On-Chain Data School (2): What Is the Cost Basis of BTC Buyers Who Keep Profiting?

TechFlow Selected TechFlow Selected

On-Chain Data School (2): What Is the Cost Basis of BTC Buyers Who Keep Profiting?

LTH-MVRV represents the profit status of long-term holders.

Author: Mr. Bag

🔸TL;DR

- This article continues from the previous discussion on MVRV and introduces LTH-MVRV.

- LTH = Long Term Holders, defined as BTC held for more than 155 days.

- LTH-MVRV represents the profit status of long-term holders.

- LTH-RP represents the average cost basis of long-term holders.

🟡 What Are LTHs?

LTH stands for Long Term Holders. According to Glassnode, they are defined as "BTC that has been held for over 155 days."

As for why the threshold is set at 155 days, Glassnode provides a detailed explanation on their website. Since the reasoning is quite complex, we'll leave it aside for now—interested readers can refer to the original material directly.

🟡 Introduction to LTH-RP

LTH-RP refers to the Realized Price of long-term holders—that is, their average cost basis. It's calculated by dividing the LTH-Realized Cap by the circulating supply.

As shown in the chart below, the light green line represents the market-wide Realized Price, while the dark green line shows the LTH Realized Price. It's clearly visible that long-term holders typically have a lower cost basis compared to the overall market average.

(Comparison between Realized Price and LTH-RP)

🟡 Introduction to LTH-MVRV

LTH-MVRV reflects the profitability of long-term holders. Its calculation is similar to that of MVRV: "Current Market Value / LTH-Realized Cap," or equivalently, "Current Price / LTH-RP."

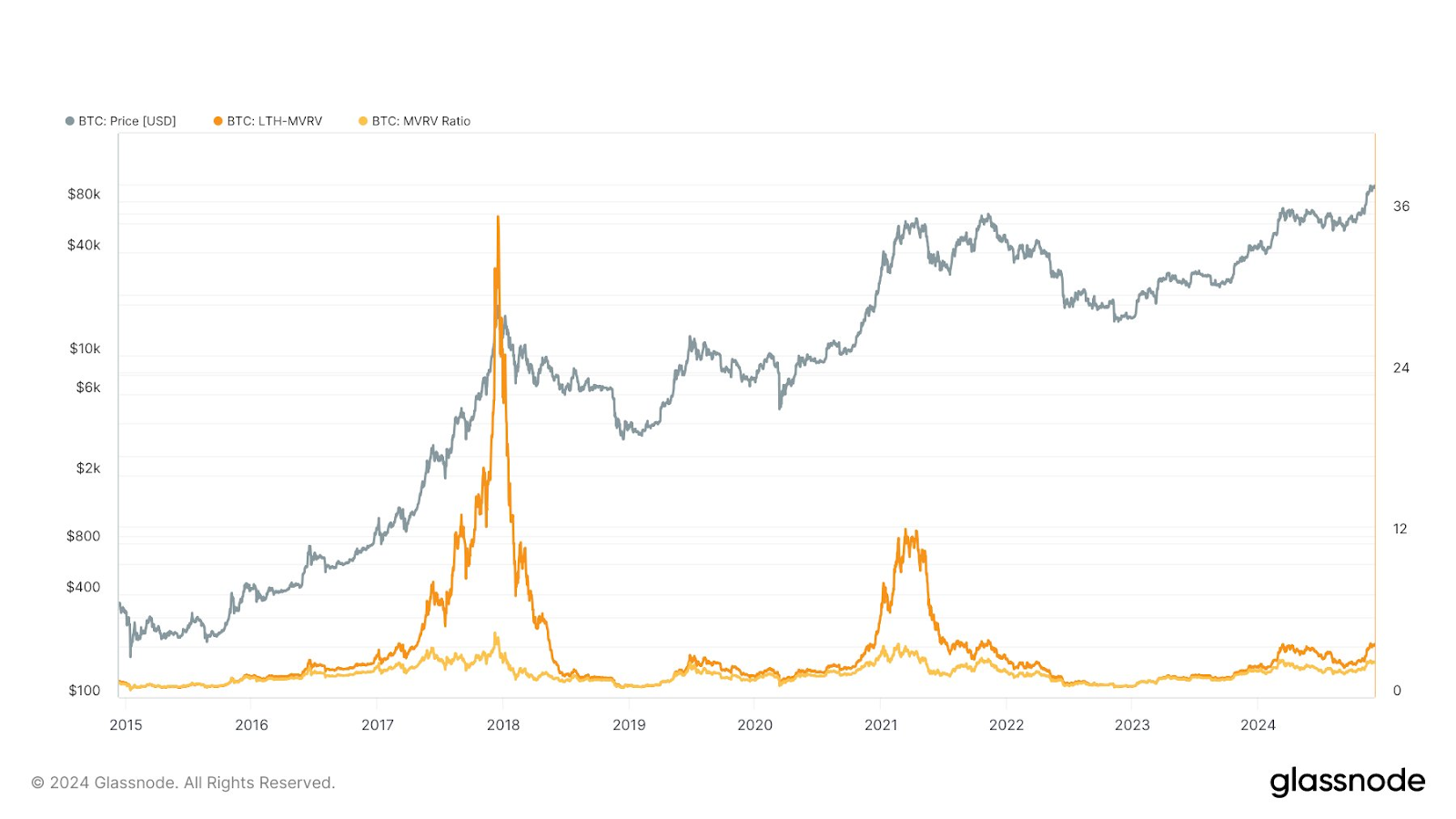

As shown in the chart below, fluctuations in LTH-MVRV tend to be more pronounced than those of MVRV. This is because long-term holders generally achieve higher profits (in simple terms, they make more money!).

(Comparison between MVRV and LTH-MVRV—the orange line is LTH-MVRV, and the yellow line is MVRV)

🟡 Applying LTH-MVRV for Bottom-Timing

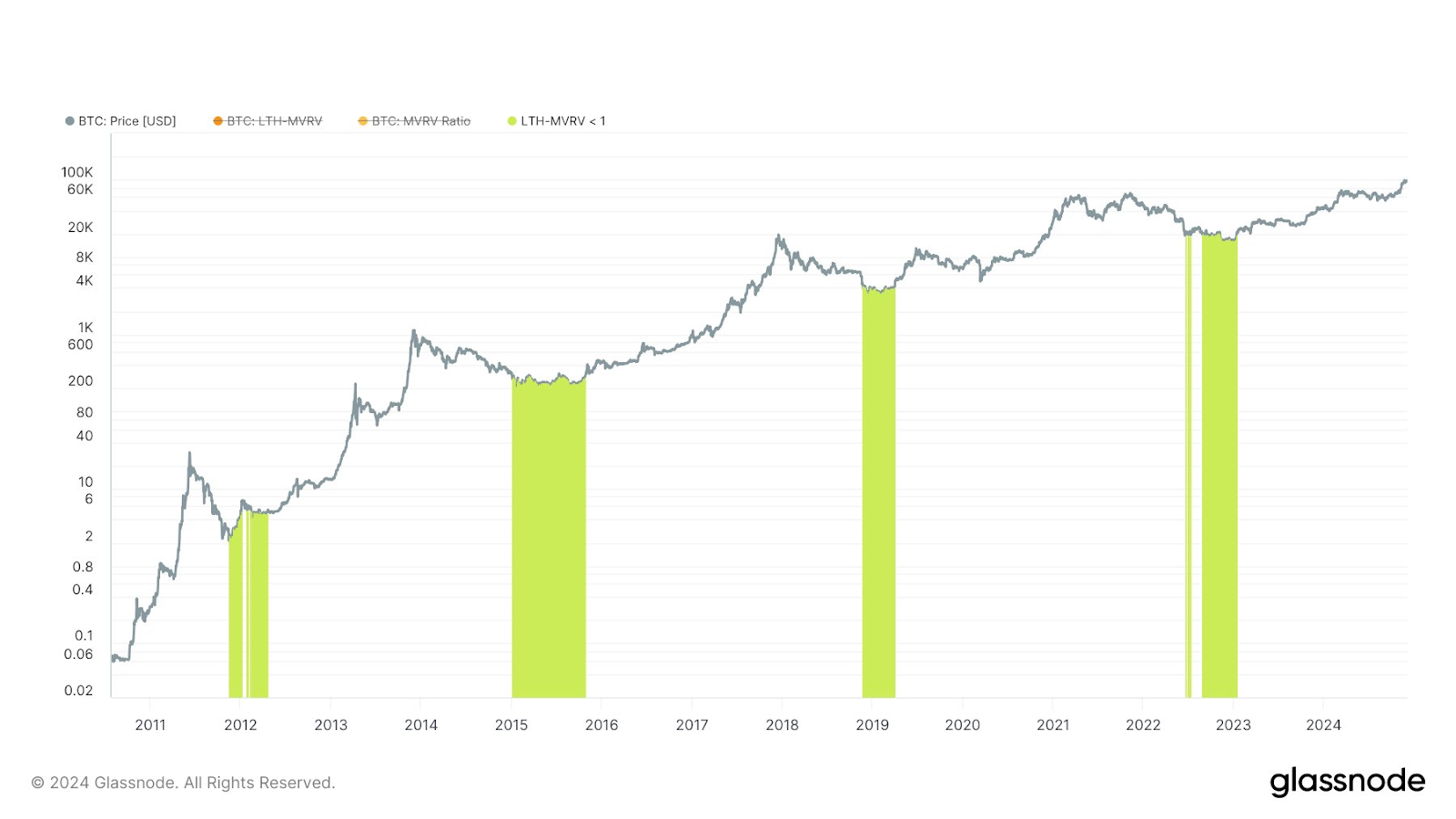

When LTH-MVRV < 1 (or when the current price falls below the LTH-RP), it means even long-term holders are underwater on average. Such moments often present excellent buying opportunities 📈.

As illustrated in the chart below, I've marked periods where LTH-MVRV < 1. These points consistently align with major cyclical market bottoms.

Therefore, this indicator could be a valuable addition when designing bottom-hunting investment strategies!

(Prices corresponding to periods when LTH-MVRV < 1)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News