Traditional Payments Meet Crypto: The Controversy Over "The Uselessness of Stablecoins"

TechFlow Selected TechFlow Selected

Traditional Payments Meet Crypto: The Controversy Over "The Uselessness of Stablecoins"

As stablecoins continue to expand, more friction and integration between crypto and traditional financial payments are on the way.

Author: TechFlow

As Circle, the giant stablecoin issuer, rang the bell on the New York Stock Exchange for its IPO, the "stablecoin craze" continues to gain momentum in the financial world.

More and more people are becoming interested in stablecoins, and companies from traditional industries that already have some connection with stablecoins have particularly strong opinions.

Last weekend, Jack Zhang, founder and CEO of cross-border enterprise payment platform Airwallex, took to Twitter to criticize stablecoins, claiming that stablecoins offer no real advantages over traditional payments.

This statement immediately sparked widespread discussion. Let's dive into what happened.

The Uselessness of Stablecoins

On June 7, Jack Zhang questioned stablecoins' ability to reduce foreign exchange costs in cross-border payments in a thread, stating that conversion costs using stablecoins for USD to EUR transactions are higher than those in traditional markets.

He argued that traditional payment systems can process transactions between G10 currencies (such as USD/EUR) at fees below 0.01%, with real-time settlement.

Not stopping at cost and efficiency comparisons, Jack Zhang went further: Over the past 15 years, he said he hasn't seen any practical value from cryptocurrencies—including stablecoins—nothing comparable to AI tools used daily. Regarding stablecoin use cases in Latin America, he dismissed them as mere "regulatory arbitrage."

If Not Better Than Stablecoins, Who Is Airwallex?

If you're familiar with Airwallex, Jack Zhang’s comments may not come as a surprise.

Airwallex is a cross-border payment platform founded in 2015, headquartered in Singapore, specializing in helping businesses achieve low-cost, high-efficiency international payments.

CEO and founder Jack Zhang was born in China and moved to Melbourne, Australia during his teenage years. His inspiration for founding Airwallex came from personal experience running a coffee shop where he was hit hard by high foreign exchange fees—prompting him to build his own cross-border payment solution.

Airwallex's strengths can be summarized as “compliance + capital.”

The company holds regulatory licenses across major global markets including China, the U.S., Europe, and Latin America. It also uses a centralized capital management system—commonly known as a "liquidity pool"—to optimize fund flows.

In practice, Airwallex pools all user funds centrally. When cross-border transfers occur, instead of settling directly through banks, the platform manages currency conversions internally via its own liquidity pool. Acting as an intermediary, Airwallex aggregates customer funds and leverages economies of scale and internal optimization to lower costs, creating its competitive advantage in low-cost, efficient cross-border payments.

In May 2025, Airwallex raised $300 million at a $6.2 billion valuation, bringing total funding above $1.2 billion. Investors include multiple pension funds, with Visa Ventures participating as a strategic investor. Public data shows Airwallex achieved an annualized revenue of $720 million in March 2025, processing over $130 billion in transaction volume annually worldwide.

Having carved out a significant position in global payments over ten years and secured massive funding, Airwallex stands as a Web2 unicorn. As a beneficiary of the traditional payment system, it's understandable that Jack Zhang might view stablecoins—the upstart challengers—with skepticism, reflecting a “mainstream force looking down on rogue players” attitude.

What Do Crypto Advocates Say?

Jack Zhang’s outright rejection of stablecoins, delivered bluntly, stirred backlash. The crypto community quickly pushed back.

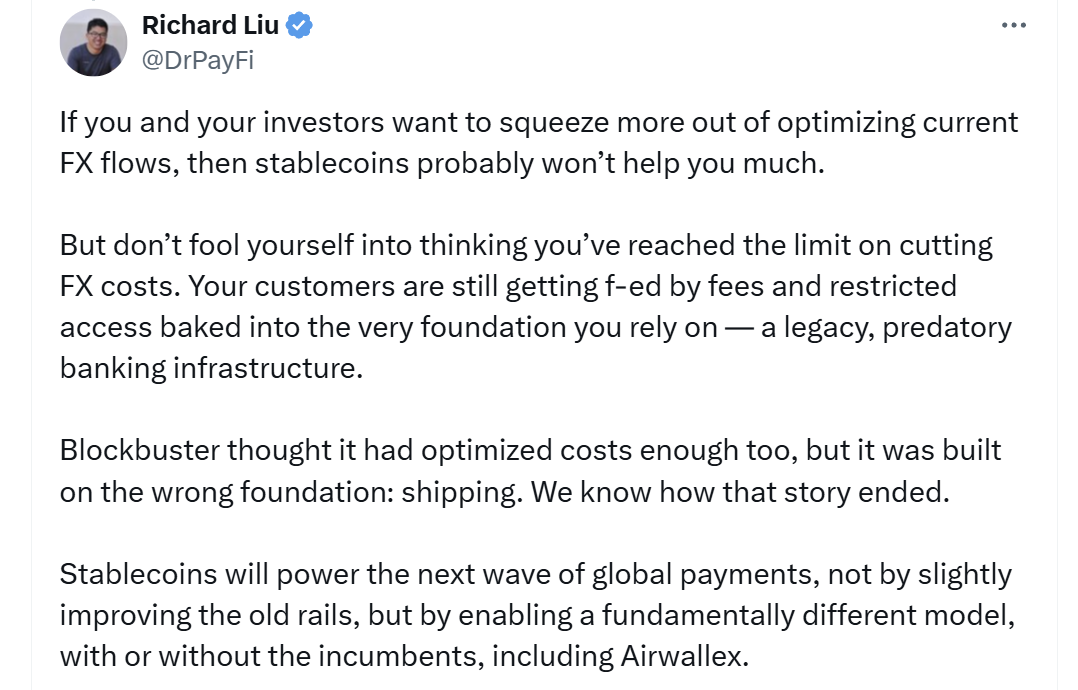

Huma Finance Co-Founder Richard Liu: You’re missing the root problem of the payment system

Don’t fool yourselves into thinking you’ve minimized FX costs as much as possible. Your customers are still paying fees and facing high limits because you rely on outdated, predatory banking infrastructure.

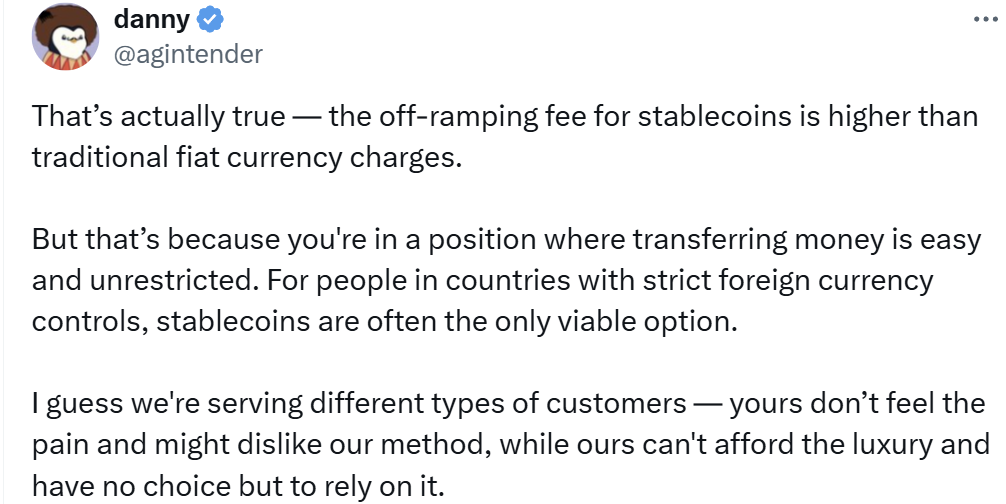

Danny @agintender: Out of touch

You think stablecoin conversion costs are higher than fiat only because you’re focused on regions where money moves freely without restrictions. For people living under strict foreign exchange controls, stablecoins are often the only viable option.

I suspect our target customers are completely different—your clients don’t feel this pain and might even dislike our methods; mine can’t afford your “luxury” and have no choice but to depend on stablecoins.

heliuslabs CEO mert: Your platform sucks too

Your platform’s fund transfer efficiency isn’t great either, which is why I prefer cryptocurrencies.

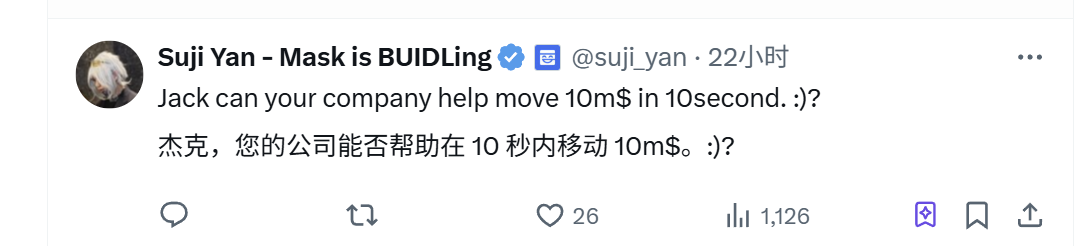

Mask Network CEO @suji_yan: Hehe…

Let’s see how fast your company can transfer $10 million in ten seconds :)?

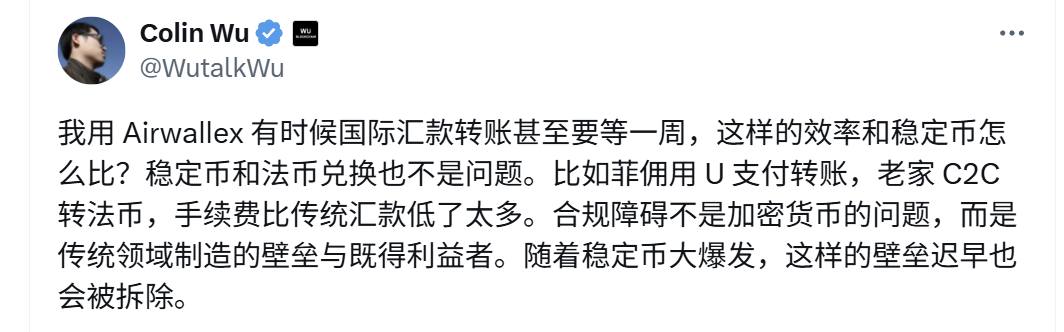

Wublockchain Editor Colin Wu: Stablecoins are more convenient; the moats of incumbents will eventually be torn down

Twitter User Earning Artist: Jack is speaking from the vantage point of his strongest moat—“compliance.”

Twitter User thcryptoskanda @thecryptoskanda: Position determines perspective.

Simon Taylor: The appeal of stablecoins lies in speed and transparency. Focusing solely on fees is too narrow-minded.

Is Airwallex Really Cheaper and More Efficient?

Jack Zhang opened his argument by comparing costs to claim stablecoins lack advantages. However, the scenario he refers to is limited to “B2B cross-border payments between G10 countries.” Across broader segments of the global payment landscape, Airwallex cannot serve every need. For individual users or populations in less developed regions, Airwallex’s fast and cheap services are simply inaccessible.

Twitter user @rachzoooo pointed out that Airwallex’s liquidity pool model resembles Wise’s approach—establishing local entities and accounts globally to route transactions via local payment rails, avoiding actual cross-border movement of funds. This allows Airwallex to provide faster and cheaper transfers compared to expensive and slow SWIFT networks.

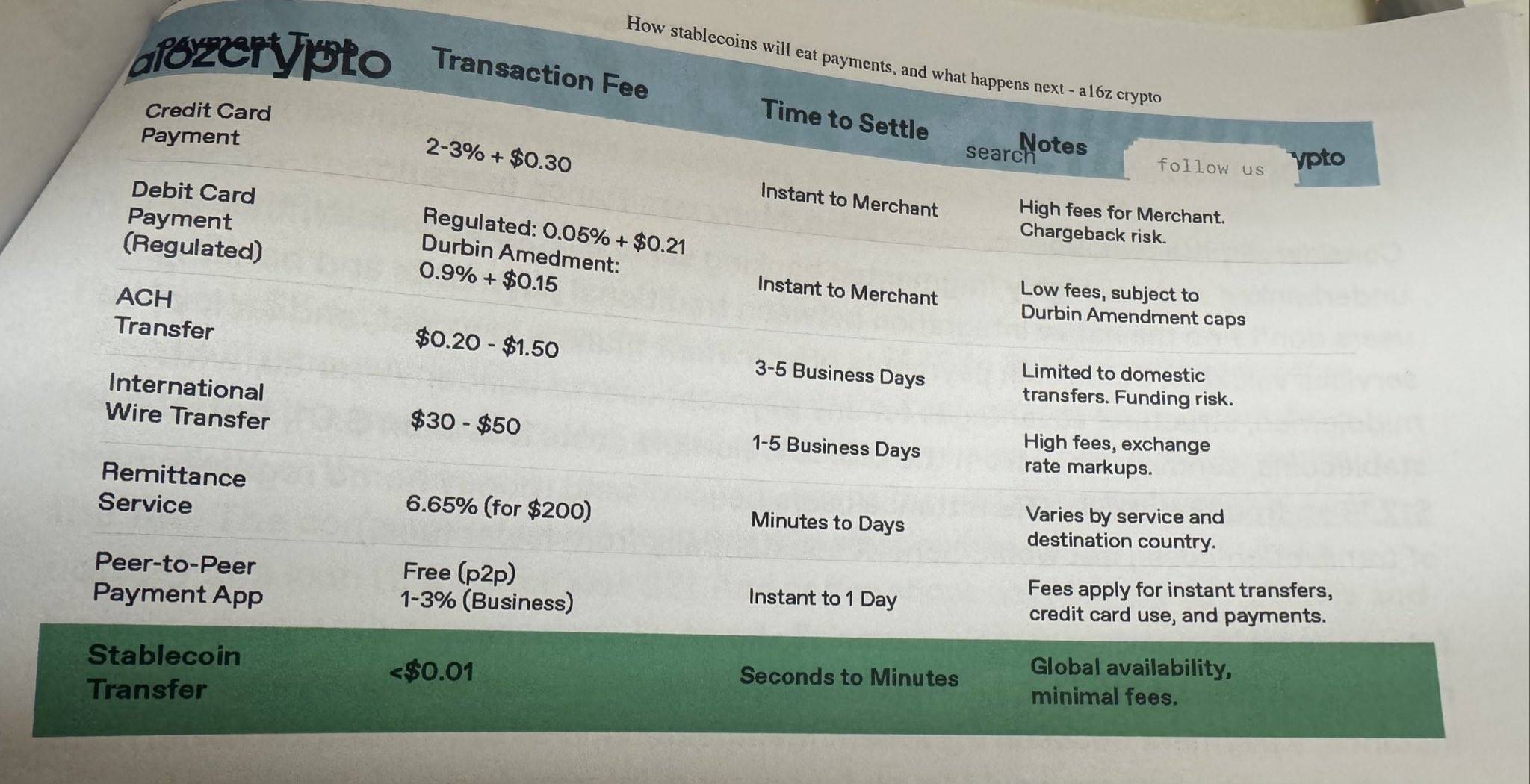

However, according to a report by a16z titled *“How stablecoins will eat payment, and what happens next,”* stablecoins are actually more efficient than local rails like ACH, offering near-instant global settlement, 24/7 availability, and extremely low transaction costs.

Conclusion

Whether stablecoins are useful or not depends entirely on one’s perspective.

In developed regions, existing payment systems are already robust, leaving little room for stablecoins to add value. But the primary users of stablecoins today aren’t in mainstream developed nations—demand is growing steadily among users in Latin America, Africa, and other emerging markets.

Jacking Zhang, benefiting from the traditional payment ecosystem, speaks from within his comfort zone, dismissing real needs in emerging markets. His critique has been widely labeled as “position determining perspective”—a classic stance of an incumbent resisting disruption.

This debate reflects the broader clash between traditional finance and crypto: Jack represents the old guard, while the crypto community bets on the future. From different vantage points, neither side appears absolutely right or wrong. The GENIUS Act granting M1 status to stablecoins, along with the market’s growing confidence shown through Circle’s IPO and subsequent FOMO, indicates strong belief in stablecoins’ potential. As stablecoins continue expanding, further friction—and eventual integration—between crypto and traditional financial systems is inevitable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News