Enterprise Overseas Expansion: Architecture Selection and Tax Optimization Strategies

TechFlow Selected TechFlow Selected

Enterprise Overseas Expansion: Architecture Selection and Tax Optimization Strategies

How important is the right enterprise architecture?

Author: Crypto Miao

"Choosing the right corporate structure is critical for Web3 companies expanding overseas. It not only optimizes tax obligations but also reduces risks and enhances global operational flexibility.

Whether leveraging a single-entity structure to benefit from low tax rates or establishing a multi-entity structure based on business needs, proper design can significantly strengthen international competitiveness and help enterprises thrive within the Web3 ecosystem."

Due to their decentralized nature, Web3 companies face unique legal, tax, and operational challenges when expanding internationally.

Selecting an appropriate corporate structure enables compliance, optimizes tax burdens, reduces risks, and increases market flexibility—allowing adaptation to diverse regional legal frameworks, technological infrastructures, and market demands.

I. What Is an Overseas Expansion Structure?

An overseas expansion structure refers to the organizational framework and management model established by a company during globalization, aimed at coordinating global resources, adapting to characteristics of different markets, and enabling efficient cross-border operations.

The design of such a structure directly impacts a company's global competitiveness and operational efficiency. Beyond equity structure, it must account for future structural adjustments, tax costs, intellectual property management, financing activities, and overall maintenance expenses.

II. Types of Overseas Expansion Structures

Tax optimization is a key consideration in structuring for Web3 companies, as global tax frameworks increasingly affect digital assets. When establishing holding companies abroad, Hong Kong, Singapore, and BVI are popular choices.

(I) Single-Entity Structure

1. Hong Kong

Hong Kong operates a low-tax regime comprising profits tax, salaries tax, and property tax, with no value-added tax or sales tax. Profits tax is 8.25% on annual profits up to HK$2 million and 16.5% on profits exceeding that threshold. Dividends received from foreign corporations (holding over 5% shares) are exempt from tax.

Hong Kong has signed double taxation agreements (DTAs) with around 45 countries and regions—including mainland China, ASEAN, and Europe—offering significant tax planning opportunities, particularly in reducing withholding taxes on cross-border dividends and interest.

2. Singapore

Singapore’s corporate income tax rate is 17%, slightly higher than Hong Kong’s. However, its tax system is favorable toward technology and R&D firms, offering various tax exemptions and deductions. Foreign-sourced dividends and capital gains are tax-exempt if conditions are met.

In addition, Singapore provides numerous tax incentive programs such as the Regional Headquarters (RHQ) and Global Trader Program (GTP), creating further tax planning opportunities.

Singapore has DTAs with over 90 countries, covering major economies including China, India, and the EU. This extensive network offers broad scope for tax planning, especially in minimizing withholding taxes on cross-border payments.

3. BVI (British Virgin Islands)

BVI is a leading offshore jurisdiction for cross-border investment, asset protection, and tax optimization, thanks to its zero-tax regime, strong privacy protections, and flexible structures—particularly suitable for holding companies and crypto-related businesses.

BVI imposes no corporate income tax, capital gains tax, dividend tax, or inheritance tax, resulting in minimal tax burden.

BVI companies do not disclose shareholder or director information publicly and can further conceal beneficial owners through nominee services, ensuring business confidentiality and asset security.

Recognized globally as legitimate offshore entities, BVI companies are widely accepted by major financial centers (e.g., Hong Kong, Singapore, London), facilitating international bank account opening, cross-border payments, trade settlements, and capital operations.

Comparison of key tax rates:

(II) Multi-Entity Structure

A multi-entity structure allows more effective tax planning. Domestic companies can establish one or more intermediate holding companies in low-tax jurisdictions (typically Hong Kong, Singapore, BVI, or Cayman Islands) to invest into target countries. Leveraging the low tax rates and confidentiality of offshore entities helps reduce overall tax liability, protect sensitive information, diversify parent company risk, and facilitate future equity restructuring, sale, or IPO financing.

Case 1 Intermediate Holding Layer: China → Singapore → Southeast Asia Subsidiary (e.g., Vietnam)

A Chinese parent company invests in Vietnam via a Singapore holding company. Singapore has bilateral tax treaties (DTAs) with both China and Vietnam, allowing withholding tax on dividends to be reduced to as low as 5%. This represents a 50% reduction compared to direct investment from China (under the China-Vietnam DTA, the rate is 10%).

Transferring shares in the Singapore holding company typically incurs no capital gains tax; whereas direct transfer of shares in the Vietnamese subsidiary may trigger a 20% capital gains tax in Vietnam. The Singapore structure aligns better with Western investor practices, enhancing liquidity in asset sales.

Additionally, the Singapore entity can serve as a regional headquarters managing multiple subsidiaries across countries, simplifying the process of attracting international investors or pursuing spin-off listings. With its developed financial market, the holding company can issue bonds or secure international loans, lowering financing costs.

Case 2 VIE Agreement Control: BVI → Hong Kong → Operating Company

In regions with strict Web3 regulations and high operational risks, a "VIE" (Variable Interest Entity) control framework can be adopted—similar to models used by Alibaba, Tencent Music, and New Oriental. A BVI holding company controls a Hong Kong company, which in turn invests in the operating company. The offshore holding company exercises control over the operating entity through layered contractual arrangements.

The BVI top-tier holding company allows tax-free share transfers and protects founder privacy.

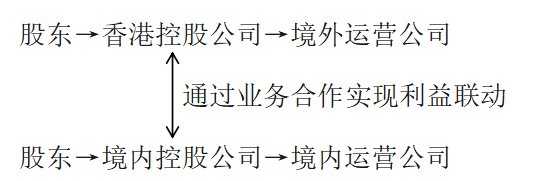

Case 3 Parallel Onshore-Offshore Structure:

A parallel onshore-offshore structure suits situations where market and regulatory uncertainty, financing needs, geopolitical factors, licensing requirements, or data security concerns necessitate division of labor between separate onshore and offshore entities. For example: Manqin Research | Can the "front store, back factory" model combining Hong Kong and Shenzhen work compliantly for Web3 startups? (Link https://mp.weixin.qq.com/s/PEdL5ArnCXOnqHov3HT4vA)

Overall tax burden is lower. Offshore companies can be registered in tax-favorable jurisdictions (e.g., Hong Kong, Singapore, Cayman Islands), which often offer lower corporate tax rates or capital gains exemptions. Through intercompany collaboration, profits can be allocated efficiently and tax deductions utilized across jurisdictions, reducing total tax liability.

Independent onshore and offshore operations. Under this structure, onshore and offshore companies operate as separate legal entities, each subject to local tax jurisdiction. This allows them to file taxes independently under local laws, avoiding consolidated global taxation due to equity linkage.

III. Conclusion

Choosing the right corporate structure is crucial for Web3 companies going global. It not only optimizes tax obligations but also reduces risks and enhances operational flexibility worldwide. Whether using a single-entity structure to benefit from low tax rates or building a multi-entity structure based on business needs, thoughtful design significantly strengthens international competitiveness and supports thriving growth within the Web3 ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News