Understanding the Market Like a Puzzle: Uncovering the Inner Logic of Liquidity, Spreads, and Price Movements

TechFlow Selected TechFlow Selected

Understanding the Market Like a Puzzle: Uncovering the Inner Logic of Liquidity, Spreads, and Price Movements

High volatility tends to be followed by high volatility, and low volatility tends to be followed by low volatility.

Author: TradeStream | Improve Your Trading

Translation: TechFlow

Trading: If we act based on common sense by doing what most people are willing to do... then it likely means we don't possess any more valuable information than others.

A Metaphor for Market Behavior: Jigsaw Puzzle

I like to describe market behavior using the metaphor of a jigsaw puzzle. Imagine the entire market as someone trying to complete a puzzle, where trading volume represents the puzzle pieces. The market strives to assemble all the pieces together. By analyzing the distribution of volume, we can clearly identify where certain "pieces" are missing. When the market detects areas with higher concentration of pieces (i.e., regions with high volume and time accumulation), it attempts to redistribute them toward areas with fewer pieces (i.e., regions with lower volume and time).

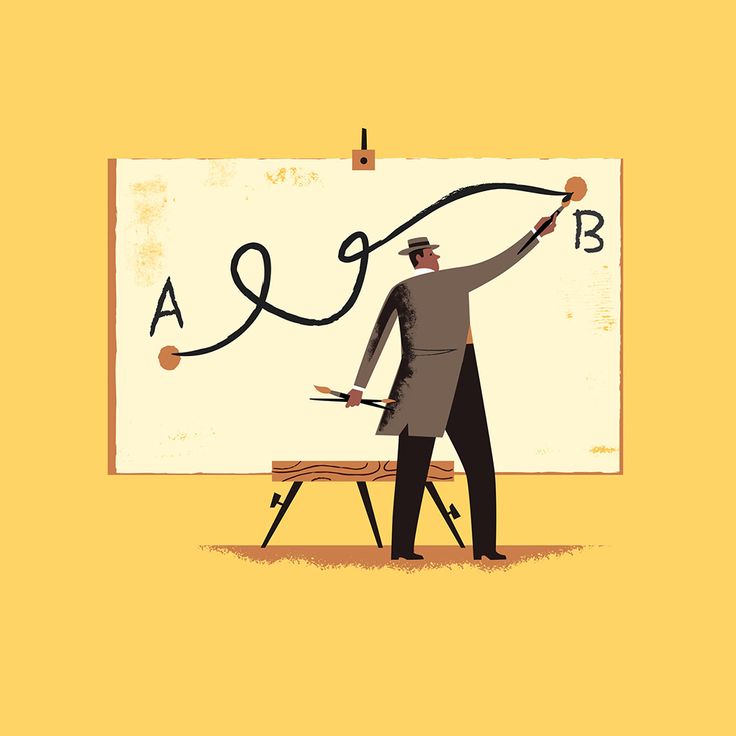

How the Market Chooses Direction

Sometimes both sides lack "pieces"—how do we determine which side the market will fill first?

This reminds me of a theory about human behavior from the book *Atomic Habits*. In such situations, we need to focus on two key factors:

Attractiveness: People generally want their actions to yield rewards, and so does the market since it reflects patterns of human behavior. As previously discussed, we tend to avoid overly crowded trading scenarios. More attractive strategies often involve trading against the majority of mispositioned participants—especially when we have clear structural justification.

Reducing resistance: According to the "Law of Least Effort," the more effort something requires, the less likely it is to happen. If resistance is too high, achieving our goal becomes significantly harder.

A Second Metaphor for Market Behavior: The Trolley Problem

Imagine the market as a train—a kind of "killer" that seeks to "hunt." When we take action at fair value zones, both sides of the market are crowded with participants, making it difficult to predict which side the train will "hunt" more heavily. However, once the market chooses one side, the other side becomes the only remaining option, simplifying our decision-making process.

What Is Liquidity?

Liquidity refers to whether there are enough counterparties available in the market to trade with. When we trade, we either consume liquidity or provide it. If price remains stable in a certain area (i.e., a balance zone) or fails to move smoothly, it's because buyers haven't consumed sufficient liquidity. Conversely, if price moves smoothly, it indicates that buyers have successfully absorbed enough liquidity.

Limit Orders vs. Market Orders

Limit orders "add liquidity," while market orders execute trades and consume this liquidity. Passive liquidity (limit orders) is typically more influential because limit orders often define market structure, whereas aggressive market orders get absorbed at critical levels.

Why are limit orders more impactful? Because when you execute a market order, you must cross the spread, meaning you immediately enter an unrealized loss position upon execution.

What Is the Spread?

The spread is the difference between the bid price (buy quote) and ask price (sell quote) of an asset. Market makers provide liquidity through the spread—immediate buy prices are usually slightly above the current market price, while immediate sell prices are slightly below.

Suppose an asset is currently priced at 10.00, and stars represent contracts. If we want to buy immediately, there may be no offer at exactly 10.00—because if there were, market makers couldn't profit. Instead, they place quoted liquidity slightly higher, say four contracts at 10.01, to capture this small differential.

If we decide to buy three contracts, we'll fill at 10.01. But what if we want to buy more—say 15 contracts? We'd have to cross the spread until we find enough resting orders to satisfy our demand. Thus, the price gets pushed up to 10.03, where sufficient contracts exist to fulfill the order.

This example illustrates why limit orders are generally more influential. Small traders have negligible price impact because they experience little slippage. However, someone wanting to buy 500 contracts without sufficient nearby liquidity would have to cross wide spreads, causing significant price movement.

Traders who place orders in areas rich in liquidity can avoid substantial slippage. Where is liquidity typically concentrated? Above swing highs and below swing lows. This is because most technical traders place stop-losses in similar ways—these levels become clusters of stop orders, making price reversals more likely at these points.

So, their stops are your entry points? Exactly.

Summary

-

Impatient buyers or sellers push price via market orders (aggressive side), consuming liquidity.

-

More patient buyers or sellers use limit orders (passive side) to resist price movement.

We can use a metaphor: market orders are like hammers, while limit orders form the floor or ceiling of a building. To break through a floor or ceiling, you need enough hammer force to destroy it.

What happens when the floor breaks? Price rapidly moves to the next floor level.

Once price reaches the next floor, upward movement becomes easier because the ceiling has already been broken, creating a "gap" that allows price to move more freely through areas of low liquidity.

Liquidity cascades are highly effective ways to make money because you're trading against price-insensitive groups forced to transact (e.g., traders being liquidated). But we must be clear about what exactly we’re trading.

If you're trading liquidity premium, this effect is typically very short-lived—lasting no more than 10–15 seconds. In cascade environments, this changes. Here, you need to assess whether liquidity has fully recovered from the initial move.

The chain reaction of momentum shifts is less reliable than liquidity premium but lasts longer. (Most people think they're trading liquidity premium when actually they're trading this momentum effect.)

The first approach (liquidity premium) is better suited for PnL attribution (analyzing why you made money) and represents the ideal execution method. The second (momentum effect) captures the core of large moves but comes with greater volatility and looser risk control.

In summary, liquidity cascades cause supply-demand imbalances because a surge of price-insensitive traders overwhelms the order book, which cannot absorb so many aggressive participants. But once the market stabilizes, price tends to return more easily to areas that lacked sufficient volume due to rapid movement.

After all, markets are two-way auction mechanisms. They often retest low-volume areas for two reasons:

-

This path offers less resistance;

-

The market seeks efficiency—it tests these zones to see if anyone is willing to trade at those price levels.

The result is a "mechanical bounce" because the order book needs time to rebalance. At this point, even minimal volume can drive significant price movement. Once stability returns, price action becomes more momentum-driven, with higher volatility—and greater profit potential.

Remember: high volatility tends to follow high volatility, and low volatility tends to follow low volatility—a phenomenon known as volatility clustering. Therefore, seize opportunities and adjust your risk management strategy according to each shift in market conditions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News