In memory of my first US stock, NVIDIA

TechFlow Selected TechFlow Selected

In memory of my first US stock, NVIDIA

Excess profits come from monopoly; monopoly originates from an ecosystem closed loop.

Author: Liam, TechFlow

1.

NVIDIA's market capitalization has surpassed 5 trillion USD. What does this mean?

This figure exceeds the annual GDP of developed nations such as Germany and Japan.

If you had purchased one share at its IPO price of $12 in 1999 and held it until today, accounting for stock splits, your investment would have grown by approximately 8,280 times.

It’s fair to say that NVIDIA is no longer just an ordinary publicly traded company, but rather a "digital nation" with its own "energy system" (data centers), "currency" (AI computing power), "citizens" (developers and enterprise customers), and "territory" (ecosystem).

Even more striking is that NVIDIA’s current P/E ratio stands at only 58, making it appear relatively "cheap" compared to many tech stocks trading at hundreds or even thousands in P/E.

In the U.S. stock market, the top 10 tech companies now have a combined market cap exceeding 30 trillion USD, accounting for over 40% of the entire market. Are we entering an era of "oligarchic capitalism," where wealth, computing power, and data are concentrated in the hands of a few corporations?

The rise of such mega-corporations marks a defining feature of the cyber age—NVIDIA’s influence now surpasses that of many national governments.

2.

Recall early 2025, when DeepSeek surged in popularity and online sentiment widely predicted NVIDIA’s downfall, claiming low-cost AI models would undermine demand for NVIDIA’s high-end GPUs.

Those who bought against the tide during the subsequent dip would now be up over 80%.

The truth of investing is often simple: have the courage to take the road less traveled.

On a deeper level, DeepSeek’s success wasn’t a threat—it signaled another explosion in AI demand. Every new model means more GPU orders.

The more AI innovation there is, the stronger NVIDIA becomes.

3.

With a $5 trillion valuation, it’s impossible to view NVIDIA merely as a chipmaker. It is now the largest "infrastructure" provider of the AI era.

From GPU hardware to the CUDA software ecosystem, from individual chips to full-scale data center solutions, NVIDIA has built the engine of a new industrial revolution. If Microsoft and Google control application-layer gateways and Apple dominates consumer experience, then NVIDIA controls the foundational layer of computing power.

This echoes the electric power companies of the Industrial Revolution. When electricity became the fundamental energy source of industrial society, power companies gained strategic dominance over traditional manufacturing. Today, history is repeating itself—the AI revolution is elevating computing power companies into the new era’s "electric utilities."

4.

NVIDIA’s real moat isn't in hardware manufacturing, but in its monopoly over software ecosystems.

The CUDA platform is like the Windows operating system of the AI era. Once developers become accustomed to this toolchain, switching costs become prohibitively high.

From TensorRT to DGX Cloud, NVIDIA has built a complete hardware-software co-design system. All major AI companies—including OpenAI, Anthropic, Meta, and Google—rely on NVIDIA’s infrastructure. This dependency creates powerful network effects: the more users, the stronger the ecosystem; the stronger the ecosystem, the higher the user stickiness.

Excess profits come from monopoly; monopoly arises from closed-loop ecosystems.

5.

An ironic reality: the biggest enemy of today’s overworked laborers might just be NVIDIA.

This Tuesday, Amazon, the U.S. e-commerce giant, announced plans to lay off 30,000 employees to cut costs, while simultaneously rushing to purchase NVIDIA H200 GPUs.

AI is replacing thousands of ordinary jobs.

For Silicon Valley workers, one hedge is simply buying NVIDIA stock.

Cruel, yet real.

6.

NVIDIA’s growth story is also a narrative evolution of technology itself.

It began solely as a game GPU company. But whenever gaming market growth slowed and graphics cards stagnated, fate seemed to send it a new "white knight."

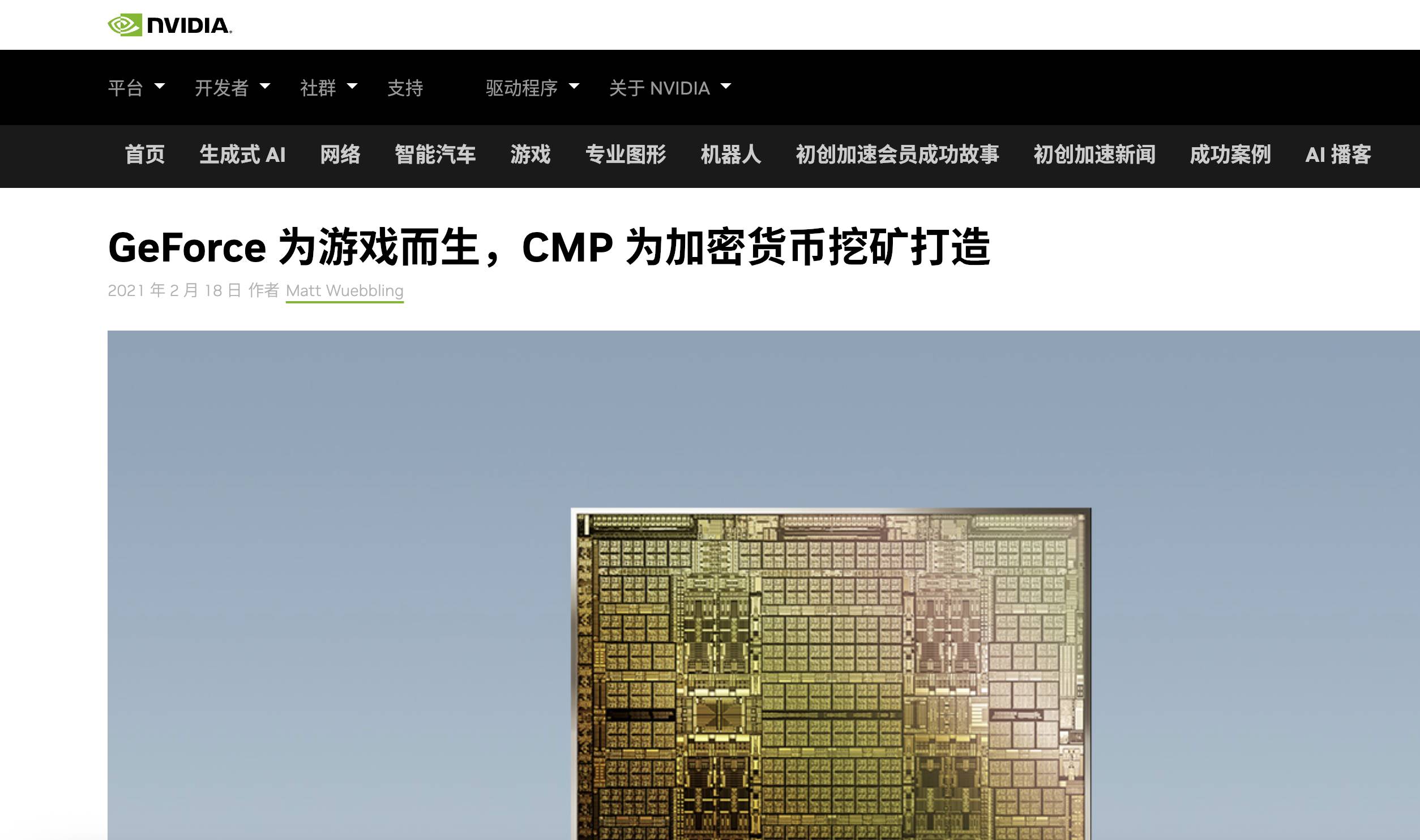

The first was cryptocurrency.

The 2017 ETH bull run turned mining-capable "GPU graphics cards" into scarce commodities. The roar of mining farms revived NVIDIA’s financials.

In fiscal year 2018, NVIDIA reported record annual revenue of $9.7 billion. Jensen Huang stated publicly, "Our GPUs support the world’s largest distributed supercomputing—this is why they’re so popular in crypto mining."

NVIDIA even launched mining-specific products like the GTX 1060 3GB and professional mining cards P106 and P104.

The second savior was AI. The AI wave ignited by OpenAI made NVIDIA the biggest beneficiary.

From gaming to mining to AI training, these seemingly different use cases share a striking commonality—insatiable demand for computing power. NVIDIA敏锐ly captured this essence: no matter how technology evolves, computing power remains the foundational currency of the digital world.

7.

To be honest, the first U.S. stock I ever bought was NVIDIA in 2021.

A beautiful beginning, but not a glorious end—I sold far too early.

But I don’t regret it, because I know that opportunity wasn’t truly mine. My purchase back then was more accidental than a result of deep, rational analysis.

Chance encounters don’t equal real investment opportunities. True opportunities require deep understanding, long-term conviction, and contrarian thinking.

What truly counts as missing out? It’s when you’ve invested immense time and resources into research, committed substantial capital, and still walk away empty-handed.

Those investors who earned massive returns from NVIDIA didn’t rely on luck—they succeeded through profound insight into technological trends and the ability to overcome human weaknesses.

Respect to them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News