IOSG: Insights and Reflections on the Consumer Applications Sector

TechFlow Selected TechFlow Selected

IOSG: Insights and Reflections on the Consumer Applications Sector

The consumer applications market is essentially an attention economy, turning the entire crypto market into a battleground of narratives and attention.

By Max Wong @IOSG

TL;DR

Infrastructure is nearing saturation; consumer applications are the next frontier. After years of pouring capital into new L1s, rollups, and developer tools, marginal technical gains have diminished, and users aren't flocking in just because "the tech is good." Value now lies in attention, not architecture.

Liquidity has stagnated, and retail participation remains low. Total stablecoin market cap is only about 25% higher than its 2021 all-time high, with recent growth primarily driven by institutions adding BTC/ETH to balance sheets—not speculative capital circulating within ecosystems.

Core Theses

-

Friendly regulatory policies will unlock a second wave of growth. Clearer U.S. policy (Trump administration, stablecoin legislation) expands TAM and attracts Web2 users who care about tangible applications—not underlying tech stacks.

-

The narrative market rewards real usage. Projects with significant revenue and product-market fit (PMF)—such as Hyperliquid (~$900M ARR), Pump.fun (~$500M ARR), Polymarket (~$12B volume)—outperform heavily funded but user-starved infrastructure plays like Berachain, SEI, and Story Protocol.

-

Web2 is fundamentally an attention economy (distribution > technology). As Web3 deeply integrates with Web2, so too will the market—B2C apps will expand the pie.

Current consumer sectors with PMF (crypto-native):

-

Trading / Perpetual futures (Hyperliquid, Axiom)

-

Launchpad / Meme coin factories (Pump.fun, BelieveApp)

-

InfoFi & prediction markets (Polymarket, Kaito)

Next wave sectors (Web2-coded):

-

All-in-one on/off ramps + DeFi super apps—integrating wallet, banking, yield, and trading (Robinhood-like experience without ads).

-

Entertainment/social platforms replacing ads with on-chain monetization (swaps, betting, prize pools, creator tokens), optimizing UX and improving creator payouts.

AI and gaming remain pre-PMF. Consumer AI needs safer account abstraction and better infrastructure; Web3 games suffer from "farmer" economies. Breakout will come only when a game focused on gameplay—not crypto mechanics—goes viral.

The Superchain thesis: Activity is consolidating around a few chains friendly to consumer apps (Solana, Hyperliquid, Monad, MegaETH). Investors should back killer apps on these chains and their supporting infrastructure.

Framework for investing in consumer apps:

-

Distribution and execution > pure tech (network effects, viral loops, brand).

-

UX, speed, liquidity, and narrative alignment determine winners.

-

Evaluate as businesses, not protocols: real revenue, scalable models, clear path to category dominance.

Bottom line: Pure infrastructure plays can no longer replicate 2021-style valuation multiples. Over the next five years, outsized returns will come from consumer apps that turn crypto's underpinnings into daily experiences for millions of Web2 users.

Introduction

For years, the industry has prioritized technology and infrastructure—building "rails": new Layer-1s, scaling solutions, dev tools, and security primitives. The driving belief was "tech is king"—if the tech is good enough, users will come. Reality disagrees. Look at projects like Berachain, SEI, and Story Protocol: absurd valuations, hyped as the "next big thing," yet lacking real traction.

This cycle, spotlight has shifted to consumer applications, raising the critical question: "What are these rails actually for?" With core infrastructure reaching sufficient maturity and diminishing marginal returns, talent and capital are pivoting toward consumer-facing products—social, gaming, creator tools, commerce—that show blockchain’s value to retail and everyday users. The consumer app market is inherently an attention economy, turning the entire crypto space into a battleground of narratives and mindshare.

This report explores:

1. Macro market context

2. Types of consumer applications in the market

a. Sectors with existing PMF

b. Sectors poised to reach PMF via crypto upgrades

3. A framework and investment thesis for consumer apps—how can institutions identify winners?

Narrative—Why Now?

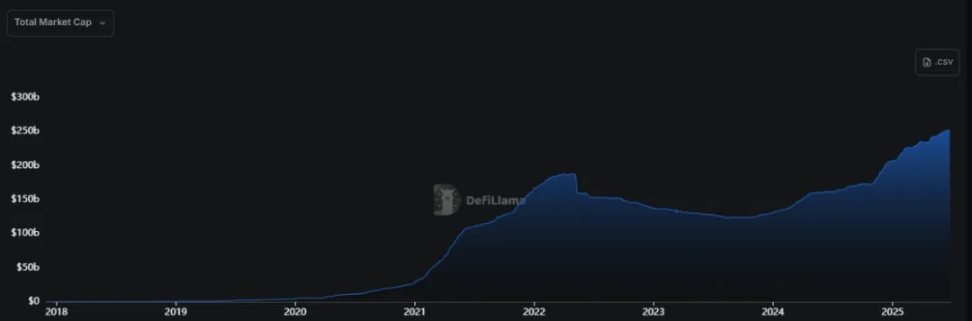

This cycle lacks the retail FOMO and NFT/altcoin mania of 2021. Tight macro conditions have constrained VC and institutional capital, leaving new liquidity growth in a state of "stagnation."

▲ Stablecoin Market Cap Trend

As shown above, stablecoin market cap grew ~5x between 2021–2022, but this cycle (H2 2023–2025) has seen only ~2x growth. At first glance, this appears steady and healthy—but it's misleading. Current market cap is only ~25% above the 2021 peak. Over a 4-year horizon, that’s extremely slow for any industry—especially given that stablecoins are now experiencing their clearest regulatory tailwinds and a pro-crypto president.

Capital inflows have slowed significantly, with most momentum only picking up after Trump’s election in January 2025. To date, new capital isn’t speculative or organic "fresh water." Instead, it comes from institutions adding BTC/ETH to balance sheets and enterprises expanding stablecoin payments. Liquidity flows stem from regulation—not market excitement over new products. This capital isn’t free-flowing or retail-driven. So even if prices hit new highs, the industry hasn’t reignited the 2021 frenzy.

This moment resembles post-.com bubble 2001—a search for the next growth vector. This time, that vector is consumer applications. Past growth was also consumer-driven, but the products were NFTs and altcoins, not applications.

Core Theses

Over the next five years, crypto will see a second wave of growth driven by Web2 users and retail

-

Clearer crypto policies under the Trump administration greenlight founders

-

Stablecoin legislation significantly expands TAM for all crypto applications

-

Past liquidity bottlenecks stemmed from unclear frameworks and isolated markets; now, clearer stablecoin rules improve liquidity

-

Positive political sentiment impacts consumer apps more than infrastructure, as they attract large numbers of Web2 users

-

Web2 users care only about interactive application layers and products that deliver direct value—they want Web3’s “Robinhood,” not a “crypto AWS”

-

Robinhood

-

Google/YouTube

-

Facebook

-

Instagram

-

Snapchat

-

ChatGPT

Market maturity → focus shifts to real users + revenue + PMF > infrastructure + tech

-

In the narrative market, capital flows to projects with real revenue and PMF—most are consumer apps with actual users

-

Hyperliquid

-

Pump.fun

-

Polymarket

-

Implication: Tech matters, but great tech alone doesn’t attract users—it must be productized. The easiest path? Consumer apps

-

Method: Unified, exceptional UX + value capture mechanisms attract users. Users don’t care if tech is slightly better unless they can *feel* it

-

Builders are shifting from 2019–2023’s “tech is king” to “user-first.” Chains attract developers based on real demand—not subsidies or tooling access

-

Analogy: Past markets paid devs to build Firefox extensions instead of gaining real users on Chrome

-

Counterexample: Cardano

Web2 has always been an attention economy (distribution > tech); as Web3 merges with Web2, so will the market—B2C apps will grow the total market

-

Viral spread and attention decide winners → consumer apps excel here

-

Network effects embed easily in consumer apps → e.g., Twitter integration with protocol rewards (Loudio, Kaito)

-

Hence, content creation becomes effortless → highly viral, mindshare-dominant

-

B2C apps generate buzz via user behavior, incentives, or community (Pump.fun vs Hyperliquid)

-

Virality drives attention → attention brings users → viral apps attract new retail and expand the market

Types of Consumer Applications in the Market

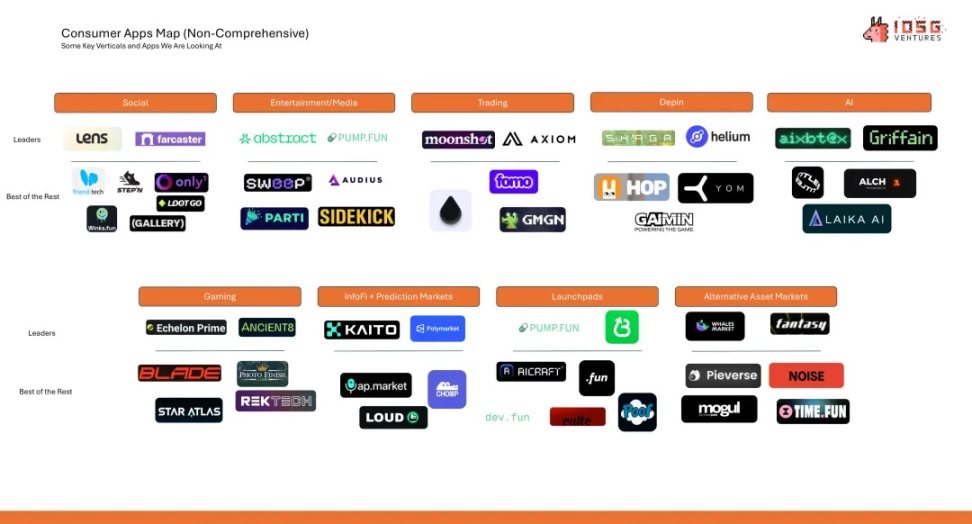

Sectors with PMF – Crypto-Coded

Trading

-

Hyperliquid: ~$900M ARR; $0 raised

-

Axiom: ~$120M ARR; $21M raised

Launchpad

-

Pump.fun: ~$500M ARR; $0 raised

-

BelieveApp: ~$60M annual fees; $0 raised

InfoFi + Prediction Markets

-

Polymarket: ~$12B annual volume (0% fee); $0 raised

-

Kaito: ~$33M ARR; $10.8M raised

These types of projects deserve close attention.

Contrast:

-

Berachain: Only $165K in fees since launch; $142M raised; down >85% from ATH

-

SEI: Only $68K in annualized fees; $95M raised; down >75%

-

Story Protocol: Only $24K in fees since launch; $134M raised; down 60%

Pure tech / infrastructure without real use cases is no longer a viable path. Institutions can no longer rely on such assets to replicate 2021-style outsized returns.

Most platforms in these categories lean Web3-native, fitting their crypto functionality. But traditional consumer sectors (see below) are being disrupted by crypto rails and moving mainstream.

Sectors Poised to Reach PMF via Crypto Upgrades – Web2-Coded

Web2⇄Web3 On/Off Ramps + DeFi Frontends

As Web2 users continue entering Web3, it’s time for one or two dominant solutions for seamless on/off ramps and DeFi access. Today’s market is fragmented and clunky.

Pain Points

-

Two-step onboarding: 75–80% of first-time buyers still purchase on centralized exchanges (Binance, Coinbase), then transfer to self-custody wallets or DeFi protocols—resulting in double KYC, double fee structures, and at least one cross-chain bridge.

-

Withdrawal friction: U.S.-licensed CEXs can freeze fiat withdrawals for 24–72 hours; EU banks increasingly flag outbound SEPA transfers as "high risk."

-

High fees: Onramp spreads range from ~0.8% (ACH) to 4–5% (credit card); stablecoin withdrawal fees vary from 0.1% to 7% depending on region and volume.

-

No aggregated yield solution: No one-stop DeFi module exists for users to consolidate yield strategies.

Payment Giants Are Moving In

-

PayPal now allows U.S. users to withdraw PYUSD directly to Ethereum and Solana, and back to any debit card in <30 seconds (fees: 0.4–1%).

-

Stripe opened its “crypto payout” API to all platforms in April 2025, enabling instant USDC withdrawals to local channels in 45 countries.

-

MoonPay processed $18.6B in transaction volume for 14M users last year, achieving 123% YoY growth thanks to instant off-ramp services covering 160+ countries.

PMF Blueprint

A global super app offering seamless on/off ramps, clean UI, and full DeFi access in one platform.

-

Single account holding funds, seamlessly linking bank accounts and crypto wallets

-

KYC only for larger transactions

-

No high fees or withdrawal delays

-

Like a savings account but denominated in crypto

-

Yield aggregator integrated with major lending protocols (Aave, Kamino, Morpho) and staking

-

Covers major spot/perp trading interfaces

Currently, Robinhood comes closest to this north star: minimalist UI/UX with integrated banking and wallet—potentially the frontrunner in this space.

Entertainment / Media / Social

Today’s content platforms (YouTube, Twitch, Facebook) monetize by capturing user attention and selling ads. But this funnel is inherently inefficient, losing potential value at multiple stages. Worse, display ads are intrusive by design, degrading UX.

Crypto can completely restructure and optimize traditional Web2 entertainment platforms.

Platform-Level Unlock

-

New monetization avenues

-

DEX integration → swap fees

-

Creator-linked tokens

-

Live event betting

-

Prize pools

-

User airdrops

-

Ad-free experience → improved retention

-

No reliance on external stakeholders

-

New creator revenue splits

-

Swap fee sharing

-

Event fee sharing

In this new paradigm, the platform becomes a distribution channel, not a monetization product. Web2 precedents exist: Twitch → Amazon, Kick → Stake, Twitter → subscriptions + GrokAI. Web3 prototypes are emerging—e.g., Parti and Pump.fun livestreams.

User-Level Unlock

-

Ad-free = better UX

-

Earn via prize pools and airdrops by supporting/watching favorite creators

-

Token dividends

Creator-Level Unlock

-

Contribution-based earnings; more transparent and fair

-

Swap fee sharing

-

Event fee sharing

-

Creator tokens enable direct fan-to-creator value flow

-

Ad-free improves retention

-

Growth is built into the model—creators benefit organically

Why Not AI or Gaming?

Consumer AI apps are still early. They need true "one-click DeFi/account management" experiences to go mainstream—current security and infrastructure aren’t ready.

For gaming, most chain-based games fail to break through because core users are "farmers" chasing profit, not gameplay—leading to poor retention. Future breakout may come from games using crypto economically (e.g., items, economy) under the hood, while players and developers focus purely on fun—like if CSGO had used on-chain economics, it might’ve thrived.

That said, smaller games leveraging crypto mechanics have seen some success (Freysa, DFK, Axie).

Thesis and Framework

Overall view: Market maturation → reduced chain fragmentation → a few "superchains" win → institutions should bet on next-gen consumer apps on these chains and their supporting infrastructure.

This trend is already underway—activity is concentrating on a few chains, not scattered across 100+ L2s.

Here, "superchains" refer to consumer-centric chains optimized for speed and UX—e.g., Solana, Hyperliquid, Monad, MegaETH.

Analogy:

-

Superchains: iOS, Android

-

Apps: Instagram, Cash App, Robinhood

-

Support stack: AWS, Azure, Google Cloud

As noted, consumer apps fall into two key categories:

-

Web2-native: Apps that first attract Web2 users by unlocking new behaviors via crypto—focus on products that integrate crypto seamlessly in the backend but don’t market themselves as "crypto apps" (e.g., Polymarket).

-

Web3-native: Success hinges on superior UX + blazing-fast interface + deep liquidity + all-in-one solution (breaking fragmentation). Next-gen Web3 users prioritize UX > yield or tech—only beyond a threshold do the latter two matter. Teams that understand this deserve valuation premiums.

Common requirements include:

Conclusion

Consumer investments don’t need radical differentiation (though it helps). Snapchat wasn’t a tech revolution—it repackaged existing modules (chat, camera AIO) into a new experience. Thus, evaluating consumer apps through an infrastructure lens is flawed. Institutions should ask: Can this become a strong business that ultimately generates returns for the fund?

To assess this, consider:

-

Distribution beats product—can they reach users?

-

Do they effectively recombine existing pieces into a novel experience?

Funds can no longer rely on pure infrastructure for returns. Infrastructure isn’t irrelevant—but in a narrative-driven market, it must have real appeal and use cases, not abstract value propositions nobody cares about. Overall, most investors are overly "right-biased" on consumer bets—too literal in applying "first principles." True winners often succeed through superior branding and UX—intangible but critical traits.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News