Dimensions of cryptocurrency market demand: attention, adoption, and liquidity

TechFlow Selected TechFlow Selected

Dimensions of cryptocurrency market demand: attention, adoption, and liquidity

No magic, the only factor that distinguishes quality and ultimately determines success is demand.

Author: Andrey Didovskiy

Translated by: Baicai Blockchain

There is a universal economic law governing all markets: supply and demand. This applies equally in the cryptocurrency space, where supply is extremely abundant. Fungible tokens, non-fungible tokens, stablecoins, governance tokens, meme coins, proof-of-work, proof-of-stake—new tokens emerge every day in overwhelming variety.

To put it into perspective, there were approximately 10,000 crypto assets in 2017. By February 2025, that number has surpassed 11.5 million, and this growth appears to be accelerating. When supply exceeds demand, market attention becomes fragmented, liquidity spreads unevenly, order books thin out, prices become abnormally sensitive to selling pressure, and sharp downward volatility (often irreversible) ensues.

When demand exceeds supply—and remains sustained—we witness the emergence of Bitcoin. Through carefully designed economic models that account for supply dynamics, combined with robust yet simple technology aligned closely with social philosophy, loyal communities are cultivated, driving a liquidity flywheel effect where liquidity generates real demand, ultimately converging on genuine assets.

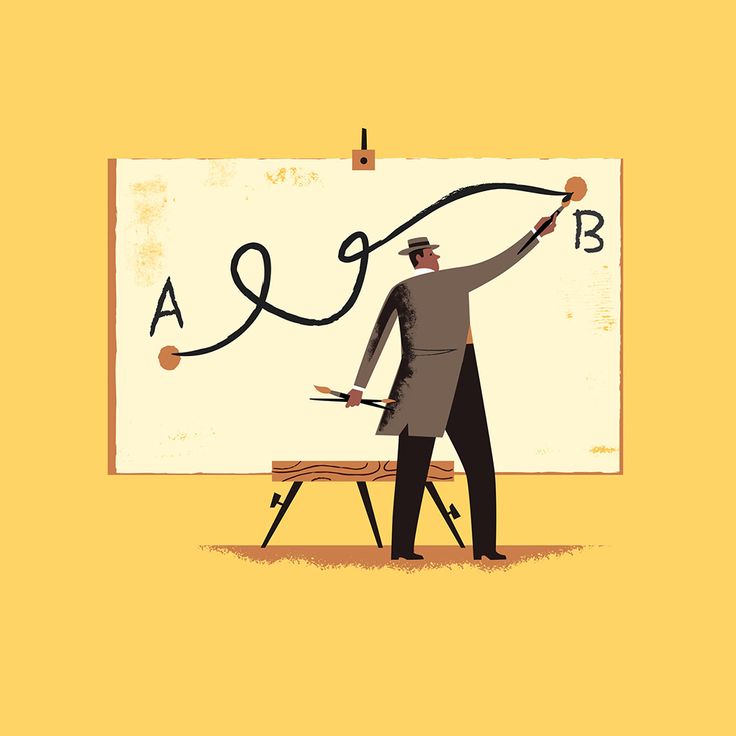

There is no magic. The only factor that distinguishes quality and ultimately determines success is demand—without question. Seemingly simple on the surface, demand is actually a multidimensional principle layered with interdependent nuances and subtleties. In other words, there are levels to it.

1. Demand Domino Effect

Demand typically flows uniformly across various assets based on the foundational elements of a project, product, or economy.

There are two fundamental types of demand: direct demand and indirect demand.

Direct demand originates from niche-specific needs. For example, wanting to use an application creates demand for its native token, which then translates into demand for the underlying network, ultimately leading to demand for that network's token.

Indirect demand is driven by macroeconomic factors such as money printing, interest rates, government policies, and political systems.

These two types of demand are interdependent. For instance, monetary policy affects the amount of capital freely circulating in society, shaping public risk appetite and thereby influencing which assets attract capital inflows. Conversely, if high-risk assets begin rising without changes in base capital, it suggests sophisticated investors anticipate future capital flows into retail hands and are positioning themselves early.

In cryptocurrency, the core drivers of demand stem from two fundamental human motivations: the pursuit of pleasure and the avoidance of pain—both fueled by stories and narratives.

The dominant narrative behind these two motivations is "sovereignty"—protecting oneself from government interference or resisting governmental control.

Narratives around pursuing pleasure include Lamborghinis, Rolexes, luxury travel, attracting attention, and gaining recognition from family and friends. This desire to be right and profit from it is what we call "gambling."

Narratives around avoiding pain center on fear of missing out (FOMO). Seeing others earn life-changing money through investments triggers emotions of not wanting to be seen as foolish or left behind. We refer to this behavior as "surrender" (losing oneself, rushing to liquidate investment portfolios).

2. Who Is Driving Demand?

To understand how demand is driven, we must first identify its sources. Since demand is typically measured through buying/selling pressure and liquidity, the key question becomes: who is pushing?

For simplicity, we can categorize "who" into three main groups:

1) Builders

This group includes individual developers building tools independently, companies creating products that generate real revenue, hackers searching for system vulnerabilities, content creators spreading information, small teams building decentralized exchanges (DEXs) and bridging protocols in garages, and of course, developers of various smart contracts.

2) Retail Investors

This group constitutes the vast majority of the market, including repliers on Crypto Twitter, KOLs, meme coin investors, NFT enthusiasts, speculative apes, and "100x bet" gamblers. They are also commonly referred to as "bagholders" or "exit liquidity." These are individuals seeking higher returns through speculation, aiming to break free from conventional frameworks and integrate into communities.

3) Institutions

This group includes companies incorporating cryptocurrencies into asset allocations, enterprises deploying tokenized debt instruments, and governments turning volcanoes into Bitcoin mining farms.

We omit here numerous intermediary roles such as market makers, exchanges, node infrastructure providers, and cloud server services.

3. Factors Driving Demand

So how exactly is demand driven in cryptocurrency? Obviously, by using internal liquidity to inflate a meme coin, securing endorsements from influential figures, and employing "community" bots to flood comments...

Just kidding. In reality, demand drivers in crypto aren't much different from other fields—the core is marketing.

We won't delve into the ethics of marketing, but it's important to note that marketing fundamentally aims to influence emotions.

To appeal to human nature, marketing methods can be reduced to two categories: attraction and coercion.

Attraction involves organically building excellent products and communities to gradually establish trust. This takes considerable time but yields lasting impact, eventually forming self-sustaining, super-systems that drive themselves.

Coercion uses unethical tactics to create the illusion that something is more valuable than it truly is. Though low-cost and short-lived, these methods are highly destructive. Prime examples can be found in Argentina's meme coins and countless stories from Pump.fun.

Regardless of which marketing method drives demand, the key lies in the nature of demand itself; here we discuss various factors measuring demand adoption.

1) Measuring Demand

The most common—and often mistaken—way to measure demand is price. A slightly better approach is measuring liquidity. Liquidity is the cornerstone of financial markets and the most critical indicator when assessing the economic health of an asset or asset class. In essence, liquidity reflects buying pressure (the desire to own) and selling pressure (the reluctance to let go).

When cryptocurrency prices rise, they create a powerful psychological feedback loop, reinforcing the belief that the asset must be valuable—turning into a self-fulfilling prophecy of price appreciation. Conversely, when prices fall, people often assume the project has lost demand.

While this phenomenon holds some validity, it fails to present a complete picture.

As a technology-first, pseudo-economic innovation, cryptocurrency demand is far more complex than imagined, involving multiple dimensions of finance and technology. Below is an incomplete list:

-

MAU (Monthly Active Users)

-

DAU (Daily Active Users)

-

Total number of on-chain addresses

-

Total number of smart contracts

-

Total number of transactions

-

Total number of developers

-

Hash rate

-

Number of miners

-

Total staked tokens

-

Number of nodes

-

On-chain transaction volume

-

TVL (Total Value Locked)

This list is extensive, and interpretations vary widely. The ongoing challenge remains: how to distinguish how much of this demand is genuinely organic, and how to combine it with other driving factors to truly understand a project's current state.

2) Behind the Demand

No matter what ultimately drives demand, the most important question is always "why." While external noise can sometimes be hard to ignore, give yourself the opportunity to explore inward, digging deep into the logical reasoning behind it.

-

Why do I want to buy this?

-

Why do others perceive value in it?

-

Why would someone want to sell it?

-

Why would someone want to own it?

-

Why would someone believe others will want it?

-

Why would a project choose to build on this network?

-

Why not another network?

Understandably, this path isn't easy—especially when overcoming personal bias and avoiding "analysis paralysis," a recursive loop of endless self-questioning that ultimately traps you in decision-making gridlock.

But realize this: when you can control your impulses and dispassionately dig deep into the "why," you'll eventually make sound decisions.

Being early isn't always best, nor is it about being right or wrong. Ultimately, what matters is success—and the key to success lies in being willing to accept potential mistakes in pursuit of profit.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News