Project teams must read: Learn from Shi Yongxin how to market through collective mindset?

TechFlow Selected TechFlow Selected

Project teams must read: Learn from Shi Yongxin how to market through collective mindset?

As long as you establish a clear mental anchor early on and consistently deliver after TGE, the market will give you time and space.

By: Jiayi

In 1981, the 16-year-old Shi Yongxin entered Shaolin Temple, which was then almost forgotten. At that time, there were only nine monks in the temple, surviving on farming and incense offerings. The turning point came a year later: Jet Li's film "Shaolin Temple" ignited nationwide attention, and the ancient monastery suddenly became a public focal point.

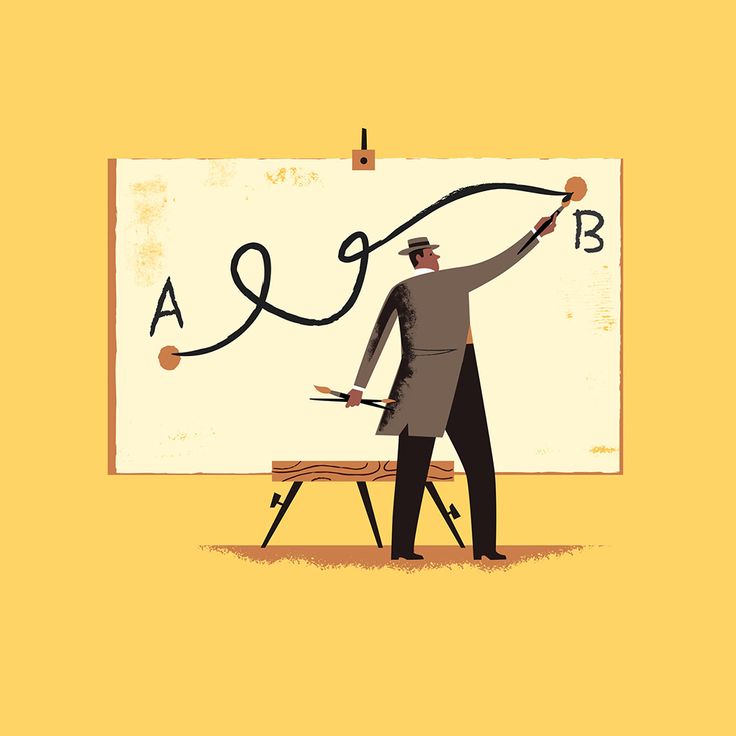

Shi Yongxin precisely captured this "mindshare dividend." He didn't invent kung fu, nor was he the most skilled martial artist, yet he achieved a cross-generational brand positioning: he deeply embedded the mental association of “Shaolin Temple = Chinese Kung Fu” into the minds of global audiences.

In the following decades, he systematically organized martial arts texts, promoted overseas performances, advanced cultural outreach, and built commercial licensing—transforming Shaolin from a religious site into the world's gateway to "kung fu awareness." More importantly, this awareness extended beyond cultural influence and eventually translated into real revenue: ticket sales, IP rights, real estate, intangible asset management... awareness became the entry point for business.

This is the power of "collective mindshare": When you establish a clear, unique label in users' minds, you earn the right to tell stories, set prices, and exist long-term.

How relevant is collective mindshare to Web3 projects?

You might ask: What can Web3 projects learn from a monk who spent forty years building a brand at Shaolin Temple?

I bring up Shi Yongxin not because he mastered livestreaming or cultural IPs, but because he accomplished something nearly every Web3 project strives for yet rarely achieves: he secured ownership of a keyword in the global user’s mind.

Web2 focuses on operations, so market share matters—the size of your user base within your vertical. Traditional business valuations and revenue depend heavily on direct market competitiveness after product launch. But for Web3 projects, I believe: “collective mindshare” outweighs actual market adoption.

Yet focusing on collective mindshare isn’t just talk—it permeates every stage from 0 to 1, especially at the critical TGE moment. After TGE, with liquidity comes a complete shift in operational logic. You're no longer just telling stories and attracting attention; you now face real-world pricing, arbitrage, and strategic gameplay. This transition is intense. If unprepared, all prior hype and expectations can collapse within days.

Therefore, project teams must think ahead: Before TGE, what kind of user mindshare should you capture? What narrative should you build? Where should you position yourself in users’ minds?

Let’s break it down.

Before TGE: How should a project build "collective mindshare"?

For most Web3 projects, TGE marks their first step onto the public stage. But true success or failure is actually decided before TGE. This phase is your golden window to capture user mindshare. It doesn’t just affect whether your token launches smoothly—it determines whether you can leverage this "moment of collective attention" to plant a memorable cognitive tag in users’ minds.

How clearly you communicate your positioning, build trust, and stabilize expectations during this period decides whether you attract genuinely valuable early participants. Otherwise, what awaits may not be takeoff—but termination.

I usually advise pre-TGE projects to conduct a "three-question mindshare audit":

1. Which tier do you occupy in users’ minds?

Are you a top-tier player in your sector, or a fringe project? Underlying this is a very real equation:

User perception of your project’s tier = Expectation around your TGE = Willingness to spend time following you = Your actual data performance, etc.

Your actual data and user engagement are often just outward expressions of users’ subjective belief in whether you’re “worth betting on.” These don’t solely stem from what you’ve done, but more from how “tiered” you appear to be.

2. What exactly do users remember about you?

This is where Web3 founders most commonly overestimate themselves. Many teams present their projects logically and coherently, yet after twenty minutes I still have to ask: “So what’s your breakout hook?”

The reality is harsh. In a market with extremely fragmented attention, countless projects promote daily. Don’t expect users to truly understand you. They’ll only remember a few keywords that trigger associations or emotions. So you must simplify, distilling everything into three takeaways users can carry away: easy to remember, sparking profit imagination, linked to future breakout potential.

Plain speaking is the skill most projects lack.

3. Is collective trust holding firm?

How do you build a project trusted by users? This is the most overlooked aspect—and the easiest one to break.

No matter how strong your tech or compelling your story, if users question your persona, team, or behavior patterns, trust collapses instantly, and mindshare detaches.

Trust breakdowns often aren’t caused by major incidents, but by small, seemingly insignificant issues piling up. For example: unanswered user questions, repeated silence; delayed rewards without explanation; community doubts met with team radio silence or cold replies like “we’ll discuss internally”; or rumors spreading behind the scenes that “this is just another exit scam.”

Each incident seems minor, but together they create a growing sense of hypocrisy—saying one thing, doing another—that gradually erodes initial trust, especially among your earliest supporters. They were once your most valuable assets, true believers in your story, but once cracks appear, they leave fastest and never return.

Just as when people worldwide think of Chinese martial arts, most don’t immediately recall Wing Chun, Baji, or Tai Chi—but Shaolin. Wing Chun isn’t inferior—it simply never had its Shi Yongxin. You must become the person who establishes collective mindshare for your project.

After TGE: The project officially becomes a "financial asset"

Post-TGE, the project ceases to be just a product, vision, or story. It becomes a priced, liquid, tradable financial asset. Whether you’re valuable, worth buying, or capable of growth is now tested in the most public, cold-blooded way.

First, user composition changes. Early adopters who once shared ideals, ran testnets, and activated communities now transform in identity. They are no longer just users—they are also traders. And an even larger wave of traders enters now. They’re not here to “listen to your story,” but to ask a far more direct question: “Does your coin offer a profit opportunity?”

Very few Web3 projects have “irreplaceable products.” Even if you outperform competitors by 20% or 30%, if the token price stagnates and the market shows no momentum, you’ll still be quickly abandoned. Users won’t give you time or patience to grow—they’ll immediately chase the project that “appears more likely to rise.”

Therefore, project teams must directly answer one question: Why should anyone buy your token?

Beneath this lie three typical user mindshare models:

🌞 Low-tier players: “Our product is great.” User: “Greatness doesn’t matter—I’m too scared to buy.”

This mindset is common: “We lead in technology, deliver excellent UX, and our team works hard.” But the market doesn’t reward effort alone.

Users typically respond: “No matter how good you say you are—any price movement? None? Then I won’t buy.”

This reflects the classic split between product value and financial value. In Web3, having only product without price elasticity cannot sustain user trust. You may be a builder, but to users, you’re just a “token with no upside surprise.”

The truth is, product quality is no longer scarce—what’s rare is the ability to generate attention-driven price expectations.

So understand this: You may think you’re building a product, but in reality, you’re competing for entry into financial sentiment mindshare.

🌞 Mid-tier players: “We have catalysts, we pump.” User: “I’ll speculate short-term and cash out fast.”

The vast majority of Web3 users are short-term speculators. They don’t seek long-term co-building, but will participate if you deliver pumps, rhythm, and catalysts.

They aren’t believers, nor community evangelists. But if you create “tradability,” they’ll enter for a round.

That’s not bad. In fact, it means you’ve created “motion.” Users recognize you as a project suitable for trading ranges—even if not a hold-to-death play, still worth camping.

If you successfully execute several effective pumps, the market begins to assume you’re a “high-momentum” token. Your token gets added to watchlists, and a group starts waiting specifically for your next move.

From ignored → participated → camped: this is how “price elasticity mindshare” slowly forms in Web3.

High-tier players: Make users feel “this token is worth keeping—once sold, I might never get back in”

The ideal—and hardest to achieve—user mindset is when users voluntarily hold your token even while cashing out elsewhere. Their thoughts shift from “Can I make quick money?” to: “I might need this project in the next cycle.” “If this token rises, I may never afford to re-enter.”

To reach this level, the project must establish a complete “trust × expectation × feedback” loop, meeting at least four conditions:

· Clear long-term direction, consistent narrative without abrupt shifts;

· Product progress delivered rhythmically, giving users visible hope;

· Project delivers catalysts while token price remains strong;

· Token price shows resilience, creating emotional elasticity—“if it rises, there’s more to tell; if it drops, it can rebound.”

Such tokens don’t need to surge daily, but users know in their hearts: “This is an asset worth long-term involvement,” leading naturally to holding, sharing, and defending.

SUI: A real case of mindshare reversal

Take a recent coin I’ve added to my long-term watchlist: $SUI. Let’s break it down.

SUI boasts a stellar team (former Meta/Facebook project engineers), with a billion-dollar+ private market valuation making it a FOMO target for major investors. Honestly, I thought SUI performed poorly initially—community sentiment was that the team seemed arrogant and detached. But about a year and a half ago, SUI suddenly recognized the importance of community, pushing ecosystem growth while actively engaging users. (Won’t elaborate on secondary market aspects due to regulatory sensitivity.)

What happened afterward is well known: SUI unexpectedly became perceived in market mindshare as the “mini SOL,” entering users’ lists of assets worth holding long-term.

In fact, SUI already weathered two major confidence tests this summer: first, the Cetus protocol security breach at the end of May, draining ~$223M in liquidity; second, a massive token unlock in early July of 44 million tokens (~$200M), one of the largest quarterly releases.

Under normal circumstances, such consecutive negatives should’ve triggered price collapse and community panic. Yet the opposite occurred: SUI wasn’t abandoned. Instead, it recently surged to $4.39, hitting its highest level since February, becoming one of the most actively traded projects in its sector.

Why did it withstand the storm? The key wasn’t just that the Sui team took responsibility swiftly instead of avoiding blame during the hack. More importantly, over the past year+, Sui used consistent action to gradually reshape user perception—transforming its once-criticized “arrogant and cold” image into that of a “trustworthy, long-term bet.”

Take the Cetus attack: though caused by a third-party smart contract, Sui wasn’t directly liable. Yet the team didn’t deflect blame. Instead, they immediately paused related contracts, froze two involved wallets, collaborated with Sui validators on voting, and partnered with the Sui Foundation to arrange loans and raise compensation funds, pledging “full reimbursement” to victims. Ultimately, 90.9% of validators voted to release $162M in frozen assets, approving the payout plan.

The entire process was transparent, swift, and highly decisive, showing outsiders once and for all: this team stands firm in crises and is willing to backstop.

It demonstrated: As long as you establish a clear mindshare anchor early and consistently deliver post-TGE, the market will grant you time and space.

Trust is the only direction I’m willing to bet on

Many projects approach me for marketing help, yet I collaborate with very few. It’s not that my standards are exceptionally high—I simply only invest my time and credibility in teams I trust.

Before deciding to assist any project, I conduct full due diligence. My core criteria are just two: Is this team trustworthy? Does their community believe in them?

If either condition fails, no matter how polished the narrative, I decline collaboration. I don’t believe marketing alone can save a flawed project, nor will I entrust my reputation to a irresponsible team.

Ultimately, the core competitiveness of Web3 projects isn’t technological barriers or funding size. It’s whether you can secure a clear, credible, and shareable position in people’s minds.

That is collective mindshare—and Web3’s ultimate winning edge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News