Bitcoin becomes the new favorite in corporate treasury, why is everyone rushing to emulate Strategy?

TechFlow Selected TechFlow Selected

Bitcoin becomes the new favorite in corporate treasury, why is everyone rushing to emulate Strategy?

Strategy is actively promoting the adoption of a new framework by credit rating agencies that could potentially classify Bitcoin as a high-grade reserve asset.

Author: Maximiliaan Michielsen

Translation: TechFlow

Corporate accumulation of Bitcoin is rapidly shifting from a bold bet to a mainstream financial strategy. Bitcoin (BTC) is no longer just synonymous with "HODLing" — a long-term buy-and-hold approach — but is increasingly seen as a productive, collateralizable asset entering corporate balance sheets.

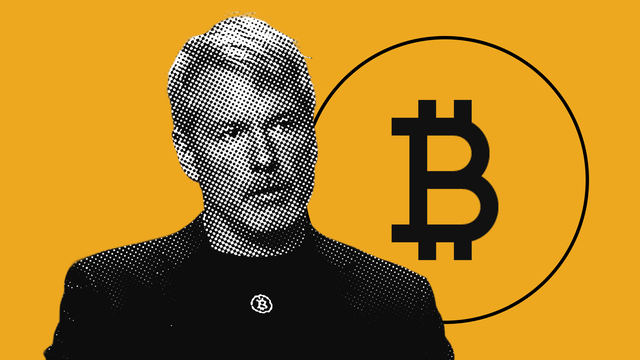

Last week, we explored how the trend of Bitcoin accumulation began with Michael Saylor’s strategy and gained momentum across companies like GameStop and MetaPlanet. The latest example is Twenty One Capital purchasing Bitcoin for $458 million. This momentum continues, with Strategy recently increasing its holdings to an astonishing 568,840 BTC — 2.7% of Bitcoin’s total supply — valued at nearly $60 billion.

While these acquisition scales are impressive, the real highlight lies in how Strategy is building an entirely new corporate financial architecture around Bitcoin.

Source: 21Shares, Bitcointreasuries. Data as of May 9, 2025

Bitcoin-Native Transformation of Corporate Finance

In its Q1 2025 earnings call, Strategy not only reported continued Bitcoin accumulation but also unveiled a strategic roadmap that could serve as a blueprint for a Bitcoin-native corporate finance model — one with the potential to reshape capital markets.

Despite reporting lower traditional earnings year-on-year — reflecting broader macroeconomic headwinds — Strategy emphasized its unwavering commitment to Bitcoin in its Q1 2025 update. In just the first four months of this year, the company raised $10 billion to support its acquisition strategy:

-

$6.6 billion raised through At-the-Market (ATM) equity offerings

-

$2 billion raised through convertible bonds

-

$1.4 billion raised through preferred stock

To support its long-term Bitcoin strategy, Strategy announced its "42/42 Plan," aiming to raise $42 billion in equity capital and $42 billion in fixed-income capital by the end of 2027.

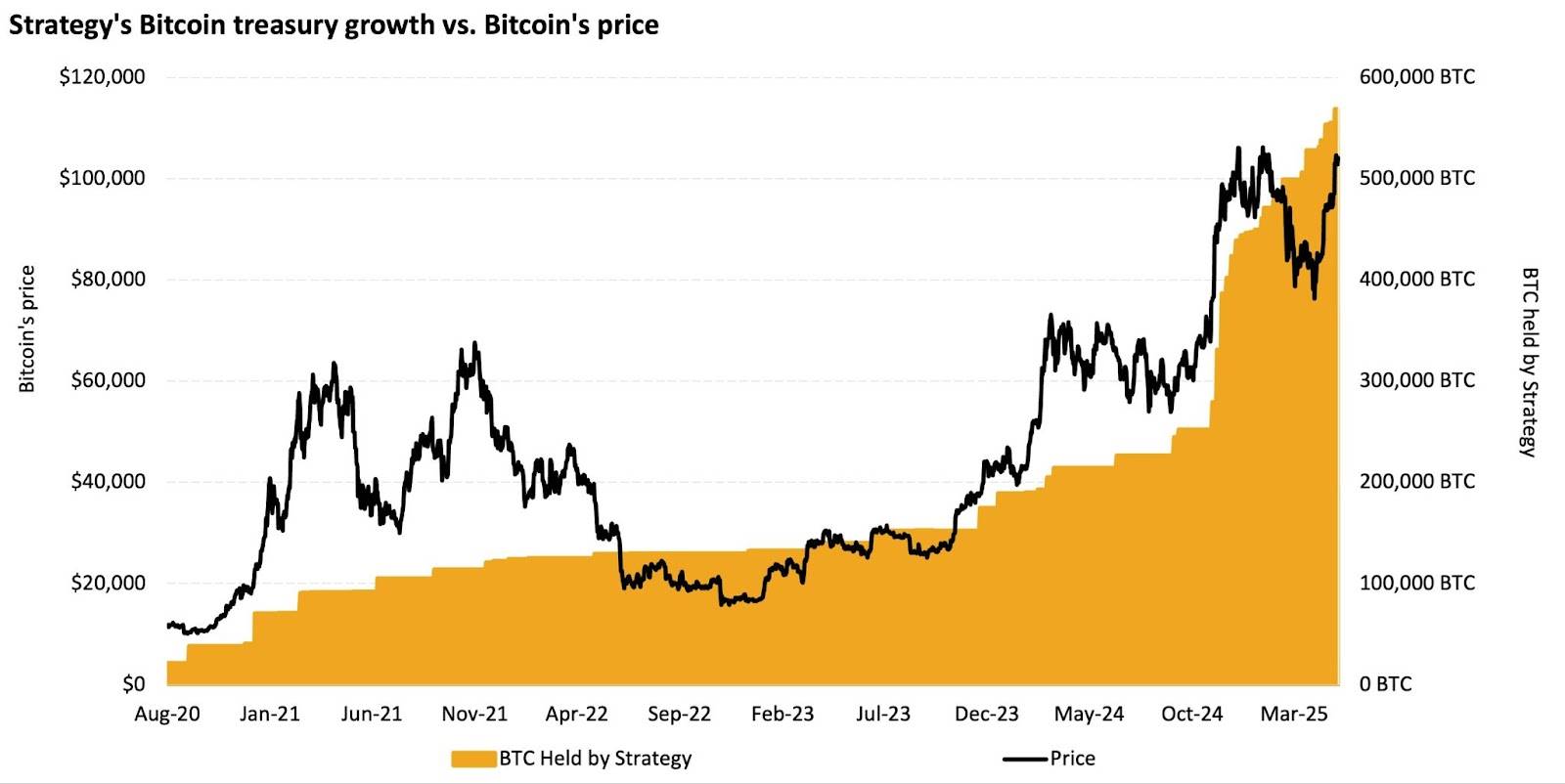

This structured roadmap is designed not only to advance Strategy’s own Bitcoin accumulation but may also become a replicable model for other corporations considering similar financial policies. Notably, Strategy has moved away from evaluating performance using traditional key performance indicators (such as EPS or EBITDA), instead adopting a Bitcoin-native financial perspective guided by three proprietary metrics:

-

BTC Yield: target increasing from 15% to 25%

-

BTC Gain: target increasing from $10 billion to $15 billion

These targets signal Strategy’s ongoing commitment to maximizing Bitcoin-adjusted shareholder value, despite recent macroeconomic volatility. As more companies seek to replicate this model, Strategy stands at the forefront of a new financial era.

Redefining the Corporate Credit Market with Bitcoin as Collateral

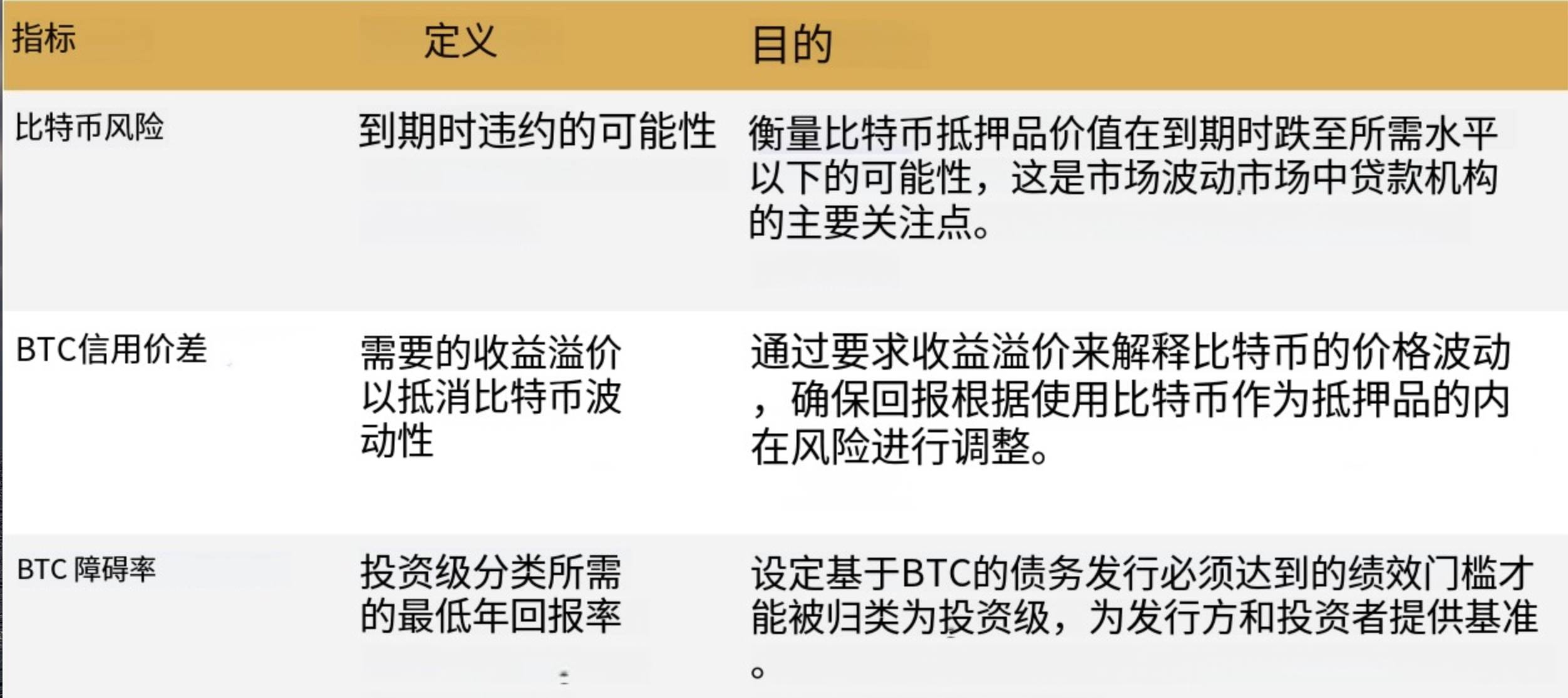

One of the most transformative pillars within Strategy’s framework is its use of Bitcoin as collateral in the corporate credit market. Beyond its capital-raising efforts, the company has introduced a BTC-backed financial instrument structure specifically tailored to Bitcoin’s unique risk profile:

Translation: TechFlow

By issuing convertible bonds and preferred shares backed by over-collateralized Bitcoin, Strategy is actively pushing credit rating agencies to adopt new frameworks that could recognize Bitcoin as a high-grade reserve asset.

If successful, this initiative could lay the foundation for a Bitcoin-backed bond market, enabling corporations to issue debt secured by their Bitcoin holdings. It would also allow institutions to access an entirely new asset class built on collateralized digital assets. Strategy’s approach is pioneering a path from experimental Bitcoin finance toward standardization.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News