Analyst解读s BTC "step-by-step" price surge pattern, is $160,000 within reach?

TechFlow Selected TechFlow Selected

Analyst解读s BTC "step-by-step" price surge pattern, is $160,000 within reach?

Willy Woo predicts that BTC's compound annual growth rate will stabilize at 8%.

Author: BitpushNews

On Monday, the cryptocurrency market continued its modest rebound, with Bitcoin briefly touching an intraday high of $107,068 before pulling back to around $102,105. According to CoinMarketCap data, at the time of writing, Bitcoin was trading at $105,850, with less than 1% fluctuation over 24 hours and a 40% increase in trading volume to $64.63 billion.

"Thousand-Dollar Staircase Rally" Pattern

Some market observers have noted that Bitcoin's recent rally has exhibited an interesting "staircase" pattern.

Analyst Trader Tardigrade observed that BTC price increases have followed a phased rhythm, with each upward leg rising approximately $10,000, followed by a brief pause. He pointed to moves from $75,000 to $85,000, then to $95,000, and most recently to $105,000. After each jump, there is typically a period of relative calm and sideways consolidation lasting seven to ten days.

For traders, this pattern offers predictable opportunities to take profits or establish new positions. These consolidation phases can serve as new support levels, indicating renewed willingness from buyers to enter. If this pattern continues, the next logical target could be $115,000—approximately 11% above current levels.

Tardigrade believes the significance of the $100,000 mark is self-evident. This round number is not only a key psychological level but also forms strong technical support. Notably, after surging 11% in early May, Bitcoin still managed a modest 0.5% gain last week—a "slow bull" characteristic that appears healthier and more sustainable compared to sharp volatility.

$160,000 Target

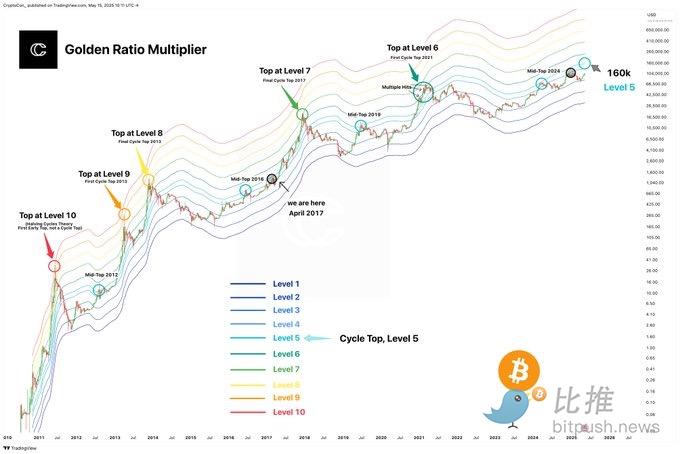

Looking further ahead, chart analyst CryptoCon offered a more optimistic outlook using the "Golden Ratio Multiplier" model.

CryptoCon stated that the Golden Ratio Multiplier model was one of the few technical indicators that accurately predicted the peak of Bitcoin’s cycle in April 2021.

According to the model, by March 2024, the market had already reached the midpoint peak of this cycle, suggesting it is likely to retest the top again. The current model indicates the fifth-level target is heading toward $160,000 and beyond—a trajectory similar to the 2015–2017 bull market cycle. The current phase corresponds roughly to April 2017, just before the main bullish surge. Historical patterns suggest such slow accumulation phases often precede accelerated rallies.

It should be noted that while this technical analysis holds some reference value, the $160,000 target is based on calculations from a specific model, and actual price movements may be influenced by various factors. For ordinary investors, understanding these cyclical characteristics can help grasp market timing, but risk management remains even more critical.

Willy Woo: BTC CAGR Will Stabilize at 8%

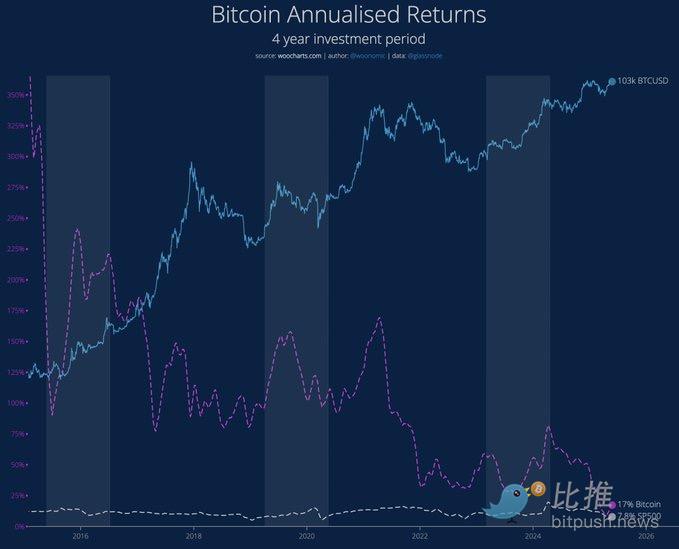

Analyst Willy Woo offers another perspective. He argues that Bitcoin has evolved from a highly volatile, explosively growing asset into a more mature financial instrument. While many still view Bitcoin as a perpetually surging "magic unicorn," Woo points out that the era of annual growth exceeding 100%, as seen in 2017, is largely over. He marks 2020 as a pivotal turning point when Bitcoin became "institutionalized," as corporations and sovereign entities began accumulating it.

With increasing institutional capital entering the market, Bitcoin’s compound annual growth rate (CAGR) has naturally declined from triple digits to around 30%-40%, and will continue to moderate. Woo attributes this to Bitcoin’s growing maturity and its expanding role as a store of capital. He emphasizes Bitcoin’s status as a global financial asset, noting that “it will continue absorbing capital until it reaches its equilibrium.”

Looking further into the future, Woo predicts Bitcoin’s CAGR will eventually stabilize at a level consistent with broader economic trends—around 8% annually (combining 5% long-term monetary expansion and 3% GDP growth). While this growth rate may seem insignificant compared to earlier years, he remains confident in Bitcoin’s long-term performance, concluding: “Until then (perhaps another 15–20 years), enjoy the ride, because few publicly investable products can match Bitcoin’s track record over the long term—even as its CAGR continues to decline.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News