The First Stock of Stablecoin: Circle's Chinese Connection

TechFlow Selected TechFlow Selected

The First Stock of Stablecoin: Circle's Chinese Connection

A journey through Circle's historical evolution and its ties with China.

Written by: TechFlow

This Thursday, following Coinbase, the crypto market's next major IPO arrives.

Circle, the issuer of the U.S. dollar stablecoin USDC, is set to begin trading on the New York Stock Exchange, aiming to raise up to $896 million, under the ticker symbol CRCL.

However, just before its上市, shares of Everbright Holdings China, a Hong Kong-listed company, surged for five consecutive days—up 44%—uncovering a hidden chapter in Circle’s past ties with China.

Everbright Holdings invested in Circle back in 2016 alongside IDG Capital, becoming one of its early shareholders.

In fact, in 2018, Chinese media reported that Circle might be injected into a certain A-share listed company in China, prompting an inquiry letter from the Shenzhen Stock Exchange, forcing the listed company to issue a public denial.

Circle’s repeated connections with Chinese firms reflect a significant part of its historical journey—a path filled with challenges and twists, evolving from a crypto wallet to an exchange and eventually a stablecoin powerhouse.

This article revisits Circle’s evolution and its complex relationship with China.

The Original Dream: America’s Alipay

In 2013, Jeremy Allaire and Sean Neville, chief scientist at Adobe, co-founded Circle in Boston—Allaire’s third formal startup venture.

Prior to this, he had founded two publicly traded companies: software firm Allaire in 1995 and online video platform Brightcove in 2012, amassing extensive industry connections along the way.

From the outset, Circle raised $9 million in Series A funding—the highest ever recorded for a cryptocurrency company at the time.

Backers included Jim Breyer, Accel Partners, and General Catalyst—all investors from Allaire’s previous company, Brightcove. In many ways, they weren’t just betting on Circle as a company, but on Jeremy Allaire himself.

Initially, Circle had no plans to launch a stablecoin. Instead, it aimed to build an “American version of Alipay.”

Its first product was a digital currency wallet focused on storing cryptocurrencies (primarily Bitcoin) and enabling fiat-to-crypto exchange, using Bitcoin as a bridge for fast cross-border transfers.

For example, while international SWIFT transfers took 3–5 business days, Circle enabled rapid money movement via a “fiat → Bitcoin → fiat” route, where Bitcoin acted solely as a transmission channel.

At the time, Allaire was a staunch Bitcoin believer, convinced that a global payment system was inevitable. He envisioned peer-to-peer payments as seamless as sending emails or text messages.

Then came a string of successes.

In August 2015, Circle secured $50 million in funding led by Goldman Sachs and IDG Capital.

This investment from IDG would later become a pivotal link between Circle and China.

The following September, Circle obtained the first-ever BitLicense from the New York State Department of Financial Services, allowing it to legally offer digital asset services within New York State.

That same year, China’s mobile payment market was fiercely competitive, with WeChat Pay rapidly gaining ground on Alipay through red envelope promotions. Across the Pacific, Circle wasn’t idle—it launched social payment features by year-end.

At the time, this seemed like a bold innovation. In hindsight, it may have reflected unclear positioning, foreshadowing multiple strategic shifts ahead.

Ties with China

In 2016, Circle deepened relationships with several Chinese venture capital firms.

That June, amid scorching summer heat, Circle announced a $60 million Series D round led again by IDG Capital, with participation from Baidu, Everbright, Yixin, Wanxiang, Zhongjin Jiazi, and others.

IDG Capital had led both the C and D rounds and gained a board seat. IDG founding partner Xiong Xiaoguo commented on the investment:

“Currently, most domestic investments in internet companies focus on applications rather than core technologies. This is largely because we see more innovation in business models domestically, while technological breakthroughs remain relatively scarce. The U.S. technologies we invest in—like Circle’s Bitcoin blockchain—are typically areas where the U.S. leads, and China either cannot yet match or lags significantly behind. While the technology is developed abroad, our goal at IDG is ultimately to bring cutting-edge innovations back to China and achieve sustainable local growth. That’s our ‘China perspective’ when investing in American companies.”

Beyond attracting Chinese capital, Circle also harbored ambitions of entering the Chinese market.

In early 2016, Circle established a standalone entity in China—Circle China, officially registered as Tianjin Secco Technology Co., Ltd., meaning “a payment system capable of operating globally.” The CEO was Li Tong, then Entrepreneur-in-Residence at IDG Capital, with Xiao Feng from Wanxiang Group serving as director.

Founder Allaire stated that Circle intended to operate within China’s regulatory framework and would not launch any products without government approval.

Moreover, Circle maintained ongoing communication with Chinese regulators and financial institutions. However, given China’s strict stance on financial security—and the requirement for a third-party payment license to conduct payment operations—Circle’s activities in China remained stalled, existing in name only.

According to QichaCha records, Tianjin Secco Technology applied for简易 deregistration on August 15, 2020, and was officially dissolved on September 7, marking Circle’s exit from China.

Thus, Circle’s dream of entering China ended as a fleeting illusion.

A Rocky Transformation

In 2016, amid escalating debates over Bitcoin forks and scalability, Allaire grew increasingly frustrated with Bitcoin’s slow progress. “Three years have passed, and Bitcoin’s development has slowed significantly,” he said in a prior interview.

On December 7, Circle issued a statement announcing it would “discontinue Bitcoin-related services.” While users could still transfer Bitcoin and fiat currencies, direct buying and selling of Bitcoin would no longer be supported. The company claimed it would shift focus to social payments.

In reality, however, Circle’s trajectory shifted not toward payments but toward trading. “Allaire downplayed Bitcoin (payments) in Circle’s business model and began focusing more on revenue-generating activities,” CoinDesk reported at the time.

What business is most profitable in crypto? Exchanges.

In 2017, Circle clarified that although it removed direct Bitcoin trading from its app, it continued market-making for major exchanges and launched Circle Trade—an OTC service catering to institutional clients.

In February 2018, Circle announced the acquisition of cryptocurrency exchange Poloniex for $400 million, formally entering the crypto exchange space. The deal was primarily financed by its largest shareholder, IDG Capital.

By May, Circle raised another $110 million, led by Bitmain, with existing investors including IDG Capital and Breyer Capital participating.

Notably, Bitmain itself was backed by IDG Capital. By this point, IDG had become Circle’s largest institutional shareholder.

This funding round was critical for Circle—not only was it based on a post-money valuation of $3 billion, but less than a year later, that valuation would plummet by 75%.

Additionally, the second half of 2018 saw the onset of a brutal bear market across crypto. Both Circle and Bitmain faced existential threats. This capital injection helped Circle survive the downturn.

With fresh funds, Circle expanded aggressively, pursuing diversification.

In July 2018, Circle launched the dollar-pegged stablecoin USDC—an inflection point in its history and arguably its most important decision.

Beyond its core exchange and stablecoin businesses, Circle broadened its scope further.

In October 2018, it acquired equity crowdfunding platform SeedInvest and launched Circle Research to publish industry insights and reports.

By now, fueled by capital, Circle had evolved into a diversified crypto conglomerate centered around its exchange: Poloniex handled trading; Circle Pay enabled transfers; SeedInvest facilitated fundraising; Circle Trade offered OTC services; and USDC served as the dollar-backed stablecoin.

Everything seemed promising—yet unbeknownst to them, winter was coming. Such diversification was perilous.

2019 became the darkest year in Circle’s history.

In February, Cointelegraph Japan first reported that Circle’s valuation on SharesPost stood at just $705 million—down from $3 billion nine months earlier after Bitmain’s investment, a staggering 75% drop.

In May, CoinDesk revealed Circle had laid off 30 employees—about 10% of its workforce—with three executives departing soon after.

But what likely troubled Allaire most was the failure of its costly acquisition: Poloniex.

On May 13, 2019, Poloniex announced delisting nine cryptocurrencies for U.S. users, citing U.S. securities laws—these tokens were deemed close to securities but unregistered with the SEC, posing compliance risks. Another six were delisted in October, causing significant revenue loss.

Allaire repeatedly expressed frustration with U.S. regulators but could do little except relocate Poloniex’s operations to Bermuda, which offered a more lenient regulatory environment. On July 23, Circle announced Poloniex had obtained a digital asset business license in Bermuda.

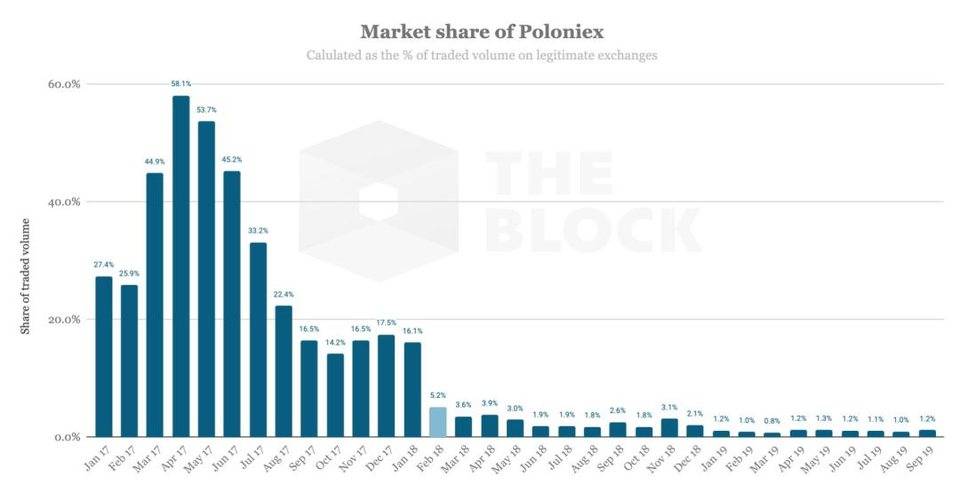

Still, Poloniex continued losing market share—from nearly 60% among compliant exchanges in 2017 to just 1% by September 2019.

Falling valuations, faltering core business, talent drain… Circle once again stood at a crossroads.

Facing survival, Circle chose drastic restructuring—gradually spinning off core businesses starting in late 2019 and refocusing entirely on USDC.

In June 2019, Circle announced it would phase out support for user payments and fees on Circle Pay beginning July 8, fully discontinuing all services by September 30.

On September 25, Circle suspended its research arm, Circle Research.

In October, to widespread surprise, Circle sold its exchange Poloniex to an Asian investment firm operating under “Polo Digital Assets,” controlled in reality by Tron founder Justin Sun.

Later SPAC filings revealed Circle lost over $156 million from acquiring and subsequently selling Poloniex.

On December 17, Circle sold its OTC desk Circle Trade to Kraken.

By 2020, Circle Invest—the crypto investment app—was transferred via equity swap to Voyager Digital.

After this series of divestitures, Circle transformed from a diversified crypto group into a focused issuer of the U.S. dollar stablecoin USDC.

The Dollar Ambassador

Circle’s stablecoin business model is simple and highly profitable: The company issues USDC, pegged 1:1 to the U.S. dollar, and invests customer deposits primarily in short-term U.S. Treasury bonds, generating nearly risk-free returns.

Currently, USDC has a circulating supply exceeding $61 billion—meaning over $61 billion in reserves are invested in U.S. Treasuries (85% managed by BlackRock’s Circle Reserve Fund) and cash (10–20% held at globally systemically important banks).

According to financial statements, in 2024, interest income from U.S. Treasury investments reached approximately $1.6 billion, accounting for 99% of Circle’s total revenue.

Yet net profit declined from $268 million to $156 million, partly due to a hidden cost: revenue sharing with partner Coinbase.

In 2018, Circle co-founded the Centre Consortium with Coinbase to launch USDC.

In 2023, the consortium disbanded. Coinbase received equity in Circle, while Circle gained full control over the USDC ecosystem—but Coinbase retained rights to a portion of reserve income.

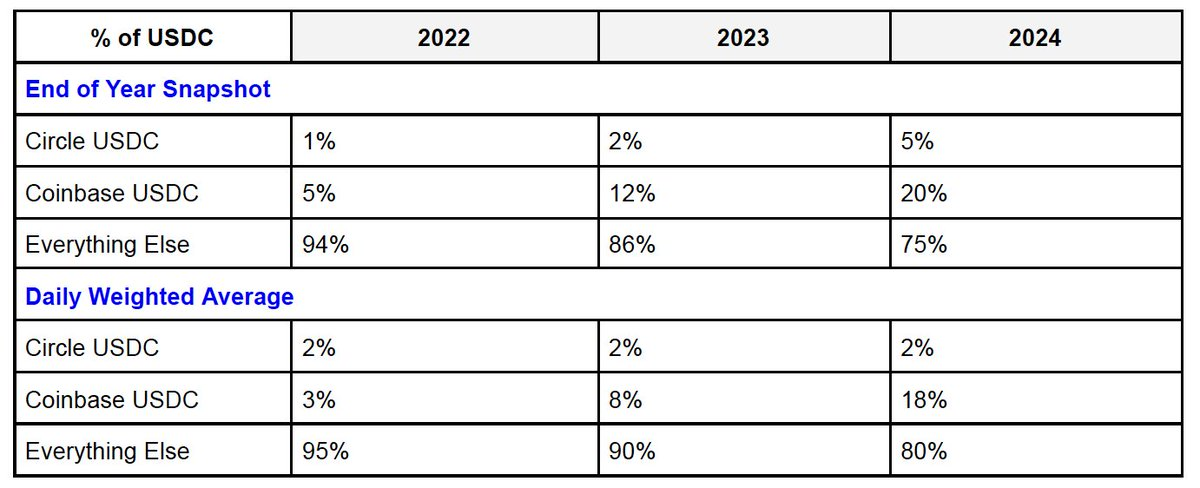

USDC supply can be broken into three segments:

• Coinbase: Includes USDC held on Coinbase Prime and the exchange.

• Circle: Includes USDC minted via Circle Mint.

• Other platforms: Includes USDC held on decentralized platforms like Uniswap, Morpho, Phantom, etc.

According to Circle’s S-1 filing, the revenue-sharing agreement with Coinbase works as follows:

USDC on Coinbase platforms: Coinbase receives 100% of reserve yield.

USDC on Circle platforms: Coinbase receives 100% of reserve yield.

USDC on non-Coinbase platforms: Coinbase and Circle each receive 50% of reserve yield.

Coinbase’s share of total USDC supply is growing rapidly—reaching about 23% in Q1 2025. USDC has now become Coinbase’s second-largest revenue source, contributing roughly 15% of its Q1 2025 revenue—surpassing staking income.

Externally, the dominant position of stablecoin leader USDT remains hard to challenge, compounded by unfavorable expectations of Fed rate cuts. Internally, Coinbase continues to claim a large cut of profits. Circle faces mounting pressures—yet its IPO comes at a timely moment.

The U.S. Stablecoin Bill (the GENIUS Act) passed the Senate on May 21 and is currently under review in the House. Once enacted, it will deliver significant strategic benefits to Circle.

The core provisions of the GENIUS Act align perfectly with Circle’s strengths:

First, every stablecoin issued must be backed one-to-one by U.S. dollars or U.S. Treasuries;

Second, issuers must register with the U.S. federal government, disclose reserve holdings monthly, ensure fund safety, and comply with anti-money laundering and anti-crime regulations;

Third, in the event of issuer bankruptcy, stablecoin holders have priority redemption rights.

Once passed, the bill will grant regulatory legitimacy to compliant players like Circle, boosting institutional and retail confidence in USDC.

Historically, uncertainty around regulation has deterred traditional financial institutions from adopting stablecoins. The GENIUS Act removes this barrier, opening new opportunities for Circle to collaborate with banks, payment providers, and large enterprises—expanding USDC’s use cases and market share.

Going forward, Circle will carry a strategic mission: To serve as a key executor of the U.S. dollar’s global strategy and provide strong support to the U.S. Treasury market.

This forms the core narrative for its IPO: The Global Ambassador of the U.S. Dollar.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News