Metrics Ventures Market Outlook: Market Reaches Mid-Cycle Adjustment, Awaiting Macro Turning Point

TechFlow Selected TechFlow Selected

Metrics Ventures Market Outlook: Market Reaches Mid-Cycle Adjustment, Awaiting Macro Turning Point

We firmly believe that Bitcoin's volatility at this point once again confirms our earlier view that this market cycle has only reached the halfway mark.

Author: Metrics Ventures

TechFlow Market Insights – March 2025 by Metrics Ventures:

1/ This month's market movements have led many in the industry to declare the bull market over. However, we firmly believe that Bitcoin’s volatility at this level reaffirms our earlier view—that this cycle is still only halfway through. This conviction is based on the correlation between Bitcoin and U.S. risk assets, the current adjustments within the dollar system, the reinforcement of long-term fundamentals, and the renewed confirmation of a温和 regulatory environment.

2/ The weakening performance of numerous altcoins, especially Ethereum, serves as the primary source of current market pessimism. As always, we maintain our stance—established since April last year—that Bitcoin has decoupled from other crypto assets. The true liquidity-driven macro bull market has not yet arrived. Moreover, the capital flow path in the next cycle remains highly uncertain.

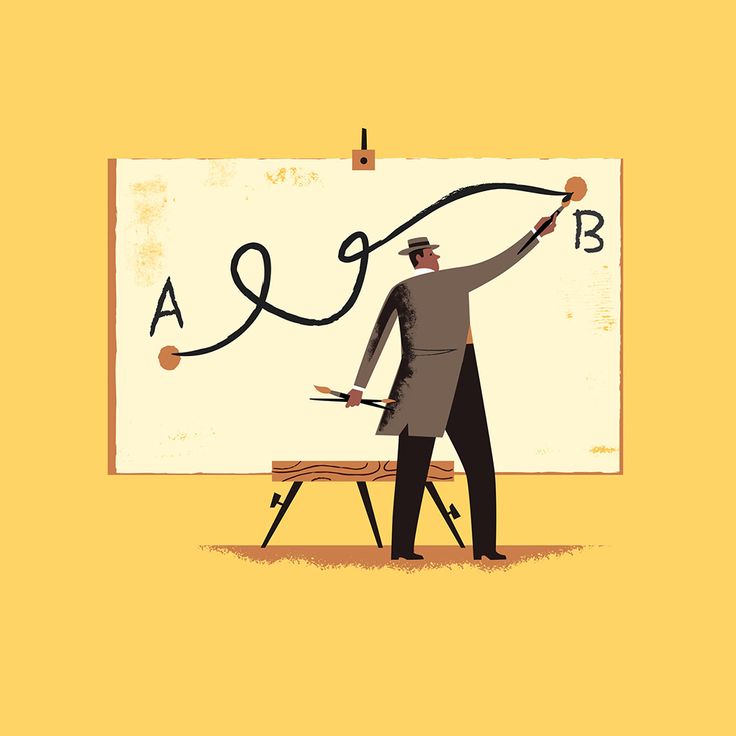

3/ Looking ahead, the breakdown below the recent high-turnover range confirms that the market has entered a phase of consolidation and regrouping. However, reviewing the historical price action of core dollar-denominated assets like AAPL, we believe Bitcoin’s key support level lies around 75,000—until that level is threatened, there is little cause for concern.

Overview and Commentary on Overall Market Conditions and Trends:

One of our core indicators for assessing Bitcoin’s current trend is its positioning as a risk asset within the U.S. dollar system. This framework remains effective because shifts among core dollar-based assets are inherently gradual, supported by macroeconomic, regulatory, and fundamental drivers. Specifically, the following trend indicators remain robust:

① Bitcoin continues to demonstrate a significantly superior Sharpe ratio compared to the Nasdaq and other “Magnificent Seven” equities. Its resilience has been further validated amid shocks such as recent tariff announcements;

② On-chain supply distribution shows no severe signs of capitulation. Even during negative news cycles, market absorption—not panic selling—has been evident, and supply growth remains under control;

③ From a regulatory standpoint, recent policy developments are, in our view, clear foundational tailwinds for the long term. Market overreactions stem largely from misunderstandings of the U.S. political and economic system—these irrational fluctuations do not alter the favorable long-term trajectory.

In light of Bessent’s recent signals regarding the pacing of risk release across the dollar system, we are confident that the medium-term correction beginning in February presents an exceptional accumulation window over the next 15 months.

Finally, we believe industry consolidation has finally entered an accelerated phase. If this cleansing process unfolds rapidly and with strong emotional intensity, it may perfectly align with the onset of the next macro liquidity bull market. That said, we must emphasize that the capital flows in the next cycle are likely to differ fundamentally from those seen in 2021. As such, long-term holdings of so-called crypto assets should be approached with particular caution.

Chart: BTC vs. Nasdaq – Relative Strength Over the Past 3 Years

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News