The crypto market remains sluggish—where are the marginal buyers?

TechFlow Selected TechFlow Selected

The crypto market remains sluggish—where are the marginal buyers?

It's not a market crash, but a structural rebalancing.

Author: Primitive Ventures

Translation: Felix, PANews

Crypto Saturation and Structural Shift

This cycle has made one thing clear: the market has reached saturation not only in capital but also in attention.

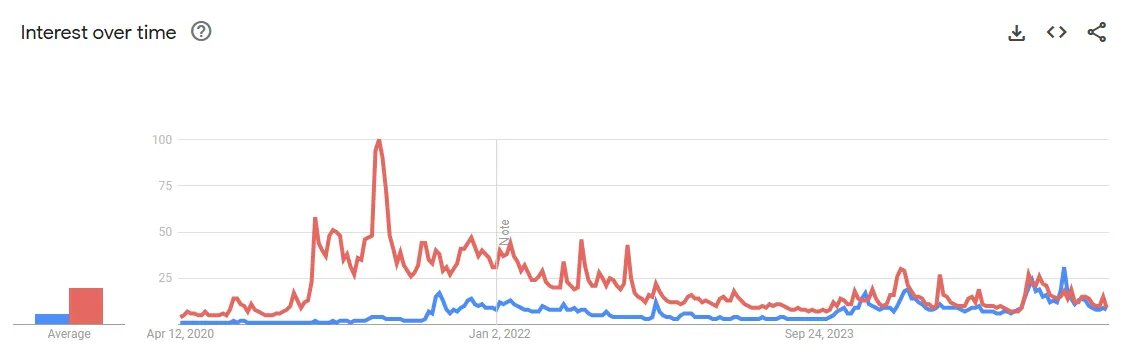

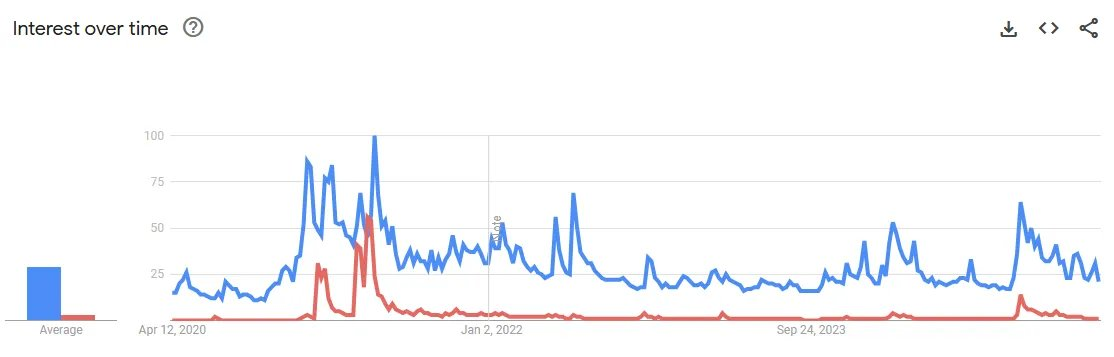

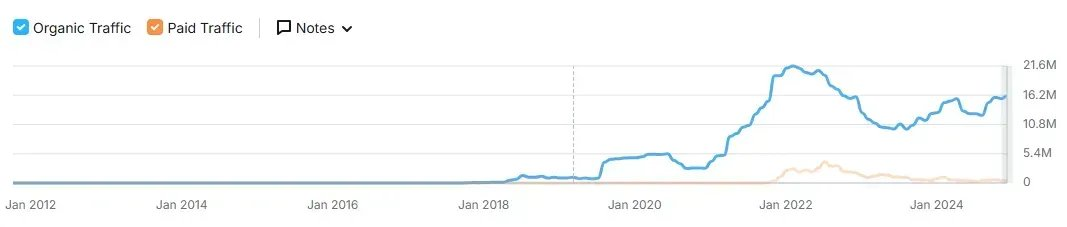

Global Google Trends data illustrates this point. Only Solana's search interest has hit new highs. Despite ETF approvals, Bitcoin reaching new peaks, and meme-driven political debates, Bitcoin, Ethereum, and even Dogecoin have failed to regain their 2021 peak search levels.

Red: Ethereum Google search interest, Blue: Solana Google search interest

Blue: Bitcoin Google search interest, Red: Dogecoin Google search interest

As attention declines, prices follow. Most major assets continue trading below their previous cycle highs. This means that while cryptocurrency as an asset has achieved mainstream awareness, it remains far from widespread adoption as a currency.

This duality defines the current landscape. Speculation is well understood, but practical utility remains misunderstood. The next marginal buyer may not come for tokens, but for infrastructure.

Player Structure: The Game Is Emptying Out

To understand why even top-down narratives fail to sustain momentum, we must examine who is still participating.

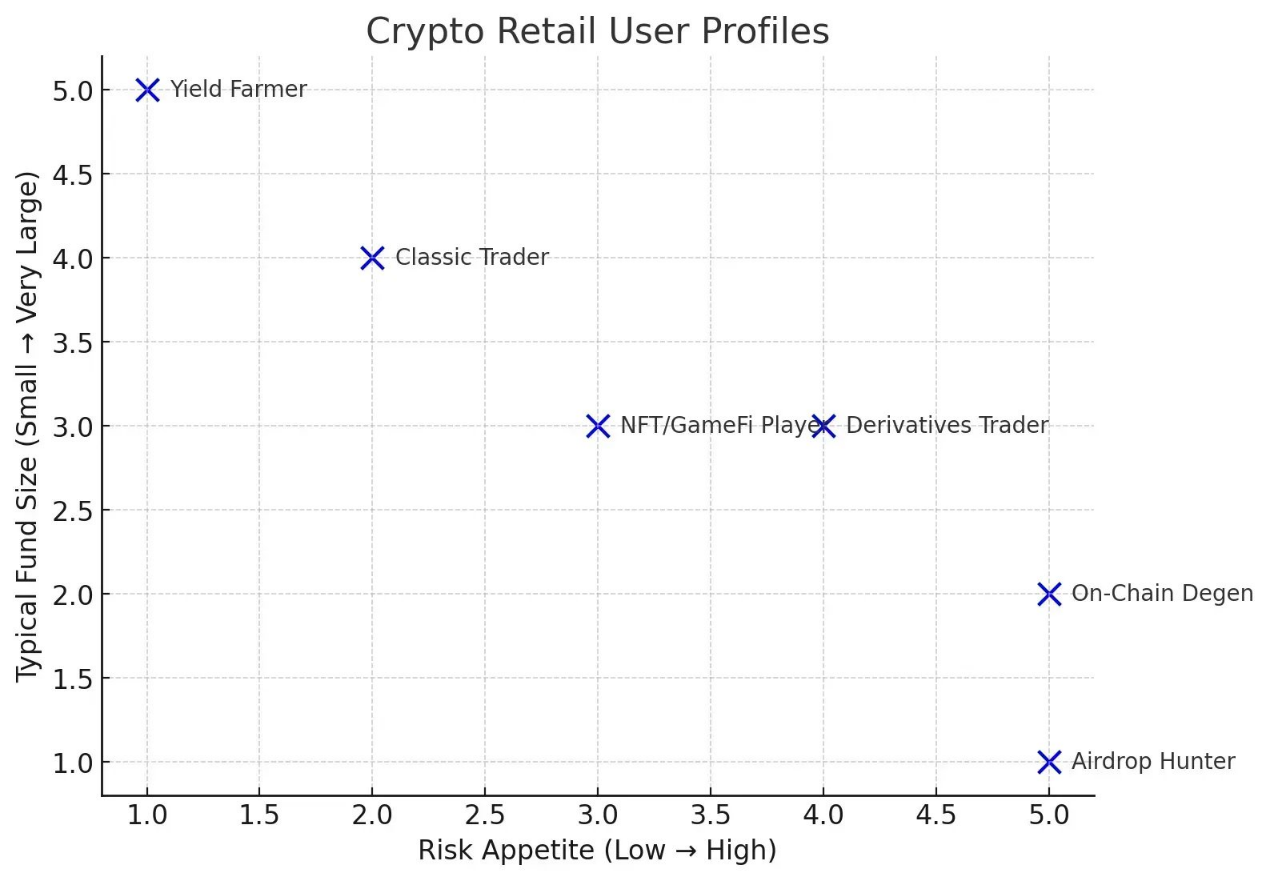

Source: PV internal research

The retail backbone once formed by centralized exchange (CEX) spot traders is gradually disappearing. As the get-rich-quick allure of CEX fades, new user inflows have stagnated. Worse, many existing users have either left or migrated to higher-risk perpetual futures trading. Meanwhile, the rise of spot ETFs has quietly drawn away another cohort of potential buyers. Centralized exchanges are no longer the default entry point.

Yield farmers, typically with larger capital allocations, are increasingly turning off-chain. With diminishing on-chain yield opportunities and declining risk-adjusted returns, capital is shifting toward more stable real-world income sources.

NFT and GameFi participants—once cultural drivers of crypto adoption—are now largely marginalized. Some migrated to memecoins, but with the Trump-themed meme wave fading, that surge appears to have peaked, leaving most participants disillusioned.

Airdrop hunters, often seen as the most dedicated on-chain user group, are now publicly clashing with projects over unfulfilled promises. Many can't even cover their costs.

Across every user segment, the trend is unmistakable: engagement is declining, conviction is weakening, and retail is exiting.

Tipping Point: Conversion Has Stalled

The issue isn't just fatigue among existing users—conversion itself has stalled.

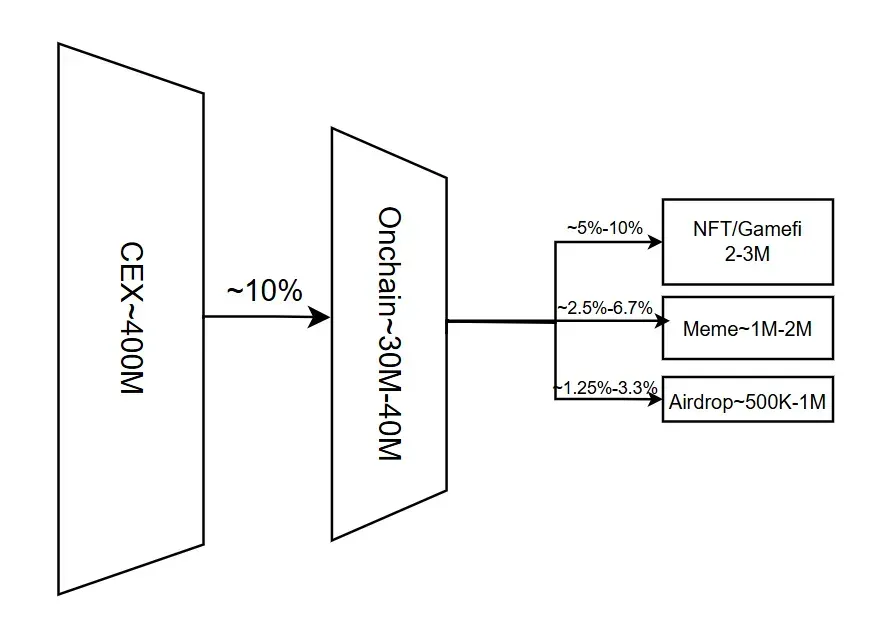

Top-tier CEXs serve around 400 million users (deduplicated), yet only about 10% convert into on-chain users (wallet holders). Since 2023, penetration has barely changed; the industry struggles to move users beyond custodial layers.

Source: PV internal research

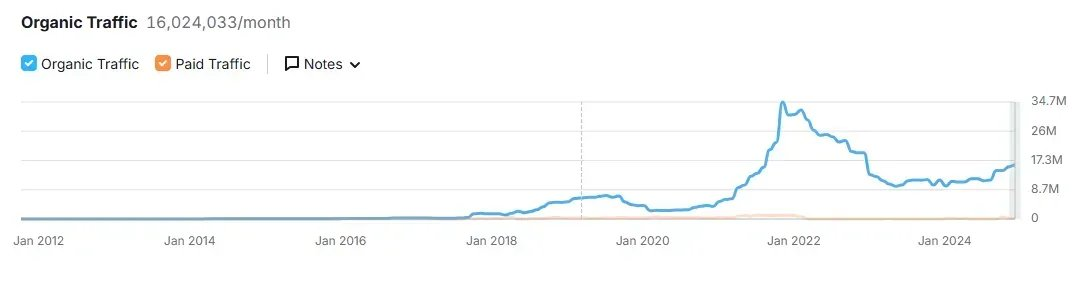

Meanwhile, traffic at major exchanges has continued declining since the 2021 bull market peak—even as Bitcoin hits new highs, traffic hasn't recovered. The conversion funnel isn't expanding.

Binance traffic; Data source: Semrush

Coinbase traffic; Data source: Semrush

Worse, we may have already hit the threshold of crypto awareness. According to a Consensys survey, 92% of global respondents have heard of crypto, and 50% claim to understand it. Awareness is no longer the barrier—interest is.

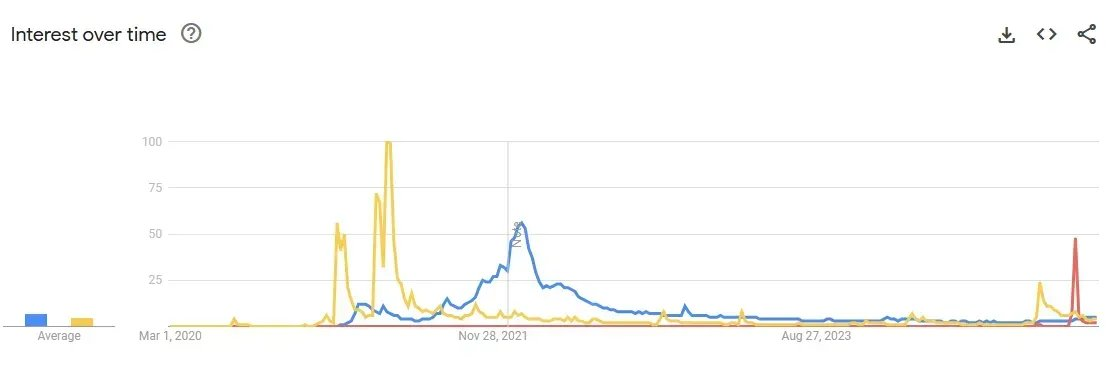

Retail enthusiasm is plateauing. In the last cycle, NFTs and Dogecoin brought in massive user waves. This cycle, even Trump-themed memecoins failed to break into the mainstream. The curiosity that once drove retail inflows is fading.

-

Yellow: Dogecoin Google search interest

-

Blue: NFT Google search interest

-

Red: Trump meme Google search interest

Slogan: Mirage Momentum

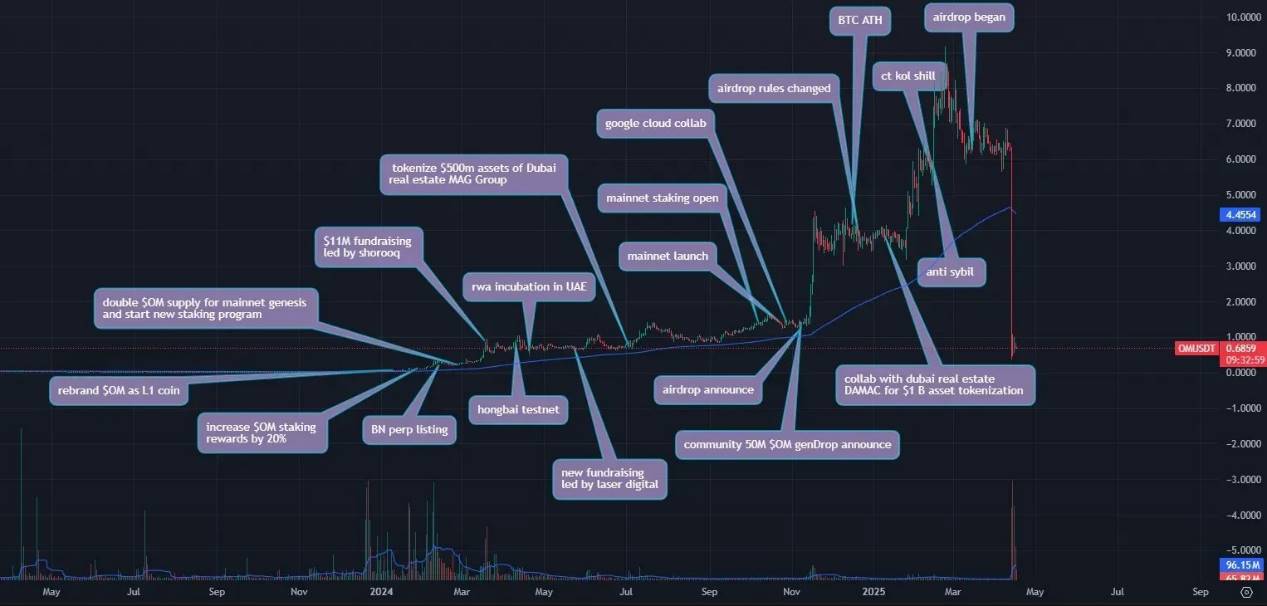

The OM rally was a carefully orchestrated operation: pivoting to the hottest RWA narrative, aligning with UAE capital, securing partnerships, leveraging KOL promotion, and squeezing liquidity through tokenomics resets.

Source: PV internal research

Yet despite a 100x price surge, there was no meaningful spot volume. OM lacked what even the perfect playbook cannot fabricate: genuine marginal buyers.

OM trading volume

When CEXs adjusted perpetual leverage and market makers faced internal friction, the system quickly collapsed. The subsequent 95% drawdown wasn’t due to minting spirals or exploits—it happened because there was simply no buying demand.

OM wasn’t a failure of execution. It reflects a structural problem: in today’s CEX environment, even a 100x price surge cannot generate new demand.

Fed Quantitative Tightening and Dollar Scarcity

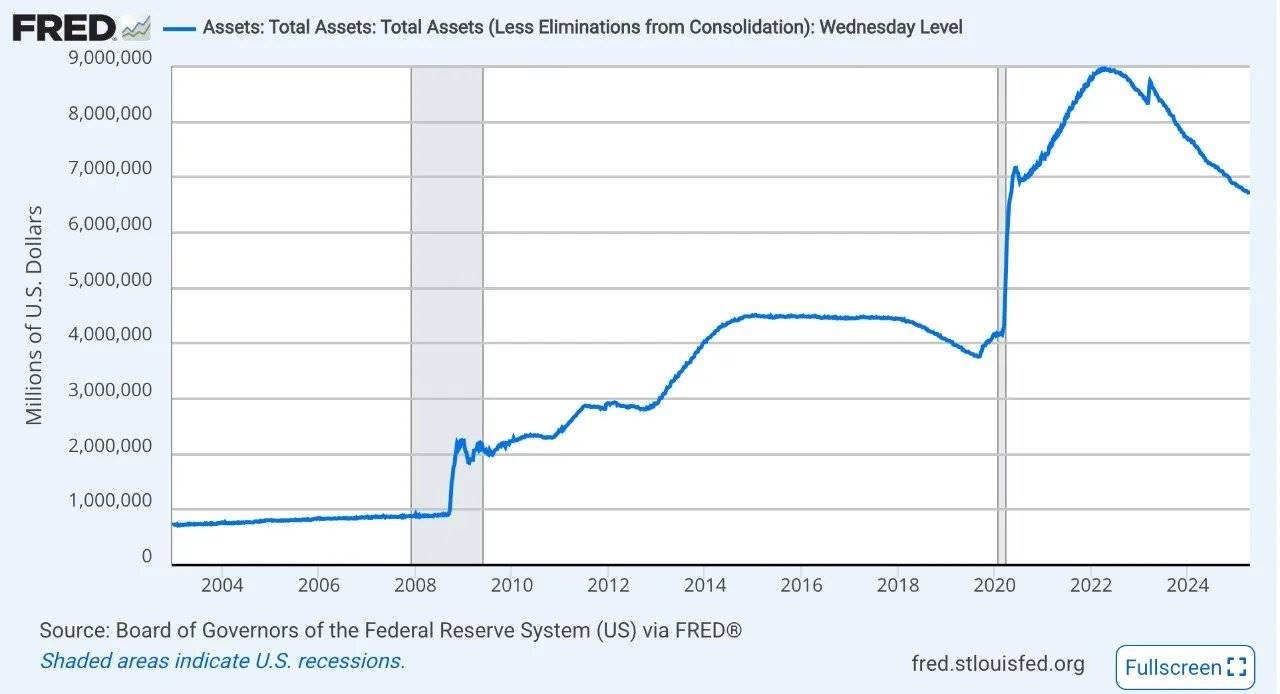

Structural shifts in buyer behavior cannot be understood without macro liquidity context. Since 2022, the Federal Reserve has significantly shrunk its balance sheet, initiating one of the most cautious quantitative tightening cycles in recent years.

The Fed’s balance sheet peaked at nearly $9 trillion post-pandemic, flooding markets with excess liquidity and greatly boosting global risk appetite. But as inflation surged, the Fed reversed course—draining reserves, tightening financial conditions, and curbing the loose leverage that had fueled speculation in risk assets including crypto.

This tightening has not only slowed capital inflows but structurally constrained the type of buyers crypto has long relied on: fast-moving, risk-tolerant speculators.

Structural Shift: Where Might the Next Demand Emerge?

If the next marginal buyer isn’t coming from native crypto speculators, they may emerge from structural shifts driven by policy, necessity, and real-world demand.

Regulatory normalization of stablecoin oversight could usher in a new phase dominated by digital dollars. In an era of rising tariffs, capital controls, and geopolitical fragmentation, cross-border capital needs faster, more discreet channels. Stablecoins—especially those aligned with U.S. interests—could become tangible tools of economic influence.

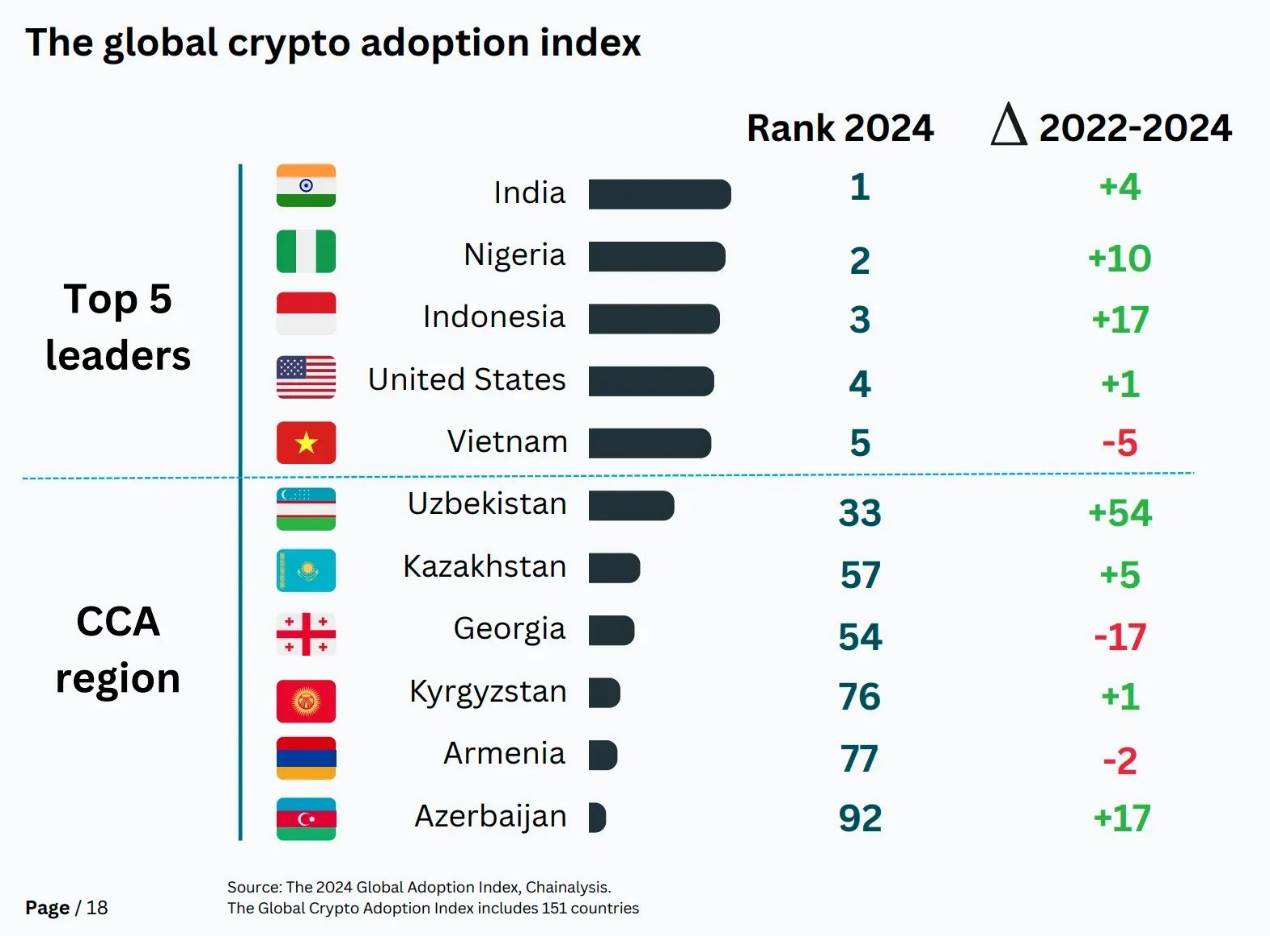

Adoption is also quietly rising in regions long overlooked by the industry. Across parts of Africa, Latin America, and Southeast Asia, where local currencies are unstable and large populations remain unbanked, stablecoins serve real purposes in remittances, savings, and cross-border trade. These users represent the new frontier of global dollarization.

As RWA scales, more users will engage not for speculation, but to access real-world assets on-chain.

The Barbell Era: This Isn’t Collapse—It’s Rebalancing

The absence of marginal buyers isn’t merely a cyclical trough—it’s a structural outcome, the downstream effect of two forces:

Cryptocurrency as an asset has captured most of the world’s attention. The dream of overnight wealth has lost its luster.

Dollar scarcity is real. The Fed’s quantitative tightening and macro tightening have structurally reduced the buyer base.

After all the cycles, narratives, and reinventions, crypto is splitting into two distinct paths—and this divergence will only widen.

On one side, the speculative ecosystem once driven by memes, leverage, and narrative reflexivity is now gasping for air as liquidity drains away. These markets depend on continuous inflows of marginal capital; without them, even the most sophisticated strategies cannot sustain demand.

On the other, policy-driven, utility-first adoption is emerging slowly but undeniably. Stablecoins, compliant channels, and tokenized real-world assets are growing—not through hype, but out of necessity. Not bubbles, but durability.

What we’re witnessing isn’t market collapse—it’s structural rebalancing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News