Bybit deeply integrates with Mantle, $MNT may receive nine-figure annual buy orders

TechFlow Selected TechFlow Selected

Bybit deeply integrates with Mantle, $MNT may receive nine-figure annual buy orders

Summary: $MNT integrates Bybit's core business, potentially driving billions in demand.

Author: MooMs

Translation: TechFlow

This week, Mantle released one of the most significant announcements of the year. Its token will be integrated into Bybit's core business. Bybit is the world's second-largest centralized exchange (CEX). I present a model forecasting that $MNT will face an average nine-digit annual buy-side pressure.

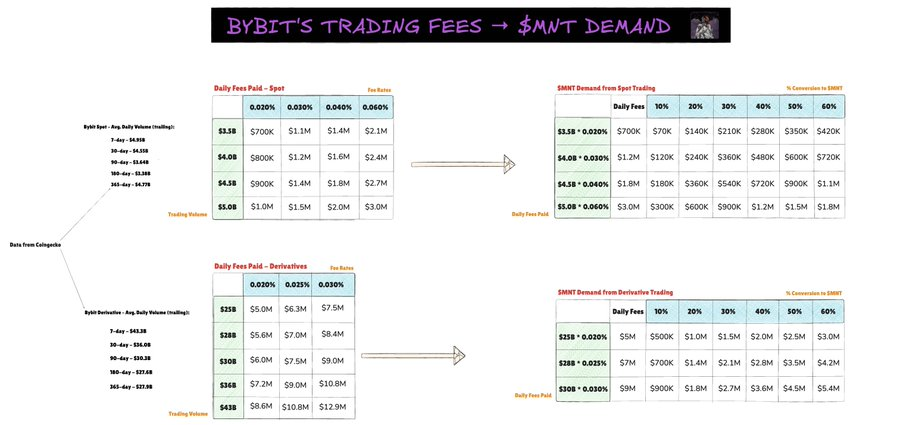

(Please zoom in to view all calculations)

Background

Bybit ranks as the second-largest CEX by spot trading volume and third by derivatives trading volume (according to @coingecko). Recently, Bybit’s Co-CEO and Spot lead joined Mantle as a core contributor, further strengthening ties between centralized exchanges (CEX) and the Mantle ecosystem. This aligns with Mantle’s efforts to bridge DeFi and TradFi, as demonstrated by the launch of @URNeobank and its growing focus on RWA. Beyond this strategy, Mantle has outlined a plan to directly integrate $MNT into Bybit’s core products.

However, the major announcement accompanying the new team addition is the planned integration of $MNT into Bybit’s core operations.

Currently, $MNT has already been integrated into:

-

Bybit’s Launchpool projects

-

Bybit’s structured products

-

Bybit’s OTC portal

Upcoming integrations announced by the team include:

-

Discounted trading fees paid in $MNT

-

VIP tier qualification via $MNT holdings

-

Trading pairs quoted in MNT

-

Others

Using MNT for fee payments and VIP tier access represents a massive utility use case for the token. Indeed, this is the best possible outcome any token could hope for.

We are talking about an exchange that had an average daily trading volume exceeding $30 billion over the past year.

BYBIT FEES → MNT DEMAND MODEL

Below, I present a simple model to estimate how Bybit’s trading fees could translate into daily $MNT buy-side pressure under realistic assumptions, separately for spot and derivatives.

Trading Volume

Spot Trading Volume: Scenarios are based on Bybit’s historical average from last year, approximately $3.5 billion to $5 billion per day.

Derivatives Trading Volume: Scenarios are based on $25 billion to $43 billion per day, consistent with last year’s historical averages.

Effective Fee Rate (in basis points)

Bybit fees vary by trading pair group, user tier, and maker/taker status. Instead of calculating each tier individually, I used weighted averages:

-

Derivatives: 0.020% / 0.025% / 0.030%

-

Spot: 0.020% / 0.030% / 0.040% / 0.060%

How the Table Was Calculated

1. Daily Fees: For each [volume x fee] combination, daily dollar fees were calculated.

2. MNT Buy Pressure: I then used the mid-range volume and fee results as a baseline and applied conversion scenarios of 10–60% to estimate daily $MNT demand.

Results

1. Conservative Scenario

-

Daily demand: $570,000

-

Annual demand: $208,000,000

Even in the conservative case—where only 10% of spot and derivatives fees flow to $MNT—the token should see an additional $500,000 in daily demand, translating to over $200 million annually.

2. Base Scenario

-

Daily demand: $2,460,000

-

Annual demand: $898,000,000

In my view, the base scenario assumes around 30% of spot and derivatives trading fees are converted to $MNT. In this case, we’re looking at nearly $2.5 million per day, equivalent to nearly $1 billion annually.

3. Optimistic Scenario

-

Daily demand: $7,200,000

-

Annual demand: $2,600,000,000

In a highly optimistic scenario—where approximately 60% of trading fees are converted to $MNT—a massive demand for the token is created. More specifically, $7.2 million per day, or $2.6 billion per year.

Of course, these are assumptions and rough estimates, but the outlook should be clear. The joining of Bybit executives to Mantle, the launch of the new bank, and the integration of $MNT into the world’s second-largest centralized exchange are all powerful catalysts for the ecosystem and its token. Fundamentals and data are bullish.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News