Eyen surges 77% in a day, HYPE emerges as new player in "tokenized stocks" arena

TechFlow Selected TechFlow Selected

Eyen surges 77% in a day, HYPE emerges as new player in "tokenized stocks" arena

US stock eye care company transforms into DeFi project, a capital rebirth experiment around HYPE.

By BUBBLE, BlockBeats

On June 17, digital eye care technology company Eyenovia (ticker: EYEN) announced it had signed a securities purchase agreement to raise $50 million via a PIPE (Private Investment in Public Equity) from institutional accredited investors. The funds will be used to establish its first cryptocurrency reserve program targeting Hyperliquid's native token, HYPE—an investment amount even exceeding the company’s $20 million market cap at the time.

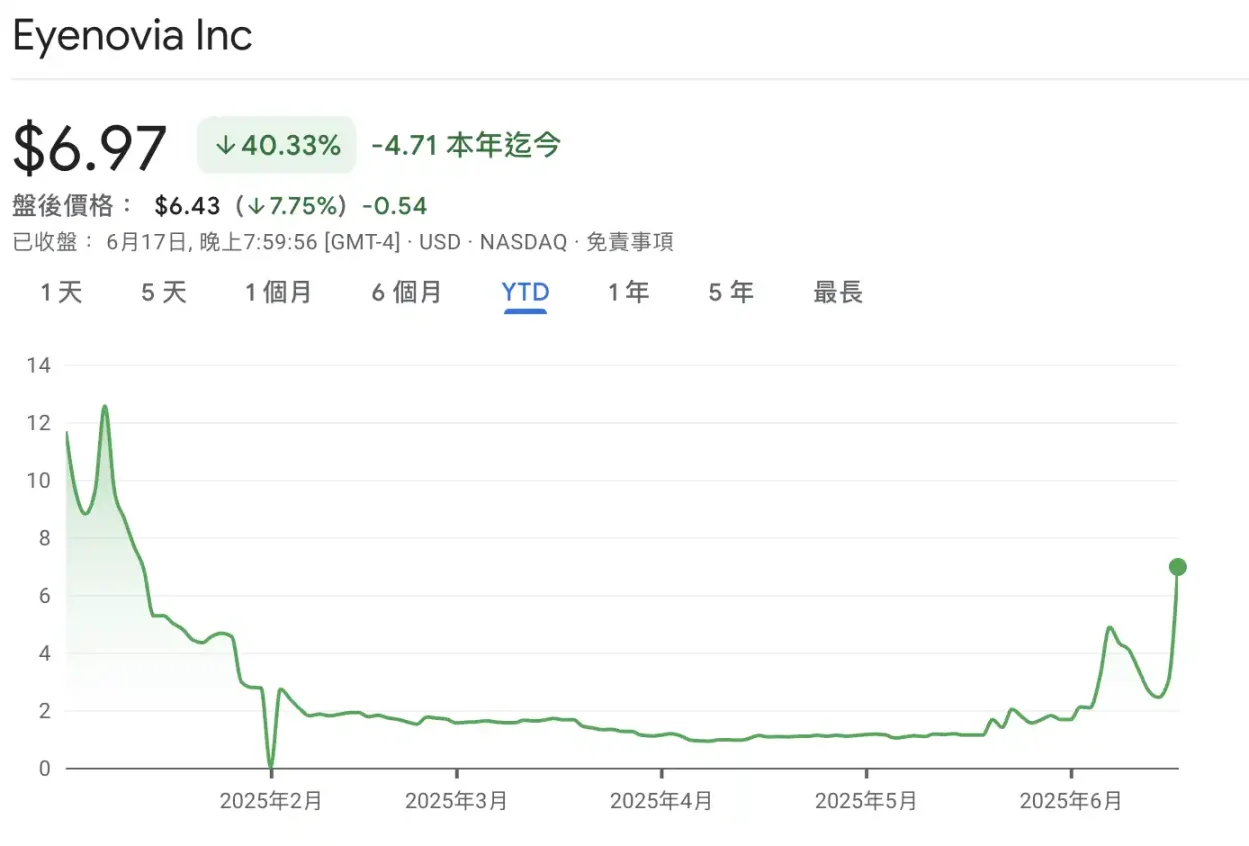

On June 23, Eyenovia announced the successful completion of its previously disclosed $50 million PIPE transaction and confirmed it had purchased 1,040,584.5 $HYPE tokens at an average price of approximately $34 per token. As part of this strategy, the company also plans to launch and operate its own network validator node alongside ecosystem partners, supporting the activity of the Hyperliquid blockchain and laying the foundation for future staking yields on HYPE. Following the news, Eyenovia's stock surged 77% intraday and rose 181% over the past five days, bringing its market capitalization to $26 million.

Eyenovia Chief Investment Officer Hyunsu Jung added: "The steps we are taking aim to provide both retail and institutional investors with a securely custodied channel to access HYPE and its native yield. Our successful acquisition of an initial HYPE position also establishes a foundation for deeper participation in the Hyperliquid ecosystem."

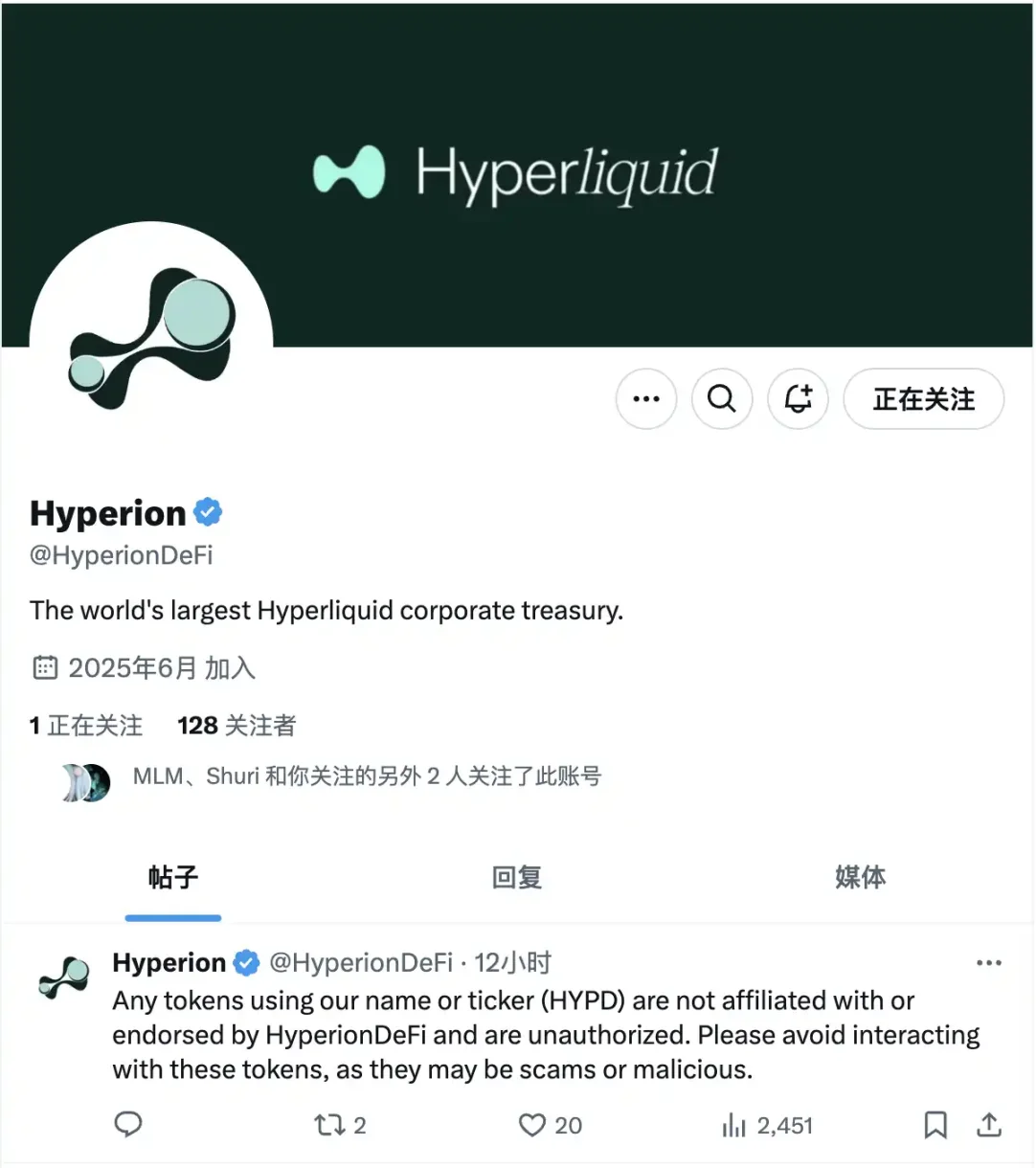

To execute this strategic transformation, the company simultaneously appointed Hyunsu Jung as its new Chief Investment Officer (CIO) and board member. Upon board approval expected in the coming days, the company is anticipated to rebrand as "Hyperion DeFi," with its ticker symbol changing to "HYPD." But what exactly is Eyenovia—the first U.S.-listed public company to adopt a "MicroStrategy-style" plan using a token on a decentralized exchange—and who is Hyunsu Jung? And as more companies increasingly leverage crypto tokens for corporate reinvention, is $HYPE truly the optimal choice?

Near Delisting: Eyenovia’s Lifeline

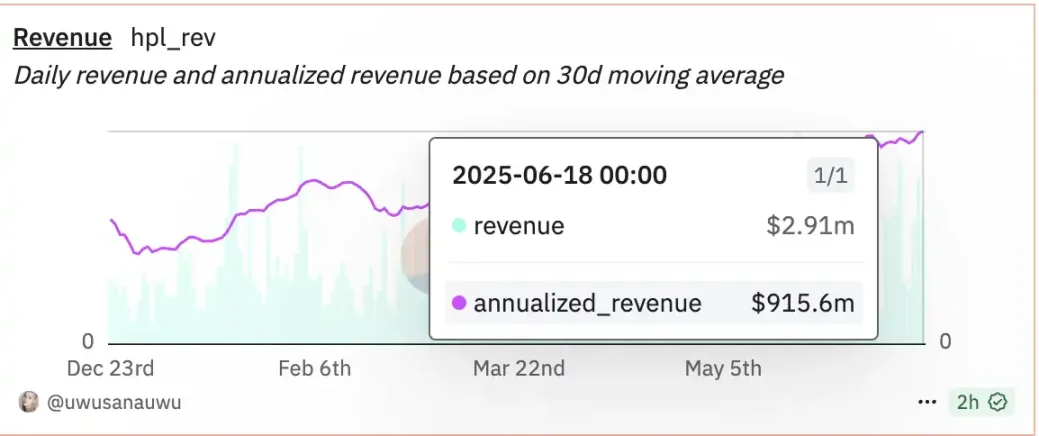

With Hyperliquid’s recent surge in activity, its mainnet TVL has climbed into the top 10 among blockchains, while $HYPE’s market cap has reached 11th place across all cryptocurrencies. Participation continues to grow, with daily platform fees consistently ranging between $2–3 million, and annualized revenue approaching $100 million.

In contrast, Eyenovia—the other party in this partnership—has not fared so well. Since going public in February 2018 at $800 per share, its price plummeted to a low of $1 by April 2025. Eyenovia is primarily an ophthalmic company centered around a device-driven micro-dosing drug delivery platform, focusing on applications such as pupil dilation, post-operative inflammation reduction, and pediatric myopia treatment.

Eyenovia’s flagship product Optejet

The company reported only $56,000 in total revenue for 2024, with a net loss of $50 million and liabilities exceeding $10 million. With cash flow dried up and multiple product trials failing, Eyenovia was on the brink of delisting. However, the HYPE reserve strategy offered a lifeline—sparking a single-day stock surge of 134% following the announcement.

The Crypto Executive Who Dropped In: Hyunsu Jung

Prior to this move, Eyenovia had no known ties to blockchain or related industries, making the appointment of its new CIO—reportedly awarded 500,000 shares of common stock as incentive—all the more notable. Public records show that Hyunsu Jung previously served as a senior consultant at EY-Parthenon and held roles as an investment analyst at GoldenTree Asset Management and an asset management analyst in New York City.

His formal entry into the blockchain industry began at DARMA Capital, an investment advisory firm founded in 2018 by Andrew Keys, a co-founder of Consensys. DARMA’s philosophy centers on helping clients hold ETH long-term while enhancing returns and managing risk through DeFi tools. It offers Ethereum staking custody and validator services, combining strategies like restaking and LSTs to generate additional yield.

In December 2023, he joined Aligned as a partner. Aligned provides infrastructure solutions for mining, high-performance computing, staking, and liquidity provision. Its founder, Neal Kaufman, formerly worked at McKinsey and, like Hyperliquid’s core team, graduated from Harvard University as a Baker Scholar (ranking in the top 5% of his class).

His experience in product development at DARMA and operations at Aligned equipped him with extensive expertise and connections essential for executing a Hyperliquid DeFi “microstrategy.”

Little information about Hyunsu is publicly available online, but Max "@fiege_max"—a core member of the Hyperliquid ecosystem—shared a decade-long friendship with Jung: "It’s been nearly ten years since Hyunsu and I were broke exchange students in Edinburgh; five years since we roomed together in San Juan and adventurously dived into crypto."

A suspected Hyperion account, reposted by community member Max.

On-Chain Hyper Microstrategy: Staking HYPE to Earn Passively

Eyenovia stated that the PIPE offering is exclusively open to institutional investors. The company will issue 15.4 million shares of convertible preferred stock and 30.8 million warrants for common stock, both convertible/exercisable at $3.25 per share. If all warrants are ultimately exercised, Eyenovia could raise an additional $150 million.

While full warrant exercise isn't guaranteed, if completed successfully, the transaction would enable Eyenovia to acquire and stake over 1 million $HYPE tokens.

The company officially announced that Anchorage Digital will custody the over one million HYPE tokens purchased with the proceeds. Just days earlier, on June 12, Canadian-listed Tony G Co-Investment saw its stock surge over 800% within an hour after purchasing 10,000 $HYPE tokens—leveraging just $430,000 to boost its market cap by $57 million.

Michael Rowe, CEO of Eyenovia, said: "We’re excited to join the growing number of companies adopting similar strategies to capture the diversification, liquidity, and long-term capital appreciation potential represented by cryptocurrencies. After thorough evaluation of all available options, the board and I agree this transaction best serves our shareholders’ interests."

Jung added: "I’m honored to join the Eyenovia team to lead this pioneering crypto treasury strategy built around HYPE, which we believe is one of the most robust digital assets. We view Hyperliquid as one of the fastest-growing and highest-revenue blockchains globally."

These statements suggest Eyenovia’s strategy goes beyond simply buying HYPE—it aims to build a comprehensive framework around it. According to Hyperliquid’s HIP-3 proposal, launching a new token on the network requires staking at least 1 million $HYPE. Token deployers can then earn 50% of the market’s total fees and set custom fee structures on top.

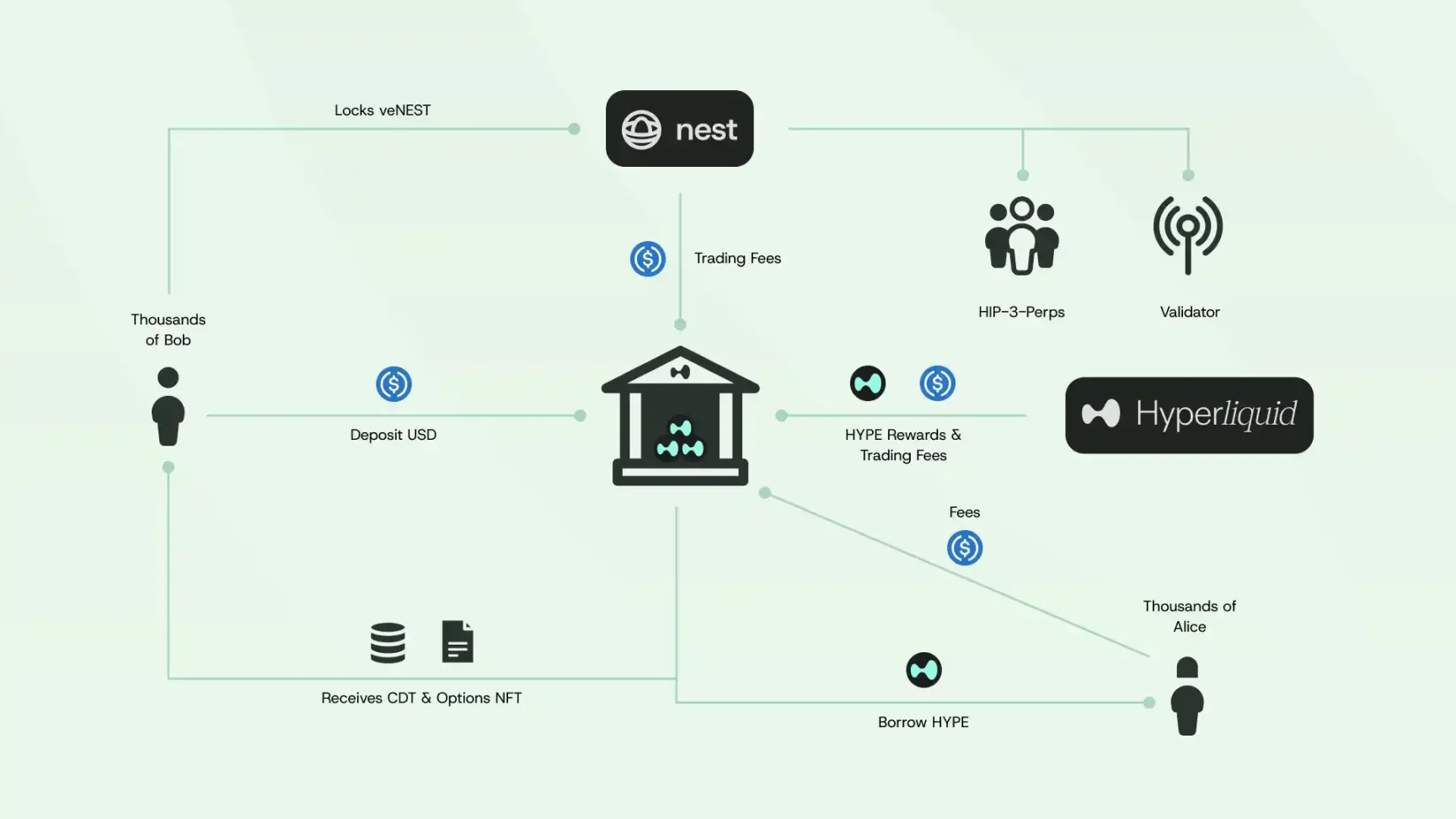

As for how to construct a Hyperliquid version of microstrategy, community member Telaga (“_Telaga_”) shared his vision. He believes HyperStrategy’s on-chain architecture is gradually emerging as a decentralized evolution of MicroStrategy’s holding thesis. Rather than being just an asset allocation model, it represents a “strategic protocol system” embedding liquidity, yield, leverage, and capital structure directly into on-chain financial infrastructure.

Telaga’s concept treats $HYPE—not as digital gold like BTC—but as a high-volatility digital asset serving as an on-chain economic engine with intrinsic cash flow, actively participating in the broader protocol economy. HyperStrategy thus designs a structured exposure and yield-compounding treasury mechanism, enabling users and institutions to earn stable long-term on-chain returns through staking, lending, trading, and market-making.

Specifically, external users deposit funds—primarily in USD stablecoins—into the treasury. In return, they receive two types of on-chain instruments: Convertible Debt Tokens (CDT), representing principal claims, and Options NFTs, symbolizing future yield rights or buyback options. This design ensures user assets remain liquid while contractually anchoring long-term value growth expectations.

Once deposited, the protocol allocates these stablecoins across multiple yield-generating modules. A primary strategy involves lending out $HYPE via on-chain lending markets to earn interest. Additionally, the treasury can participate in trading and liquidity provision on Hyperliquid, collecting trading fees and platform incentives. It may also act as a validator node, staking $HYPE to earn network rewards. In advanced configurations, funds could be deployed into Nest’s trading protocol, earning extra revenue through LP market-making and veNEST locking. HyperStrategy also integrates on-chain derivatives protocols like HIP-3 perpetual contracts to further optimize capital efficiency.

For revenue recycling, the treasury periodically aggregates income from staking rewards, trading fees, and lending interest. These earnings are then allocated according to predefined rules—used for buybacks, reinvestment, CDT redemptions, or fulfilling Options NFT obligations. Some designs may incorporate NAV (Net Asset Value) growth logic, aligning the entire system more closely with traditional asset managers in terms of transparency and stability.

Following Eyenovia, on June 20, U.S.-listed Everything Blockchain Inc. (EBZT) also entered the space, announcing plans to allocate $10 million across five major blockchains—including Hyperliquid, Solana, XRP, Sui, and Bittensor—to build a multi-token staking vault catering to institutional adoption trends. EBZT stated this initiative will make it the first U.S. public company to directly return staking yields to shareholders, expecting to generate around $1 million annually in staking rewards, which it intends to distribute as dividends. From this perspective, returning investor value through compounded on-chain yields appears more sustainable than mere token speculation.

Why HYPE?

The HyperStrategy model differs fundamentally from BTC-focused plays. Instead of merely accumulating $HYPE, it constructs an on-chain treasury capable of generating long-term compounded returns. This transforms token holding from passive ownership into a configurable, manageable, and dividend-capable mode of on-chain asset management. For traditional public companies like Eyenovia entering Hyperliquid, such protocol-based strategies offer not just an entry point to on-chain exposure, but an entirely new financial model featuring liquidity, cash flow, governance rights, and potential capital appreciation.

The emerging protocol economy around $HYPE appears to be providing a foundational testing ground for enterprises exploring on-chain financial operations, treasury management, and balance sheet innovation. Of course, some community members caution that with Coinbase and Robinhood announcing the rollout of perpetual futures in the U.S., Hyperliquid—whose major holders are predominantly based in the U.S.—faces unprecedented competitive pressure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News