Ethereum Foundation announces layoffs—does this mean project teams are finally taking action?

TechFlow Selected TechFlow Selected

Ethereum Foundation announces layoffs—does this mean project teams are finally taking action?

Has the Ethereum Foundation finally woken up?

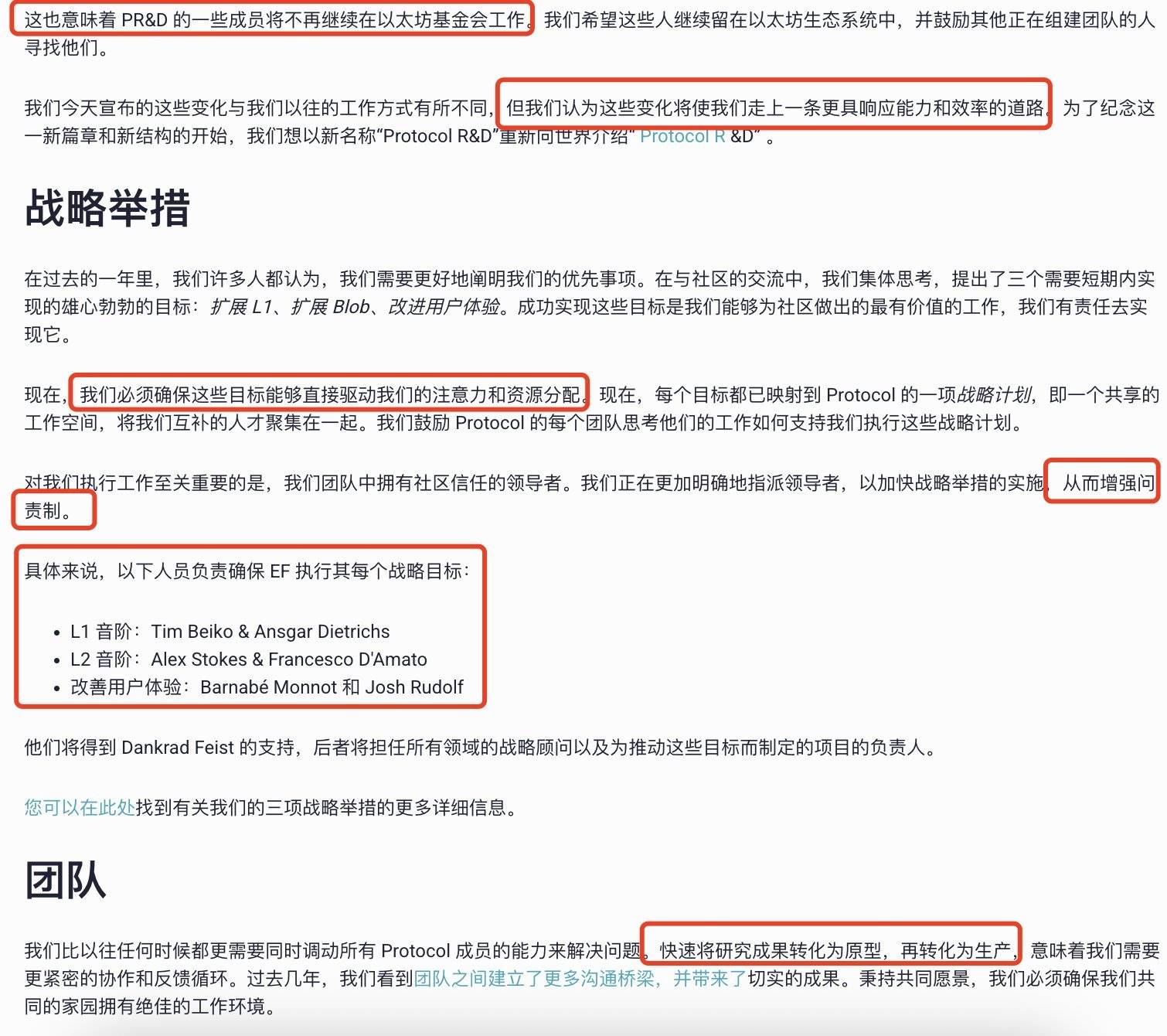

On June 2, the Ethereum Foundation (EF) announced a change in the operational model of its internal protocol R&D team, renaming the former "Protocol R&D" team to simply "Protocol," while stating that “some members of PR&D will no longer continue working at the Ethereum Foundation” — the Ethereum Foundation has begun layoffs.

According to the detailed announcement released by EF, this reorganization aims to make the team more focused and efficient. Additionally, the announcement noted that although some staff are being let go, the foundation encourages them to continue contributing within the Ethereum ecosystem.

How Did It Come to This?

Controversial Moves by the Foundation Spark Community Backlash

The Ethereum Foundation's layoffs probably surprise no one.

As early as March, EF conducted a leadership reshuffle. Aya Miyaguchi, the controversial Executive Director who had served for seven years, was promoted to Chair of the EF board — effectively transitioning from a position of real authority to a ceremonial, figurehead role.

This leadership change sparked discussions across the market: many viewed Aya’s removal from executive power as EF’s first step toward moving from idealism to pragmatism. (See TechFlow article: After the Power Shift, Where Is the Ethereum Foundation Headed?)

Over the past year, dissatisfaction with EF has been mounting. Beyond its ongoing $ETH sales, the foundation has repeatedly drawn criticism for various decisions.

Following the Cancun upgrade in March 2024, transaction fees on Layer 2 dropped significantly — a clear technical win. However, according to Token Terminal data, shortly after the upgrade, Ethereum’s Layer 1 network revenue plummeted by 99% during the summer of 2024. The lack of balance between technological advancement and the economic health of the ecosystem left investors and the community deeply disappointed.

In May 2024, EF was embroiled in a major scandal when multiple core Ethereum figures were found to have ties with the EigenLayer Foundation. Senior EF researchers Justin Drake and Dankrad Feist both served as paid consultants for EigenLayer, receiving millions of dollars worth of token incentives. This obvious conflict of interest stirred intense controversy within the community. The risks of integrating EigenLayer’s proof-of-stake protocol into Ethereum under such circumstances were difficult to predict. Some community members lamented: "Foundation members are restaking into their own pockets." Not until November of that year did Justin Drake and Dankrad Feist announce they were stepping down from their advisory roles at EigenLayer.

In August 2024, concerns resurfaced over EF’s lack of spending transparency. On August 24, it was revealed that the Ethereum Foundation transferred 35,000 $ETH (worth $94 million at the time) from its treasury to Kraken exchange. Although then-Executive Director Aya clarified that the transfer was part of normal "funds management" and did not necessarily mean a sale, the move — made without prior notice and accompanied by an uncooperative "no comment" stance — angered many. Combined with the foundation’s long-standing practice of publicly selling $ETH to cover operating costs, market sentiment toward EF hit rock bottom.

Ethereum Has Become Too Disconnected from the Community

Beyond these unpopular actions — sales, scandals, and opacity — the Ethereum Foundation’s overall direction has also disappointed.

In this market cycle, $ETH’s price performance has left most people underwhelmed. The rallying cry “BTC breaks 100K, ETH breaks 8K” awkwardly achieved only half its goal — a shortfall closely tied to the Ethereum Foundation’s recent strategic direction. The leadership’s overly idealistic vision and approach may serve a small group’s dreams, but for the broader community and market, building castles in the air doesn’t put food on the table.

X user Jason Chen (陈剑 Jason, @jason_chen998) once tweeted: “The early OGs of Ethereum enjoyed so much windfall profit that financially, they show no hunger at all. In fact, anyone expressing a desire to make money is looked down upon by others. This top-down culture has made Ethereum ecosystem developers extremely ‘pure.’ Yes, I get a headache hearing that word — every time I talk to those purity cultists.”

With internal issues piling up and external discontent growing — compounded by a token price that appears increasingly unattractive for long-term investment — the Ethereum Foundation may finally be feeling the pressure.

These layoffs might represent the first step in treating the deep-rooted ailments that have plagued EF for years.

Are Projects Actually Delivering Now?

A New Strategy: From Idealism to Pragmatism

Returning to EF’s latest decision, the core logic is clear: Less research, more delivery.

Not only are (potentially) theoretical researchers without tangible results being cut, but accountability mechanisms are also being strengthened, with ecosystem development now tied to KPIs. Going forward, EF will focus primarily on the following three strategic initiatives:

-

Scaling Ethereum’s base layer: Improving mainnet performance and throughput.

-

Expanding blobspace for Rollups: Increasing data capacity required by rollups to support Layer 2 solutions.

-

Improving user experience: Enhancing the usability and accessibility of the Ethereum network.

Regardless of future execution, this strategy at least appears problem-oriented — finally making “pragmatism” concrete. (Editor’s note: Especially regarding improving mainnet performance — the last time Binance Alpha launched a $PFVS airdrop, mainnet transaction fees spiked to $70–80 per transaction, which was rather embarrassing.)

Vitalik Buys ETH, Foundation Seeks New Backers

On June 4, Decrypt reported that Consensys CEO and Ethereum co-founder Joe Lubin revealed the company is in talks with a sovereign wealth fund and bank from a “major country” about building infrastructure within the Ethereum ecosystem.

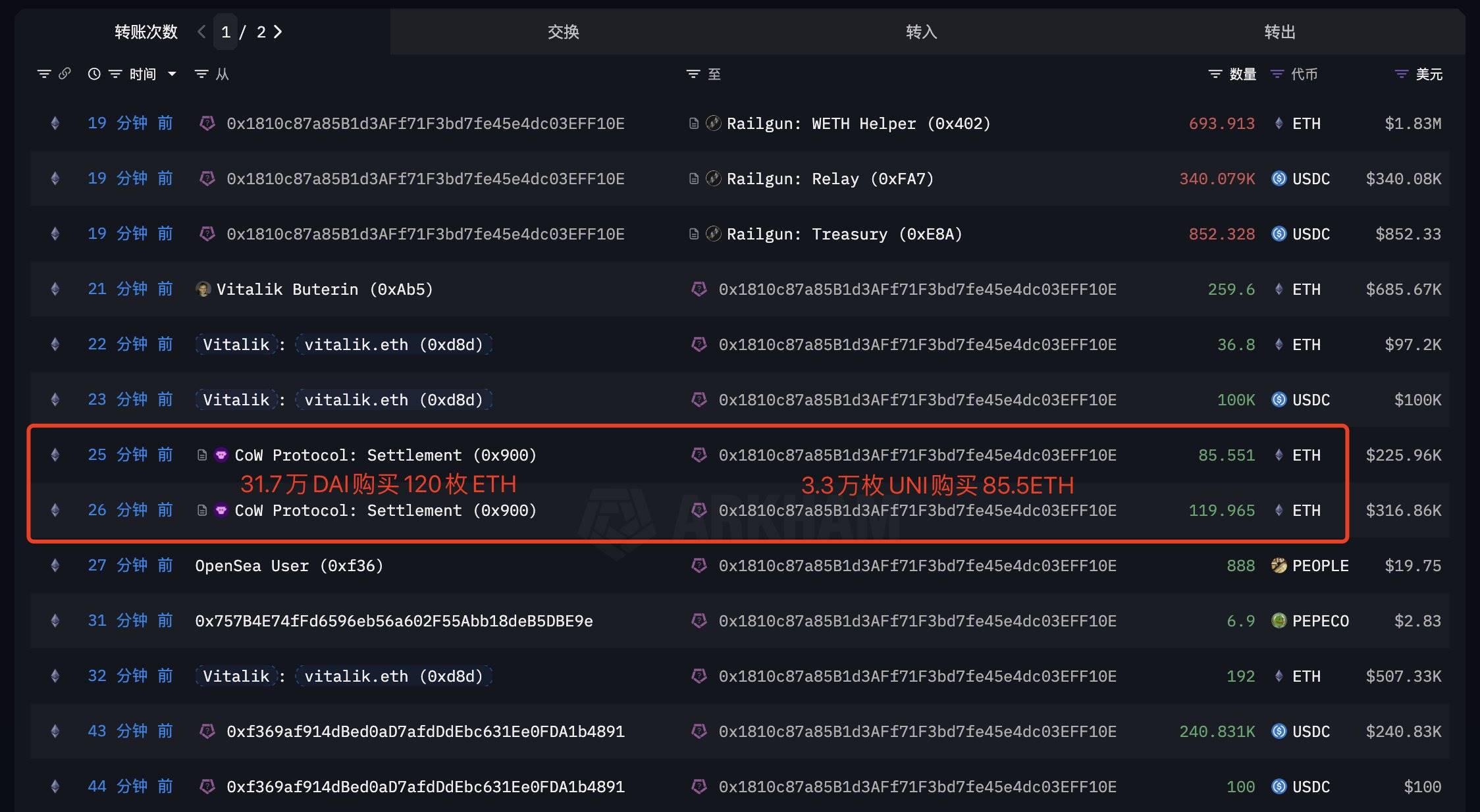

On the same day, X user Yujin (余烬, @EmberCN) reported that V God @VitalikButerin used 317,000 DAI and 33,000 $UNI to purchase 205.5 $ETH, and later transferred a total of 693.9 ETH ($1.83M) and 340,000 USDC via the 0x1810 address using Railgun.

Looking Ahead, Ethereum Still Faces Major Challenges

Whether this reorganization represents EF’s self-rescue or the inevitable consequence of years of impractical development, it underscores a fundamental truth: pragmatism is now essential for any project aiming for long-term survival. Even Ethereum cannot escape the law that castles in the air eventually collapse — let alone other public chains and applications with weaker communities.

The new strategy clearly signals EF’s intent and directional shift, but effective execution remains the most critical challenge.

Moreover, even as pragmatism takes center stage, achieving greater transparency in disclosures and finding the right balance between decentralized ideals and centralized management remain unavoidable hurdles for Ethereum’s evolution.

To shift market sentiment, beyond just price pumps, Ethereum may need to undergo repeated rounds of deep “cutting out the rot” to truly heal.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News