Left Hand TradFi, Right Hand DeFAI: Is Mantle Leading the On-chain Financial Breakout to Singularity?

TechFlow Selected TechFlow Selected

Left Hand TradFi, Right Hand DeFAI: Is Mantle Leading the On-chain Financial Breakout to Singularity?

With Mantle Index Four (MI4) and Mantle Banking products as entry points, explore the journey and new征程 of Mantle in building an on-chain financial empire.

Author: TechFlow

Recently, Mantle, the fourth-largest L2 by TVL, highlighted two upcoming innovative products—Mantle Index Four (MI4) and Mantle Banking—in its Q2 community newsletter.

This announcement sent shockwaves across the ecosystem, reigniting the competitive narrative among L2s in the new market cycle.

From Base’s string of AI Agent breakthroughs to Sonic's game-focused mainnet launch with strong token performance, the concept of “L2” is increasingly mentioned less on its own. Instead, L2s are becoming an underlying infrastructure enabling differentiated narratives at higher levels.

So, what kind of narrative does the market favor?

We can observe that whether it's traditional institutional capital entering blockchain via Bitcoin ETFs or real-world assets being tokenized for more efficient circulation, the crypto market remains consistent in one pursuit: how to maximize the utility of existing capital.

Revisiting Mantle’s ecosystem growth over the past year through this lens, the rapid data-driven success of core products like mETH, cmETH, and the rebranded ƒBTC (formerly FBTC), reveals a clear trend. This early disruptor—one that long ago moved beyond conventional L2 competition—is now aggressively advancing toward its vision of becoming a “cross-chain liquidity hub,” using “higher capital efficiency” as its primary lever.

As we enter 2025, amid unprecedented uncertainties brought by U.S. neoliberal forces symbolized by the $TRUMP meme, new capital inflows, and sector rotations are unfolding.

In this era where “chaos is a ladder,” how will Mantle continue enhancing capital efficiency, capture diverse yield opportunities, sustain its strong growth momentum, bridge the gap between crypto and traditional finance, and champion the slogan “bringing crypto into everyday finance” to elevate its brand narrative toward inclusive on-chain financial services?

Using Mantle Index Four (MI4) and Mantle Banking as starting points, this article explores Mantle’s journey so far and its next chapter in building the edifice of on-chain finance.

2024: Mantle’s Quest to Become a Cross-Chain Liquidity Hub

The essence of finance lies in asset interoperability, which generates liquidity;

Liquidity reflects the efficiency of asset circulation, making finance often reducible to just one thing: the creation and management of liquidity.

Based on this fundamental principle, to build on-chain finance and maximize capital utility, Mantle began by innovating at the most foundational level—assets themselves.

December 2023: Mantle officially launched mETH, its liquid staking protocol. Users stake ETH to receive mETH while earning a stable annual yield above 6%.

October 2024: Mantle introduced cmETH, a liquid restaking token, allowing users to stake mETH to obtain cmETH.

August 2024: Mantle launched FBTC by integrating Ignition BTC—a novel synthetic asset pegged 1:1 with BTC. On February 14, 2025, Ignition FBTC announced a rebranding, officially renaming itself Function, with FBTC relaunched as &fnol;BTC, a cross-chain yield-bearing Bitcoin asset.

From LSTs to LRTs, from ETH-Fi to BTC-Fi, Mantle has laid the foundational architecture of its on-chain financial ecosystem through multiple income-generating assets.

However, merely creating assets doesn’t generate liquidity—demand must also be created. In facilitating asset circulation, Mantle has seized upon two explosive growth vectors: broader adoption and richer yields.

First, compared to other assets, Mantle’s sophisticated design gives its assets distinct advantages:

mETH uses a permissionless ERC-20 receipt token model that automatically accumulates yield directly within the token. This native yield-bearing property not only enhances capital efficiency and holding returns but also makes mETH easy for applications to integrate, enabling deeper embedding across diverse ecosystem scenarios.

cmETH, as an LRT, shares similar native yield characteristics and high composability with mETH.

&fnol;BTC emphasizes cross-chain fragmentation and integration, allowing users to access various Bitcoin-based DeFi yield sources regardless of which chain they’re on, thanks to its 1:1 BTC-pegged nature.

Beyond intrinsic strengths, Mantle understands that “better resources create better assets.” By cultivating a robust ecosystem, it has built rich circulation channels for yield-bearing assets, achieving remarkable on-chain milestones.

According to Mantle’s official ecosystem page, over 230 projects have joined the Mantle ecosystem, spanning DEXs, restaking, real-world assets (RWA), gaming, and more—with DeFi standing out particularly, hosting over 13 lending protocols.

As core yield-bearing assets in the Mantle ecosystem, mETH, cmETH, and &fnol;BTC enjoy natural advantages in deep integration:

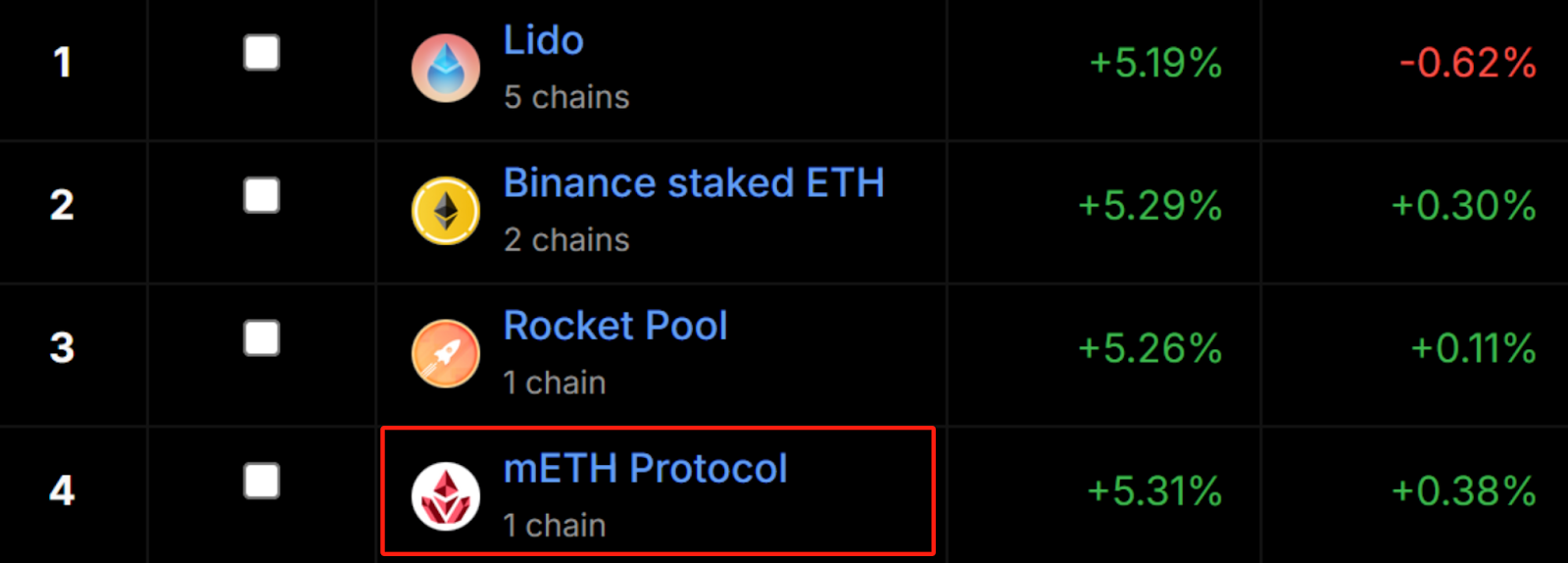

mETH currently partners with 42 projects, including well-known names such as Eigenlayer, Symbiotic, Karak, Zircuit, INIT Capital, and Pendle. According to DeFi Llama, mETH surpassed $100 million TVL within one week of launch, reached a peak of $2.1 billion in 2024, and currently maintains around $1.5 billion in TVL, ranking it the fourth-largest LSD on Ethereum.

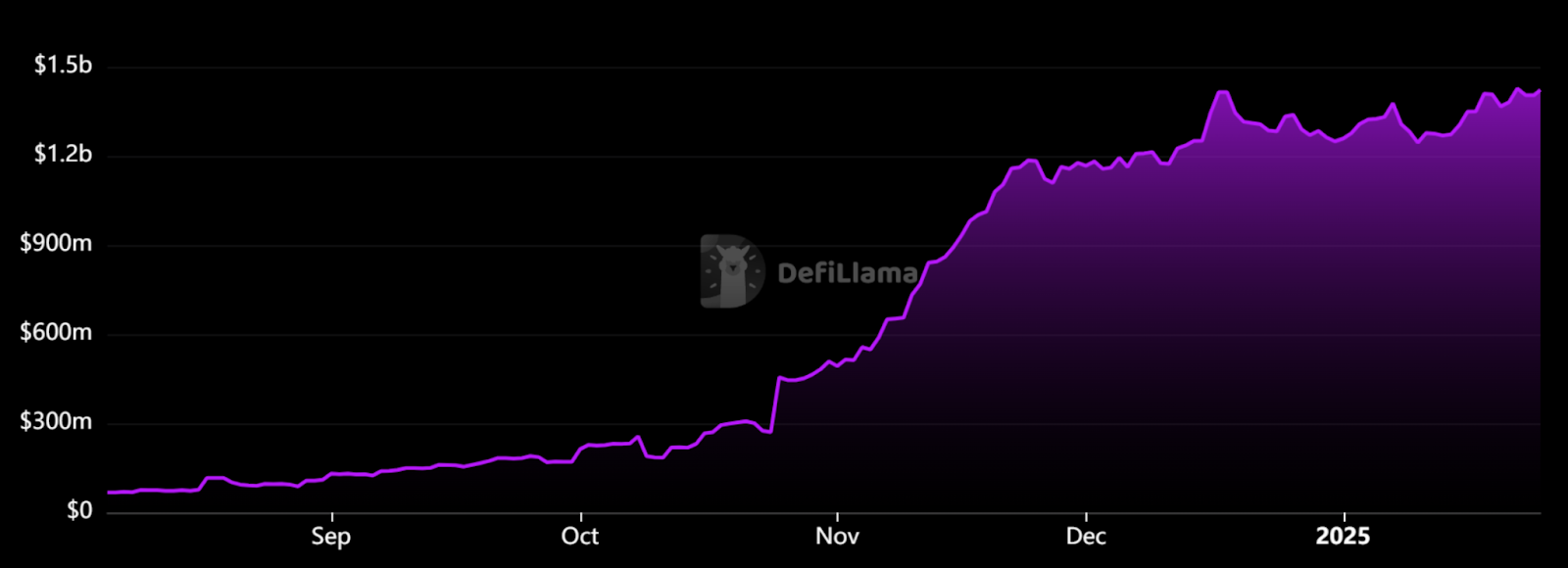

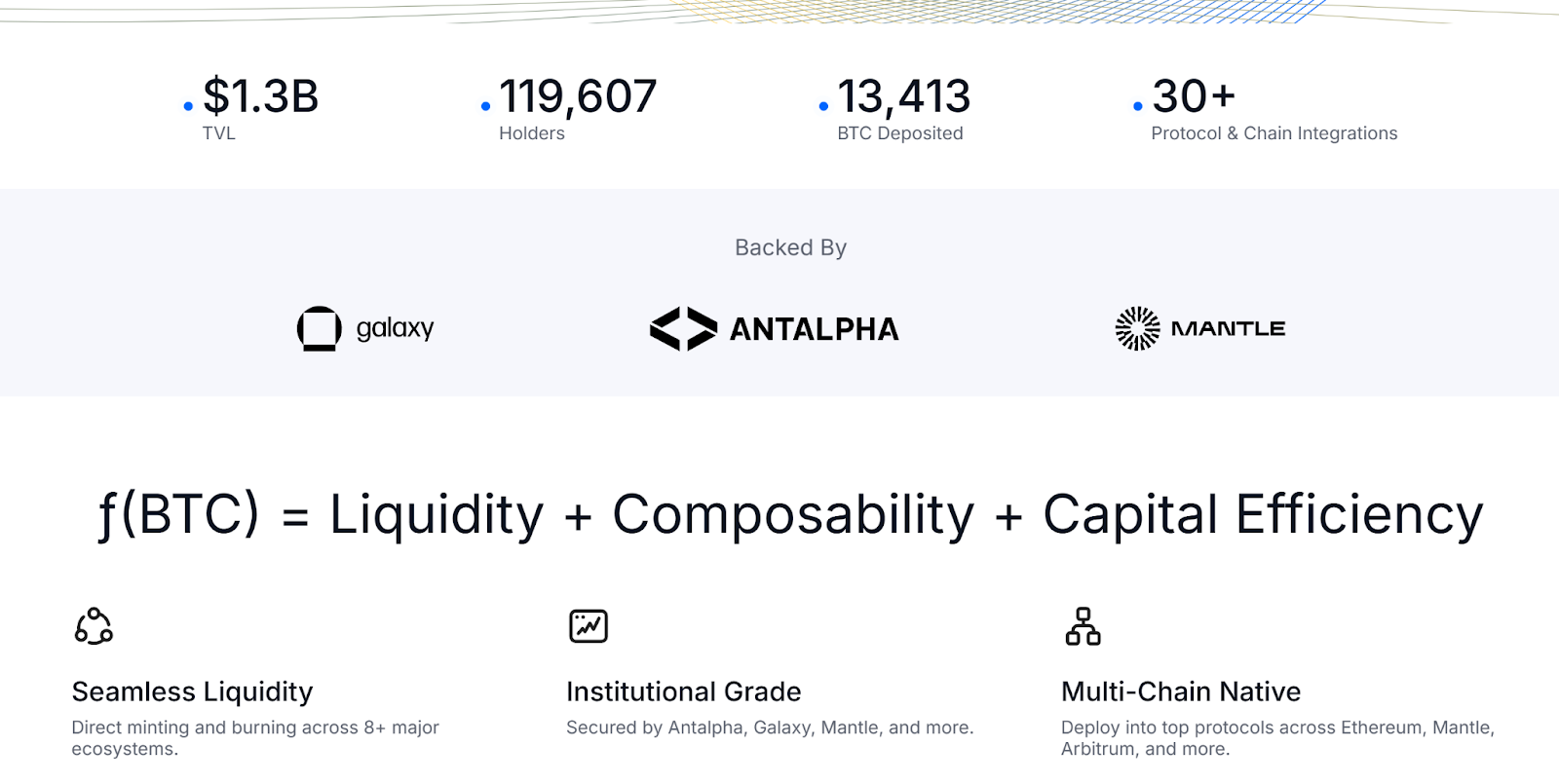

&fnol;BTC has partnered with 28 projects, including BTCFi players like Solv, Bedrock, Pell Network, Lombard, Satlayer, Bounce Bit, Fuel, and BOB. Since its August launch, &fnol;BTC TVL quickly exceeded $100 million and experienced explosive growth in October, surging from $270 million to $1.18 billion by late November—an increase of over 400%. It now holds approximately $1.42 billion in TVL.

Additionally, Memes and mini-games serve as Mantle’s secret traffic drivers. Meme projects within the ecosystem have sparked widespread engagement, while Catizen, a clicker-style cat-raising game, has attracted over 20 million registered users.

Diverse ecosystems bring varied use cases and market demand, which in turn drives activity on the underlying Mantle Network, fueling its rapid growth throughout 2024.

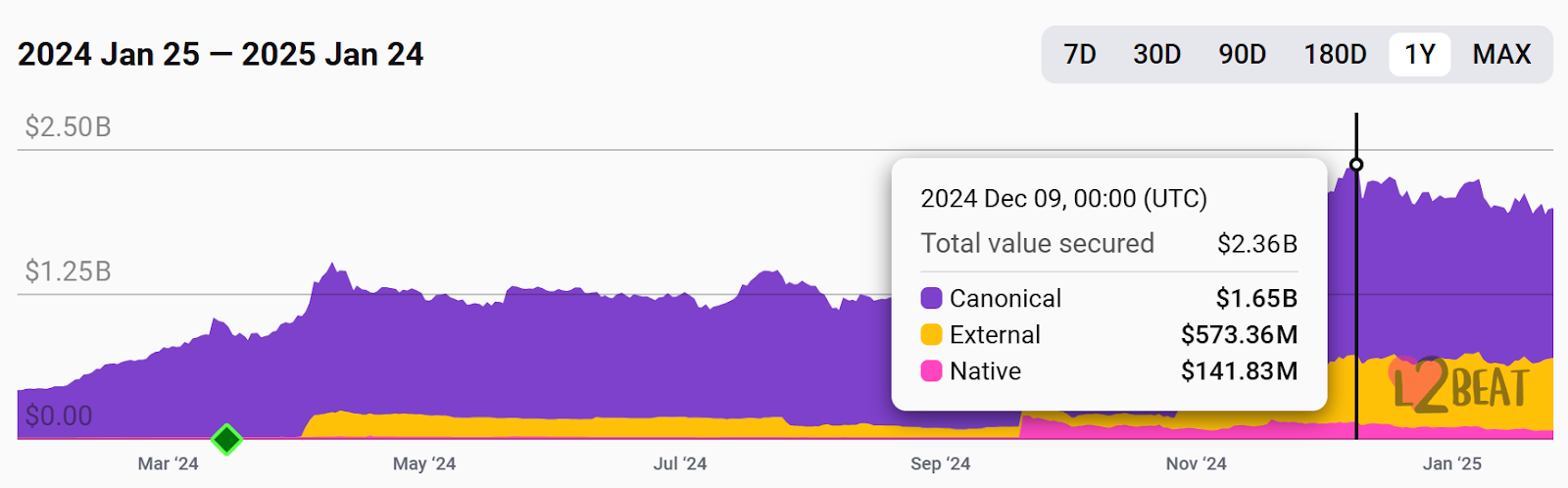

In terms of TVL: according to L2beat data, Mantle’s TVL was approximately $340 million in January 2024 and rose to about $2.06 billion by December 31, marking a year-over-year increase of over 600%. On December 9, 2024, Mantle hit its annual peak TVL of $2.36 billion—a nearly 690% rise from the start of the year—and currently stabilizes around $1.9 billion.

Notably, on-chain analysis shows that Mantle’s TVL primarily comes from DeFi products such as DEXs, lending platforms, and restaking protocols within its ecosystem. This in-dApp TVL not only increases the quality of Mantle’s TVL growth but also significantly demonstrates user engagement within the Mantle ecosystem.

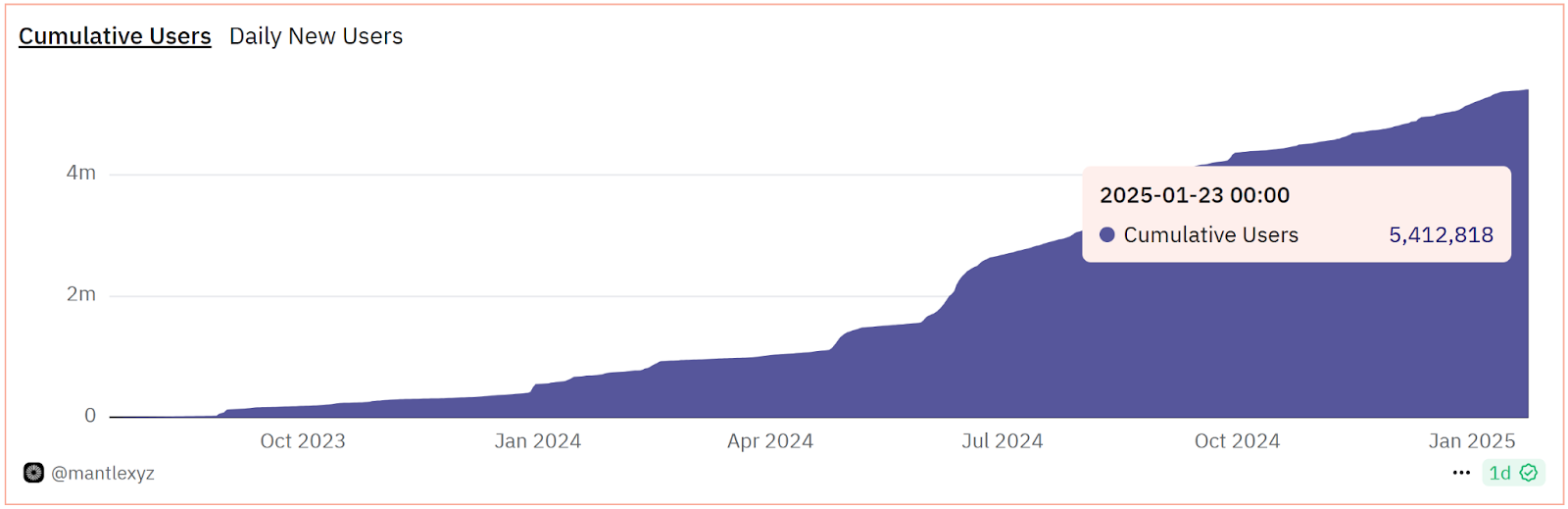

Data from Dune indicates that Mantle averages over 45,000 daily active users, peaking at 191,000 on September 11, 2024. Daily new user registrations peaked at 200,000 on September 10, 2024. Currently, Mantle has approximately 5.39 million total users—nearly tenfold growth from 550,000 at the beginning of 2024.

Using yield-bearing assets to expand its ecosystem footprint, 2024 was undoubtedly a year when Mantle boldly advanced toward its goal of becoming a “hub for time liquidity in crypto.”

As 2025 begins, how will Mantle continue leveraging assets to deepen its on-chain financial vision and achieve further notable successes?

The unveiling of Mantle Index Four (MI4) and strategic focus on the AI sector offer early clues to Mantle’s answer.

2025: The Multi-Dimensional Expansion of Mantle’s On-Chain Financial Vision

Before breaking new ground, maintaining and strengthening core advantages remains crucial.

Thus, at the beginning of 2025, Mantle outlined key plans for its three flagship yield-bearing assets—mETH, cmETH, and &fnol;BTC:

On one hand, a new yield pool model for mETH will launch in Q1 2025. Coupled with ongoing ecosystem development, this will expand application scenarios and yield sources for mETH/cmETH, attracting more participants.

On the other hand, &fnol;BTC will continue focusing on institutional-grade Bitcoin yield infrastructure:

After the rebranding from Ignition FBTC to Function, &fnol;BTC now centers on three pillars: institutional trust and security, long-term sustainable growth, and cross-chain composable infrastructure. Its mission is to deliver greater capital efficiency and tangible yield sources for institutional chains, DeFi protocols, and seasoned DeFi participants.

Prior to this, &fnol;BTC secured investments from influential financial firms including Ant Alpha and Galaxy Digital, embodying the core philosophy “&fnol;(BTC) = liquidity + composability + capital efficiency.” Moving forward, &fnol;BTC will collaborate with institutions to build secure and trusted BTC assets, deeply integrating them with diverse financial use cases such as lending, staking, and liquidity provision.

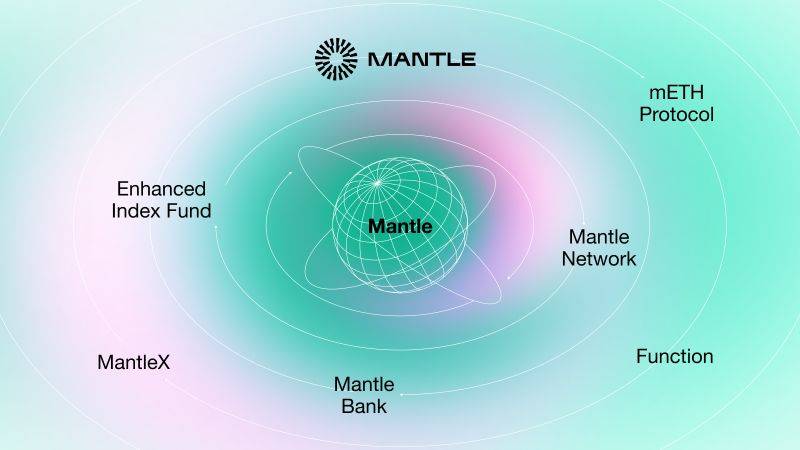

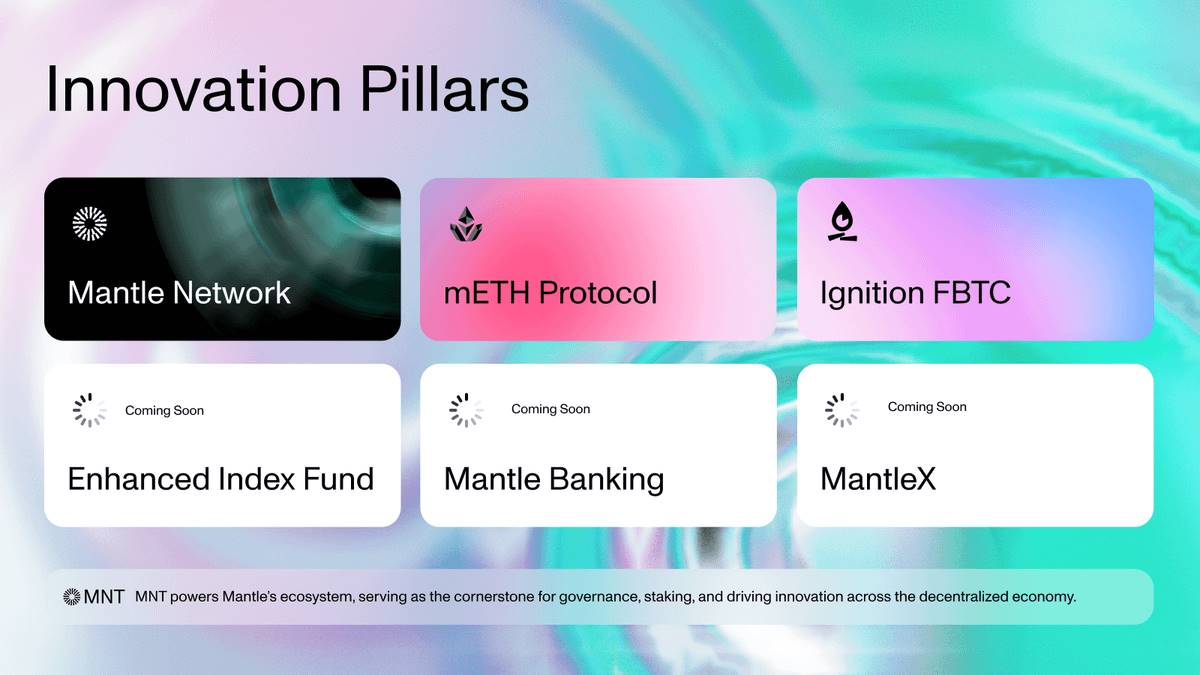

Beyond these three yield-bearing assets, the recent announcement of three new products marks the main course of Mantle’s 2025 on-chain financial feast. With this, the full picture of Mantle’s six-pillar ecosystem is now revealed to the community.

Mantle Index Four (MI4)

With the election of crypto-friendly President Trump, the U.S. may lead the market into a period of relaxed crypto regulation. More traditional users, capital, and institutions are expected to enter crypto finance. Thus, 2025 will be a pivotal year for deep integration between on-chain and traditional finance—and Mantle Index Four (MI4) serves as the bridge connecting the two.

As an institutional-grade compliant product, MI4 meets growing market demand for diversified crypto exposure. Its target audience includes both crypto natives and traditional financial investors:

For crypto users, Mantle MI4 offers institutional-grade asset security and custody services.

For traditional finance users, Mantle MI4 provides a simple, intuitive, and compliant gateway into crypto finance.

More importantly, like Mantle’s yield-bearing assets, Mantle MI4 delivers strong yield potential—making it highly attractive to traditional finance users and drawing more incremental users into the Mantle ecosystem.

Initially, Mantle MI4 will include four assets: BTC, ETH, SOL, and USD, employing a rules-based rebalancing strategy to ensure transparency and low costs. However, efforts to integrate the fund with more assets within the Mantle ecosystem are underway. According to official statements, Mantle aims for $1 billion in AUM after launch. Backed by the immense credibility of Mantle Treasury—the largest project treasury in the crypto space—this goal is realistically achievable.

Mantle Banking

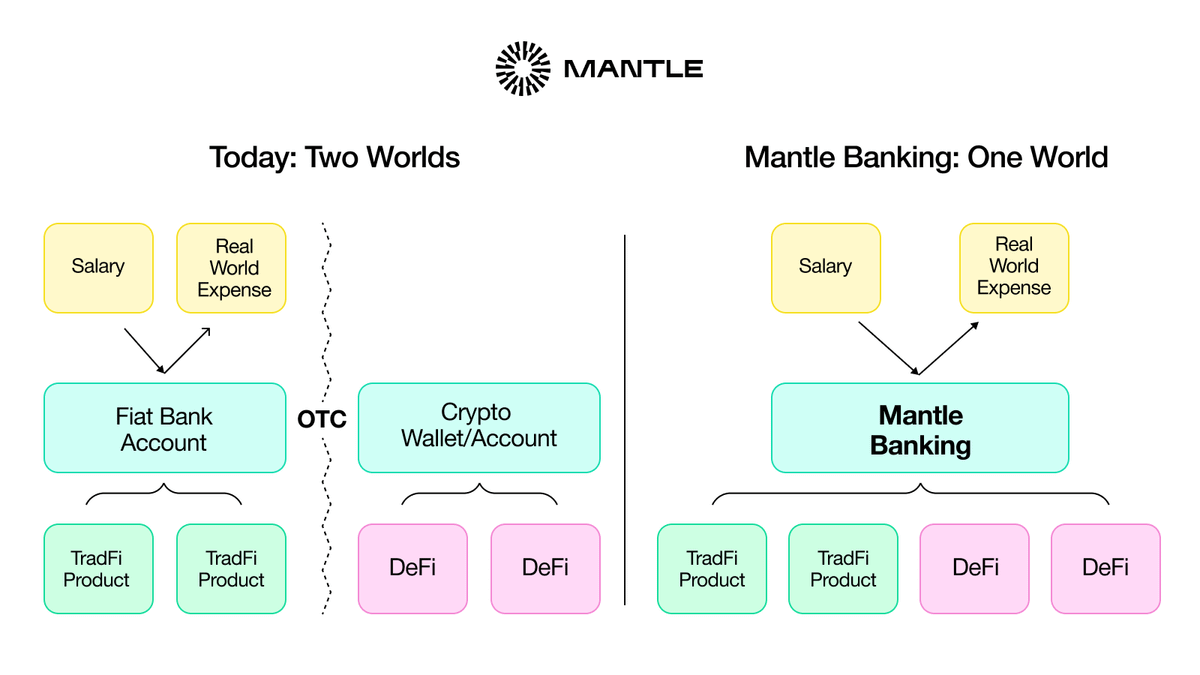

Positioned as a cryptocurrency bank, Mantle Banking seeks deep integration between blockchain technology and banking services, offering fully blockchain-native solutions for payments, lending, and wealth management—representing the “on-chain bank” component of Mantle’s broader financial vision.

Specifically, Mantle Banking enables users to manage fiat and crypto assets seamlessly within a single account—spending, saving, and investing all in one place. By unifying the experience across fiat and crypto accounts, Mantle Banking creates a smooth and efficient user journey between TradFi and DeFi.

In the future, empowered by Mantle Banking: users can deposit their fiat salary directly into a unified Mantle Banking account, tokenize it into stablecoins, and then spend globally via virtual cards at sub-market rates across multiple currencies—just like using regular fiat money.

Mantle Banking aims to bring crypto services into everyday life for a broader user base, bridging fiat and crypto through a DeFi-first approach. Committed to transforming financial infrastructure into seamless, secure, and user-friendly Web3 experiences, Mantle Banking will serve as a convenient entry point for mass-market users and a critical opportunity for crypto finance to reach households worldwide.

MantleX

Notably, amid rising excitement around AI narratives, Mantle’s launch of MantleX signals its ambitions in the AI domain.

As DeFAI gains traction, we’re witnessing a deep convergence between AI and on-chain finance—leveraging AI’s strengths in data analytics, risk forecasting, and autonomous smart contract execution to deliver more efficient asset management, intelligent risk controls, and personalized financial services. Indeed, breakthroughs in AI could unlock transformative advances in on-chain finance.

MantleX represents Mantle’s significant step into AI, focusing on two main areas:

-

Attracting more AI projects into the Mantle ecosystem: MantleX is currently in discussions with several prominent AI Agent teams and has secured cooperation intentions from over 40 AI projects, set to deeply integrate with the Mantle ecosystem in 2025.

-

Operating the Mantle AI Fund: This fund incentivizes ecosystem teams to develop practical AI Agents, with the long-term vision of enabling agents to autonomously operate MantleX.

Meanwhile, the mETH team is actively researching integration with DeFAI to further streamline user experiences and enhance yields.

Additional AI support initiatives, including a Hacker House program, are also underway. As a large-scale event focused on AI, Hacker House aims to discover top-tier AI Agent projects and talent within the ecosystem.

Beyond these, centered on the vision of “bringing crypto into everyday finance,” Mantle plans to roll out more innovative products to attract traditional finance players and funds into on-chain finance through multiple avenues. In this context, Mantle’s early moves in the RWA space during 2024 could prove pivotal:

RWA—a sector with trillion-dollar potential by bringing real-world assets on-chain—was not only one of the fastest-growing segments in 2024, but multiple institutions predict continued rapid expansion in 2025.

In 2024, Mantle established deep collaborations with leading RWA projects Ondo Finance and Ethena, with USDY and USDe playing key roles in the Mantle ecosystem. As Mantle continues pushing its strategy of merging on-chain and traditional finance, these partnerships will help onboard broader TradFi capital and catalyze innovative financial products and services.

If 2024 was a year of unstoppable momentum for Mantle, then 2025 is shaping up to be a year of bold ambition.

Whether through MI4 or focused investment in the AI sector, Mantle is positioning itself as a compelling value proposition—making its native token $MNT a must-watch research topic.

The Return of the Value Token Concept: Why $MNT Deserves Attention

Thanks to its unique value proposition driven by thoughtful design, many community members betting on the Mantle ecosystem view $MNT as the “golden shovel” of Mantle—far more than just a governance token. It plays multiple roles as a gas payment medium, ecosystem incentive tool, and overall value hub for the entire Mantle ecosystem.

Unlike many L2s that use ETH as gas, Mantle uses $MNT as its native gas token.

This strategic decision positions MNT as a central pillar within the ecosystem. As the network scales, every transaction on Mantle requires MNT for gas fees—creating sustained and stable demand along with consistent network revenue. This strengthens ecosystem autonomy and lays a solid foundation for MNT’s long-term value.

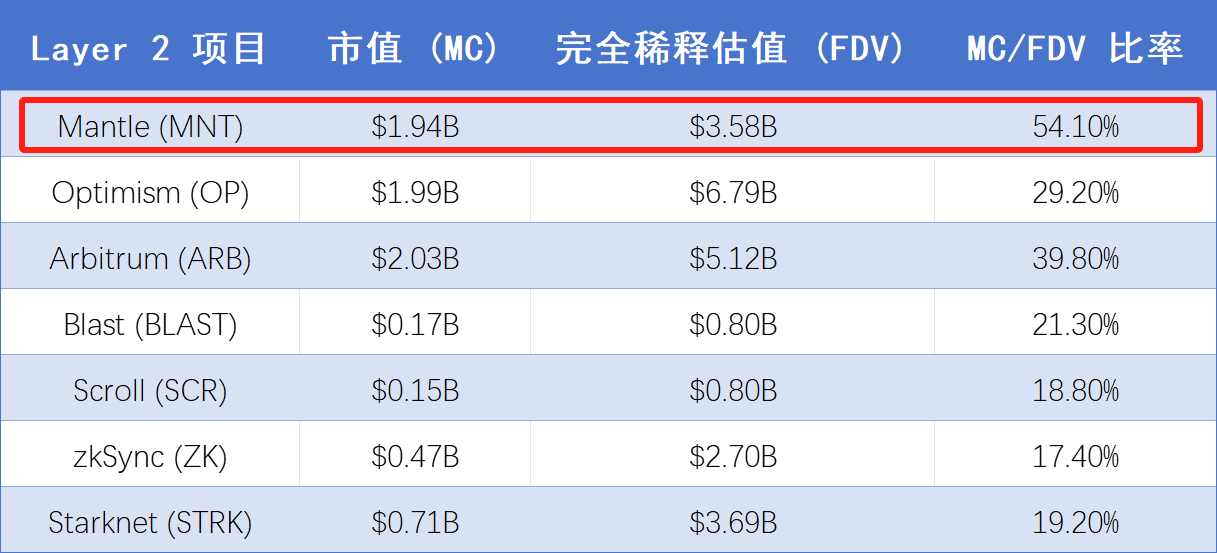

Another major appeal of $MNT lies in its healthy token structure—all non-circulating tokens belong to the treasury and are managed via community voting, with no future unlocks planned.

Compared to other projects facing multi-million dollar token unlocks, $MNT has no scheduled releases. According to MC/FDV metrics from CoinMarketCap, $MNT appears healthier than many other L2 tokens, facing minimal selling pressure and offering stronger support for sustainable long-term growth.

Additionally, Mantle Reward Station plays a vital role in encouraging long-term holding, rewarding token holders generously, and incentivizing ecosystem participation:

Users who lock MNT tokens on Mantle Rewards Station earn MNT Power. By allocating MNT Power to different reward pools, users unlock additional ecosystem incentives. The longer the lock-up period, the more MNT Power earned and the higher the rewards. Importantly, locked MNT tokens retain full governance rights.

To date, Mantle Rewards Station has attracted over 36,438 users locking MNT worth approximately $128 million, distributing over $10 million in token rewards.

Most importantly, $MNT has one powerful catalyst driving its momentum: Mantle Treasury.

As the largest project treasury in Web3, Mantle Treasury holds a staggering $4 billion in assets—including $1 billion in mainstream assets, the only project treasury to do so. It also owns stakes in mETH, FBTC, Ethena, and others. Beyond its massive scale and sound structure, it boasts exceptional profitability. Official data shows Mantle Treasury has already generated over $50 million in profits this year, providing a robust value foundation for $MNT.

Even more critically, Mantle Treasury is fully governed by MNT holders, ensuring ecosystem development and fund allocation align with community interests—further establishing $MNT as one of the most promising L2 tokens in the market.

ZK Architecture Transition: Laying the Foundation for Inclusive On-Chain Finance

Finally, let’s discuss Mantle’s technical design.

While many believe L2 technologies are becoming homogenized, any L2 aiming to support billion-dollar-scale ecosystems must possess unique technical merits.

As an L2, Mantle stays true to the original purpose of Layer 2s—delivering higher performance and scalability—providing users with fast, low-cost, and seamless experiences from onboarding to interaction.

But unlike other L2s, Mantle’s core advantages can be summarized in three aspects:

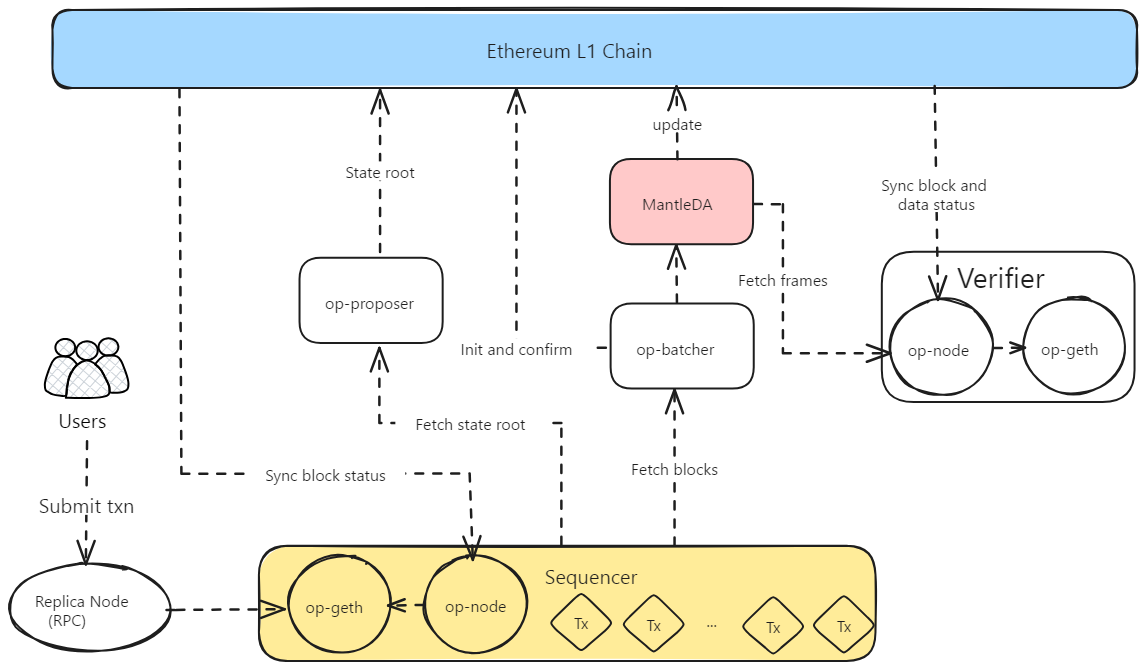

First, modular design: By decoupling core blockchain functions—transaction processing, state validation, and data availability—into dedicated layers, Mantle optimizes performance, reduces costs, and improves flexibility and security.

Second, decentralized sequencers: Through the introduction of a “scheduler” to determine the next block producer (Sequencer), Mantle achieves secure and trustless block production, reducing risks of single points of failure or censorship and enhancing decentralization.

Most importantly, Mantle is the first L2 to adopt EigenDA: As a data availability solution, EigenDA leverages EigenLayer’s restaking mechanism to inherit Ethereum’s robust security. Mantle submits only essential state roots to Ethereum while storing bulk transaction data on EigenLayer—ensuring high data availability while drastically lowering fees and improving data processing efficiency. This paves the way for on-chain finance applications requiring high throughput and low cost.

These three technical advantages strongly supported Mantle’s rapid ecosystem growth in 2024. As Mantle pushes forward AI-driven innovation and deeper integration between on-chain and traditional finance in 2025, technological advancement becomes even more critical.

In Mantle’s latest tech roadmap, its deep collaboration with Succinct has drawn significant community attention:

With the testnet launching in Q1 2025 and plans to upgrade to mainnet, Mantle Network will transition from an optimistic rollup to a ZK validity rollup using Succinct’s SP1.

This architectural shift opens up new possibilities and raises the ceiling for Mantle’s on-chain financial vision:

On one hand, post-transition, Mantle’s finality time will drop from seven days to just one hour, with smoother, faster, and cheaper interactions (costing only cents per transaction). This enables institutional-grade settlements and unlocks capital efficiency opportunities across both traditional finance and blockchain industries.

On the other hand, combining the powerful capabilities of Succinct’s SP1 zkVM with OP Stack’s modularity brings Mantle a higher level of security—making it more appealing to traditional institutions and enabling mainstream users to explore Mantle’s on-chain finance safely and easily, adding foundational strength for continued growth in 2025.

Looking ahead, Mantle will continue executing multiple technical roadmap items, using innovation to continuously improve performance, cost-efficiency, security, and user experience—further driving prosperity in its on-chain financial ecosystem.

Conclusion

2025 is destined to be the most uncertain year for the crypto industry—but also the year with the greatest breakout potential for on-chain finance.

On-chain finance is often seen as a more attractive alternative due to its decentralized nature, which fundamentally shifts asset control, dramatically improves capital efficiency, introduces innovation and flexibility in financial products, and revolutionizes yield distribution.

The inauguration of crypto-friendly President Trump will keep global attention fixed on the crypto space—from appointing multiple crypto experts to his cabinet to the $TRUMP meme effect bringing in waves of new users and capital, and helping more traditional institutions recognize the power of crypto finance. Many anticipate that under U.S.-led relaxed regulatory conditions, on-chain finance will see breakthrough growth.

Against this optimistic backdrop, Mantle’s plans and ambitions for 2025—ranging from ZK architecture upgrades to the MI4 product—are clearly evident.

And if we examine things from the perspective of developers—the soul of any ecosystem—Mantle’s emergence as a decentralized financial hub connecting on-chain and off-chain worlds is already underway:

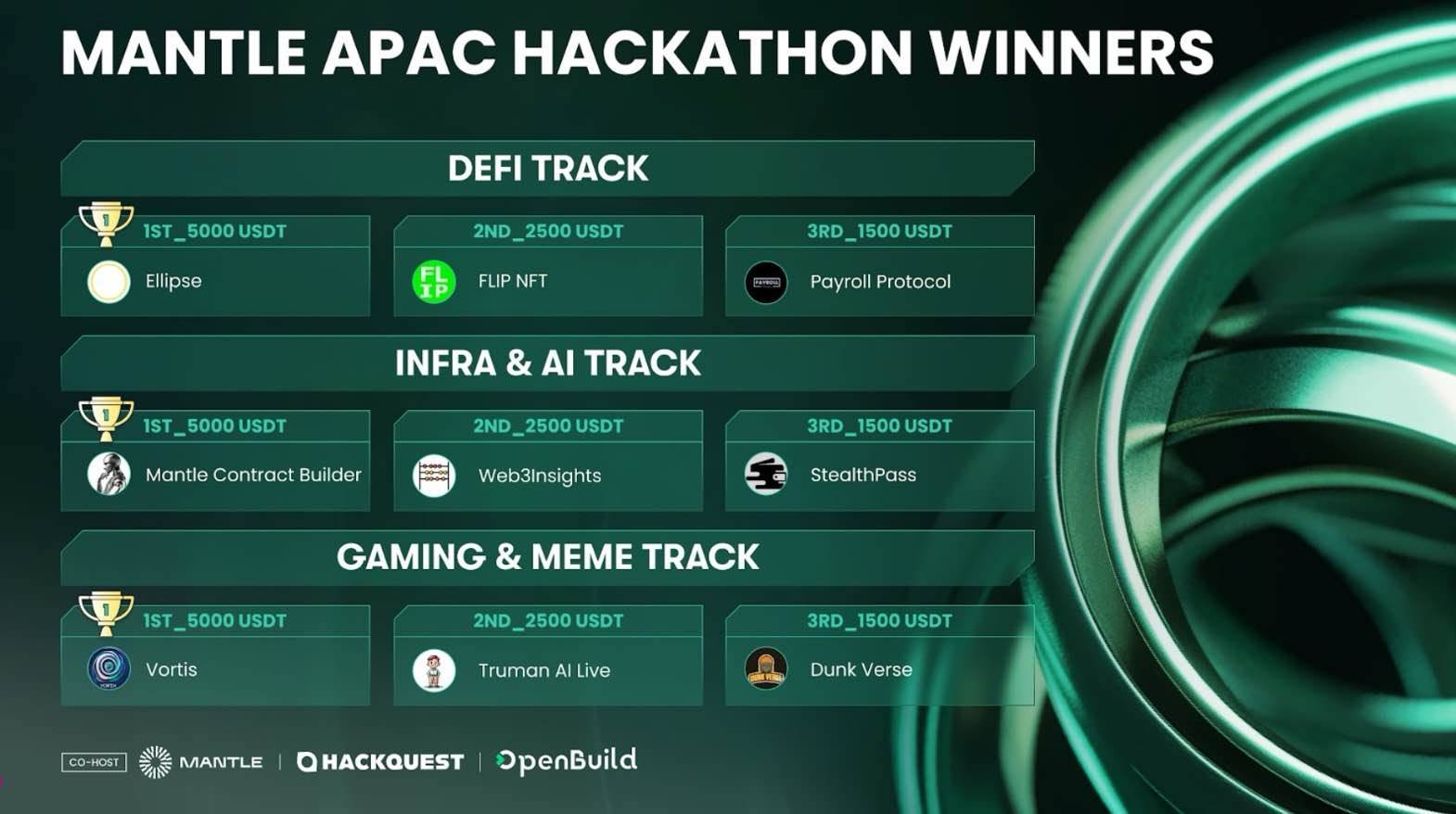

At the recently concluded Mantle APAC Hackathon, over 360 developers actively participated, submitting more than 170 innovative projects. Additionally, Mantle’s testnet incentive program launched in 2024 attracted over 5,000 global developers, deployed 12,000 smart contracts, and achieved a daily average of over 1 million transactions on testnet.

Such a large and highly engaged developer community fuels higher expectations for innovation explosions within the Mantle ecosystem and accelerated realization of its on-chain financial vision. Having already built strong momentum in product reputation, on-chain performance, and community presence in 2024, can Mantle leverage liquidity as its central narrative—connecting yield-bearing assets, DeFi, AI, and more—to pioneer a truly breakout era for on-chain finance?

A new year, a new narrative chapter is about to begin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News