Hyperliquid: When Liquidity Becomes a Moat

TechFlow Selected TechFlow Selected

Hyperliquid: When Liquidity Becomes a Moat

Technical performance is the key point of the moment, while economic design is the fundamental factor in creating lasting value.

Author: Saurabh Deshpande

Translation: TechFlow

Hello,

Earlier this year, I hinted that we would build liquidity positions from our balance sheet. Over the past few weeks, we’ve been steadily building our position in Hyperliquid.

This aligns with our ongoing exploration into speed, margins, revenue, and business models. Saurabh’s article today explains why we’re investing in Hyperliquid.

For full disclosure, at the time of writing, we had no contact with anyone at Hyperliquid. No marketing managers were harmed in the making of this article. We will continue to invest, co-build, and research the future of on-chain growth markets. Our thesis is that given Hyperliquid’s ability to attract venture capital, it will become a primary avenue for application development in the coming months.

Long before the term “blockchain” existed, merchants used a shared infrastructure known as the “Silk Road.” Though the route had existed for centuries, it was considered dangerous and inefficient. Local warlords charged tolls, bandits attacked caravans, and traders had to navigate dozens of different legal systems and currencies. Each trading post operated independently, hoarded information, and priced services based on what the market could bear.

During the Pax Mongolica, Genghis Khan improved commerce by unifying the fragmented Silk Road. European merchants could now travel safely all the way to China. They operated under a unified legal framework, used standardized weights and measures, and were protected by a single security force. The Mongols established a system called "Yam" (TechFlow note: relay stations providing food, shelter, and fresh horses for Mongol military messengers), a network of stations, horses, and sealed imperial tablets (TechFlow note: paiza, meaning "imperial tablet," a badge carried by Mongol officials and envoys indicating privileges and authority). This allowed merchants to travel greater distances and improved the transport of goods.

The Yams functioned like easily replicable nodes. They created network effects—making the entire system stronger with each new participant. The more merchants used the route, the safer it became, the more reliable the service, and the lower the cost for everyone. The Mongol trade network lasted for centuries and enabled one of the greatest transmissions of knowledge, technology, and culture in the medieval world.

Humans have always solved scalable commerce problems this way: by building shared infrastructure that grows stronger with every new participant. Later major inventions were essentially derivatives of the Silk Road, helping us conduct business more efficiently. With steamships, telegraphs, and container ships, we reduced the cost of moving goods by multiple orders of magnitude, bringing it closer to zero. Today, even in digital finance, value transfer still relies on networks whose fundamentals remain unchanged.

There’s a simple truth in financial markets: money needs to move—and move efficiently. Joel has already explored this in “Money Moves.” The blockchain world has spent years building tech stacks while largely ignoring this fundamental principle. Most DeFi protocols launch with fanfare, attract initial liquidity during incentive periods, then watch helplessly as users and volume migrate to the next high-yield hype project. This is a predictable pattern in DeFi.

Traditional finance isn’t inclusive. But those who have access gain leverage, amplifying profits. Behind the glass doors of banks and prime brokers, dollars are re-pledged across trades. The same collateral is reused across positions. As a result, the utilization of the entire engine approaches 100%. But only a select few institutions have access to these controls.

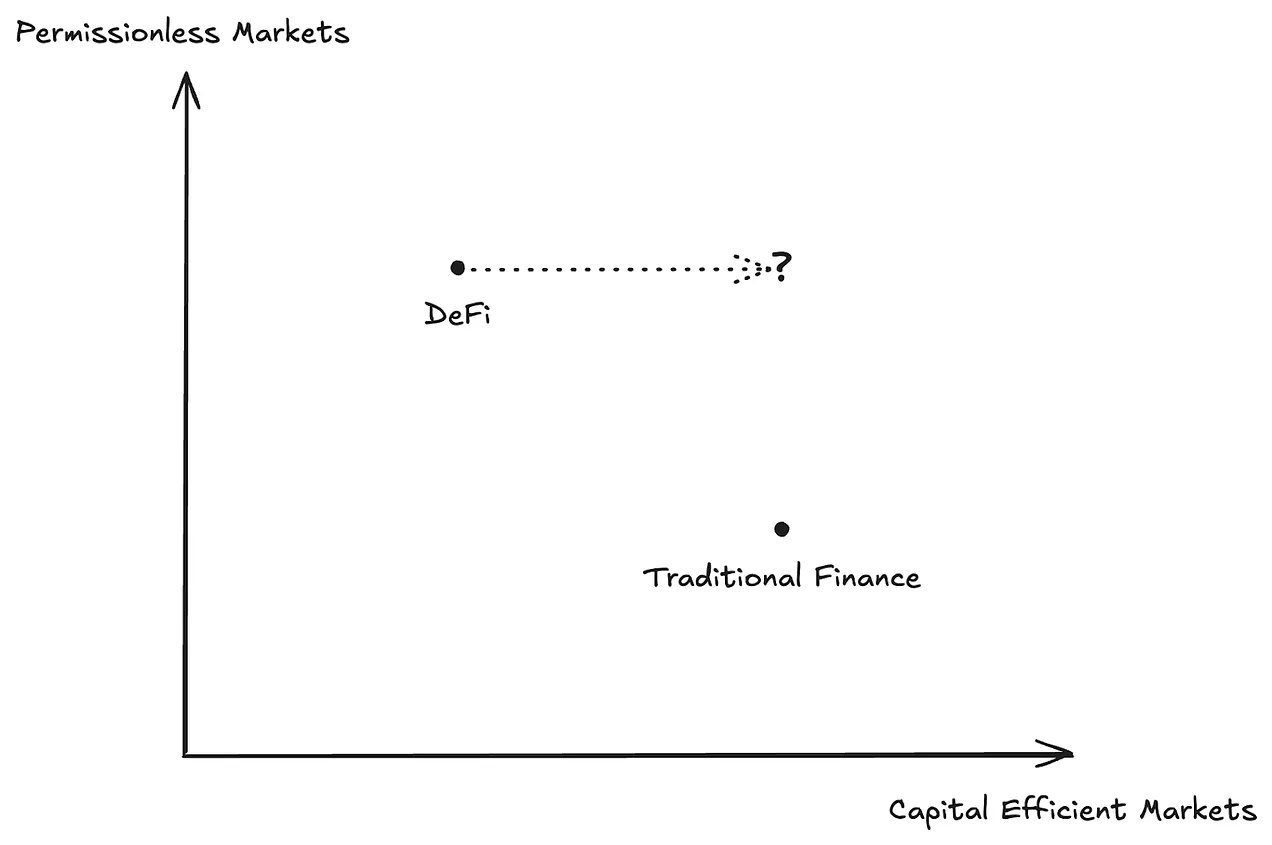

DeFi opens these gates: anyone with a browser can borrow, swap, or hedge. But openness comes at a cost—stranded collateral. Isolated margin accounts, over-collateralized loans, and liquidity pools that cannot communicate with each other. In the “Permissionless vs. Capital-Efficient Markets” chart below, traditional markets sit in the bottom-right corner, DeFi lingers in the top-left, and the top-right quadrant remains empty. Hyperliquid is betting on planting a flag in that void. This matters because if financial institutions are going to use blockchain infrastructure, they won’t do so merely because it offers permissionless access. They want a system that matches the efficiency of their existing setups. Without institutional adoption, crypto cannot unlock its next phase of growth.

Our previous articles on Hyperliquid focused primarily on the exchange. This piece dives into the Hyperliquid ecosystem and how it attempts to redefine capital efficiency and liquidity in DeFi.

Hyperliquid’s bet is that “less is more”—by reducing noise and unnecessary steps, wealth accumulates better. And crucially, it brings its friends along. Hyperliquid isn’t trying to be a general-purpose computer or a metaverse theme park. It aims to be the financial district of Manhattan—dense, concentrated into a single matching engine.

The question is: Can Hyperliquid turn its exchange into such a high-density gravity well that capital cannot escape? The answer lies in two interwoven ideas: how fast value circulates, and how hard it is for value to leave.

Value Transfer

First, blockchains are about money. That may sound obvious, but it’s worth examining what “moving money” actually means in practice. The Silk Road succeeded because it made trade easier, faster, and safer than any alternative. But it wasn’t unique. Historically, many have built fortunes by controlling integrated infrastructure networks.

The Rothschild family gained fame in financial services, but their empire was built on a powerful information network across 19th-century Europe. While other financiers waited days for news via horse and ship, the Rothschilds used carrier pigeons, private couriers, and strategic telegraph investments to deliver market intelligence within hours. Later, they invested heavily in railroads—not for freight revenue, but because railroads were the arteries of 19th-century commerce. Control the rails, control the economy.

J.P. Morgan pursued a similar strategy in the United States. He financed railroad construction and organized industries around them. He consolidated competing rail lines into integrated networks, standardized track gauges so trains could actually connect, and eliminated redundant routes. When Andrew Carnegie needed to move steel from Pittsburgh, he did so via Morgan’s rails. When John D. Rockefeller needed to transport oil from Pennsylvania to refineries, he struck deals with Morgan’s railroad empire.

Morgan’s real innovation was vertical integration of the infrastructure itself. He controlled the steel companies that built the rails, the banks that funded their expansion, and the railroads that transported the goods. It became almost a circulatory system for American capitalism. By the time he was done, you couldn’t move money, materials, or information across the U.S. without paying Morgan somewhere along the chain.

Any chain that enables smooth movement of capital between its parts holds an inherent advantage.

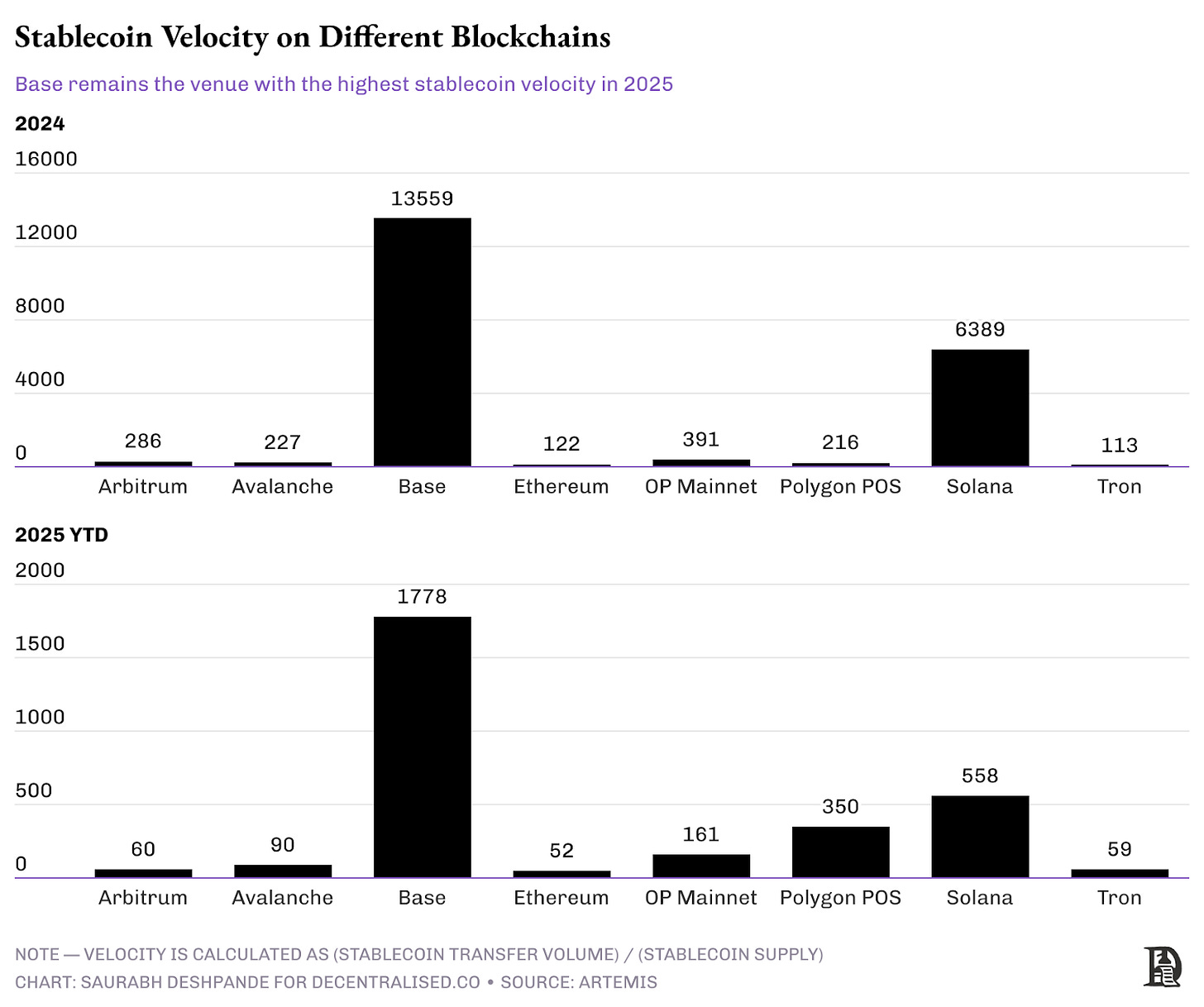

Stablecoins have become crypto’s killer app. As of June 22, Ethereum, Solana, and Tron transferred $12.2 trillion worth of stablecoins in 2025 alone. Different blockchains have found niches in how they handle stablecoin transfers. Tron dominates payments in emerging markets, Ethereum handles large-scale institutional transfers, and Solana excels at high-frequency, low-value transactions.

Solana emerged as the go-to platform for memecoin trading in 2024. This is reflected in Solana’s stablecoin velocity. With just $1.8 billion in stablecoin supply, Solana settled $11.5 trillion in stablecoin volume. In other words, each stablecoin changed hands over 6,300 times. As AI agents rose, so did transaction activity on Base. With low supply, Base saw extremely high stablecoin velocity in 2024. In 2025, stablecoins on Base turned over more than 1,700 times.

These numbers show that money behaves differently when costs approach zero. On Ethereum, where a transaction might cost $10, small traders are unlikely to regularly transact $50 or $100. But on Solana, where fees are less than a cent, we see this constantly. Exchanges, liquidity providers, and MEV extractors earn via fees and slippage. Validators profit from bribes by MEV extractors. You don’t make big profits on small volumes—you make tiny profits on massive volumes. When friction vanishes, speed becomes everything.

On-chain activity falls into two categories—high-value actions (e.g., Ethereum due to high liquidity) and low-value, high-frequency actions (e.g., Base and Solana). Could both coexist on a single chain? Hyperliquid’s approach is intriguing. Its ecosystem isn’t optimized for one type of capital flow—it provides infrastructure for all types.

The Hyperliquid ecosystem consists of two parts:

-

Hyperliquid DEX, powered by HyperCore—the native L1 orderbook system, and

-

HyperEVM—a high-performance, EVM-compatible blockchain built by the Hyperliquid team.

While these are the building blocks, precompiles and builder codes serve as distribution mechanisms.

Precompiles are specialized smart contracts that connect HyperEVM and HyperCore, enabling seamless data access and execution across environments. These contracts allow developers direct access to trading data such as perpetual positions, spot balances, value equity, oracle prices, and staking delegations.

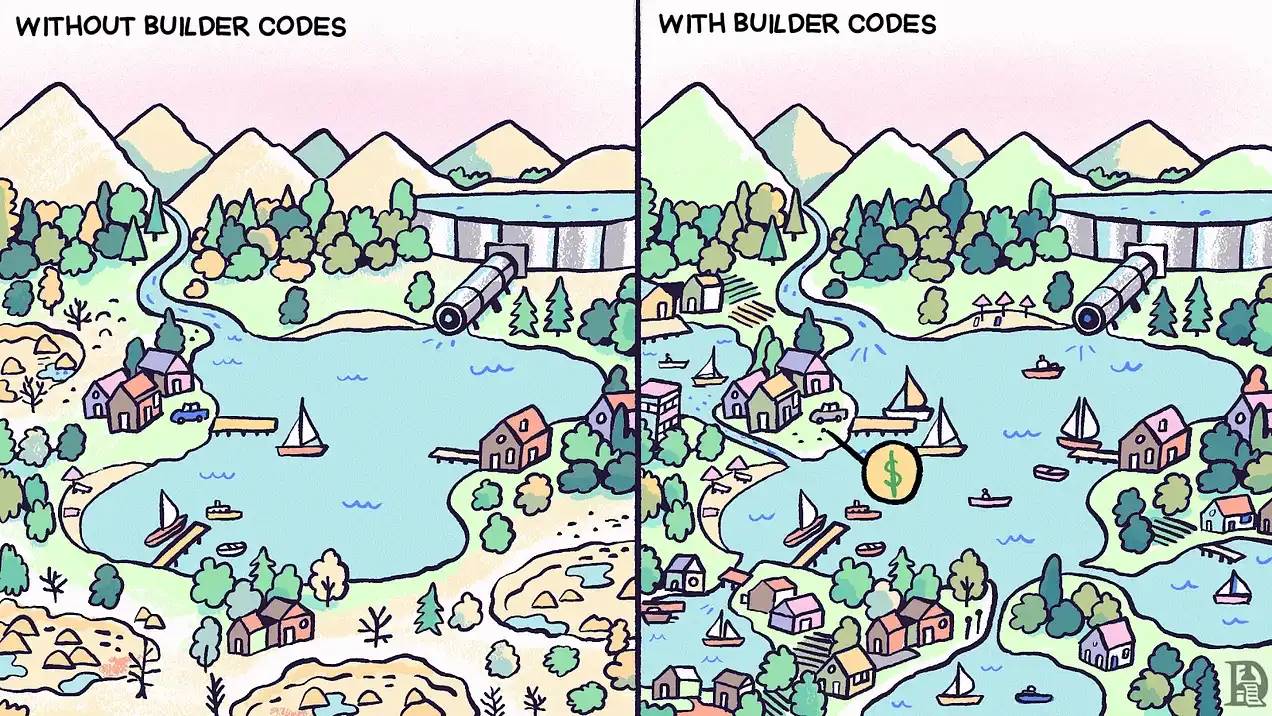

Builder codes on Hyperliquid are identifiers developers can use when building apps or tools on the platform. When users interact with Hyperliquid through a developer’s app (e.g., a trading bot or interface), the developer’s builder code earns rewards. This allows them to earn a share of transaction fees generated by users. It creates a direct monetization path for developers building valuable tools and applications within the Hyperliquid ecosystem.

Improving Capital Efficiency

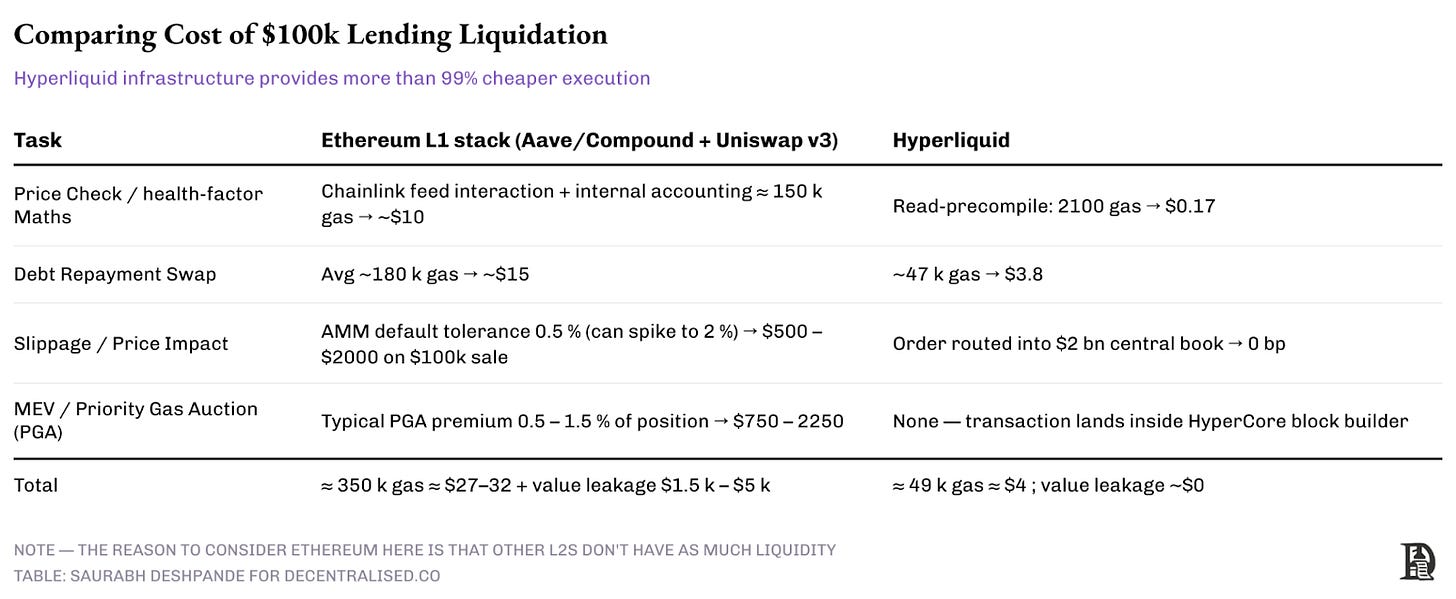

Traditional DeFi lending protocols are highly inefficient when managing collateral positions. On Ethereum-based platforms like Compound or Aave, liquidating a $100,000 USDC loan backed by $150,000 worth of ETH requires several costly operations:

-

Oracle price call consumes 80,000 gas ($10–30),

-

External DEX swap costs 150,000 gas ($15–50), and

-

Slippage loss due to AMM mechanics ranges from 0.5% to 2% ($500–$2,000),

-

Front-running liquidators extracting MEV add another ~1% value loss, typically resulting in total inefficiencies of $500–$3,000 per liquidation.

Hyperliquid’s precompile functionality eliminates these inefficiencies by directly integrating the orderbook. Lending smart contracts can use read precompiles to fetch prices directly from the HyperCore orderbook and send liquidation orders via write system contracts on HyperEVM. The same $100,000 liquidation scenario requires only 2,100 gas to fetch price data and 47,000 gas to execute. Compared to traditional Ethereum-based protocols, this drastically reduces costs and eliminates slippage by accessing over $2 billion in orderbook liquidity.

The result? Liquidating $100,000 via a lending app on Ethereum costs around $27 in gas plus MEV leakage (~$1,500), whereas on Hyperliquid it costs less than $5.

Protocolized Liquidations

Precompiles enable protocolized liquidations, where lending protocols implement automatic liquidation mechanisms similar to the perpetual system on HyperCore.

In traditional finance, when you fail to meet margin requirements, your broker immediately sells your stock at market price. It’s convenient and causes no value leakage because they have direct access to deep markets.

In most DeFi protocols, the process is more complex. When your loan goes underwater, the protocol must find someone willing to liquidate you, then hope they can sell your collateral across multiple exchanges without losing too much to slippage. It’s like having to sell your house through a series of middlemen instead of directly on the market.

Hyperliquid operates more like traditional finance. When your collateral drops too low, the smart contract sells it directly into a deep orderbook handling billions in daily volume. Your position is closed at a fair market price—no need to find someone to take on your loan or leak value.

This architecture improves capital efficiency at the protocol level. Traditional DeFi protocols maintain separate liquidity reserves and typically offer 75% loan-to-value (LTV) ratios due to execution risk. Lending protocols built on Hyperliquid can eliminate buffers and offer LTVs above 90%, since liquidations are executed with guaranteed deep liquidity. This allows users to deploy capital 20–25% more efficiently while maintaining the same risk profile. Ultimately, it forms a unified liquidity layer where every DeFi protocol gains institutional-grade execution with full transparency and composability.

Liquidity as Moat

Liquidity is the soul of financial applications. If your product is great but lacks liquidity, it’s not really a product. In traditional DeFi, liquidity is mostly zero-sum. DeFi is composable to some extent, but we haven’t truly unified liquidity. When one platform has liquidity, others lack it.

Blockchains like Ethereum face a problem: when Aave needs to liquidate a large position, it must split the order across multiple blocks (reducing gas efficiency) to pull liquidity from different platforms, or risk severe slippage. As noted earlier, Ethereum typically ends up paying around $1,000 to various intermediaries for a $100,000 liquidation. Because of this, projects are forced to integrate with multiple external DEXs—increasing complexity, gas costs, and execution risk—while still not guaranteeing optimal pricing.

On the surface, this seems like just a liquidity issue. But it spills over and consumes teams’ scarce resources. Poor execution ultimately harms the protocol. Founders end up spending precious time on non-core activities. If you're running a lending protocol, one of your core goals is growing loan volume. Sure, liquidating bad debt matters. But if there’s a better way to tap into a massive pool of liquidity, it means you don’t have to stress over finding the optimal way to unwind risky positions—you can spend time growing instead of maintaining.

New protocols often launch with minimal liquidity, creating a classic “chicken-and-egg” problem: traders avoid the platform due to poor execution, which in turn prevents liquidity providers from earning meaningful fees.

It’s often wise to look back at how traditional financial systems solved these issues. Stock exchanges in London, New York, and Mumbai eventually dominated because everyone traded there. There were no L2s fragmenting users or spreading liquidity back then. Network effects in finance are especially powerful because they compound: more participants mean better prices, which attract more participants, leading to even better prices.

Hyperliquid is tackling this by strengthening liquidity collaboration. Do you believe your app can bring liquidity and wants to benefit from it?

Hyperliquid’s builder code is a permissionless fee-sharing mechanism that allows DeFi developers to earn revenue from transactions executed through their applications. They aim to solve fragmentation by ensuring all apps tap into the same unified liquidity pool of over $2 billion. Hyperliquid is one of the most liquid exchanges not just in DeFi, but in crypto overall. All projects built on HyperEVM can easily leverage this liquidity.

Applications using builder codes don’t compete for liquidity—they contribute to and benefit from a shared liquidity layer. When users trade through any builder code app, they access the same deep orderbook as Hyperliquid’s core exchange. Whether it’s a mobile wallet, trading bot, or complex DeFi protocol, it applies.

This architecture means a newly launched lending protocol doesn’t need to bootstrap its own liquidity or integrate with multiple external decentralized exchanges (DEXs). Lending smart contracts can use precompiles to read prices directly from the HyperCore orderbook and send liquidation orders via write system contracts, instantly gaining access to institutional-grade liquidity depth. The protocol benefits from the same liquidity serving billions in daily volume—regardless of its age or size—ensuring efficient liquidations.

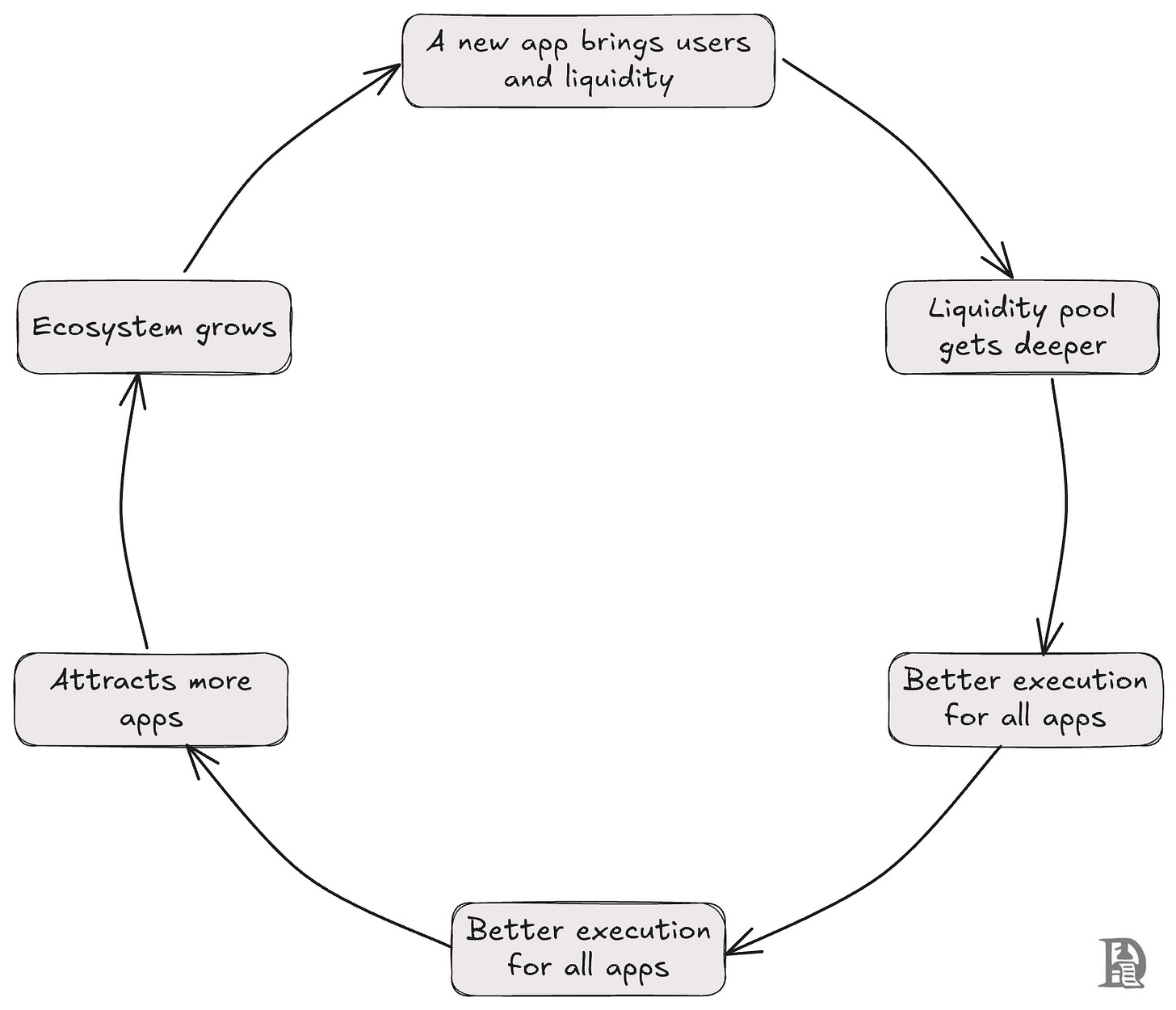

Builder Code Network Effects

In most DeFi ecosystems, new apps are like new restaurants opening on the same street. They compete for the same customer base, slicing up the existing pie. On Ethereum or Solana, when a new DEX launches, it must convince users and LPs to leave Uniswap or Raydium. It’s a zero-sum game: one app’s gain is another’s loss.

Builder codes completely invert this. Every new app on Hyperliquid actually strengthens the entire ecosystem—like adding a store to a shopping mall. When a new trading bot launches and brings 1,000 active users, those users increase trading volume in HyperCore’s liquidity pool (which all other apps use). More volume means better prices for everyone. Stronger execution for lending protocols means tighter spreads on derivatives platforms—even competing trading bots benefit from deeper liquidity.

This is positive-sum because when the shared infrastructure gets stronger, everyone wins. Instead of fighting over a fixed slice, each new participant contributes to a bigger pie for all.

Since liquidity is now accessible with just a few lines of code, the quality of the application becomes what truly matters.

This dynamic reverses the traditional fragmentation of DeFi liquidity. Protocols no longer launch with empty orderbooks or shallow AMM pools—they immediately inherit the execution quality of the entire Hyperliquid ecosystem. A derivatives trading app launching today can offer the same tight spreads and deep liquidity as mature protocols, eliminating typical entry barriers faced by incumbents.

The unified liquidity model also enables complex cross-protocol interactions previously impossible. Decentralized hedge funds can execute sophisticated multi-asset strategies across different builder code apps while maintaining consistent execution quality, since all trades settle on the same underlying orderbook.

This reminds me of how every factory used to be half power plant. Unable to transport electricity, factories had to generate it on-site. They installed steam engines, fed coal into boilers day and night, and ran intricate belts to massive overhead drive shafts. A significant portion of workers spent their days shoveling coal, tightening pulleys, and oiling bearings—work that only kept the lights on, not improving the quality of products on the assembly line.

Then came public AC grids and small electric motors. Factories could now buy kilowatt-hours like water. Maintenance crews shrunk; shop floors became flexible; management shifted focus from “keeping boiler pressure up” to “how can we double output?”

Builder codes work the same way. They free developers from the burden of sourcing and managing liquidity. They can now prioritize user experience and focus on building applications with exceptional UX.

HyperEVM Ecosystem

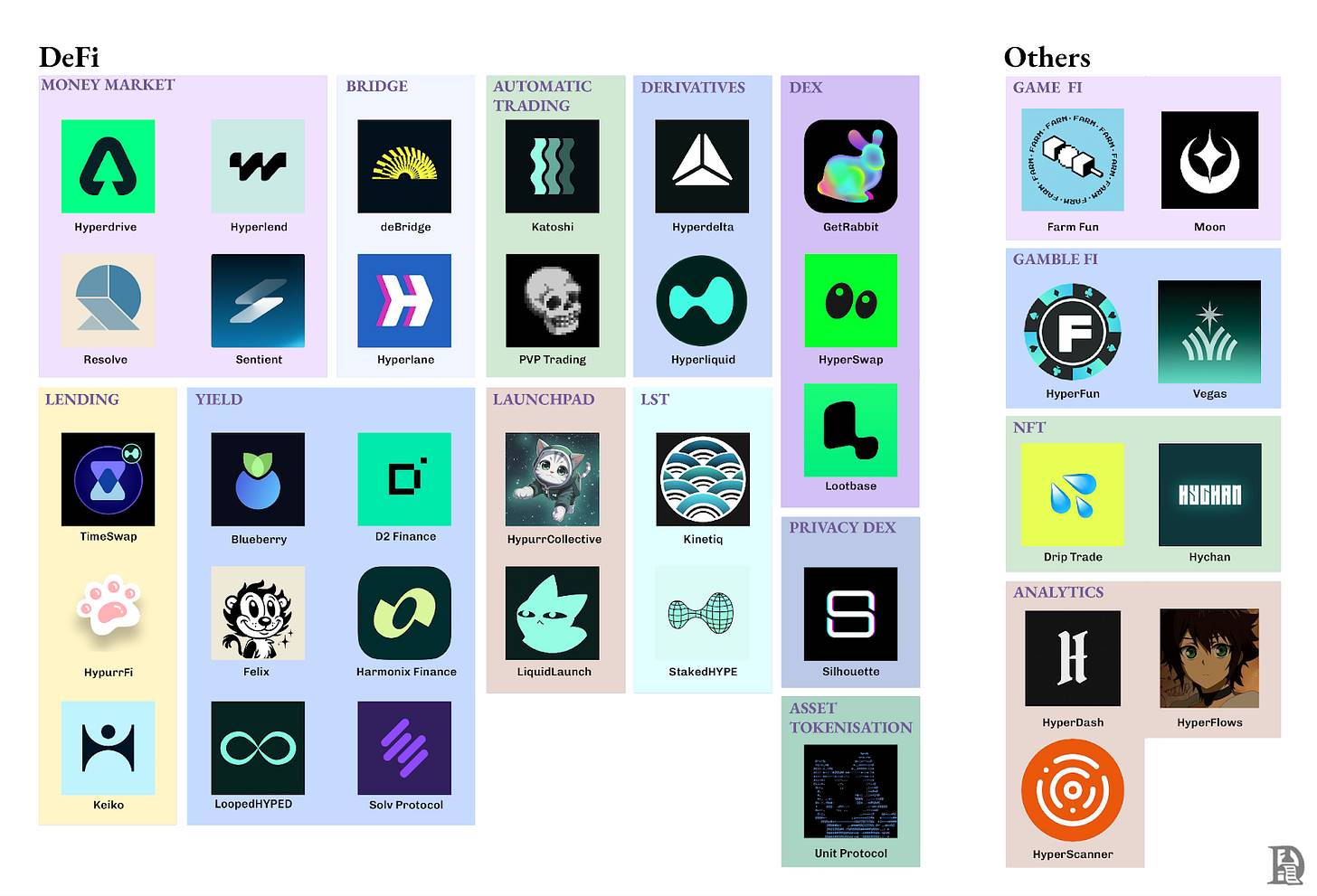

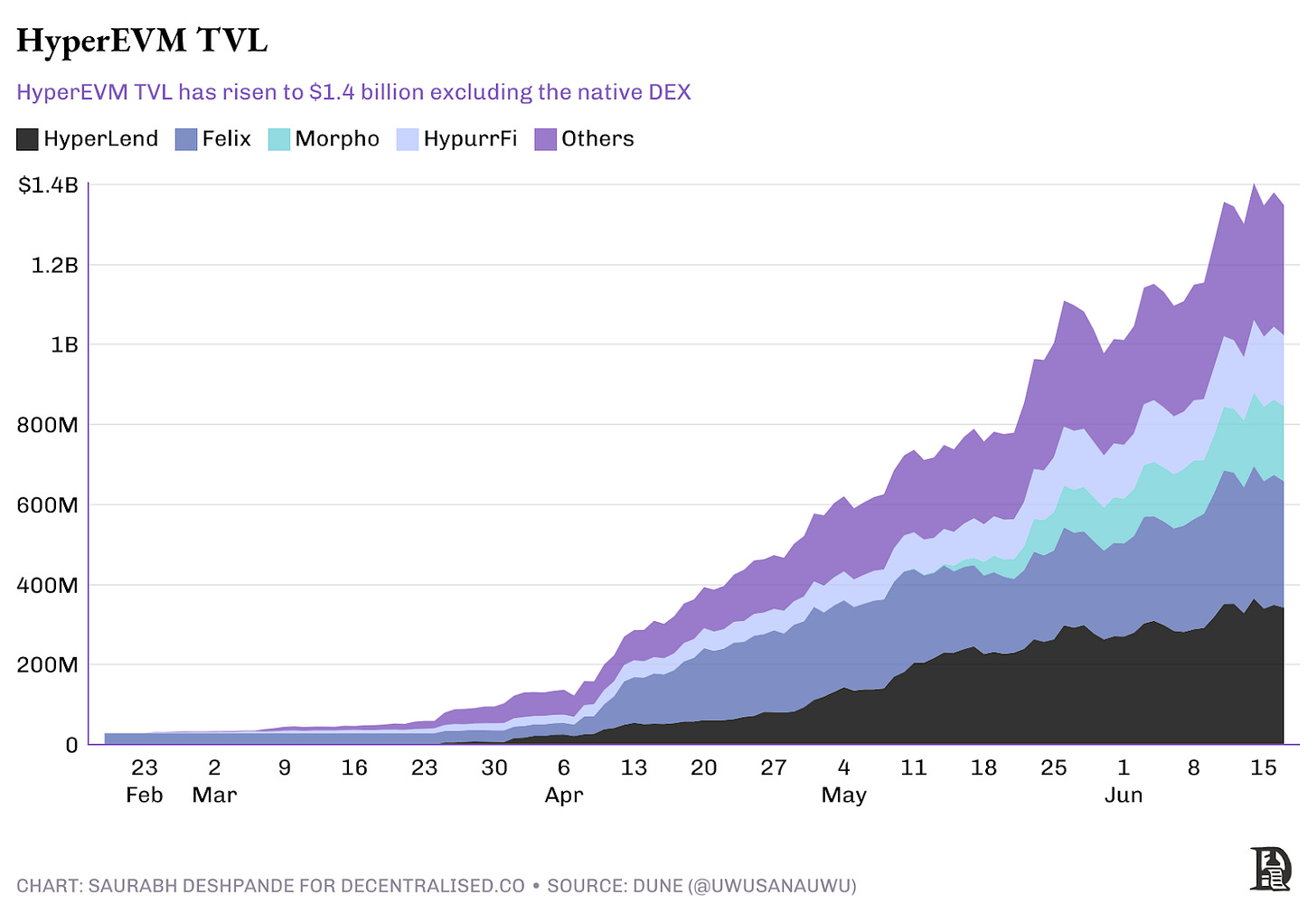

The HyperEVM ecosystem has rapidly grown into a comprehensive DeFi infrastructure, with over $1.5 billion in total value locked (TVL) across more than 100 projects. HyperEVM uses the same HyperBFT consensus as HyperCore, enabling direct interaction with spot and perpetual contracts via precompiles and system contracts. HyperEVM | Hyperliquid Docs. This unique architecture allows protocols to build complex financial apps leveraging native orderbook liquidity while maintaining full EVM compatibility.

Note—This map is not exhaustive.

Projects span from lending markets to liquid staking to synthetic assets. But they all benefit from the same unified liquidity layer. Applications across sectors are being built on Hyperliquid.

Lending and Money Markets:

-

HyperLend ($470M TVL)—The main lending protocol with direct access to orderbook liquidity for instant, efficient liquidations.

-

HypurrFi ($319M TVL)—A leveraged lending market and home of USDXL, a stablecoin backed by U.S. Treasuries.

-

Unit Protocol—A bridging layer bringing BTC, ETH, and SOL onto Hyperliquid as uBTC, uETH, etc.

-

Felix Protocol—A multi-collateral stablecoin (feUSD), reducing reliance on external stablecoins.

Exchanges:

-

HyperSwap and KittenSwap—AMM-based DEXs processing $75M in daily volume. Unlike major exchanges, they still need to bootstrap their own liquidity.

Liquid Staking:

-

StakedHYPE—Simple liquid staking where stHYPE automatically compounds rewards.

-

Kinetiq—An intelligent validator selection system that automatically delegates to top-performing validators.

-

LoopedHYPE—Automated leveraged staking with 3x to 15x leverage, offering potential APYs above 10%.

The ecosystem’s rapid growth shows that removing liquidity bootstrapping friction yields significant benefits. With protocols launching and enjoying immediate access to deep liquidity, HyperEVM’s total value locked (TVL) has steadily climbed to $1.5 billion.

What Does This Mean?

I believe Hyperliquid has four clear advantages.

First, obviously, instant access to deep liquidity with reduced execution risk. Launching on Hyperliquid means immediate access to a robust liquidity pool handling billions in daily volume. This eliminates the typical cold-start liquidity challenges that plague new protocols. Additionally, direct access to unified liquidity significantly reduces slippage and MEV extraction risks, ensuring smoother, safer transactions from day one.

Second, persistent fee sharing. Builder codes embed a permanent fee-sharing mechanism into every transaction, offering a sustainable economic model. This ensures protocols earn revenue proportional to the actual value they create, rather than relying on temporary incentives or unsustainable liquidity mining programs.

Third, focus on development. Developers are free to dedicate their energy and resources to building better products and optimizing user experience. They no longer need to spend significant time, money, or effort maintaining liquidity incentives, pool management, or negotiating with partners to sustain liquidity.

BasedApp exemplifies this. Instead of spending months building trading infrastructure from scratch, they focused on what users actually want: “holding, trading, and using crypto in the real world.” Their mobile app launched with full access to Hyperliquid’s liquidity for perpetual trading, combined with a mature Visa card infrastructure for real-world spending. As founder Edison Lim put it, they could focus on creating an “operating system for on-chain finance” instead of solving liquidity bootstrapping.

Finally, cross-protocol synergies. Every new protocol enhances the shared liquidity ecosystem, creating a virtuous cycle—increased activity attracts more participants, further deepening the liquidity pool. This interconnected approach generates lasting network effects that benefit all participants and ensure sustained ecosystem growth.

Most ecosystem building follows a familiar playbook: grant funding and hackathons. These have value, but they miss the root problem. The real friction isn’t lack of capital or ideas—it’s the constant battle for liquidity. Every nascent protocol must bribe its way into liquidity and then fight against mercenary capital when incentives dry up. Builder codes flip this burden entirely. Plug in, inherit a $2 billion orderbook, and earn a percentage of fees based on the traffic you generate. Teams like Lootbase can focus on product, not fragmented LP incentive schemes.

For developers, this creates a fundamentally different value proposition. On other chains, you might get a $50K grant to build a DEX, then spend six months convincing market makers to provide liquidity and burning cycles on incentive design. On Hyperliquid, you get instant access to over $2 billion in orderbook liquidity from day one. Your success depends on building a great product—not your ability to pitch VCs for liquidity mining grants.

Hyperliquid doesn’t offer traditional grants or accelerator programs. You won’t get hand-holding throughout development or guaranteed market support. Instead, you get the infrastructure needed to build apps that work from day one. If you create real value for users, builder codes ensure you earn a fair economic return.

Hyperliquid will face competition from new chains like MegaETH and Monad, which are launching soon with impressive technical specs. Whether these chains can match Hyperliquid’s shared liquidity and capital efficiency approach remains to be seen. Technical performance is table stakes today—economic design is what builds lasting value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News