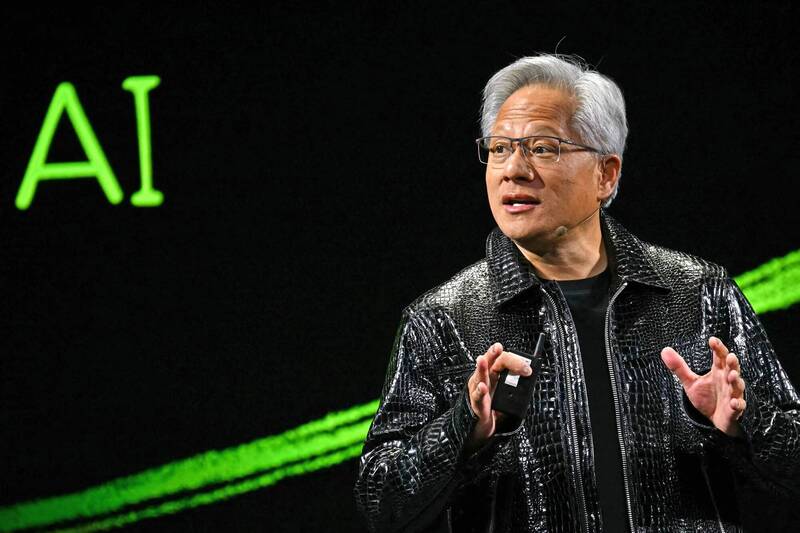

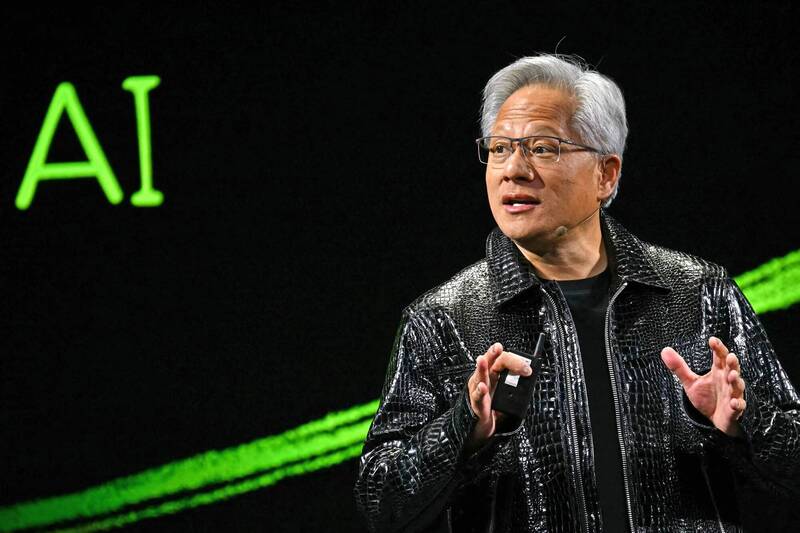

Huang Renxun didn't see the bubble

TechFlow Selected TechFlow Selected

Huang Renxun didn't see the bubble

Nvidia continues to rise.

The outside world is in turmoil, but after NVIDIA released its earnings report, its stock price still rose.

This was a remarkably strong financial report, with robust performance across overall quarterly revenue, profits, and its core data center business. Jensen Huang even stated that NVIDIA has $500 billion worth of unfulfilled chip orders on hand and that cloud GPUs are completely sold out.

Most notably, during the earnings call, Jensen Huang addressed external concerns about an AI bubble, stating he sees no evidence of one.

NVIDIA's latest earnings release drew significant attention, largely due to deep divisions in market sentiment. On one side are prominent short-sellers like Michael Burry, the real-life inspiration behind "The Big Short." On the other, there are bullish investors such as investment bank DA Davidson, which recently shifted from skepticism to optimism and increased its position in NVIDIA.

Thus, NVIDIA finds itself caught between polarized views. There seems to be little consensus on NVIDIA’s future—or indeed the path forward for the entire AI industry.

01

Let's first examine NVIDIA’s earnings report.

The report covers the third quarter of fiscal year 2026, ending October 26 this year.

The results were overwhelmingly positive, surpassing analyst expectations in revenue, profit, and other key metrics. The company also expressed confidence in its outlook.

The report shows that NVIDIA achieved $57.01 billion in revenue for Q3, well above the expected $54.92 billion. Net profit reached $31.91 billion, a 65% year-on-year increase.

Adjusted earnings per share came in at $1.30, exceeding the market expectation of $1.25.

In terms of specific business segments, data centers remain NVIDIA’s backbone, once again setting a new record in performance.

Data center revenue reached $51.2 billion in Q3, accounting for nearly 90% of total revenue and growing 66% year-over-year—far surpassing the projected $49 billion. Within this segment, “computing” made up the largest portion, generating $43 billion in revenue.

This growth was primarily driven by sales of the GB300 series chips. GB300 is NVIDIA’s next-generation AI computing platform, equipped with 72 Blackwell Ultra AI GPUs and 36 Grace CPUs based on the Arm Neoverse architecture. Announced in May and entering mass production in the third quarter, it has quickly gained traction.

During the earnings call, NVIDIA CFO Colette Kress revealed: “GB300 sales have surpassed those of GB200, contributing approximately two-thirds of Blackwell’s total revenue. The transition to GB300 has been very smooth.”

Besides “computing,” the data center segment also saw strong performance in “networking,” which generated $8.2 billion in revenue.

Other businesses, though smaller in proportion, also showed solid growth in Q3 FY2026. Gaming brought in $4.3 billion in quarterly revenue, up 30% year-over-year; professional visualization earned $760 million, a 56% increase; automotive and robotics contributed $590 million, rising 32% year-over-year.

To grasp how extraordinary this growth is, consider the state of NVIDIA before the current AI wave. Exactly three years ago, in November 2022, NVIDIA reported $5.93 billion in revenue for Q3 of fiscal year 2023—a 17% decline year-over-year. In just three years, quarterly revenue has expanded tenfold.

You could say that what used to be NVIDIA’s entire quarterly revenue now amounts to roughly the 10% of income generated outside its dominant data center business.

02

Immediately after releasing the earnings, the market responded positively, with after-hours trading seeing NVIDIA’s stock rise over 5%.

This reaction wasn’t guaranteed. The reason this earnings report attracted so much attention is because concerns about an AI bubble have reached unprecedented levels.

Views on NVIDIA’s future are sharply divided.

On one hand, many institutions remain bullish, choosing to buy or issuing optimistic forecasts.

The most dramatic shift came from investment bank DA Davidson, which abruptly upgraded NVIDIA’s rating from “Neutral” to “Buy” and raised its price target from $195 to $210 per share.

This marked a major reversal—DA Davidson had previously been bearish on NVIDIA, with analysts warning of potential drops of up to 48% in its stock price.

In its new report, DA Davidson stated: “Our growing optimism regarding the expansion of AI computing demand has replaced our earlier concerns about NVIDIA.”

On the other hand, opposing voices are equally loud.

The most notable comes from Michael Burry, the real-life figure behind the film *The Big Short*, whose Scion Asset Management has taken a large short position against NVIDIA.

Burry himself broke two years of silence, posting on X with an image of his movie character staring at a computer screen, captioned: “Sometimes we see bubbles. Sometimes we can do something about them. Sometimes the only winning move is not to play.”

Though he didn't explicitly name what bubble he meant, most observers believe he was referring to the AI bubble.

Burry isn’t always right. While he famously predicted the subprime mortgage crisis, he also warned years ago of a “century-scale crash” for meme stocks and crypto buyers—a prediction mocked by Elon Musk as coming from a “broken clock” that occasionally tells the correct time.

But who can ignore the signal this time? Especially now, as debate over an AI bubble intensifies, and NVIDIA—serving as the central hub of Silicon Valley’s AI ecosystem—is under intense scrutiny.

03

NVIDIA naturally has to confront these debates. During the earnings call, questions about the AI bubble were inevitably raised.

Jensen Huang neither avoided nor sidestepped the issue, offering a direct rebuttal:

“There’s a lot of talk about an AI bubble, but from our perspective, the situation is entirely different compared to the dot-com bubble era. AI is transforming existing workloads—we don’t see any AI bubble.”

NVIDIA’s confidence stems from extremely strong GPU sales. Huang noted in the report that Blackwell chip sales have far exceeded expectations and that cloud GPUs are completely sold out. “Demand for computing power—both for training and inference—is accelerating and compounding exponentially. We’ve entered a virtuous cycle of AI.”

He also revealed that NVIDIA currently holds $500 billion in unfulfilled chip orders, with delivery schedules booked through 2026, including the next-generation Rubin processor set for mass production next year.

In Huang’s view, the AI ecosystem is rapidly expanding, with more foundational model developers, more AI startups emerging across more industries and countries. AI is becoming ubiquitous and all-powerful. Therefore, concerns about an AI bubble are unwarranted.

Looking ahead, NVIDIA remains confident and optimistic.

NVIDIA forecasts fourth-quarter revenue of approximately $65 billion, exceeding the analyst consensus of $61.66 billion.

The post-earnings movement of NVIDIA’s stock indicates that both the financial results and the tone of the earnings call have somewhat eased market anxiety.

Thomas Monteiro, Senior Analyst at Investing.com, commented: “This answers many questions about the current state of the AI revolution. The conclusion is simple: in the foreseeable future, AI is far from peaking, whether measured by market demand or supply chain capacity.”

However, this doesn’t mean all tensions have vanished.

Some analysts argue that this earnings report may not be enough to quell fears about an AI bubble.

In Q3, NVIDIA significantly increased its spending to lease back its own chips from cloud customers unable to rent them out. These leaseback contracts totaled $26 billion, doubling from the previous quarter.

Cloud giants including Microsoft and Amazon are investing billions into AI data centers. Some investors believe these companies are artificially inflating earnings by extending the depreciable lifespan of AI computing equipment, such as NVIDIA chips.

In Q3, NVIDIA’s customer concentration increased further, with its top four clients accounting for 61% of sales—up from 56% last quarter.

The company continues to make massive bets on AI firms, investing billions in companies that are often also its key customers—raising concerns about an “AI economic circular dependency.”

Beyond this, numerous uncontrollable factors could constrain NVIDIA. Geopolitical issues persist, particularly its exclusion from the Chinese market. NVIDIA is now shifting focus to the Middle East, having recently received approval to export chips worth up to $1 billion there.

Then there’s the question of actual GPU utilization in the future. Jacob Bourne, analyst at eMarketer, said:

“While demand for GPUs remains enormous, investors are increasingly asking: Can hyperscale cloud providers actually deploy this compute fast enough? The key issue is whether physical constraints—power, land, and grid access—will limit how quickly this demand translates into revenue growth beyond 2026.”

The debate over the AI bubble and NVIDIA’s future will continue.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News