Analyzing Hyperliquid and the CEX Derivatives Landscape: A Paradise and a Fence for Extreme Traders

TechFlow Selected TechFlow Selected

Analyzing Hyperliquid and the CEX Derivatives Landscape: A Paradise and a Fence for Extreme Traders

Who is taming desire? Who is unleashing fluctuations? Who is returning to humanity?

Author: danny

Navigating the landscape of crypto derivatives: Why does Hyperliquid enable massive trades while centralized exchanges impose stricter limits? The conflict between freedom and order has never been merely about regulation versus technology—it's fundamentally a question of value reversion in trading systems.

Overview

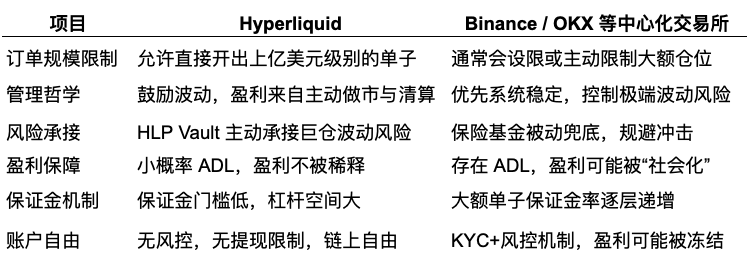

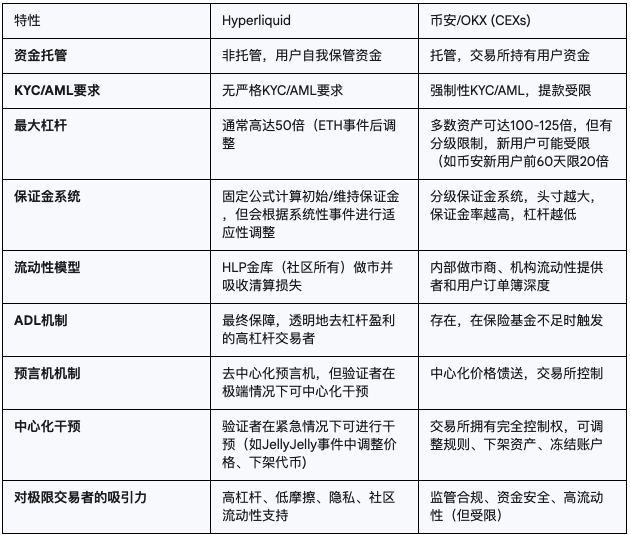

Frequent extreme trading (i.e., "ultra-high leverage + massive positions") on the decentralized platform Hyperliquid is no accident. It stems from an underlying design philosophy and mechanism inherently suited to high-risk, high-flexibility trading styles. For traders pursuing "small capital, big returns" strategies, Hyperliquid offers six key advantages:

Hyperliquid functions more like an arena for extreme traders—a system engineered to allow extreme risk exposure, support high-frequency trading strategies, and protect user rights through non-custodial fund structures. In contrast, Binance and OKX act more like “gatekeepers of the financial system,” prioritizing stability and compliance at the cost of constraining individual extreme strategies.

Neither approach is absolutely superior; they simply represent different choices based on risk appetite and strategic preferences.

Feature Comparison Overview

For detailed background and mechanics of Hyperliquid, refer to this article:

https://x.com/agintender/status/1938445355118649745

This article begins with the HLP Vault—the core mechanism—to explore Hyperliquid’s so-called “naturally whale-friendly” architecture.

The (Un)eventful Main Text Begins

1. Liquidity Model: How the Hyperliquid HLP Vault Works

The Hyperliquid HLP (Hyperliquid Liquidity Provider) Vault is a core component enabling the platform to efficiently operate as both market maker and liquidator. The HLP Vault is not just a passive liquidity pool—it actively participates in market making and liquidations. Its rapid growth to over $500 million in TVL demonstrates success in attracting capital, directly translating into the deep liquidity required for large-scale trading. Moreover, its risk-adjusted performance is strong, with a Sharpe ratio of 2.89 (compared to Bitcoin’s 1.80), and it shows a -9.6% negative correlation with Bitcoin.

A critical feature of the HLP is its role in absorbing losses during major liquidation events. This supports extreme traders taking massive positions by providing a buffer against potential losses that might otherwise ripple through the market. The “democratized” nature of the HLP implies a broader and potentially more resilient base of liquidity providers, contrasting sharply with platforms relying on only a few large institutional market makers.

Market Maker & Liquidator Role vs. Insurance Fund

The HLP Vault acts as the default market maker on the platform. This means it continuously provides bid and ask quotes, supplying liquidity across all trading pairs. When users trade, a significant portion of their orders are matched directly against the HLP Vault.

Beyond market making, the HLP Vault plays a crucial role in the liquidation process. When a trader’s margin becomes insufficient to maintain their position, the HLP Vault steps in to liquidate those positions, preventing bad debt accumulation and ensuring platform stability.

CEXs rely on centralized insurance funds to cover losses from under-collateralized liquidations. While these funds are often substantial, their capacity is finite. During periods of extreme volatility, widespread liquidations may exceed the insurance fund’s ability to absorb losses, forcing CEXs to trigger ADL (Auto-Deleveraging) or other emergency measures.

The limited capacity of insurance funds restricts how much a single or multiple large blow-ups an exchange can withstand. If a massive position collapse generates losses beyond the fund’s coverage—even with insurance—it may still be insufficient.

When a mega-position held by an extreme trader blows up, it can severely strain a CEX’s insurance fund, potentially triggering ADL—resulting in profitable positions being forcibly closed and possibly eroding trust among other traders.

Community Ownership and Profit Distribution

A unique aspect of the HLP Vault is its community ownership. Users can stake USDC to mint HLP tokens, thereby becoming owners of the vault. This means profits generated by the vault are distributed directly to HLP token holders.

Profits come primarily from three sources:

-

Trading fees: The HLP Vault earns fees from trades matched against it.

-

Funding rates: As a market maker, the HLP Vault collects or pays funding rates depending on market conditions. When perpetual contracts trade at a premium (above spot price), the HLP collects funding; when at a discount, it pays.

-

Liquidation fees: The HLP Vault earns fees when it liquidates positions.

These profits are regularly distributed to HLP token holders (typically weekly), or used to buy back Hyperliquid tokens (executed every 10 minutes).

Distributed Risk to Support Large Positions

The HLP Vault manages and supports large positions through several risk-distribution mechanisms:

-

Diversified liquidity providers: The HLP Vault is composed of numerous independent stakers rather than a single entity. This decentralized structure spreads risk across many participants, reducing the impact of any one party failing.

-

Automated hedging and rebalancing: The HLP Vault’s algorithm continuously monitors the market and automatically adjusts its hedging strategy to manage risk exposure. For example, if the vault accumulates a large directional position, it may hedge externally or adjust its quotes to reduce exposure.

-

Smart risk management: The HLP Vault is designed to absorb large orders and effectively manage associated risks through internal hedging and liquidation mechanisms. This allows Hyperliquid to support individual positions larger than those typically allowed on many centralized exchanges (CEXs).

The HLP Vault is one of Hyperliquid’s core mechanisms. Arguably, even its Oracle price design (updated every 3 seconds), funding rate algorithm, and leverage limits are all built around the HLP. These are not isolated components but interconnected parts of a cohesive system. The funding rate algorithm gives the HLP a structural edge, while the Oracle price builds confidence among HLP participants—fueling continuous growth of the vault, enabling it to absorb larger positions and withstand higher volatility.

2. House Edge: Hyperliquid’s Funding Rate Algorithm

Hyperliquid’s funding rate algorithm aims to tightly anchor perpetual contract prices to the underlying asset’s spot price. Beyond offering traders predictable funding costs, it also grants the HLP a structural “house edge.”

Components

The funding rate consists of two parts:

-

Average Premium Index: Reflects the deviation between the perpetual contract’s market price and the oracle’s spot price. A positive index indicates the perpetual trades above the oracle price; negative indicates below.

-

Interest Rate: A fixed base rate, typically set to offset financing costs of holding contracts. Hyperliquid usually sets this at 0.3%, higher than Binance’s standard.

Oracle-Based Pricing Characteristics

Hyperliquid calculates funding rates based on oracle prices—not its internal spot price. This ensures funding rates reflect fair external market values, preventing distortions due to internal manipulation. This feature significantly boosts confidence among HLP participants, encouraging more capital inflow into the vault (since Hyperliquid itself “can’t” manipulate the price).

High-Frequency Collection and Extreme Rates

-

High-frequency collection: Hyperliquid charges funding once every 8 hours (1/8th per hour). This frequent adjustment allows faster response to market changes and encourages quicker convergence of perpetual prices to spot.

-

Extreme rates: Hyperliquid allows funding rates as high as 4% per hour. This high cap enables rapid correction of price deviations during volatile markets.

Risk Cost Expectation and Price Reversion Mechanism for Large Positions

Together, these features create a predictable risk environment and price reversion mechanism for large positions:

-

Predictable risk cost: Although funding rates fluctuate, the algorithm is transparent and based on observable oracle prices. Traders can reasonably forecast the potential funding cost of holding large positions. Extreme traders can factor in high funding costs upfront, allowing better risk management.

-

Fast market price reversion: The combination of frequent adjustments and extreme caps means that when perpetual prices deviate significantly from oracle prices, funding rates quickly rise (or fall), strongly incentivizing traders to align their positions with market consensus. This pulls prices back toward spot levels, preventing sustained decoupling. For large positions, this is crucial—it ensures a powerful self-correcting mechanism even during extreme deviations (reducing pressure on HLP’s holdings).

3. Capital Efficiency: Comparing Margin Requirements on Hyperliquid Contracts

There is a stark difference between Hyperliquid and centralized exchanges like Binance and OKX regarding initial and maintenance margin requirements for large Bitcoin perpetual contracts. This divergence arises because the existence of the HLP makes the platform more tolerant of volatility.

Hyperliquid’s Margin Requirements

Hyperliquid uses fixed and relatively flat margin requirements, applying the same rate (e.g., 1% initial, 0.5% maintenance) across all position sizes. Even extremely large positions qualify for these low margin rates.

Binance and OKX Tiered Margin Systems

Both Binance and OKX use tiered margin systems, where larger positions require progressively higher initial and maintenance margins. The logic is simple: bigger positions pose greater risk and thus need more collateral to cover potential losses. For instance, a $10 million BTC contract might allow 20x leverage, but a $100 million contract could be capped at 5x or lower.

This system protects the exchange itself. A giant position blowing up could exceed the insurance fund’s capacity, threatening platform stability. By limiting leverage on large positions, CEXs reduce single-point risk.

This directly limits extreme traders’ ability to build massive positions on CEXs. They must either commit more capital as margin or split positions across multiple accounts or platforms—increasing operational complexity.

Take Bitcoin perpetuals as an example:

-

Binance: May offer up to 125x leverage (0.8% initial margin) for small positions. But as notional value increases, available leverage decreases—meaning margin requirements rise. For example, positions above a certain threshold may be limited to 50x (2% margin) or less.

-

OKX: Similar to Binance, OKX has detailed tiered risk limits. Bitcoin perpetual leverage decreases with increasing notional value, starting from a maximum of 100x and stepping down. The larger your BTC contract value, the higher your required margin.

Evaluating Whether Hyperliquid Offers Lower Margin Thresholds

Hyperliquid offers relatively lower margin thresholds for large positions at specific leverage levels.

-

Small positions: Hyperliquid’s margin rates may be comparable to the highest-leverage tiers on CEXs (lowest margin rates).

-

Large positions: Due to tiered systems, Binance and OKX significantly increase margin requirements once positions cross certain thresholds. Hyperliquid maintains low, fixed rates, enabling extreme traders to build enormous positions with relatively low capital outlay.

Illustrative example:

Suppose you want to open a $100 million long position in Bitcoin perpetuals.

-

On Binance or OKX, due to tiered margins, you might not access 100x or even 50x leverage. You may be restricted to 10x or 20x, requiring $10 million or $5 million in initial margin.

-

On Hyperliquid, with a uniform 1% margin rate, you’d only need $1 million in initial margin.

Therefore, for traders aiming to build massive positions, Hyperliquid’s low and consistent margin requirements constitute a clear advantage.

4. Profit Withdrawals: Investigating Hyperliquid’s Withdrawal Policies

Non-Custodial Platform Nature

Hyperliquid is a non-custodial platform. This means users retain significant control over their funds, which are stored directly in their EVM-compatible wallets. The platform does not hold custody of users' crypto assets.

Withdrawal Limits and Profit Blocking

Due to its non-custodial nature, Hyperliquid does not impose withdrawal limits or profit-withdrawal blocks like centralized exchanges (CEXs).

-

No daily withdrawal limits: Users can withdraw all or part of their funds anytime, subject only to blockchain network conditions. There are no daily or per-transaction caps imposed by CEXs for compliance, risk management, or internal liquidity purposes.

-

No profit withdrawal blocking: Hyperliquid does not restrict withdrawals based on profitability. Whether in profit or loss, users have absolute control over their funds.

For compliance (AML/KYC), risk control, and internal liquidity management, CEXs typically enforce daily or per-transaction withdrawal limits. In some cases, especially after massive profits, withdrawals may face additional scrutiny or delays. These restrictions reflect the custodial power CEXs hold over user funds—they must ensure sufficient reserves, meet regulatory standards, and prevent illicit flows.

For traders like James Wynn who wish to swiftly withdraw huge profits or flexibly move large sums, CEX withdrawal limits present a serious obstacle. They cannot freely control their capital as they can on Hyperliquid. Hyperliquid’s non-custodial model avoids these issues, offering greater financial freedom—at least on the surface.

5. Profit Protection: Hyperliquid’s Liquidation Mechanism vs. Auto-Deleveraging (ADL)

Hyperliquid’s Liquidation Mechanism

Hyperliquid triggers liquidations based on margin ratios. When a trader’s maintenance margin ratio falls below a threshold (typically 0.5%), their position is marked for liquidation. The HLP Vault acts as the liquidator, taking over and closing these positions to prevent bad debt. Thus, the stronger the HLP Vault’s funding, the lower the probability of ADL being triggered.

Both Binance and OKX include Auto-Deleveraging (ADL). When the insurance fund cannot cover liquidation losses, ADL forcibly closes profitable traders’ positions based on profit size and leverage. ADL serves as the final defense for CEXs during extreme market conditions, protecting the platform and maintaining market order by redistributing some losses to profitable traders, avoiding insolvency or systemic risk.

For extreme traders holding massive profitable positions, ADL introduces significant uncertainty. Even if they correctly predict market direction and achieve huge unrealized gains, they may still be forced to close their winning positions due to others’ losses—eroding potential profits. This unpredictability is highly undesirable for extreme traders.

Hyperliquid’s Approach to Profitable Positions

The key difference between Hyperliquid and CEXs lies in its lack of ADL. This means:

-

Profitable positions are safe: Even during extreme volatility and mass liquidations, profitable traders do not face automatic position reductions. This offers greater certainty and security, ensuring profits aren't used to cover others’ losses.

-

HLP Vault absorbs losses: If liquidations result in bad debt, those losses are borne by the HLP Vault—not passed on to profitable traders via ADL. This is made possible by the HLP Vault’s robust liquidity and risk management.

This distinction makes Hyperliquid far more favorable to profitable positions during extreme market moves, allowing extreme traders to hold large winning positions with greater peace of mind.

6. How the HLP Vault and Funding Rate Algorithm Work Together to Attract Extreme Traders

The unique designs of the HLP Vault and funding rate algorithm synergize to attract and support extreme traders like James Wynn in executing massive trades. Key aspects include:

1. (Near) Infinite Liquidity and Depth (HLP Vault):

-

Large Order Absorption: As the primary market maker, the HLP Vault’s vast capital pool and automated market-making algorithms provide exceptional depth, capable of absorbing ultra-large orders. For traders like James Wynn who aim to establish tens or even hundreds of millions in a single trade, this is essential. Traditional CEXs would likely suffer severe slippage or fail to fully execute such a single large order.

-

Low-Slippage Trading: With the HLP Vault consistently supplying liquidity, even large trades experience minimal slippage, ensuring execution near optimal market prices—critical for high-frequency and extreme trading.

2. Predictable Risk Costs and Market Calibration (Funding Rates):

-

Structural edge for HLP: The algorithm’s design attracts more investors to deposit capital into the HLP Vault, increasing liquidity and fee earnings—creating a flywheel effect.

-

Clear funding cost expectations: The transparency and high-frequency collection of funding rates allow traders to accurately estimate the cost of holding large positions. While funding may be high, it’s transparent and calculable—enabling traders to incorporate it into their risk models. For extreme traders, this eliminates blind risk-taking.

-

Price anchoring and arbitrage opportunities: The presence and high cap of funding rates ensure perpetual prices quickly revert to spot. This creates strong self-correcting dynamics even during large deviations, offering arbitrage opportunities. Extreme traders can exploit spot-perpetual spreads, earning returns by bearing funding costs or rapidly entering positions expecting price convergence.

3. Capital Security and Freedom (Non-Custodial & No ADL):

-

Full capital control: Hyperliquid’s non-custodial setup ensures traders like James retain full control over their massive funds, able to withdraw anytime without fear of platform restrictions or potential freezes. Amid frequent reports of withdrawal issues or fund locks on centralized platforms, this offers immense psychological reassurance.

-

Profits remain secure (No ADL): Without ADL, even during market chaos and mass liquidations, James’s profitable positions won’t be auto-closed. This allows extreme traders to confidently hold winning positions, knowing their gains won’t be sacrificed to cover others’ losses—maximizing protection of potential returns.

In summary, the HLP Vault delivers unmatched liquidity and depth, while the funding rate algorithm provides transparent, effective risk cost management and market calibration. Combined with non-custodial control and the absence of ADL, these elements create a unique trading environment tailored to extreme traders like James Wynn—those seeking high leverage, massive positions, and uncompromised capital safety and profit integrity.

Final Thoughts

Hyperliquid’s rise signals an evolving market. High-performance (real yield) decentralized exchanges, despite containing some centralized elements in practice, are carving out a significant niche by offering functionalities that traditional CEXs either restrict or cannot provide—such as high leverage, low friction, and community-driven liquidity.

This suggests future derivative trading may become increasingly fragmented and specialized, with different platforms catering to diverse trader needs, risk appetites, and tolerance for decentralization.

There is no right or wrong, superior or inferior—only different choices shaped by risk preference and strategy style.

The path of leverage. The destination of contracts.

Who tames desire? Who unleashes volatility? Who returns to human nature?

May we always retain a sense of reverence for the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News