Bitcoin Halving Anniversary: This Time Is Different

TechFlow Selected TechFlow Selected

Bitcoin Halving Anniversary: This Time Is Different

This is the weakest performance ever recorded following a halving.

Source: Kaiko Research

Compilation and editing: BitpushNews

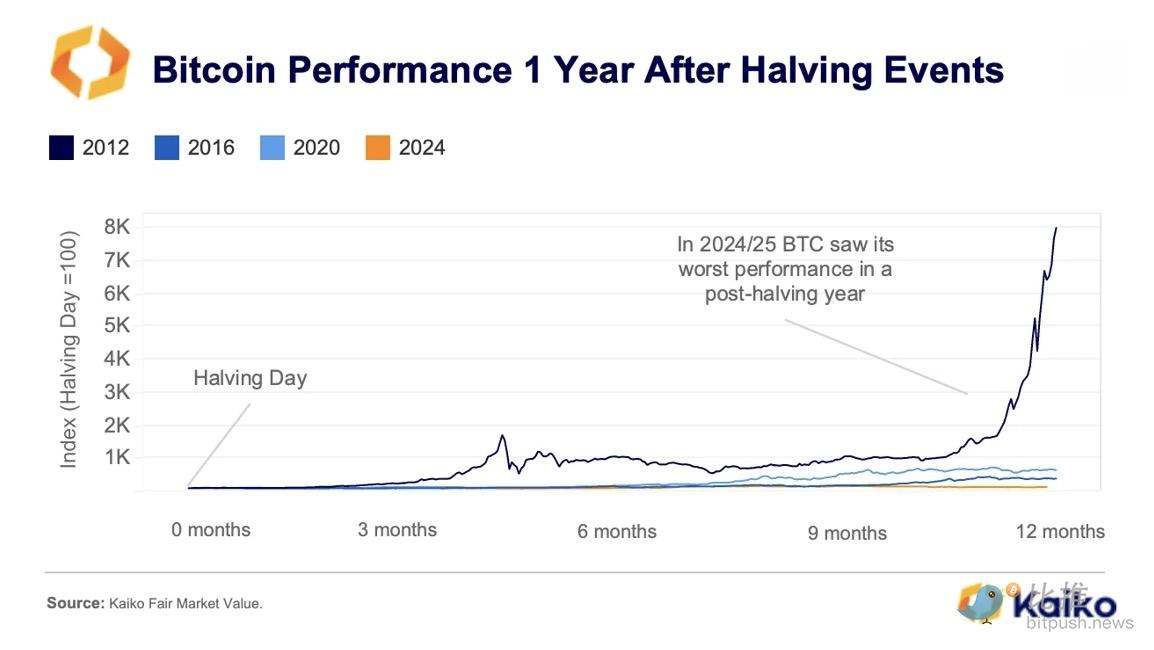

On the one-year anniversary of Bitcoin's 2024 halving, its trading price sits between $80,000 and $90,000—making this the weakest post-halving performance in percentage growth ever recorded.

In previous halvings, Bitcoin typically saw strong rebounds within 12 months: after the 2012 halving, BTC surged an astonishing 7,000%; the 2016 and 2020 cycles posted gains of 291% and 541%, respectively. So far, the 2024 cycle has failed to follow this trend.

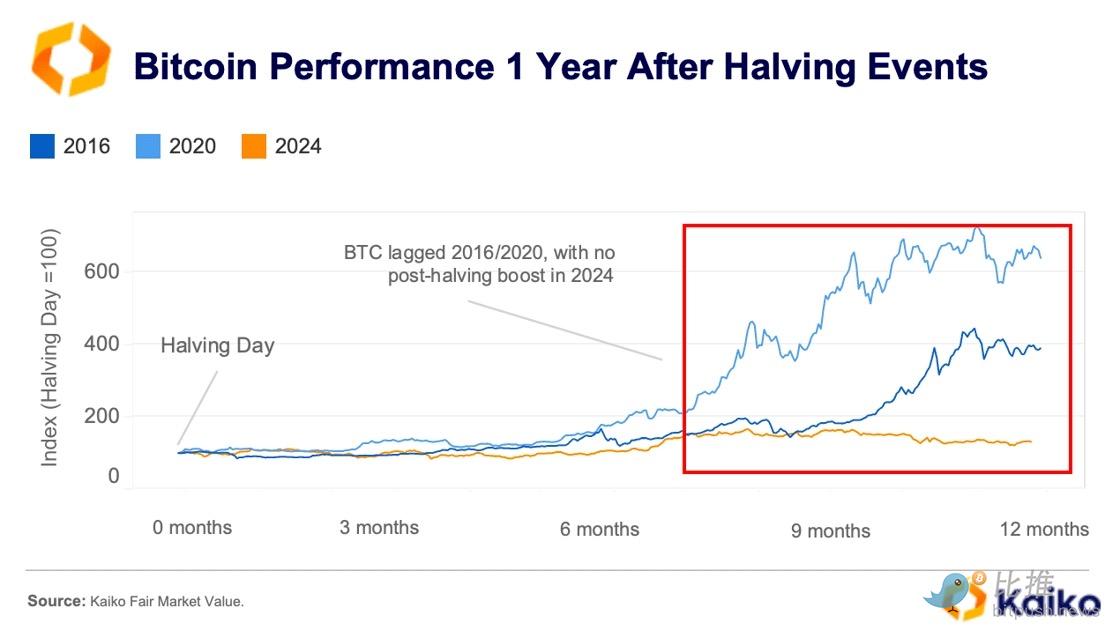

Excluding 2012, the typical price rally nine months post-halving has notably disappeared.

This sluggish performance coincides with heightened macroeconomic uncertainty. In Q1 2025, global trade tensions intensified, driving a sharp rise in risk-averse sentiment. Over the six months following the halving, the Economic Policy Uncertainty Index (FRED) averaged 317—compared to averages of 107, 109, and 186 during the same post-halving periods in 2012, 2016, and 2020, respectively.

However, increasing regulatory clarity around digital assets in the U.S. may help reduce uncertainty and restore investor confidence in the crypto market over the coming months.

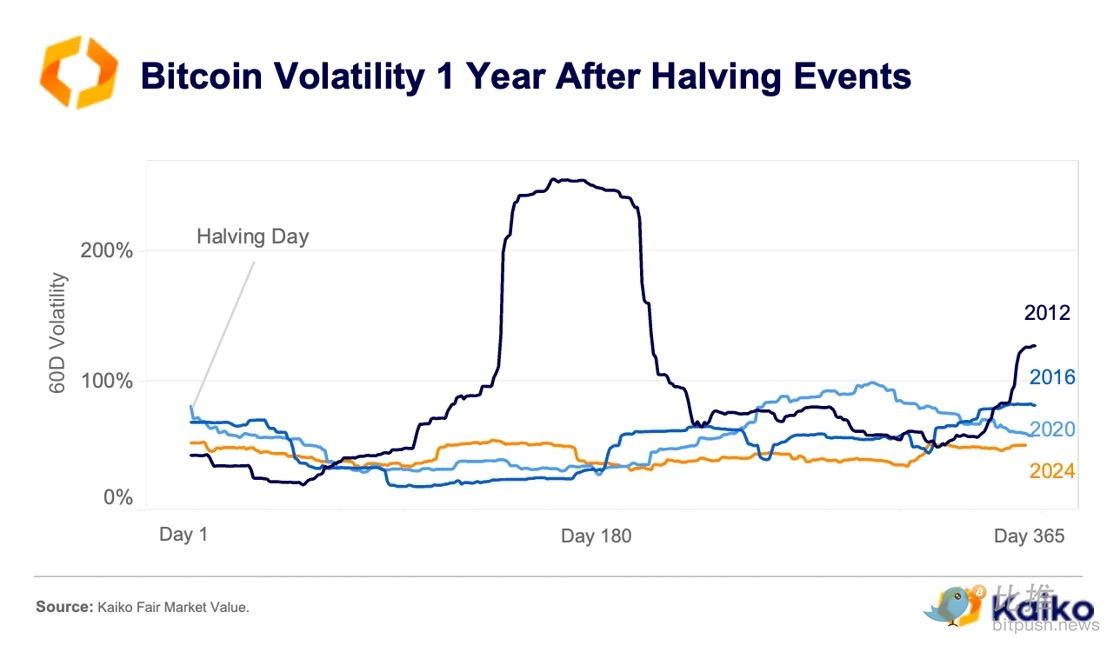

Despite ongoing market uncertainty, Bitcoin’s price behavior in 2024 has shifted significantly. Its 60-day price volatility has dropped sharply—from over 200% in 2012 to just under 50% today. As Bitcoin matures, it is now more likely to deliver stable, albeit potentially more modest, returns compared to earlier cycles.

Meanwhile, miner dynamics present a more nuanced picture. In April, Bitcoin’s network hash rate hit an all-time high, signaling increased competition, likely driven by new miners entering the network or the deployment of more efficient hardware. However, when hash rate rises without a corresponding increase in Bitcoin’s price, miners’ profit margins come under pressure—highlighting a growing disconnect between network security and price performance.

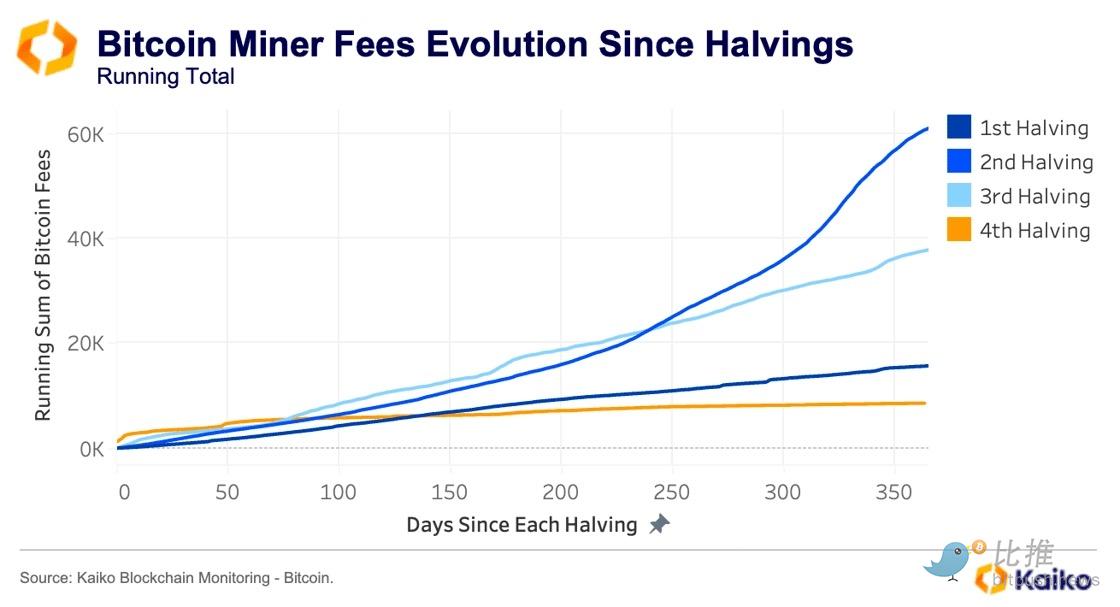

Miner revenue comes from block rewards and transaction fees. After the 2024 halving, transaction fees briefly spiked to record highs, primarily due to the launch of the Runes protocol, which increased demand for block space by enabling the issuance of fungible tokens. Since then, however, BTC miner fees have declined and mostly remained below the block reward (3.125 BTC).

Since the fourth halving, growth in miner fees has slowed markedly. With block rewards now halved, consistent on-chain transaction activity is crucial to maintaining miner incentives—especially amid lackluster price appreciation. In the year since the 2024 halving, total transaction fees paid amounted to slightly over 8,000 BTC, compared to 37,000 BTC in the first year after the third halving.

Data Points

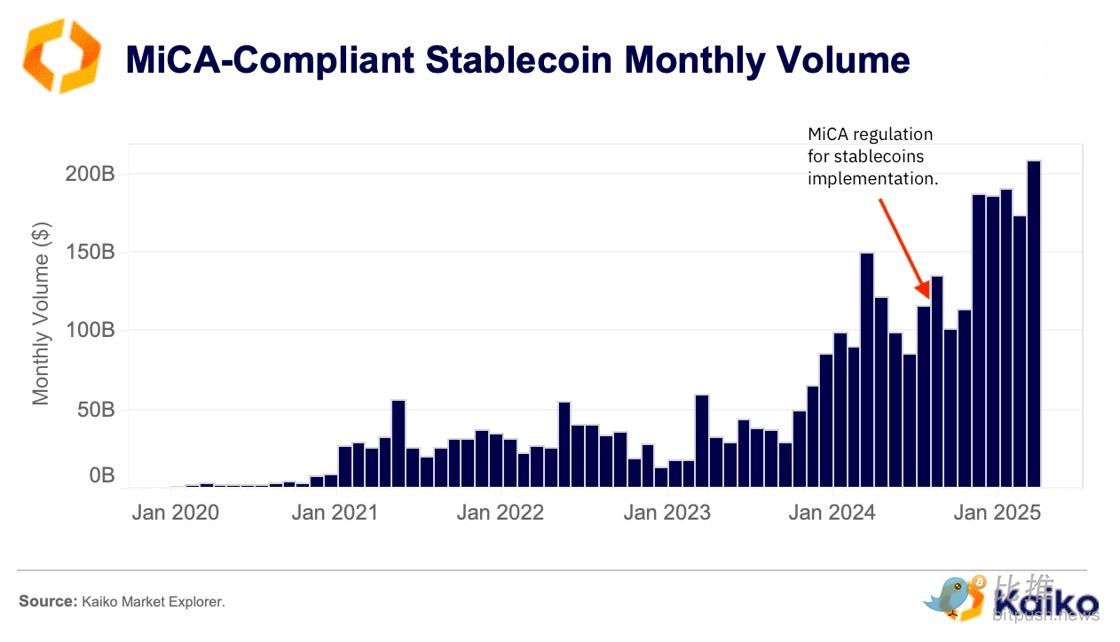

Trading volume of MiCA-compliant stablecoins hits record highs.

Stablecoins regulated under the EU’s Markets in Crypto-Assets (MiCA) framework have shown remarkable resilience amid broader market volatility, with their trading volumes growing faster than non-compliant counterparts.

Since early 2024, the combined monthly trading volume of Circle’s USDC and EURC, Banking Circle’s EURI, and Société Générale’s EURCV has more than doubled, reaching a record $209 billion in March 2025.

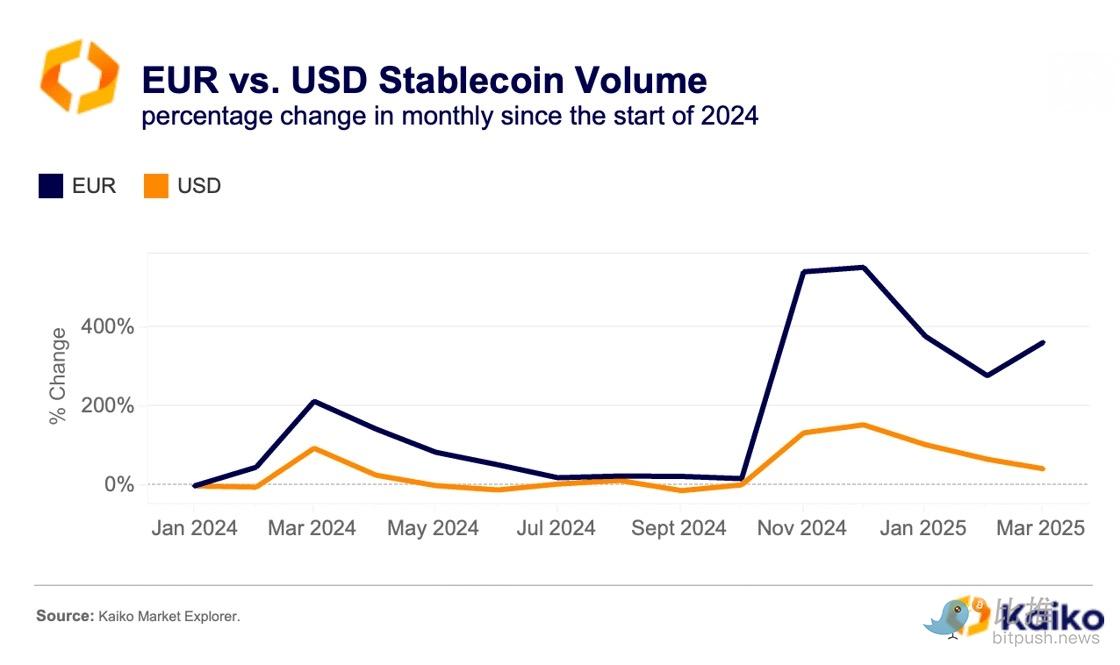

Among MiCA-regulated stablecoins, USDC continues to lead in nominal trading volume. However, euro-denominated stablecoins have gained significant momentum: from January 2024 to March 2025, monthly trading volume of euro-backed stablecoins rose 363%, compared to just 43% for dollar-backed equivalents.

Despite rapid growth, retail adoption of euro stablecoins remains constrained by high transaction fees and limited liquidity. For example, Coinbase charges significantly higher fees for EURC conversions than for USDC, potentially limiting broader usage.

ETH Staking Index: Coming Soon?

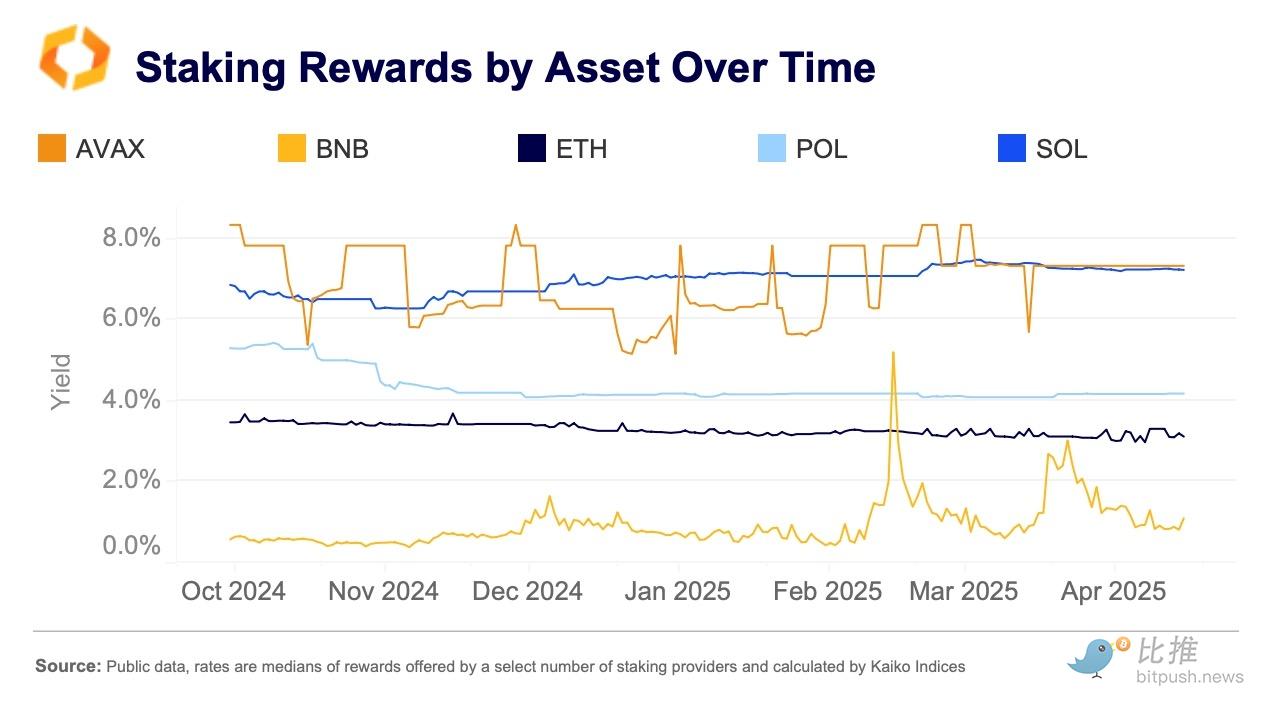

BTC dominated headlines in 2024 following last year’s successful launch of spot ETFs in the U.S. These funds even overshadowed ETH ETFs, which also attracted substantial inflows. Lower interest in these products was partly due to the lack of staking functionality in ETH ETFs.

This could change in 2025, as issuers seek to file revised applications with the U.S. Securities and Exchange Commission. And it’s not just ETH that stands to benefit—a wide range of proof-of-stake assets are vying for ETF approval, many offering staking yields significantly higher than ETH.

In fact, SOL has consistently offered higher rewards, and the first spot products including staking benefits were launched last week in Canada. Demand for these funds has been healthy, with Cathie Wood’s Ark Invest purchasing shares of 3iQ’s SOLQ ETF, which now manages nearly CAD 100 million in assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News