From Zero to Return: A Veteran Crypto Investor's 6-Year Journey

TechFlow Selected TechFlow Selected

From Zero to Return: A Veteran Crypto Investor's 6-Year Journey

The market is merely a reflection of emotions; once you can control your own emotions and hedge against your own foolishness, good things will happen.

Author: Dyme

Translation: Luffy, Foresight News

The market is a funny thing. It often rewards bad behavior, but eventually always reverts to the mean. Those who never consider this end up eating their own consequences and being humbled.

Recently, several people have asked me how I went from zero to achieving consistent, substantial profits, surpassing all my previous trading results and setting new highs for my portfolio.

In short: deep surrender, stupid mistakes, and luck.

My "zero" isn't the same as others', though there are similarities. It was never literally nothing—it was a mental collapse, a complete abandonment of self.

I failed in every attempt, had to crawl slowly out of a dark abyss, and then came back stronger. You have no idea whether I'm just playing a role-playing game. I'm not, but you don't have to believe me either.

I've never written down these experiences all at once before—only shared fragments here and there over the years. My friends and those who've followed me long-term know what happened. I evolved from a "stupid top signal" into someone who now seems to actually understand the market clearly.

Unless you can understand the pain I've been through, you won't gain anything useful from this article. So buckle up—we're about to embark on a journey. This will be a long story.

If you don’t want to hear my boring tale, feel free to skip straight to "What You’re Here For (The Good Stuff)." It’s time to finally organize these experiences properly.

2019

After working at a job I didn’t like for about four and a half years, I finally quit. I had long been a strong supporter of Bitcoin. But seeing others get rich through leveraged trading, I wanted to try it too, so I decided to take six months off work to focus solely on learning trading.

I knew absolutely nothing about chart analysis or trading, yet I started experimenting with options and stock trading, drawing lines on charts. Anyone who remembers my early charts knows they were a mess, and my calls were frequently wrong. More importantly, I had zero concept of risk management.

Still, I realized that reading market signals seemed increasingly important. I kept tinkering with amateur-level charts, and after 2017, my online peers became much more skilled in this area.

Many of us became very wealthy briefly in 2017, only to watch our fortunes slip away as Bitcoin plunged 80%. I suspect I wasn’t the only one thinking: “It’s time to learn technical analysis so I’ll never lose this badly again.”

In 2019, I had roughly two to three thousand followers, mostly crypto enthusiasts.

I didn’t enter this field to become famous—just to dedicate six months to trading and learn the basics: chart patterns, moving averages, etc. I didn’t know what worked and what didn’t. But I had to start somewhere.

I had savings to cover six months of living expenses and qualified for unemployment benefits. My immediate future was financially secure.

So in August 2019, given my years of service, I asked my employer to lay me off (everyone knows they never object to unemployment claims). They agreed.

Unfortunately, shortly after that, Bitcoin hit its 2019 peak, followed by choppy, sideways movement until mid-2020. It was the worst possible timing—I had just quit my job to fully commit to trading.

Finally, I had time to think, learn, and do things I’d never had time for while working 40–50 hours a week—though I also had to bear all the risks and downsides that came with such freedom.

I got to work—trading SPX call options, stocks, analyzing charts daily, trying to make even $100–$500 per day. The crypto market was bleak in the year before 2020, and I only saw occasional small profits, but I stuck with it.

If I hadn’t been a complete beginner, that period would’ve actually offered decent trading conditions

2020

Things were going reasonably well—I logged in daily, shared my (poor) views online, and my follower count grew. I occasionally profited, and my account balance trended upward overall. People appreciated that I shared valuable insights online, since not everyone had time to think deeply (they still had jobs). I lost a lot of money, but always managed to recover quickly. For a beginner, it was acceptable.

Leveraged trading became my lifestyle. I stared at 15-minute charts, traded with 20x leverage, desperately trying to squeeze profits from the market—until February 20, when my holdings peaked, and I truly believed I was doing well.

Then came the pandemic—the "nuclear weapon."

Almost the same week, my unemployment benefits expired.

So my original plan—to study for a while, then return to a real job—vanished instantly. It felt like the end of the world—a new virus emerged.

I managed to short the market and turned 0.5 BTC into 1 BTC during the pandemic crash using 50x leverage. That week, it was the only thing going right; my stock positions were crushed, and I was certain my income was doomed.

It felt like fate forcing me to go all-in on trading.

Luckily, Jerome (the Fed Chair) and his "printing press" saved the world.

What happened next is common knowledge—the market surged over the next year. It was the peak of the "only up" era. The market could make you money, but it was absurdly irrational.

FTX

Even more thrilling than the rising market was leveraged trading. I had some experience, but very limited, and little understanding of macro conditions. I just knew Jerome was printing money, so the market would definitely rise.

Then our "savior" arrived—he would lead us into paradise and never do anything terrible.

We didn’t know it then, but FTX was about to take us on a lifetime journey.

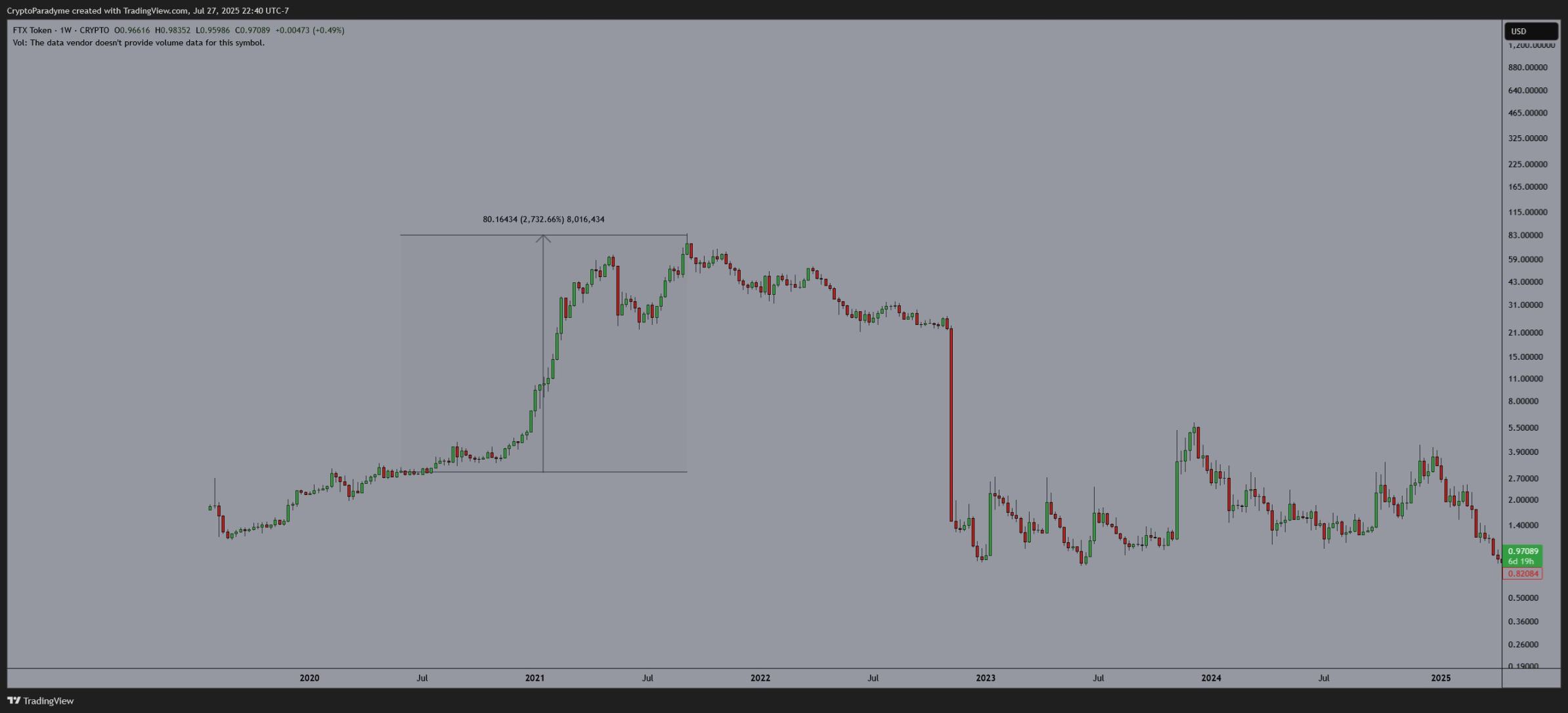

I deposited around $4,000–$5,000 into FTX, buying FTT (FTX's platform token) multiple times at $2–$4 per coin.

FTT rose 3000%. Suddenly, I had $40,000–$50,000 in my leveraged account. I’d never had that much money before. (This was the first red flag.)

I deposited more funds to do more leveraged trades because my staked FTT couldn’t be used as collateral. Emotionally, I was now fully invested in the FTX ecosystem.

I still can’t believe this chart is real

The day my follower count hit 10,000 was exactly when the "only up" rally began. The world never stops surprising.

I went from someone who only replied under others’ tweets to a somewhat known figure.

In the following months, despite the insane market, my mental and physical health deteriorated rapidly. Lockdowns in my area were strict. My weight skyrocketed; I left home only two or three times a week. My routine was a mess. I nearly became friends with DoorDash delivery drivers, consuming 4,000–5,000 calories daily to cope with pandemic despair and doom.

Those days were awful.

But I was making tons of money in the market—bills were paid, all assets were rising—so I kept doubling down.

I routinely used 10x–20x leverage. Sometimes I’d make $40,000; sometimes lose $20,000.

I also did lending, perpetual contracts for yield, and blindly jumped into every new meme coin (like COPE).

I stayed up late because I hated waking early, and with no job, I’d trade at open, then sleep until 4 p.m.

Not great for my health.

Besides, I earned solid referral income. At peak weeks, it reached $1,000 a day.

I used that money for trading and to offset losses.

I caught several rallies in Dogecoin, SOL, Bitcoin, and various altcoins.

I was a classic bull-market "genius."

The market rewarded me.

https://x.com/CryptoParadyme/status/1388019214515118080

My peak account balance on FTX was about $250,000, driven mainly by SOL, FTT, and Bitcoin.

Later, SBF (FTX founder) reduced the daily withdrawal limit for non-KYC accounts from $9,000 to $2,000. In hindsight, this might have been the first sign of his legal troubles—but who knows?

I withdrew funds every few days, but the money was still trapped inside FTX, and I was greedy, wanting more. I calculated it would take about 120 days to withdraw everything, requiring daily login and withdrawal actions.

Part of the blame lies with SBF’s new rules, but part lies with me. Because at one point, I really thought: “I should withdraw this $250,000 and improve my life.”

I could have fully withdrawn before FTX collapsed.

Even after the market topped in November 2021, I kept gambling. I wasn’t trading anymore—I was fighting the trend. Even as buy-side dried up, I fought against Bitcoin’s cycle.

Daily losses piled up. With constant withdrawals and losses, my account balance rapidly hit zero.

I lost two-thirds of my funds on FTX due to forced trading. Most of my trading career occurred in a "only up" market. No one warned me to change strategy—except Jim and Insilico, whom I dismissed as annoying bears back then, but they were among the few who accurately called the top. Credit where it’s due.

There were no legendary entry opportunities during that time—only endless pain.

2022

Things got worse.

In the first week of 2022, my grandmother—the woman who raised me and one of the most important people in my life—passed away.

We knew it was coming, but it didn’t make it easier. She suffered greatly, and we found slight relief knowing she was finally at peace.

With family gone, the future bleak, and markets still not trending up,

Purely by luck, I inherited some money months later. Not much, but something.

Due to its sensitive origin, I held this money with deep reverence. But by any measure, it wasn’t enough to change my life.

Like a gambler, on my father’s advice, I tried investing in dividend stocks for income—but lost 20% within four to five months.

Clearly, in a rate-hiking cycle, no one wants dividend stocks.

I didn’t want to risk this money further.

So I parked the cash (my first sign of learning)—in an account I barely checked. I needed time to think, and I didn’t understand the current market.

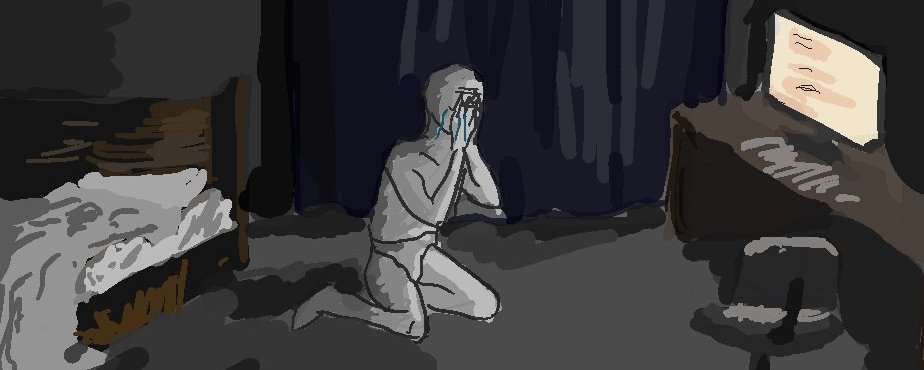

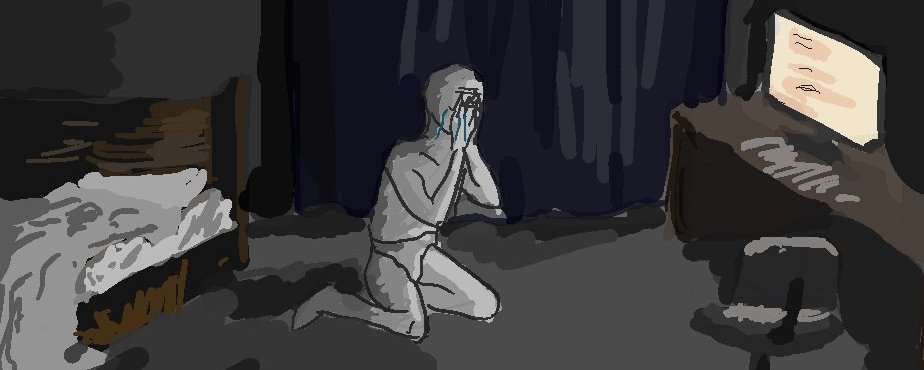

Hitting Rock Bottom

Until early 2022, stocks were generally rising, and I did fairly well in stock trading.

My brokerage account peaked at $120,000 in 2021, starting from around $20,000—pretty good for a beginner.

Rates had been low for 14 years; I had no idea what I was doing. I made money over the past two years betting on SPX upside, so I kept randomly drawing lines and aggressively deploying capital.

Months passed. I shorted occasionally but made little. Repeated losses. Tried catching falling knives.

What no one tells you in trading is that both losses and gains compound. But so does the mental exhaustion from consecutive losses—just as earlier euphoria blinded me to potential downside.

My need for income grew, pushing me further down the risk path because I wanted to recover losses.

I traded emotionally. I was overweight, lockdowns continued. I lost significant weight—and wiped out my entire portfolio.

Then I finally hit rock bottom. At my most mentally unstable moment, I poured my last $40,000 of personal funds into SPX call options, believing the market was finally turning, and I’d never repeat this mistake.

Jerome hiked rates again. The market crashed. Within hours, I lost $30,000–$35,000.

In hindsight, I think I was escaping grief over my grandmother’s death, pushing myself to the edge to feel pain. Those days were terrible—a chaotic period in my life.

I probably had $8,000–$10,000 left (excluding retirement accounts and inherited money, which I considered untouchable), plus a pile of worthless silver.

My confidence was shattered.

This was my "zero."

I think I lost over $400,000 total. But I never did a full audit.

Everyone’s "zero" is different. It’s never literally zero, but for me, it meant years of effort wasted and a need for change.

My full-time trading attempt from 2019 to 2022 ended in failure.

I had bills to pay, and my money would run out in two or three months.

My dumbest move might have been risking my tiny remaining capital to recover losses. Luckily, I suppressed that urge.

I started selling physical assets to pay bills—even sold some silver for rent, something I’d never done before.

I looked for jobs. But I was emotionally broken, a mess. In that state, I couldn’t land anything. I think many of us felt similarly in 2022.

My parents had to step in multiple times to cover my bills.

After years of independence, needing parental help to avoid homelessness was devastating.

I took online gigs to survive, but the income wasn’t enough.

Things couldn’t get worse—that was possibly my most humbling moment.

I focused on going to the gym and studying the market. I temporarily left Twitter several times. I didn’t know what to do next.

I spent lots of time in libraries, reading macroeconomics books. I don’t know how much I retained, but it provided some comfort.

2023–2024

In May 2023, I did something responsible—I got a job.

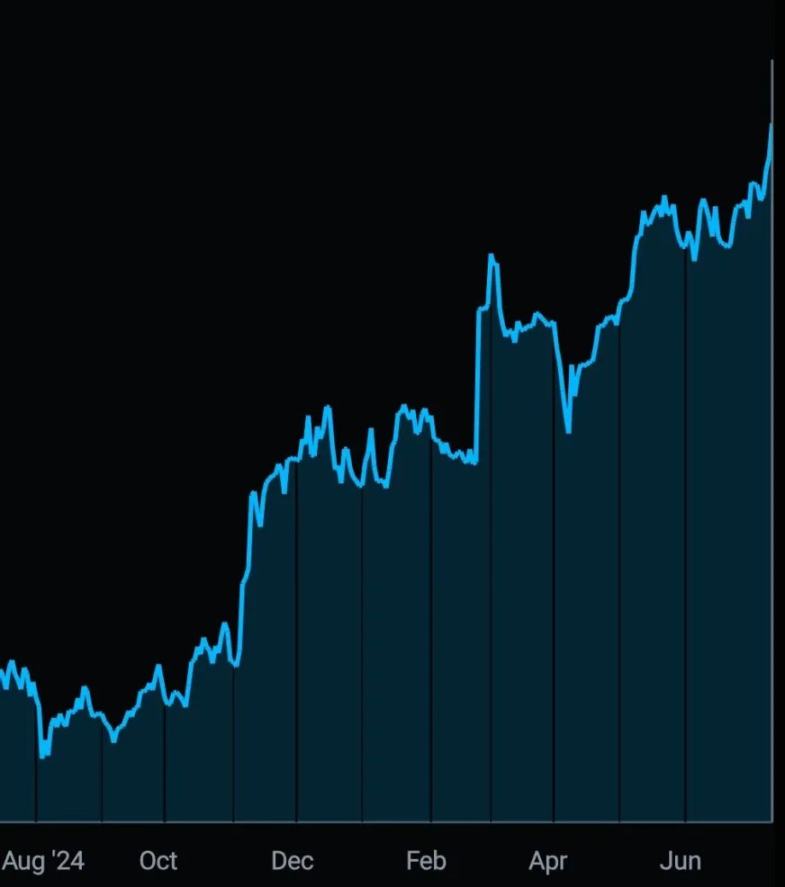

Once stable and earning enough for foreseeable needs, in August, I used my grandmother’s inheritance to buy Bitcoin for about $25,000. Not much, but my first major investment in over a year.

I didn’t make this decision lightly. I spent months thinking, researching the market, rebuilding my cash reserves.

Again, the amount wasn’t large (under $100,000). I knew Bitcoin would keep rising, and I did what I thought was responsible.

I also moved funds from my meager retirement account into Bitcoin via Grayscale Bitcoin Trust (GBTC), betting on ETF approval.

I set these investments aside and ignored them. To this day, I haven’t cashed them into my bank account, but I’ve taken profits at different points.

I kept working. Kept accumulating Bitcoin.

I believe my grandmother would’ve been happy seeing these investments grow. Her final act pulled me from rock bottom and gave me direction.

I kept working. But I applied lessons learned from years in the market, and from past mistakes.

I bought more Bitcoin, SOL. Deposited money weekly into other accounts ("out of sight, out of mind").

About three years later.

Everything started going smoothly. Now, my portfolio has repeatedly hit new highs.

Since mid-2023, I’ve consistently profited while minimizing losses.

Finally, I know how to do this properly.

My portfolio value

What You’re Here For (The Good Stuff)

Did you jump straight here? That’s fine.

I bet you already realize I did many stupid things—maybe you’ve done some too (you definitely have).

I completely changed how I traded and invested in the market.

I became focused, rarely sold, sought multiple catalysts for trades. Went all-in when confident, responsibly invested part of my income, rebuilt cash reserves.

I had several big winning trades—beyond Bitcoin, including ARM, COIN, SPY, SOL, and meme coins like DOGE.

These trades delivered substantial returns because I understood their narratives, patiently invested during key moments of market panic, and decisively took profits when topping seemed imminent.

After exiting, I’d allocate part of the proceeds to long-term holds and search for the next opportunity.

Those $10,000–$20,000 gains quickly compounded into six-figure returns, letting me enjoy a rare pleasure: the magic of compounding.

Use compounding wisely. As your portfolio grows, its power becomes increasingly evident.

90% of my trading involves holding quality assets in spot, sometimes adding options.

Hard-Earned Lessons

Mindset

Money no longer gives me the euphoric high it once did. Of course, making money is "good" for me and my portfolio. But you’re a capital manager—your job is growing your account. You made $10,000 last week—how’s your quarterly performance?

If you feel "excited" about a trade, you’re likely doing it for the wrong reasons. In growing and preserving capital, you must be a cold operator.

Face Reality

Cash or assets in exchanges aren’t real. They’re fake.

"Fake, all fake. It’s a scam, a trap. Like fairy dust. Doesn’t exist. Never realized. Irrelevant—can’t even find it on the periodic table… This shit isn’t real."

Withdraw your money into your hands, or someone else will take it

Leverage

Use leverage sparingly and responsibly. Across this entire cycle, I’ve done leveraged trades maybe four times. I’ve tried many times, but leverage no longer excites me. I still trade options weekly, but at a fraction of past size—just icing on the cake.

Follow the Money

Easier said than done, but clearly, last year’s meme coin frenzy was a money-making opportunity. I participated, but with small positions. Small bets, big returns.

On several coins, I turned 1–5 SOL into 40, 50, or even 100 SOL.

I also had losses (Boden cost me $100K, RTR, and other scam coins). But because I controlled position size, losses are now just annoying, not threatening.

Just don’t get trapped in whatever market you’re watching.

Understand the Narrative

Whether AI, Solana Summer, Bitcoin ETFs, or Ethereum’s decline, narratives always emerge, and charts often reveal the path. Are people buying during drops? Then you buy too.

Bitcoin? BlackRock is buying heavily, institutions are following. Jump in.

AI? Great. Going long Nvidia was (and may still be) an excellent trade.

HOOD (Robinhood)? A bank for young people. Follow it.

Don’t fight the trend. Market going up? Ride it—until it becomes unreasonable.

Hold Spot Peacefully

Spot holdings have no liquidation price or maintenance costs. I wish someone told me this earlier. If you trade perpetuals, keep your core capital separate from your trading account. Don’t put your entire net worth into a perpetual account.

I fell into the leverage trap early, thinking it was the "only way" to make money.

Accept Losses

The market doesn’t care how smart you are. If you lose badly, accept it and restart. Don’t cling to hope that trades will turn in your favor—especially with leverage.

Market Psychology Is Real

Recall 2023 and 2024—many meaningless events triggered market crashes. Even on charts, breaking support sometimes signaled bullishness.

Think from the perspective of those dumber than you. When they fear, do the opposite. Focus on longer timeframes, mark your price levels. Sell small when overly optimistic; buy when falling.

Typically, when crypto liquidations exceed $1 billion (on the downside), it’s time to buy. But as the market grows, this threshold may need adjusting.

Time Is Your Greatest Wealth

Everyone owns time—until death. Use patience to harness it.

Learn to Watch the Market

It sounds simple, but one of my top mistakes was failing to recognize shifts—interest rate changes, crypto bear markets, etc.

In hindsight, it was clear that widespread profitability ended and the landscape changed.

Not making money for one or two months is fine.

Waiting is good. Identify market extremes—when big moves come, use them well.

The market offers compounding growth—you just need calmness to seize it.

If you trade to make money, you’ll emotionally feel pressured to profit daily, forcing trades.

When you become a calm spot swing trader, you gain the patience and insight to think clearly.

Stay Focused

Managing 40 positions is for fools, unless it’s your full-time job. You only need 1–3 good trades with meaningful sizing.

When capable, a blind robo-advisor is a great place for cash.

Using third parties to hedge your excitement and stupidity was a huge breakthrough for me. Most don’t do fancy things—just invest in index funds and ride, charging a few basis points.

I can’t describe how good it feels to have a real wealth manager or robo-advisor—put your money there and forget it. Trust that markets rise long-term and let them do what’s worked for decades.

This is especially helpful if you’re unfamiliar with technical analysis or struggling with trading.

The market is just a reflection of emotions. Once you control yours and hedge your stupidity… good things happen.

I believe this narrative reflects my memory as accurately as possible.

Hope you enjoyed reading. Hope it helps someone. Never give up (I almost did).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News