WOO X Research: What to Do Amid Market Volatility? Explore These Low-Risk Yield Options

TechFlow Selected TechFlow Selected

WOO X Research: What to Do Amid Market Volatility? Explore These Low-Risk Yield Options

Tariff policies and the Federal Reserve's stance intensify market volatility.

Author: WOO X Research

In April 2025, Trump's tariff policies triggered significant volatility in global financial markets. On April 2, he announced "reciprocal tariffs" on major trading partners, setting a baseline rate of 10% and imposing higher rates on specific countries: 34% on China, 20% on the European Union, and 32% on Taiwan (with semiconductors exempted). The 10% baseline tariff officially took effect on April 5, intensifying global supply chain tensions. On April 9, Trump suspended the higher rates for 90 days (until July 8) for 75 countries that had not retaliated, but raised tariffs on China to 145%, citing China’s imposition of 34% retaliatory tariffs on U.S. goods. The EU, meanwhile, announced it would pause retaliatory tariffs on €21 billion worth of U.S. goods until July 14 to create space for negotiations.

These policy moves sparked strong market reactions. The S&P 500 lost $5.8 trillion in market value over four days following the tariff announcements—the largest weekly decline since the 1950s. Bitcoin prices fluctuated between $80,000 and $90,000. On April 17, Federal Reserve Chair Powell stated at the Chicago Economic Club that tariffs could push inflation higher and suppress growth, but the Fed would not intervene with interest rate cuts, remaining focused on long-term data. Goldman Sachs and JPMorgan raised their estimates for U.S. recession probability to 20% and 45%, respectively. With corporate profits and prices both potentially affected, market outlook remains uncertain. In such times, what should investors do? Low-risk stablecoin yield products in DeFi may offer a way to stabilize portfolios during this turbulent period. Below are four stablecoin-based yield products to consider.

This article does not constitute investment advice; investors should conduct their own research.

Spark Saving USDC (Ethereum)

Visit the Spark website (spark.fi), connect your wallet, select the Savings USDC product, and deposit USDC.

Note: Spark is a decentralized finance (DeFi) platform providing a front-end interface for SparkLend, a blockchain-based liquidity market protocol. Users can participate in lending and borrowing activities through this platform.

Yield Source: Earnings from Savings USDC come from the Sky Savings Rate (SSR), supported by income generated through cryptocurrency collateralized loans, U.S. Treasury investments, and liquidity provision to platforms like SparkLend via the Sky protocol. USDC is converted 1:1 into USDS through Sky’s PSM and deposited into the SSR vault to earn yield. The sUSDC token increases in value as earnings accumulate. Spark provides USDC liquidity.

Risk Assessment: Low. USDC has high stability, and Spark’s multiple audits reduce smart contract risks. However, potential impacts of market volatility on liquidity should be noted.

Current Data:

Source: Spark Official Website

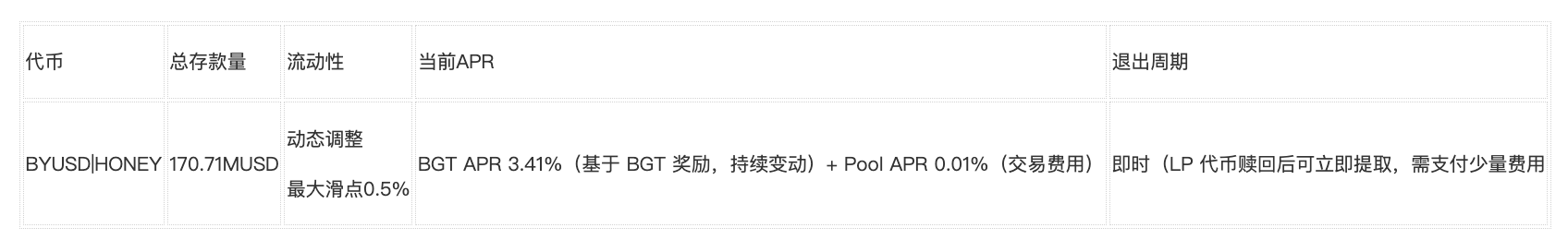

Berachain BYUSD|HONEY (Berachain)

Visit the Berachain website, go to BeraHub, connect a Berachain-compatible wallet, navigate to the Pools page, select the BYUSD/HONEY pool, and deposit BYUSD and HONEY to provide liquidity. Users receive LP tokens, which can be staked in Reward Vaults to earn BGT.

Note: Berachain is a high-performance, EVM-compatible Layer 1 blockchain utilizing an innovative Proof of Liquidity (PoL) consensus mechanism, incentivizing liquidity providers to enhance network security and ecosystem vitality. This product refers to the BYUSD/HONEY liquidity pool deployed on BEX, Berachain’s native DEX. HONEY is Berachain’s native stablecoin (multi-asset collateralized, soft-pegged to the U.S. dollar), while BYUSD is another stablecoin on Berachain.

Yield Source: Returns primarily come from BGT rewards (3.41% APR, based on staking weight and BGT emissions distributed by validators, updated every 5 hours) and transaction fee shares from the pool (0.01% APR). BGT is Berachain’s non-transferable governance token that can be burned 1:1 for BERA (irreversible) and entitles holders to a share of fee revenues from core dApps such as BEX, HoneySwap, and Berps (specific proportions determined by governance). Due to the nature of the stablecoin pair, price volatility risk in the BYUSD/HONEY pool is low.

Risk Assessment: Low to moderate. Both BYUSD and HONEY are stablecoins with stable prices. Berachain’s PoL mechanism has undergone audits by firms like Trail of Bits, reducing smart contract risk. However, BGT rewards depend on validator distribution and governance decisions, and may fluctuate if emission parameters are adjusted.

Current Data:

Source: Berachain Official Website

Provide Liquidity to Uniswap V4 USDC-USDT0 (Uniswap V4)

Go to the Merkl website (app.merkl.xyz), connect your wallet, and deposit USDC or USDT into the “Provide Liquidity to Uniswap V4 USDC-USDT0” product to provide liquidity to Uniswap V4.

Note: Merkl is a DeFi investment aggregation platform offering users a one-stop solution across opportunities such as liquidity pools and lending protocols. This product facilitates liquidity provision to Uniswap V4’s USDC/USDT pool via Merkl. Uniswap V4, launched in 2025, introduces a “hooks” mechanism allowing developers to customize pool functions—such as dynamic fee adjustments and automatic rebalancing—to improve capital efficiency and return potential.

Yield Source: UNI token incentives.

Risk Assessment: Low to moderate. The USDC/USDT pool involves a stablecoin pair, minimizing price volatility risk. However, smart contract risks exist, and returns may decline after the incentive period ends.

Current Data:

Source: Merkl Official Website, Uniswap Official Website

Echelon Market USDC (Aptos)

Visit the Echelon Market website (echelon.market), connect an Aptos-compatible wallet, go to the Markets page, select the USDC pool, deposit USDC to participate as a supplier. Users receive supply receipts, with earnings accruing in real time.

Note: Echelon Market is a decentralized crypto market built on the Aptos blockchain using the Move programming language. Users can borrow or lend assets through non-custodial pools to earn interest or use leverage. This product allows users to deposit USDC into a pool on the Aptos mainnet and earn yield. Echelon Market integrates with Thala Protocol, which provides stablecoins and liquidity layers on Aptos, issuing deposit receipt tokens such as thAPT.

Yield Source: Earnings include USDC supply interest (5.35%) and thAPT rewards from Thala (3.66%). thAPT is Thala’s deposit receipt token, minted and redeemed 1:1 for APT, with a 0.15% fee applied upon redemption; these fees go into the sthAPT (staked yield token) reward pool.

Risk Assessment: Low to moderate. USDC has high stability, but users should monitor smart contract risks within the Aptos ecosystem and how thAPT redemption fees may affect net returns. Instant withdrawal offers high liquidity, though market fluctuations could impact the value of thAPT rewards.

Current Data:

Source: Echelon Market Official Website

Summary

The table below ranks products by TVL from highest to lowest. For reference only; not investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News