Pump.fun's $4 billion valuation for launching its token, while a drained market waits for a savior

TechFlow Selected TechFlow Selected

Pump.fun's $4 billion valuation for launching its token, while a drained market waits for a savior

The last king, or the final cut?

Written by: TechFlow

The meme wave continues, but market enthusiasm seems to have reached its peak.

While new memes are launched every day, compared to last year, how long has it been since you've seen a truly breakout "golden dog" meme coin?

Meme coins may be losing steam, but that doesn't seem to stop the rise of meme launch platforms.

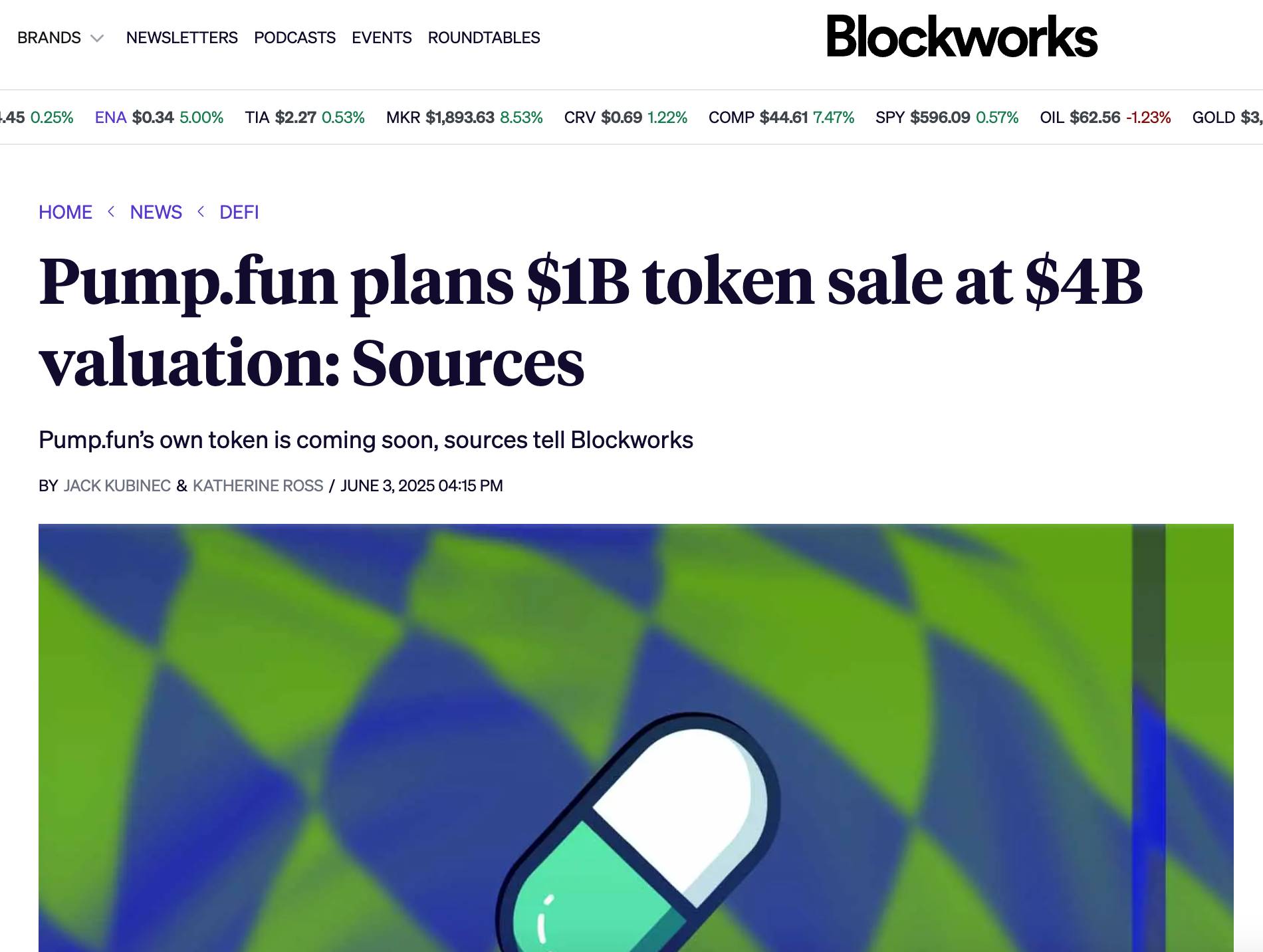

On June 4, according to Blockworks, Pump.fun plans to launch its own token, aiming to raise $1 billion at a fully diluted valuation (FDV) of $4 billion, selling approximately 25% of the tokens.

The token offering will be open to both public and private investors. Rumors suggest an accompanying airdrop, with the token potentially named "$PUMP," though specific details remain unconfirmed.

Although Pump.fun has not officially confirmed the authenticity of this token launch plan, for comparison, Circle—the issuer behind stablecoin USDC—publicly targeted a $720 million valuation during its U.S. stock market IPO attempt.

Market reactions to this news are already diverging.

Immediately after the report, ALON (a token sharing the name of Pump founder @a1lon_9) on Pump.fun surged by 102%, continuing the pure speculation game.

Some believe in Pump.fun’s ability to attract capital and anticipate dividends or governance benefits from the token; others dismiss it outright, calling the $4 billion valuation absurd and masking nothing more than a “rug-pull” scheme.

Excitement and exhaustion coexist, opportunities intertwined with risks.

If this meme launchpad—closest to trading, closest to gambling, closest to volatility—really launches a token, will it be the savior of a drying market, or the final cut before walking away without looking back?

The answer may lie in its valuation logic and market dynamics.

Pump.fun's Rise: Is It Worth $4 Billion?

If the token launch plan disclosed by Blockworks is accurate, PUMP would have an FDV of around $4 billion. Does it deserve that price tag?

We might explore the valuation logic using some data.

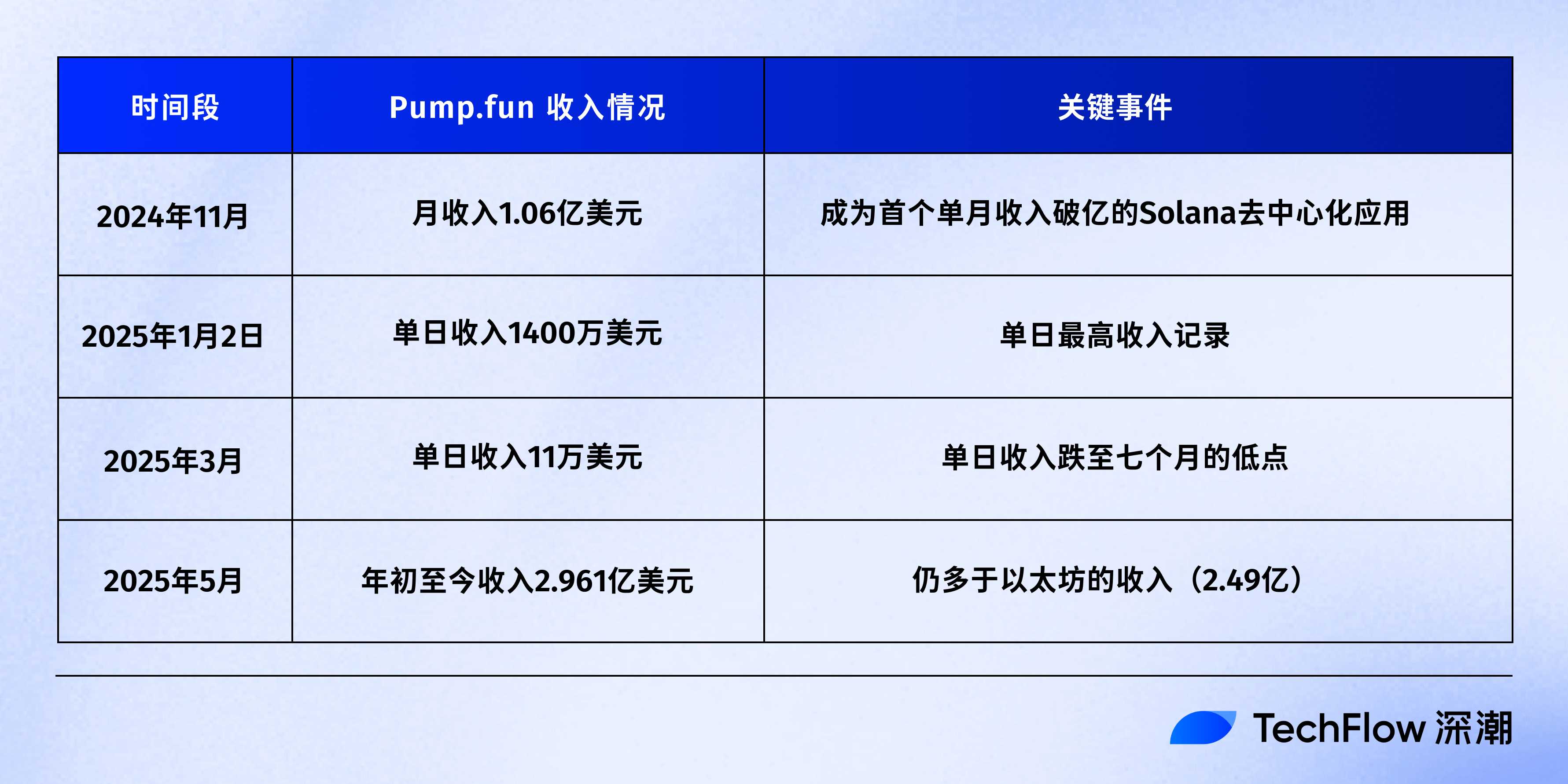

Public data shows that as of May this year, Pump.fun had generated a total annual revenue of $296 million. Extrapolating under similar conditions, the annualized revenue comes to approximately $710 million ($296.1 million ÷ 5 × 12).

Based on this income level, using traditional valuation methods, the price-to-sales ratio (P/S, $4 billion valuation divided by annual revenue) stands at 5.63—meaning the market pays $5.63 for every dollar of revenue. This metric is commonly used in traditional markets to assess growth potential, and figures for DeFi projects like Uniswap are comparable.

If the PUMP token grants revenue-sharing rights, assuming half the income (about $350 million) is distributed to token holders, the price-to-earnings ratio (P/E, valuation divided by profit) would be around 11.4, lower than the average for U.S. tech stocks.

However, the issue is that meme-related businesses rarely follow traditional valuation models. While revenue does factor into a meme launchpad’s valuation, FOMO and shifting market sentiment dominate.

Circle operates the stable, regulated USDC business, justifying its $720 million IPO valuation. Yet Pump.fun, valued at $4 billion as the top meme launchpad in crypto circles, now exceeds half of Circle’s valuation—making this seem somewhat unreasonable.

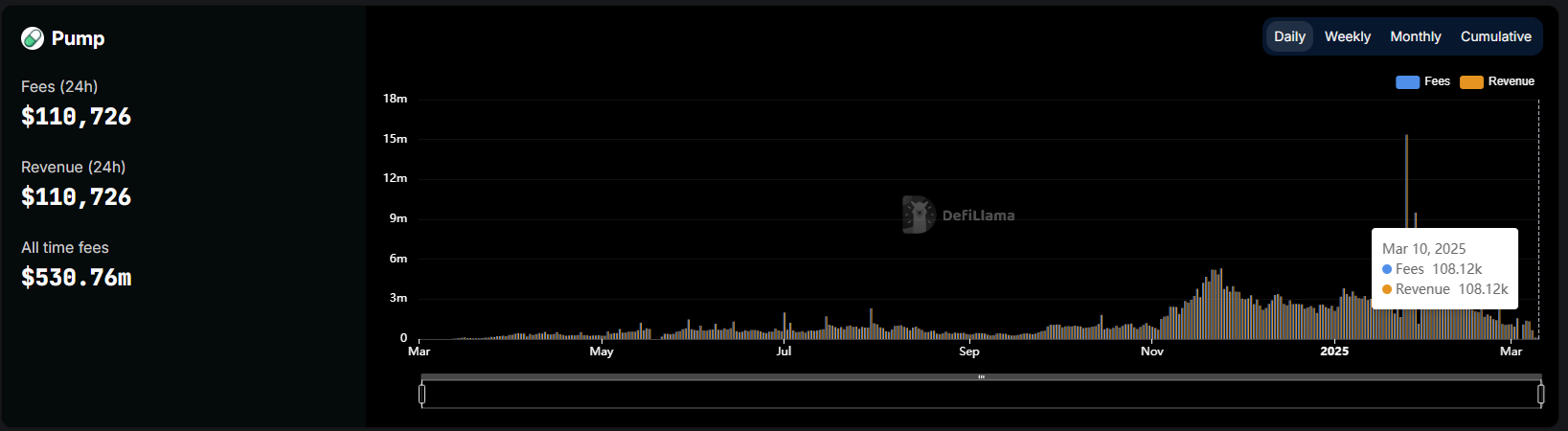

Moreover, Pump.fun’s revenue is far from stable. At its lowest point, daily revenue was only about $110,000.

From exceeding $100 million in monthly revenue in November 2024, reaching a high of $14 million in daily revenue on January 2, 2025, to dropping to just $110,700 on March 9 this year—Pump.fun’s revenue has fluctuated nearly a hundredfold, highlighting the cyclical nature of the meme market.

The revenue low in March 2025 reflects the broader evaporation of meme market capitalization and fading enthusiasm—an emotion-driven business model built on fragile income streams.

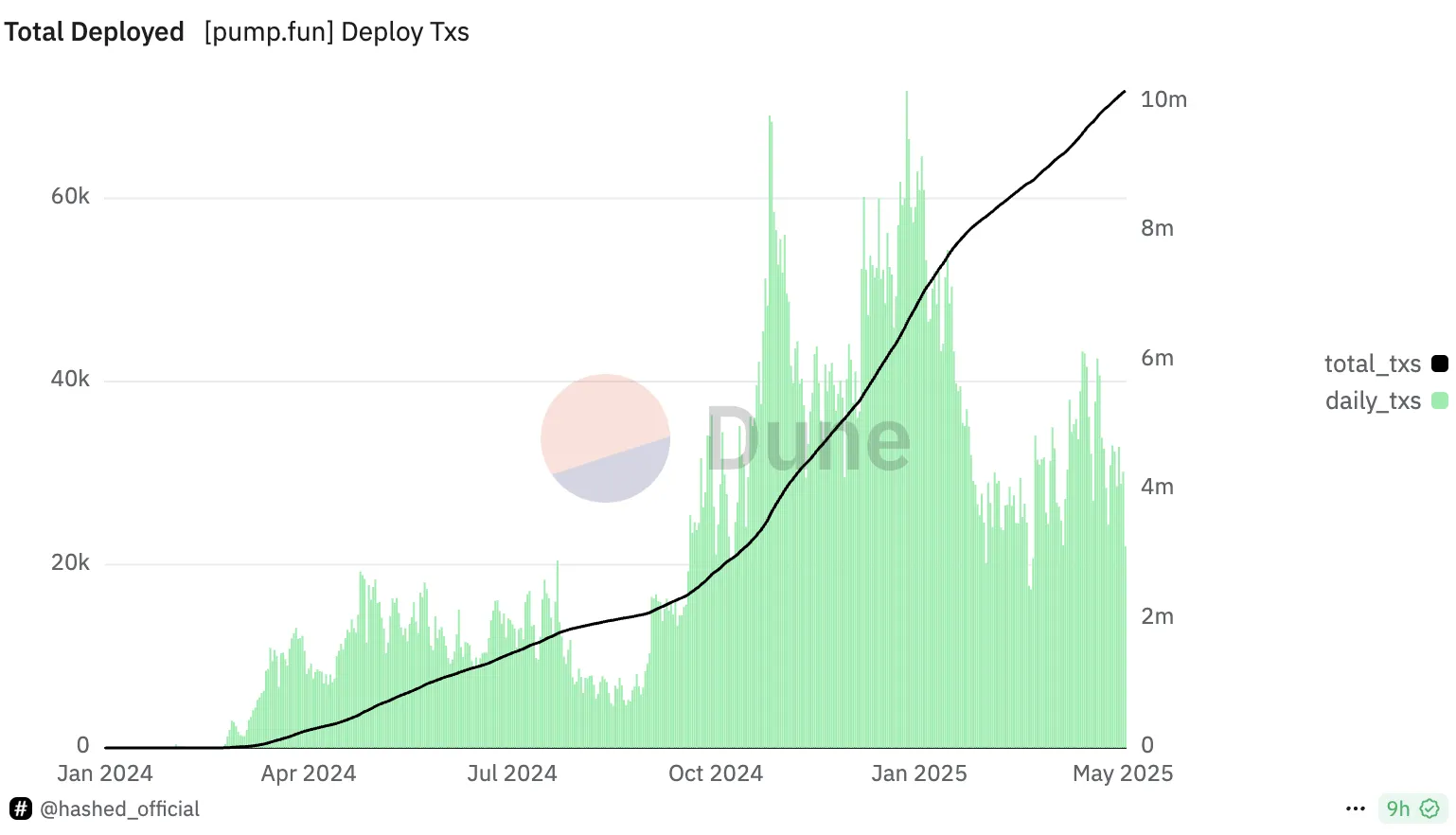

Yet even so, supply never runs dry. With an average of 30,000 new tokens launched daily, Pump.fun accounts for half of all Solana DEX trading volume.

This constant flood of new tokens contrasts sharply with the volatile market sentiment, making it extremely difficult to anchor Pump.fun’s valuation to any stable benchmark.

A Drying Market: The Final Cut?

Pump.fun continues to push forward—whether through rumored token launches, past attempts to build its own AMM, or innovative live-streaming features—the platform clearly isn’t standing still.

(See: Meme Retreat, Pump.fun自救: Can PumpSwap Sustain Future Business?)

But the overall market, especially the meme sector, appears increasingly exhausted.

Signs of market "dry-up" are evident. In December 2024, the total market cap of meme coins dropped from $137 billion to $96 billion—wiping out $40 billion.

In 2025, Solana DEX trading volume declined by 20% year-on-year. Most newly launched tokens quickly fall to zero, their lifespans shortening further. PVP (player-versus-player) investing has become hellishly difficult.

Occasional golden dogs appear, but none can recreate past glories.

Retail investors have shifted from frenzied chasing to cautious观望, and community discussions reflect fatigue. The market now craves new narratives—AI’s next wave, stablecoins, corporate crypto reserves—not high-stakes bets on inflated valuations of aging platforms.

Meanwhile, Pump.fun’s past actions raise eyebrows. In 2024, the platform repeatedly sold earned SOL for USDC. Data from January showed Pump.fun had already dumped around $182 million worth of SOL since the start of the year.

Earning SOL drains liquidity; selling SOL inevitably affects price and confidence.

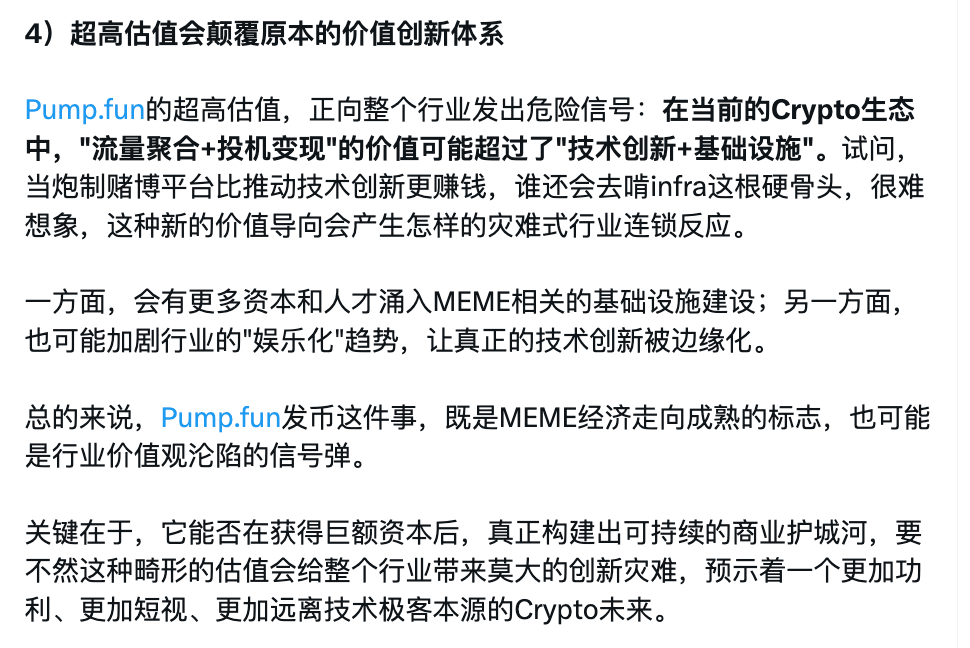

The community remains largely skeptical of Pump’s token launch. For instance, researcher Haotian commented: “It’s hard to imagine a meme launch platform being valued higher than most blue-chip DeFi protocols. This might signal either the maturation of meme economics—or the collapse of industry values.”

After raising funds via token issuance, what will Pump.fun actually do? Can it bring fundamental upgrades to the meme market?

Based on current information, the answer appears negative. Not to mention that last month alone saw the emergence of multiple competing launchpads, each challenging the once-dominant king in their own way.

The last king—or the final harvest?

Until the truth unfolds, caution is definitely warranted.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News