Has cryptocurrency trading in China started to be taxed?

TechFlow Selected TechFlow Selected

Has cryptocurrency trading in China started to be taxed?

Combined with the recent incident involving Chen's "tax payment" using virtual currency, analyze China's legal stance on current virtual currency trading activities.

By: Liu Zhengyao

Introduction

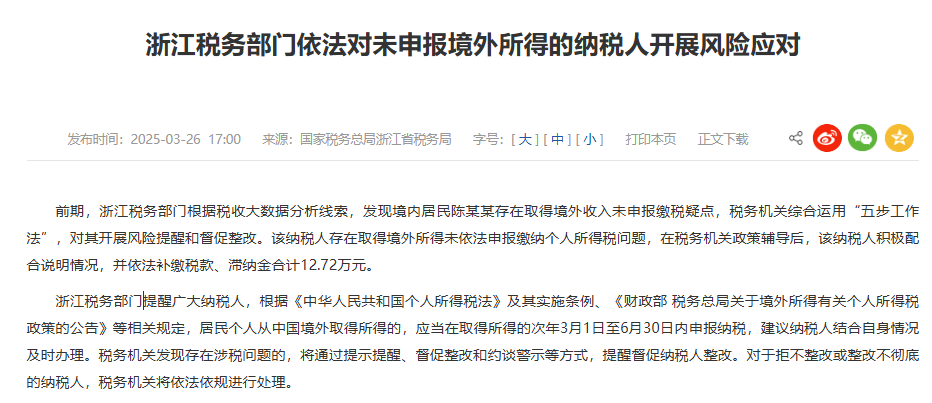

In recent days, a story has circulated online about Mr. Chen from Zhejiang Province being assessed 127,200 RMB in personal income tax and late payment penalties by the State Taxation Administration of Zhejiang Province (hereinafter referred to as "Zhejiang STA") for failing to voluntarily declare taxes on profits from virtual currency trading. On March 26, 2025, there was indeed such a notice posted on the official website of Zhejiang STA. Interestingly, it stated: “After receiving policy guidance from the tax authorities, the taxpayer actively cooperated and explained the circumstances...”

(Screenshot source: Official website of Zhejiang STA)

As a mainland lawyer who entered the Web3 space early on, Attorney Liu must admit that he is not aware of any currently existing clear and enforceable tax policies regarding virtual currencies within China.

Before discussing whether Chinese tax authorities can actually levy taxes on virtual currency transactions, we first need to confirm whether Mr. Chen mentioned in this announcement truly engaged in virtual currency trading—after all, the official website does not specify whether Mr. Chen traded USDT or other virtual currencies.

1. Was Mr. Chen taxed due to gains from virtual currency trading?

According to Wu Shuo's tweet, the source of the claim that Mr. Chen was taxed on profits from virtual currency trading actually comes from a company called "Sanchi Legal Tech," whose CEO, Zhang Qingqing, authored the article. It quoted someone saying: “I already paid capital gains tax in Singapore on my crypto investments—why is the Chinese tax bureau still asking me to pay more?”

The article then cites Mr. Chen’s case with the following description:

“Don’t believe the myth ‘safe if taxed in Singapore’! China does not recognize the legality of virtual currencies; foreign taxes paid cannot be credited. Mr. Chen from Zhejiang earned 636,000 RMB trading USDT, paid 100,000 RMB in Singapore, but was still required to pay an additional 127,200 RMB in China. The correct approach: trade through licensed exchanges in Hong Kong, keep transaction records, proactively declare at a 20% rate, and avoid being labeled as ‘tax evasion’ and hit with fines.”

In Attorney Liu’s view, this statement somewhat misrepresents current practical operations, legal frameworks, and tax practices related to cryptocurrency.

First, while China strictly prohibits cryptocurrency speculation and commercial activities involving digital assets—classified as illegal financial activities—it has never officially stated that “virtual currencies are illegal.” Instead, only their status as legal tender is denied. As early as December 3, 2013, in the “Notice on Preventing Bitcoin Risks,” and again on May 18, 2021, in the “Announcement on Preventing Risks Related to Virtual Currency Trading,” both Bitcoin and virtual currencies were defined as “virtual commodities.” In current judicial practice—especially in criminal cases—China’s judiciary fully recognizes the property attributes of virtual currencies (particularly major cryptocurrencies), treating them as objects protected under Chinese criminal law.

Second, few people in the crypto community actually “trade USDT” for profit, given that USDT is a stablecoin. While minor price differences may exist between platforms for arbitrage opportunities involving USDT or USDC, these are generally inaccessible to ordinary individuals. We won't delve deeper here.

Third, the so-called “correct approach” suggested by the author is extremely difficult for average individuals to implement. For example, mainland residents typically cannot even open accounts on licensed Hong Kong exchanges, let alone conduct trades there.

Finally, returning to our main topic: whether Mr. Chen was indeed taxed due to profits from virtual currency trading remains unconfirmed by any official or authoritative body. Therefore, we cannot fully verify the authenticity of this report.

2. Does Chinese law have regulations on taxation for virtual currency trading?

Even assuming Mr. Chen did pay back taxes due to crypto trading, according to the Zhejiang STA announcement, the assessment was made based on China’s Individual Income Tax Law, its Implementation Regulations, and the “Announcement on Individual Income Tax Policies Regarding Overseas Income” issued by the Ministry of Finance and the State Taxation Administration. However, none of these documents explicitly establish taxation rules specific to virtual currency transactions.

On September 28, 2008, the State Taxation Administration issued a reply to Beijing’s tax bureau titled “Reply on Levying Individual Income Tax on Income Gained from Buying and Selling Virtual Currency via the Internet,” which stated: “Income obtained by individuals through purchasing virtual currency from players online and reselling it at a higher price constitutes taxable income under individual income tax, and shall be subject to tax under the category of 'property transfer income.'”

However, those familiar with the crypto space know that Bitcoin—the flagship cryptocurrency in today’s context—wasn’t mined until January 2009, meaning this directive predates Bitcoin’s creation. This policy was clearly aimed at regulating centralized virtual currencies like QQ Coins. Whether this 2008 rule can be extended to cover decentralized cryptocurrencies today depends heavily on the legal status of such transactions in mainland China.

3. Is virtual currency trading legal in mainland China?

One reason many people are particularly interested in taxation of crypto transactions is the belief that if the government starts collecting taxes, doesn’t that imply official recognition of such activities?

It is well known that under the “September 24 Notice,” China maintains a strict regulatory stance toward virtual currencies: prohibiting speculation, banning exchange services between fiat and virtual currencies, peer-to-peer trading, acting as a central counterparty in crypto trades, and forbidding any virtual currency exchanges from operating within mainland China. These activities are collectively labeled as “illegal financial activities.”

4. Can tax authorities currently impose taxes on virtual currency investment and trading?

Likewise, according to the “September 24 Notice,” investments in virtual currencies and their derivatives by mainland entities (including individuals, corporations, and unincorporated organizations) fall into a self-assumed risk category where Chinese law offers no protection. Given this, it would be logically, legally, and regulatorily inconsistent for mainland tax authorities to levy taxes on speculative crypto trading.

That said, in practice, some local tax bureaus might, due to insufficient understanding of current crypto regulations, observe mainland Web3 users profiting from crypto trading—specifically when proceeds are cashed out and transferred into domestic bank accounts—and demand tax payments. They may overlook the fact that these same individuals often face account freezes by domestic judicial authorities, withdrawal blocks by exchanges, or losses without compensation after exchange bankruptcies (e.g., FTX).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News