After the market crash, why did I bet on MNT?

TechFlow Selected TechFlow Selected

After the market crash, why did I bet on MNT?

Most tokens are "toxic waste," and this is my last place of hope.

Author: Kyle

Translation: TechFlow

I can't comment on perpetual market mechanics, as that's not my area of expertise.

But I can share my market view — I believe the market is undergoing a structural shift.

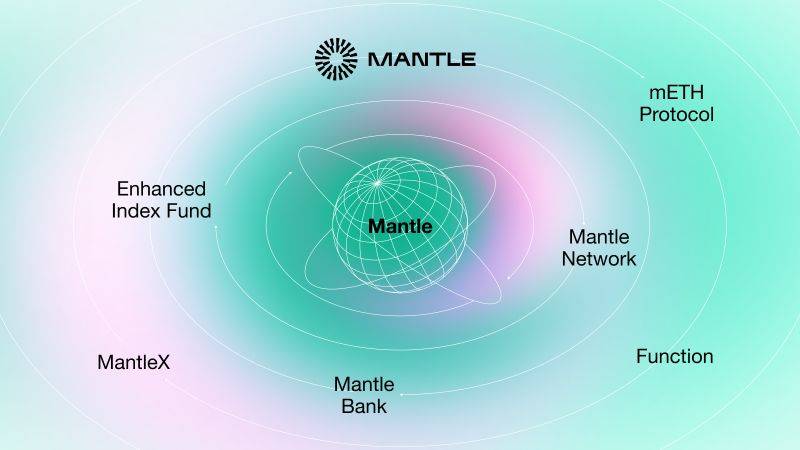

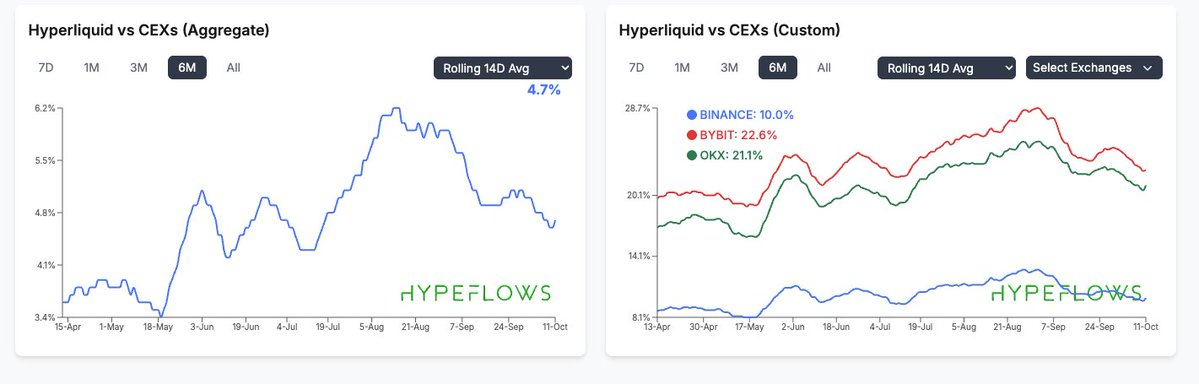

First, the entire market's momentum in 2025 stems from competition between decentralized exchanges (DEX) and centralized exchanges (CEX), fueled by the emergence of Hyperliquid and on-chain capital markets — both have valid reasons to exist. On-chain capital markets offer low liquidity, low fully diluted valuation (FDV) driven rallies (price increases), making them highly attractive because they require less marginal buying pressure and lack early investors dumping their holdings.

Perpetual DEXs were able to thrive because Binance appears to have gradually lost its appeal among traders. Many newly listed tokens on Binance (such as NXPC, Zerebro, and perpetual markets) have consistently declined in price after launch. This price action (PA) has driven many traders away from Binance, who now see it as trader-unfriendly and not a profitable platform.

I discussed these two trends at the time. I remember saying something like "the Binance empire is slowly crumbling as these new listings keep falling."

However, I believe this "DEX vs CEX" narrative will no longer be the market's primary driver going forward. In fact, overall, this trend peaked one or two months ago and has been declining since.

This doesn't mean I'm bearish on DEXs, perp DEXs, or Hyperliquid. What I'm trying to say is that this narrative was asymmetric over the past year, but that asymmetry is no longer clear to me.

For beginners:

1) Many highly competitive and capable perp DEXs (like Lighter) are fighting for resources within an already small market (especially after suffering over $20 billion in liquidations, further shrinking the market size).

2) Over the past few months, numerous events related to perp DEXs and DEXs have occurred — mainly involving insiders and criminals using these platforms as preferred trading venues.

Examples include White House insider trading, North Korean wash trading, celebrity-linked on-chain scams, Milei tokens, Trump tokens, etc. DEXs took the brunt, but perp DEXs also witnessed many ethically questionable incidents.

The transparency of perp DEXs seemed counterproductive during these events. For instance, whales dislike being "tracked" (e.g., Launchcoin, Jelly Jelly), obvious insider deposits, and rarely discussed loss transparency. Most CEXs only display leaderboards showing top earners, while perp DEX transparency also exposes those with the biggest losses.

This may seem insignificant temporarily, but imagine if traditional finance giant Citadel joined and everyone could see they were losing money. Traditional finance (TradFi) values privacy.

In any case, these events didn't create an impact comparable to the Trump token incident (which caused the demise of on-chain DEXs), but over time, these issues have accumulated.

3) Clearly, recent events over the past few days have had nearly equivalent market impact to the Trump incident.

Taking all factors together, I believe perp DEXs no longer hold an asymmetric advantage. Again, please understand my point clearly.

As a whole, I remain optimistic about perpetual products. But as a regular trader and someone skilled at identifying asymmetric opportunities, I must say the perp DEX space no longer holds strong appeal for me.

Yet, I believe we'll soon see a narrative shift toward competition among centralized exchanges. You might think this is contradictory, given recent events also involved CEXs.

But this actually works in my favor. Let me explain my thinking.

The broader narrative is very simple. Over the past few months, several key criteria stood out when selecting tokens:

-

Token holder alignment — ideally no VC continuously unlocking and selling tokens. This exists on a spectrum ranging from fully diluted supply to fully controlled supply.

-

Product and revenue growth sustained over time.

-

Priority given to token holders — the token must have some utility or focus, rather than merely satisfying points 1 and 2 while completely neglecting the token itself, as many tokens do.

-

The token must generate incremental demand.

Combining these metrics with my reflections over the past two days — in crypto, there are actually only three broadly investable areas: provenance, exchanges, and stablecoins.

Applying these three categories along with the investment criteria I mentioned, the resulting investable tokens are:

-

Provenance tokens - Bitcoin (BTC) / Ethereum (ETH)

-

Exchange tokens - BNB / HYPE / MNT / ASTER

-

Stablecoins - Unfortunately, many DeFi protocols fail to meet the above three criteria. In fact, I believe the best way to gain exposure to stablecoin investments is through equity, such as Circle (CRCL), or even better, Tether equity.

Recent events over the past two days further reinforced the importance of these standards. I have zero interest in 99% of tokens on the market, especially those dependent on Crypto Twitter (CT). Crypto Twitter hasn't just suffered heavy losses over the past week, but also lacks new incremental capital inflows (retail investors are now betting on "meme stocks").

The investment thesis for Bitcoin and Ethereum is obvious — they have consistent traditional finance (TradFi) demand and don't rely on revenue. Their narrative stands independently.

But for other altcoins, 99% fail these criteria. The only category I'm genuinely interested in is exchange tokens.

Now circling back to competition among centralized exchanges (CEX). What do I mean exactly? First, I've already explained how perp DEXs gradually lost their edge over the past year until the crash event fundamentally shifted the trend.

Second, another impact point of this black swan event lies with Binance, particularly their crisis management approach. I won't dive into specifics (mainly because I'm not skilled at detailed analysis nor an expert here), but let me give a few examples:

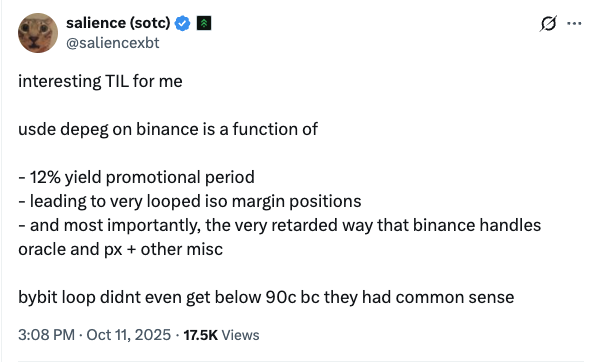

The most notable point is that USDe depegged more severely on Binance than on Bybit, causing significant pain for Binance users.

I won't bet against Binance, as clearly it has regained dominance in the CEX vs DEX narrative — reviving the BSC boom, possibly pushing BNB beyond $1,000, etc. Binance is also an excellent product serving millions globally.

However, I believe this could mark the beginning of emerging CEXs capturing larger market shares. Just as exchanges like Lighter are challenging Hyperliquid, I believe room exists in the market for rising CEXs to grow.

Clearly, my choice is very straightforward. Bybit has repeatedly demonstrated professionalism and proper handling of situations.

In my view, Bybit is more growth-oriented than any other exchange — to my knowledge, it's the only major exchange boldly experimenting across multiple domains. They've entered stock trading, launched Byreal (a Solana-based DEX), and support forex, commodities, and more.

They remind me of Robinhood (?), with that viral founder mentality — constantly launching new products, iterating rapidly — full of arena-like energy. Most importantly, their token sits in a highly asymmetric position, meeting all criteria:

-

Exchange tokens have the largest demand pool among all token models. Billion-dollar exchanges require VIP traders to buy MNT for fee discounts — creating a permanent demand pool that consistently attracts new buyers, rather than relying on "weekly hype" or "in-and-out" liquidity — this is sustained buy-side pressure.

-

Strong alignment between token holders and project team. Since they have revenue streams, they don't need to sell tokens for funding — in fact, the opposite is true. Plus, no VC involvement, etc.

-

Product and revenue continue growing. This goes without saying.

-

Priority given to token holders — holding MNT now grants access to Launchpool (new token launches).

Overall, from a pricing perspective, MNT's positioning also appears asymmetric to me. By fully diluted valuation (FDV), these tokens are all valued higher: WLFI, CRO, SUI, ADA; by market cap (MC): SHIB, LTC, LINK, etc.

I want to remind everyone that BNB ranks 4th among all tokens, behind only BTC, ETH, and Tether. Yet Mantle (MNT) ranks 34th — truly absurd. Regardless, the key takeaway is that these past few days deeply reinforced my realization that most tokens are "toxic waste," and this is now my final place of hope.

I'm naturally a long-term holder; I dislike chasing hot trades (I'm genuinely bad at it); my strength has always leaned toward swing trading. Therefore, what I'm showing you is the only token I truly hold right now:

gMNT.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News