Market warms up, Meme coin "trenches" come back to life

TechFlow Selected TechFlow Selected

Market warms up, Meme coin "trenches" come back to life

Memecoins remain the instrument of choice for speculation, while Solana is the house of this "casino."

Author: Nico

Translation: TechFlow

I've been in the "trenches" for quite some time now, and many on crypto Twitter (CT) claim they’ve already “died.”

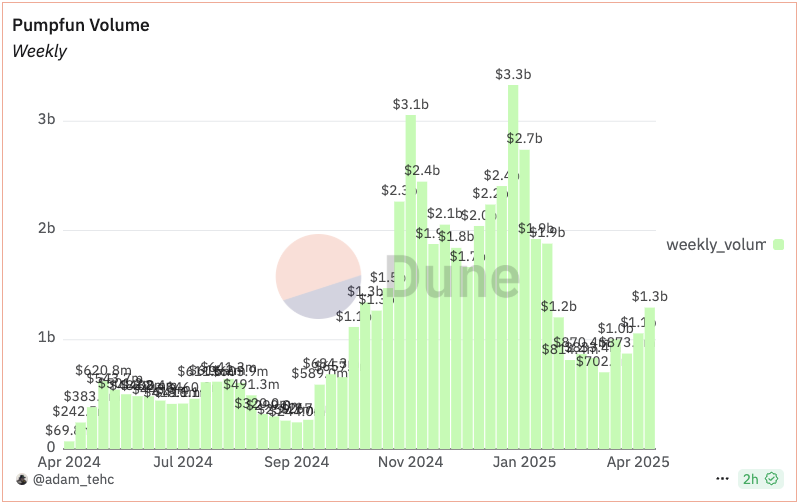

Compared to a few months ago, meme coin trading volume has declined significantly, and $TRUMP undoubtedly marked a local peak in terms of mindshare, trading volume, and liquidity attraction within the meme coin space.

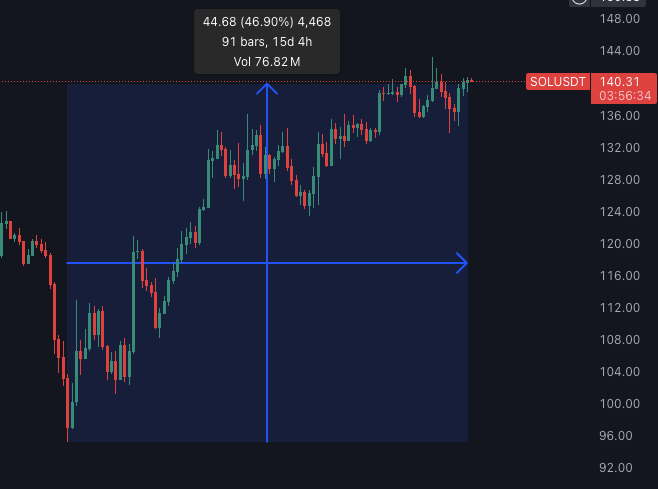

Back then, $SOL reached $290 and BTC surpassed $100K—bull market in full swing. Since then, BTC has pulled back into the $74K–$88K range, while SOL hit a local low of $95. However, SOL has now rebounded above $140 (up 46% in just 15 days), and BTC has reclaimed $90K. It’s time to reassess the current landscape.

Despite lower SOL prices, widespread bearish sentiment, and a generally dull market atmosphere, the data paints a different picture. Let's examine the numbers through April so far:

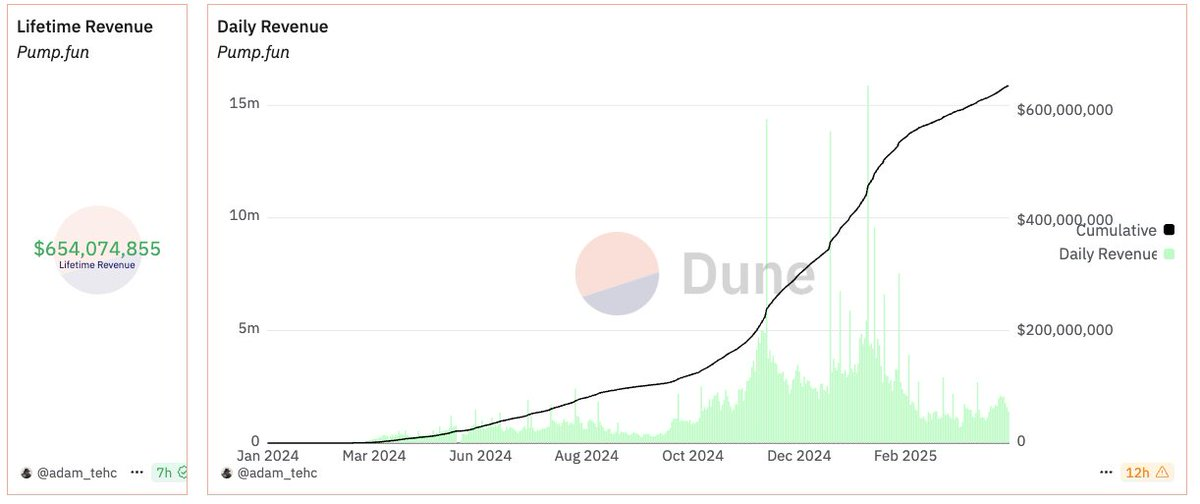

@pumpdotfun has generated approximately $650 million to date, with daily trading volumes ranging from $1M to $2.7M in April—averaging toward the higher end, around $1.5M to $2M.

As SOL price rises and TRUMP-related trading volume declines, April has seen a notable resurgence in activity. With the launch of PumpSwap and an almost seamless migration, the dynamics around the migration event have smoothed the trading experience—evident in rising weekly total trading volumes.

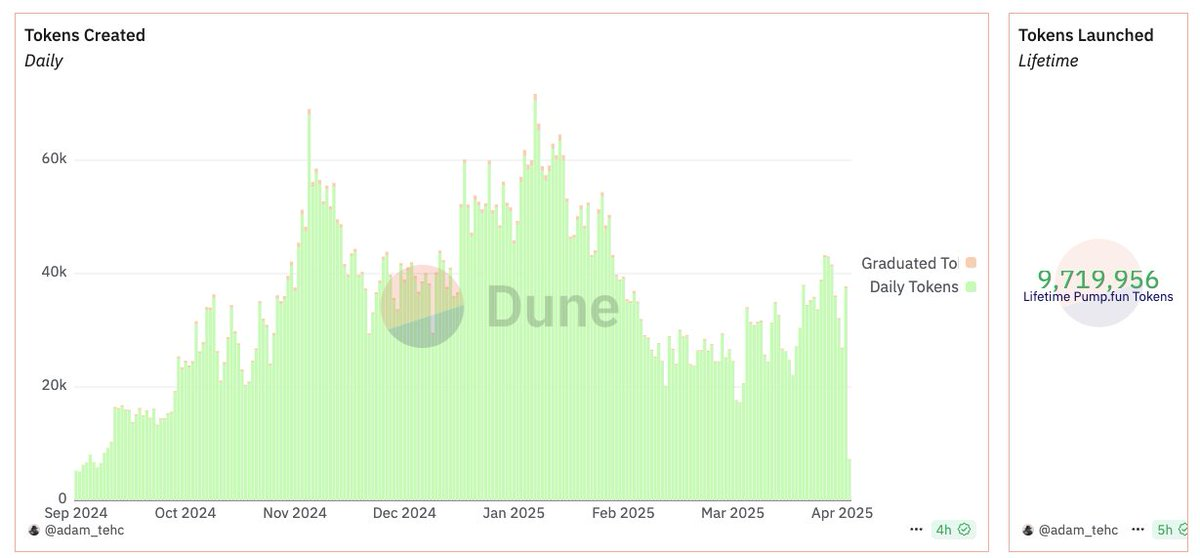

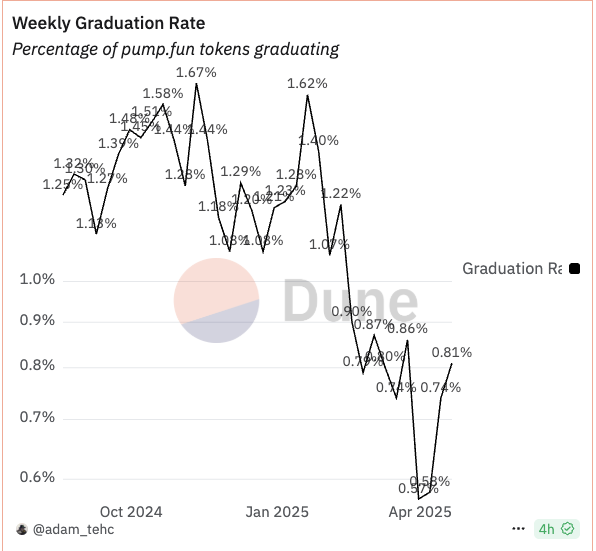

To date, 9.7 million tokens have been created, with 20,000 to 40,000 new tokens launching daily in April, and 100 to 350 graduating per day (“graduation rate” between 0.4% and 0.8%).

The declining graduation rate over time correlates with reduced user and trading volume, suggesting a higher proportion of player-versus-player (PvP) trading within the trenches. Small groups bundle supply at launch and dump on each other; when they fail to attract additional liquidity to lock up tokens, they exit early.

Active Users

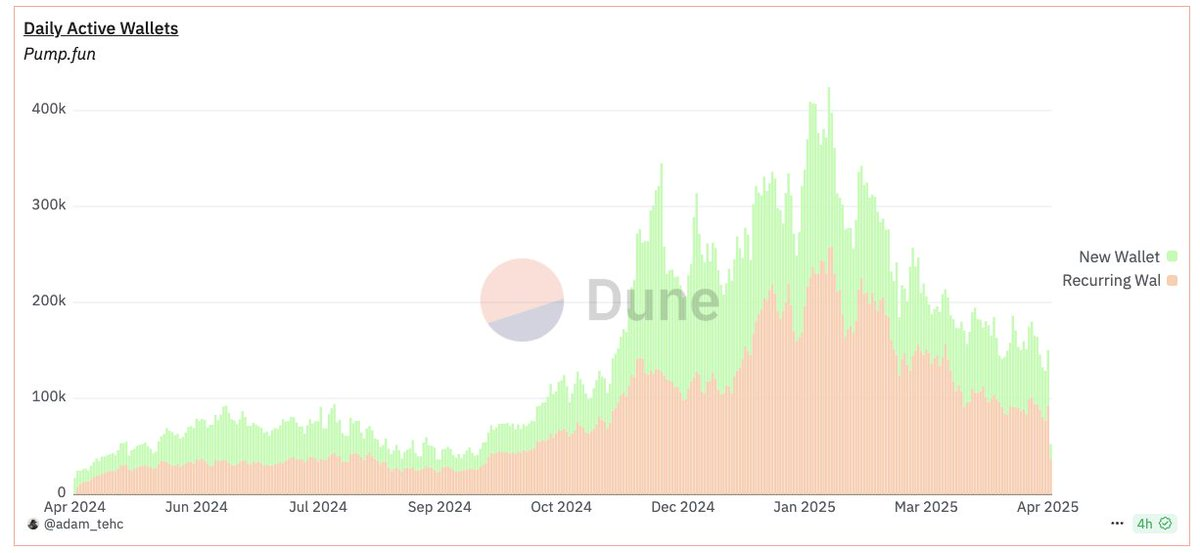

During the peak period from December 2024 to February 2025, PumpFun meme coins saw 200,000 to 400,000 daily users trading. Since then, user counts have trended downward, remaining below 200,000 for the past two months.

Currently, there are about 150,000 active wallets per day, fairly evenly distributed between existing/reused and newly created wallets. It’s important to note that most traders operate across multiple wallets and periodically rotate their active ones.

Bot Trading Statistics

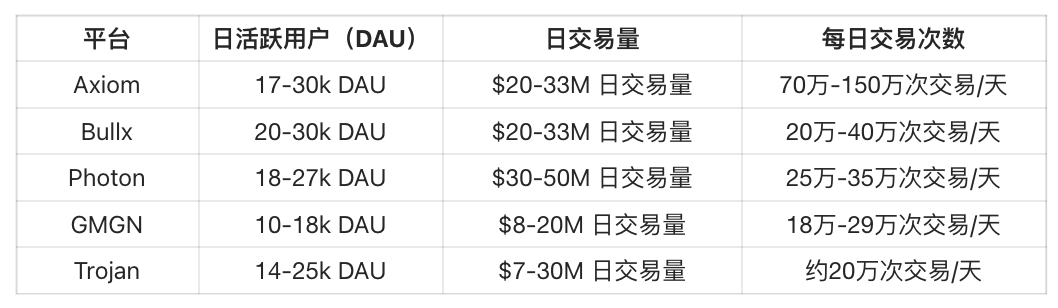

It is well known that the majority of meme coin trading activity occurs through the top five trading terminals: @AxiomExchange,

@bullx_io, @tradewithPhoton, @gmgnai, and @TrojanOnSolana.

These figures align roughly with our observations, totaling over 100,000 users and more than $100 million in daily trading volume.

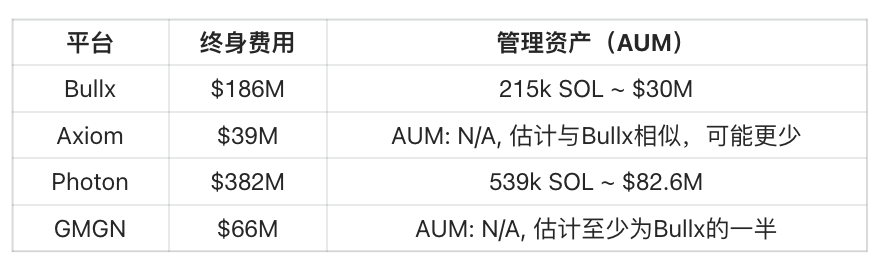

Platform AUM and Fee Overview

The total value of SOL circulating in the meme coin market across these and other platforms likely exceeds $200 million. In my next article, I will assess the total value locked across all liquidity pools and tokens.

PumpSwap

PumpSwap sees daily trading volumes between $300M and $480M, accounting for 9–19% of Solana’s decentralized exchange (DEX) volume. Since all new PumpFun tokens are launched and traded on PumpSwap, this implies significant ongoing trading of pre-PumpSwap tokens still occurs via Raydium and Meteora.

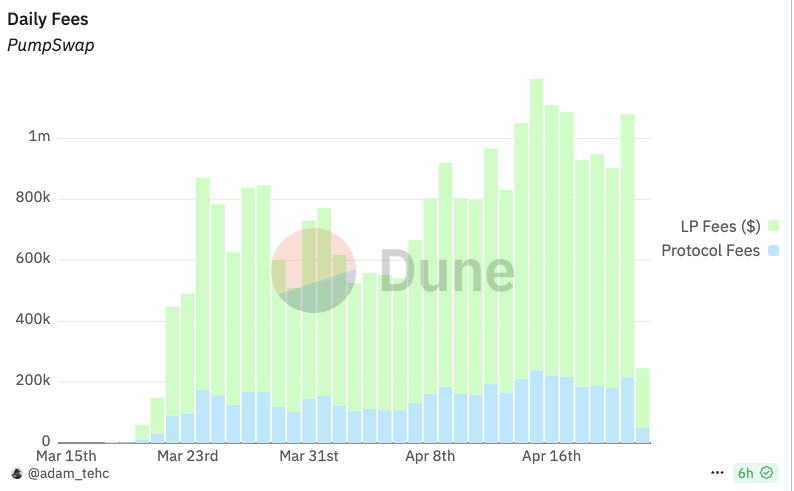

PumpSwap is a smart move by the PumpFun team, charging a 0.25% fee—0.020% goes to liquidity providers (LPs), and 0.05% accrues to the protocol.

In its first month since launch, PumpSwap has generated approximately $25 million in total fees ($100K–$240K per day), with LPs earning around $20 million and the remaining $5 million going to the protocol.

As PumpSwap’s market share continues to grow steadily, I expect these numbers to rise further, especially as we see increasing preference for trading new tokens over older ones.

This preference for newer coins supports my argument about how the meme coin space will continue evolving. Undoubtedly, the meme coin “trenches” have become tougher recently, as the remaining active participants are seasoned veterans who endured the difficult periods of low SOL prices, shrinking volumes, and declining user counts.

The meme coin ecosystem relies on attracting new liquidity in the form of new users—initially drawn from more serious crypto investors and industry participants stepping away from their losing altcoins in search of faster returns.

As the sector grows, retail participants gradually enter these deep trenches as well.

Meme coins remain the instrument of choice for speculation, while Solana acts as the house of this “casino.” Their simplicity, low entry barrier, and highly asymmetric upside potential make them particularly attractive to new traders. Every day brings something new—everything can be tokenized: people, content, events, memes—making the pool of potential themes virtually endless.

People are tired of DeFi coins that require fine-tuned management and often demand deep understanding of protocol design and mechanics. Outside of meme coins, the few projects I’m willing to bet on are Hyperliquid and its ecosystem, and Fartcoin—riding the wave of attention due to “hot air rising.”

Do you think the trenches have disappeared? The work isn’t done yet—it’s only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News