Bear's here, are bulls back? Where is the market headed next?

TechFlow Selected TechFlow Selected

Bear's here, are bulls back? Where is the market headed next?

Holders are gradually taking profits, but the market has not yet exhibited extreme euphoria.

Author: Ignas | DeFi Research

Translation: TechFlow

In June 2021, when ETH dropped from $4,300 to $2,150—halving in price—I decided to sell all my holdings.

At that time, I was completely drained by the intensity of the bull market. Continuous research and work had left me mentally and physically exhausted. I desperately wanted everything to stop. When my portfolio shrank by 50%, I took it as a signal of bear market onset and promptly liquidated all positions, feeling an immediate sense of relief.

However, the market quickly rebounded, with ETH surging 125% to reach $4,800. I could only watch from the sidelines. While I earned some yield holding stablecoins, I missed out on this rally entirely.

Now, I feel we’re entering a similar phase again—but this time, my mindset is much stronger. I’ve chosen to hold firmly through volatility and wait for the market recovery.

But what if I’m wrong? What if this truly marks the beginning of a bear market?

Currently, fear dominates market sentiment: the impact of Trump’s tariff policies, stocks sitting at historical highs and potentially triggering a crash that drags down crypto alongside. Meanwhile, you might notice Warren Buffett is sitting on massive cash reserves, making you wonder whether he knows something we don’t. “Smart people” across social media platform X are sharing pessimistic forecasts, claiming a market collapse is imminent.

This is what's known as Goblin Town (slang for a market crash).

Nonetheless, I choose not to be overwhelmed by this fear, uncertainty, and doubt (FUD), and hope to share some data and insights to help everyone analyze the current situation calmly.

Is Bitcoin Still in a Bull Market?

Below are several indicators from CryptoQuant that help determine whether Bitcoin is overvalued ("expensive") or undervalued ("cheap").

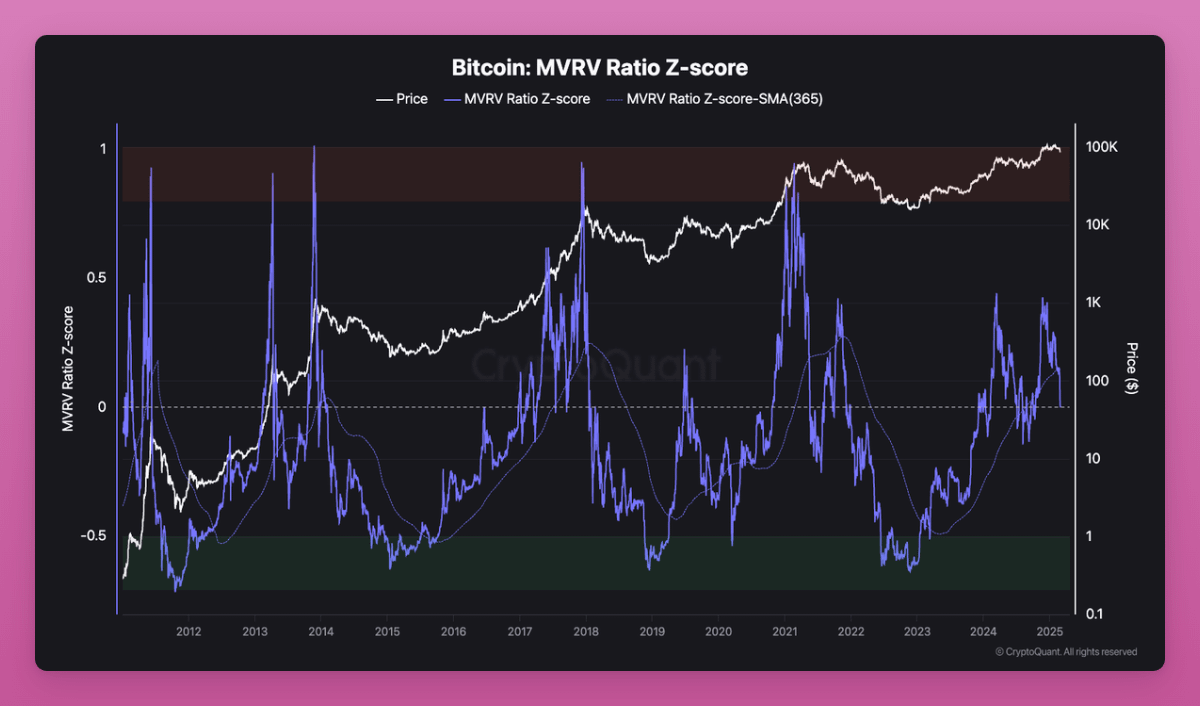

MVRV Z-Score Indicator

The MVRV Z-Score measures how far Bitcoin’s price has deviated from its historical trend, indicating whether it is overvalued (red zone) or undervalued (green zone).

-

Currently, Bitcoin’s price is not in the overvalued zone, but it is also far above the deeply undervalued range.

-

The market still has room to grow, but we are in the mid-cycle phase rather than the early stage.

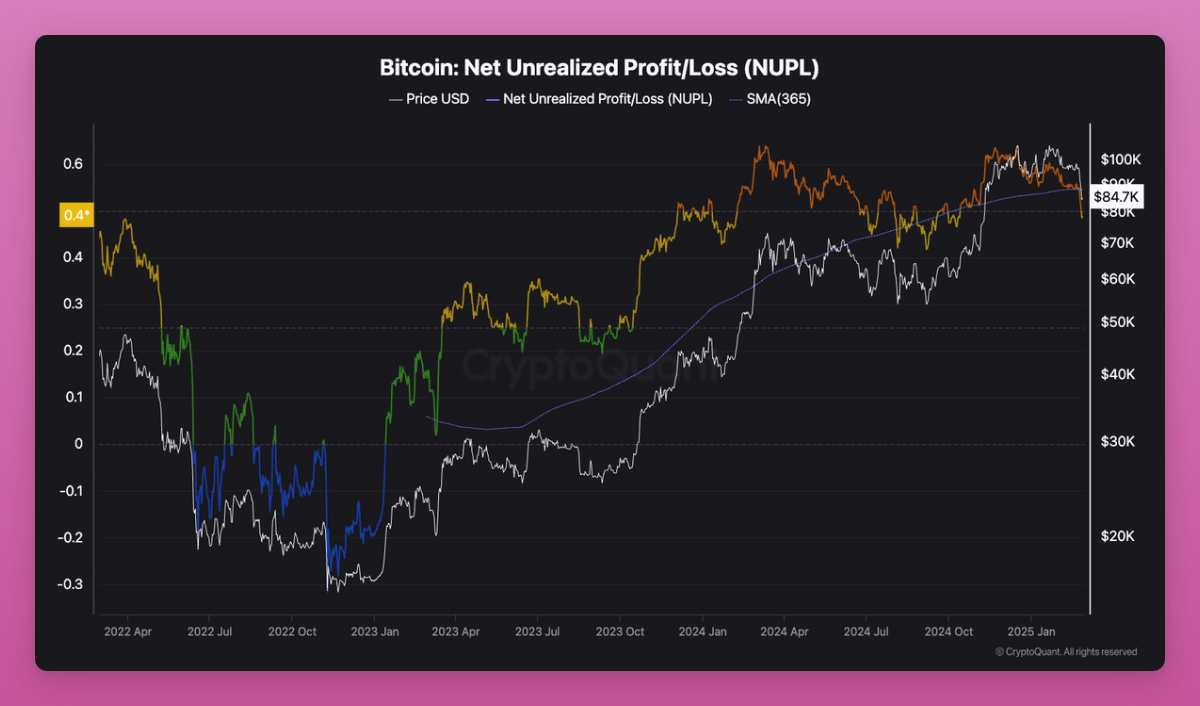

NUPL (Net Unrealized Profit/Loss)

The NUPL indicator gauges market sentiment based on unrealized profits—indicating fear, optimism, or euphoria.

-

Currently at the optimistic/denial stage (~0.48), suggesting the vast majority of holders remain in profit.

-

Historically, when NUPL exceeds 0.6, the market typically enters a greed/euphoria phase, signaling a potential top.

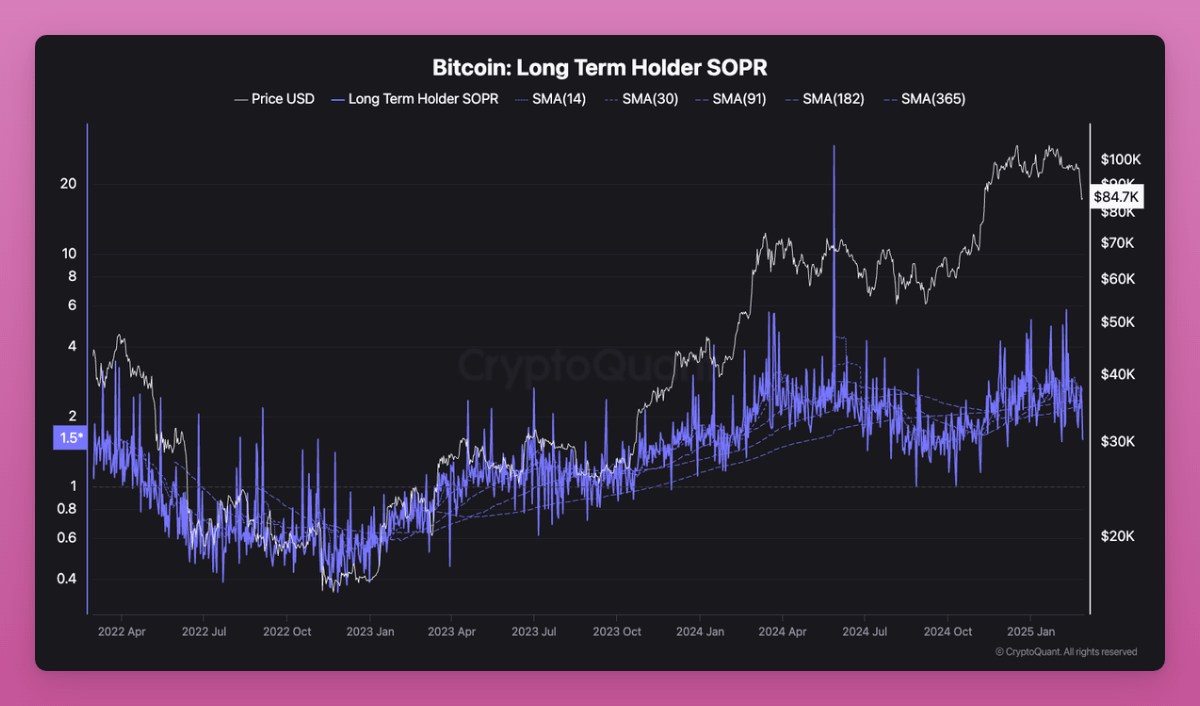

Long-Term Holder SOPR (Spent Output Profit Ratio)

SOPR tracks the behavior of long-term holders, revealing whether they are selling at a profit or loss.

-

The current value is 1.5, indicating long-term holders are taking profits, but selling pressure is not aggressive.

-

In a healthy uptrend, consistent profit-taking by long-term holders is normal.

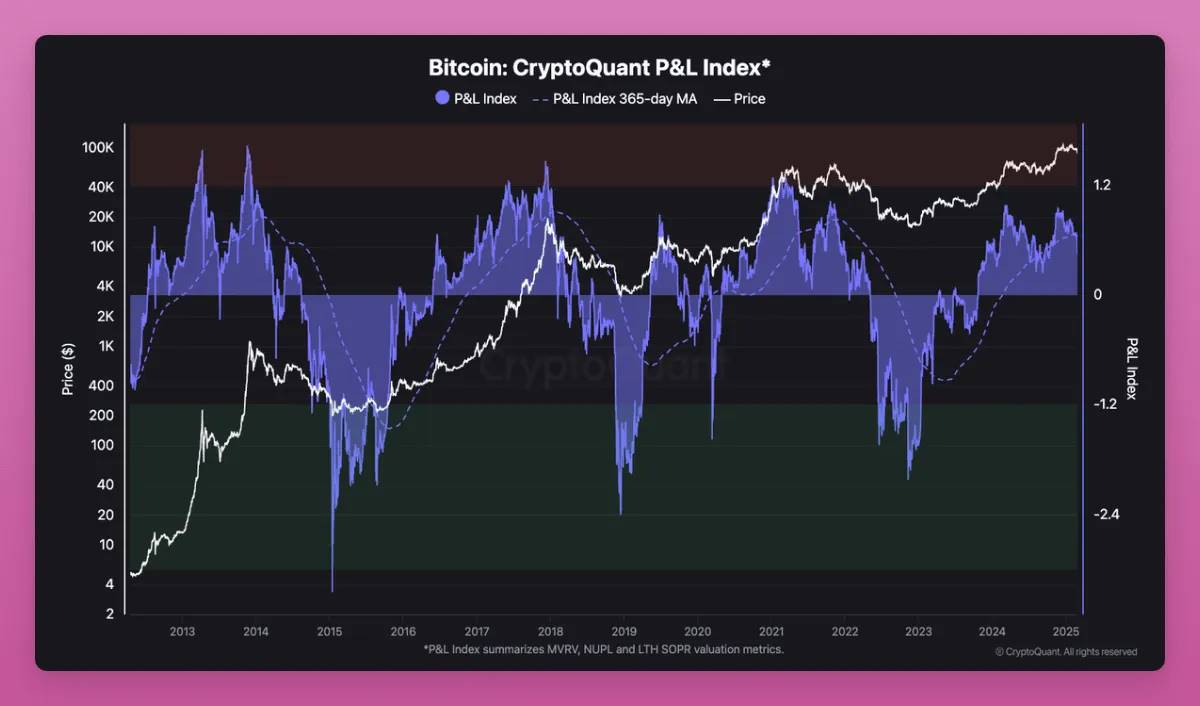

CryptoQuant P&L Index

This index combines MVRV, NUPL, and SOPR data to assess overall market valuation.

-

Currently above its 365-day moving average, confirming that the bull market remains intact.

-

When the index surpasses 1.0, it may signal the formation of a cycle top.

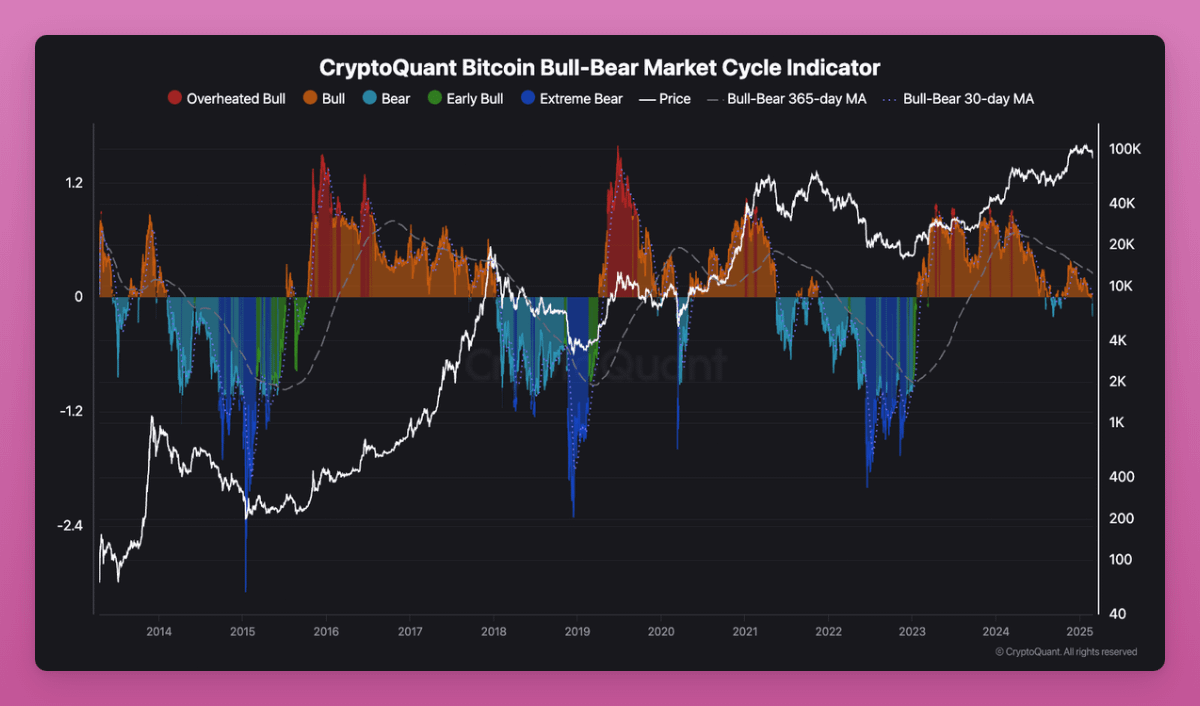

CryptoQuant Bitcoin Bull-Bear Cycle Indicator

If you follow just one Bitcoin indicator, I recommend this one. It’s a momentum-based metric derived from the P&L Index, designed to track Bitcoin’s bull and bear cycles.

-

Bitcoin is solidly within the bull market zone (orange), indicating a strong upward trend.

-

It has not yet entered the overheated bull zone (red), which historically marks cycle peaks.

Summary – What Comes Next?

-

Bitcoin is currently in the mid-phase of its bull cycle.

-

Holders are gradually taking profits, but extreme euphoric sentiment has not emerged.

-

There is still room for further upside before reaching overvalued territory.

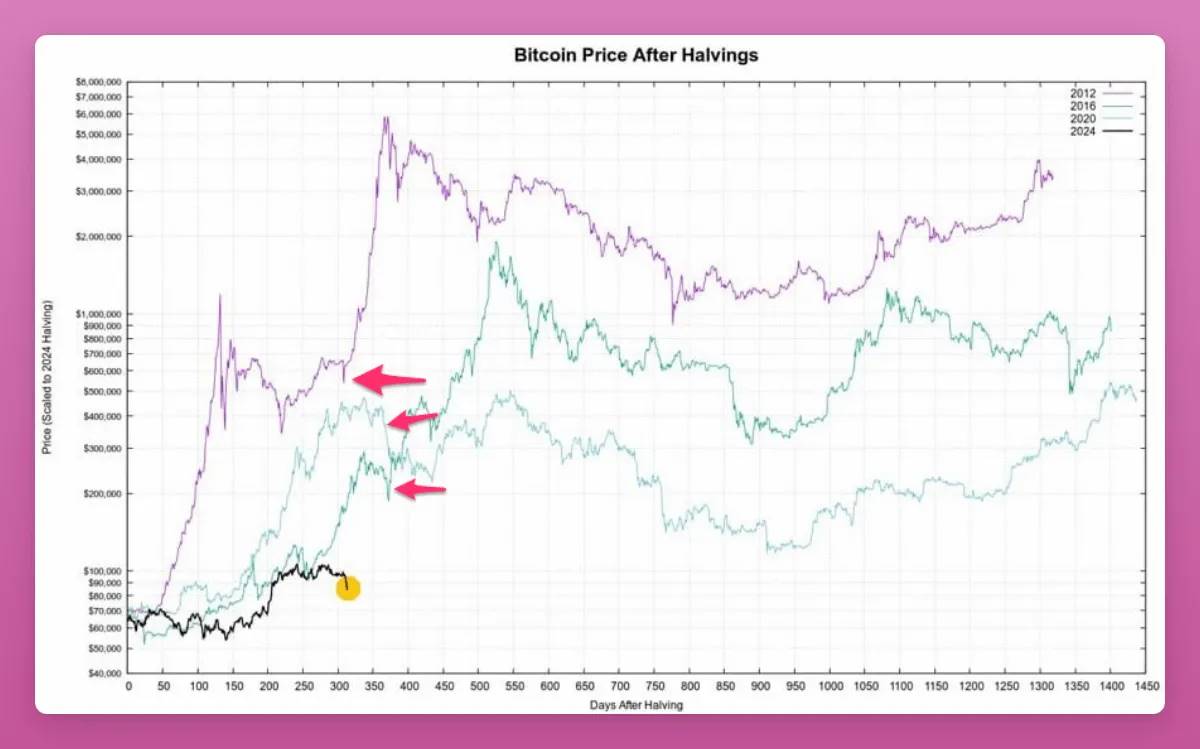

If history repeats itself, Bitcoin still has significant upside potential before hitting major cycle highs.

Interestingly, a chart shared by CZ on X (Twitter) perfectly captures how I feel about the market’s future path:

“I don’t look at charts, but…” — CZ on X

Currently, Bitcoin has confirmed entry into a bull market, but has not yet reached the euphoric levels seen at past cycle tops. On-chain data suggests there’s still room to run, though some profit-taking is already underway.

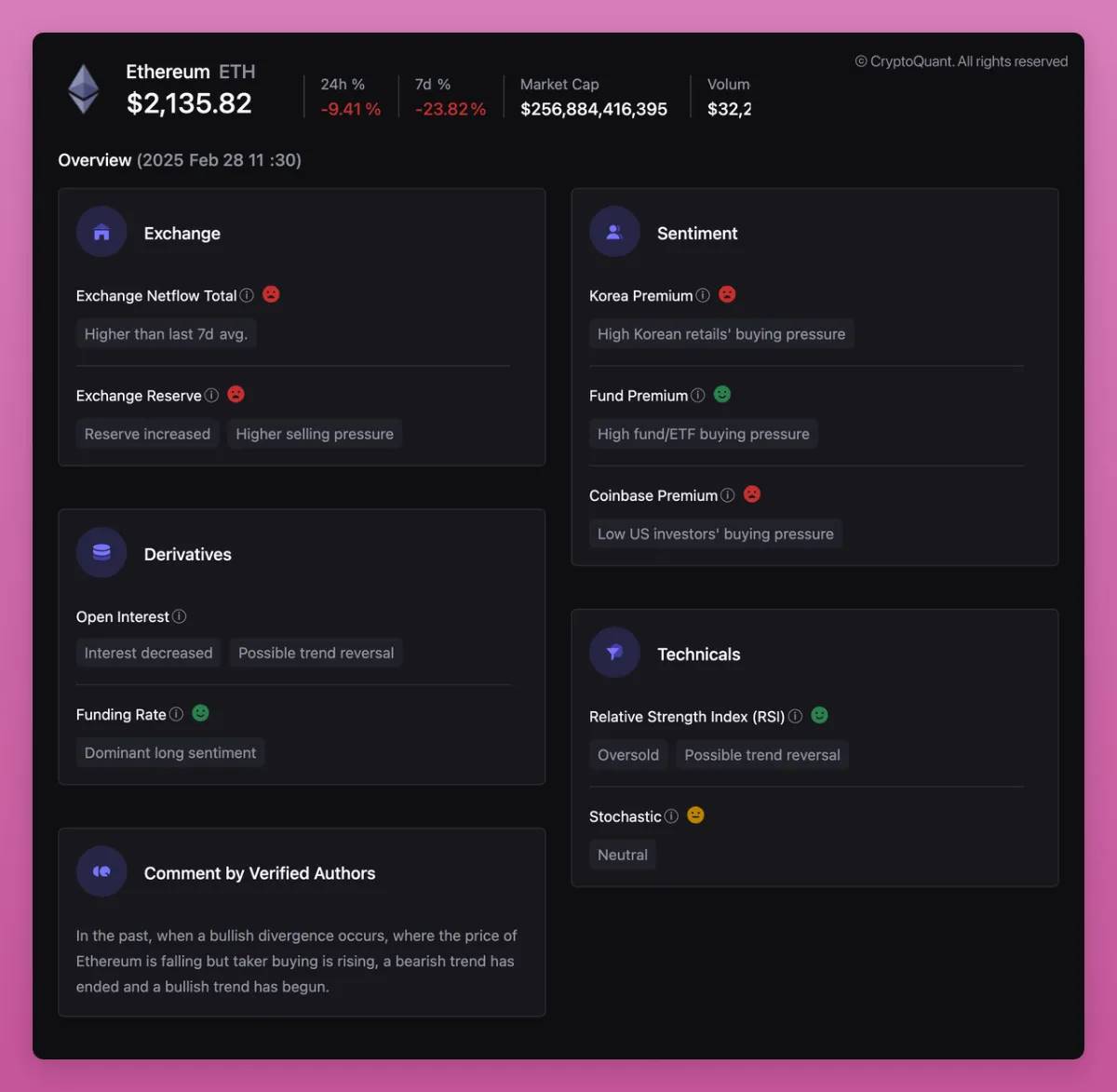

Ethereum’s Situation: Concerning

Over the past two years, ETH has declined 70% against BTC. Since December 2024 alone, it has dropped 48%!

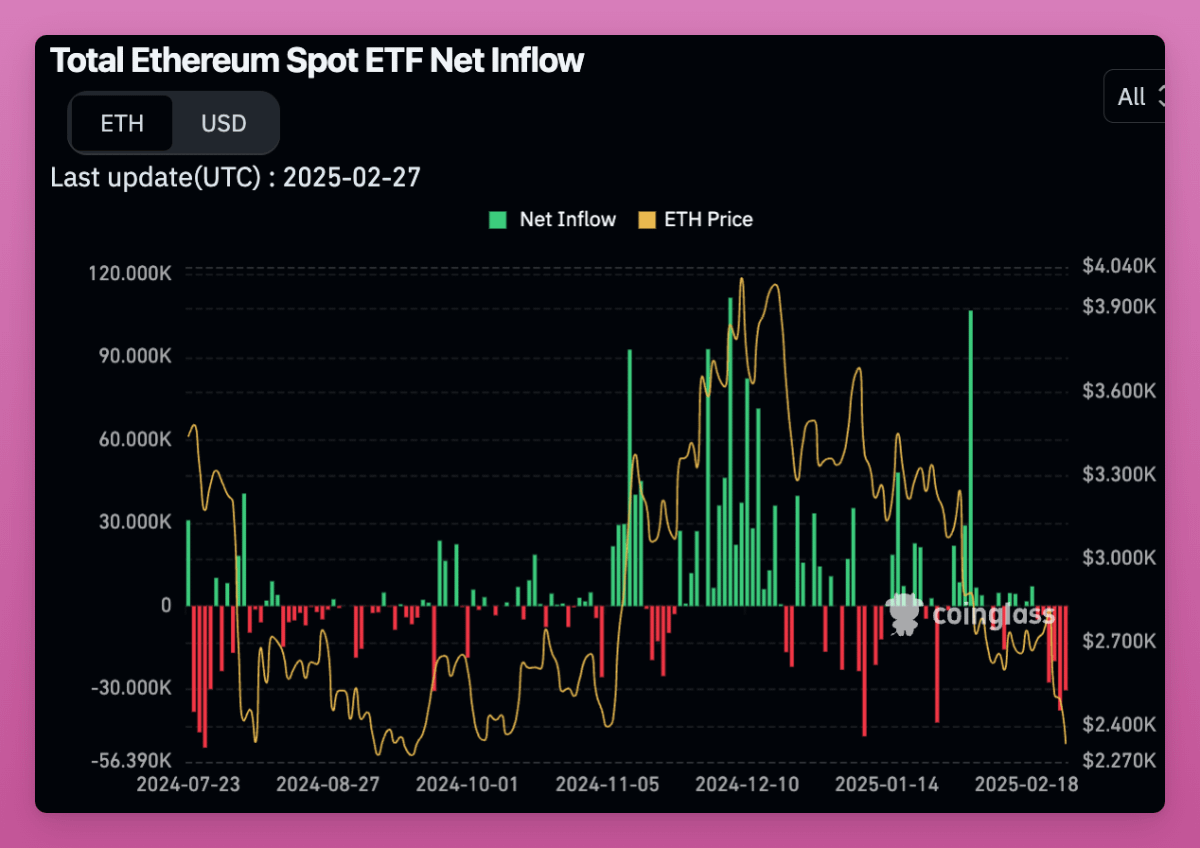

In addition, ETH ETF outflows show no positive signals whatsoever.

Is ETH Currently the Most Attractive Risk-Reward Opportunity?

I’ve shared some thoughts on X suggesting that ETH catalysts are slowly building up:

-

Leadership changes at the Ethereum Foundation (EF) (Aya stepped down, but no new executive director has been announced yet).

-

Initiating L1 scaling—though currently limited to gas limit adjustments, the shift in thinking itself is significant.

-

Pectra introduced EIP-7702 (simplified approval mechanism) and EF’s Open Intents Framework, both of which will significantly improve L2 user experience.

-

Community interest in memecoins is waning, with more attention returning to Ethereum fundamentals.

-

The excitement around MegaETH shows: 1) People still love innovative L2s; 2) Successful L2s further validate the modular thesis.

-

Base announced reducing block times from 2 seconds to 200 milliseconds and launching L3s (similar in concept to MegaETH). Though personally, I'm not a Base fan.

-

Ethereum remains the premier public chain for asset tokenization—even BlackRock is backing it.

-

ETH’s price is severely oversold—it’s genuinely very low, haha.

L1 scalability may take years to materialize, and UX improvements require support from multiple partners (e.g., Base hasn't joined the Open Intents Framework yet).

Ethereum Outlook: Bullish or Bearish?

My biggest concern is that ETH might completely miss this bull cycle and only become a compelling buy opportunity during the next bear market.

Yet market sentiment can shift rapidly. If the Ethereum Foundation and broader community can make tangible progress in:

1) L1 scaling,

2) Significant improvement in modular L2 user experience,

3) Overcoming the current “loser mentality” in the community,

Then ETH could stage a powerful comeback and reclaim dominance in the latter half of this cycle.

However, currently, SOL’s market cap is just one-third that of ETH, offers better user experience, and over time, its "Lindy effect" strengthens (as long as the network remains stable).

These factors pose a real challenge to ETH’s dominance in the smart contract space.

Altcoins: Key Metrics to Watch

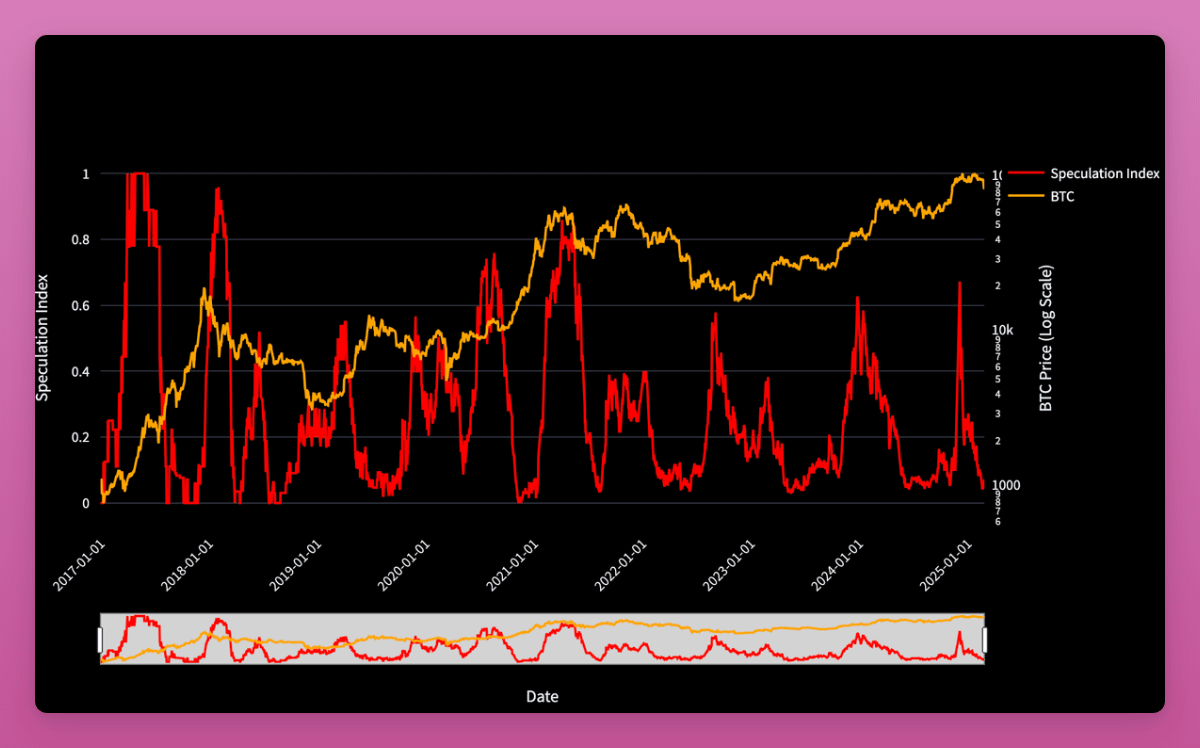

Robust Speculation Index measures whether altcoins are outperforming Bitcoin across multiple timeframes.

-

The current reading is low (~0.0–0.2), indicating Bitcoin is outperforming most altcoins.

-

Historically, low speculation often sets the stage for an altcoin rebound.

Aylo shared a similar Crypto Breadth chart on X (Twitter), suggesting altcoins may have bottomed. If Bitcoin strength persists, we might see an altcoin rally soon.

Question: Which altcoins should you buy?

When selecting altcoins, I use these criteria:

-

No major token unlocks scheduled in the near term.

-

Strong product-market fit (PMF)—the product meets real demand and gains user traction.

-

Revenue-sharing mechanisms (e.g., token buybacks) are a key plus.

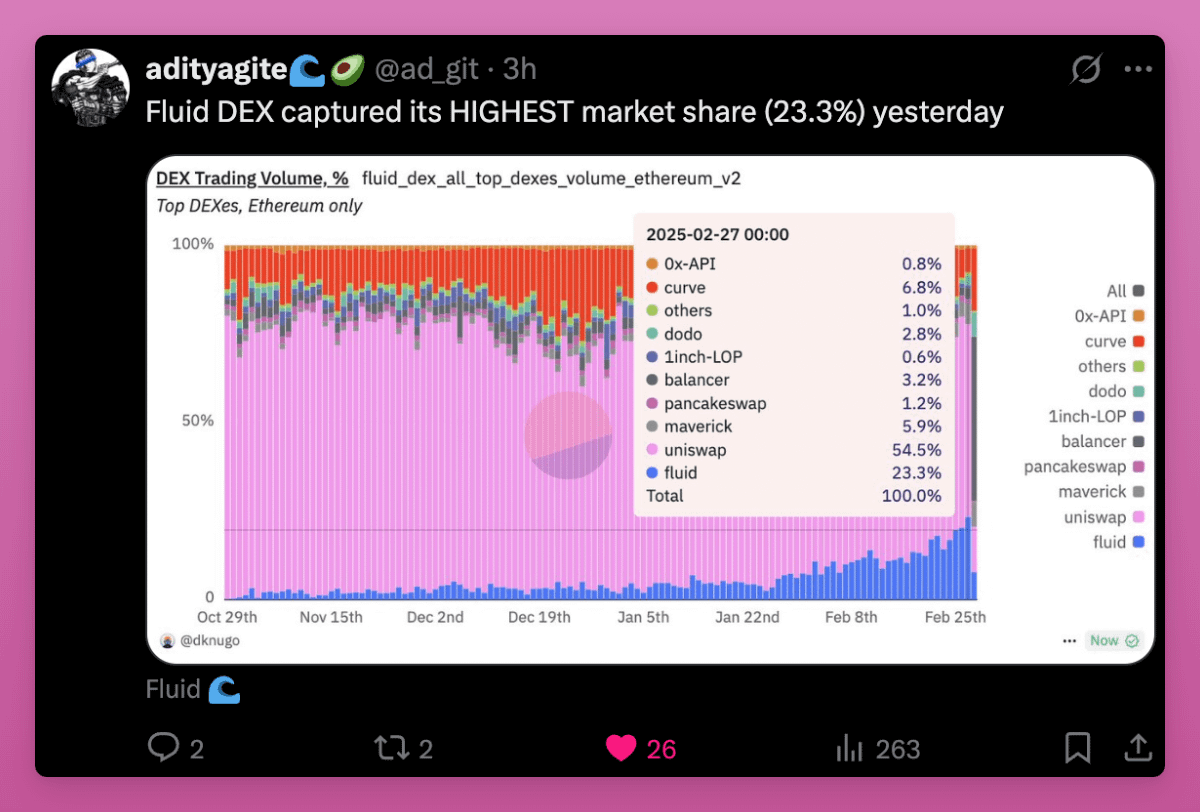

FLUID is a decentralized lending protocol launched just months ago, yet its trading volume on DEXs now rivals Uniswap. Recently, FLUID announced an upcoming token buyback program, boosting my confidence in its future.

Other Altcoins Worth Watching:

-

ENA: Successfully weathered the Bybit hack and multiple liquidation waves. Recently raised $100 million at a $0.40 valuation. Additionally, growing adoption of sUSDe by protocols and centralized exchanges (CEXs) makes it promising. The caveat: ENA faces major token unlocks soon, which could pressure the price.

-

$SKY (formerly MKR): Taiki highlighted several positives:

-

$30 million monthly token buybacks (~1.9% of supply).

-

USDS (formerly DAI) supply nearing all-time highs.

-

SPK farming increases token demand and revenue streams.

-

Potential tailwinds from stablecoin regulation.

-

-

$KMNO: Dominates Solana’s lending market with $1.8 billion in TVL, yet a market cap of only $85 million—suggesting severe undervaluation. However, Solana users are mostly traders, not yield farmers. That said, this could change quickly.

-

$S from Sonic: Its DeFi ecosystem is expanding rapidly (including deployment of key protocols like Aave), backed by a 200 million $S airdrop, excellent UX, and rising attention on X. Crucially, no large token unlocks provide a more stable price foundation.

-

HYPE: Lots of discussion on X about its strong tokenomics and vibrant community—worth monitoring.

-

PENDLE: When markets refocus on fundamentals and speculators seek yield, Pendle becomes highly attractive.

-

AAVE: Undergoing tokenomic upgrades; Version 3.3 brings improved revenue performance.

What did I miss?

Beyond these, I’m particularly excited about upcoming token airdrops from MegaETH, Monad, Farcaster, Eclipse, Initia, Linea, and Polymarket.

Macroeconomic Environment

I fully believe in Bitcoin’s value as digital gold. Compared to physical gold, Bitcoin enables self-custody and superior transferability, making it more appealing.

The current macro environment provides an ideal test case for Bitcoin: tariffs, wars, fiscal deficits, and massive monetary expansion—all serve as potential tailwinds.

In my 2025 blog post “Truths and Lies in Crypto,” I cited BlackRock research: Bitcoin sometimes sells off initially during major macro events. Yet chaos, uncertainty, and potential money printing ultimately create strong support for Bitcoin.

Current Market Observations

I believe the current market volatility stems from Trump abruptly breaking away from established global order. This uncertainty triggers short-term panic. However, people will gradually adapt to this new global reality.

Fundamentally, nothing has changed that weakens crypto’s core thesis. On the contrary, we see increasingly positive developments daily: The U.S. Securities and Exchange Commission (SEC) has dropped lawsuits against cryptocurrencies, new crypto legislation has been introduced, and overall government sentiment toward crypto is turning more favorable.

Still, a point raised by Ansem is worth noting: When good news fails to drive prices higher, that itself becomes a bearish signal. This suggests the market may need time to digest and adjust to the current state.

Nevertheless, I still hope the market adjusts faster than his optimistic forecast for 2026/27.

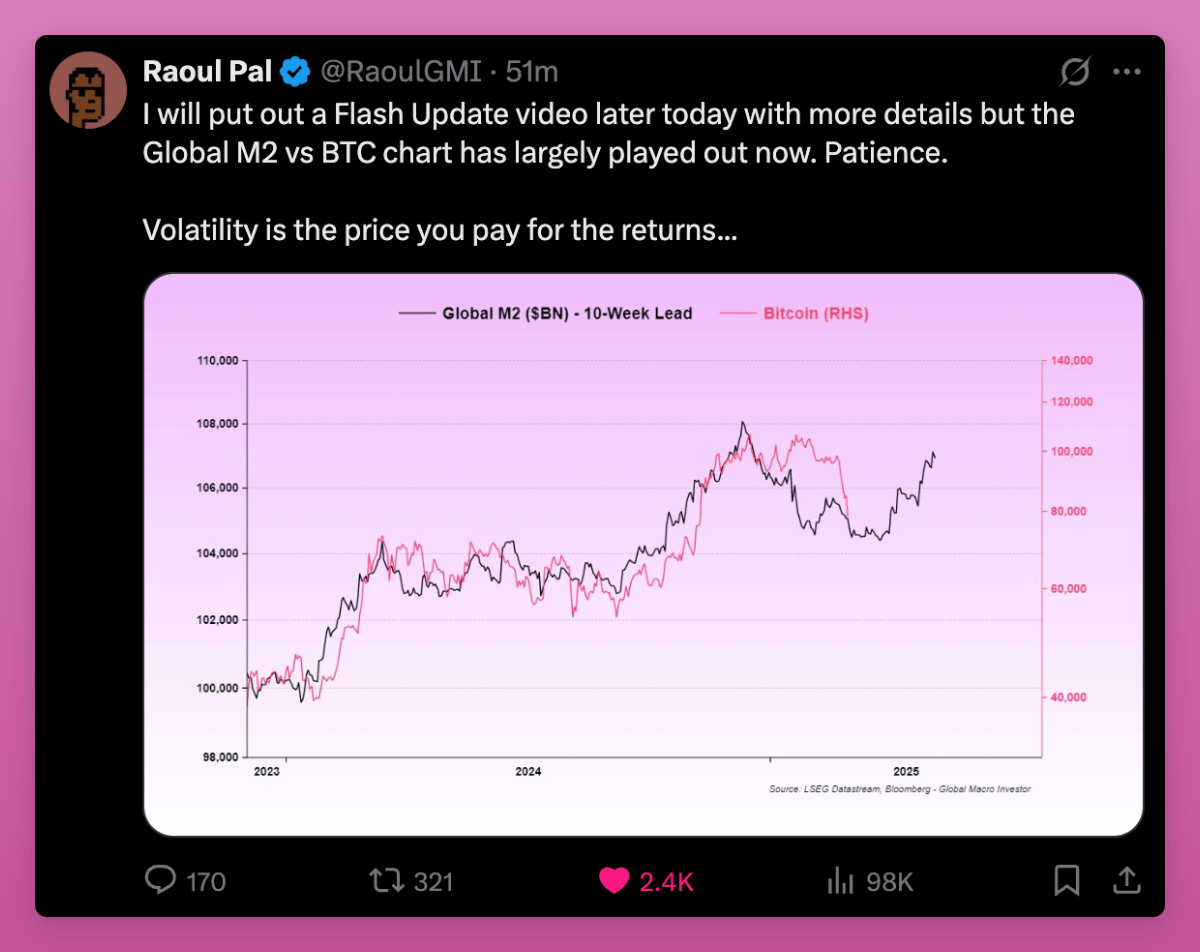

If Raoul Pal’s analysis and charts are correct, Bitcoin’s price should catch up with global M2 supply growth before 2026. M2 is a key measure of global money supply, and aligning with it would further cement Bitcoin’s status as “digital gold.”

Conclusion

In summary, I remain confident in the cryptocurrency market and believe that patience will ultimately be rewarded.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News