ECB cuts rates as expected; Fed unlikely to cut in May, US tariff policy may have limited impact | Market Insights April 14–18

TechFlow Selected TechFlow Selected

ECB cuts rates as expected; Fed unlikely to cut in May, US tariff policy may have limited impact | Market Insights April 14–18

Stablecoin supply continued to expand this week, with U.S. spot Bitcoin ETFs seeing minor net inflows and Ethereum ETFs experiencing net outflows.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total cryptocurrency market cap stands at $2.67 trillion, with BTC accounting for 62.95% ($1.68 trillion). Stablecoin market cap is $234.4 billion, up 0.47% over the past seven days, with USDT representing 61.85% of that.

This week, BTC prices have been range-bound, currently trading at $85,107; ETH has also been range-bound, now at $1,603.

Among the top 200 projects on CoinMarketCap, most declined while a few rose: CORE gained 29.36% over 7 days, RAY increased by 23.51%, DEEP surged 41.51%, and T rose 36.69%.

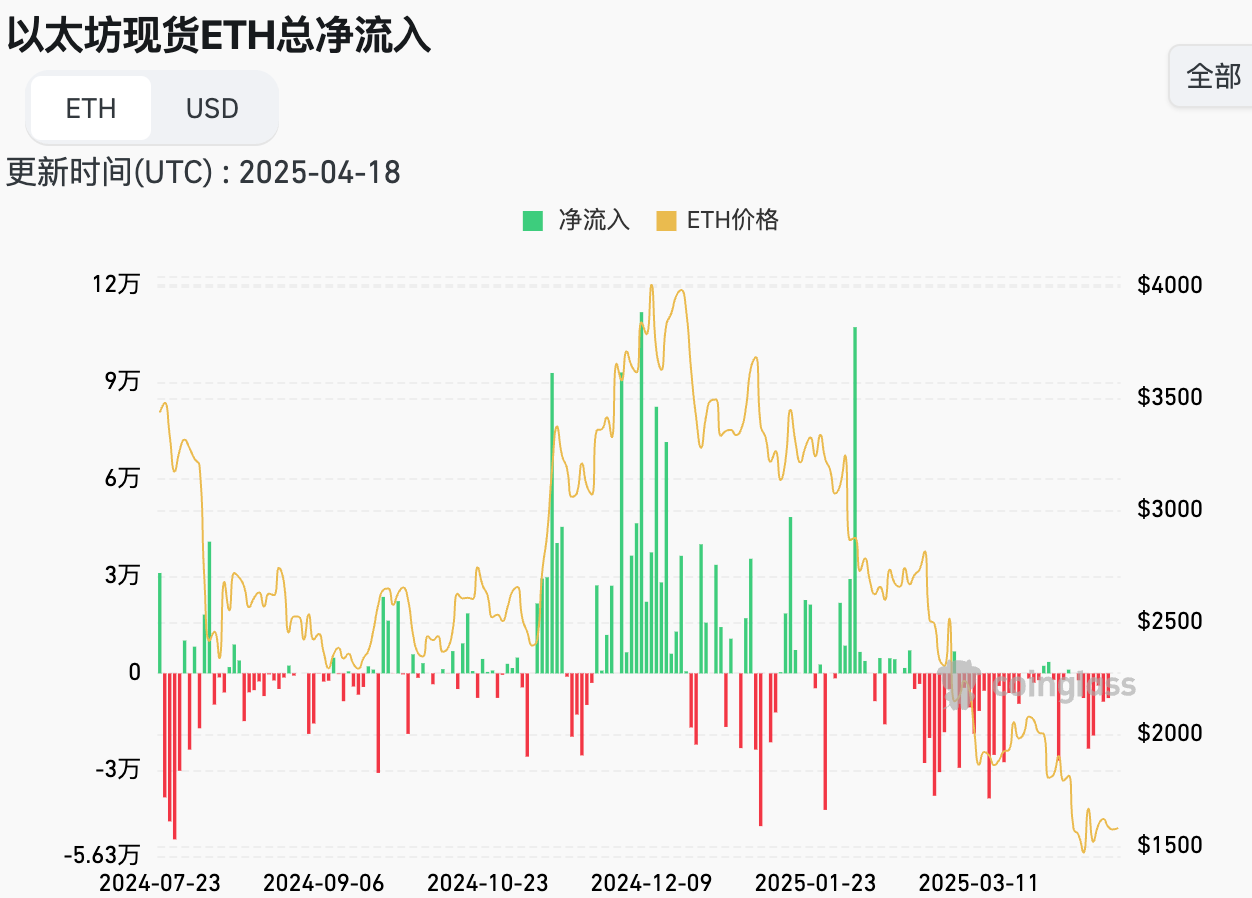

This week, U.S. spot Bitcoin ETFs saw net inflows of $13.9 million; U.S. spot Ethereum ETFs recorded net outflows of $32.3 million.

The "Fear & Greed Index" on April 19 was 32 (lower than last week), reflecting weekly sentiment: 1 day neutral, 6 days fearful.

Market Outlook: This week, stablecoin issuance continues to increase, with minor net inflows into U.S. spot Bitcoin ETFs and net outflows from Ethereum ETFs. The U.S. aims to strengthen its global negotiation position through higher tariffs; however, the impact of these tariffs on crypto is expected to be limited. BTC and ETH prices are likely to remain in narrow ranges as the broader market gradually recovers. Investor sentiment remains fearful, the U.S. Dollar Index has fallen below 100, and gold prices hit new highs—indicating persistent risk-averse investment behavior. The probability of a 25-basis-point Fed rate cut in May is 9.1%, down from the previous week. The market may bottom out gradually between April and May, with BTC expected to trade within the $80k–$90k range.

Understanding the Present

Weekly Major Events Recap

1. On April 14, Jupiter co-founder meow tweeted, “Over the coming months, we’ll be launching a lot of products, governance ideas, experimental metadata, thought fragments, and new technical concepts.”

2. On April 15, PeckShield reported that perpetual contract DEX KiloEx suffered an attack, losing approximately $7.5 million (including $3.3 million on Base, $3.1 million on opBNB, and $1 million on BNB Chain). KiloEx has since urgently suspended operations.

3. On April 15, OpenSea announced that Solana token trading is now live on OS2 for select closed-test users, with wider rollout planned over the coming weeks. Currently only tokens are supported; NFT trading will follow later.

4. On April 15, Circle’s euro-backed stablecoin EURC reached an all-time high in supply. Rising demand for euro-denominated digital assets may be driven by escalating U.S. trade tensions and a weakening dollar.

5. On April 15, Bo Hines, Executive Director of the White House Task Force on Digital Assets, stated that the U.S. might use tariff revenues to purchase Bitcoin.

6. On April 15, ZKsync’s airdrop distribution administrator account was compromised, resulting in the unauthorized minting of 111 million ZK tokens.

7. On April 17, the U.S. SEC revealed details of its third Crypto Policy Roundtable, scheduled for April 25. The event will focus on custody issues, featuring two panel discussions—one on broker-dealers and wallet custody, and another on investment advisors and fund custody.

8. On April 16, MANTRA issued a statement regarding the OM price crash, affirming normal team operations and committing to take all necessary measures amid market turmoil. The team confirmed no selling occurred during the drop and that all mainnet OM tokens allocated to the team and advisors remain locked.

9. On April 17, Federal Reserve Chair Powell said cryptocurrencies are becoming increasingly mainstream, noting that establishing a legal framework for stablecoins is a sound idea. Stablecoins could gain broad appeal, he added, emphasizing the need for consumer protections.

10. On April 16, Raydium launched LaunchLab, a token launch platform for creators, developers, and communities. Tokens can be deployed via the JustSendIt model, raising SOL (e.g., 85 SOL in one case), with liquidity immediately migrated to Raydium’s AMM—featuring zero migration fees and no permission-based censorship.

11. On April 18, on-chain analyst Yujin reported that Blur, which unlocks monthly, transferred 23.8 million BLUR tokens (worth ~$2.3 million) to Coinbase Prime one hour ago.

Macroeconomic Developments

1. On April 14, the U.S. SEC delayed its decision on Grayscale’s application to add staking functionality to ETHE.

2. On April 14, Japan's 20-year government bond yield rose to 2.435%, the highest level since 2004.

3. On April 17, Federal Reserve Chair Powell stated that the central bank’s dual mandate goals are not yet in conflict, but current trends point toward rising unemployment and inflation.

4. On April 18, the European Central Bank cut interest rates by 25 basis points—the seventh consecutive rate cut over the past year—with the decision passed unanimously.

5. On April 18, U.S. President Trump expressed confidence in reaching a tariff agreement with China, saying: “I think we’ll make a deal with China, and we’ll make deals with everybody. If we don’t, then we set targets and just go with them—that’s fine too. Things should get sorted out in the next three or four weeks.”

6. On April 18, according to CME’s “FedWatch” tool, the probability of a 25-basis-point rate cut by the Fed in May is 9.1%, while the likelihood of unchanged rates is 90.9%.

ETF Updates

Data shows that from April 14 to April 18, U.S. spot Bitcoin ETFs had net inflows of $13.9 million. As of April 18, GBTC (Grayscale) has seen cumulative outflows of $22.736 billion, currently holding $16.152 billion in assets; IBIT (BlackRock) holds $48.598 billion. Total market capitalization of U.S. spot Bitcoin ETFs stands at $96.936 billion.

U.S. spot Ethereum ETFs had net outflows of $32.3 million.

Looking Ahead

Upcoming Events

1. TOKEN2049 Dubai 2025 will take place in Dubai from April 30 to May 1, 2025;

2. Canada Crypto Week will be held in Toronto, Canada, from May 11 to 17, 2025.

Project Milestones

1. Lorentz mainnet upgrade will go live on opBNB on April 21;

2. Japanese exchange coinbook has been fully acquired by BACKSEAT Corporation and will be renamed “BACKSEAT Digital Asset Exchange Co., Ltd.” on April 21;

3. DoubleZero’s token sale for 2Z on CoinList ends on April 22;

4. Interoperability protocol Hyperlane’s airdrop will occur on April 22. Of the total token allocation, 57% will go to users, while remaining circulating tokens will be distributed to core team (25%), investors (10.9%), and foundation treasury (7.1%).

Key Announcements

1. Coinbase Derivatives announced it has submitted an application to the U.S. Commodity Futures Trading Commission (CFTC) to launch XRP futures contracts, with the official launch expected on April 21, 2025.

Token Unlocks

1. Bittensor (TAO) will unlock 216,000 tokens on April 21, valued at ~$59.53 million, representing 1.03% of circulating supply;

2. Scroll (SCR) will unlock 40 million tokens on April 22, worth ~$9.32 million, or 4% of circulating supply;

3. Coin98 (C98) will unlock 16.53 million tokens on April 23, valued at ~$920,000, or 1.65% of circulating supply;

4. Altlayer (ALT) will unlock 195 million tokens on April 25, worth ~$5.32 million, or 1.95% of circulating supply;

5. Axelar (AXL) will unlock 13.51 million tokens on April 27, valued at ~$3.97 million, or 1.13% of circulating supply.

About Us

Hotcoin Research, the core research hub of the Hotcoin ecosystem, is dedicated to providing global crypto investors with professional analysis and forward-looking insights. We offer a three-pillar service framework of “trend analysis + value discovery + real-time monitoring,” delivering in-depth industry trend breakdowns, multi-dimensional project evaluations, and round-the-clock market tracking. Through our bi-weekly strategy livestreams “Top Pick Selection” and daily news digest “Blockchain Headlines,” we provide precise market interpretations and actionable strategies tailored to investors at every level. Leveraging cutting-edge data analytics models and extensive industry networks, we empower novice investors to build foundational knowledge while helping institutional players capture alpha, jointly seizing value growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News