Now you can buy NVIDIA on Kraken—how is it different from trading stocks through a brokerage?

TechFlow Selected TechFlow Selected

Now you can buy NVIDIA on Kraken—how is it different from trading stocks through a brokerage?

Crypto projects and brokers compete for users, the era of crypto-stock convergence may be coming.

Author: BUBBLE, BlockBeats

In recent years, more and more institutions and regulators in traditional finance have begun embracing cryptocurrencies, while an increasing number of crypto projects aim for compliance to gain greater exposure. Building takes time, but breakthroughs happen in an instant—trends such as the incoming Trump administration, shifts in SEC stance, recent passage of stablecoin legislation, and Coinbase’s inclusion into the S&P 500 index signal a pivotal shift.

This has emboldened previously cautious crypto projects and brokerage firms to aggressively pursue security tokenization, giving rise to a wave of "on-chain Nasdaq" platforms.

Where Else Can You Buy “On-Chain Stocks”?

While crypto-themed stocks are popular among U.S. investors, tokenizing U.S. equities and securities within the crypto space has recently gained significant momentum.

Comparison of security tokenization projects in crypto. Chart: BlockBeats

XStocks

Kraken, a veteran cryptocurrency exchange founded in 2011, announced on May 22 a partnership with Backed Finance to launch a tokenized stock and ETF trading service named "xStocks." The initial offering will cover over 50 U.S.-listed stocks and ETFs, including Apple, Tesla, and Nvidia.

The project will be exclusively issued on the Solana blockchain, receiving strong support from Solana. Multiple team members from Kraken and Backed appeared at Solana Accelerate 2025 yesterday to share their vision for the future of security tokenization.

Bybit

Founded in 2018, Bybit does not issue tokens in the stock tokenization space but serves as a trading channel for tokenized assets. It partners with retail platforms like Swarm to provide markets for trading stock or ETF tokens. Bybit offers stock trading tools based on Contracts for Difference (CFDs), enabling users to participate in stock price movements without owning the underlying shares. A key feature is the ability to leverage positions up to 5x.

Bybit also supports trading of RWA tokens (such as TRAC) through copy trading and its NFT marketplace, targeting curated user investment in tokenized assets. Currently, it offers trading for 78 selected stocks including Apple, Tesla, and Nvidia, charging a fee of 0.04 USDT per share, with a minimum order fee of 5 USDT.

Ondo

Ondo Finance is one of the most comprehensive infrastructure projects in crypto's security tokenization space, building an integrated RWA (Real World Assets) ecosystem encompassing asset issuance, liquidity management, and foundational infrastructure. Its core products include two asset-backed tokens—OUSG and USDY—as well as the liquidity protocol Nexus, lending platform Flux, and the upcoming compliant permissioned chain, Ondo Chain.

In February 2025, Ondo hosted its inaugural Summit in New York, unveiling the design of its GM ("Global Markets") platform. This platform aims to tokenize thousands of global public securities—such as Apple, Tesla, and S&P 500 ETFs—and enable 24/7 trading and instant settlement on-chain. All GM tokens are backed 1:1 by physical securities, with issuance and redemption processes incorporating compliance controls. Targeted at markets outside the U.S., the initiative seeks to build a "Wall Street 2.0."

To support this ambitious strategy, Ondo announced the launch of Ondo Chain, a compliance-focused chain for institutional use. Built on a semi-permissioned architecture, it allows open development and issuance, but validator nodes are operated by prominent financial institutions to ensure regulatory compliance and security. The chain natively supports financial operations such as dividend distributions and stock splits, and introduces on-chain proof-of-reserves to guarantee full backing of tokenized assets. It aims to become the foundational infrastructure for future on-chain prime brokerage and cross-asset collateralization. On May 19, JPMorgan’s Kinexys executed the first cross-chain "Delivery vs Payment" transaction on Ondo Chain.

Although GM and Ondo Chain are not yet live, Ondo’s ecosystem already boasts core assets OUSG and USDY with respective valuations of $545 million and $634 million. OUSG is primarily held by institutions on Ethereum, while USDY shows higher retail adoption on Solana.

Notably, most Ondo team members hail from top-tier institutions such as Goldman Sachs and McKinsey. The company actively engages with U.S. regulators like the SEC and CFTC, deeply involving itself in policy-making, compliance design, and public relations. This includes appointing former Congressman Patrick McHenry to its advisory board, showcasing Ondo’s ambition and capability to bridge traditional finance and the crypto industry.

Securitize

The increasingly compliant crypto industry also features companies with strong ties to governments and brokerages—such as Cantor, which facilitated Tether’s purchase of 99% of its Treasury bonds. As one of the U.S. Treasury’s 24 primary dealers, Cantor participates directly in Treasury issuance and trading, maintaining close operational relationships with the Federal Reserve and the Department of the Treasury. This collaboration enabled Tether to generate $2 billion in Treasury income alone by mid-2023.

Such Cantor-Tether partnerships are not isolated cases. BlackRock, the world’s largest asset manager, launched its BUIDL fund in 2024, which has since grown to manage over $2.5 billion, emerging as a leader in the RWA sector. Securitize, founded in 2017 and specializing in blockchain technology and digital asset securitization, serves as the designated custodian for BUIDL.

Unlike traditional crypto firms, Securitize’s leadership is filled with Wall Street executives. Brett Redfearn, former Director of the SEC’s Division of Trading and Markets, was hired in 2021 and continues to serve as Senior Strategic Advisor and Chair of the Advisory Board. Securitize also maintains close ties with Paul Atkins, the newly appointed SEC Chair. Atkins joined Securitize back in 2019 as a committee member and board director, holding up to $500,000 in call options, before stepping down only in February this year. Coincidentally, in that same year—2019—Securitize became an SEC-registered broker-dealer and operator of an SEC-regulated Alternative Trading System (ATS).

On the cusp of broader regulatory acceptance, Securitize may leverage its compliance pedigree to become one of the best bridges between crypto and traditional finance.

Taking Food from the Tiger’s Mouth?

Signs of brokerages entering crypto began even earlier, with multiple exchanges attempting to integrate crypto services years ago.

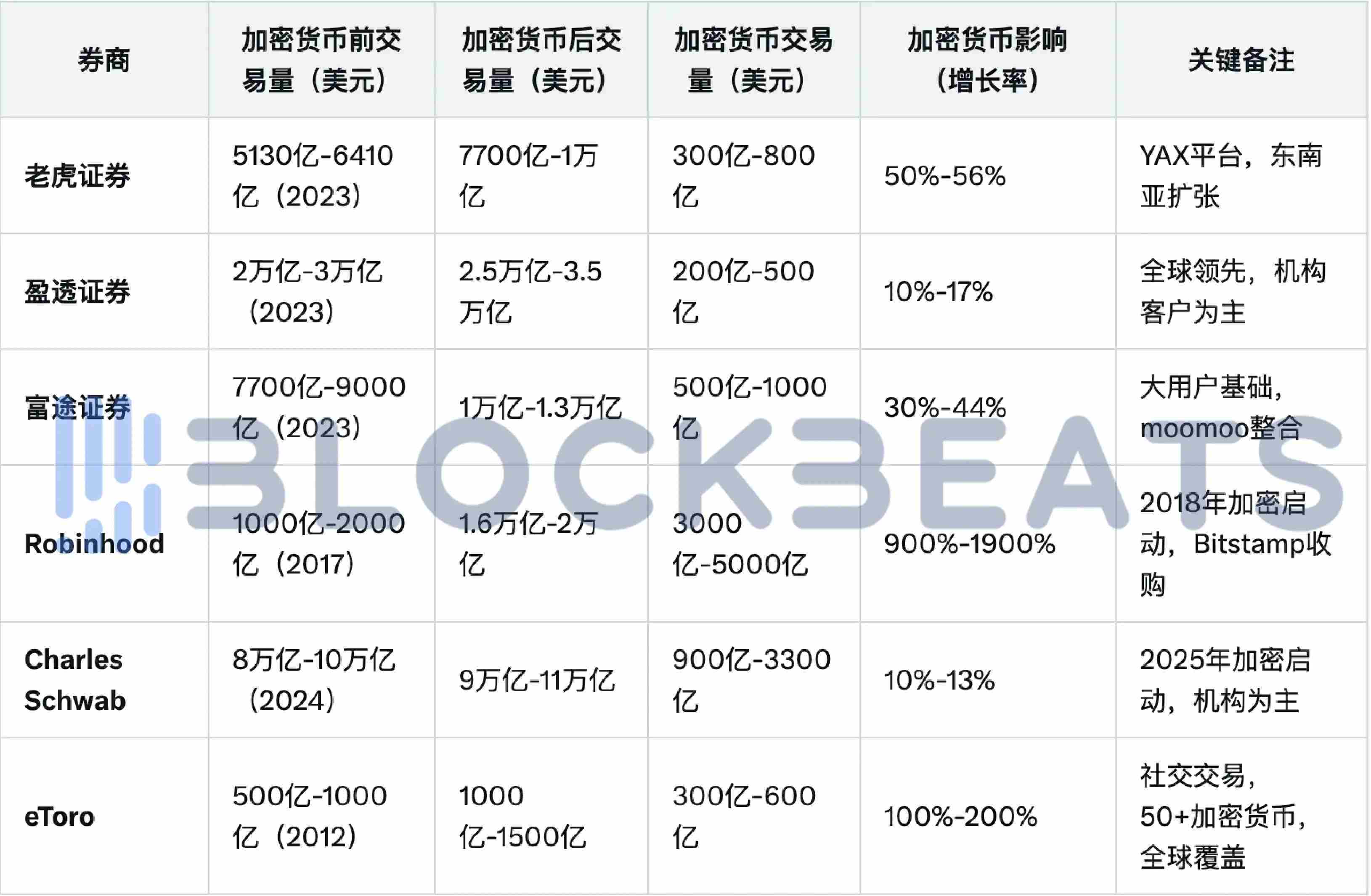

Data comparison of major securities firms before and after joining the "crypto movement." Chart: BlockBeats

Toro, an Israeli fintech company founded in 2007, first introduced Bitcoin trading services in 2013. eToro then continuously expanded its digital asset offerings, gradually adding support for mainstream cryptocurrencies such as Ethereum, Ripple (XRP), and Litecoin.

Robinhood may be the most well-known brokerage in the Crypto sphere, having entered the crypto space as early as 2018 and gaining widespread recognition during the Trump Coin era. After announcing the acquisition of European digital asset exchange Bitstamp for $200 million, Robinhood entered Singapore in March this year, leveraging Bitstamp’s regulatory approvals to integrate into Singapore’s crypto-friendly framework. Bitstamp has received in-principle approval from the Monetary Authority of Singapore (MAS), providing Robinhood with significant regulatory advantages and streamlining market entry.

By prioritizing regulatory compliance, Robinhood differentiates itself from offshore platforms operating in legal gray areas—a key advantage traditional brokerages hold over some crypto CEXs in driving global tokenized securities adoption.

Robinhood’s expansion into Singapore forms part of a broader international growth strategy. It has already rolled out crypto trading in Europe and launched stock options trading in the UK. With expanding licenses, Robinhood is now delivering comprehensive financial services—including both digital and traditional finance—across multiple regions.

This month, Robinhood accelerated its push into securities tokenization. On May 8, it announced plans to launch a blockchain-based platform for trading U.S. assets in Europe. Then on May 20, Robinhood submitted a 42-page proposal to the U.S. Securities and Exchange Commission (SEC), advocating for a federal-level "RWA tokenization" framework aimed at modernizing U.S. securities markets.

And it’s not just Europe and the U.S.—some Hong Kong brokerages began exploring this space last year. Starting in June 2024, several Hong Kong brokerages began rolling out trading services for virtual assets like Bitcoin. Firms including Victory Securities, Tiger Brokers, and Interactive Brokers have all launched related offerings. Some view their crypto businesses as strategically vital, projecting that crypto-related revenue could account for roughly a quarter of total company income.

On May 7, 2025, Futu Securities officially launched deposit services for Bitcoin, Ethereum, and USDT. Users can now deposit, trade cryptocurrencies, and manage traditional financial assets—including Hong Kong, U.S., and Japanese stocks, options, ETFs, funds, and bonds—all via the Futu Niuniu platform, enabling rapid conversion between virtual and traditional asset markets.

Past Failures and the Dilemma of Offshore Platforms

As early as around 2020, some crypto platforms had already boldly experimented with "tokenized stocks." This model aimed to map traditional equities onto blockchain as tradable digital assets, breaking down barriers of time, geography, and access inherent in traditional financial markets.

In this experiment, FTX was undoubtedly the most aggressive pioneer.

Around 2020, FTX launched its tokenized stock trading feature, allowing users to trade tokens representing major U.S. stocks such as Tesla (TSLA) and Apple (AAPL). These tokens were issued by its Swiss subsidiary, Canco GmbH, and linked to real shares held by third-party brokers, creating a "1:1 pegged" mapping.

At the time, users could invest in popular U.S. stocks with as little as $1, trading 24/7—an early realization of Nasdaq’s later ambition to absorb "global liquidity." Additionally, users could theoretically redeem tokens for actual shares, though this process was practically constrained by platform policies and compliance requirements.

Comparison of previous tokenized stock trading models between FTX and Binance. Chart: BlockBeats

To appear "compliant," FTX partnered with German financial services firms CM-Equity AG and Digital Assets AG to establish a regulatory framework, aiming to grant legitimacy and financial interoperability to these U.S. stock tokens. However, the business did not survive long. In November 2022, FTX collapsed amid allegations of fund misappropriation and fraud, abruptly ending its tokenized stock operations.

In April 2021, Binance briefly entered the tokenized stock arena, launching stock token products settled in its stablecoin BUSD, featuring star stocks like Coinbase (COIN) and Tesla (TSLA), further promoting fractional investing.

However, Binance’s challenges came not from the market but from regulators. Due to the lack of a unified regulatory framework for security tokens, financial authorities in Italy, Germany, and the UK first raised concerns, arguing these stock tokens might constitute unauthorized securities issuance or trading. Subsequently, Japan, the U.S., Canada, Thailand, and the Cayman Islands launched investigations, initiated criminal proceedings, or banned Binance from operating domestically.

Meanwhile, as both crypto exchanges and brokerages chase the security tokenization market, discussions have emerged within the community. For "Crypto Native" capital—whether from the ICO era or those experienced in Memecoin trends—the returns derived from traditional analysis of corporate PE, PS ratios, business models, and financial statements may pale in comparison to what they’re accustomed to. This makes traditional stocks less appealing to native crypto investors.

Conversely, high-net-worth individuals from traditional finance are highly interested in the "high yields" of crypto and AI assets—but this was previously a goal of crypto CEXs. Now, as both sides’ offerings converge, such clients tend to trust established traditional brokerage platforms like Robinhood, eToro, and Futu more.

Stablecoins + Securities On-Chain: Is a Liquidity Loop Coming?

On May 22, David Sacks, the White House’s head of cryptocurrency and artificial intelligence—dubbed the "Crypto Czar"—stated that the stablecoin bill would unlock trillions of dollars for the U.S. Treasury. The day before, the U.S. Senate voted to advance the "cloture motion" on the GENIUS Stablecoin Bill, clearing procedural hurdles for formal debate. At least 15 Democratic lawmakers switched positions to support the motion, and the bill is now set for full consideration—though it has not yet passed.

Nonetheless, the market remains broadly optimistic about the progress of the GENIUS Act. The bill would establish a clear regulatory framework for security tokenization, potentially extending from stablecoins and RWA tokenization to stock tokenization. This could reduce compliance risks and attract more institutional investors. Projects like Backed Finance and Securitize have already launched tokenized stocks under MiFID II and SEC regulations; if the GENIUS Act passes, their growth could accelerate significantly.

Once stablecoins are regulated, blockchain could reduce friction in cross-border transactions, drawing global investors into U.S. markets. In fact, many institutions and countries are already responding. On May 17, MoonPay partnered with Mastercard to allow users to spend stablecoins at over 150 million locations worldwide where Mastercard is accepted, with immediate conversion to fiat at point of sale. On May 21, South Korean presidential candidate Lee Jae-myung proposed issuing a won-backed stablecoin. Meanwhile, according to The Wall Street Journal, major banks including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are discussing jointly issuing a stablecoin with Zelle operator Early Warning Services and real-time payments network Clearing House.

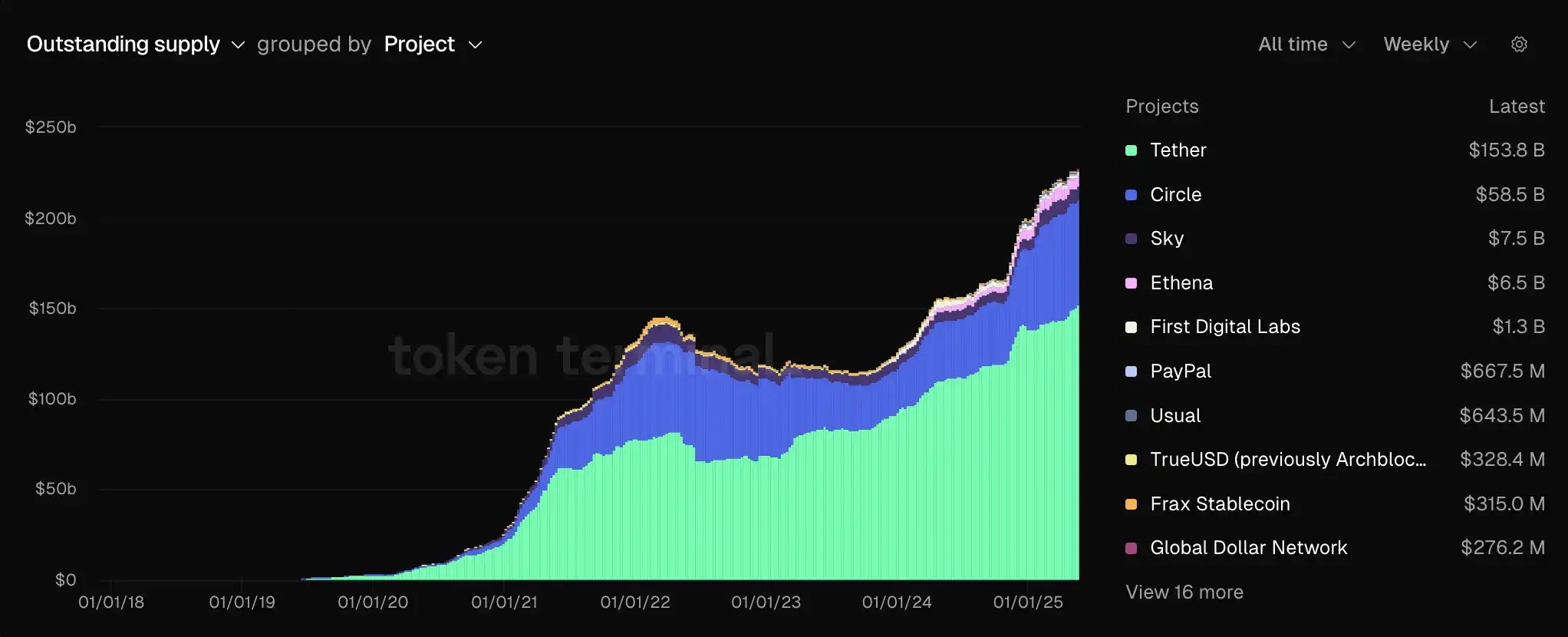

Still, JPMorgan analysts challenged David Sacks’ claim of trillions in unlocked value. They argue that while the U.S. stablecoin regulatory framework is advancing, predictions that total stablecoin supply will triple or quadruple from the current ~$240 billion to nearly $1 trillion within one to two years are "overly optimistic."

Nevertheless, after years of development, stablecoins now represent 1.1% of the total U.S. dollar supply. Thanks to their high yields, convenience, and potential role in global securities tokenization, they have reached a scale that traditional markets can no longer ignore.

Data source: tokenterminal. Current market share of major stablecoins

The "tokenization" transformation in crypto mirrors the music industry’s shift from physical records to digital music—from the chaotic copyright disputes sparked by Napster to the rise of compliant platforms like iTunes and Spotify. The path from chaos to compliance is never easy. Yet today, as crypto and securities rapidly converge, we stand at a historic crossroads. This journey may be fraught with uncertainty and risk, but perhaps a more open, transparent, and efficient financial era is on the horizon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News