencies and related derivatives by any legal person, unincorporated organization, or natural person that violate public order and good customs are invalid, and losses arising therefrom shall be borne by the parties themselves.” Thus, under China’s current system, citizens possess the right to buy and sell virtual currencies.

Given that virtual currencies can be bought and sold as personal property or commodities, does this activity require taxation?

Is Taxation Required?

This article discusses only basic individual virtual currency transactions, temporarily excluding scenarios such as airdrops, DeFi yields, token staking, etc. Whether taxation is required can be examined from several perspectives.

From the state's perspective, virtual currency trading is not an encouraged industry and therefore receives no corresponding tax incentives or exemptions. Furthermore, under current policy and economic conditions, the state will not abandon collecting taxes from this potential revenue source.

From a regulatory standpoint, taxing individuals falls under the scope of individual income tax. According to the *Personal Income Tax Law of the People's Republic of China*, the following types of individual income shall be subject to personal income tax:

From a taxation viewpoint, individuals trade virtual currencies primarily to generate gains. The most relevant categories would likely be interest, dividends, bonuses, or capital gains. However, holding virtual currency lacks a profit-generating entity or predictable return on invested funds. Therefore, based on holding purpose and asset nature, it better aligns with capital gains.

Legally speaking, as of now, China has not enacted specific tax laws or regulations targeting virtual currencies. China’s virtual currency tax policies mainly rely on interpretations of existing tax laws and practices adopted by local tax authorities.

In addition to the aforementioned *Personal Income Tax Law of the People's Republic of China*, the current *State Administration of Taxation Reply on Levying Individual Income Tax on Income Earned by Individuals Through Buying and Selling Virtual Currencies Over the Internet* (Guoshui Han [2008] No. 818) states: “Income earned by individuals who purchase virtual currency from internet gamers and resell it at a higher price shall be considered taxable income under the category of ‘capital gains’ and subject to individual income tax accordingly.” Although this document was issued before Bitcoin’s creation, blockchain-based virtual currencies are legally indistinguishable from game-based virtual currencies. Hence, they should also be taxed under the “capital gains” category.

How Should Tax Amount Be Calculated?

Tax law stipulates: For capital gains, the taxable income is the balance after deducting the original value of the property and reasonable expenses from the transfer income. A proportional tax rate applies—20%.

In practice, transfer income is generally easy to confirm, whereas determining the original value (purchase cost) becomes key to calculating the tax liability.

When purchasing a virtual currency with RMB, holding it, then selling and converting back into RMB, the sale price serves as income and the purchase price as cost.

Tax payable = (income - cost) × 20%

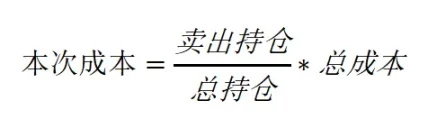

However, due to blockchain features and investor trading habits, users often conduct multiple purchases and coin-to-coin trades over time. When partially converting assets back into RMB, it may be impossible to accurately trace which purchase batch corresponds to the sale. In such cases, referencing common accounting methods used for other assets, a proportional allocation method may be applied:

Tax payable = (income - current cost) × 20%

If taxpayers cannot provide cost documentation, tax authorities may use valuation agencies for assessment or apply deemed taxation.

Therefore, investors should properly retain purchase records and asset snapshots at the time of sale to accurately calculate costs and file tax returns.

How to Plan Tax Obligations Reasonably?

As an emerging digital economic sector, the Web3 industry offers broad opportunities for tax planning due to its unique operational models and cross-border characteristics. Through strategic planning—such as selecting jurisdictions with lower tax rates or preferential policies, distinguishing income types to optimize tax treatment, optimizing asset structure design, and leveraging tax reductions or deferral tools—participants can effectively reduce tax burdens while remaining compliant.

Notably, under China’s current personal income tax system, the treatment of investment gains and losses depends on the specific investment type and tax rules. For most investments, including cryptocurrency trading, tax authorities typically assess taxes on a per-transaction basis rather than settling net annual gains or losses (unlike comprehensive income, which undergoes annual reconciliation). This means that losses from different transactions within a year usually cannot offset gains from other transactions (in contrast to corporate entities, funds, or IRS regulations in the United States).

Within this framework, individual investors can also optimize their tax strategies by adjusting asset nature and reporting methods. For example, converting part of holdings into stablecoins at market peaks and holding them until market troughs before cashing out into fiat allows investors to reasonably defer some tax payments.

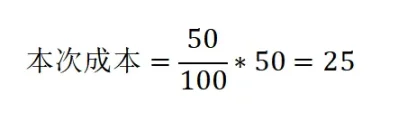

Scenario 1: Purchase virtual currency A at a cost of 50 yuan. Immediately sell half when price rises to 100 yuan, converting 50 yuan into fiat. Later, the market declines and the remaining A drops to 20 yuan. Taxable amount:

Tax payable = (50 - 25) × 20% = 5

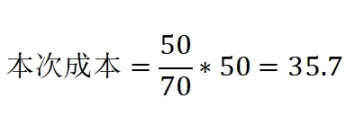

Scenario 2: Purchase virtual currency A at a cost of 50 yuan. Convert 50 yuan worth into stablecoins when price reaches 100 yuan. After the market drops, the value of held A becomes 20 yuan, making total assets 70 yuan. Then sell 50 yuan worth of stablecoins for fiat. Taxable amount:

Tax payable = (50 - 35.7) × 20% = 2.86

In both scenarios, the final outcome is selling 50 yuan into fiat while retaining 20 yuan of A. However, cashing out during a bull market incurs 5 yuan in taxes, whereas doing so in a bear market results in only 2.86 yuan. Legally speaking, this contradicts the intuitive belief that one should “withdraw profits during bull markets.”

It should be noted that this assumption relies on tax authorities permitting the use of the proportional allocation method for tax base calculation.

What Are the Risks of Non-Declaration?

A popular saying goes: “The tax bureau knows you better than you know yourself.” While somewhat exaggerated, this reflects the integrated application of modern tax administration technologies—big data analytics, inter-departmental information sharing, electronic tax systems, and intelligent risk monitoring. Especially since the launch of China’s Golden Tax Phase III system, its powerful data collection and analysis capabilities can reconstruct your economic activities from multiple dimensions.

If tax evasion is detected, the tax authority will order back payment, impose a daily penalty of 0.05% in arrears interest, and may levy fines ranging from 50% to five times the evaded tax amount. In serious cases, criminal liabilities may also apply.

Mankun Lawyers' Summary

In the Web3 era, compliant tax filing is increasingly important. Despite the innovative economic models and technological advancements brought by blockchain, cryptocurrencies, and decentralized finance (DeFi), fulfilling tax obligations remains a non-negotiable legal duty.

Web3 practitioners and users must stay informed about tax policies, proactively record transactions, retain transaction proofs, take asset snapshots (snapshots) at critical points, and engage in lawful tax planning within the boundaries of the law to avoid legal risks stemming from non-compliance.

The complexity of tax obligations arises not only from policy uncertainty but also closely relates to investors’ awareness of compliance. Going forward, as regulatory frameworks gradually improve, rules in this domain may become clearer. Until then, staying vigilant and proactively adapting to changes will be key for investors to protect their interests in the Web3 space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News