Crypto mining companies face pressure on profits—can tax planning be the way out?

TechFlow Selected TechFlow Selected

Crypto mining companies face pressure on profits—can tax planning be the way out?

Mining profits continue to decline under the influence of multiple factors, and the global cryptocurrency mining industry is quietly entering a new industry cycle.

Author: FinTax

1. The Profit Margin Crisis in Crypto Mining

In November 2025, Marathon Digital Holdings (MARA) revealed a strategic shift in its third-quarter financial report, announcing that it would "sell a portion of newly mined bitcoins to support operational funding needs." This move highlights the mounting pressure crypto miners face as profit margins continue to shrink.

Likewise, Riot Platforms (RIOT), another mining giant, reported in its October 2025 production and operations update that it produced 437 bitcoins during the month—a 2% decline from the previous month and a 14% drop year-on-year—while selling 400 bitcoins. In April 2025, RIOT had also sold 475 bitcoins—the first time since January 2024 that RIOT sold self-mined bitcoins.

RIOT long adhered to a "HODL" strategy, preferring to hold most of its mined bitcoins in anticipation of price appreciation. However, in this post-halving cycle, the company has adopted a more flexible capital approach. The CEO explained that such sales reduce the need for equity financing, thereby limiting dilution for existing shareholders. This indicates that even top-tier mining firms committed to holding strategies must now periodically sell part of their output to maintain financial health amid shifting market and operational demands.

From the perspective of price and hash rate data, mining profits are being steadily squeezed. By the end of 2025, network hash rate reached a record high of 1.1 ZH/s. At the same time, bitcoin's price dropped to around $81,000, with hash rate pricing (hashrate) falling below $35 per PH/s, while median hash rate costs soared to $44.8 per PH/s—meaning intensified competition and shrinking margins, with even the most efficient miners barely breaking even.

Marginal returns on mining are declining, while fixed electricity and financing costs remain stubbornly high. Under these conditions, although some mining companies have accelerated their shift toward AI and high-performance computing (HPC), they still face varying degrees of financial strain and survival pressure. At this juncture, effective tax planning becomes a critical strategy for alleviating cash flow pressure and sustaining long-term operations. Next, we will use the United States as a case study to examine whether tax planning can effectively reduce the overall operational burden on mining firms.

2. Tax Burden on Crypto Miners: The U.S. Case

2.1 Corporate Tax Framework

In the United States, corporations can be structured as either pass-through entities or C corporations (C Corporations, standard joint-stock companies). Under U.S. tax law, pass-through entities pass profits directly to shareholders, who pay taxes at the individual level under personal income tax rates, resulting in single-level taxation. In contrast, C corporations are taxed at the corporate level at a flat rate of 21%, and dividends distributed to shareholders are taxed again at the individual level, creating double taxation.

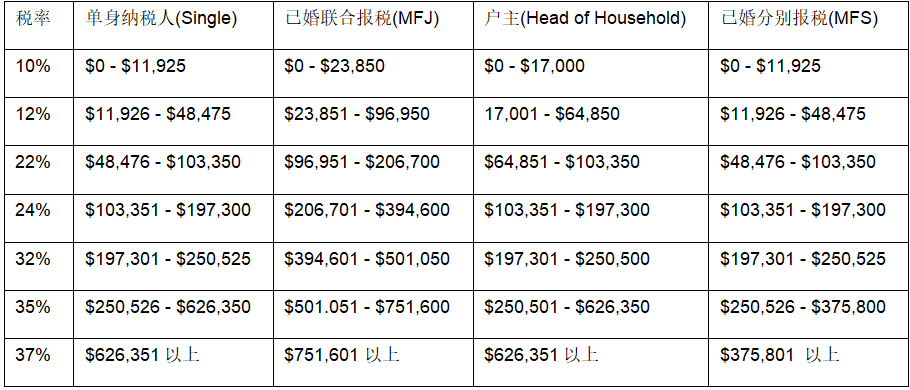

More specifically, sole proprietorships, partnerships, S corporations, and most limited liability companies (LLCs) are classified as pass-through entities and do not pay federal corporate income tax. Income from these entities is treated as personal ordinary income and reported at individual income tax rates, which can reach up to 37% (as shown in the chart).

Table 1: 2025 U.S. Federal Ordinary Income Tax Rates and Brackets

Cryptocurrencies are treated as property, so the taxable nature of mining income and sale proceeds remains unchanged—but actual tax liabilities may vary depending on the taxpayer’s entity type:

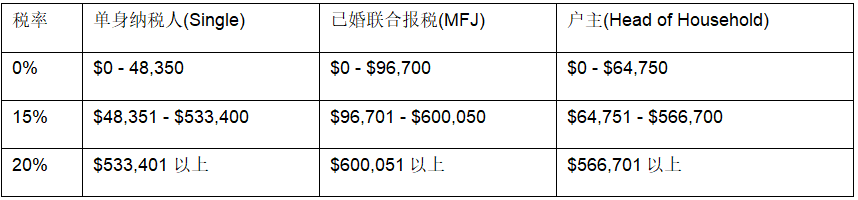

(1) If a crypto mining firm is a pass-through entity, it does not pay federal corporate income tax. Instead, shareholders must report their share of profits on individual tax returns. Taxes applicable to cryptocurrency acquisition and transactions include ordinary income tax and capital gains tax. First, cryptocurrencies obtained through mining, staking, or airdrops require shareholders to report ordinary income at fair market value upon receipt, taxed at ordinary income rates ranging from 10% to 37%. Second, when the entity sells, exchanges, or spends the cryptocurrency, shareholders must also pay capital gains tax. Gains from holdings of one year or less are considered short-term capital gains and taxed at ordinary income rates (10%–37%). Gains from holdings exceeding one year are considered long-term capital gains, eligible for preferential rates of 0%, 15%, or 20%, depending on taxable income (as shown in the chart).

Table 2: U.S. Long-Term Capital Gains Tax Rates and Brackets

(2) If a crypto mining firm is a C corporation, it is subject to a flat 21% federal corporate income tax, plus applicable state taxes. Cryptocurrencies acquired via mining, staking, or airdrops are recorded as revenue at fair market value. Capital gains from selling, exchanging, or spending cryptocurrencies—regardless of holding period—are included in corporate revenue. After deducting costs and related expenses, the resulting profit is taxed at 21% at the federal level, along with state-level taxes. If the C corporation distributes dividends to shareholders, additional dividend taxation occurs, resulting in double taxation.

2.2 Challenges of Multiple Tax Liabilities

In the U.S., large, publicly funded, or soon-to-be-listed mining firms such as MARA, RIOT, and Core Scientific almost universally operate as C corporations, while smaller or startup mining firms tend to adopt pass-through structures.

Different financing needs, cash retention strategies, and tax considerations lead to divergent corporate structure choices. The crypto mining industry is capital-intensive, requiring strong internal retained earnings during expansion phases. The C corporation structure supports profit retention by deferring tax liabilities from passing through to owners immediately, thus reducing cash outflows caused by owners having to pay taxes on undistributed profits. Most LLCs adopt a pass-through structure, offering early-stage tax flexibility—such as being taxed as a partnership or S corporation to reduce tax burdens—and can later restructure into a C corporation as they grow. As such, many startups initially use an LLC structure and gradually transition to a C corporation as scale and funding needs increase.

Regardless of structure, crypto mining firms face multiple layers of tax burden. For pass-through entities, business income flows through to owners: miners incur tax liability upon receiving newly mined coins, and further tax obligations arise upon disposal, requiring owners to bear tax responsibilities in two consecutive stages. In contrast, C corporations record mining or related revenues on their books, calculate profits collectively, and pay corporate income tax. If profits are distributed to shareholders, dividend taxes are triggered again. Nevertheless, through appropriate tax planning, mining firms can legally reduce their tax payments, transforming what would otherwise be a burden into a competitive advantage amid shrinking profit margins.

3. Possibilities for Tax Optimization in Crypto Mining

Again using the United States as an example, crypto mining firms can pursue various tax optimization strategies to achieve savings.

3.1 Leveraging Equipment Depreciation to Optimize Current Tax Liability

The recently enacted U.S. "One Big Beautiful Bill Act" reinstated the 100% bonus depreciation provision under Section 168(k) of the Internal Revenue Code. This "accelerated depreciation" policy allows taxpayers to fully deduct the cost of qualifying fixed assets—such as mining rigs or servers—in the year of purchase, thereby reducing taxable income. Originally set at 100% between 2018 and 2022, the bonus depreciation rate began phasing down annually starting in 2023 and was scheduled to reach 0% by 2027. The new act restores 100% bonus depreciation for qualified assets placed in service between January 19, 2025, and January 1, 2030. Additionally, the act increases the Section 179 depreciation limit, raising the cap on equipment expenses eligible for full expensing from $1 million to $2.5 million. This is highly significant for mining firms: mining rigs, power infrastructure, cooling systems, and other fixed assets can be fully expensed in the first year, significantly lowering taxable income and improving immediate cash flow. Beyond tax savings, the "accelerated depreciation" method also enhances the present value of capital.

It should be noted that accelerated depreciation must be applied carefully based on annual cost and revenue profiles to avoid generating net operating losses (NOLs) that cannot be fully utilized. For instance, suppose a U.S. mining firm earns $400,000 in revenue in 2024 and spends $500,000 on mining equipment. If it takes a full $500,000 deduction in the same year, the result is a $100,000 NOL due to lower revenue. While this eliminates current-year tax liability, it also means the company cannot distribute profits—even if cash is available. Under U.S. tax rules, NOLs carried forward can only offset up to 80% of taxable income in subsequent years. Therefore, indiscriminate use of accelerated depreciation in low-profit years may not be prudent.

3.2 Structuring Cross-Border Operations to Strategically Manage Capital Gains

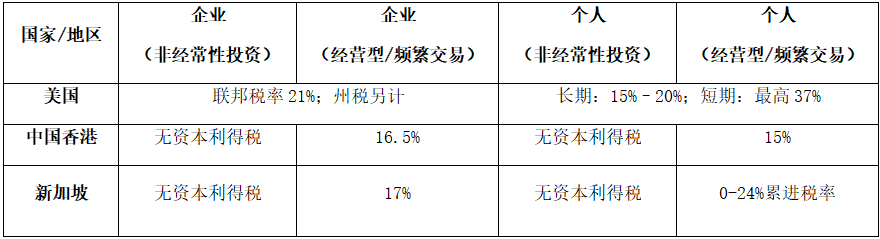

Tax policies on cryptocurrency vary across jurisdictions. In the United States, any taxable transaction that yields a profit—whether occasional disposal or frequent trading or commercial activity—must be reported and taxed. This uniform "tax all gains" approach places significant tax pressure on domestic crypto miners. In contrast, Singapore and Hong Kong offer more favorable crypto tax regimes. Currently, both jurisdictions exempt individuals and businesses from capital gains tax on non-regular investment gains in cryptocurrency. As long as transactions are deemed non-recurring investments, holders do not owe tax on asset appreciation, enabling zero-tax long-term holding benefits. Of course, frequent traders or those engaged in commercial activities must still pay corporate or personal income tax on profits. Singapore’s corporate tax rate is approximately 17%; Hong Kong’s is 16.5%. While active traders remain taxable, these rates are clearly more competitive than the U.S. federal corporate tax rate of 21%.

Table 3: Comparison of Tax Rates in the U.S., Hong Kong, and Singapore

Given differences in tax regimes across jurisdictions, U.S.-based crypto mining firms can legally reduce their tax burden through cross-border structuring. For example, a U.S. Bitcoin mining company could establish a subsidiary in Singapore, first selling its daily mined bitcoins to this affiliate at fair market price, then allowing the subsidiary to resell them globally. Through this "sell internally, then externally" arrangement, the U.S. parent company pays corporate income tax only on initial mining revenue, while the Singapore subsidiary's profits from Bitcoin appreciation may qualify for Singapore’s exemption from capital gains tax, potentially avoiding such taxes altogether. The tax-saving effect of this cross-border structure is evident: the key lies in legally shifting the value appreciation phase of crypto assets from high-tax to tax-free or low-tax jurisdictions, maximizing profit retention.

3.3 Utilizing Mining Rig Hosting–Leasing Structures to Align Economic Substance and Tax Liability

The mining rig hosting–leasing model is widely used in the crypto mining industry, driven by the commercial logic of separating asset ownership from mining operations to improve capital and resource allocation efficiency. This arrangement naturally creates profit distribution, with different entities recognizing income based on their roles. For example, an offshore entity in a low-tax jurisdiction purchases, owns, and leases out mining equipment, while a U.S.-based entity focuses on mining operations and pays rent or hosting fees to the offshore entity. In this setup, the offshore entity’s equipment-related income may benefit from lower tax rates. Although the hosting–leasing structure did not originate solely for tax purposes and has genuine commercial rationale, it offers room for cross-border tax planning.

Naturally, implementing this structure within a single enterprise must meet certain compliance requirements. For instance, the offshore leasing entity must possess economic substance, actually own the mining equipment, and set rental prices according to arm’s length principles—ensuring rents fall within reasonable market ranges.

4. Conclusion

Mining profits continue to decline under multiple pressures, and the global crypto mining industry is quietly entering a new phase. At this turning point, tax planning is no longer merely an optional financial tool but may become a breakthrough strategy for mining firms to preserve capital health and enhance competitiveness. Mining companies can conduct systematic tax planning—tailored to their business models, profitability structures, and capital investment patterns—ensuring compliance with regulatory and tax laws, transforming tax liabilities into strategic advantages, and laying the foundation for long-term, sustainable growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News