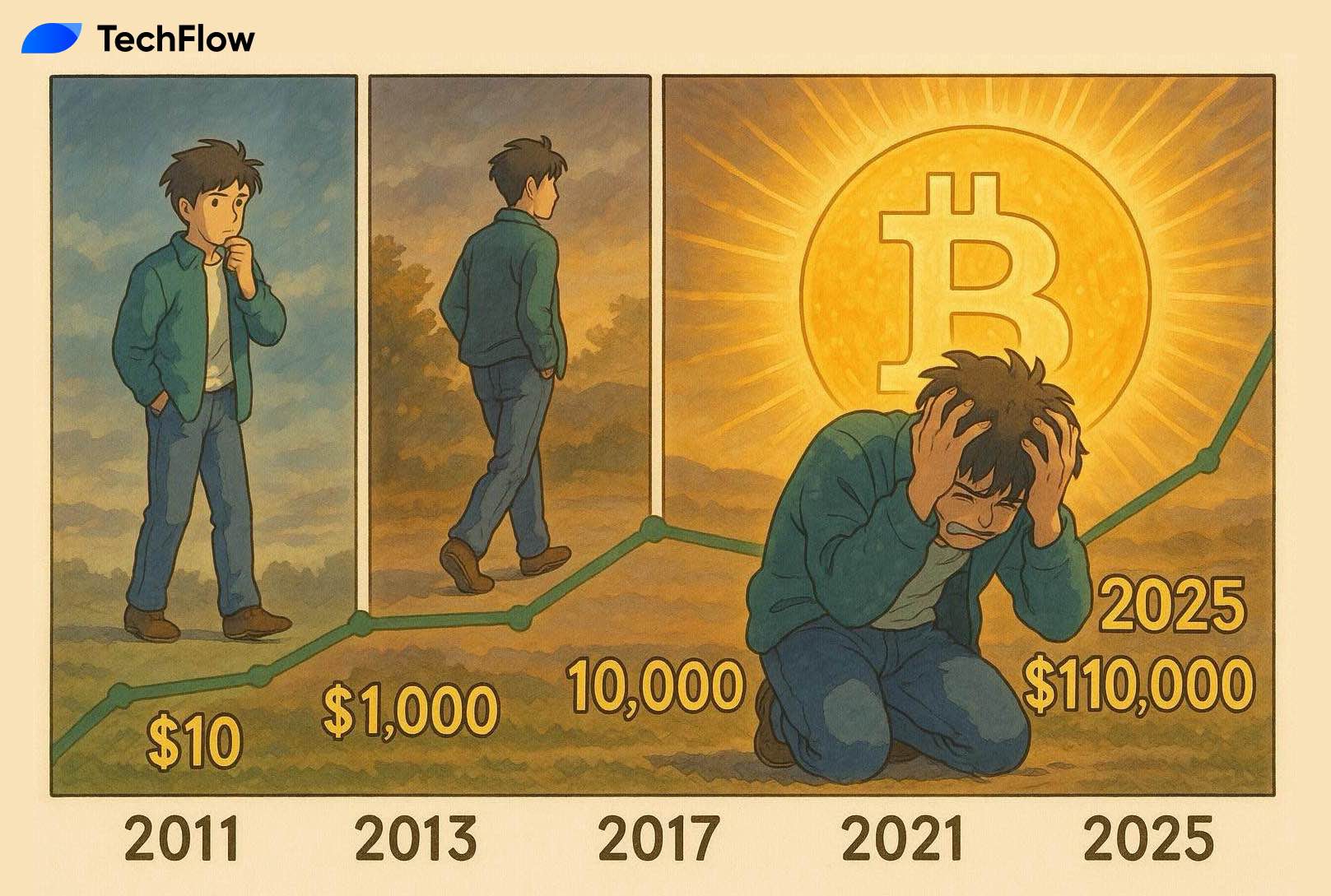

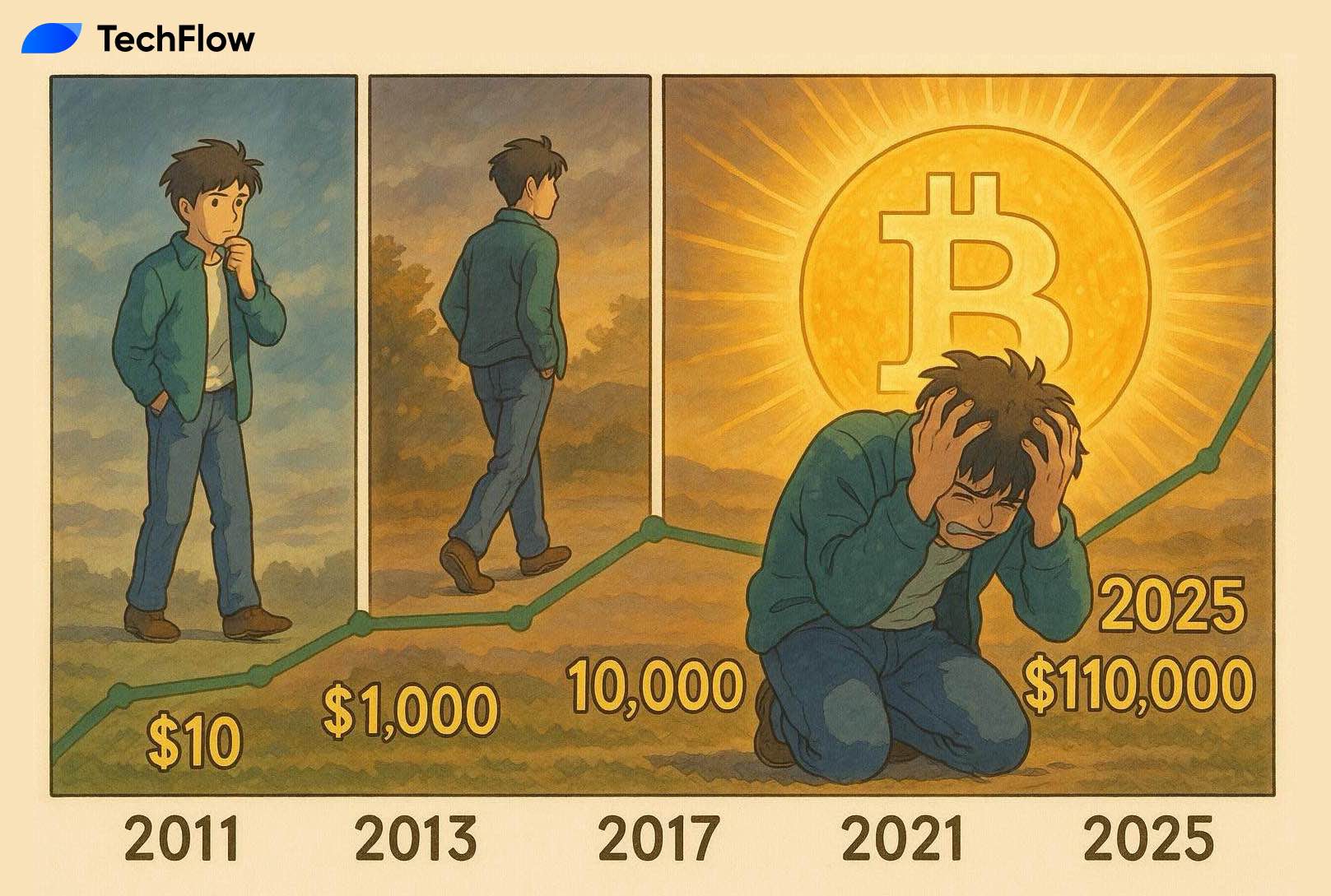

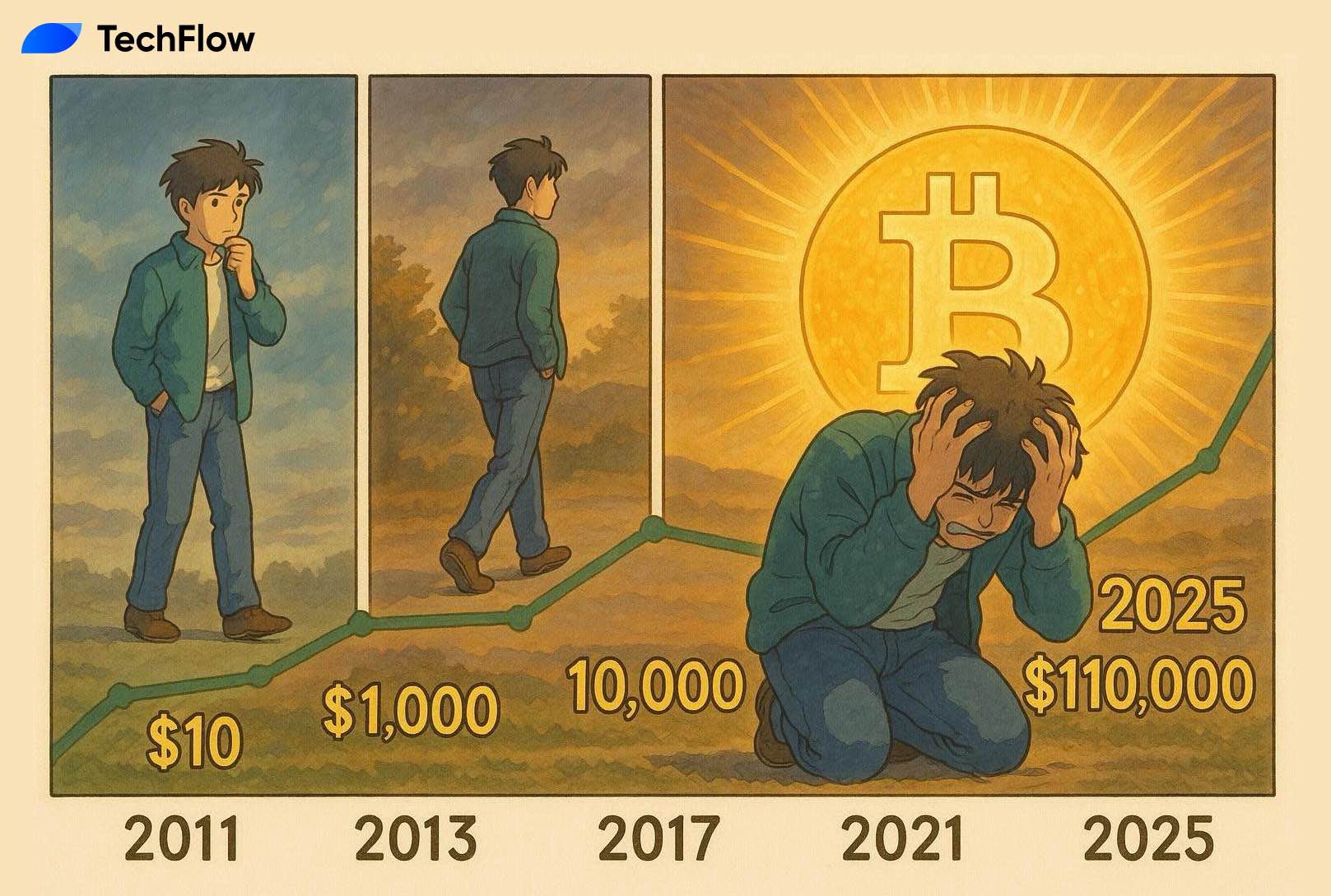

Bitcoin surpasses $100,000: regrets and missed opportunities over the years

TechFlow Selected TechFlow Selected

Bitcoin surpasses $100,000: regrets and missed opportunities over the years

The market is always right.

By: TechFlow

On May 22, Bitcoin Pizza Day's 14th anniversary, Bitcoin broke through $110,000, hitting a new all-time high.

This means that at any point in the 15 years since 2010, buying Bitcoin would not have resulted in a loss—Bitcoin never betrays anyone.

I suspect many friends, like me, may have seen numerous reflections and sighs on social media about how they once missed Bitcoin or sold their holdings too early.

For example, one of my colleagues once sold 10 Bitcoins to pay rent, followed by endless regrets: "If only I had bought Bitcoin back then," "If only I had held on..."

At such times, many people attribute early Bitcoin investors' wealth purely to luck, claiming they just "knew early," as if merely "knowing early" inevitably equals "getting rich overnight."

Today, I want to share two stories to discuss: what truly constitutes missing Bitcoin, and why people miss it?

The first story is about the "Zhihu girl" and Bitcoin.

You might have seen this Zhihu answer: On December 21, 2011, a female college student asked on Zhihu, "A junior student has 6,000 yuan—any good financial investment suggestions?"

That day, a user named "blockchain" replied: "Buy Bitcoin, secure your wallet file, then forget you ever had 6,000 yuan. Check again in five years."

The responder was Chang Jia, an early Bitcoin evangelist and founder of 8btc (Babbitt).

Ever since, whenever Bitcoin surges, netizens flood the comment section, tirelessly telling the questioner how valuable her investment would be today. The latest figure: if she had invested all 6,000 yuan in Bitcoin back then, she could have bought over 300 BTC, now worth $33 million—or 230 million RMB.

So, here’s the question: did she eventually buy Bitcoin?

Hehe, actually I know what happened next. In 2018, while working in Beijing, I happened to contact the original Zhihu user—let’s call her Zhuzi for now—and a colleague conducted an exclusive interview with her.

The final answer: no.

She made no investments. In spring 2012, she used her 6,000-yuan scholarship to travel around cities like Hangzhou with friends for a week.

Since then, every time Bitcoin surged, the stream of comments under that post seemed to remind her: you missed a chance to get rich overnight.

Yet Zhuzi still never bought Bitcoin. Although she later regretted it, she said, "If I were still the same person I was back then, I’d make the same choice as seven years ago." In her view, a person's character is fixed—like a character in a novel—actions stem from that persona and don’t change much.

So, here’s the question: do you think Zhuzi really missed Bitcoin? If you were Zhuzi, would you lie awake at night filled with regret?

Hold that thought. Let me share the second story.

The protagonist of the second story is somewhat of an internet celebrity—some stock enthusiasts might know him. His name is Lao Duan.

Lao Duan, real name Duan Hongbin, is a financial columnist and one of China’s earliest Bitcoin adopters.

In 2010, he first encountered Bitcoin on Google Reader and was instantly captivated. He once described Bitcoin as "a tool for geeks to rise from rags to riches."

Recalling that moment, Lao Duan thought geeks had invented something new in the virtual world. He compared Bitcoin to "the stones on the Island of Stone Money." Here’s a quick lesson—take notes: the Island of Stone Money refers to Yap Island in the western Pacific. There, currency is stone. These stones range from a few centimeters to several meters in diameter, some weighing tons. They’re immovable, simply left in place, with ownership tracked orally. Transactions rely on consensus and collective memory, making it one of the earliest "virtual currency" systems. The island’s monetary system illustrates a key economic principle: money’s value lies not in physical form, but in social consensus and trust.

Back to Lao Duan: from Bitcoin’s inception, he became one of its earliest advocates in China.

In July 2011, Lao Duan wrote his first article on Bitcoin titled “What Can Appreciate 3,000-Fold in a Year?” In it, he argued that Bitcoin, as a government-independent monetary system, derives value solely from market trust and demand. He noted that the hard cap of 21 million coins prevents counterfeiting and replication, while the programmed issuance rate avoids inflation.

Lao Duan urged readers to buy at least one Bitcoin. He said: "One Bitcoin costs about 100 RMB now—less than a meal. Even if you lose it all, it’s no big deal. But if Bitcoin gains tens of millions of users in the coming years, there won’t even be one coin per person. Owning one would make you rich."

In 2025, as Bitcoin breaks $110,000, these words sound remarkably prescient.

That same year, Lao Duan co-founded the Chinese Bitcoin community "8btc" with two other early adopters, Chang Jia and QQagent. This community profoundly influenced later blockchain participants. Notably, QQagent later became Wu Jihan, co-founder of Bitmain and translator of the Bitcoin whitepaper—an individual who reshaped crypto history.

In July 2012, when Bitcoin hovered around $7, Lao Duan launched the "Lao Duan Bitcoin No.1 Fund"—China’s first Bitcoin fund. Due to legal and market risks, it wasn’t open to the public. Initial capital totaled 100,000 RMB, with 40% from Lao Duan himself and 60% from friends.

Lao Duan publicly promised full reimbursement if Bitcoin disappeared or lost all value. As fund manager, he charged no management fee—only 20% of profits as commission.

Why was Lao Duan so confident in Bitcoin’s rise?

His reasoning was simple: value is determined by the market. If more people believe it’s valuable, it becomes valuable. Unlike fiat money, Bitcoin avoids inflation, so allocating part of one’s cash to Bitcoin makes sense.

Moreover, due to Bitcoin’s four-year halving cycle, November 28, 2012 marked the end of the first cycle. By economic principles, rising demand plus falling supply must drive prices up.

Yet, this digital-native "uninvited guest" accelerated far beyond Lao Duan’s expectations, propelled by real-world black swan events.

In early 2013, Cyprus’s president announced a bank deposit tax to secure EU emergency loans. Panic ensued. People rushed to banks, converting cash into Bitcoin, sending its price from over $30 to $265 in months.

Lao Duan felt immense pressure. Every morning, he saw his fund’s net value soar—up more than tenfold in eight months. Investors called daily, urging him to "sell now, lock in gains." Under this pressure, Lao Duan liquidated the fund prematurely in April.

In a media interview, Lao Duan explained: "I thought Bitcoin’s rally was nearing its end."

After this volatility, Lao Duan began doubting Bitcoin. He believed: "Prices keep rising only as long as new buyers come in. Once they stop, it collapses immediately."

Eventually, Lao Duan declared: "I will never buy another Bitcoin."

In November 2013, five months after liquidating his fund, Bitcoin surged again—unexpectedly.

By then, Lao Duan had shifted from evangelist to critic. That month, he published a landmark article titled “How Many More Will Bitcoin’s ‘Nameless Man’ Devour?”—publicly breaking with Bitcoin.

He bluntly stated: "Bitcoin has gone mad! We are witnessing a giant bubble forming."

He argued this bubble differs from past ones—it’s global, and its future surge will shock everyone. When it bursts, it will trap countless people. He stressed this isn’t a prediction, but an inevitability.

He further claimed Bitcoin resembles a "pyramid scheme": early participants profit from later ones, who must recruit new members to earn. Without fresh recruits, the system collapses. He likened Bitcoin to "No-Face" from *Spirited Away*, saying its greatest value lies in fulfilling people’s dreams of getting rich overnight.

In the article, Lao Duan summarized two "truths" about Bitcoin.

First, for most people, logic doesn’t work—the real driver is "jealousy." People think: "Why can you get rich, but not me?" So they pull out savings and buy Bitcoin without hesitation.

Second, actual applications don’t matter. What matters is how many newcomers join the game. Whether news is good or bad, it’s all good for Bitcoin—the only thing it fears is silence.

Thus, Lao Duan parted ways with the Bitcoin world, promoting altcoins instead and settling into the stock circle as a financial columnist.

For a long time afterward, Lao Duan never mentioned Bitcoin publicly on social media. The crypto community gradually forgot him. Today, when people think of Bitcoin pioneers in China, names like Wu Jihan and Li Xiaolai come to mind—not Lao Duan.

In March 2021, Lao Duan mentioned Bitcoin again. He revealed he once owned a four-digit number of Bitcoins—worth billions of RMB—but sold most after gaining tens of times returns. Now, he still holds a three-digit "remainder," all trapped in a bankrupt exchange—Mt. Gox.

Mt. Gox was once the world’s largest Bitcoin exchange. In 2014, it lost over 850,000 Bitcoins to hacking. Since 2019, Mt. Gox has been executing a compensation plan, repeatedly delayed—until this July, when payouts finally began, with some creditors receiving funds.

Ironically, the hacked and bankrupt Mt. Gox became the final custodian of an early Bitcoin pioneer’s holdings.

As Bitcoin surges again, new entrants remember today’s industry leaders and their legendary tales: Wu Jihan, Wu Gang, Shenyu, Xu Mingxing, Li Lin, Zhao Changpeng... Meanwhile, Lao Duan, once a Bitcoin pioneer, fades into the river of Bitcoin history.

Alright, the second story ends here.

Both learned about Bitcoin around 2021—between Zhuzi and Lao Duan, who truly missed Bitcoin?

In my view, Zhuzi didn’t "miss" Bitcoin at all.

This is a common misconception: many mistake hearing information for having a graspable investment opportunity—for instance, at a gathering, someone suggests buying Bitcoin or Nvidia, but you don’t act...

Later, when Bitcoin and Nvidia stocks skyrocket, you feel you’ve missed a shot at financial freedom, posting on social media: "An opportunity for financial freedom was right before me, and I didn’t cherish it."

I’d say you’re overthinking it. That wasn’t your opportunity.

In reality, such information is just one among countless bits you receive daily. You didn’t research it deeply. Plus, you’ve forgotten many incorrect investment tips—this is survivorship bias: you only remember cases that turned out successful.

So, what truly counts as missing out? It’s when you’ve spent significant time and effort researching, invested heavily, yet still gained nothing.

For example, Lao Duan deeply researched Bitcoin, earned tens of times returns, but exited early and turned against it—missing out on Bitcoin’s subsequent exponential growth.

That’s a real case of missing out.

Why did Lao Duan, once a true believer, suddenly break with Bitcoin?

I’ll venture an amateur opinion.

After liquidating his Bitcoin fund in 2013, Lao Duan firmly believed the rally was ending. To justify his decision, he sought reasons to prove himself right. This psychological defense mechanism blinded him to Bitcoin’s continued growth—just like hoping your ex-partner fails after a breakup.

But when Bitcoin kept rising, he couldn’t admit he’d sold too early, nor dare buy back at double, triple, or higher prices—leading to severe cognitive dissonance.

To ease this mental conflict, he criticized Bitcoin to rationalize his exit, labeling it a "bubble" and "pyramid scheme," thus reducing regret. Like someone attacking an ex to justify a breakup.

As a former pioneer and influencer, his "missing out" cost him influence in the community. Buying back would mean admitting past error—a huge blow to pride.

Plus, after shifting from advocate to critic, he gained new supporters and formed a new identity. This shift made it harder to admit mistakes or change stance.

The new identity became his "cognitive prison."

I think this reveals a human weakness—a self-defense mechanism. When facing major judgment errors, we often deny the other side rather than admit our own fault to protect self-esteem.

But in investing, emotions don’t matter. The market is always right. Staying open-minded beats clinging to biases. Admitting mistakes timely is wiser than persisting in error.

This is why I always believe: never blindly follow experts’ advice in investing. Compared to ordinary people, their weaknesses are often more pronounced.

The more professional someone is, the more prone they are to cognitive biases, and the harder it is for them to admit error—especially after publicly stating a position. That stance becomes part of their identity, making reversal extremely costly.

So remember: the market is always right—have the courage to admit mistakes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News