The entire Web3 is paying for two men, and a blockchain application boom might just be an illusion

TechFlow Selected TechFlow Selected

The entire Web3 is paying for two men, and a blockchain application boom might just be an illusion

The blockchain industry isn't without progress; rather, its progress is mostly "digging deeper vertically" rather than "expanding horizontally."

Author: Liu Honglin

Every so often, the Web3 industry experiences a narrative of "application explosion": NFTs transforming the art market, blockchain games disrupting game distribution models, DAOs rewriting corporate governance logic, and AI+Crypto promising a new era of "on-chain AI agents"... Yet after each wave of hype, one increasingly clear question remains: the industry's boundaries seem not to have truly expanded.

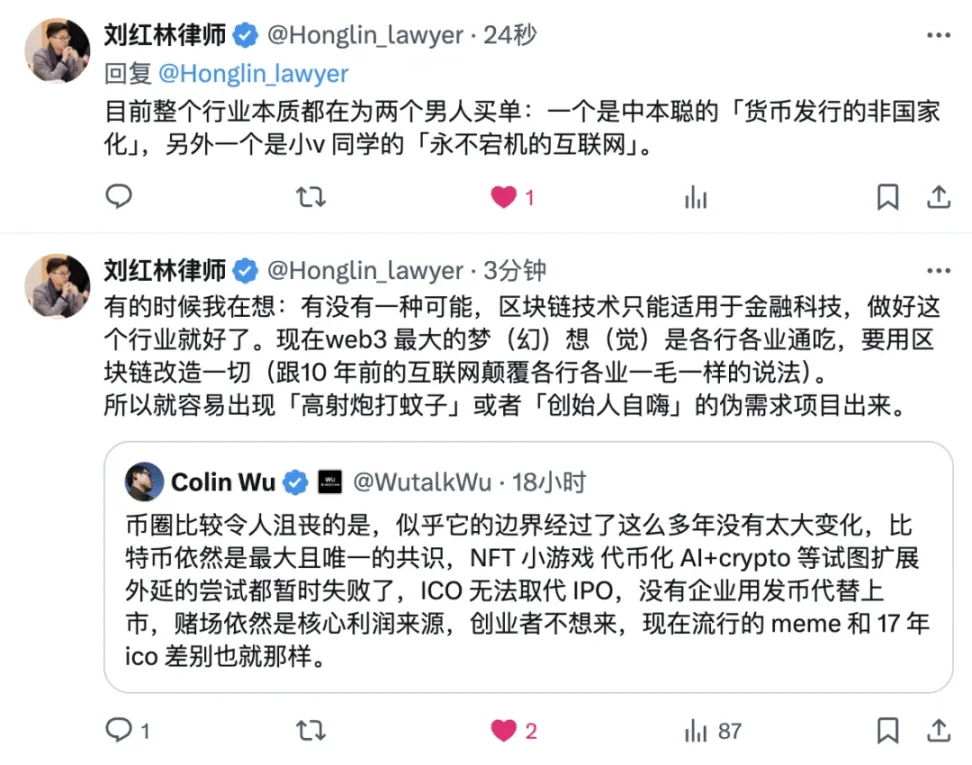

This reflection was prompted by a recent tweet from Wu Shuo: "What's frustrating about crypto is that its boundaries haven't changed much over the years. Bitcoin remains the largest and only consensus. Attempts to expand its scope—NFT mini-games, tokenized AI+crypto—have temporarily failed. ICOs haven't replaced IPOs, no companies use token issuance instead of going public, casinos remain the core profit source, entrepreneurs aren't interested, and today's popular memes aren't that different from the 2017 ICO era."

Indeed, from a market structure perspective, we haven’t seen a new "mainstream asset" challenge BTC’s position, nor has any new business model enabled Web3 to move beyond the realm of "financial technology." While NFTs, blockchain gaming, SocialFi, and AI narratives have generated significant buzz, few projects have successfully transitioned from "concept" to "sustainable application."

We seem to be experiencing a collective illusion—a technology sector driven forward by narratives, repeatedly attempting to go further, only to find ourselves circling back to the original path.

The Limits of Blockchain Fit: Is It Really Suitable for "Every Industry"?

The "omnipotence fantasy" of Web3 has been repeatedly promoted over the past few years: building "on-chain social," "on-chain e-commerce," "on-chain education," and "on-chain entertainment," as if any industry not yet connected to blockchain presents an opportunity for "transformation." But upon closer inspection, blockchain’s technical characteristics—immutability, verifiable ownership, and trustless contract execution—are indeed well-suited for financial scenarios, but less so for information-driven or socially motivated industries.

The internet’s underlying logic is "zero-cost replication," while blockchain operates on "restricted replication + cost per write." Under this technical framework, attempting to rebuild platforms like TikTok, Taobao, or Twitter on blockchain is fundamentally mismatched. High costs, poor user experience, and unstable performance are inherent issues, while users don’t particularly demand "decentralized social media" or "traceable live streaming platforms."

More importantly, even in industries that appear to genuinely need "ownership verification," "traceability," or "revenue sharing"—such as music rights, art trading, or e-commerce supply chains—blockchain integration has not significantly reduced costs or improved efficiency. Instead, it often adds complexity and raises barriers to understanding. Ultimately, "blockchain transformation" becomes a fundraising pitch rather than a tool for enhancing business efficiency.

The Entire Web3 Industry Is Paying for Two Men

To some extent, the entire Web3 industry today is paying for two men.

One is Satoshi Nakamoto—the creator of Bitcoin—who posed the question: "Can currency issuance exist without reliance on state institutions?" From Bitcoin to stablecoins, from CBDCs to privacy coins, global monetary experiments can all be seen as responses to the challenge left by Satoshi. The rise of stablecoins essentially represents an exploration of private credit replacing sovereign national credit; government regulatory crackdowns, in turn, reflect the self-defense mechanisms of state institutions.

The other is Vitalik Buterin, co-founder of Ethereum. His proposition is: "Can we build a globally distributed internet system that never goes down?" From smart contracts and decentralized identity systems to trustless governance (DAO), the entire Ethereum ecosystem attempts to construct a new system independent of traditional trust mechanisms. Yet in reality, on-chain systems still face persistent problems such as governance failures, high gas fees, and performance bottlenecks—a structural contradiction between "never going down" and "sustainable operation."

From this perspective, Web3 development isn't meaningless, but its expansion has consistently revolved around these two core questions—reconstructing monetary systems and internet infrastructure—rather than the fantasy of "penetrating every industry."

Market Validation: Why Are the Most Successful Projects Still "FinTech"?

We can observe the real picture from the most "stable" business models currently in the industry: exchanges, stablecoin issuance, on-chain asset management, cross-border payments, custody services, and RWA (Real World Asset) tokenization. All of these share financial attributes and address specific market demands and regulatory adaptation challenges.

Circle’s USDC is gradually establishing a "bank-like" model across multiple countries, directly integrating with local payment systems; licensed virtual asset exchanges in Hong Kong are attracting traditional financial institutions to explore new paths such as "tokenized financial products + exchange listing"; Singapore is rapidly advancing RWA pilots through financial regulatory sandboxes, circulating real estate, funds, and other traditional assets in token form. These represent concrete steps forward within existing regulatory frameworks—not revolutionary, but practically valuable.

In contrast, we rarely see "on-chain social" platforms survive a full market cycle, and almost no blockchain games escape the lifecycle of "short-term token launch + short-lived ecosystem." As for on-chain content platforms or DAO-based city governance initiatives, most remain experimental, far from any "explosion."

The Recurrence of "Pseudo-Applications": Are We Wasting Resources?

A common risk exists within the industry: vast amounts of capital, manpower, and resources are poured into applications lacking sustainability. These projects often follow strong "fundraising logic" but lack reusable product design or viable technical pathways, ultimately ending up in the awkward situation of "demo completed, project terminated."

For example, certain "AI+Crypto" projects are essentially just calling OpenAI APIs on-chain and adding token incentives—functionally identical to Web2 AI tools, and often with worse user experience. Similarly, many NFT social projects rely entirely on "secondary market expectations" for user retention; once prices drop, their social value collapses.

The common traits of such projects: narrative-first, fictional use cases, delayed product development, and lack of stable user demand. Driven by market cycles, investors and startups repeatedly channel resources into these directions, inflating industry bubbles and diluting potential sustained investment in infrastructure, payments, compliance, and other critical areas.

Illusion or Unwillingness to Accept "Real Boundaries"?

So we return to the starting point: is the anticipated blockchain breakthrough merely an illusion?

Possibly. But more precisely: not an illusion, but a misjudgment.

We misjudged blockchain’s applicable boundaries, treating it as next-generation internet infrastructure capable of solving all problems; we misjudged the universality of user demand, assuming everyone needs "decentralization"; and we misjudged compliance thresholds and technical costs, overlooking the inertia of real-world institutions and efficiency considerations.

Yet we must also recognize that within the boundaries of financial technology, Web3 still holds substantial opportunities. Rebuilding global payment networks, improving transparency in asset digitization, and the gradual maturation of compliant token issuance and secondary market trading systems are forming Web3’s most solid foundation. It doesn’t require excessive storytelling or total disruption—simply delivering real value in this domain is enough to sustain a developing industry.

Conclusion: Only by Returning to the Core Problem Can We Move Forward

The blockchain industry hasn't stagnated—it has progressed mostly through "deep vertical advancement" rather than "horizontal expansion." The industry isn't valueless, but that value doesn't mean every sector must adopt Web3; it isn't futureless, but that future may be narrower and more focused than we imagined—yet also more real.

When we look back at the old slogan of "blockchain-transform everything," we might realize: what’s truly worth pursuing isn't grand visions, but technological adaptations and institutional innovations that can endure market cycles. And these require not imagination, but stronger execution and more rational industry understanding.

Where will Web3 ultimately go? We may not foresee all answers, but at least one thing is clear: only by letting go of illusions can we see reality. And reality itself needs no embellishment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News